Inevitable Document

Since 2016, the responsibilities of tax agents have expanded dramatically. Every quarter you have to submit reports on form 6-NDFL. As soon as it arrives at the inspectorate, tax officials immediately begin to study it. Moreover, this happens within the framework of desk control, on the premises of the Federal Tax Service. That is, the presence of a representative of the company that submitted the next payment is not expected.

The problem is that during such an audit, the inspection specialist, while studying your reporting, may have questions about filling it out. And only a tax agent can remove them. But it’s better to be able to predict such situations. When, for example, due to an error in 6 personal income tax, explanations to the tax office could immediately clarify the company’s position and its reputation as a conscientious tax agent.

We will talk about the most common such situations below and along the way we will give an example of explanations to the tax office for 6 personal income tax . The form and content of this calculation appendix are not regulated in any way by law. Therefore, freedom of creativity is already your trump card. But I think that the approach to this document should be approximately the same when giving explanations as part of a tax audit.

Discrepancies between 2-NDFL and 6-NDFL

Expert consultation

When preparing reports for submission to the Federal Tax Service, you need to check them against control ratios. The correctness and correctness of filling is checked by comparing certain calculation indicators. Our expert Nadezhda Chetvergova examined the control ratios (possible discrepancies and the reasons for their occurrence) between Appendix No. 1 to the calculation in form 6-NDFL and form 6-NDFL.

***

Let us remind you that the 2-NDFL certificate has been canceled from reporting for 2022, but it has not disappeared completely.

Now information on the income of individuals of the expired tax period and the amounts of tax calculated, withheld and transferred to the budget system of the Russian Federation for this tax period for each individual, for 2022 and subsequent tax periods, is submitted by tax agents to the tax authority as part of the calculation for Form 6-NDFL, approved by order of the Federal Tax Service of Russia dated October 15, 2020 N ED-7-11/ [email protected] , in the form of Appendix No. 1 “Certificate of income and tax amounts of an individual” (hereinafter referred to as Appendix No. 1 to the calculation according to the form 6-NDFL). Appendix No. 1 to the calculation in form 6-NDFL will be filled out only as part of the annual report in form 6-NDFL; for the 1st quarter, half a year and 9 months this appendix is not filled out.

Typical situations in the ConsultantPlus legal reference system will allow an accountant to quickly resolve issues that he encounters on a daily basis.

Let's start with the very first “discrepancy” - this is the very difference in reporting forms.

Unlike Appendix No. 1 to the calculation in form 6-NDFL, the calculation 6-NDFL shows the generalized amount of income, personal income tax, tax deductions for individuals, income recipients, in total amounts, without “depersonalization”.

So, let’s move on to the control ratios themselves, they were sent by Letter of the Federal Tax Service of Russia dated March 23, 2021 N BS-4-11/ [email protected]

When checking the final annual calculation in Form 6-NDFL, compare the generalized indicators of Section. 2 calculations with information reflected in certificates of income and tax amounts of an individual, namely, income in field 110 at the appropriate rate must be equal to the sum of the fields “Total amount of income” section. 2 at the same rate for all completed certificates.

If it is not equal, this may indicate that you incorrectly reflected the amount of accrued income.

Need to check:

- field 110 - whether you have reflected all income at this rate for the period. In case of discrepancies, add missing ones, delete unnecessary ones;

- certificates of income and tax amounts of an individual - are the fields “Total amount of income” section filled out correctly for each taxpayer? 2 at the corresponding rate.

The indicator of tax deductions given in field 130 of section. 2, must be equal to the sum of the indicators of the lines “Deduction amount” section. 3 all completed certificates and indicators of the lines “Deduction amount” of the Appendices to the certificates.

***

We have considered only part of the relationships related to Appendix No. 1 to the calculation in form 6-NDFL and the calculation itself in form 6-NDFL. And there are many more of them.

The ConsultantPlus legal reference system will help you fill out the calculation for 6-NDFL correctly (correctly), in it you will find step-by-step instructions for filling out with examples:

Typical situation: How to fill out 6-NDFL for 9 months of 2022 (Glavnaya Kniga Publishing House, 2021) {ConsultantPlus}

Typical situation: 6-NDFL for 9 months of 2022: examples of filling out (Glavnaya Kniga Publishing House, 2021) {ConsultantPlus}

Typical situation: How to check 6-NDFL using control ratios (Glavnaya Kniga Publishing House, 2021) {ConsultantPlus}

Ready-made solution: How to submit Form 6-NDFL (ConsultantPlus, 2021) {ConsultantPlus}

Question

What control ratios need to be checked when reflecting dividends in 6-NDFL?

Answer

The answer to this question can be found in the control ratios themselves (Letter of the Federal Tax Service of Russia dated March 23, 2021 N BS-4-11/ [email protected] ).

Fragment on dividends:

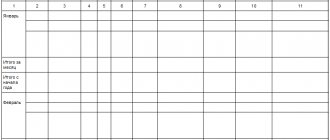

| Form KS | |||||

| source documents | reference ratio (CR) | in case of failure to comply with the CC: | |||

| N p/p | KS <1> | possible violation of the Legislation of the Russian Federation (link) | wording of the violation | inspector's actions | |

| 1 | 2 | 3 | 4 | 5 | 6 |

| 6-NDFL | 1.8 | line 111 = the amount of income in the form of dividends (according to income code 1010) of Appendix No. 1 to 6-NDFL, submitted for all taxpayers by this tax agent (ratio applies to 6-personal income tax per year) | Art. 126.1, Art. 226, art. 226.1, Art. 230, art. 23, art. 24 Tax Code of the Russian Federation | if line 111 <,> the amount of income in the form of dividends (according to income code 1010) of Appendix No. 1 to 6-NDFL, presented for all taxpayers by this tax agent, then the amount of accrued income in the form of dividends is under/overestimated | In accordance with paragraph 3 of Art. 88 of the Tax Code of the Russian Federation, send a request to provide explanations or make appropriate corrections within five working days. If, after considering the provided explanations and documents, or in the absence of explanations, the NA establishes a violation of the legislation on taxes and fees, draw up an inspection report in accordance with Art. 100 Tax Code of the Russian Federation. |

Thus, if you paid dividends, make sure that the field indicator is 111 section. 2 is equal to the total amount of dividends (according to income code 1010) reflected in income certificates, if line 111 <,> the amount of income in the form of dividends (according to income code 1010) of Appendix No. 1 to 6NDFL, presented for all taxpayers by this tax agent, is underestimated /the amount of accrued income in the form of dividends is overstated.

Nadezhda Chetvergova, leading economist-consultant at Chto Delat Consult LLC

Using the example of a small commercial organization, we looked at how to prepare the base of the 1C: Enterprise Accounting 8.3 program for reporting, how to carry out basic regulated accounting reports, and find and correct possible errors.

Towards zero settlement

It has already become an established practice that Form 6-NDFD with zero columns does not need to be sent to the inspectorate. Meanwhile, this does not prevent the inspection from asking why you did not submit the calculation. And it's better to answer. Moreover, sometimes it makes sense to proactively submit such a letter.

On our website, you can view and download a sample explanation to the tax office for 6 personal income tax , if during the reporting period the company did not pay income and did not withhold tax, you can here:

Sample explanations on 6-NDFL for the tax office

Let's take a closer look at the most common cases of explanations to the tax office regarding the calculation of 6-NDFL with samples of filling out:

- organizations that did not start operations in the reporting period:

- delivery of zero calculation:

- detection of errors in indicators in the calculation of 6-NDFL:

To calculations with errors

The second type of most common situation in which you can’t get away with 6-NDFL alone is when the inspectorate has requested comments from a tax agent and wants him to adjust the submitted calculation. This usually happens when a specialist from the Federal Tax Service has found obvious “jambs” in the calculation. Then it is absolutely in the interests of the tax agent to submit explanations to the tax office for errors 6 personal income tax .

Clause 3 of Article 88 of the Tax Code of the Russian Federation provides five working days for submitting updated reports. The law says nothing about any explanations. This means that there is no need to explain anything. At your discretion.

Other cases

Almost errors in the calculation of 6-personal income tax include possible discrepancies in the indicators. Especially sum ones. It is quite easy for inspectors and tax agents themselves to identify such flaws during desk audits. The control ratios approved by the tax service help with this (letter dated March 10, 2016 No. BS-4-11/3852).

EXAMPLE According to the explanations of the Federal Tax Service, the amount of personal income tax taken (p. 070), reduced by the tax that was returned (p. 090), cannot be more than the tax transferred on the company’s settlement card with the budget. Simply put:

Page 070 – page 090 ≤ KRSB

Otherwise, the tax authorities will consider that you withheld personal income tax, but did not contribute it in full to the budget. Your sample explanation to the tax office regarding 6 personal income tax can resolve the contradiction that has arisen. It is possible that you will have to reconcile the calculations with the budget.

Tax agents often make mistakes not in 6-NDFL, but in related documents. For example, such as a payment for the corresponding amount of tax according to the calculation. An incorrect OKTMO code leads to the fact that personal income tax is not received into the budget on time. In this case, a sample explanation to the tax office (including 6 personal income taxes ) may have the following content:

Also see “6-NDFL for 9 months of 2016: example of filling out”.

Explanations to the tax office: errors 6-NDFL

Before submitting 6-NDFL, the calculation must be checked for compliance with the control ratios (letter of the Federal Tax Service of the Russian Federation dated March 13, 2017 No. BS-4-11/4371). If this is not done, the camera will reveal, for example, a discrepancy between the 6-NDFL calculation data and the 2-NDFL certificates, or other violations due to which the calculation will not be accepted by the inspectorate. The list of main violations in form 6-NDFL was recently published by the Federal Tax Service of the Russian Federation in letter dated November 1, 2017 No. GD-4-11/22216.

A common reason for tax authorities to request clarification is a technical error in the calculation. The tax agent may make a simple typo that will distort the indicators and lead to logical inconsistencies. For example, when entering the amount of tax deductions, an extra zero was indicated, and as a result, the deductions exceeded the amount of income.

In addition to explanations to the tax office regarding 6-NDFL, a sample of which we provide, you must submit to the Federal Tax Service a corrected form with updated indicators.

To the Head of the Federal Tax Service of Russia No. 43 for Moscow

from Antares LLC

INN 7701111111/KPP 770000000

OGRN 12345678910111

Ref No. 12/34 dated 11/19/2017

Explanations

In response to your request No. 0001-111-33/222 dated November 15, 2017, we inform you of the following:

in the calculation we presented on form 6-NDFL for 9 months of 2017, a technical error was made - a typo, which resulted in a discrepancy: the amount of tax deductions on line 030 exceeded the amount of accrued income on line 020. Corrected calculation on form 6-NDFL for 9 months of 2022 submitted to the Federal Tax Service on November 19, 2017 (attached a copy).

Appendix: copy of the calculation in form 6-NDFL for 9 months of 2017

General Director Pavlov V.V. Pavlov