What is a chart of accounts

A unified chart of accounts of a government institution (CA) is needed to systematize accounting registers according to quantitative, group and digital values, depending on the object of accounting and the target functioning of a particular organization. It is the link between accounting indicators and financial statements. The plan combines those accounts that are used in operations directly related to the financial and economic activities of enterprises. All reflected information is used to analyze the functioning of institutions and forecast its further financial development.

The plan is used in accounting for absolutely all organizations, regardless of their form of ownership. The following types are distinguished according to the types of economic entities:

- register for business entities;

- for budgetary institutions;

- accounts for credit institutions.

Each PS created for different types of economic entities reflects data grouped in accordance with the sectoral and organizational specifics of the institutions. Intersectoral ministries and departments are responsible for the content and regulatory regulation of the document. For each type of institution, its own instructions for use have been developed, which provide details of accounts and subaccounts to them.

The plan aims to:

- to simplify and create a unified accounting methodology;

- ensuring variability in records of similar operations;

- improvement of control measures regulating the correctness of accounting transactions;

- generalization of similar indicators obtained from various sources both at the enterprise and across regions and the country as a whole;

- streamlining the preparation of accounting documentation, interim and final reporting;

- reducing errors in invoice correspondence.

Who is required to use the chart of accounts?

All economic entities that maintain accounting records are required to apply the chart of accounts. Exemptions are provided only for individual entrepreneurs and private practitioners. Other commercial firms, government agencies and enterprises are required to maintain accounting.

But merchants also have the right to organize accounting as part of their activities. There is no prohibition on conducting. Individual entrepreneurs make decisions independently. If accounting is necessary, you will have to comply with the current rules:

- Develop and approve accounting policies.

- Appoint responsible persons.

- Maintain primary and accounting documentation.

- Conduct audits, inventories and inspections.

- Prepare financial statements.

Some economic entities have the right to conduct accounting in a simplified form. For example, non-profit organizations, small businesses, representatives of Skolkovo. But even the transition to a simplified method does not exempt you from using a single PS.

IMPORTANT!

The use of a chart of accounts is mandatory for all economic entities that must maintain accounting records. There are no exceptions even for simplifiers.

Basic rules for accounting in budgetary organizations

Public sector employees are public sector organizations: state and municipal institutions, authorities, extra-budgetary funds. And state and municipal institutions are divided into autonomous, budgetary and state-owned (clause 2 of article 9.1 7-FZ of January 12, 1996). Accounting for such entities is carried out within the framework of state accounting policy. All actions are subject to strict order and subordinate hierarchy.

Budget accounting is regulated by instructions approved by Order of the Ministry of Finance No. 157n dated December 1, 2010. Instruction No. 157n contains the accounting rules on which the formation of accounting policies for all public sector organizations and government bodies is based. In addition, Instruction No. 157n establishes a unified chart of accounts (unified PAS).

IMPORTANT!

State employees are guided not only by Order of the Ministry of Finance No. 157n, but also by 402-FZ dated December 6, 2011. Not only commercial but also non-profit structures, which include public sector organizations, are required to comply with the accounting law. 402-FZ prescribes the accounting procedure.

The basic accounting rules are:

- The manager is responsible for accounting;

- the institution develops accounting policies independently, but on the basis of regulatory standards;

- events of financial and economic activity are recorded in primary documents and reflected in accounting;

- assets should be restated periodically;

- accounting is kept in rubles;

- only reliable information is reflected in the accounting registers;

- The institution has an internal control system.

Plan for state employees

The unified chart of accounts for accounting in budgetary institutions for 2022 is regulated by Order of the Ministry of Finance of Russia No. 157n dated December 1, 2010. Instruction 157n regulates the financial and economic activities of institutions operating in the Russian budget system.

All budgetary organizations are divided into autonomous, budgetary and state-owned. For each structure, various regulations have been approved that are responsible for accounting within a given organizational form:

- Order of the Ministry of Finance of the Russian Federation No. 162n dated December 6, 2010 - for government institutions, extra-budgetary funds and government bodies;

- order No. 174n dated December 16, 2010 - for BU;

- order No. 183n dated December 23, 2010 - for AU.

Clause 21 of Order No. 157n of the Ministry of Finance states what a budget accounting chart of accounts is (with explanations and entries) - this is a register used by government agencies, extra-budgetary funds and government bodies. That is, those organizations that operate within the framework of order 162n.

IMPORTANT!

The Ministry of Finance approved changes to Order 162n (Order of the Ministry of Finance No. 246n dated October 28, 2020). Now, when maintaining budget accounting, business transactions are reflected in the accounts of the working PS, approved by the institution as part of the formation of the institution’s accounting policy, using the financial security code in the 18th digit of the account number. When financed from the budget of the Russian Federation - code 1, from funds at temporary disposal - 3. This rule is used starting from 01/01/2021. Another important innovation is accrual accounting. According to the rules of this method, all operating results are recognized upon completion of transactions.

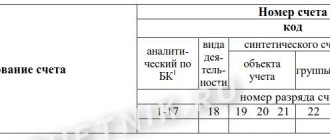

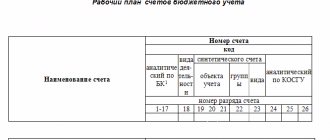

All other state employees use accounting software in their work. This difference arose in connection with the possibility of budgetary and autonomous institutions conducting business activities and receiving income from it (clauses 2, 3 of Article 298 of the Civil Code of the Russian Federation). Budgetary organizations formulate a work plan based on instruction No. 157n. The numbering of working accounts consists of 26 digits, which reflect the analytical accounting code, the type of cash security, the synthetic accounting account code and the code of the financial and economic transaction according to KOSGU.

The budget plan consists of balance sheet and off-balance sheet accounts. It is carried out in accordance with funding sources: budgetary and extra-budgetary.

Generating working chart of accounts numbers

To correctly reflect transactions according to the new rules, all necessary changes have been implemented in the 1C: Public Institution Accounting 8 configuration. To create the numbers of the Working Chart of Accounts in the new structure, you will need to create new elements in the “Classification Characteristics of Accounts (CPC)” directory.

To generate account numbers for budgetary and autonomous institutions with a new structure, a new type of account classification characteristic “AU and BU” has been added to the reference book “Classification characteristics of accounts (KPS)”. We recommend switching to the use of a new type of CPS (Fig. 1).

Rice. 1

For the type of KPS “AU and BU”, the attribute “Clarification of the indicator” has been added, which allows you to clarify the type of directory to determine the type of the last three digits of the KPS (categories 15-17). The clarifying indicator can take one of the following values: KRB, KDB, KIF or gKBC (Fig. 2).

Rice. 2

In categories 5 – 14, a code from an arbitrary classifier “Analytical KPS Code” can be indicated, which is used to conduct analytics in accordance with the accounting policies of the institution.

Note: the developer has retained the ability, as before, to use the CPS of the “Budget classification” type.

Structure of the budgetary chart of accounts

The structure of the budget plan is presented in the following sections:

| Chart of accounts section | Contents of accounts | Account code, example |

| Non-financial assets | The “Non-financial assets” section reflects information about all non-current assets of an economic entity. The section includes accounting for the following objects:

New groups:

| 0 101 05 000 “Vehicles” - generation of information on the initial cost of vehicles owned (operably managed) by the enterprise. 0 108 51 000 “Real estate that constitutes the treasury” - reflects the initial cost of real estate located in the treasury. No depreciation is charged on such property. Also, for assets located in the treasury, there is no provision for the allocation of particularly valuable and other property. |

| Financial assets | The “Financial Assets” section accumulates information about all current assets of the institution. Current assets are understood not only as funds in the cash desk and current accounts of an institution, but also as investments in financial assets, advances and receivables. The section includes the following groups:

| 0 201 11 000 “Cash in the institution’s accounts” - discloses information about the availability of finances in current accounts opened with the body providing cash services to the entity (in rubles and foreign currency). 0 205 31 000 “Calculations for income from the provision of paid services (work).” It accrues income from business and other income-generating activities. |

| Liabilities | The “Obligations” section discloses data on accepted obligations:

| 0 302 11 000 “Payroll calculations” - reflects the amount of accrued wages in favor of employees working under an employment contract. 0 302 21 000 “Settlements for communication services” - reflects accounts payable arising under contracts for the provision of communication services. 0 303 01 000 “Calculations for personal income tax” - records data on tax deductions made from the salaries of employees of the organization and from other taxable income. |

| Financial results | A special section “Financial result” is used to reflect income and expenses based on the results of the activities of an economic entity for a certain period. Detailing by time intervals is provided. Information is grouped according to the results of the current period, previous years and future periods. | 0 401 10 000 “Current period income” - used to calculate the institution’s income due in the current financial year. 0 401 28 000 “Expenses of the financial year preceding the reporting year” - discloses information about incurred expenses of the previous period. |

| Authorization of expenses | The registers in the “Authorization of Expenses” section disclose accounting information on:

| 0 501 11 000 “Adjusted LBO” - reflects the amount of completed limits of budget obligations within the current financial year. |

Charts of accounts and accounting instructions

Before examining charts of accounts applicable to government agencies, we note that the main regulatory act on accounting is the Law “On Accounting” dated December 6, 2011 No. 402-FZ, which is required to be applied not only by commercial organizations, but also by non-profit organizations, including state This law contains basic requirements for accounting and rules for its conduct in the Russian Federation. We list the main ones:

- Accounting is mandatory for all economic entities, with the exception of individual entrepreneurs and divisions of foreign organizations, if they comply with the rules of tax legislation.

- The head of an economic entity is responsible for the functioning of the accounting service.

- The organization must draw up its accounting policies independently.

- It is necessary to register all economic events of the organization in primary documents, the data from which is transferred to the accounting registers.

- Assets and liabilities are subject to periodic restatement.

- All accounting data is recorded in rubles.

- The organization must ensure the reliability of the information contained in the reports.

- The organization must have established internal control procedures.

Forms for primary documents, as well as accounting registers and reporting for public sector employees, can be found in ConsultantPlus. Get trial access to the system for free and go to the directory.

Based on accounting principles for government organizations, a unified chart of accounts and instructions have been developed, approved by Order of the Ministry of Finance of Russia dated December 1, 2010 No. 157n. They apply to all government agencies and government agencies. In addition, in accordance with clause 21 of the unified chart of accounts, each type of government institution has its own private chart of accounts, approved by:

- by order of the Ministry of Finance of Russia dated December 23, 2010 No. 183n for AU;

- by order of the Ministry of Finance of Russia dated December 16, 2010 No. 174n for BU;

- by order of the Ministry of Finance of Russia dated December 6, 2010 No. 162n for CU.

Let us note one more nuance in terminology. The phrase “budget accounting” is often used in relation to all types of government institutions. However, based on the wording used in the above-mentioned legal acts, AU and BU maintain accounting records, but state bodies, extra-budgetary funds and other institutions specified in paragraph 1 of the instructions (order No. 162n) maintain budgetary accounting.

It is also important to pay attention to other basic legislative acts that are necessary for maintaining records in a government agency. Order of the Ministry of Finance of Russia dated November 29, 2019 No. 207n contains the lists of BCCs for 2020, and order of the Ministry of Finance of Russia dated November 29, 2017 No. 209n approved the procedure for applying KOSGU from 01/01/2019. The instructions on the procedure for compiling and submitting reports on budget execution, approved by Order of the Ministry of Finance of Russia dated December 28, 2010 No. 191n, and the instructions approved by Order of the Ministry of Finance of Russia dated March 25, 2011 No. 33n, contain reporting forms and rules for filling them out. Order of the Ministry of Finance of Russia dated March 30, 2015 No. 52n approved the forms of primary documents and registers for public sector employees. In addition, there are a number of legal acts for certain industries and other specific legal acts.

Starting from 2022, they plan to make amendments to some KOSGU. Find out what innovations they plan to introduce in the Review from ConsultantPlus experts. If you don't have access to the legal system, get a free trial online.

The chart of accounts of a government institution contains 5 sections. The first section “Non-financial assets” includes:

- fixed assets by various groups and types;

- intangible assets;

- non-produced assets;

- inventories, goods, finished products;

- depreciation;

- investments in non-financial assets;

- expenses.

An unusual subsection for those familiar only with classical accounting may be non-produced assets, which are land, subsoil resources and other assets not created by man in production. They are reflected in accounting at their original cost only when they began to participate in economic turnover (except for land). And the receipt of rights to use such objects is shown on the balance sheet on account 01. Land plots are listed at cadastral value. Another feature is the use of an account for investing in inventories. It is used to accumulate the costs of production or purchase of materials.

For more details about the first section of the chart of accounts, read the article “Non-financial assets in budget accounting are...” .

The second section “Financial assets” covers:

- funds indicating the places of their storage;

- financial investments, namely all types of securities and participation in other companies;

- receivables related to counterparties, payers of social insurance contributions, tax revenues, loans issued, etc.;

- advances to employees, contractors, foreign organizations, etc.;

- investments in financial assets.

Accounts payable for loans, wages, debts to counterparties for goods, work and services, obligations for transfers to other government agencies, social benefits, payment of taxes, etc. are contained in the third section “Liabilities”.

The fourth section, “Financial Result,” groups accounts for recording income, expenses, and financial results. Basically, the composition of assets and liabilities is comparable to the corresponding items in non-budgetary organizations, but there are also differences, both in the list of possible accounts and in their accounting. In the instructions for the unified chart of accounts you can find information on accounting and the use of accounts.

A feature of accounting in government agencies, among other things, is the presence of section 5 “Authorization of expenses” in the chart of accounts. It is necessary to record the receipt and use of funds allocated from the budget, liability limits received from budget managers, the use of these limits, planned income and expenses. That is, when a notification is received from higher authorities for the current period about limits on the acquisition of, for example, inventories, the institution reflects this on the accounting accounts. Postings to the accounts of this section are contained in paragraphs. 190–209 (order No. 183n), paragraphs. 161–180 (order No. 174n), paragraphs. 131–150 (order No. 162n) instructions for charts of accounts. Accounting entries for authorization of expenses are made between the accounts of this section.

There are 30 off-balance sheet accounts for government agencies. The approach for recording them is the same as in accounting for commercial organizations, using a one-way entry, that is, only by debit for receipts and only by credit for disposals. The balance sheet includes property that is not in operational management, guarantees, awards, strict reporting forms, objects that, according to instructions, should not be on the balance sheet, etc. The organization also has the right to independently open additional off-balance sheet accounts to monitor the safety of property and other management tasks.

Chart of accounts for budgetary and government institutions

Current table of budget accounting accounts in 2022 for state and budgetary institutions according to instruction 157n:

| Balance account name | Synthetic account of an accounting object | Group name | ||

| Synthetic | Analytical | |||

| Group | View | |||

| 1 | 2 | 3 | 4 | 5 |

| NON-FINANCIAL ASSETS | 1 0 0 | 0 | 0 | |

| Fixed assets | 1 0 1 | 0 | 0 | |

| 1 0 1 | 1 | 0 | Fixed assets - real estate of the institution | |

| 1 0 1 | 2 | 0 | Fixed assets - especially valuable movable property of an institution | |

| 1 0 1 | 3 | 0 | Fixed assets - other movable property of the institution | |

| 1 0 1 | 9 | 0 | Fixed assets - other movable property of the institution | |

| 1 0 1 | 0 | 1 | ||

| 1 0 1 | 0 | 2 | ||

| 1 0 1 | 0 | 3 | ||

| 1 0 1 | 0 | 4 | ||

| 1 0 1 | 0 | 5 | ||

| 1 0 1 | 0 | 6 | ||

| 1 0 1 | 0 | 7 | ||

| 1 0 1 | 0 | 8 | ||

| Intangible assets | 1 0 2 | 0 | 0 | |

| 1 0 2 | 2 | 0 | Intangible assets - especially valuable movable property of an institution | |

| 1 0 2 | 3 | 0 | Intangible assets - other movable property of the institution | |

| Non-produced assets | 1 0 3 | 0 | 0 | |

| 1 0 3 | 1 | 0 | Non-produced assets - real estate of the institution | |

| 1 0 3 | 3 | 0 | Non-produced assets - other movable property | |

| 1 0 3 | 9 | 0 | Non-produced assets - as part of the grantor's property | |

| 1 0 3 | 0 | 1 | ||

| 1 0 3 | 0 | 2 | ||

| 1 0 3 | 0 | 3 | ||

| Depreciation | 1 0 4 | 0 | 0 | |

| 1 0 4 | 1 | 0 | Depreciation of the institution's real estate | |

| 1 0 4 | 2 | 0 | Depreciation of particularly valuable movable property of the institution | |

| 1 0 4 | 3 | 0 | Depreciation of other movable property of the institution | |

| 1 0 4 | 4 | 0 | Depreciation of rights of use of assets | |

| 1 0 4 | 5 | 0 | Depreciation of property constituting the treasury | |

| 104 | 6 | 0 | Amortization of rights to use intangible assets | |

| 1 0 4 | 9 | 0 | Depreciation of the property of an institution in a concession | |

| 1 0 4 | 0 | 1 | ||

| 1 0 4 | 0 | 2 | ||

| 1 0 4 | 0 | 3 | ||

| 1 0 4 | 0 | 4 | ||

| 1 0 4 | 0 | 5 | ||

| 1 0 4 | 0 | 6 | ||

| 1 0 4 | 0 | 7 | ||

| 1 0 4 | 0 | 8 | ||

| 1 0 4 | 0 | 9 | ||

| 1 0 4 | 2 | 9 | ||

| 1 0 4 | 3 | 9 | ||

| 1 0 4 | 4 | 9 | ||

| 1 0 4 | 5 | 1 | ||

| 1 0 4 | 5 | 2 | ||

| 1 0 4 | 5 | 4 | ||

| 1 0 4 | 5 | 9 | ||

| Material reserves | 1 0 5 | 0 | 0 | |

| 1 0 5 | 2 | 0 | Material reserves are particularly valuable movable property of an institution. | |

| 1 0 5 | 3 | 0 | Material reserves - other movable property of the institution | |

| 1 0 5 | 0 | 1 | ||

| 1 0 5 | 0 | 2 | ||

| 1 0 5 | 0 | 3 | ||

| 1 0 5 | 0 | 4 | ||

| 1 0 5 | 0 | 5 | ||

| 1 0 5 | 0 | 6 | ||

| 1 0 5 | 0 | 7 | ||

| 1 0 5 | 0 | 8 | ||

| 1 0 5 | 0 | 9 | ||

| Investments in non-financial assets | 1 0 6 | 0 | 0 | |

| 1 0 6 | 1 | 0 | Investments in real estate | |

| 1 0 6 | 2 | 0 | Investments in particularly valuable movable property | |

| 1 0 6 | 3 | 0 | Investments in other movable property | |

| 1 0 6 | 4 | 0 | Investments in financial lease objects | |

| 1 0 6 | 6 | 0 | Investments in the rights to use intangible assets | |

| 1 0 6 | 0 | 1 | ||

| 1 0 6 | 0 | 2 | ||

| 1 0 6 | 0 | 3 | ||

| 1 0 6 | 0 | 4 | ||

| Non-financial assets in transit | 1 0 7 | 0 | 0 | |

| 1 0 7 | 1 | 0 | The institution's real estate is in transit | |

| 1 0 7 | 2 | 0 | Particularly valuable movable property of the institution is in transit | |

| 1 0 7 | 3 | 0 | Other movable property of the institution in transit | |

| 1 0 7 | 0 | 1 | ||

| 1 0 7 | 0 | 3 | ||

| Non-financial assets of treasury property | 1 0 8 | 0 | 0 | |

| 1 0 8 | 5 | 0 | Non-financial assets that make up the treasury | |

| 1 0 8 | 5 | 1 | ||

| 1 0 8 | 5 | 2 | ||

| 1 0 8 | 5 | 3 | ||

| 1 0 8 | 5 | 4 | ||

| 1 0 8 | 5 | 5 | ||

| 1 0 8 | 5 | 6 | ||

| 1 0 8 | 5 | 7 | ||

| 1 0 8 | 9 | 0 | ||

| 1 0 8 | 9 | 1 | ||

| 1 0 8 | 9 | 2 | ||

| 1 0 8 | 9 | 5 | ||

| Costs of manufacturing finished products, performing work, services | 1 0 9 | 0 | 0 | |

| 1 0 9 | 6 | 0 | Cost of finished products, works, services | |

| 1 0 9 | 7 | 0 | Overhead costs of production of finished products, works, services | |

| 1 0 9 | 8 | 0 | General running costs | |

| Rights to use assets | 1 1 1 | 0 | 0 | |

| 1 1 1 | 4 | 0 | Rights to use non-financial assets | |

| 1 1 1 | 4 | 1 | ||

| 1 1 1 | 4 | 2 | ||

| 1 1 1 | 4 | 4 | ||

| 1 1 1 | 4 | 5 | ||

| 1 1 1 | 4 | 6 | ||

| 1 1 1 | 4 | 7 | ||

| 1 1 1 | 4 | 8 | ||

| 1 1 1 | 4 | 9 | ||

| 1 1 1 | 6 | 0 | Rights to use intangible assets | |

| Impairment of non-financial assets | 1 1 4 | 0 | 0 | |

| 1 1 4 | 1 | 0 | Depreciation of the institution's real estate | |

| 1 1 4 | 2 | 0 | Depreciation of particularly valuable movable property of an institution | |

| 1 1 4 | 3 | 0 | Depreciation of other movable property of the institution | |

| 1 1 4 | 4 | 0 | Impairment of rights to use assets | |

| 1 1 4 | 6 | 0 | Impairment of rights to use intangible assets | |

| 1 1 4 | 0 | 1 | ||

| 1 1 4 | 0 | 2 | ||

| 1 1 4 | 0 | 3 | ||

| 1 1 4 | 0 | 4 | ||

| 1 1 4 | 0 | 5 | ||

| 1 1 4 | 0 | 6 | ||

| 1 1 4 | 0 | 7 | ||

| 1 1 4 | 0 | 8 | ||

| 1 1 4 | 0 | 9 | ||

| 1 1 4 | 6 | 0 | ||

| 1 1 4 | 6 | 1 | ||

| 1 1 4 | 6 | 2 | ||

| 1 1 4 | 6 | 3 | ||

| FINANCIAL ASSETS | 2 0 0 | 0 | 0 | |

| Institutional funds | 2 0 1 | 0 | 0 | |

| 2 0 1 | 1 | 0 | Cash in the institution’s personal accounts with the Treasury | |

| 2 0 1 | 2 | 0 | Funds of the institution in a credit institution | |

| 2 0 1 | 3 | 0 | Cash in the institution's cash desk | |

| 2 0 1 | 0 | 1 | ||

| 2 0 1 | 0 | 2 | ||

| 2 0 1 | 0 | 3 | ||

| 2 0 1 | 0 | 4 | ||

| 2 0 1 | 0 | 5 | ||

| 2 0 1 | 0 | 6 | ||

| 2 0 1 | 0 | 7 | ||

| Funds in budget accounts | 2 0 2 | 0 | 0 | |

| 2 0 2 | 1 | 0 | Funds in budget accounts with the Federal Treasury | |

| 2 0 2 | 2 | 0 | Funds in budget accounts in a credit institution | |

| 2 0 2 | 3 | 0 | Budget funds in deposit accounts | |

| 2 0 2 | 0 | 1 | ||

| 2 0 2 | 0 | 2 | ||

| 2 0 2 | 0 | 3 | ||

| Funds in the accounts of the body providing cash services | 2 0 3 | 0 | 0 | |

| 2 0 3 | 0 | 1 | ||

| 2 0 3 | 1 | 0 | Funds in the accounts of the body providing cash services | |

| 2 0 3 | 2 | 0 | Funds in the accounts of the body providing cash services are in transit | |

| 2 0 3 | 3 | 0 | Funds in accounts for cash payments | |

| 2 0 3 | 0 | 2 | ||

| 2 0 3 | 0 | 3 | ||

| 2 0 3 | 0 | 4 | ||

| 2 0 3 | 0 | 5 | ||

| Financial investments | 2 0 4 | 0 | 0 | |

| 2 0 4 | 2 | 0 | Securities other than shares | |

| 2 0 4 | 3 | 0 | Shares and other forms of capital participation | |

| 2 0 4 | 5 | 0 | Other financial assets | |

| 2 0 4 | 2 | 1 | ||

| 2 0 4 | 2 | 2 | ||

| 2 0 4 | 2 | 3 | ||

| 2 0 4 | 3 | 1 | ||

| 2 0 4 | 3 | 2 | ||

| 2 0 4 | 3 | 3 | ||

| 2 0 4 | 3 | 4 | ||

| 2 0 4 | 5 | 2 | ||

| 2 0 4 | 5 | 3 | ||

| Income calculations | 2 0 5 | 0 | 0 | |

| 2 0 5 | 1 | 0 | Calculations for tax revenues, customs duties and insurance contributions for compulsory social insurance | |

| 2 0 5 | 2 | 0 | Calculations for property income | |

| 2 0 5 | 3 | 0 | Calculations of income from the provision of paid services (works), compensation of costs | |

| 2 0 5 | 4 | 0 | Calculations of fines, penalties, penalties, damages | |

| 2 0 5 | 5 | 0 | Calculations for gratuitous cash receipts of a current nature | |

| 2 0 5 | 6 | 0 | Calculations for gratuitous cash receipts of a capital nature | |

| 2 0 5 | 7 | 0 | Calculations of income from operations with assets | |

| 2 0 5 | 8 | 0 | Calculations for other income | |

| 2 0 5 | 1 | 1 | ||

| 2 0 5 | 2 | 1 | ||

| 2 0 5 | 2 | 2 | ||

| 2 0 5 | 2 | 3 | ||

| 2 0 5 | 2 | 4 | ||

| 2 0 5 | 2 | 6 | ||

| 2 0 5 | 2 | 7 | ||

| 2 0 5 | 2 | 8 | ||

| 2 0 5 | 2 | 9 | ||

| 2 0 5 | 3 | 1 | ||

| 2 0 5 | 3 | 2 | ||

| 2 0 5 | 3 | 3 | ||

| 2 0 5 | 3 | 5 | ||

| 2 0 5 | 4 | 1 | ||

| 2 0 5 | 4 | 4 | ||

| 2 0 5 | 4 | 5 | ||

| 2 0 5 | 5 | 1 | ||

| 2 0 5 | 5 | 2 | ||

| 2 0 5 | 5 | 3 | ||

| 2 0 5 | 6 | 1 | ||

| 2 0 5 | 7 | 1 | ||

| 2 0 5 | 7 | 2 | ||

| 2 0 5 | 7 | 3 | ||

| 2 0 5 | 7 | 4 | ||

| 2 0 5 | 7 | 5 | ||

| 2 0 5 | 8 | 1 | ||

| 2 0 5 | 8 | 3 | ||

| 2 0 5 | 8 | 4 | ||

| 2 0 5 | 8 | 9 | ||

| Calculations for advances issued | 2 0 6 | 0 | 0 | |

| 2 0 6 | 1 | 0 | Calculations for advances on wages, accruals on wage payments | |

| 2 0 6 | 2 | 0 | Calculations for advances for work and services | |

| 2 0 6 | 3 | 0 | Calculations for advances on receipt of non-financial assets | |

| 2 0 6 | 4 | 0 | Calculations for advance gratuitous transfers of a current nature to organizations | |

| 2 0 6 | 5 | 0 | Calculations for gratuitous transfers to budgets | |

| 2 0 6 | 6 | 0 | Social Security Advance Settlements | |

| 2 0 6 | 7 | 0 | Calculations for advances for the purchase of securities and other financial investments | |

| 2 0 6 | 8 | 0 | Calculations for advance gratuitous transfers of capital nature to organizations | |

| 2 0 6 | 9 | 0 | Calculations for advances on other expenses | |

| 2 0 6 | 1 | 1 | ||

| 2 0 6 | 1 | 2 | ||

| 2 0 6 | 1 | 3 | ||

| 2 0 6 | 2 | 1 | ||

| 2 0 6 | 2 | 2 | ||

| 2 0 6 | 2 | 3 | ||

| 2 0 6 | 2 | 4 | ||

| 2 0 6 | 2 | 5 | ||

| 2 0 6 | 2 | 6 | ||

| 2 0 6 | 2 | 7 | ||

| 2 0 6 | 2 | 8 | ||

| 2 0 6 | 2 | 9 | ||

| 2 0 6 | 3 | 1 | ||

| 2 0 6 | 3 | 2 | ||

| 2 0 6 | 3 | 3 | ||

| 2 0 6 | 3 | 4 | ||

| 2 0 6 | 4 | 1 | ||

| 2 0 6 | 4 | 2 | ||

| 2 0 6 | 5 | 1 | ||

| 2 0 6 | 5 | 2 | ||

| 2 0 6 | 5 | 3 | ||

| 2 0 6 | 6 | 1 | ||

| 2 0 6 | 6 | 2 | ||

| 2 0 6 | 6 | 3 | ||

| 2 0 6 | 7 | 2 | ||

| 2 0 6 | 7 | 3 | ||

| 2 0 6 | 7 | 5 | ||

| 2 0 6 | 9 | 6 | ||

| Calculations for credits, borrowings (loans) | 2 0 7 | 0 | 0 | |

| 2 0 7 | 1 | 0 | Calculations for granted credits, borrowings (loans) | |

| 2 0 7 | 2 | 0 | Settlements within the framework of targeted foreign loans (borrowings) | |

| 2 0 7 | 3 | 0 | Settlements with debtors under state (municipal) guarantees | |

| 2 0 7 | 0 | 1 | Settlements for other debt claims | |

| 2 0 7 | 0 | 3 | ||

| 2 0 7 | 0 | 4 | ||

| Calculations with accountable persons | 2 0 8 | 0 | 0 | |

| 2 0 8 | 1 | 0 | Settlements with accountable persons for wages, accruals for wage payments | |

| 2 0 8 | 2 | 0 | Settlements with accountable persons for payment for work and services | |

| 2 0 8 | 3 | 0 | Settlements with accountable persons for receipt of non-financial assets | |

| 2 0 8 | 5 | 0 | Settlements with accountable persons for gratuitous transfers to budgets | |

| 2 0 8 | 6 | 0 | Settlements with accountable persons for social security | |

| 2 0 8 | 9 | 0 | Settlements with accountable persons for other expenses | |

| 2 0 8 | 1 | 1 | ||

| 2 0 8 | 1 | 2 | ||

| 2 0 8 | 1 | 3 | ||

| 2 0 8 | 2 | 1 | ||

| 2 0 8 | 2 | 2 | ||

| 2 0 8 | 2 | 3 | ||

| 2 0 8 | 2 | 4 | ||

| 2 0 8 | 2 | 5 | ||

| 2 0 8 | 2 | 6 | ||

| 2 0 8 | 2 | 7 | ||

| 2 0 8 | 2 | 8 | ||

| 2 0 8 | 2 | 9 | ||

| 2 0 8 | 3 | 1 | ||

| 2 0 8 | 3 | 2 | ||

| 2 0 8 | 3 | 4 | ||

| 2 0 8 | 6 | 1 | ||

| 2 0 8 | 6 | 2 | ||

| 2 0 8 | 6 | 3 | ||

| 2 0 8 | 9 | 1 | ||

| 2 0 8 | 9 | 3 | ||

| 2 0 8 | 9 | 4 | ||

| 2 0 8 | 9 | 5 | ||

| 2 0 8 | 9 | 6 | ||

| Calculations for damage and other income | 2 0 9 | 0 | 0 | |

| 2 0 9 | 3 | 0 | Cost compensation calculations | |

| 2 0 9 | 3 | 4 | ||

| 2 0 9 | 3 | 6 | ||

| 2 0 9 | 4 | 0 | Calculations of fines, penalties, penalties, damages | |

| 2 0 9 | 4 | 1 | ||

| 2 0 9 | 4 | 3 | ||

| 2 0 9 | 4 | 4 | ||

| 2 0 9 | 4 | 5 | ||

| 2 0 9 | 7 | 0 | Calculations for damage to non-financial assets | |

| 2 0 9 | 7 | 1 | ||

| 2 0 9 | 7 | 2 | ||

| 2 0 9 | 7 | 3 | ||

| 2 0 9 | 7 | 4 | ||

| 2 0 9 | 8 | 0 | Calculations for other income | |

| 2 0 9 | 8 | 1 | ||

| 2 0 9 | 8 | 2 | ||

| 2 0 9 | 8 | 9 | ||

| Other settlements with debtors | 2 1 0 | 0 | 0 | |

| 2 1 0 | 0 | 2 | ||

| 2 1 0 | 8 | 2 | Settlements with the financial authority to clarify unknown revenues to the budget of the year preceding the reporting year | |

| 2 1 0 | 9 | 2 | Settlements with the financial authority to clarify unclear revenues to the budget of previous years | |

| 2 1 0 | 0 | 3 | ||

| 2 1 0 | 0 | 4 | ||

| 2 1 0 | 0 | 5 | ||

| 2 1 0 | 0 | 6 | ||

| 2 1 0 | 1 | 0 | Calculations for tax deductions for VAT | |

| 2 1 0 | 1 | 1 | ||

| 2 1 0 | 1 | 2 | ||

| 2 1 0 | 1 | 3 | ||

| Internal settlements based on receipts | 2 1 1 | 0 | 0 | |

| Internal settlements for disposals | 2 1 2 | 0 | 0 | |

| Investments in financial assets | 2 1 5 | 0 | 0 | |

| 2 1 5 | 2 | 0 | Investments in securities other than shares | |

| 2 1 5 | 3 | 0 | Investments in shares and other forms of participation in capital | |

| 2 1 5 | 5 | 0 | Investments in other financial assets | |

| 2 1 5 | 2 | 1 | ||

| 2 1 5 | 2 | 2 | ||

| 2 1 5 | 2 | 3 | ||

| 2 1 5 | 3 | 1 | ||

| 2 1 5 | 3 | 2 | ||

| 2 1 5 | 3 | 3 | ||

| 2 1 5 | 3 | 4 | ||

| 2 1 5 | 5 | 2 | ||

| 2 1 5 | 5 | 3 | ||

| OBLIGATIONS | 3 0 0 | 0 | 0 | |

| Settlements with creditors on debt obligations | 3 0 1 | 0 | 0 | |

| 3 0 1 | 1 | 0 | Settlements on debt obligations in rubles | |

| 3 0 1 | 2 | 0 | Settlements on debt obligations for targeted foreign loans (borrowings) | |

| 3 0 1 | 3 | 0 | Calculations for state (municipal) guarantees | |

| 3 0 1 | 4 | 0 | Settlements on debt obligations in foreign currency | |

| 3 0 1 | 0 | 1 | ||

| 3 0 1 | 0 | 2 | ||

| 3 0 1 | 0 | 3 | ||

| 3 0 1 | 0 | 4 | ||

| Calculations for accepted obligations | 3 0 2 | 0 | 0 | |

| 3 0 2 | 1 | 0 | Calculations for wages, accruals for wage payments | |

| 3 0 2 | 2 | 0 | Calculations for works and services | |

| 3 0 2 | 3 | 0 | Calculations for receipt of non-financial assets | |

| 3 0 2 | 4 | 0 | Calculations for gratuitous transfers of a current nature to organizations | |

| 3 0 2 | 5 | 0 | Calculations for gratuitous transfers to budgets | |

| 3 0 2 | 6 | 0 | Social security payments | |

| 3 0 2 | 7 | 0 | Calculations for the acquisition of financial assets | |

| 3 0 2 | 8 | 0 | Calculations for gratuitous capital transfers to organizations | |

| 3 0 2 | 9 | 0 | Calculations for other expenses | |

| 3 0 2 | 1 | 1 | ||

| 3 0 2 | 1 | 2 | ||

| 3 0 2 | 1 | 3 | ||

| 3 0 2 | 2 | 1 | ||

| 3 0 2 | 2 | 2 | ||

| 3 0 2 | 2 | 3 | ||

| 3 0 2 | 2 | 4 | ||

| 3 0 2 | 2 | 5 | ||

| 3 0 2 | 2 | 6 | ||

| 3 0 2 | 2 | 7 | ||

| 3 0 2 | 2 | 8 | ||

| 3 0 2 | 2 | 9 | ||

| 3 0 2 | 3 | 1 | ||

| 3 0 2 | 3 | 2 | ||

| 3 0 2 | 3 | 3 | ||

| 3 0 2 | 3 | 4 | ||

| 3 0 2 | 4 | 1 | ||

| 3 0 2 | 4 | 2 | ||

| 3 0 2 | 5 | 1 | ||

| 3 0 2 | 5 | 2 | ||

| 3 0 2 | 5 | 3 | ||

| 3 0 2 | 6 | 1 | ||

| 3 0 2 | 6 | 2 | ||

| 3 0 2 | 6 | 3 | ||

| 3 0 2 | 7 | 2 | ||

| 3 0 2 | 7 | 3 | ||

| 3 0 2 | 7 | 5 | ||

| 3 0 2 | 9 | 3 | ||

| 3 0 2 | 9 | 5 | ||

| 3 0 2 | 9 | 6 | ||

| Calculations for payments to budgets | 3 0 3 | 0 | 0 | |

| 3 0 3 | 0 | 1 | ||

| 3 0 3 | 0 | 2 | ||

| 3 0 3 | 0 | 3 | ||

| 3 0 3 | 0 | 4 | ||

| 3 0 3 | 0 | 5 | ||

| 3 0 3 | 0 | 6 | ||

| 3 0 3 | 0 | 7 | ||

| 3 0 3 | 0 | 8 | ||

| 3 0 3 | 0 | 9 | ||

| 3 0 3 | 1 | 0 | ||

| 3 0 3 | 1 | 1 | ||

| 3 0 3 | 1 | 2 | ||

| 3 0 3 | 1 | 3 | ||

| Other settlements with creditors | 3 0 4 | 0 | 0 | |

| 3 0 4 | 0 | 1 | ||

| 3 0 4 | 0 | 2 | ||

| 3 0 4 | 0 | 3 | ||

| 3 0 4 | 0 | 4 | ||

| 3 0 4 | 8 | 4 | ||

| 3 0 4 | 9 | 4 | ||

| 3 0 4 | 0 | 5 | ||

| 3 0 4 | 0 | 6 | ||

| 3 0 4 | 8 | 6 | ||

| 3 0 4 | 9 | 6 | ||

| Calculations for cash payments | 3 0 6 | 0 | 0 | |

| Settlements on transactions on the accounts of the body providing cash services | 3 0 7 | 0 | 0 | |

| 3 0 7 | 1 | 0 | Settlements on transactions on the accounts of the body providing cash services | |

| 3 0 7 | 0 | 2 | ||

| 3 0 7 | 0 | 3 | ||

| 3 0 7 | 0 | 4 | ||

| 3 0 7 | 0 | 5 | ||

| Internal settlements based on receipts | 3 0 8 | 0 | 0 | |

| Internal settlements for disposals | 3 0 9 | 0 | 0 | |

| FINANCIAL RESULTS | 4 0 0 | 0 | 0 | |

| Financial result of an economic entity | 4 0 1 | 0 | 0 | |

| 4 0 1 | 1 | 0 | Revenues of the current financial year | |

| 4 0 1 | 1 | 6 | Income of the financial year preceding the reporting year, identified through control measures | |

| 4 0 1 | 1 | 7 | Income of previous financial years identified through control measures | |

| 4 0 1 | 1 | 8 | Income of the financial year preceding the reporting year, identified in the reporting year | |

| 4 0 1 | 1 | 9 | Income of previous financial years identified in the reporting year | |

| 4 0 1 | 2 | 0 | Expenses of the current financial year | |

| 4 0 1 | 2 | 6 | Expenses of the financial year preceding the reporting year, identified through control activities | |

| 4 0 1 | 2 | 7 | Expenses of previous financial years identified through control activities | |

| 4 0 1 | 2 | 8 | Expenses of the financial year preceding the reporting year identified in the reporting year | |

| 4 0 1 | 2 | 9 | Expenses of previous financial years identified in the reporting year | |

| 4 0 1 | 3 | 0 | Financial results of previous reporting periods | |

| 4 0 1 | 4 | 0 | revenue of the future periods | |

| 4 0 1 | 4 | 1 | Deferred income to be recognized in the current year | |

| 4 0 1 | 4 | 9 | Deferred income to be recognized in subsequent years | |

| 4 0 1 | 5 | 0 | Future expenses | |

| 4 0 1 | 6 | 0 | Reserves for future expenses | |

| Result for budget cash transactions | 4 0 2 | 0 | 0 | |

| 4 0 2 | 1 | 0 | Receipts | |

| 4 0 2 | 2 | 0 | Disposals | |

| 4 0 2 | 3 | 0 | The result of past reporting periods for cash budget execution | |

| AUTHORIZATION OF EXPENSES | 5 0 0 | 0 | 0 | |

| 5 0 0 | 1 | 0 | Validation for current financial year | |

| 5 0 0 | 2 | 0 | Authorization for the first year following the current (next financial year) | |

| 5 0 0 | 3 | 0 | Authorization for the second year following the current one (first year following the next one) | |

| 5 0 0 | 4 | 0 | Authorization for the second year following the next one | |

| 5 0 0 | 9 | 0 | Authorization for other subsequent years (outside the planning period) | |

| Limits on budget obligations | 5 0 1 | 0 | 0 | |

| 5 0 1 | 0 | 1 | ||

| 5 0 1 | 0 | 2 | ||

| 5 0 1 | 0 | 3 | ||

| 5 0 1 | 0 | 4 | ||

| 5 0 1 | 0 | 5 | ||

| 5 0 1 | 0 | 6 | ||

| 5 0 1 | 0 | 9 | ||

| Liabilities | 5 0 2 | 0 | 0 | |

| 5 0 2 | 0 | 1 | ||

| 5 0 2 | 0 | 2 | ||

| 5 0 2 | 0 | 5 | ||

| 5 0 2 | 0 | 7 | Obligations accepted | |

| 5 0 2 | 0 | 9 | Deferred liabilities | |

| Budget allocations | 5 0 3 | 0 | 0 | |

| 5 0 3 | 0 | 1 | ||

| 5 0 3 | 0 | 2 | ||

| 5 0 3 | 0 | 3 | ||

| 5 0 3 | 0 | 4 | ||

| 5 0 3 | 0 | 5 | ||

| 5 0 3 | 0 | 6 | ||

| 5 0 3 | 0 | 9 | ||

| Estimated (planned, forecast) assignments | 5 0 4 | 0 | 0 | |

| Right to assume obligations | 5 0 6 | 0 | 0 | |

| Approved amount of financial support | 5 0 7 | 0 | 0 | |

| Financial support received | 5 0 8 | 0 | 0 | |

Changes in instructions

According to Instruction No. 157n, the account number consists of 26 digits, of which 1-17 digits contain an analytical code based on the classification of receipts and disposals. In the program “1C: Public Institution Accounting 8”, the specified part of the account is called the “account classification characteristic” (hereinafter referred to as KPS). All changes affected the procedure for forming the CPS.

From January 1, the structure of the account number of budgetary and autonomous institutions has changed.

In accordance with clause 21.1 of Instruction No. 157n, starting in the digits of the account number from 1 to 4, the code of the section and subsection of budget expenses should be indicated.

State institutions still indicate budget classification codes in categories 1-17 (from 4 to 20 categories).

There are a number of exceptions to the general rule when zeros are indicated in digits 1-17. For example, zeros in the CPS are indicated for accounts 304.01 “Settlements for funds received for temporary disposal”, 401.30 “Financial result of past reporting periods”, as well as synthetic accounts.

For each account, the types of KPS are determined from the corresponding types of codes for the classification of budget income (KDB), budget expenditures (KRB) and sources of financing budget deficits (CIF). The list of types available for a particular account is fixed in Appendix No. 2 to Instruction No. 157n.

The list of CPS types available for individual accounts has been expanded, including the addition of:

- to account 209.30 type and KDB;

- to account 209.40 type KDB;

- to account 209.71 type CIF;

- to account 210.05 types KRB and CIF;

- to account 304.06 KRB, KDB and KIF.

This rule expands the list of transactions available for recording. For example, before the changes were made, account 209.30 “Calculations for cost compensation” had the KDB type available and it was possible to reflect the accrual of income with economic classification code 130 “Revenue from the provision of paid services.” However, in accordance with Instruction No. 157n, the account is also intended for operations to withhold certain amounts that employees previously received (accountable amounts not returned on time, vacation pay upon dismissal, if the employee has not fully earned vacation leave, but has already managed to take it off). Now, when withholding such amounts, you can indicate the KPS type KRB, corresponding to the value of the KPS of the corresponding accounts 208.00 “Settlements with accountable persons” and 302.11 “Payroll settlements”. The change was made to the Unified Chart of Accounts by order of the Ministry of Finance of the Russian Federation dated November 16, 2016 No. 209n. This order also made changes to Instructions No. 162, No. 174n and No. 183n.

An important innovation for all types of institutions is the procedure for recording transactions in accounts:

- analytical accounting of account 100.00 “Non-financial assets” (except for accounts 106.00 “Investments in non-financial assets”, 107.00 “Non-financial assets in transit”, 109.00 “Costs of manufacturing finished products, performing work, services”);

- 201.35 “Cash documents”.

In 5-17 digits of working account numbers, zeros should be indicated, unless otherwise provided for by the intended purpose of the property. Zeros are also indicated when reflecting transactions for the gratuitous transfer of the above fixed assets and monetary documents in the order of intradepartmental, interdepartmental and interbudgetary settlements and between institutions of various types in 5-17 categories of corresponding accounts 401.20 “Expenditures of the current financial year” and 304.04 “Intradepartmental settlements”. Thus, when forming the CPS, codes of target budget items by government institutions and codes of types of expenses by institutions of all types are not included.

Instructions No. 162, No. 174n and No. 183n contain rules for the formation of CPS for individual accounts, which are an exception to the general rule.

| Type of institution | Operation | Corresponding account number |

| Zeros in 5-14 digits of the account number | ||

| official | Accrual of reserves for future expenses | 401.60 401.20 |

| Zeros in 5-17 digits of the account number | ||

| budget and autonomous | Adjustment of settlements with the founder when the value of real estate and especially valuable movable property changes (according to KFO 4) | 210.06 401.10 (KEC 172) |

| Receipt and outflow of funds in accounts and at the cash desk of the institution | 201.00 | |

| autonomous | Reflection of current year expenses for depreciation and write-off of inventories | 401.20 (KEC 270) |

The principle of working with a register

Accounting accounts are numerical codes that indicate a specific type of asset, liability, income, expense and capital. They are used to systematize information about accounting objects.

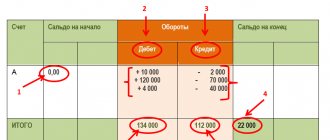

The key principle of working with these accounting registers is the preparation of accounting entries using the double entry method. Transactions on off-balance sheet accounts are reflected in a simple way. Double entry involves the simultaneous reflection of one transaction in two accounts at once: the debit of one and the credit of the other. For example, when the size of an enterprise’s assets changes, the importance of their sources of financing will necessarily change. The principle also applies to the preparation of reports and balance sheets.

All accounts are classified into:

- Active. They can only have a debit balance of the account (positive value). The balance of active accounts at the end of the reporting period forms the active part of the balance sheet.

- Passive. Can only have a credit balance (debt, obligation, debt). Indicators of passive accounts reflect the liabilities of the balance sheet.

- Active-passive. Mixed type: characterized by balances of both debit and credit. Balances are included in the reporting, depending on the type of balance for the reporting period.

Read more: “Active and passive accounts: what is the difference and how to work with them.”

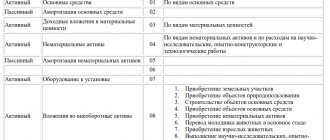

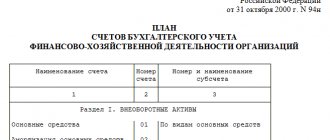

Unified Chart of Accounts

And this is a table of the chart of accounts with a breakdown for 2021 for commercial enterprises and non-profit organizations by order of the Ministry of Finance No. 94n dated October 31, 2000:

| Account number | Name |

| 01 | Fixed assets |

| 02 | Depreciation of fixed assets |

| 03 | Profitable investments in material assets |

| 04 | Intangible assets |

| 05 | Amortization of intangible assets |

| 07 | Equipment for installation |

| Investments in non-current assets | |

| 09 | Deferred tax assets |

| Materials | |

| 11 | Animals being raised and fattened |

| 14 | Reserves for reduction in the value of material assets |

| 15 | Procurement and acquisition of material assets |

| 16 | Deviation in the cost of material assets |

| 19 | Value added tax on purchased assets |

| Primary production | |

| 21 | Semi-finished products of our own production |

| 23 | Auxiliary production |

| 25 | General production expenses |

| General running costs | |

| 28 | Defects in production |

| 29 | Service industries and farms |

| 40 | Release of products (works, services) |

| Goods | |

| 42 | Trade margin |

| 43 | Finished products |

| Selling expenses | |

| 45 | Goods shipped |

| 46 | Completed stages of unfinished work |

| 50 | Cash register |

| 51 | Current accounts |

| 52 | Currency accounts |

| 55 | Special bank accounts |

| 57 | Transfers on the way |

| 58 | Financial investments |

| 59 | Provisions for impairment of financial investments |

| 60 | Settlements with suppliers and contractors |

| 62 | Settlements with buyers and customers |

| 63 | Provisions for doubtful debts |

| 66 | Calculations for short-term loans and borrowings |

| 67 | Calculations for long-term loans and borrowings |

| 68 | Calculations for taxes and fees |

| 69 | Calculations for social insurance and security |

| 70 | Payments to personnel regarding wages |

| 71 | Calculations with accountable persons |

| 73 | Settlements with personnel for other operations |

| 75 | Settlements with founders |

| 76 | Settlements with various debtors and creditors |

| 77 | Deferred tax liabilities |

| 79 | On-farm settlements |

| 80 | Authorized capital |

| 81 | Own shares (shares) |

| 82 | Reserve capital |

| 83 | Extra capital |

| 84 | Retained earnings (uncovered loss) |

| 86 | Special-purpose financing |

| 90 | Sales |

| 91 | Other income and expenses |

| 94 | Shortages and losses from damage to valuables |

| 96 | Reserves for future expenses |

| 97 | Future expenses |

| 98 | revenue of the future periods |

| 99 | Profit and loss |

Accounting in budgetary organizations: correspondence and chart of accounts

It is difficult for novice accountants to comprehend accounting in budgetary organizations, because There is no uniform instruction in the legislation for the application of the Chart of Accounts for accounting of budgetary organizations. At the same time, the correspondence of accounts for reflecting business transactions is given in separate instructions and guidelines, which are collected in this material. The chart of accounts, structure, features of accounting in budgetary institutions are in the article.

1. Organization of accounting in budgetary organizations

In accordance with the Budget Code, a budget organization is an organization that meets the following conditions:

1) formed by the President of the Republic of Belarus, state bodies, including local executive and administrative bodies, or another state organization authorized by the President of the Republic of Belarus;

2) created to carry out managerial, socio-cultural, scientific, technical or other functions of a non-commercial nature;

3) financed from the relevant budget based on the budget estimate;

4) maintains accounting records in accordance with the Chart of Accounts approved for budgetary organizations, and (or) taking into account the specifics of accounting and reporting in accordance with the law.

Such organizations mainly include government institutions: education, health care, physical education, sports and tourism, social services, science and culture, and centers for supporting the activities of budgetary organizations.

When organizing accounting, budgetary organizations are guided by the following main regulations:

— Law of July 12, 2013 N 57-Z;

- Resolution dated 08.02. 2005 N 15;

- Resolution No. 50 dated April 22, 2010.

2. Chart of accounts, its structure and application

Accounting for the execution of cost estimates for budgetary funds, estimates of income and expenses of extra-budgetary funds, for designated funds and other sources is carried out by budgetary organizations in accordance with the Chart of Accounts with the preparation of a single balance sheet for all sources of funds (clause 6 of Instruction No. 15).

This Chart of Accounts is a systematic list of accounting accounts, the structure of which includes 12 sections and 27 synthetic accounts, built in an orderly manner from 01 to 41. Synthetic accounts are combined into sections according to the economic content of accounting objects.

Each section contains:

— names of synthetic accounts and their two-digit codes;

— names of subaccounts and their three-digit codes.

In practice, current accounting of business transactions and reporting is carried out using subaccounts.

The procedure for applying the Chart of Accounts is determined not by a single instruction, but by separate legal acts for accounting for assets and expenses.

Note Typical transactions reflecting the correspondence of accounts compiled on the basis of regulatory legal acts data are collected in the classifier “Typical transactions in budgetary organizations”.

Since separate sub-accounts are used both to account for transactions on budgetary funds and funds received from extra-budgetary funds (material assets, funds in settlements, etc.), in order to ensure their separate accounting, each sub-account can be assigned a distinctive feature in the form of a number.

The working chart of accounts is reflected in the accounting policy of the budgetary organization (paragraph 3, paragraph 4, article 9 of Law No. 57-Z).

Another feature of using the Chart of Accounts is that expenses according to the corresponding estimates (budgetary and extra-budgetary) are divided into cash and actual.

At the same time, their records are kept in accordance with the budget classification (part 3, paragraph 2 of Instruction No. 157, part 3, paragraph 4 of Instructions No. 364).

For reference According to Decree No. 82 dated 02/09/2019, it is planned to develop and implement a chart of accounts for budgetary organizations, integrated with budget classification (Chapter 4 of the reform concept No. 82).

Note For the use of budget classification by sections, subsections, paragraphs, articles, subarticles and elements, see the “Budget Classification” classifier.

The applied subaccounts in the context of the names of synthetic accounts (accounting objects), legal acts that determine the procedure for using subaccounts and their correspondence with other subaccounts are shown in the following table, built by sections in accordance with the structure of the Chart of Accounts of budgetary organizations:

| N p/p | Name of the synthetic account (accounting object) | Applicable subaccount codes | Correspondence of subaccounts with other subaccounts |

| Section I. Fixed assets | |||

| 1. | Fixed assets (account 01) | 010 — 019 | Determined by the Accounting Instructions OS N 60 and the Intangible Accounting Instructions N 25 |

| 2. | Depreciation of fixed assets (account 02) | 020 | |

| Section II. Material reserves | |||

| 3. | Products in warehouse, shipped (invoice 03) | 030 — 031 | Defined by section I of the table of Guidelines No. 59 |

| 4. | Equipment, construction materials for capital construction and materials for scientific research (account 04) | 040 — 044 | Defined by section II of the table of Guidelines No. 59 |

| 5. | Animals for growing and fattening (count 05) | 050 | Defined by section III of the table of Guidelines No. 59 |

| 6. | Materials and food (account 06) | 060 — 069 | Defined by section IV of the table of Guidelines No. 59 |

| Section III. Individual items included in working capital | |||

| 7. | Individual items included in working capital (account 07) | 070 — 073 | Determined by the table in the appendix to the Instructions for accounting of EP in SOS N 63 |

| Section IV. Production costs | |||

| 8. | Production costs (account 08) | 080, 082, 084 | Accounting for the costs of R&D and the results of scientific and technical documentation is defined in Chapter. 4 Instructions for accounting for intangible assets No. 25 |

| Section V. Cash | |||

| 9. | Current accounts according to the budget (account 10) | 100 — 105 | Defined by clauses 1 - 9, clause 37 of the table of Instructions No. 364 |

| 10. | Current accounts for extrabudgetary funds (account 11) | 111, 112, 114, 118 | Defined by clauses 10 - 21, clauses 37 - 40 of the table of Instructions No. 364 |

| 11. | Cash desk (count 12) | 120, 121 | Defined by paragraphs 22 - 23, paragraphs 33 - 36 of the table of Instructions No. 364 |

| 12. | Other cash (account 13) | 130 — 132, 134 | Defined by paragraphs 24 - 32 of the table of Instructions No. 364 |

| Section VI. Intradepartmental financing calculations | |||

| 13. | Intradepartmental financing calculations (account 14) | 140, 142 — 145 | Partially contained in clauses 1 - 2, clause 4, clause 37 of the table of Instructions No. 364, defined by clauses 1 - 2 of Instructions No. 71 |

| Section VII. Calculations | |||

| 14. | Settlements with suppliers and customers (account 15) | 150, 151, 154, 155 | Partially contained in paragraphs 6 - 7, paragraphs 14 - 17 of the table of Instructions No. 364 |

| 15. | Settlements with accountable persons (account 16) | 160 | Partially contained in paragraphs 22 - 23, paragraphs 34 - 36 of the table of Instructions No. 364 |

| 16. | Settlements with various debtors and creditors (account 17) | 170 — 179 | Partially contained in paragraphs 6, 8, 9 22 - 23 of the table of Instructions No. 364 |

| 17. | Settlements with staff for wages and scholarship holders (account 18) | 180 — 188 | Contained in part in: - clause 9, 23 of the table of Instructions No. 364; — clause 1 of table Instruction No. 157 |

| 18. | Calculations for payment of pensions and benefits (account 19) | 191, 192, 194 | — |

| Section VIII. Expenses | |||

| 19. | Budget expenses (account 20) | 200, 202, 203, 206 | Defined by section I of the table of Instruction No. 157 |

| 20. | Other expenses (account 21) | 210 — 212, 215 | Defined by sections II and III of the table of Instruction No. 157 |

| Section IX. Financing and loans | |||

| 21. | Financing and loans (account 23) | 230 — 232, 235 — 238 | Contained in part in: - clauses 1, 11, 37 of the table of Instructions No. 364; - clauses 6, 9 of the table of Instruction No. 157 |

| Section X. Funds and funds for special purposes | |||

| 22. | Economic Stimulus Funds (Account 24) | 240, 246 | — |

| 23. | Fund in fixed assets (account 25) | 250 | Determined by the Accounting Instructions OS N 60 and the Intangible Accounting Instructions N 25 |

| 24. | Fund of individual items as part of working capital (account 26) | 260 | Determined by the table in the appendix to the Instructions for accounting of EP in SOS N 63 |

| 25. | Targeted funds (account 27) | 271, 272 | — |

| Section XI. Implementation | |||

| 26. | Implementation (count 28) | 280, 281 | Contained in part in: - clause 11 of the table of Instructions No. 364; - Ch. 4 and 5 Instructions for accounting of intangible assets N 25; - table 1 Methodological recommendations of the Ministry of Education dated 01/05/2011 |

| Section XII. Revenues and financial results | |||

| 27. | Profits and losses (account 41) | 410, 411 | Defined by Part 5 of the letter of the Ministry of Finance dated January 28, 2014 N 15-1-19/75 |

Off-balance sheet accounts are allocated to a separate group in the Chart of Accounts of budgetary organizations. These accounts are used to record business transactions on assets and settlements that are not included in the economic turnover of a budget organization and are not reflected in the balance sheet, but are subject to control. All off-balance sheet accounts have two-digit codes and are active, i.e. accounting is maintained using a simple system reflecting business transactions without using double entry.

| Name of the off-balance sheet account | Account code | Rationale for use |

| Leased fixed assets | 01 | — |

| Inventory assets accepted for safekeeping | 02 | Clause 2 of Resolution No. 74 (Part 3, Clause 22 of the Instructions for Accounting of Intangible Intangibles No. 25) |

| Strict reporting forms | 04 | Chapter 5 Instructions No. 196 |

| Written off debt of insolvent debtors | 05 | — |

| Material assets paid for through centralized supply | 06 | — |

| Debt of pupils and students for unreturned material assets | 07 | — |

| Challenge sports prizes and cups | 08 | — |

For reference If, in relation to specific business transactions, individual components of assets, liabilities, equity capital, income, expenses of an organization, the legislation of the Republic of Belarus does not establish a procedure for their reflection in accounting and reporting, such a procedure is developed by the organization independently using professional judgment based on the requirements established legislation of the Republic of Belarus (clause 5 of article 9 of Law No. 57-Z).

Read this material in ilex >>* *follow the link you will be taken to the paid content of the ilex service

Accounts for business entities

The plan for business entities that keep records using the double entry method, including non-profit organizations, is fixed and regulated by Order of the Ministry of Finance No. 94n dated October 31, 2000. This plan is the same for all institutions, except budgetary and credit (banks).

PAS consists of synthetic and analytical accounts, each of which has a specific numbering. Thus, the register structure represents first and second order accounts. The working document of each organization is developed in accordance with a single PS and includes synthetic and subaccounts.

Accounting registers differ in their content and are active, passive and active-passive. In total, the PAS, which is used by non-profit organizations and other business entities, contains 71 synthetic accounts, including 11 off-balance sheet accounts. The following sections of the PS for business entities are distinguished:

- fixed assets;

- productive reserves;

- production costs;

- finished products, goods;

- cash;

- calculations;

- capital;

- financial results.

Accounts for banking organizations

The Central Bank of the Russian Federation has made significant changes to the current plan for credit institutions. Now the procedure by which the bank’s chart of accounts is applied is regulated by the regulation of the Central Bank of the Russian Federation No. 579-P dated 02/27/2017 (as amended on 02/28/2019) with the indication of the Central Bank of the Russian Federation No. 4722-U dated 02/15/2018.

The structure of the plan consists of the following chapters:

- Chapter A - balance sheet accounts;

- Chapter B - trust management accounts;

- Chapter B - off-balance sheet accounts;

- Chapter D - accounts for accounting for claims and obligations under derivative financial instruments and other agreements (transactions), under which settlements and delivery are carried out no earlier than the next day after the conclusion of the agreement (transaction).

Each chapter includes specific sections and subsections.