General rules for dismissal during liquidation of an organization

If the organization is liquidated, then all employees are subject to dismissal - both those who are currently performing their labor functions, and those who are on vacation or sick.

In addition, upon dismissal due to the liquidation of an organization, even employees with young children and women on maternity leave and child care cannot be kept at work. When dismissing an employee for this reason, the company must notify within the established time frame:

- employee of the organization;

- trade union;

- employment service.

It is imperative to accrue and pay the required compensation to the employee, draw up and personally hand over the work book and income certificate. As soon as the liquidation procedure is completed, all personnel documents must be archived. Next, we will consider the main stages of this procedure.

The procedure for dismissing an employee during liquidation of an organization is described in more detail in the Ready-made solution of the ConsultantPlus system. Get a trial access to the system and follow the instructions for free.

Rules for notifying the employment center about mass layoffs

Notification of impending layoffs to the employment service. According to Art. 25 of Law No. 1032-1, organizations must notify the labor exchange no later than 2 months before the start of the event, and individual entrepreneurs must do this no later than 2 weeks before the start of layoffs.

This is also important to know:

Deduction for unworked vacation days upon dismissal: detailed instructions

Mass liquidation is the liquidation of an enterprise of any organizational and legal form with 15 or more employees, or the dismissal of workers in the amount of 1 percent of the total number of employees in connection with the liquidation of enterprises within 30 calendar days in regions with a total number of employees of less than 5 thousand people.

Notification must be made in writing by registered mail or courier. In this case, a copy of the notification with a mark from the employment service or with a postal receipt must be kept as evidence of the notification.

The Central Employment Center notification form can be viewed at the employment center notification link.

Dismissal upon liquidation of an organization: we notify the trade union committee

The primary trade union organization should be notified of future dismissal. This must be done 3 months remaining until the termination of the employment relationship (clause 2 of article 12 of the Federal Law “On trade unions, their rights and guarantees of activity” dated January 12, 1996 No. 10-FZ).

It is allowed to compose a notification in any form. The document should contain a list of employees subject to dismissal, as well as indicate the number of the liquidation decision and the date of the protocol.

Often, to sign a collective agreement, workers create a labor council. This association is not a trade union organization, and the law does not oblige it to notify.

Are you liquidating a legal entity? Sign up for a free trial access to ConsultantPlus and read the step-by-step instructions for liquidating an LLC with samples of the necessary documents.

Liability for violations during dismissal upon liquidation

If the dismissal procedure during the liquidation of a business is carried out in violation of labor laws, it can be challenged in court. Violations may include:

- Failure to comply with the statutory deadlines for notifying an employee or accruing payments to him.

- Violation of any of the points of a procedural nature - failure to draw up internal acts or orders.

- Late issuance of a work book or errors in the entries made in it.

This is also important to know:

Dismissal due to the death of an employee: step-by-step instructions for registration

Important! When the liquidation of a business entity is carried out due to the death of the employer, this procedure is not considered dismissal by liquidation, but is carried out in a completely different format - due to circumstances that do not depend on the will of the parties.

To challenge the legality of dismissal, the employee must, no later than within one month from the date of dismissal, file a claim with the district court against the employer. Geographically, it is possible to appeal to both the court at the place of residence and the court at the location of the employer. Moreover, if the specified period was missed for valid reasons, if such reasons are confirmed, the court may restore it.

Dismissal may also be considered illegal if there was a fictitious liquidation procedure of the enterprise, or if there was a termination of the activities of one of the branches while the business entity continued to exist. In this case, the employee may demand compensation. Possible compensation that an employee illegally dismissed following liquidation can count on includes, first of all, reinstatement at work with compensation for all days of forced absence from the moment of dismissal until the court decision. In addition, the legislation directly provides for the right to claim moral damages from the employer, but judicial practice in most cases only satisfies direct material claims against the employer. Responsibility for paying wages if the employer was an individual entrepreneur rests with him even after cessation of activity as an individual. If the employer was a legal entity, compensation may be paid from its financial or material assets. In addition, they can be recovered from the responsible persons of the said enterprise - according to the legislation on subsidiary liability, it can be borne by the director of the enterprise, his deputy and the chief accountant even after the liquidation of the business.

Dismissal due to liquidation of the organization: notify the employment service

The employment service must also be notified that layoffs are coming. At the same time, depending on the scale (massiveness) of termination of agreements, deadlines are established within which a message must be sent to the service, and the procedure for such notification. As stated in Decree of the Government of the Russian Federation dated 02/05/1993 No. 99, mass dismissal should be considered the simultaneous termination of employment agreements with 15 or more employees.

If there is a mass dismissal due to the liquidation of an organization, then the employment service must be notified twice:

- 3 months remaining before the start of the dismissal procedure, send Information on the mass release of workers in the form given in Appendix 1 to Resolution No. 99.

- 2 months remaining before the start of the dismissal procedure, submit Information about the dismissed employees in the form given in Appendix 2 to Resolution No. 99. They provide the personal data of each employee, his average earnings, education, profession and qualifications.

The above criteria for mass participation are not dogma. Regional authorities are given the right to determine their own limits for this indicator. However, this must satisfy the main principle: the social security of employees must not be violated (Article 2 of the Regulations under Resolution No. 99).

When there is no widespread dismissal, the employment service can be notified once - up to two months before the start of the dismissal procedure (Clause 2 of Article 25 of the Law of the Russian Federation “On Employment of the Population in the Russian Federation” dated April 19, 1991 No. 1032-1).

There is no official form for such notifications. You are allowed to compose a document in any form. It should mention the employee’s personal data, profession, personal working conditions, specialty, etc. From business practice it follows that personnel officers use the form given in Appendix 2 in such cases.

Notifications must be submitted to the employment service on paper - in person or by mail.

Liquidation of a legal entity

An enterprise or organization can be closed either voluntarily or forcibly. The decision on this is issued in the same place where the decision to open this enterprise was made at one time.

According to the law, the closure of a company is the complete cessation of all activities by it. At the same time, it is unacceptable to transfer the rights to the organization to other persons.

The organization is considered closed, and the process is completed only after the corresponding entry appears in the Unified Register of Enterprises.

That is, the liquidation of a company is a certain form of completion of the activities of a legal entity. In this case, any activity of this enterprise is completely stopped:

- Production.

- Scientific and technical.

- Trade or public and others.

After a decree on liquidation of a legal entity is issued, all loans the company has must be returned to creditors. And also carried out:

- Sale of company property.

- Return of share contributions to the founders of the organization.

Warning to employees about dismissal due to liquidation of the enterprise

In the event of dismissal due to the liquidation of an organization, strict deadlines have been established within which the employer must meet in order to warn employees of the upcoming termination of their employment relationship. This time period should not exceed two months. This is done on an individual basis and necessarily against the personal signature of the employee (Part 2 of Article 180 of the Labor Code of the Russian Federation).

A sample notification of an employee about the upcoming dismissal due to the liquidation of the organization was prepared by ConsultantPlus experts. Get free trial access to the system and proceed to the sample.

In addition, it is necessary to notify in writing by mailing those employees who are currently on vacation (labor, pregnancy, etc.) or sick.

NOTE! If difficulties arise with the employee’s approval of the order (absent, does not want to get acquainted, etc.), the personnel service can send him a letter by mail. The shipment is sent by registered mail with acknowledgment of receipt. Two months will be counted from the day on which the employee signed the receipt of receipt of the letter.

The employer has the opportunity to terminate the employment relationship before the expiration of these two months. But this will require the written consent of the dismissed employee. In addition, in these circumstances, the employee will have to be paid compensation. It is calculated from average monthly earnings and is directly proportional to the time remaining before dismissal (Part 3 of Article 180 of the Labor Code of the Russian Federation).

To notify seasonal workers, other temporary standards are provided: the employer is given 7 calendar days (Article 296 of the Labor Code of the Russian Federation). If we are talking about persons with whom the employment relationship is valid for 2 months or less, then only 3 calendar days are given to notify them (Article 292 of the Labor Code of the Russian Federation).

Basic rules for notifying employees about layoffs following liquidation

In accordance with Art. 180 of the Labor Code of the Russian Federation, such messages must be made no later than 2 months before the date of the intended dismissal of employees. If citizens work on the basis of short-term employment contracts for a period of up to 2 months, they must be notified that the enterprise will be liquidated or employees will be fired at least 3 days before the dismissal.

Each employee must be notified individually in writing with a personal signature. If delivering the notice in person is problematic, the organization sends it to the employee by mail (usually at the place of registration or actual residence) by registered mail with notification and inventory. And this procedure is sufficient to consider the employee aware of the upcoming termination of the employment contract. Confirmation of the fact that all employees have been informed are copies of notifications certified by the signatures of employees, or postal counterfoils (if the notification was sent by letter).

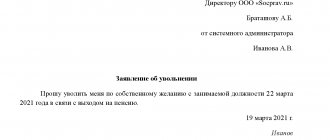

Preparation of documents for employees dismissed due to liquidation of the organization

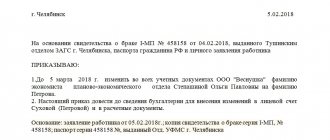

Termination of contractual relations in the labor sphere must be accompanied by an order. When dismissing one employee, to correctly draw up an order, you should rely on form T-8; if we are talking about a group of employees, use form T-8a. Such templates were approved by the Decree of the State Statistics Committee of the Russian Federation “On approval of unified forms of primary accounting documentation for recording labor and its payment” dated January 5, 2004 No. 1.

For information on the procedure for filling out these forms, see the article “Unified Form No. T-8 - form and sample of completion.”

An enterprise can also develop its own documents for maintaining personnel records (letter of Rostrud dated 01/09/2013 No. 2-TZ).

The order should indicate the reason for termination of the employment relationship. In this case, it means that the organization is being liquidated. This area is regulated by the norm indicated in clause 1, part 1, art. 81 Labor Code of the Russian Federation. The order, in addition, must necessarily contain a reference to the number and date of the decision to terminate the company’s activities.

On the day of dismissal, the employee must be handed over the work book (Part 4 of Article 84.1 of the Labor Code of the Russian Federation). Before this, the personnel service must properly prepare a record containing a link to the above-mentioned clause 1, part 1, art. 81 Labor Code of the Russian Federation.

ATTENTION! The rules for maintaining work books in force from 09/01/2021 (approved by order of the Ministry of Labor dated 05/19/2021 No. 320n) do not provide for familiarization of the employee with the signature of the work records entered into the paper work book (previously, employees signed the dismissal record). Read more about the new rules for registering a work book, effective from September 2022, here.

In addition to the work book, the company must issue the employee a certificate of the amount of payments for which insurance premiums were calculated for the previous two years (subclause 3, clause 2, article 4.1 of the Federal Law “On compulsory social insurance in case of temporary disability and in connection with maternity” dated December 29, 2006 No. 255-FZ). The form of the certificate is approved in Appendix 1 to the order of the Ministry of Labor of Russia dated April 30, 2013 No. 182n.

In addition, at the employee’s request, issue him a 2-NDFL certificate.

Registration of a dismissal order due to reduction during liquidation

An order upon liquidation of an organization is issued strictly after a 2-month period after notifying employees, in rare cases -

Later. Before this period, the employee cannot be fired; this fact is a violation of labor legislation. The order is drawn up according to a single unified form T-8 or T-8 a (mass dismissal).

This is also important to know:

Reasons for leaving a job: grounds for terminating an employment contract

You can view and download the unified order form T-8 here.

Free legal consultation We will answer your question in 5 minutes!

Ask a Question

Free legal consultation

We will answer your question in 5 minutes!

Ask a Question

You can view and download the unified order form T-8 for mass dismissal here.

Part 2 Art. 841 of the Labor Code of the Russian Federation determines the mandatory familiarization of the dismissed employee with the relevant order. But no one can force a person to familiarize himself with the issued dismissal order against signature. Therefore, in case of refusal, a corresponding act must be drawn up.

Payments to persons dismissed due to liquidation of the organization

If the dismissal of an employee is due to the liquidation of the organization, upon termination of the contract he is entitled to pay severance pay. Its value is established by law and is equal to 1 average monthly salary (Part 1 of Article 178 of the Labor Code of the Russian Federation). Payment must be made on the day when the employment contract ceased to be valid.

If an employee looks for a new job for more than a month, then the employer is obliged to pay him the average monthly salary for the 2nd month from the date of dismissal or for part of it in proportion to the period of employment that falls on that month (Part 2 of Article 178 of the Labor Code of the Russian Federation). It is possible to extend it for another month or part of it in proportion to the period of employment (up to 3 months in total), but only if the dismissed employee is registered with the employment service within two weeks after termination of employment and has not found a decent place of work (Part 3 Article 178 of the Labor Code of the Russian Federation). In this case, the employer has the right to pay, instead of the specified transfers for the 2nd and 3rd months after employment, a one-time compensation in the amount of twice the average monthly earnings (Part 4 of Article 178 of the Labor Code of the Russian Federation).

For accruals for the 3rd month, if it is made according to the general rule, a decision of the employment service is therefore required. But all payments fall on the shoulders of the liquidated company, so the procedure for calculating payments will only make sense until the moment of liquidation.

For information on the procedure for calculating personal income tax on compensation payments, see the article “Severance pay, payments upon dismissal and personal income tax.”

For information on how to calculate the average salary, see the article “How to calculate the average monthly salary (formula).”

Conditions regarding the place of work in the employment contract.

The employer's resolution of the issue with employees upon termination of the activities of a separate division will depend on how the condition regarding the place of work is spelled out in the employment contract.

According to Part 2 of Art. 57 of the Labor Code of the Russian Federation, mandatory for inclusion in the employment contract is a condition about the place of work, and in the case when an employee is hired to work in a branch, representative office or other separate structural unit of the organization located in another area - about the place of work indicating the name of the separate structural unit and its location.

In accordance with Art. 72 of the Labor Code of the Russian Federation, changes in the terms of the employment contract determined by the parties, including transfer to another job, are allowed only by agreement of the parties, with the exception of cases provided for by the Labor Code of the Russian Federation. An agreement to change the terms of an employment contract determined by the parties is concluded in writing.

Transfer to another job in accordance with Art. 72.1 of the Labor Code of the Russian Federation is a permanent or temporary change in the labor function of the employee and (or) the structural unit in which the employee works (if the structural unit was specified in the employment contract), while continuing to work for the same employer, as well as transfer to work in another location together with the employer.

Transfer to another job is permitted only with the written consent of the employee, with the exception of cases of temporary transfer due to a natural or man-made disaster, as well as cases of downtime.

The employee’s consent is not required to move him from the same employer to another workplace, to another structural unit located in the same area, or to assign him work on another mechanism or unit, unless this entails a change in the terms of the employment contract determined by the parties. It is necessary to keep in mind that by structural divisions we mean both branches, representative offices, and departments, workshops, sites, shops, etc., and by other locality - an area outside the administrative-territorial boundaries of the corresponding locality.

Thus, if an employment contract with an employee specifies a specific structural unit and its address as the place of work, and the employer offers him work in separate units located in other cities, this will be a transfer, not a relocation, since the structural units are located in another terrain.

This position is reflected in paragraph 16 of the Resolution of the Plenum of the Armed Forces of the Russian Federation dated March 17, 2004 No. 2 and the Determination of the Moscow Regional Court dated June 15, 2010 in case No. 33-11570.

If the employment contract indicates only the name of the organization and address as the place of work, but there is no information about the place of work in a separate structural unit, work in a separate division of the organization located in the same area as indicated in the employment contract will not be considered a transfer to another job.

The employee’s consent to work in a structural unit, the location of which coincides with the location of the organization specified in the employment contract, and changes in the terms of the contract are not required, since the employee will continue to work in the same organization, but without indicating a separate structural unit as the place of work .

However, it should be noted that if work in another structural unit is associated with a change in the employee’s labor function or other terms of the employment contract, then the rules on transfer should be applied to such relations (Part 1 of Article 72.1 of the Labor Code of the Russian Federation). The concept of labor function is defined in Art. 15 Labor Code of the Russian Federation. In addition, it must be borne in mind that Part 4 of Art. 72.1 of the Labor Code of the Russian Federation prohibits the transfer and transfer of an employee to work that is contraindicated for him for health reasons.

We hand over documents for employees dismissed due to the liquidation of the organization to the archives

Documents related to both personnel and wages must be stored in the organization’s archives for a strictly established period of time.

HR documents include those that contain information about hiring, dismissal, transfers, salaries, bonuses, and certification of employees.

After the organization is liquidated and removed from the register, the specified personnel records must be transferred to the archive (municipal or state). To do this, the liquidation commission or liquidator on behalf of the company that is terminating its activities must draw up an agreement with such an archive (Clause 10, Article 23 of the Federal Law “On Archiving in the Russian Federation” dated October 22, 2004 No. 125-FZ).

Results

When dismissing, you must comply with the time frame and procedure for informing employees and relevant departments about this fact.

Otherwise, the company may be fined for violating labor laws (Article 5.27 of the Code of Administrative Offenses of the Russian Federation). Penalties are provided in the range from 35,000 to 50,000 rubles. for companies and from 1,000 to 5,000 rubles. for officials. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Compensation for unused vacation

Vacation compensation is mandatory for each employee. Even if an employee has worked for the company for less than 6 months, he has the right to compensation for unused vacation.

This is also important to know:

Dismissal in the event of bankruptcy of an enterprise: dismissal of employees in the event of bankruptcy of an organization

If the employee has used the vacation in advance, then the administration does not have the right to withhold vacation pay from the payments due. Calculation of compensation upon dismissal is made at the rate of 2.33 days for 1 month of unused vacation, rounding the number of months according to mathematical rules.