In any organization, the execution and documentation of financial transactions is the most important component of all business processes. The functions of the chief accountant are key in many ways. This is a person related to the “holy of holies” of the financial and economic activities of the enterprise. Therefore, despite the fact that from the point of view of labor legislation this is the same employee as everyone else, parting with him can be fraught with many problems and difficulties for the business owner.

FILES

What are the specifics of releasing the chief accountant from his position, what special grounds exist for this, and how to minimize the risks of changing a key figure for the organization, we will tell you in this article.

What should be done if the chief accountant resigns at his own request ?

Features of the dismissal of the chief accountant

The responsibilities of the chief accountant differ sharply from the range of activities of other employees, therefore the appointment and dismissal of a second person after the management has a number of features.

- In addition to the provisions of the Labor Code of the Russian Federation, labor relations with the chief accountant are considered by Federal Law No. 129 “On Accounting”.

- The chief accountant reports directly to the general director, who makes the final decision on dismissal and is responsible for the entire procedure.

- To test the competence of this important employee, a period has been set longer than for others: the trial period can last up to 6 months (Part 5 of Article 70 of the Labor Code) without taking into account sick leave and vacations. During the test, the dismissal procedure is simplified.

- There is no need to rush to hire an accountant on a permanent basis: the law allows you to enter into a fixed-term contract with him. At the end of its validity, a decision is made - to part ways, since the document has expired, or to continue cooperation.

- Everything related to financial responsibility must be fixed in advance (in the text of the employment contract itself or in a separate document).

Question: Is it possible to hire a new chief accountant to transfer cases before the date of dismissal of the previous one and how to organize the reception and transfer of cases and material assets? View answer

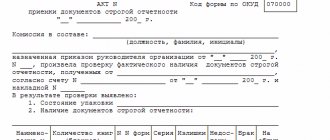

Contents and structure of the act of transfer of affairs

The act of transfer of cases is drawn up in two copies, one each for the receiving and transferring parties. The deadlines for the transfer of cases and the signing of the transfer act are fixed in the order of the manager.

It must be written in:

- Date and place of document preparation.

- The name of the document is “Act of Acceptance of Transfer”.

- Name of the employing company.

- Full name of the transmitting party and recipient of information.

- List of documents to be transferred, indicating the number of sheets and form (copy, original, etc.). The standard list of transferred documents and property includes accounting policies, reporting, certificates of work performed, reconciliations of settlements with suppliers, inventories, primary documents, contracts with suppliers and contractors, Internet banking passwords, cash, codes, etc.

- Signatures of the parties.

All documents transferred under the deed must be checked and signed by the receiving party. The results of the inventory and the inspection carried out are annexed to the report.

The act may also reflect the following points:

- features of the accounting policy of the software and hardware used for accounting (what special programs are used, what is the procedure for maintaining databases, storing primary documentation, etc.);

- what is the procedure for accessing the accounting system, including passwords;

- the presence or absence of discrepancies in accounting registers, etc.

Sample document: the form of the act of transfer and acceptance of documents can be downloaded here.

What to base the dismissal on?

According to the Labor Code, the end of cooperation with the chief accountant is exactly the same as with another employee. However, in addition to the articles of the Labor Code, federal laws provide some grounds specific to key positions, such as director and chief accountant. Let's consider all the legislative reasons for dismissing the chief accountant.

How to organize the transfer of affairs upon dismissal of the chief accountant ?

The chief accountant wants to leave on his own

An employee’s own desire is a valid reason for any dismissal. The value of an employee, financial responsibility and even a pile of unfinished business will not be able to detain the chief accountant if he decides to leave his job.

ATTENTION! Sometimes employers, wanting to protect the company, include clauses in the employment contract according to which the accountant is allegedly deprived of the right to resign during the period of unfinished reports, etc. Since the Labor Code as a legislative act takes precedence over internal documents, even after signing an agreement with such clauses, the accountant has the right to resign after working the required two weeks.

Guided by Art. 80 of the Labor Code, the accountant notifies the employee in writing 14 days in advance of his resignation. These days he hands over affairs to his successor. The manager is responsible for the acceptance of cases, as well as for all accounting (clause 1, article 6 of Federal Law No. 129). If he could not find a deputy, then he must take over the business himself, otherwise he will have to let the accountant go “as is.”

IMPORTANT! If the manager does not want to dismiss the chief accountant, refusing to sign the application and prohibiting him from registering it with the secretariat, the document can be sent by registered mail and the work can be stopped after the established 14 days. An illegally detained work book will have to be demanded through the court.

The manager's initiative in dismissing the chief accountant

IMPORTANT! A sample act of acceptance and transfer of affairs upon dismissal of the chief accountant from ConsultantPlus is available at the link

The law provides many reasons for which a manager has the right to show the chief accountant the door. Among them are those that apply to both key and ordinary employees.

- Forged documents when drawing up an employment contract.

- Expiration of a fixed-term contract. A warning about unwillingness to renew the contract must be provided to the employee 3 days in advance. If this does not happen after the expiration of the term, the contract automatically turns into an open-ended one.

- Failure to fulfill one’s duties or performance with violations (several times, confirmed by penalties, or once, but rudely).

- Absenteeism.

- An employee appears drunk or under the influence of narcotic or other toxic drugs.

- Reluctance to work in changed conditions, subordination or territorial location.

- Violation of the provisions of the employment contract (if they do not contradict the Labor Code of the Russian Federation).

- Inconsistency of the position identified as a result of the certification.

- Liquidation of the organization.

- Reduction in staff or numbers.

IMPORTANT INFORMATION! Retrenchment is a fairly rare reason for dismissing an accountant, because any organization needs a person to keep financial records. Only if the enterprise is very small, the director himself can perform the functions of an accountant, then it is permissible to reduce this position.

Grounds related to financial liability

The chief accountant has the right to be dismissed if it is established that he:

- committed theft, embezzlement, destroyed or damaged anything belonging to the company or other employees (the fact must be confirmed by a court or other authorized body);

- by his actions or inaction related to the maintenance of valuables, he has lost the trust of management;

- participated in making a decision that resulted in damage to the organization’s property.

Reasons related to the uniqueness of accounting responsibilities

Due to the fact that the labor functions of the chief accountant provide for exceptional awareness of all business processes, it is permissible to replace this employee if:

- the organization has a new owner (having “your own person” in a key position is the right of the owner);

- the owner wants to change the organization’s property and persons in key positions;

- The chief accountant divulged a secret protected by law.

NOTE! Information contained in the constituent documents, as well as in submitted reports, cannot be considered secret. Therefore, information about the movement of money is not recognized by law as a trade secret, and if the accountant spilled the beans about this, dismissal on this basis is unacceptable.

What to do if the employment contract has ended and the documents have not been submitted?

If the chief accountant resigns of his own free will (Article 80 of the Labor Code of the Russian Federation), then he has 14 days to complete the submission of papers. In the dismissal order, the manager prescribes the condition for completing the acceptance of documentation, and what to do if the deadline has come to an end and the work on submitting the papers has not been completed?

There are several options for resolving the situation. It is illegal to force an employee who terminates cooperation to continue working, as is not to make timely payments and not to hand over a work book. We can offer:

- register a new chief accountant and offer them cooperation for a period of, say, 7-14 days, with a clear delineation of responsibilities and final execution of the act;

- dismissal not at will, but by agreement of the parties (Article 78 of the Labor Code of the Russian Federation), when the period is determined by a mutual decision of the employer and the resigning employee.

Peaceful separation from the former employer when transferring affairs according to the act is the best advertisement for the chief accountant. A self-respecting chief accountant should understand that it is worth trying to put the papers in order and hand over all matters as quickly as possible in the best possible way in order to resign without problems and on a time that suits the chief accountant leaving the enterprise.

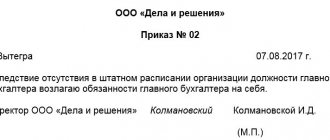

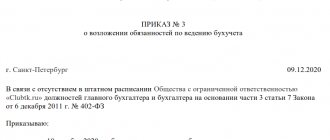

How to transfer business into new hands

The management must think over the mechanism for transferring accounting responsibilities even before it comes in handy, because the work of the accounting department should not be interrupted. This procedure is not stipulated by law, but usually the procedure for transferring cases is initiated by an order of the director, drawn up in free form.

This document must provide for the possibility of dividing the responsibility of the dismissed and new accountant. The text of the order must indicate:

- the basis for the transfer (dismissal article);

- deadlines for review and transfer of cases;

- composition of the commission carrying out the inspection;

- personal data of the receiving person;

- signatures of the parties, seal of the organization.

To whom should it be conveyed?

Cases are taken over by the future chief accountant selected by management. In large companies, the staffing table provides for the position of deputy chief accountant, which is very convenient in such situations. If a new employee has not been found, the director can appoint a temporary deputy or take over the work himself.

Checking cases

Before transferring affairs, the boss has the right to conduct a large-scale analysis of all accounting activities, check the maintenance of financial records, make an inventory of funds and an inventory of valuables.

Particular attention should be paid to the following points of accounting papers:

- accounting of finances, cash;

- government payments;

- inventory total;

- obligations to counterparties.

The director can carry out the audit on his own or invite a third-party auditor. If the results of the audit reveal violations on the part of the accountant, he faces administrative liability, including criminal liability, as well as financial liability, collected in accordance with the law.

What to convey?

The concept of “cases” subject to transfer refers to business documentation and attributes under the jurisdiction of the chief accountant:

- balance sheet and cash reports;

- documents of structural units;

- bank papers;

- archival documents valid for up to 5 years;

- safe key, seal.

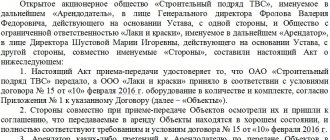

Upon completion of the process, an act is drawn up that reflects the status of the accounting documents and records the position of funds as of the date specified in the resignation letter.

Step-by-step instructions for transferring cases when changing the chief accountant in 2022

Before the upcoming change of chief accountant and the transfer of affairs to a new employee, it is advisable to carry out a number of activities.

Suspend powers of attorney

The chief accountant in most cases acts on the basis of a power of attorney, one or more. The document can be either one-time or have a prolonged validity. When changing the chief accountant and transferring affairs, it is necessary to cancel each of the existing powers of attorney. When a document is issued for a long period, it is advisable to inform all interested contractors and government agencies about the change of chief accountant. We are talking about the company’s partners, the tax service, the Pension Fund of Russia, the Social Insurance Fund, etc.

Make changes to the process of signing papers through the Bank-Client system

Often, the chief accountant of a company has the right to endorse payment orders. It is worth creating a new card that will contain a seal impression and current signatures. Some firms currently use an interdependent signature system. In other words, the signature of the general director is not valid without the confirming signature of the chief accountant.

If the bank card contains signatures that do not have equivalent validity, it will most likely take some time to put the new signature into effect. This is due to the need to change the electronic certificate to work in the Bank-Client system. If an organization needs to process a payment as soon as possible during the period of change of chief accountant and transfer of cases, then it can generate it on paper. But only if such a possibility is permissible under the terms of the agreement with the bank.

Take inventory

When changing the chief accountant during the transfer of affairs, the company's property and its obligations should be subject to verification. The chief accountant is not one of the persons responsible for the safety of the company's fixed assets, materials or goods. Nevertheless, carrying out inventory activities in relation to the company’s property will give the owner an idea of how accurately the accounting was organized by the chief accountant. The obligations of the company, its debts on debit and credit fall under the competence of the chief accountant. Checking them is a necessary condition when changing the chief accountant and transferring affairs.

Order to conduct an inventory when changing the chief accountant:

Assess accounting and reporting

When changing the chief accountant and transferring affairs to a new employee, it is worth checking:

- accounting, tax accounting, management accounting (provided that its maintenance is provided for by company policy);

- the company's accounting policies, internal regulations;

- documentation related to interaction with the Federal Tax Service and other government agencies. These can be various notices, demands, reconciliation acts, etc.;

- accounting database and the correctness of the registers contained in it. Sometimes organizations using the simplified tax system keep virtually no records.

The same actions are required by the transfer of affairs when changing the chief accountant in a budget organization. When using TCS (telecommunication channels), it is possible to send a request to the Federal Tax Service in order to obtain information about the current status of reporting. The received document will provide information about the completeness of the tax reporting submitted. It is advisable to review the existing requirements from the Federal Tax Service and compare them with the responses sent. In other words, it is necessary to check whether the chief accountant submitted all the necessary information to the tax authorities and whether he did so on time.

What threatens the chief accountant?

Criminal liability includes evasion of taxes, fees, insurance premiums from an organization or failure to fulfill its duties as a tax agent. The chief accountant can be prosecuted for this if he consciously (deliberately) participated in the commission of crimes (Articles 199, 199.1, 199.4 of the Criminal Code of the Russian Federation, paragraphs.

Interesting materials:

What is a star-delta connection? What is a star connection? What is a Python socket? What is a solenoid and what is it used for? What is a solenoid in an automatic transmission? What is the somatic nervous system? What is a sonata and what is a symphony? What are sorbents? What is a sorting center at Russian Post? What is adulthood?

Responsibility of a former accountant

It must be remembered that if a new accountant reveals the mistakes of his predecessor during his work, he does not bear any responsibility for them.

The former accountant bears administrative and even criminal liability for his mistakes even after dismissal. You can be held accountable for financial and tax violations within a year, for others - within two months.

Administrative violations discovered after the expiration of the statute of limitations will remain unpunished for the accountant.

Most often, accountants are faced with responsibility for:

| Violation | Fine |

| Violation of the rules for working with cash and cash registers | 4000-5000 rub. |

| Violation of reporting on currency transactions | 4000-5000 rub. |

| Violation of norms for the provision of statistical data | 3000-5000 rub. |

| Conducting activities without registering with the tax authorities | 2000-3000 rub. |

| Failure to meet tax return filing deadlines | 300-500 rub. |

| Distortion in reporting amounts by more than 10% | 2000-3000 rub. |

If, after the dismissal of an employee, it turns out that he caused material damage to the company, it is worth first finding out whether his financial liability was fixed in the contract.

According to articles of the Labor Code of the Russian Federation number 238 and 241: If, after the dismissal of an employee, it turns out that he suffered material damage to the company, it is worth first finding out whether his financial liability was fixed in the contract.

- If an agreement on full liability was in force, the perpetrator will have to pay compensation in full;

- An employee who is not financially responsible shall compensate for damages no more than his average salary.

Common mistakes

Error:

The act of acceptance and transfer of cases from the dismissed chief accountant to the new chief accountant was drawn up in a single copy.

A comment:

Two copies of the act of acceptance and transfer of affairs to the chief accountant must be drawn up - the first is stored in the organization, the second is transferred to the previous chief accountant.

Error:

The act of acceptance and transfer of affairs to the new chief accountant is not certified by the head of the company.

A comment:

The acceptance certificate must be signed by the head of the company, the former chief accountant and the current chief accountant, and the chairman of the commission (if it was convened).