Is VAT paid under a simplified taxation system?

The answer to this question is given by Art. 346.11 of the Tax Code of the Russian Federation, according to the norms of which firms operating on the simplified tax system are not recognized as VAT payers, except in cases relating to:

- import of goods into the Russian Federation;

- tax specified in Art. 174.1 of the Tax Code of the Russian Federation (operations under simple partnership and trust management agreements).

In addition, VAT under the simplified tax system must be paid to “simplified” tax agents. They will have to do the same when they issue invoices to their partners that include VAT. Situations in which “simplified people” are considered tax agents are given in Art. 161 of the Tax Code of the Russian Federation: transactions of sale, purchase and lease of state property, acquisition of goods, works, services on the territory of Russia from foreign counterparties not registered with the Russian tax authorities.

For more details, see the material “Who is recognized as a tax agent for VAT (responsibilities, nuances)” .

For information on how to take into account “input” and “import” VAT under the simplified tax system, see the Ready-made solution from ConsultantPlus. Get trial access to K+ for free.

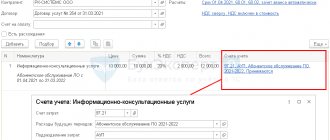

“Simplified” VAT accounting

Having received documents for the purchased goods from the supplier, an accountant of a company using the simplified tax system invariably asks the question: how to take into account input VAT? There are only two options. The first is to expense it. The second is to increase the cost of purchased assets by the amount of indirect tax. We partly examined this situation in the article “VAT – a cost or an expense?” in the November issue of last year. The Ministry of Finance of Russia undertook to fully clarify this situation in its letter dated November 4, 2004 No. 03-03-02-04/1/44.

VAT on expenses...

Indirect tax paid to the seller of goods, according to experts from the financial department, should be taken into account as expenses. This rule applies regardless of the purpose for which the assets were acquired: for resale or for one’s own needs. Let's see how financiers argue their position.

Argument one. A company operating under a simplified regime has the right to reduce its income by the amount of material expenses (subclause 5, clause 1, article 346.16 of the Tax Code of the Russian Federation). According to paragraph 2 of the same article, such costs are taken into account in the manner prescribed by Chapter 25 of the Code, namely Article 254 “Material costs”. It is also said here that the cost of inventory items included in expenses in tax accounting is taken “without taking into account the amounts of taxes that are subject to deduction or included in expenses in accordance with ... the code.”

Argument two. Financial department specialists recalled that in Chapter 26.2 “Simplified Taxation System” of the Tax Code there is a rule that directly indicates that input VAT can be attributed to expenses. This is subparagraph 8 of paragraph 1 of article 346.16. Let us quote him: “... the taxpayer reduces the income received by... the amount of value added tax on purchased goods (works, services).”

In addition, financial workers suggested that it is possible to take into account the amounts of indirect tax on the basis of subparagraph 22 of paragraph 1 of the same article 346.16 as “amounts of taxes... paid in accordance with the law...”. It's funny, but they used to have a completely different point of view. In a letter dated April 16, 2004 No. 04-03-11/61, specialists from the Ministry of Finance emphasized that on this basis it is possible to reduce the base for a single tax by “the amounts of only those taxes and fees from which organizations using the simplified taxation system are not entitled to pay.” released."

Summarize. If a company has purchased inventory items, input VAT does not need to be included in the purchase price. Because it is a separate expense. This means that the company must record it as a separate line in the book of income and expenses.

...and the cost

The situation is different when purchasing fixed assets. Employees of the Ministry of Finance indicated that in this case VAT should be included in their cost. Let us present their arguments.

It is known that under the simplified regime, the company has the right to reduce the income received by expenses for the acquisition of fixed assets. Subparagraph 1 of paragraph 1 of Article 346.16 allows you to do this.

The law on accounting states that enterprises using the simplified tax system take into account fixed assets in the manner prescribed by law (clause 3 of article 4). And according to this procedure, the initial cost of fixed assets “is recognized as the amount of actual costs... for acquisition... with the exception of value added tax and other refundable taxes” (clause 8 of PBU 6/01).

Experts from the financial department draw the following conclusion: “due to the fact that the amounts of value added tax paid upon the acquisition of fixed assets... by a taxpayer applying the simplified taxation system are non-refundable taxes, they are included in the cost of the acquired fixed assets.” Employees of the Ministry of Finance propose the same procedure for accounting for input VAT paid when purchasing intangible assets.

Let us note that the financiers' arguments are not without flaws. Their position is based solely on PBU standards. However, the first consideration should be the provisions of Code Section 346.16. Since it is she who determines the composition of costs for calculating the single tax. So, she allows the amount of taxes paid by the company (and the VAT transferred to the supplier) to be expensed. The Ministry of Finance admitted this in the first part of the letter.

Fear factor

It is obvious that inspectors will most likely use the Ministry of Finance’s clarifications in their work. Therefore, whether to follow them or not is ultimately up to you. It's all about the "price of the issue." Let me explain. As part of the cost of a fixed asset or as a separate item, VAT will in any case be included in expenses. But in the first case this will happen a little later - as soon as the main tool begins to be used. If you usually purchase property and put it into operation at the same time, it is better to listen to the opinion of financial workers and include input VAT in the purchase price. This way you are guaranteed to avoid conflicts with inspectors.

It’s another matter if you purchased the equipment, say, in March, but plan to use it only in April. Then an increase in its value can become fatal. Because as soon as the cost of fixed assets exceeds 100 million rubles, you can say goodbye to the right to a special regime.

opinion

IN AND. Meshcheryakov, author of the book “Annual Report 2004”:

“A simplified company should not increase the purchase price by the amount of input VAT. The capital’s Federal Tax Service also agrees with this (letter dated January 13, 2004 No. 21-09/01610). However, in order to attribute the indirect tax to expenses, it put forward a condition: the company must receive an invoice from the seller. In other words, a company that does not need a tax deduction should require a document intended specifically for this purpose. Absurd. Firstly, the Tax Code does not mention this condition. Secondly, the Ministry of Finance did not mention it either. And thirdly, an invoice is not a basis for attributing VAT to expenses.”

R. Yaroshenko, tax lawyer

Simplified Taxation System and VAT: purchase from a foreign person on the territory of the Russian Federation

entered into an agreement with a foreign manufacturer for the purchase of materials, while the sale of materials is carried out on the territory of the Russian Federation. What will happen to VAT in this case? It depends on whether the “foreigner” has a permanent establishment in the Russian Federation. A Russian company should pay VAT under the simplified tax system only if there is no such representative office. In this case, the Russian buyer is a tax agent who, in accordance with paragraphs. 1 and 2 tbsp. 161 of the Tax Code of the Russian Federation, is obliged to withhold VAT from the foreign counterparty and pay it to the budget.

Example

A Russian company, using the simplified tax system, entered into a contract with a foreign seller who does not have a permanent representative office in Russia for $12,000, including VAT. The contract is executed on the territory of the Russian Federation. In this case, the Russian company needs to withhold VAT from the “foreigner” under the simplified tax system in the amount of $2,000 and transfer it to the budget, and pay the remaining $10,000 for purchases.

To summarize: a “simplified” seller is required to pay VAT if the place of transaction is the Russian Federation and foreign sellers do not have the independent ability to pay VAT due to the fact that they do not have a permanent establishment in the Russian Federation.

For information on the procedure for deducting VAT withheld by a tax agent, read the article “How can a tax agent deduct VAT when purchasing goods (work, services) from a foreign seller.”

List of persons recognized as tax agents for VAT (Article 161 of the Tax Code of the Russian Federation)

In accordance with Art. 161 of the Tax Code of the Russian Federation, a person (organization or individual entrepreneur) registered with the tax authorities is recognized as a tax agent for VAT if it:

- purchases goods (work, services) from a foreign person who is not registered as a taxpayer on the territory of the Russian Federation, with the purpose of their subsequent sale on the territory of the Russian Federation (clauses 1 and 2 of Article 161 of the Tax Code of the Russian Federation);

- carries out transactions (rent, purchase, transfer) with property owned by government bodies of the Russian Federation, constituent entities, municipalities and local governments (clause 3 of Article 161 of the Tax Code of the Russian Federation);

For more details, see the material “Tax agent for VAT in transactions with state property .

- sells property by court decision (clause 4 of article 161 of the Tax Code of the Russian Federation);

- sells confiscated property, ownerless and purchased valuables, treasures and valuables belonging to the state by right of inheritance (clause 4 of Article 161 of the Tax Code of the Russian Federation);

- conducts intermediary activities in the sale of goods (works, services, property rights) and participates in settlements with foreign persons who are not registered as taxpayers on the territory of the Russian Federation (clause 5 of Article 161 of the Tax Code of the Russian Federation);

- from 01.10.2018 - when providing railway rolling stock or containers on the territory of the Russian Federation on the basis of contracts of assignment, commission or agency agreements (clause 5.1 of Article 161 of the Tax Code of the Russian Federation);

- owns the vessel on the 46th calendar day after the transfer of ownership of it, if it was not registered in the Russian International Register of Ships within 45 days from the date of transfer of ownership (clause 6 of Article 161 of the Tax Code of the Russian Federation);

- from 01/01/2018 - buyers of raw animal skins, scrap and waste of ferrous (non-ferrous) metals, secondary aluminum and its alloys (Clause 8 of Article 161 of the Tax Code of the Russian Federation);

- from 01/01/2019 - buyers of waste paper (clause 8 of article 161 of the Tax Code of the Russian Federation).

Persons who apply special tax regimes (Unified Agricultural Tax, Simplified Taxation System, PSN) or persons exempt from paying VAT under Art. also work as tax agents for VAT. 145 and 145.1 of the Tax Code of the Russian Federation (Article 161 of the Tax Code of the Russian Federation, see also letters of the Ministry of Finance of Russia dated December 30, 2011 No. 03-07-14/133, October 5, 2011 No. 03-07-14/96, June 28, 2010 No. 03-07 -14/44, 06/22/2010 No. 03-07-08/181, 05/26/2010 No. 03-07-14/38 and 04/29/2010 No. 03-07-14/30).

VAT when working on the simplified tax system: is there a tax when renting state property?

In the case of leasing state property, in accordance with clause 3 of Art. 161 of the Tax Code of the Russian Federation, the tenant will have to pay VAT under the simplified tax system. In this case, the tax base will correspond to the amount of rent including VAT. Moreover, the need to pay tax does not depend on whether the payment in the agreement with the lessor is indicated with VAT or without it: if the price is indicated without VAT, the “simplified” will need to charge a tax on top of it and pay it to the budget.

See also the material “The Federal Tax Service reminded when the duties of an agent do not arise when renting government property .

VAT accounting under the simplified tax system for fixed assets and intangible assets

In accordance with paragraph 3 of Art.

346.16 of the Tax Code of the Russian Federation, expenses on fixed assets and intangible assets, and therefore input VAT, are recognized in equal shares from the moment the fixed asset object is put into operation or intangible assets are registered. At the same time, fixed assets that are subject to state registration are taken into account in expenses from the moment of documentary confirmation of the submission of documents for registration of rights. However, in order to be able to reflect these VAT amounts in accounting, it is necessary to comply with the requirements of sub. 4 paragraphs 2 art. 346.17 Tax Code of the Russian Federation:

- fixed assets and intangible assets must be used in business activities;

- fixed assets and intangible assets must be paid for.

If you are planning to sell fixed assets, we recommend that you familiarize yourself with the material “Simplified OS sales have been waiting for 3 years .

Simplified VAT when purchasing state property

When selling state property, the tax base, according to clause 3 of Art. 161 of the Tax Code of the Russian Federation, corresponds to the amount of income from the sale including VAT. In this case, it is not the seller of state property who must pay the tax, but its buyer, who is recognized as a tax agent. It is he (in this case, the “simplified” buyer) who is obliged to calculate VAT under the simplified tax system, withhold it from income payable, and transfer it to the budget.

However, sub. 12 paragraph 2 art. 146 of the Tax Code provides the opportunity for a “simplified” buyer not to withhold VAT on the income of the seller of state property if the conditions for the purchase of state and municipal property established by Art. 3 of the Law of the Russian Federation “On the peculiarities of the alienation of real estate in state ownership...” dated July 22, 2008 No. 159-FZ:

- As of July 1, 2015, the property rented by the simplifier had already been leased to him for at least 2 years.

- He has no arrears of rent or other related payments (fines, penalties).

- The property is not included in the approved list of property intended for rental and free from the rights of third parties.

- On the day of concluding the repurchase agreement, the simplifier is listed in the register of small and medium-sized businesses.

Issuing an invoice with VAT instead of a document without VAT

There are cases when a “simplifier”, at the request of the buyer, issues an invoice in which he indicates VAT, although he is exempt from it. By doing this, he does himself a disservice: as a result, he will have to not only pay the VAT allocated in the invoice, but also submit a VAT return to the simplified tax system.

If the simplifier still decides to issue VAT invoices, then you should remember that the form has recently changed. This is due to the fact that the experiment on the traceability of goods has ceased to be an experiment and has become mandatory for those who import and sell certain types of goods. At the same time, all VAT taxpayers, as well as special regimes, are required to use the new invoice forms.

You can download the updated invoice form by clicking on the image below:

ConsultantPlus experts have prepared step-by-step instructions for preparing each line of the updated invoice. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

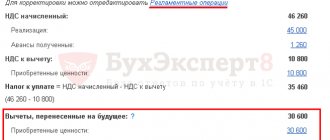

How to account for output VAT

Enterprises and individual entrepreneurs using the special simplified tax system “income minus expenses” (it is also called the simplified tax system 15% - according to the difference tax rate) do not charge VAT on sales (clauses 2, 3 of article 346.11 of the Tax Code of the Russian Federation).

They do not have “outgoing” VAT and are not required to calculate and pay it. Except for the case when the simplified person pays customs VAT. For more information about the simplified tax system option under consideration, read this article.

NOTE! The application of the simplified tax system retains the obligation of the simplifier in terms of tax agency for VAT (Article 161 and paragraph 5 of Article 346.11 of the Tax Code of the Russian Federation).

In practice, there are situations when the payer of the simplified tax system of 15% needs to issue the primary invoice to the buyer indicating VAT, then:

- the tax indicated in the documents must be paid;

- you need to generate a VAT return (for the period of issuing documents with the allocated tax) and submit it to the Federal Tax Service (Articles 173, 174 of the Tax Code of the Russian Federation).

NOTE! From 01/01/2016, “outgoing” VAT amounts are no longer required to be included in income, as was previously the case (law of 04/06/2015 No. 84-FZ, letter of the Ministry of Finance dated 08/21/2015 No. 03-11-11/48495). But it will not be possible to include such VAT in expenses (subclause 22, clause 1, article 346.16 of the Tax Code of the Russian Federation).

For more information about the rules for accounting and paying VAT on the simplified tax system, read: “VAT under the simplified tax system: in what cases to pay and how to take into account the tax in 2022 - 2021” .

Accounting for “output” VAT with a simplified tax system of 15% is not very difficult, but with “input” VAT questions may arise.

ConsultantPlus experts explained in detail how to correctly account for VAT under the simplified tax system:

Get trial access to the K+ system and upgrade to the Ready Solution for free.

VAT under the simplified tax system in 2021-2022

In 2021-2022, there are no innovations in terms of VAT when applying the simplified tax system. In this case, you need to remember the following.

1. “Simplified” companies can enter into a written agreement with their counterparties not to issue invoices to them.

2. “Simplers” are required to reflect in the VAT return the information contained in the issued invoices.

3. Intermediaries who are not tax agents working for the simplified tax system, when receiving or issuing invoices, are required to send a journal of invoices to the Federal Tax Service by the 20th day of the month following the reporting month.

For more information about the accounting journal, see our material “ Invoice journal - sample ” .

Results

An organization or individual entrepreneur using the simplified tax system is not a VAT payer, with the exception of operations for the import of goods and trust management.

However, simplifiers can act as tax agents, performing duties to withhold VAT from taxpayers when carrying out transactions specified in Art. 161 of the Tax Code of the Russian Federation, its payment to the budget. Also, the obligation to pay VAT arises for “simplified” companies when issuing invoices with an allocated tax amount. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Sale of foreign goods (works, services, property rights) by an intermediary

An intermediary participating in settlements and selling in Russia goods (work, services), property rights owned by a foreign company that is not registered with the tax authorities is required to act as a tax agent (Clause 5 of Article 161 of the Tax Code of the Russian Federation).

The intermediary must remit VAT on all sales proceeds. In this case, the tax must be calculated at the regular rate, not the estimated rate. The calculation will be like this:

| Amount of VAT payable | = | Cost of sold property (excluding VAT) | × | 10 or 18% |

Paragraph 15 of Article 167 of the Tax Code states:

“For tax agents specified in paragraphs 4 and 5 (this paragraph refers to intermediary firms selling goods to foreigners. - Ed.) Article 161 of this code, the moment of determining the tax base is determined in the manner established by paragraph 1 of this article ( This paragraph talks about the general procedure for determining the tax base (after receipt of money or shipment of goods. – Ed.).”

This means that the intermediary must “determine the tax base” and calculate the tax based on the earliest date:

- receipt of advance payment from the buyer;

- shipment of goods.

After receiving the prepayment, the tax agent must pay VAT based on the amount actually received.

If the intermediary did not receive the advance payment and transferred the goods to the buyer, then the tax must be calculated in the quarter in which the shipment took place. The moment of receipt of money for the sold goods does not matter.

Use the online calculator to calculate VAT

EXAMPLE In March, the German company Werbung instructed JSC Aktiv to sell its goods in Russia.

Werbung is not registered with the Russian tax office. This means that Aktiv must pay VAT to the budget for a German company. The cost of goods transferred for sale is 100,000 rubles. (without VAT). The amount of intermediary remuneration is 10,000 rubles. “Active” must sell the goods for 118,000 rubles. (RUB 100,000 + RUB 100,000 × 18%). Of this amount, 18,000 rubles. (RUB 100,000 × 18%) the Russian company must transfer to the budget as a tax agent. In March, the intermediary found a buyer who agreed to buy the goods. “Aktiv” applies a simplified taxation system. In this case, the amount of VAT transferred to the budget is a “simplified” agent » cannot be taken into account as part of “tax” expenses. The fact is that Article 346.16 of the Tax Code allows the amount of input VAT paid for purchased goods, works or services, the cost of which is also included in expenses, to be reflected in expenses. In our situation, the “simplifier” does not acquire, but, on the contrary, sells the goods of a foreign principal. “Aktiv” should also not include in income the money received from buyers for the goods sold (the intermediary is involved in the settlements). After all, Article 346.15 of the Tax Code states that “simplifiers” do not take into account in their income the amounts listed in Article 251 of the Tax Code. Among others, the money received by the intermediary from buyers for the sold goods of the principal is mentioned here. But the amount of his intermediary remuneration (10,000 rubles) “Asset” must be taken into account as part of income. Situation 1

In March, the Aktiva account received a 50% prepayment from the buyer in the amount of 59,000 rubles.

(including VAT - 9000 rubles). The company shipped the goods to the buyer in April. At the end of the first quarter, Aktiv must pay VAT for the German company on the prepayment amount. It is equal to 9000 rubles. (RUB 59,000 × 18%: 118%). After shipment of the goods, “Active” will charge VAT on the entire cost of the sold batch (18,000 rubles) and at the same time deduct VAT on the amount of the advance received (9,000 rubles). Situation 2

In March, Aktiv shipped goods to the buyer for 118,000 rubles. (including VAT - 18,000 rubles). In May, money was received from the buyer. In this case, transfer tax to the budget in the amount of 18,000 rubles. “Asset” is also due at the end of the first quarter.

The procedure for paying VAT by an intermediary selling goods to a foreigner who is not registered for tax purposes in Russia is described in the “STS in Practice” guide.