From our article you will learn:

Organizations and individual entrepreneurs submit reports to the state statistics service. Submission of documents occurs selectively, but once every five years is mandatory for all representatives of small and medium-sized businesses. In 2022, Rosstat conducted continuous statistical monitoring of small businesses. The next time companies will have to provide Rosstat with information about revenue, equipment and employees is in 2026.

In this article we will tell you how and to whom individual entrepreneurs should provide statistical reports.

Who needs to submit the 1-IP report

From the title of the report itself, it is easy to guess that individual entrepreneurs should be included in the 1-IP statistics.

However, the form of observation is not carried out by a continuous method, but by a selective method, therefore not all individuals registered as entrepreneurs are required to send a report to the regulatory authorities, but only those who are included in the sample. The sample definitely does not include entities engaged in retail trade (with the exception of retail trade in motor vehicles, motorcycles and auto parts). All others should check their obligation to submit a report on the Rosstat website. You can do this in two ways:

- Download the list of forms to be submitted by searching by TIN/OGRNIP/OKPO in the special service https://websbor.gks.ru/online/info.

- Check the presence of OKPO in the list of subjects included in the sample. This list is located in the section “Respondents” / — “List of respondents for whom selective federal statistical observations are carried out.”

IMPORTANT! Even if an entrepreneur did not operate in 2021, he is still required to send a report to Rosstat when included in the sample.

If an entrepreneur is not required to submit a report for 2022, then he can breathe easy. If OKPO was found among respondents, then you need to think about where to download form 1-IP for statistics.

What kind of reporting do individual entrepreneurs without employees submit to Rosstat?

When Rosstat does not conduct a comprehensive study, the agency itself decides which organization will participate in the submission of reports. Individual entrepreneurs may also be included in this list. If an individual entrepreneur has no employees, then there is no need to submit information about the number and wages of employees. The frequency of presentation of other information may be annual, quarterly or monthly. The Statistics Service will send notifications to respondents. If the letter is delayed, the firm will file late and receive a penalty. Therefore, it is better to check whether you need to submit reports to Rosstat. How to do this, read our article.

Which 1-IP form is relevant in 2022

Statistical reports are updated almost annually, so it is important to keep the forms up to date. In 2022, it is necessary to send to statistics Form 1-IP, approved by Rosstat Order No. 462 dated July 30, 2021 (form code according to OKUD 0601018). The agreed form is presented in Appendix 10 to the said order.

In the reference and legal system “ConsultantPlus” you can find all the current statistical reporting forms, including forms 1-IP, and also download it in Excel format for subsequent filling out. To do this, use demo access to the system. It's free.

It’s not enough to find it, it still needs to be prepared in the correct way so that the workers of the statistical bodies checking and registering the report do not have questions for the entrepreneur.

Who should submit Form 1-IP to the statistics service?

Statistical form 1-IP is required to be submitted to the territorial bodies of state statistics by entrepreneurs conducting commercial activities without forming a legal entity, in other words, individual entrepreneurs, with the exception of persons engaged in retail trade.

For such entrepreneurs, a special form 1-IP (trade) is provided. Should an individual entrepreneur applying NAP submit Form No. 1-IP to the territorial statistics body? The answer to this question is in ConsultantPlus. Get trial demo access to the K+ system and access the material for free.

Important! Entrepreneurs engaged in retail trade in cars, motor vehicles and other types of transport are required to report in Form 1-IP.

The report must contain reliable information about the activities of the individual entrepreneur for the reporting period, types of activities and the average number of employees.

However, it should be remembered that the report in Form 1-IP is selective. If an individual entrepreneur is included in the inspection list for the reporting year, he receives a notification from Rosstat.

From personal experience! To be sure that all reports are submitted on time and you do not face penalties, we recommend that you regularly check the lists of forms that must be submitted in a particular reporting period on the Rosstat website. This can be done in the “Reports” section. From experience, these lists are not always complete and reliable, therefore, in order to avoid misunderstandings with statistical authorities, we advise you to upload data indicating the date the report was generated. From practice: a saved list of reports with deadlines is accepted by the court as evidence in the event of challenging fines imposed on taxpayers.

How to fill out 1-IP for 2022

In 2022, entrepreneurs fill out the form with indicators for the previous 2022, since it is annual. Note that there is also a monthly form, but it has the name 1-IP (month) and a different OKUD code.

When filling out, you should be guided by the relevant instructions from Order No. 462, given in the same Appendix 10.

The form consists of a title page and a main part consisting of questions that the entrepreneur must answer.

Title page

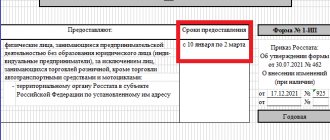

It is standard for all statistical reports. It contains the name of the form itself, the date and number of orders, the person who approved it and made changes, as well as the submission periods. For 1-IP, a sample of such a period looks like this:

That is, sending to the statistical authorities must be done in the period between the two reflected dates.

The entrepreneur needs to indicate information about himself on the title page:

- mailing address;

- FULL NAME.;

- OKPO;

- TIN.

There is also a space provided for the signature of the entrepreneur.

Main section

Includes five questions regarding the activities of an individual entrepreneur for 2022.

Question 1

The answer to the question can only be one of the proposed options: either “YES” or “NO”.

If the “YES” option is selected, the respondent goes straight to question 3.

If “NO”, then go to question 2, and questions 3, 4, and 5 will remain unanswered.

Question 2

There are also two options available here - “YES” or “NO”. After selecting the desired answer, the survey is completed.

If an entrepreneur is both employed and engaged in business activities, he will fill out a report for all sections regarding his business.

Question 3

The answer must be presented as a numerical indicator expressed in thousand rubles. and reflecting the amount of income from the sale of goods (works, services). This indicator must include the amount of taxes (VAT, excise taxes, etc.) presented to the buyer/customer.

The answer should be 0 if the entrepreneur carried out activities in 2021, but did not receive any income from it.

Question 4

Here, the areas of business that the individual entrepreneur was engaged in in the previous year are listed in as much detail as possible. In addition to the name of the type of activity itself, opposite each of them in line 4.1, it is necessary to indicate the share of revenue in the total amount of funds received for the year, as well as the corresponding OKVED code 2.

After summing up all the shares, the compiler should get 100%.

Question 5

The answer to this question is divided into three parts. Line 5.1 indicates the average number of partners involved in the business of the reporting entrepreneur, line 5.2 - helping family members, line 5.3 - employees.

The average number of persons for each category is found in two stages:

- The number of persons working in each calendar month is summed up, including those temporarily absent (sick, on vacation, etc.).

- The resulting amount is divided by 12 or by the number of months in which the activity was carried out, if the entrepreneur did not work for a full year. Indicators are rounded to whole numbers according to rounding rules.

To complete the form, you must understand all the terms used in the question. Their explanation is given in the instructions for filling out the form.

The completion of the report is completed by the signature of the person responsible for the presentation of statistical data, indicating his position, full name, contact telephone number, email address and date of compilation.

To make it easier for readers to navigate the report and the explanations provided, we suggest viewing a sample of filling out Form 1-IP, prepared by specialists on our website. You can download it for free from the link below:

To check the correctness of entering data into the report, Rosstat employees use the following control ratios:

- If the answer is “No” to question 1, the answer to question 2 must be given.

- A completed answer to question 3 means that the answer to question 1 was “Yes.”

- The sum of the indicators entered in the lines of column 4.1 should be equal to 100.

- If column 4.1 is completed, then the answer to question 3 must be completed and vice versa.

Procedure and example of filling out the form

Form 1-IP consists of two parts. The first contains general information for those filling out, positions for entering personal (personal) data of the individual entrepreneur, as well as the statistical code of the individual entrepreneur - according to OKPO and the tax number of the individual entrepreneur - INN. The second part is a questionnaire with questions.

You can download the current 2022 form to fill out here.

Photo gallery: Form No. 1-IP

Annual form 1-IP is submitted to Rosstat at the official request of the latter

In the second part of Form 1-IP, the entrepreneur must indicate whether he carried out activities, what kind of activities he had and what the volume of revenue was.

The number of partners of a businessman in the reporting period is also of interest to statistical authorities.

Filling rules

Instructions for completing Form No. 1-IP are set out in Appendix No. 14 to Rosstat Order No. 541 dated August 21, 2017. You can read them in detail by following the link.

Fill out the form manually or using a printing device. The information is entered in the appropriate fields of the form. Corrections, additions, and deletions are prohibited. It can only be filled out on the prescribed form. Forms are available free of charge at Rosstat departments.

Filling out the first part:

- In the “Postal address of an individual entrepreneur” field, indicate the original place of residence, even if it does not coincide with the place of registration.

- In the “Individual Entrepreneur” field, enter the last name, first name and patronymic of the individual entrepreneur and sign.

- In the corresponding columns of the table with which the first part ends, enter the code according to OKPO and TIN.

Filling out the second part:

- When answering the first and second questions, you need to put an “x” in the appropriate boxes.

- In the second question, if the main activity (bringing the largest share of income) is carried out not at the place of registration, the entity in which it was carried out is entered in a special field.

- When answering the third question, the amount of revenue from all types of income in thousands of rubles is indicated on the line. Payments actually received in the reporting year are taken into account. If there was no revenue, they put zero.

Determining the amount of revenue depends on various factors.

Table: features of revenue calculation

| No. | Factors influencing the calculation of the amount of revenue | How is revenue determined? |

| 1 | Amounts of taxes (value added tax, excise taxes and other similar payments) presented to the buyer (acquirer) of goods (works, services) | Amounts are added to the revenue amount |

| 2 | Payment was received in kind, i.e. in the form of goods (work, services) and other property | The amount of revenue is determined based on the transaction price |

| 3 | The transaction price has not been determined | the amount of revenue is determined by the cost of goods (work, services) and other property received, calculated at their market prices |

| 4 | It is impossible to establish the cost of goods (work, services) received and other property | The amount of revenue is determined based on prices for similar goods (work, services) sold under comparable circumstances |

| 5 | Activities were carried out, but there was no revenue | Put "0" |

| 6 | Revenue from retail trade (sale of goods purchased for resale to the public), excluding trade in motor vehicles and motorcycles | Information about such revenue is not included in Form No. 1-IP |

When answering the fourth question, the types of activities carried out and the goods produced are entered in the rectangles on the right, and the shares of these products in total revenue are indicated next to them. Each type of activity and product produced corresponds to one rectangle. The sum of all specified shares must be 100%.

When answering the fifth question, enter information about the number of employees by group in the designated spaces:

- in clause 5.1 - about partners;

- in paragraph 5.2 - about helping family members;

- in paragraph 5.3 - about hired workers.

Table: characteristics of employee groups

| No. | Group of workers | Who applies | Notes |

| 1 | Partners | Persons who participate in a business on the terms of a property or other contribution and perform certain work in this business (may or may not be members of the same household) | Partners do not include persons who do not work for the individual entrepreneur |

| 2 | Helping family members | Persons who work as assistants in a business owned by a household member or relative | – |

| 3 | Wage-earners | Persons who perform work for hire for compensation (cash or in kind) on the basis of a written contract or oral agreement. | Hired employees are not individual entrepreneurs who pay taxes and have entered into a civil law agreement and/or have a patent taxation system |

The form indicates the average number of persons working in the reporting year for each group. To calculate the average number for a group, add up the number of people who worked in each calendar month, including those temporarily absent (sick, on vacation, etc.), and divide:

- by 12, if the reporting individual entrepreneur worked for a full year;

- for the number of months of work of an individual entrepreneur, if he worked for less than a year.

The results obtained are rounded to whole numbers according to general mathematical rules.

At the bottom of the form, the person responsible for the accuracy of the information signs and indicates his contact information, entering them in the indicated place.

Sample filling

It's no secret that 2022 is over. Let's fill out form 1-IP from Pyotr Ivanovich Nektov (fictitious person).

Conditions for filling out the form

Let's assume that on December 28, 2022 Nektov P.I. received a letter from Rostat with form No. 1-IP for submission to statistics.

Pyotr Ivanovich received notification of the submission of form No. 1-IP

Entrepreneur P.I. Nektov assigned TIN: 4709ХХХХХХХХ; OKPO: XXXXXXXXXXX. Ivan Petrovich carried out activities at the address: 187700, Leningrad region, city of Lodeynoye Pole, Gagarin street, building 77, has a telephone number 8 (21364) 33251. In 2022, Pyotr Ivanovich manufactured kitchen furniture based on individual orders from area residents. Sales revenue received in 2022 amounted to 100,000 rubles.

Actions after receiving the letter

Let us assume that IP Nektov P.I. delivered a letter from Rostat regarding the submission of Form No. 1-IP for 2022 on February 20, 2022. To make sure that the report was required, he opened the Rosstat website and performed the operations described in the subsection of the article “How to make sure that submission is required.” Having walked through the Petrostat website on February 20, 2022, IP Nektov P.I. in the list of Leningrad region entrepreneurs required to submit the form, I found my TIN and OKPO. After that, I started filling out the form on my home computer. I copied the form from the ConsultantPlus legal system, opening in it the Rosstat order indicated in the presented sample.

First part of the form

In the first part of the form Pyotr Ivanovich:

- typed: 187700, Leningrad region, city of Lodeynoye Pole, Gagarin street, building 77;

- Nektov Pyotr Ivanovich;

- XXXXXXXXXXXX;

Information filled in by the entrepreneur is indicated in blue.

Second part of the form

The second part of the form is filled out by the entrepreneur as follows:

- When answering the first question, Ivan Petrovich put an “X” next to the word yes; he did not answer question 1.1.

- Answering the second question, Ivan Petrovich put an “X” next to the word yes.

- When answering the third question, he entered: 100 thousand rubles.

Examples of the individual entrepreneur's response are filled in blue

- Answering the fourth question, Ivan Petrovich entered “Manufacture of kitchen furniture for individual orders” and indicated that the share was 100%.

- I put dashes in paragraphs 5.1, 5.2 and 5.3 because I worked alone.

- Below, I once again entered my last name, first name, patronymic, signed, indicated the telephone number and date of completion.

Information submitted on behalf of the individual entrepreneur is entered in blue.

How and when should you report?

From January 1, 2022, all entities, without exception, are required to submit reports electronically. Before this date, small businesses had the right to report on paper. Thus, all entrepreneurs will have to send Form 1-IP electronically via TKS.

Previously, Rosstat orders approved specific deadlines for submitting reports. From January 1, 2022, in accordance with Rosstat order No. 925 dated December 17, 2021, time periods have been defined during which reports, including 1-IP, must be included in statistics. For our report, this period begins on January 10 and ends on March 2, 2022.

We invite you to familiarize yourself with the full calendar for submitting statistical reporting for 2022, compiled by K+ experts. To view help information, sign up for a free trial access to the system.

Is there liability for failure to submit the form?

Responsibility is provided for any violation in terms of reporting to regulatory authorities. Statistical reporting is no exception. Thus, for failure to submit or untimely submission of Form 1-IP to statistics for 2022, an entrepreneur will be fined under Art. 13.19 Code of Administrative Offenses of the Russian Federation. This article provides for two types of fines:

- for a primary violation - from 10 to 20 thousand rubles. for an individual;

- for repeated violation - from 30 to 50 thousand, also for an individual.

NOTE! Article 13.19 of the Administrative Code contains fines for legal entities, but we do not consider them, since legal entities do not report in the agreed form.

Considering the size of the fine, it is very important for entrepreneurs to report on the form in a timely manner.

Results

Statistical form 1-IP must be submitted to the statistical authorities by all individual entrepreneurs included in the sample. The report for last year must be submitted electronically between January 10 and March 2, 2022. Failure to do so will result in extremely unpleasant consequences in the form of a fine.

In the article, we analyzed all the questions asked to respondents, identified the control ratios by which the correctness of filling out the form will be checked, and also provided a sample of filling out 1-IP for 2022.

Sources: Code of Administrative Offenses of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.