How to reflect a loss in 1C 8.3? Before the release of “1C:ERP Enterprise Management” version 2.4.2, in which the developer introduced automation of the procedure to reflect last year’s losses, users had to resort to accounting for them and reflecting operations in the operational management loop to items in the directory of deferred expenses (abbreviated as RBP) . Even with the release of update 2.2, where the possibility of independently entering accounting, management, and tax accounting amounts debuted in the distribution documentation of the BPR, the ability to specify a distribution item for the BPR with the posting of account 99 and calculating the offset amounts from the proceeds in automatic mode remained unrealized.

Because of this, up to version 2.4.2, in order to reflect losses in regulated accounting for enterprises maintaining registration records in the general taxation system, the “Operations” document was used, where users had to manually fill in the distribution amount for VR and NU.

Reflection of losses in 1C:ERP

The main innovation of update 2.4.2 is the ability to maintain records within tax accounting, as well as reflect losses when preparing an income tax return, without the need to carry out manual operations.

For these tasks, the following were introduced into the system: account 97.11 and a directory with the same name. At the same time, the added directory is the only subaccount available for the added account.

As a rule, filling out the directory of past losses is carried out automatically: when closing the calendar year and before the balance sheet is reformed, the system checks for the presence in the directory of an entry with a year that would correspond to the period being closed. If there is no date, a new element for the current year will be added automatically.

To account for time differences in financial losses, in accordance with the requirements of the accounting standard of the Russian Federation 18/02, an asset of the same name is added to the list of types of tax liabilities/assets (ONO/ONA).

Closing the month for enterprises on the OSN (general taxation system) in terms of calculation and accounting of losses is carried out as follows:

- According to account 99.01.1 (Losses and income from activities with special tax purposes), the balance in tax accounting is calculated.

- If the balance presented in the paragraph above corresponds to financial losses, the amount of the latter is written off from this account, transferred to account 97.11 (Dt 97.11 - Kt 99.01.1), at the same time filling in the NU amount in the account assignment. Already on this account, in the account assignment of the analytical account of past losses, the element of the directory of the same name is filled in in accordance with the year being closed. If such an element does not exist, the system will create it automatically.

- If at the enterprise for which the year is closed, a flag appears in the accounting policy, accounting provision 18/02 is required, and the amount of the transferred loss is entered into the “Amount Kt BP” and “Amount Dt BP” with a negative value. The balance in the debit of account 09 “Deferred tax assets” at the time of closing the calendar year in the analytical account “Loss of the current period” is transferred to the debit of account 09 to the analytical account “Losses of previous years” (account assignment creation is required Dt 09 “Losses of previous years” - Kt 09 "Loss of the current period"). The existing balance on the above account 09 according to the analytical account “Loss of the current period” at the end of the last year and at the beginning of the current year is taken as an error that must be corrected, followed by repeating the registration procedure for closing it.

Deferred tax asset

If the tax authorities recognized the receipt of profit in their report earlier than they did in the company’s accounting department, then the same temporary difference arises. In this case - deductible. This means that in the next reporting periods the company will pay less income tax. The deferred tax asset is the part of the amount by which the tax will be reduced. Thus, the difference in the two types of reporting will disappear.

In addition to the deductible, there is also a taxable difference. It appears in the opposite case: when tax authorities receive information about profits later than recorded by the accountant. In such a situation, the tax is increased, and the amount by which it increases is called a deferred tax liability (abbreviated as IT).

In practice, assets appear more often than liabilities.

How to calculate assets

To obtain the amount of IT, the following formula is used, which is also relevant when calculating the deferred tax liability:

The temporary difference is multiplied by the income tax rate.

Situations when deferred tax assets are used

- The sale of the main product (product) of the company occurred at a loss - if the accounting department can write off this loss in the current reporting period, then the tax office will write it off for several years, during the period of use of the product (product);

- interest payments on a loan for fixed assets - according to accounting standards, are included in their own value, and the tax authorities include these expenses in the current period;

- revaluation of the difference in the rate of debt by the end of the reporting period - is valid only for accounting, the tax office revaluates the difference on the date when the debt is fully repaid;

- the company writes off expenses for processes (commercial, administrative) into cost before they are included in the tax report;

- Provisions for future expenses or doubtful debts are recognized differently from the tax authorities.

The situations described are suitable for the emergence of both assets and liabilities.

Closing last year's losses in 1C 8.3

Closing of recorded losses from last year is carried out by performing the regulatory process of closing the month, if there is a profit for the current period. For these purposes, in the program updated to version 2.4.2, the list of month-closing procedures includes the “Write-off of losses from previous years” procedure, carried out automatically if there is a balance on the debit of account 97.11. When performing this step, the system calculates the amount of losses for previous years (up to ten years) and, if there is a profit for the current period, writes off the loss to the amount of previously recorded profit, as a result of which account assignments Dt 99.01.1 - Kt 97.11 of the amount according to NU are formed .

If a flag is set in the enterprise’s accounting policy indicating that the organization maintains accounting in accordance with accounting regulations 18/02, then the amount of financial losses written off from account 97.11 is expressed in the amount of time differences with a negative value.

The write-off is carried out before the calculation of the direct state tax, which comes from the profit of the enterprise. The result of the procedure is taken into account in the process of calculating income tax at the subsequent stage of closing the month.

Loss in the current period

Let's consider a situation where, at the end of 2016, our company had a loss of 338,138.43 rubles. The next month our profit was exactly 300,000 rubles.

The loss is calculated at the close of the month by a special assistant, which is located in the “Operations” section of the program. Our example closes December 2016 at the same time as the fourth quarter and full year close.

After completing the transaction to close December 2016, we can receive a certificate “Calculation of income tax.” It will reflect detailed data, including the amount of loss we need for 2016.

Our team provides consulting, configuration and implementation services for 1C. You can contact us by phone +7 499 350 29 00 . Services and prices can be seen at the link. We will be happy to help you!

As we can see from the generated report, for the entire current year 2016, which we are closing, the loss amounted to 388,138.43 rubles. This amount is calculated for all months of 2016 and is its financial result.

Now this loss must be attributed to later dates due to the fact that in the future it will be compensated by incoming income.

Transfer of last year's losses when updating 1C ERP settings to the latest version

All of the above applies to new systems that do not provide information on losses for previous years, which remain after the system is updated from previous versions. But what to do if the system has already accounted for account 97.21 and the losses were closed manually?

In this case, after updating the settings, the balance will need to be manually assigned to the beginning of the current year from account 97.21 to account 97.11, using the “Operation (reg.)” document. Since after updating the settings, the directory of last year’s losses will be empty, you will need to manually prepare elements for those years for which there are unclosed losses, and when transferring from the account, fill out analytical account 97 yourself and correctly.

It is important not to forget the fact that the write-off of last year's losses (up to ten years) is not carried out automatically. In this case, a notification will appear about the presence of such amounts when closing regulated accounting for the last month of the year.

In order to write off last year's losses for a period of ten years or more from the current moment, you will need to use the document “Operation (reg.)”, starting from the decision made and filling out the following entries:

- Dt 91.02 PR – Kt 97.11 NU for a loss that is subject to write-off;

- Dt 91.02 VR – Kt 97.11 VR for a loss with a negative value that is subject to write-off.

Closing losses for previous years

Recorded losses for previous years are closed in the process of executing the regulatory procedure for closing the month at the expense of the profit of the current period. For these purposes, in 1C:ERP 2.4.2, the operation “Write off losses of previous years” was added to the list of month-closing procedures, which will be automatically done if there is a balance on the debit of account 97.11. In the process of performing this step, the system calculates the amount of losses for the past (within the last 10) years and, if there is a profit in the current period, writes off the loss to the amount of recorded profit, generating entries Dt 99.01.1 - Kt 97.11 amounts for tax accounting (NU ).

If a flag is set in the organization’s accounting policy indicating that the organization maintains accounting in accordance with PBU 18/02 “Accounting for calculations of corporate income tax,” then the amount of loss written off from account 97.11 is indicated in the amounts of temporary differences (TD) with a minus sign.

The write-off operation will be made before calculating income tax, and its result is taken into account when calculating income tax at the next step of closing the month.

Free expert consultation

Pavel Aleksanyan

Project manager

Thank you for your request!

A 1C specialist will contact you within 15 minutes.

Analysis of the results of calculation and write-off of last year’s losses

In the list of references in the “Reference-Calculation” section there is a report “Write-off of losses of previous years”, which presents information on the balances of last year’s losses at the beginning and end of the period, the profit of the current period and the amount of losses that are taken into account in the reduction of income in the context of the periods of formation and write-off of financial losses.

Still have questions? Order a free consultation with our specialists!

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter

The occurrence of a loss while working in 1C

So, let's consider the first option: the loss in the period arose in the process of working with the 1C: Enterprise Accounting 3.0 program (note that this scheme also works for the previous edition of the 1C 8.3 Enterprise Accounting 2.0 program).

Based on the results of the activities of Moneta LLC in the fourth quarter of 2015, a loss was recorded in the amount of 235,593.27 rubles. In January 2016, a profit was made in the amount of 211,864.41 rubles.

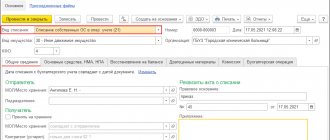

Let's look at the results of document posting for December 2015:

As you know, we obtain the results of an organization’s financial activities as a result of automatic calculations using the Month Closing processing, which includes a list of necessary routine operations (menu Operations – Period Closing – Month Closing).

As we can see, the resulting loss for December is recognized as a deferred tax asset. The financial result in postings for the month amounted to 245,762.71 rubles:

To see the financial result for the entire tax period, we will generate a reference calculation Calculation of income tax (menu Operations – Reference calculations – Accounting and tax accounting – Calculation of income tax):

As can be seen from column 10 of the calculation certificate, the loss for the past 2015 amounted to 235,593.27 rubles.

Determination of loss to be carried forward

Loss in accounting registers (AU)

To determine the amount of loss, you need to check the financial result and fill out an income tax return.

The loss carryforward can be determined in different ways:

- Generate a report Account Analysis 99.01.1 (Reports—Account Analysis). Account turnover 99.01.1 according to tax records will show the amount of loss to be carried forward to future tax periods.

To display tax accounting data in Account Analysis : PDF

- in the report form, click the Show settings ;

- in the report settings form on the tab Indicators check the box NU (tax accounting data); After that, click on the button Form you can create a report.

- The same amount can be seen in the postings of the routine operation Balance Reformation in the Month Closing procedure in December (Operations – Month Closing).

In the Analysis of account 99.01.1, the loss received in the tax period is transferred to Dt 84.02 by the regulatory operation Balance sheet reformation .

Loss in income tax return

In the annual declaration, the loss received at the end of the tax period is reflected in:

- Sheet 02 page 060 “Total profit (loss).”

The loss indicated in the declaration must correspond to the amount of the loss according to tax accounting (the balance in the debit of account 99.01.1 in NU before the reformation).