Let’s study how “simplified” people should take into account input VAT in 1C 8.3 Accounting 3.0 when goods, works, services are purchased from an organization with OSNO. At the same time, primary documents were received from the supplier with allocated VAT, including an invoice. Let's look at how to deal with this situation in more detail.

Despite the fact that taxpayers under the simplified tax system must submit all Purchase Books and all Sales Books as part of the Declaration, there is no need to report VAT if an invoice with allocated VAT is received. Only those “simplifiers” who are intermediaries report VAT. Otherwise, if the organization is a simple “simplified” organization and receipt documents with VAT are received, then there will be no reflection in the VAT Declaration or filling out the Purchase Book and Sales Book.

Is VAT paid under a simplified taxation system?

The answer to this question is given by Art. 346.11 of the Tax Code of the Russian Federation, according to the norms of which firms operating on the simplified tax system are not recognized as VAT payers, except in cases relating to:

- import of goods into the Russian Federation;

- tax specified in Art. 174.1 of the Tax Code of the Russian Federation (operations under simple partnership and trust management agreements).

In addition, VAT under the simplified tax system must be paid to “simplified” tax agents. They will have to do the same when they issue invoices to their partners that include VAT. Situations in which “simplified people” are considered tax agents are given in Art. 161 of the Tax Code of the Russian Federation: transactions of sale, purchase and lease of state property, acquisition of goods, works, services on the territory of Russia from foreign counterparties not registered with the Russian tax authorities.

For more details, see the material “Who is recognized as a tax agent for VAT (responsibilities, nuances)” .

For information on how to take into account “input” and “import” VAT under the simplified tax system, see the Ready-made solution from ConsultantPlus. Get trial access to K+ for free.

Accounting for input tax in expenses

Input added tax is the amount added by the supplier (performer) to the cost of valuables, services, and work. If the buyer company operates in the main mode, then this tax can be reimbursed by reducing the VAT payable by its amount. A simplified company will not be able to reimburse the tax, since such an economic entity is not recognized as a payer of the tax in question.

It is allowed to take into account the paid added tax in expenses that reduce the tax base. This operation must be performed in the same quarter in which expenses include the cost of acquisitions, services of various types, and work. It is impossible to take into account inventory items, fixed assets, services, and work at a cost that includes tax. It is necessary to take into account the tax separately, including it in expenses as a separate operation.

Article 346.17 determines the time frame within which a simplifier can take into account the input added tax paid to the supplier in his expenses. The following terms vary depending on the type of acquisition:

- Upon sale - in relation to paid assets acquired for resale;

- Upon receipt - in relation to paid material assets, raw materials, services, works;

- Upon the start of operation - in relation to purchased and paid for operating systems.

An important condition is that only paid VAT can be included in expenses under the simplified tax system.

The added tax must be transferred to costs and operations related to the import of valuables. The simplifier cannot reimburse such additional tax, despite the fact that the subject is obliged to pay it under the simplified tax system.

If the additional tax relates to standardized advertising expenses, then it can be included in expenses within the limits of a certain standard. Input tax above this standard cannot be taken into account in costs.

VAT cannot be classified as an expense for tax purposes if the cost of goods and materials for which it was paid is also not included in the expenses taken into account when calculating the tax burden. An example of such expenses is entertainment expenses.

To write off VAT as an expense, you need to wait until the goods are sold (materials are capitalized or fixed assets are put into operation). When tax is written off on goods purchased for resale, the moment of their actual sale should be taken into account. In this case, the attribution of tax to expenses must be carried out in a part proportional to the cost of the realized values.

What has been written above is true for those simplifiers who take into account the difference between income and expense values to calculate the tax burden. If only income is taxed, then there is no point in taking into account expenses, and therefore there is no need to classify paid input VAT as expenses.

Simplified Taxation System and VAT: purchase from a foreign person on the territory of the Russian Federation

entered into an agreement with a foreign manufacturer for the purchase of materials, while the sale of materials is carried out on the territory of the Russian Federation. What will happen to VAT in this case? It depends on whether the “foreigner” has a permanent establishment in the Russian Federation. A Russian company should pay VAT under the simplified tax system only if there is no such representative office. In this case, the Russian buyer is a tax agent who, in accordance with paragraphs. 1 and 2 tbsp. 161 of the Tax Code of the Russian Federation, is obliged to withhold VAT from the foreign counterparty and pay it to the budget.

Example

A Russian company, using the simplified tax system, entered into a contract with a foreign seller who does not have a permanent representative office in Russia for $12,000, including VAT. The contract is executed on the territory of the Russian Federation. In this case, the Russian company needs to withhold VAT from the “foreigner” under the simplified tax system in the amount of $2,000 and transfer it to the budget, and pay the remaining $10,000 for purchases.

To summarize: a “simplified” seller is required to pay VAT if the place of transaction is the Russian Federation and foreign sellers do not have the independent ability to pay VAT due to the fact that they do not have a permanent establishment in the Russian Federation.

For information on the procedure for deducting VAT withheld by a tax agent, read the article “How can a tax agent deduct VAT when purchasing goods (work, services) from a foreign seller.”

Accounting for input tax when transferring activities to the simplified tax system

When switching to the simplified tax system from the main mode, it is necessary to restore the input tax shown in accounting as reimbursed. This is due to the fact that, being on OSNO, the company subtracts input VAT from the total amount of tax payable, and in the simplified system this opportunity is lost.

It is not necessary to restore all VAT deductible, but only its share related to:

- Products purchased on OSNO, but not sold at the time of transition;

- Materials purchased at OSNO but not used;

- Intangible assets and fixed assets - in terms of their value in the residual value on the day of transition.

The restoration procedure boils down to the calculation of tax payable in an amount equal to the restored amount. Having switched to the “simplified” system, the company needs to pay the restored added tax, corresponding to the balances of inventory items in warehouses (purchased and paid for OSNO), as well as the cost of fixed assets and NAMA of the residual type. If a revaluation was performed for a non-current asset, its results are not taken into account when restoring.

The restoration process is carried out in the tax period preceding the transfer of the business to a simplified tax system. The restored value is recorded in expenses (it is not taken into account in the cost of these inventory items, intangible assets, fixed assets).

The restored input tax must be entered into the Sales Book, entries are made on the basis of those invoices on the basis of which the tax was previously deducted. It is necessary to take the same invoices and register the fact of restoration.

If a non-current asset was acquired a long time ago, but its useful life did not end at the time of transfer, then it is possible that there is no longer an invoice for it due to the end of its shelf life. In this case, the registration entry in the Book is made on the basis of a certificate - a document drawn up by an accountant in free form.

VAT when working on the simplified tax system: is there a tax when renting state property?

In the case of leasing state property, in accordance with clause 3 of Art. 161 of the Tax Code of the Russian Federation, the tenant will have to pay VAT under the simplified tax system. In this case, the tax base will correspond to the amount of rent including VAT. Moreover, the need to pay tax does not depend on whether the payment in the agreement with the lessor is indicated with VAT or without it: if the price is indicated without VAT, the “simplified” will need to charge a tax on top of it and pay it to the budget.

See also the material “The Federal Tax Service reminded when the duties of an agent do not arise when renting government property .

Reflection in accounting of subscriber services

Regulatory regulation

BU: Expenses for the maintenance of computer programs are taken into account as part of expenses for ordinary activities (clause 5, clause 7 of PBU 10/99). Until the service is provided, payment must be reflected in accounts receivable (clause 3, clause 16 of PBU 10/99).

Simplified tax system: Subscription fees for servicing computer programs are taken into account in expenses under the simplified tax system (clause 19, clause 1, article 346.16 of the Tax Code of the Russian Federation). Expenses for work and services of third-party organizations can be recognized at the moment when one of the events last occurred (clause 1, clause 2, article 346.17 of the Tax Code of the Russian Federation):

- services and work are performed and accepted by the organization;

- payment to the contractor has been made.

When making a one-time payment for services that are ongoing in nature, expenses can include the cost of only the services actually provided (Letter of the Ministry of Finance of the Russian Federation dated December 12, 2008 N 03-11-04/2/195).

We agree with the position of the Ministry of Finance and believe that a one-time write-off of expenses for the entire amount at once is unlawful, since in this case:

- the requirement of economic justification for expenses is not met (clause 1 of Article 252 of the Tax Code of the Russian Federation): we write off what has not yet actually been provided;

- there are no grounds for recognizing expenses established by paragraphs. 1 item 2 art. 346.17 of the Tax Code of the Russian Federation for services of third parties, since payment of an advance by the buyer (invoice 60.02) several months in advance does not mean that the supplier provided services for all these months (even if the supplier submitted documents for the entire amount of the advance). pp. 1 item 2 art. 346.17 of the Tax Code of the Russian Federation recognizes such expenses only at the time of repayment of the debt . But the buyer’s debt (account 60.01) will arise only when the services are provided to him actually, and not exclusively “on paper” (i.e., monthly, and not at a time).

In addition, a one-time write-off of ongoing expenses is unlawful (and hardly advisable), given the potential for termination of the contract and the need to make accounting adjustments in this regard.

The amount of input VAT is included in the price and taken into account in expenses (clause 8, clause 1, article 346.16 of the Tax Code of the Russian Federation).

In KUDiR on the simplified tax system (income-expenses), the amount of incoming VAT must be shown as a separate line (clause 8, clause 1, article 346.16 of the Tax Code of the Russian Federation). This is an independent and separate type of expense for the purposes of the simplified tax system.

Read more Expenses for the purchase of works and services under the simplified tax system

Accounting in 1C

The receipt of an act from the service provider is reflected in the document Receipt (act, invoice, UPD) transaction type Services (act, invoice, UPD) in the section Purchases – Receipt (acts, invoices, UPD).

In the Accounts , indicate:

- Cost account - deferred expense account 97.21 “Other deferred expenses”;

- Future expenses — element of the RBP directory, formatted as follows:

Type for NU - Other ; - Type of asset in the balance sheet - Accounts receivable ;

- Amount — the cost of subscription services for the entire period (indicated for reference);

- Recognition of expenses - By calendar days ;

- The write-off period from... to... is the period of provision of services (in our example from 04/01/2021 to 03/31/2022);

- Cost account - an expense account to the debit of which the RBP will be evenly included (in our example - “General business expenses”);

In accounting, expenses for ongoing services will be written off evenly over the period of their provision as deferred expenses.

In order for VAT on services to be reflected simultaneously with the expenses themselves:

- in the section Taxes and reports - simplified tax system - procedure for recognizing expenses - incoming VAT, check the Accepted expenses for purchased goods (work, services) ;

- VAT should be highlighted in the receipt document.

Postings according to the document

The document generates transactions:

- Dt 60.01 Kt 60.02 - offset of advance payment to the supplier;

- Dt 97.21 Kt 60.01 - accounting for software subscription services 2021-2022 in accounts receivable.

Simplified VAT when purchasing state property

When selling state property, the tax base, according to clause 3 of Art. 161 of the Tax Code of the Russian Federation, corresponds to the amount of income from the sale including VAT. In this case, it is not the seller of state property who must pay the tax, but its buyer, who is recognized as a tax agent. It is he (in this case, the “simplified” buyer) who is obliged to calculate VAT under the simplified tax system, withhold it from income payable, and transfer it to the budget.

However, sub. 12 paragraph 2 art. 146 of the Tax Code provides the opportunity for a “simplified” buyer not to withhold VAT on the income of the seller of state property if the conditions for the purchase of state and municipal property established by Art. 3 of the Law of the Russian Federation “On the peculiarities of the alienation of real estate in state ownership...” dated July 22, 2008 No. 159-FZ:

- As of July 1, 2015, the property rented by the simplifier had already been leased to him for at least 2 years.

- He has no arrears of rent or other related payments (fines, penalties).

- The property is not included in the approved list of property intended for rental and free from the rights of third parties.

- On the day of concluding the repurchase agreement, the simplifier is listed in the register of small and medium-sized businesses.

Input VAT under the simplified tax system - taken into account in expenses without consequences

Working in simplified terms, you of course know that the list of expenses that can be taken into account when calculating a single tax (the “income-expenses” object) is limited. All of them are listed in clause 1 of Article 346.16 of the Tax Code. And among them there is one type of cost “with a twist”: it is an independent type of expense, but on the other hand, it can only be taken into account simultaneously with other expenses. What are we talking about? You probably realized that the topic of this article is input VAT under the simplified tax system.

Where does VAT come from on the simplified tax system?

According to clause 2.3 of Article 346.11 of the Tax Code, organizations and individual entrepreneurs using a simplified taxation system with the object “income-expenses” are not VAT payers. There are also exceptions (introduction of goods into the territory of the Russian Federation, duties of a tax agent), but today we will not consider them.

Where does VAT come from on the simplified tax system? It all depends on what suppliers and contractors you work with, whether they are VAT payers or not. If they are, then when selling their goods, services, or work to you, it is their responsibility to charge and pay VAT. Those. you receive goods, works, services at cost including VAT (10% or 18%).

A reputable supplier will issue you an invoice. Then, if a number of conditions are met, you will be able to include this input VAT under the simplified tax system into expenses. What are these conditions? The answer depends on what exactly you purchased (ordered).

Please note: companies using the simplified tax system are not VAT payers and do not issue it to their customers, and, therefore, cannot make a VAT deduction.

VAT on materials

To include VAT on materials in expenses, you will need (clause 8, clause 1, article 346.16 of the Tax Code):

— materials must be purchased and capitalized;

— materials on the cost of which the supplier has charged VAT must be paid;

— the materials themselves can be taken into account in the costs of the simplified tax system (Articles 346.16, 346.17).

It turns out that VAT will be included in expenses simultaneously with the inclusion of expenses for the materials themselves.

VAT on goods

In the case of goods, the situation is a little more complicated. At a minimum, to include VAT in expenses, you must pay the goods to the supplier and capitalize them. But to the question whether, after meeting these two conditions, it is possible to immediately include VAT in expenses, or whether you need to wait for the sale of goods (i.e., the moment when expenses on goods will be written off), the Tax Code does not give a clear answer.

Therefore, there are 2 points of view:

1. The official position of the Ministry of Finance (letter dated September 24, 2012 No. 03-11-06/2/128): VAT on goods is applied to expenses no earlier than the moment when the goods themselves are expensed.

2. VAT is a separate type of expense, which is included in the list of tax codes. The Code does not provide information on when to include VAT in expenses and does not tie this point to the sale of goods. This means that VAT can be expensed after it has been paid to the supplier. But this point of view will have to be proven in court. And since there is no judicial practice on this issue, it is impossible to predict the court’s decision in advance.

As a rule, goods are shipped to customers in batches, which means that each time it will be necessary to calculate how much VAT to charge to expenses. Let's see an example.

Example

LLC "Vesnushka" works on the simplified tax system with the object "income-expenses" and is engaged in the wholesale trade of household appliances. On February 25, 2013, the organization purchased a batch of refrigerators worth 590,000 rubles. (including VAT RUB 90,000). Payment to the supplier was made on March 10. And on March 20, part of a batch of refrigerators was sold with a purchase price of 200,000 rubles. (without VAT). The rest of the batch was sold on March 25.

On March 20, we can include the cost of goods in expenses - 200,000 rubles. and VAT on these goods – 36,000 rubles. And on March 25 we will include RUB 300,000 in expenses. goods at purchase price and 54,000 rubles. VAT on these goods.

VAT on fixed assets and intangible assets

The situation is different with input VAT on fixed assets and intangible assets. Such a tax does not apply to a separate type of expense under clause 8 of clause 1 of Article 346.16 of the Tax Code. Expenses for the purchase of fixed assets and intangible assets during the period of work on a simplified basis are written off according to paragraph 3 of Article 346.16 and paragraph 4 of paragraph 2 of Article 346.17 of the Tax Code (letter of the Ministry of Finance dated November 12, 2008 No. 03-11-04/2/167). Namely, after their commissioning and payment to the supplier in equal quarterly installments.

The initial cost of fixed assets and intangible assets in accounting using the simplified tax system is determined according to the accounting rules (PBU 6/01 and PBU 14/2007). In accounting, non-refundable taxes are included in the original cost. According to the simplified tax system, value added tax is not refundable, therefore input VAT on fixed assets and intangible assets is included in the initial cost.

Example

Parus LLC purchased a lathe worth RUB 236,000. (including VAT 18%) February 18, 2013. The machine was paid for on February 26 and put into operation on February 28.

Quarterly we include in expenses: March 31 - 59,000 rubles, June 30 - 59,000 rubles, September 30 - 59,000 rubles, December 31 - 59,000 rubles.

Registration in KUDiR

Another common question is how to make an entry in the book of income and expenses for input VAT? According to the Tax Code, value added tax is an independent type of expense (clause 8, clause 1, article 346.16), therefore it is recorded in the book as a separate line. There are many explanations on this topic from the Ministry of Finance and the Federal Tax Service.

What happens if you do not allocate VAT as a separate line, but write it down along with the cost of materials or goods? Such a violation cannot be classified as gross according to clause 3 of Article 120 of the Tax Code, since the accounting book on the simplified tax system is a tax accounting register, not an accounting register. Therefore, there will be no sanctions for this. However, it is not worth giving tax inspectors any more grounds for complaints.

Does a simplified person need an invoice?

Input VAT is a separate type of expense, which means, according to clause 1 of Article 252 of the Tax Code, it must be confirmed by primary documents. Which ones?

1. Documents related to the purchase of property: payment orders, invoices, certificates of services rendered, work performed.

2. Invoice (letter of the Ministry of Finance dated September 24, 2008 No. 03-11-04/2/147), compiled in accordance with all the rules by the Government Decree dated December 26, 2011. No. 1137.

One can argue with the opinion on the mandatory presence of invoices to include VAT in expenses. According to the Tax Code, an invoice is a document that is needed only for deducting VAT and nothing else. There is a resolution of the Federal Antimonopoly Service of the Moscow District dated April 11, 2011. No. KA-A40/2163-11, according to which it is allowed to take into account VAT in expenses only on the basis of acts or invoices that indicate the amount of VAT.

Find out how to fill out invoices here. Find out how to deal with VAT when switching to the simplified tax system here.

Are your suppliers compliant with VAT and issue you invoices on time and correctly? Please share in the comments!

You might be interested in:

Issuing an invoice with VAT instead of a document without VAT

There are cases when a “simplifier”, at the request of the buyer, issues an invoice in which he indicates VAT, although he is exempt from it. By doing this, he does himself a disservice: as a result, he will have to not only pay the VAT allocated in the invoice, but also submit a VAT return to the simplified tax system.

If the simplifier still decides to issue invoices with VAT, then you should remember that from July 1, 2022, invoices are issued in a new form. This is due to the fact that the experiment on the traceability of goods has ceased to be an experiment and has become mandatory for those who imports and sells certain types of goods. At the same time, all VAT taxpayers, as well as special regimes, are required to use the new invoice forms. Read more about the new form here.

You can download the updated invoice form by clicking on the image below:

ConsultantPlus experts have prepared step-by-step instructions for preparing each line of the updated invoice. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

Payment of invoices with VAT under the simplified tax system

In the payment order, the buyer should not allocate VAT, that is, “Without VAT” is written. But often in practice, the VAT rate of 18% (10%) is erroneously indicated on payment slips. What to do? Do I need to generate an invoice and pay VAT to the budget?

The obligation of the “simplified” person to remit VAT arises when issuing an invoice to the buyer with allocated VAT on the basis of clause 5 of Art. 173 Tax Code of the Russian Federation. If an invoice with an allocated tax was not issued, then the obligation to transfer to the budget the VAT indicated by the buyer in the payment invoice does not arise due to the letter of the Ministry of Finance of Russia dated November 18, 2014. No. 03-07-14/58618.

In more detail, how to deal with possible errors associated with VAT under the simplified tax system, as well as legal requirements under the simplified tax system, was studied in the Master Class: SIMPLIFIED - All changes and Accounting in 1C:8. Theory and practice .

Will be considered:

- Theory “9 Circles Simplified. All changes for 2016." Lecturer: Klimova M.A. Read more >>

- Practice “STS - features and errors of accounting in 1C:8” Lecturer - O.V. Sherst Read more >>

Give your rating to this article: ( 12 ratings, average: 4.33 out of 5)

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

I am already registered

After registering, you will receive a link to the specified address to watch more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP 8 (free)

By submitting this form, you agree to the Privacy Policy and consent to the processing of personal data

Login to your account

Forgot your password?

VAT under the simplified tax system in 2020-2021

In 2020-2021, there are no innovations in terms of VAT when applying the simplified tax system. In this case, you need to remember the following.

1. “Simplified” companies can enter into a written agreement with their counterparties not to issue invoices to them.

2. “Simplers” are required to reflect in the VAT return the information contained in the issued invoices.

3. Intermediaries who are not tax agents working for the simplified tax system, when receiving or issuing invoices, are required to send a journal of invoices to the Federal Tax Service by the 20th day of the month following the reporting month.

For more information about the accounting journal, see our material “ Invoice registration journal - sample 2021 ” .

Sales with VAT for an organization using the simplified tax system in the 1C program: Enterprise Accounting 8

Published 12/23/2016 10:25 Lately, very often I have been asked questions related to accounting for VAT when applying the simplified tax system. It happens that organizations using special regimes are forced to make concessions to the buyer and provide documents with allocated VAT. What consequences does this have for “simplified people”, and how to reflect these operations in 1C: Enterprise Accounting 8, we’ll talk in this article.

First of all, to reflect the fact of sales (in our case, services), we create a new act (Tab “Sales” - “Sales (acts, invoices)”). We fill in the required information and click on the link “Document without VAT” (this setting is set automatically for organizations using the simplified tax system), change the value to “VAT in total” or “VAT on top”.

After changing the VAT accounting method, columns appear in the tabular section to indicate the percentage and amount of tax.

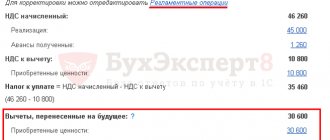

We post the document and see that a transaction has been generated for calculating VAT to account 68.02.

It is also necessary to issue an invoice.

Now I want to draw your attention to one important point: the VAT received from the buyer should not be included in the tax base for calculating the single tax when applying the simplified tax system. This means that from the amount of payment received from the buyer, for the purposes of accounting for income in KUDiR, we must exclude VAT. Let's enter a document for the receipt of funds and see how this operation will be reflected in the tax accounting of the simplified tax system. Go to the “Bank and Cash Desk” section and create the “Receipt to Current Account” document.

The buyer received an amount of 23,600 rubles.

But if we go to the tab “Book of income and expenses (section 1)”, we will see that only 20,000 rubles are taken into account in income. Information on the exclusion of VAT from the amount of income is in the contents of the transaction.

If an organization applying the simplified tax system has issued documents with allocated VAT to the buyer, then the obligation arises to submit a declaration to the tax authority based on the results of the reporting period and pay this tax to the budget. Let's figure out which sections of the VAT return must be completed. Go to the “Reports” section, create and fill out a new declaration. The amount of tax payable to the budget must be reflected in line 030 of section 1.

Also in this case, section 12 is completed, because the organization is not a VAT payer in accordance with the law.

But sections 3 and 9 for organizations on the simplified tax system will remain empty.

At the end of the tax period, the calculated VAT must be paid to the budget; we register this fact with the document “Write-off from the current account” with the transaction type “Payment of tax”.

The amount of VAT paid is not taken into account in the expenses for determining the tax base when calculating the single tax, therefore, when posting a document in the register “Book of Income and Expenses (Section 1)”, the “Expenses” column remains empty, and only the “Total Expenses” column is filled in (column 6 book of accounting of income and expenses).

Author of the article: Olga Shulova

Let's be friends on Facebook

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

0 Galina 14.12.2021 17:34 Hello, and if an organization uses the simplified tax system (income expenses) and already accepts one supply with VAT from a supplier, do we reflect it in the purchase book? are we deductible?

Quote

+1 Natalya 06.16.2021 22:45 Thank you, I really liked the article, everything is presented in an accessible way

Quote

0 Oksana 10.23.2020 22:10 Thank you. I really liked the article - the accessibility of the presentation and visualization at a high level.

Quote

0 Alexandra 12/26/2018 04:12 Excellent article, Thank you very much. Is the same thing implemented but in accounting 8.2?

Quote

0 Y 01/23/2018 13:01 Tell me, what about the downward adjustment of sales with VAT in the last tax period for an organization using the simplified tax system?

Quote

+1 Olga Shulova 07/21/2017 09:50 I quote Arthur:

What about advances with VAT? You say: “But if we go to the tab “Book of Income and Expenses (Section 1)”, we will see that only 20,000 rubles are included in income. Information on the exclusion of VAT from the amount of income is in the contents of the transaction.” My income includes the amount including VAT! The situation is as follows: the buyer pays an advance invoice with VAT, we issue an invoice for the advance payment, the sale has not yet been carried out. What should I do? Why is output VAT included in income?

Good afternoon

I will copy you the answer to this topic directly from the 1C developers: “The calculation of VAT and the issuance of VAT invoices to customers by organizations that are not VAT payers due to the use of special tax regimes is supported in the program for transactions involving the sale of goods and the provision of services. Issuing advance invoices for such organizations when selling their own goods and services is not economically feasible, since the deduction of such VAT when offsetting the advance sales is not provided for by the legislation of the Russian Federation.” Accordingly, accounting for VAT on advances for organizations using the simplified tax system in 1C programs is not automated. You can make manual adjustments to the movements of documents, but there are certain risks from the point of view of legislation and when excluding this VAT from income and subsequent offset of VAT from the advance upon sale Quote 0 Arthur 07/20/2017 17:19 What about advances with VAT? You say: “But if we go to the tab “Book of Income and Expenses (Section 1)”, we will see that only 20,000 rubles are included in income. Information on the exclusion of VAT from the amount of income is in the contents of the transaction.” My income includes the amount including VAT! The situation is as follows: the buyer pays an advance invoice with VAT, we issue an invoice for the advance payment, the sale has not yet been carried out. What should I do? Why is output VAT included in income?

Quote

0 Olga Shulova 07/06/2017 20:17 I quote Yulia_G:

Olga, thanks for the article! Everything is written clearly. But I have a question, what to do when receiving an advance payment from the buyer. Doesn’t the company expose SF for advance payment on the simplified tax system? How to reflect the Receipt of Income excluding VAT (for calculating the advance payment according to the simplified tax system)? If possible, you can write.

Julia, hello!

I would like to advise you to read this discussion on the forum (copy the link into your browser) accountingbezzabot.rf/ …/… The question is ambiguous, I wrote what exactly confuses me, but our reader has a slightly different experience. I think you will find it interesting. Quote 0 Yulia_G 07/05/2017 16:20 Olga, thanks for the article! Everything is written clearly. But I have a question, what to do when receiving an advance payment from the buyer. Doesn’t the company expose SF for advance payment on the simplified tax system? How to reflect the Receipt of Income excluding VAT (for calculating the advance payment according to the simplified tax system)? If possible, you can write.

Quote

Update list of comments

JComments

Results

An organization or individual entrepreneur using the simplified tax system is not a VAT payer, with the exception of operations for the import of goods and trust management.

However, simplifiers can act as tax agents, performing duties to withhold VAT from taxpayers when carrying out transactions specified in Art. 161 of the Tax Code of the Russian Federation, its payment to the budget. Also, the obligation to pay VAT arises for “simplified” companies when issuing invoices with an allocated tax amount. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.