- Title page

- Section 1. Data on the obligations of the tax agent

- Section 2. Calculation of calculated, withheld and transferred personal income tax amounts

- Appendix 1. Certificate of income and tax amounts of an individual

- Section 1. Data about the individual - recipient of income

- Section 2. Total amounts of income and tax based on the results of the tax period

- Section 3. Standard, social and property tax deductions

- Section 4. The amount of income from which tax is not withheld by the tax agent and the amount of tax not withheld

- Application. Information on income and corresponding deductions by month of the tax period

Title page

The title page reflects information about the tax agent.

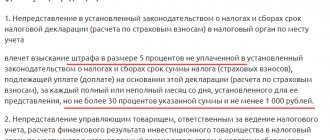

“Adjustment number” field , “0” is automatically entered in the primary calculation; in the updated calculation for the corresponding period, you must indicate the adjustment number (for example, “1”, “2”, etc.). In this case, continuous numbering must be ensured.

It is not allowed to indicate the adjustment number in an updated calculation without a previously accepted primary calculation.

In the “Tax period” , the calendar year and code of the reporting period for which the calculation is being submitted are automatically indicated.

The field “Submitted to the tax authority” reflects the code of the tax authority to which the calculation is submitted. It is selected from the directory. By default, the field is automatically filled with the code that was specified when the client registered in the system.

In the “Location (accounting)” , select the code for the place where the calculation is submitted by the tax agent from the corresponding directory. Thus, agents who are legal entities choose the code “214”, individual entrepreneurs – “120”, etc.

The largest taxpayers also choose code “214”, which corresponds to registration with the tax authority at their location.

“Tax Agent” field reflects the short name of the organization in accordance with the constituent documents. Entrepreneurs, lawyers, notaries indicate their full (without abbreviations) last name, first name, patronymic (if any).

The INN and KPP (if any) of the tax agent are also indicated.

The largest taxpayers indicate the TIN and KPP according to the certificate of registration of the Russian organization with the tax authority at the location (5th and 6th category of KPP - “01”).

In the “OKTMO Code” , the OKTMO code of the municipality is indicated. This code is selected from the corresponding classifier. You can find out your OKTMO code using the electronic service of the Federal Tax Service “Federal Information Address System” (https://nalog.ru, section “All services”).

In the “Form of reorganization, liquidation” , select the code of the form of reorganization (liquidation) or deprivation of authority (closing) of a separate division from the corresponding directory.

The field “TIN/KPP of the reorganized organization” indicates the TIN and KPP that were assigned to the organization before its reorganization or before the closure of a separate division.

When filling out the “Contact phone number” , the tax agent’s phone number specified during registration is automatically reflected.

The title page section also displays information about the signatory of the settlement:

- Manager - if the document is submitted by a tax agent;

- Authorized representative - if the document was submitted by a representative of the tax agent. In this case, the name of the representative and details of the document confirming his authority are indicated.

To change the signatory in the calculation, you must follow the appropriate link to the “Details” and provide the required information.

Section 1. Data on the obligations of the tax agent

Section 1 reflects information about withheld (refunded) tax, the deadline for transfer (refund) of which occurs in the last three months of the reporting period.

If the tax is withheld and the deadline for its transfer occurs in the next reporting period, then information about this tax in Section 1 for the current reporting period does not need to be reflected, except in the case of payment of income on the last working day of the reporting period (see here).

Line 010 indicates the BCC of the tax.

From 01/01/2021, in addition to the main BCC used by tax agents, a new BCC 18210102080011000110 is used for taxes calculated from a tax base exceeding 5 million rubles.

Line 020 reflects the total amount of tax withheld for all individuals for the last three months of the reporting period.

Line 021 indicates the date no later than which the tax amount must be transferred.

If the deadline for tax remittance, reflected on line 021 , falls on a weekend or holiday, then the next working day following it is indicated.

Line 022 indicates the generalized amount of tax withheld by the agent, subject to transfer within the period reflected on line 021 .

The sum of the values of all rows 022 must correspond to the value of row 020 , i.e.:

page 020 = ∑ page 022

Line 030 reflects the total amount of tax returned by the tax agent to individuals for the last three months of the reporting period (for example, when the employee submitted a notification of the right to a social or property deduction not from the beginning of the year).

Line 031 indicates the tax refund date.

The refund of the overly withheld tax amount must be made by the tax agent within three months from the date of receipt of the application from the employee.

Line 032 indicates the amount of tax returned by the tax agent within the period reflected in line 031 .

The sum of the values of all rows 032 must correspond to the value of row 030 , i.e.:

page 030 = ∑ page 032

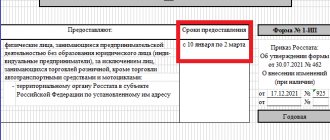

Form 5 financial statements

Form 5 does not currently appear in the mandatory financial statements. The previously used document with some changes is now recommended by Order of the Ministry of Finance No. 66n as an example for preparing explanations for the balance sheet. This is a set of several tables that decipher in detail all the lines of the financial statements.

If an organization considers it necessary to submit these explanations in the structure of the annual accounting report, then they should be submitted no later than March 31, following the reporting year. Information can now be submitted to the Federal Tax Service exclusively in electronic format.

Section 2. Calculation of calculated, withheld and transferred personal income tax amounts

Section 2 indicates, generalized for all individuals, the amounts of accrued and actually received income, calculated and withheld tax on an accrual basis from the beginning of the tax period at the appropriate rate.

If the tax agent paid income to individuals taxed at different tax rates, section 2 is completed separately for each tax rate.

“Rate” field indicates the corresponding tax rate.

Line 105 indicates the BCC of the tax.

From 01/01/2021, in addition to the main BCC used by tax agents, a new BCC 18210102080011000110 is used for taxes calculated from a tax base exceeding 5 million rubles.

Line 110 reflects the total amount of income accrued for all individuals on an accrual basis from the beginning of the tax period.

Lines 111-115 provide a breakdown of accrued income by type of payment:

- income accrued to individuals in the form of dividends is indicated on line 111 ;

- income accrued under employment contracts - on line 112 ;

- income accrued under civil law contracts (GPA) - on line 113 ;

- income accrued to highly qualified specialists (HQS) under employment contracts and GPA - on line 115 (from lines 112 and 113 ).

Line 120 reflects the number of individuals to whom taxable income was accrued during the corresponding reporting period.

If the same individual is fired and hired during the same tax period, he is counted only once.

On line 121 of the total number of persons reflected on line 120 , the number of HQS who received income under employment contracts and GPA is indicated.

Line 130 , on an accrual basis, the total amount of tax deductions that reduce the taxable income indicated in line 110 . The amount of tax deductions also indicates other amounts that reduce the tax base, and non-taxable amounts if income is exempt from tax within certain limits (for example, financial assistance in the amount of 4,000 rubles).

If the amount of the deduction is greater than the amount of income, then the deduction is indicated in an amount not exceeding the income.

Line 140 reflects the amount of calculated tax generalized for all individuals on an accrual basis from the beginning of the year.

Line 141 reflects the amount of calculated tax on dividends paid for all individuals from the beginning of the year. In this case, the tax amount for each taxpayer is calculated separately for each income payment.

Line 142 reflects the amount of calculated tax generalized for all VKS on an accrual basis from the beginning of the year.

Line 150 indicates the amount of fixed advance payments that the foreigner paid when obtaining a patent. By this amount, the tax agent can reduce the amount of calculated tax if the appropriate documents are available (application from an employee, notification from the Federal Tax Service, receipts for payment of fixed payments).

Line 155 reflects the amount of income tax withheld in respect of dividends received by a Russian organization and subject to offset when determining the amount of tax on income from equity participation in this organization.

Line 160 indicates the amount of tax withheld, calculated on an accrual basis from the beginning of the tax period.

If line 110 indicates the amount of income, but its actual payment has not yet been made in the reporting period, then line 160 does not reflect tax on such income, since it will be withheld in another reporting period.

Line 170 reflects the amount of tax that cannot be withheld by the tax agent (for example, in case of payment in kind in the absence of cash payments). This amount does not include tax on wages, which will be paid in the next reporting period.

Line 180 reflects the amount of tax over-withheld by the tax agent.

Line 190 indicates the amount of tax returned by the tax agent (for example, in the case of excessive tax withholding from the employee’s income).

General information on form 5-NDFL

This is a special report form containing data on all taxpayers in the region. It necessarily reflects 3 groups of different information. The 5-NDFL summary tables reflect the following data:

- Tax base subject to different rates (9, 13, 30 and 35%).

- Information on provided tax deductions (TD) of various categories.

- Forecasts for determining tax deductions and deductions for future periods.

In addition, the certificate also reflects other data that reveals the nuances of these points in more detail. On a national scale, this is an important document. Its necessity is economically justified, and the form and procedure for filling it out are regulated by orders and letters of the Ministry of Finance.

There are a number of such documents, united under the concept of “approval of statistical reporting forms by the Federal Tax Service.” First of all, you should familiarize yourself with Order of the Federal Tax Service of Russia No. ММВ-7-1/674 of 2014, which describes the process of filling out summary tables of form 5-NDFL. Also, such regulations stipulate the deadlines for submitting the combined documentation and those responsible for its preparation.

Appendix 1. Certificate of income and tax amounts of an individual

The certificate must be completed when preparing calculations for the tax period - a calendar year.

Filling out the certificate begins by adding an individual using the “+Employee” button.

Next, indicate the unique serial number of the certificate assigned by the tax agent.

“00” is automatically reflected in the “Adjustment number”

The corrective certificate must indicate the correction number (for example, “01”, “02”, etc.). When filling it out, indicate the number of the previously submitted certificate.

When filling out the cancellation certificate, the code “99” and the number of the primary certificate are automatically indicated. This certificate is issued in the event that it is necessary to cancel the indicators in a previously submitted certificate.

When submitting a corrective or canceling certificate by the legal successor of the tax agent, the number of the previously submitted certificate by the tax agent is indicated in the “Certificate Number” .

Important information

It is worth knowing that this type of report is submitted 2 times a year. Based on it, a forecast for tax deductions in the next period is formed, which makes it possible to approximately estimate the volume of budget filling. Responsibility for the correct completion of the report and its timely submission lies with the heads of a specific territorial division of the Federal Tax Service.

There is a time limit for filing this type of report. It must be ready 5 days after employers and individuals submit data on 2- and 3-NDFL. Specific dates for submitting data are formed depending on the level of the report - first, data is provided by municipalities, regional summary forms are compiled on their basis, and later a document at the federal level is filled out.

Section 1. Data about the individual - recipient of income

This section provides information about the individual.

In the “TIN in the Russian Federation” , the individual’s TIN is indicated, confirming that person’s tax registration. If the taxpayer does not have a TIN, this field is not filled in. At the same time, you can find out the TIN on the website of the Federal Tax Service of Russia (https://nalog.ru) in the “Services/ Information about the TIN of an individual” section.

The appropriate fields indicate the last name, first name and patronymic (if any) of the individual without abbreviations, as in the passport. The use of Latin letters is allowed only for foreigners.

In the “Taxpayer Status” , indicate the status code:

- “1” - for tax residents (for Russians and employees from EAEU countries);

- “2” - for non-residents;

- “3” - for non-residents - highly qualified specialists;

- “4” - for migrants living abroad;

- “5” - for non-resident refugees;

- “6” - for foreign employees who work on the basis of a patent;

- “7” - for tax residents - highly qualified specialists.

Next, indicate the date of birth of the individual.

In the “Citizenship (country code)” , select the code of the employee’s country of permanent residence from the corresponding directory.

If a person does not have citizenship, then the code of the country that issued the identity document is indicated.

In the “Identity document code” , select the document type code in accordance with the directory and indicate its series and number.

Features of filling out an appendix to the balance sheet

Let's consider the nuances of filling out all sections separately.

Table 1 “Intangible assets and R&D expenses”

includes 5 subsections:

- Availability and movement of intangible assets.

- The original cost of intangible assets that were created by a company.

- Intangible assets, the cost of which has been fully repaid.

- Availability and movement of R&D results.

- Unfinished and unformed R&D. Unfinished transactions for the acquisition of intangible assets.

In this section, the balance sheet indicators from pages 1110, 1120 and 1190 should be disclosed. Data should only be reflected on those assets that are owned by the company. Assets that the organization received for temporary use do not need to be included.

Table 2 “Fixed assets”

includes 4 tables:

- Availability and movement of fixed assets.

- Unfinished capital investments.

- Change in the value of fixed assets as a result of additional equipment, completion or reconstruction.

- Other uses of fixed assets.

This section is intended to disclose information on pages 1150, 1160 and 1190 of the balance sheet, as well as to reflect the organization’s unfinished capital investments.

Table 3 “Financial investments”

includes two subsections:

- Availability and movement of financial investments.

- Other uses of financial investments.

Used to explain lines 1170 and 1240 of the balance sheet with data on the organization’s material investments in current and non-current assets.

Table 4 "Reserves"

combines two sections:

- Availability and movement of inventories.

- Inventory pledged.

Here it is necessary to classify reserves by groups or types, and also separately indicate those that are pledged.

Table 5 “Receivables and payables”

reveals information from the balance sheet in 4 areas:

- Availability and movement of accounts receivable.

- Overdue accounts receivable.

- Availability and movement of accounts payable.

- Overdue accounts payable.

Page No. 1230, 1410, 1450, 1510, 1520 and 1550 are explained in detail here.

Table 6 “Production costs”

applied as an explanation to the statements of financial performance. Here it is necessary to disclose in more detail the indicators of lines 2120, 2210 and 2220 from this document.

Table 7 “Estimated liabilities”

is intended to disclose pages 1430 and 1540 about obligations that are entered into by the company for a period of up to 12 months or more than that period.

Table 8 “Securing obligations”

includes information about the amounts of collateral that have been issued or received by the organization.

Table 9 “State aid”

used to disclose data from line 1530 of the balance sheet. This is information about budget loans received in the form of long-term or short-term loans.

In addition to these sections, the documentation may contain information about features or changes in the company’s accounting policies, various agreements and obligations of the organization, and other issues.

It is convenient to conduct accounting and generate reporting in the Astral Report 5.0 web service. All current forms of reporting documents are presented on the service, and for automatic completion you can download all databases and company documents for previous periods. The prepared reports can be sent directly from the service to the Federal Tax Service, having certified the document with an electronic signature.

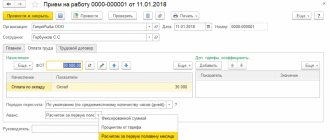

Section 2. Total amounts of income and tax based on the results of the tax period

Section 2 reflects the final data calculated on the basis of information from section 3 and the appendix to the help.

This section is completed separately for each tax rate.

“Rate” field indicates the corresponding tax rate.

The BCC of the tax is indicated in a separate field.

In the “Total amount of income” , the amount of income accrued and actually received by an individual based on the results of the tax period is automatically calculated. To do this, all income reflected in the annex to the certificate is summed up. In this case, income is not reduced by tax deductions specified in section 3 and the appendix to the certificate.

In the “Tax base” , the value of the tax base from which the tax is calculated is automatically calculated. To do this, all tax deductions reflected in Section 3 and the appendix to the certificate are subtracted from the indicator reflected in the “Total Amount of Income” .

If the amount of deductions specified in section 3 and the appendix to the certificate exceeds the total amount of income, zero is indicated in the “Tax base” .

In the “Calculated tax amount” , the tax amount is automatically calculated as the product of the tax base and rate.

The field “Amount of tax withheld” indicates the amount of tax actually withheld from the income of an individual.

The field “Amount of fixed advance payments” is filled in if the tax from a foreigner working under a patent has been reduced by the amount of advance payments paid by him.

The field “Amount of corporate income tax subject to offset” indicates the amount of income tax withheld in relation to dividends received by a Russian organization and subject to offset when determining the amount of tax in relation to income from equity participation in this organization.

“Tax amount transferred” field indicates the total amount of tax transferred for the year.

In the “Amount of tax over-withheld by the tax agent” field, the amount of tax over-withheld and not returned by the tax agent is automatically calculated, as well as the amount of tax overpayment that occurred due to a change in the tax status of an individual.

Structure of Form 5 of the Appendix to the Balance Sheet

To fill out, use a standardized version of the appendix to the balance sheet.

Form 5 of the financial statements combines 8 sections, each of which contains from one to four tables. Table columns allow you to disclose data on all movements of the company's assets and funds that took place during the reporting period.

Since filling out this reporting document is left to the discretion of the company, it is not possible to enter data into all sections.

Section 3. Standard, social and property tax deductions

The section is completed if an individual has the right to tax deductions and receives them from a tax agent.

If a tax agent presents standard, social and property tax deductions to an individual, then you can reflect them in this section by clicking on the “New entry” and indicating the codes and amounts of deductions.

If a tax agent provided an individual with tax deductions based on notifications, then fill in the data in the subsection “Notification confirming the right to deduction .

In the “Notification type code” , select the appropriate deduction code, and also indicate the number and date of issue of the notification, and the code of the tax authority that issued it.

How are the balance sheet and form number 5 related?

Appendix on form number 5 is completed after the formation of the balance sheet and is intended to clarify the information that is very briefly presented in the main report. The scope of the application depends on which reporting lines are filled in the balance sheet and which of them are disclosed in more detail.

In particular, the form in question does not include an explanation for the “Cash and Equivalents” line item. The reason for this lies in the fact that the breakdown of this part of the balance sheet is given in the statement of cash flows.

There is no need to explain in detail the components of capital and profit - for this purpose, reports on changes in capital and financial results of the organization's activities are used.