During the operation of an enterprise, situations arise when the organization collects a fine or, on the contrary, receives a fine. Let's consider the reflection of fines and penalties in 1C 8.3 Accounting, to which account should we assign penalties and fines for taxes in 1C 8.3 postings.

Fines and penalties for accounting and accounting purposes are divided into categories:

- Administrative fines;

- Other fines, penalties, penalties from extra-budgetary funds and tax authorities;

- Fines, penalties, penalties for contractual obligations with the counterparty.

Depending on the type of fine, 1C 8.3 applies different accounting procedures. Let's look at the most common situations.

For more details, see the online course: “Accounting and tax accounting in 1C: Accounting 8th ed. 3 from A to Z"

Administrative fines

A special resolution is issued for an administrative fine for a company. In addition to standard information, it indicates

- Amount of fine;

- The article under which the company was fined;

- Required information about the payee.

To pay an administrative fine, an enterprise has 60 calendar days, which must be counted from the day the resolution came into force.

After receiving the resolution, the accountant is obliged to reflect the accrual of the fine in the accounting registers of the 1C 8.3 program.

Administrative fines are accounted for as part of other expenses. This procedure is prescribed in clause 11 of PBU 10/99.

The accounting entries will be as follows: Dt 91 subaccount Other expenses Kt 76 - the administrative fine is reflected in other expenses.

In 1C 8.3, the accrual of an administrative fine should be reflected as an Operation. Go to the Operations menu, select the type of operation Operations entered manually:

Open the selected operation:

Using the Create button, create a new operation and fill in:

- The date of the document and correspondence of accounts corresponding to the accounting entries;

- We recommend filling out the comments line;

- When filling out the analytics, you should use the previously created Miscellaneous Income and Expenses – Administrative Fines item or create a new one:

When choosing analytics for a cost item, you should take into account that the amount of the fine is accepted only for accounting purposes, so you should select the expense/income item “not accepted for accounting”, that is, with a “tick”. The cost should not be marked in the NU column in the cost directory:

Due to the fact that fines in tax accounting cannot be written off as expenses, therefore, a permanent tax liability of the PNO arises.

You should pay attention to the result of generating transactions in 1C 8.3. In the column “Dt NU” the amount of the fine is not reflected. The fine is reflected according to the rules of PBU 18/02:

After posting the document, you need to print the accounting certificate on the Accounting certificate tab. Sign and keep in the accounting documents in the original:

Small enterprises may not apply PBU 18/02 and permanent differences are not formed in accounting.

Labor wars: can the State Labor Inspectorate fine be transferred to the guilty employee?

The GIT organization was fined for violating labor legislation under Art. 5.27 Code of Administrative Offenses of the Russian Federation. The employer considered that it had suffered damage and demanded that the fine imposed be collected from the guilty employee.

On the agenda

: Appeal ruling of the Rostov Regional Court dated February 27, 2018 No. 33-3330/2018.

Background

: The GIT organization was fined for violating labor legislation under Art. 5.27 Code of Administrative Offenses of the Russian Federation. The reason for the fine was the actions of a leading HR specialist who did not enter into an agreement with the employee to amend the employment contract. In this regard, the employer considered that it had suffered damage and demanded that the imposed fine be collected from the guilty employee.

Standards involved

: Art. 238 Labor Code of the Russian Federation

Price issue

: 30,000 rubles

When collecting a fine from the employee imposed by the State Tax Inspectorate, the employer referred to the fact that he was fined due to the fault of the employee who dishonestly performed his job duties. The employee, due to his qualifications and experience, knew that he was committing a violation. According to Art. 238 of the Labor Code of the Russian Federation, the employee is obliged to compensate the employer for direct actual damage caused to him.

The court found the employer's arguments unfounded. The fine was paid by the organization due to its violation of labor laws. Payment by a legal entity of a fine for such a violation cannot be the basis for imposing financial liability on the employee.

The concept of direct actual damage is not identical to the concept of a fine. The guilty employee was not the person brought to administrative responsibility. Consequently, the employer’s payment of a fine according to the resolution of the State Tax Inspectorate does not entail any obligations or consequences for him.

The fine cannot be attributed to direct actual damage that the employee is obliged to compensate. Otherwise, this circumstance expands the limits of the employee’s financial liability to the employer.

Demands to recover the amount of the fine paid from the employee in the form of material damage are actually aimed at releasing the employer from liability.

Considering that the organization performs all actions indirectly through its employees, it, from the employer’s point of view, should not bear any responsibility at all and under no circumstances. But this contradicts the goals of administrative punishment defined in Article 3.1 of the Code of Administrative Offenses of the Russian Federation.

Taking into account the above, the court refused to allow the employer to recover monetary compensation from the employee in order to pay the administrative fine.

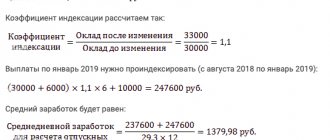

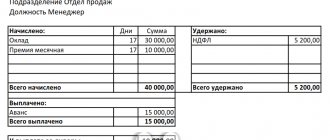

To which account in the postings should penalties and fines for taxes be attributed in 1C 8.3

In accounting, the amounts of fines and penalties for property tax, VAT, income tax, etc. are reflected by the entry: Dt 99 Kt 68 subaccount Calculations for fines and penalties - tax penalties and fines for property and profit taxes are accrued or other taxes:

Reflecting an operation in accounting is similar to accounting for administrative fines, only the accounting analytics changes. The registration is carried out based on the requirements of the Federal Tax Service. We recommend opening separate sub-accounts for account 68, where the amounts of penalties and fines for taxes will be shown.

When transferring amounts to the budget: Dt 68 subaccount Calculations of fines and penalties Kt 51 - penalties and fines for tax are transferred to the budget, the balance on account 68 will be closed.

If an organization plans to challenge fines in court or in a higher authority, penalties and fines should still be accrued in accounting by posting: on the debit of account 99 and the credit of account 68. If the court decides positively in favor of the organization, make a reversing entry.

Due to the fact that in accounting all fines are written off to the financial result, no differences arise according to PBU 18/02.

Fines, penalties, penalties under business contracts

The most common fines in the activities of an enterprise are fines, penalties, and penalties under business contracts.

In more detail, how to keep records of fines and penalties under contracts with counterparties in the 1C 8.3 Accounting program is discussed in our article.

In accounting, fines, penalties, and penalties for violation of contractual obligations are included in non-operating expenses. The amounts awarded by the court are accepted for accounting purposes in the period when the court decision on their collection was made. Reflected in accounting by postings:

- Dt 91.2 Other expenses Kt 76 Settlements with various debtors and creditors for the amount of accrued fines awarded by the court;

- Dt 76 Settlements with various debtors and creditors Kt 51 Current account for the amount of transfers, that is, payments.

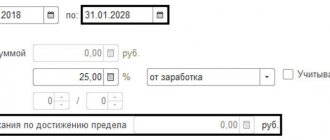

The operation for reflecting a fine in accounting is the same as for reflecting administrative fines - an operation entered manually, only the corresponding account and analytics change:

Since fines and penalties under business contracts are accepted for tax accounting, when posting the document, the amount will be reflected in both accounting and tax accounting.

How to calculate a fine if contractual obligations are not fulfilled

Penalties are assessed if the supplier has not fulfilled contractual obligations.

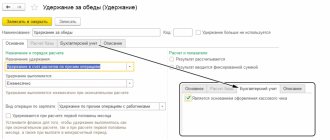

Similarly to accounting for administrative fines, we fill out the Transaction entered manually:

- We indicate the name, debit and credit accounts;

- Amount for the transaction and subaccount;

- The subconto debit indicates the counterparty;

- Document on debiting from a bank account, on the basis of which penalties are calculated, agreement;

- In the loan subconto we indicate the item of other income and expenses from the directory Directory of Items of Income and Expenses, where we select the income item Fines, penalties and penalties for receipt (payment):

For the amount of the fine, use the document Receipt to current account with the transaction type Other receipt. Type of current account - account 76.02 Calculations for claims, since the amount of the fine is accepted to the NU, the same type of entries are generated in both the BU and the NU.

If you need help in mastering a wider range of operations in the 1C program, then we suggest you take our professional course “ 1C Accounting 3.0 on the TAXI interface ”. For more information about the course, watch the following video:

Please rate this article:

( 10 ratings, average: 4.70 out of 5)

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

I am already registered

After registering, you will receive a link to the specified address to watch more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP 8 (free)

By submitting this form, you agree to the Privacy Policy and consent to the processing of personal data

Login to your account

Forgot your password?

What is included in the cost structure

The composition of costs is determined by Article 101 of the Arbitration Procedure Code of the Russian Federation and Article 88 of the Code of Civil Procedure of the Russian Federation. In particular, they include any costs arising from the proceedings, as well as state fees. Let's look at a sample list:

- Payment for the services of experts, lawyers and consultants.

- Amounts paid to experts, translators and others.

- Costs associated with the inspection.

- Postage costs.

- Other expenses deemed necessary by the court.

- Costs of representing a party.

- Compensation for lost time, paid on the basis of Article 99 of the Code of Civil Procedure of the Russian Federation.

- Expenses for transport and accommodation of persons participating in the proceedings (Article 94 of the Code of Civil Procedure of the Russian Federation).

- Duty.

Some expenses have a fixed amount. For example, this is a duty. Part of the costs can be of any volume. In particular, this is compensation for loss of time. Its amount must be reasonable and appropriate to all the circumstances of the case.

Question: How to record legal expenses incurred by an organization when filing a claim in an arbitration court? In accordance with the agency agreement and on the basis of the submitted report with supporting documents attached, the organization pays for the services of an attorney (law firm) in the amount of 120,000 rubles. (including VAT 20,000 rubles), and also reimburses the expenses of the representative of the organization - an attorney for accommodation at the place of trial in the amount of 8,000 rubles. (VAT is not presented by the hotel). The legal proceedings are related to the demand from the buyer for the shortfall in payment for a sold fixed asset (fixed asset) (the sale of fixed assets is subject to VAT). Tax accounting uses the accrual method. View answer