Documenting

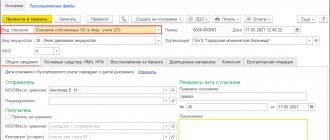

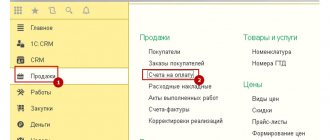

When moving a fixed asset internally, fill out the invoice according to form No. OS-2. In particular, the invoice is drawn up:

- when transferring a fixed asset for operation to another division of the organization. When transferring a fixed asset from a warehouse into operation, an invoice in form No. OS-2 must be drawn up if the fixed asset is put into operation after it is registered;

- when transferring a fixed asset for repair, reconstruction, modernization, completion (additional equipment) to a special division of the organization (for example, a repair service);

- when changing materially responsible persons.

When moving a fixed asset, the delivering unit issues an invoice in triplicate. The invoice must be signed by:

- an employee responsible for the safety of fixed assets in the delivering unit;

- employee responsible for the safety of fixed assets in the recipient department.

The first copy of the invoice remains in the delivery department and serves as justification for the absence of a fixed asset. The second copy is transferred to the recipient unit, the third to the accountant to reflect the movement of fixed assets in accounting and in the inventory card in form No. OS-6 (OS-6a) or in the inventory book in form No. OS-6b (intended for small enterprises).

This procedure is provided for in the instructions approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 No. 7.

Situation: how to formalize the transfer of a fixed asset to a separate division of the organization, allocated to a separate balance sheet?

When transferring a fixed asset from one division to another, an invoice is drawn up in form No. OS-2 (instructions approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 No. 7). The disadvantage of this form is that it does not contain data on accrued depreciation. Therefore, when transferring fixed assets to a separate division allocated to a separate balance sheet, you can modify No. OS-2 by including the necessary details, or use another document, for example, an advice note.

Enter information about the transfer of fixed assets to a division of the organization allocated to a separate balance sheet in the inventory card in form No. OS-6 (OS-6a) or in the inventory book in form No. OS-6b.

The card in form No. OS-6 is kept in one copy for each fixed asset item. Therefore, the accountant of the head office of the organization must transfer the account card to the accountant of a separate division allocated to a separate balance sheet. This is necessary for the correct calculation of depreciation for the transferred fixed asset, as well as for reflecting in it the operations associated with this object (for example, revaluation, disposal, etc.).

The card in form No. OS-6a is kept in one copy for a group of homogeneous fixed assets. Therefore, if not the entire group of fixed assets is transferred to a separate division, the card in form No. OS-6a must be kept in the head office of the organization. To correctly calculate depreciation, the accountant of a separate division allocated to a separate balance sheet must provide a copy of the card in form No. OS-6a. Based on the copy, the accountant of a separate division can create a separate card for this fixed asset in Form No. OS-6. The above is also true if the organization keeps records of fixed assets in a book according to form No. OS-6b.

Filling algorithm

The invoice is filled out on both sides. It consists of a header on the title side, a table of seven columns that continues on the reverse side, as well as a place for a brief description of the transferred object and signatures of the responsible persons.

In the upper right corner of the title part of the document there is a link to the Decree of the State Statistics Committee of 2003, which approved this form as mandatory. After 10 years, it became a recommendation, but its use continues.

At the top of the invoice, the OKUD and OKPO forms and the name of the company within which the movement takes place are indicated. The unit from which the object is being withdrawn is indicated first (it is called the “delivery”). The recipient department is indicated below.

Attention! The invoice must be filled out by the delivery department.

After the names of the departments, the name of the document, the date of preparation of the paper and the assigned number are written.

Below is a table with:

- number;

- a description that includes the date of manufacture (or construction), full name, inventory number;

- number of transferred objects in pieces;

- cost;

- results.

After the table, space is left to describe the object, its technical and other characteristics. When filling out, these lines cannot be left blank.

You can mention the condition (good, excellent, satisfactory), existing defects (scuffs, chips, etc.), and describe the packaging. If warranty cards or instructions are included, these are also included.

At the end there should be signatures (deciphered) of the persons who made the delivery and acceptance. The fact that information about the movement was entered into the accounting book is confirmed by the chief accountant (or simply the accountant who carried out the data transfer).

Important! When putting signatures, mentioning the positions of persons is mandatory.

Accounting: the division is not allocated to a separate balance sheet

If the recipient division is not allocated to a separate balance sheet, then the movement of fixed assets is reflected in internal records in accounts 01 “Fixed Assets” (03 “Income Investments in Material Assets”) and 02 “Depreciation of Fixed Assets.” For example, if a fixed asset is transferred from workshop No. 2 to workshop No. 1, then the following entries are made:

Debit 01 (03) subaccount “Fixed assets in workshop No. 1” Credit 01 (03) subaccount “Fixed assets in workshop No. 2” - reflects the movement of fixed assets from workshop No. 2 to workshop No. 1 in the amount of the original (replacement) cost;

Debit 02 subaccount “Fixed assets in workshop No. 2” Credit 02 subaccount “Fixed assets in workshop No. 1” - reflects the movement of fixed assets from workshop No. 2 to workshop No. 1 for the amount of accrued depreciation.

Example of reflection in accounting and taxation of internal movement of fixed assets

OJSC "Proizvodstvennaya" is engaged in construction activities. The head office of the organization is located in Moscow. "Master" uses the accrual method. The organization does not perform operations that are not subject to VAT.

To carry out his activities, “Master” transferred the bulldozer to a unit located in Kursk. The division is not allocated to a separate balance sheet. The bulldozer was transported by a third-party organization, the cost of which was 11,800 rubles, including VAT - 1,800 rubles. The initial cost of the fixed asset is RUB 1,500,000. Accumulated depreciation – RUB 500,000. Accounting and tax accounting data are the same.

The Master's accountant made the following entries in the accounting:

Debit 01 sub-account “Kursk branch” Credit 01 sub-account “Moscow branch” – 1,500,000 rubles. – the movement of the bulldozer is reflected in the amount of the original cost;

Debit 02 subaccount “Moscow branch” Credit 02 subaccount “Kursk branch” – 500,000 rubles. – the movement of the bulldozer is reflected in the amount of accrued depreciation;

Debit 20 Credit 60 – 10,000 rub. (118,000 rubles – 18,000 rubles) – the cost of services for transporting the bulldozer is taken into account;

Debit 19 Credit 60 – 1800 rub. – VAT is taken into account on the cost of services for transporting the bulldozer;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 1800 rub. – accepted for VAT deduction;

Debit 60 Credit 51 – 11,800 rub. – services for transporting the bulldozer were paid for.

The accountant reduced the tax base for income tax by the cost of services for transporting the bulldozer in the month in which it was delivered to the Kursk branch of the organization.

Sample invoice for internal movement, transfer of goods, containers in the TORG-13 form

At the beginning of the document it is written:

- the name of the organization, as well as its OKPO code, activities according to OKPD and type of operation;

- number and date of invoice;

- the sender of the product (package) and the type of activity of this division;

- similar information about the recipient;

- accounts through which the movement of inventory items is carried out.

Below is a table where they fit:

- name of the product (package);

- its code, grade, unit of measurement (name and according to OKEI);

- quantity and price supplied (quantity, weight).

The table summarizes the results and places the signatures of the financially responsible persons.

Accounting: the division is allocated to a separate balance sheet

If the recipient division is allocated to a separate balance sheet, then when moving the fixed asset is written off from the balance sheet of the organization's head office. For settlements with a separate division, use account 79-1 “Settlements for allocated property” (Instructions for the chart of accounts).

In the accounting of the head office of the organization, you need to make the following entries:

Debit 79-1 Credit 01 (03) – reflects the transfer of fixed assets to a unit allocated to a separate balance sheet in the amount of the original (replacement) cost;

Debit 02 Credit 79-1 - reflects the transfer of fixed assets to a division allocated to a separate balance sheet for the amount of accrued depreciation.

In the accounting of a division allocated to a separate balance sheet, the receipt of fixed assets from the head office of the organization is reflected by the following entries:

Debit 01 (03) Credit 79-1 – the initial (replacement) cost of the fixed asset transferred from the head office of the organization is taken into account;

Debit 79-1 Credit 02 – the amount of accrued depreciation on fixed assets transferred from the head office of the organization is taken into account.

Using account 79-1 does not change the balance sheet currency for the organization as a whole. The fact is that separate divisions are not legal entities and do not generate separate financial statements (Clause 3 of Article 55 of the Civil Code of the Russian Federation, Article 2 of Law No. 402-FZ of December 6, 2011). The balance sheet and other forms of reporting are prepared by the head office of the organization, taking into account indicators for all divisions, including those allocated to a separate balance sheet (clause 8 of PBU 4/99). Account 79-1 is an account for intra-company settlements and, in general, according to the organization, the balance on this account should always be zero (Instructions for the chart of accounts).

An example of reflecting in accounting the receipt of property by a separate division of an organization allocated to a separate balance sheet

OJSC "Proizvodstvennaya" is engaged in the production of artificial leather. “Master” has a separate division allocated to a separate balance sheet. To carry out its activities, this division received from the “Master” a machine that the “Master” had previously used in production.

The initial cost of the fixed asset is RUB 2,500,000. Accumulated depreciation – RUB 500,000. The accountant of the separate division continued to calculate depreciation at the rate calculated in the head office - 25,000 rubles.

In the accounting of the head office, the accountant reflected the transfer of property as follows:

Debit 79-1 Credit 01 – 2,500,000 rub. – the transfer of fixed assets to a unit allocated to a separate balance sheet is reflected in the amount of the original cost;

Debit 02 Credit 79-1 – 500,000 rub. – the transfer of fixed assets to a unit allocated to a separate balance sheet is reflected in the amount of accrued depreciation.

When receiving property from the head office, the following entries were made in the accounting of the separate division:

Debit 01 Credit 79-1 – RUB 2,500,000. – the initial (replacement) cost of the machine transferred from the head office of the organization is taken into account;

Debit 79-1 Credit 02 – 500,000 rub. – the amount of accrued depreciation on fixed assets transferred from the head office of the organization is taken into account.

The result was a 79-1 finish for the organization as a whole.

The accountant of a separate division calculates depreciation on a monthly basis until the cost of the fixed asset is completely written off:

Debit 20 Credit 02 – 25,000 rub. – depreciation has been calculated on the received machine.

Internal movement of fixed assets - document flow

Home — Articles

In total, Resolution No. 7 approved 14 forms of primary documents, including the Invoice for the internal movement of fixed assets (Form No. OS-2). According to the Instructions for the use and completion of primary accounting documentation forms for accounting for fixed assets, form N OS-2 is used to register and record the movement of fixed assets within an organization from one structural unit (workshop, department, site, etc.) to another . The invoice is issued by the structural unit that transfers the fixed asset, that is, it is the deliverer. Three copies of the invoice are drawn up: the first copy is transferred to the accounting department of the organization, the second copy remains with the person responsible for the safety of the fixed assets of the delivery unit, and the third copy is intended for the unit receiving the fixed asset. Each of the three copies must be signed by the responsible persons of the delivering unit and the receiving unit. The accounting unit for fixed assets, as you know, is an inventory item . In accordance with clause 11 of Methodological Instructions N 91n, each inventory item is assigned a corresponding inventory number . During the period that the fixed asset is in the organization, the inventory number assigned to the object is retained. When fixed assets are received by the organization, an inventory card (book) is opened for each inventory item. The basis for filling out the card are, in particular, acts of acceptance and transfer of fixed assets (forms NN OS-1, OS-1a, OS-1b). The movement of fixed assets within the organization is also reflected in the inventory card (book) for accounting for fixed assets (forms NN OS-6, OS-6a, OS-6b). In the inventory card for recording a fixed asset object (Form N OS-6), internal movement is reflected in section. 4 “Information on acceptance, internal movements, disposal (write-off) of fixed assets.” In the tabular part of Sect. 4 indicates the date and number of the document on the basis of which the entry is made, the type of transaction, the name of the structural unit, the residual value of the object, as well as the surname and initials of the person responsible for storage. So, let's look at the order in which the Invoice for the internal movement of fixed assets should be filled out (Form N OS-2). The invoice indicates the OKUD form code. According to the All-Russian Classifier of Management Documentation OK 011-93, approved by Decree of the State Standard of the Russian Federation of December 30, 1993 N 299, form N OS-2 corresponds to code 0306032. Then the name of the organization, its OKPO code assigned by the territorial body of state statistics, and also the name of the structural unit-deliver and recipient. Please note that the Procedure for the use of unified forms of primary accounting documentation, approved by Resolution of the State Statistics Committee of Russia dated March 24, 1999 N 20, determines that all details of the unified forms must remain unchanged (including codes). Removing individual details from unified forms is not allowed. Next, you should indicate the document number and the date of its preparation. Documents must be numbered in chronological order and numbers must not be repeated during the reporting year. If an organization keeps records using computer technology, then a number is assigned to the document when it is compiled, which avoids repetition. If an organization has a large number of divisions, it is possible to provide for the numbering of documents separately for each such division. In this case, all departments should be assigned a digital or letter code, which will be indicated in the document. According to paragraph 4 of Art. 9 of the Law “On Accounting”, the primary accounting document must be drawn up at the time of the transaction. If this is not possible, then the document is drawn up immediately after its completion. Persons drawing up and signing primary documents must ensure timely and high-quality execution of documents, the reliability of the data contained in the documents, as well as their transfer within the established time frame to the accounting department to reflect transactions in accounting. After filling out the details already mentioned, you can begin filling out the tabular form of the invoice. It indicates the name of the transferred fixed asset object, the date of its acquisition (year of manufacture, construction), as well as the inventory number assigned to the object. The number of objects being transferred, the unit cost and the total cost are also indicated. In the case of simultaneous transfer of several names of fixed asset objects, information about each object is entered in a separate line indicating its number. In the unfilled terms of the invoice, dashes should be added. On the reverse side of Form N OS-2, in the “Note” section, a brief description of the technical condition of the fixed asset object is indicated, as well as the positions and personnel numbers of the persons handing over and accepting the valuables. It also contains transcripts of the signatures of these persons indicating the date of signing the document. The chief accountant makes a note that the movement of the fixed asset item is noted in the inventory card (book). So, the invoice must be properly executed, that is, all the necessary details must be filled out in the document and the document must have the appropriate signatures, as established by clause 7 of Methodological Instructions No. 91n.

Note! According to clause 82 of Methodological Instructions No. 91n, the movement of a fixed asset item between structural divisions of an organization is not recognized as a disposal of a fixed asset item. The organization's costs associated with moving an object within the organization, that is, transportation and other costs, according to clause 74 of Methodological Instructions N 91n are included in production costs (selling costs).

It is necessary to recall that assets in respect of which the conditions provided for in clause 4 of PBU 6/01 are met, and with a value within the limit established by the organization’s accounting policy, but not more than 20,000 rubles. per unit, can be reflected in accounting and reporting as part of inventories. To ensure the safety of these objects, the organization should organize control over the movement of such objects. In Letter of the Ministry of Finance of Russia dated May 30, 2006 N 03-03-04/4/98 it is noted that if an organization decides to account for such objects as part of inventories, it must maintain appropriate accounting cards for them - a receipt order in the form N M-4, demand invoice in form N M-11, materials accounting card in form N M-17 and other primary documents . These forms of primary accounting documents were approved by Resolution of the State Statistics Committee of Russia dated October 30, 1997 N 71a “On approval of unified forms of primary accounting documentation for accounting of labor and its payment, fixed assets and intangible assets, materials, low-value and wear-and-tear items, work in capital construction” . A few words should be said about how the transfer of property from one division to another is reflected in the accounting records of an organization. In addition to the fact that an organization can have various workshops, departments, sites, production and other divisions in its structure, it can also have representative offices and branches. Representation according to Art. 55 of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation) is a separate division of a legal entity located outside its location, which represents the interests of the legal entity and protects them. A branch is a separate division of a legal entity located outside its location and performing all or part of its functions, including the functions of a representative office. Clause 3 of Art. 55 of the Civil Code of the Russian Federation establishes that representative offices and branches are not legal entities and are vested with property by the legal entity that created them. Accounting in an organization that transfers fixed assets to its branches will depend on whether or not the branch is allocated to a separate balance sheet. If the branch is not allocated to a separate balance sheet, then the operations carried out by the branch, as well as its property and liabilities, are accounted for by the main organization in the corresponding sub-accounts opened to the accounting accounts. According to the Chart of Accounts for accounting financial and economic activities of organizations and the Instructions for its application, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n (hereinafter referred to as the Chart of Accounts), an account is intended to summarize information on the availability and movement of fixed assets in an organization 01 "Fixed assets". On account 01 “Fixed assets”, analytical accounting should be kept for individual inventory items, while the construction of analytical accounting should provide the ability to obtain data on the availability and movement of fixed assets necessary for the preparation of financial statements (by type, location, and so on). For account 01 “Fixed assets” you can open, for example, the following subaccounts: 01-1 “Fixed assets in operation of the parent organization”; 01-2 “Fixed assets in the operation of the branch.” Then the transfer of a fixed asset item to the branch will be reflected in the accounting record as a debit entry in account 01-2 “Fixed assets in operation of the branch” in correspondence with the credit of account 01-1 “Fixed assets in operation of the parent organization.” The corresponding sub-accounts must be opened for the depreciation account for fixed assets (account 02 “Depreciation of fixed assets”), as well as for other accounts. If a branch of an organization is allocated to a separate balance sheet, accounting in the main organization will be slightly different. The chart of accounts for summarizing information on all types of settlements with branches, representative offices, divisions and other separate divisions of the organization, allocated to separate balance sheets, is account 79 “Intra-business settlements”. It is recommended to open a subaccount 79-1 “Settlements for allocated property” for account 79 “On-farm settlements”. This sub-account takes into account the status of settlements with branches, representative offices, departments and other separate divisions of the organization, allocated to separate balance sheets, for non-current and current assets transferred to them. The property allocated to the divisions is written off by the organization from account 01 “Fixed assets” to the debit of account 79 “Intra-business settlements”. Accordingly, the registration of property by a separate division is reflected in the credit of account 79 “Intra-business settlements” in correspondence with the debit of account 01 “Fixed assets”.

We make corrections to primary documents

How to correct a primary accounting document

Application of a universal transfer document

How to check the authenticity of a sick leave certificate

Document retention periods

Accounting: expenses for internal movement during reconstruction

When internally moving fixed assets, an organization may incur expenses. For example, transportation costs, costs for dismantling and installing equipment, etc. The procedure for accounting for these costs depends on whether the movement of a fixed asset is associated with its reconstruction (modernization, additional equipment).

If a fixed asset is transferred from one division of the organization to another as part of reconstruction (modernization, additional equipment), then the costs of the transfer are taken into account in account 08 “Investments in non-current assets”:

Debit 08 Credit 60 (10, 70, 68, 69...) – expenses associated with the internal movement of fixed assets for reconstruction (modernization, additional equipment) are taken into account.

After completion of reconstruction work (modernization, additional equipment), expenses associated with internal movement are included in the initial cost of the fixed asset:

Debit 01 (03) Credit 08 – the initial cost of a fixed asset has been increased by the amount of costs associated with its movement for reconstruction (modernization, additional equipment).

This procedure for reflecting expenses for the internal movement of a fixed asset in connection with its reconstruction, modernization or additional equipment follows from paragraph 42 of the Methodological Instructions approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n.

The procedure for assigning inventory numbers of fixed assets

The legislation does not provide for any specific procedure for generating an inventory number. Therefore, companies are given the right to develop it independently and consolidate it in the UE. As a rule, when compiling a sequence of digits of an inventory number, they are guided by the ease of working with the formatting object and the accepted production cipher algorithms. For example, in large companies with an extensive network of separate divisions and workshops, the number values must include information about the balance sheet account/sub-account, the branch where the facility is located, the digital designation of the workshop, department codes, etc.

When wondering how to assign an inventory number to a fixed asset, they rely on identifying the optimal variation of the number, which will make it easier and faster to track the use of the object in the company. For example, the sequence of numbers could be like this:

- balance account;

- company branch code;

- workshop number used in internal nomenclature;

- department where the object is located;

- serial number of the object.

Depending on the criteria in force in the company, other information can be encrypted in the inventory number: the depreciation group to which the object belongs, the territorial code of the unit’s location, etc.

If the company is small and only a few PF objects are used, then it would be correct to assign inventory numbers to them in order: 01, 02, 03, etc. They are registered in inventory journals, which are generated automatically or kept by hand.

Accounting: expenses for internal relocation

If the transfer of a fixed asset is not related to its reconstruction (modernization, additional equipment), then the costs of moving are included in the current expenses of the organization. In this case, take into account the costs arising from the internal movement of fixed assets in the following order.

If the movement of a fixed asset is carried out by a special division of the organization (for example, a transport service), then reflect the costs of this work by posting:

Debit 23 Credit 70 (10, 68, 69...) – expenses for internal movement of fixed assets are reflected.

After completing the work on moving the fixed asset, write off the expenses recorded on account 23:

Debit 25 (26, 44...) Credit 23 – expenses for internal movement of fixed assets are written off.

If there is no such division in the organization, then do not take into account the costs of internal movement of fixed assets in account 23. As they arise, do the wiring immediately:

Debit 25 (26, 44...) Credit 70 (10, 68, 69...) - expenses for internal movement of fixed assets are taken into account.

If the movement of a fixed asset is carried out with the involvement of a third-party organization (for example, a transport company), then reflect the costs of paying it remuneration by posting:

Debit 25 (26, 44...) Credit 60 – expenses for internal movement of fixed assets carried out with the involvement of a third party are taken into account.

This procedure follows from paragraph 74 of the Methodological Instructions, approved by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n, and the Instructions for the chart of accounts (account 23).

Fixed assets in budget accounting - 2018-2019: introductory information and changes

In accordance with paragraph 21 of Order No. 157n, the concept of “budget accounting of fixed assets” applies only to certain government organizations. For example, government institutions, government agencies, extra-budgetary funds. In addition to the unified chart of accounts, a special chart of accounts must be used in budget accounting (Order of the Ministry of Finance of Russia dated December 6, 2010 No. 162n).

The remaining government institutions, maintaining accounting and tax accounting of fixed assets in 2018-2019, in addition to the unified chart of accounts, use charts of accounts approved by order of the Ministry of Finance of Russia dated December 16, 2010 No. 174n or dated December 23, 2010 No. 183n (depending on the type of organization) and others regulations.

Read about the regulatory documents governing accounting in budgetary structures.

In this article we will refer to orders No. 157n and 162n as the basis for budget accounting. However, this material may also be useful to other budget structures, since it reveals the general principles of OS accounting since 2016, and especially the logic of making transactions.

One of the main criteria for recognition of fixed assets is the service life of the property, namely an interval exceeding 12 months. In addition, the facility must be used to carry out the activities of the institution permanently or repeatedly. Another feature is that the operating systems are not owned by the institution, but are quickly managed.

NOTE! Fixed assets do not include objects classified as inventories in accordance with clause 99 of Order No. 157n. For example, fishing gear, gas-powered saws, etc.

The service life can be determined according to the OS classifier approved by Decree of the Government of the Russian Federation dated January 1, 2002 No. 1, according to the maximum limit for groups 1–9. And for OS with a service life of more than 30 years, the standards from the Decree of the Council of Ministers of the USSR No. 1072 dated October 22, 1990 are applied. The SPI may be revised during modernization.

Each inventory item as a unit of accounting for fixed assets must be assigned a number. And an inventory card is created for each object, with the exception of items costing less than 3,000 rubles and library objects.

To account for fixed assets, a synthetic account 010100000 “Fixed Assets” is provided. The budget accounting account number consists of 26 digits, and only 18–26 digits are used in the accounting of the institution. Depending on the group and type of fixed assets, as well as the essence of their movement, the code in the 22–26 digits changes in the account number.

Below we consider the scheme for generating an accounting account number in a budgetary organization, and also decipher the category codes using an example. A detailed explanation of the categories can also be found in clause 21 of the instructions to the chart of accounts (order No. 157n), in the table of the budget accounting chart of accounts and in clause 2 of the instructions to it (order No. 162n).

| Account digit number | ||||

| Financial support | Accounting object | Accounting object group | Type of accounting object | Type of receipts, disposals of an accounting object |

| Example: account 110118310 “Increase in the value of other fixed assets - real estate of the institution” | ||||

| 1 - at the expense of the budget | 101—fixed assets | 1—real estate | 8 - other fixed assets | 310 - increase in OS cost |

Read about creating a working chart of accounts in a budget organization.

Note that for budget accounting of fixed assets, according to Order No. 162n, only 2 types of financial support are possible: at the expense of the budget (code 1) and funds at temporary disposal (code 3).

Thus, government institutions, government agencies and other organizations falling under the jurisdiction of Order No. 162n cannot have their own non-budgetary income.

The main changes in accounting for fixed assets in 2016–2018 are associated with the introduction into force of the All-Russian Classifier OF (OKOF) OK 013-2014 (SNA 2008) on 01/01/2017.

The latest changes in fixed asset accounting are as follows:

- Since 2016, film and photographic equipment, due to a reduction in useful life, has been classified in group 3 of fixed assets accounting, and in 2016–2018 its useful life is 3–5 years.

- In 2016, objects with a new value limit (100,000 rubles) began to be accepted for tax accounting of fixed assets. This limit is valid for OSes put into operation after 2015.

- In 2022, the provisions reflected in the main documents on the rules for accounting for fixed assets were clarified in relation to objects leased, free use, trust management, and also those that are the subject of concession agreements.

In addition, the texts of orders No. 157n and 162n, related to the accounting of fixed assets, have undergone a number of editorial changes.

BASIC: income tax

Reflection in tax accounting of expenses for moving a fixed asset within an organization depends on whether this is related to its reconstruction (modernization, additional equipment).

If a fixed asset is transferred from one division of the organization to another as part of reconstruction (modernization, retrofitting), then do not take into account the costs of movement in the current expenses of the organization. In this case, the costs of moving a fixed asset are considered expenses associated with reconstruction (modernization, additional equipment) (Clause 2 of Article 257 of the Tax Code of the Russian Federation). Therefore, take them into account in the same order as all other expenses that arise for an organization during the reconstruction (modernization, retrofitting) of a fixed asset. For more information, see

- How to reflect in accounting the reconstruction of fixed assets,

- How to reflect in accounting the modernization of fixed assets,

- How to reflect the completion (retrofitting) of fixed assets in accounting.

If the transfer of a fixed asset is not related to reconstruction (modernization, additional equipment), then take into account the costs of moving in the following order.

If the transfer of a fixed asset is not related to the production activities of the organization, then the costs of moving do not reduce the tax base. This is explained by the fact that all expenses that reduce the tax base must be economically justified (clause 1 of Article 252 of the Tax Code of the Russian Federation). For example, when calculating income tax, moving expenses are not taken into account due to the need to use fixed assets in departments of the socio-cultural sphere (for example, in boarding houses, gyms, etc.) that are not service industries and farms.

If the transfer of a fixed asset is related to the production activities of the organization, then take into account the costs of its movement when calculating income tax in the following order. When using the accrual method, reduce the tax base according to the rules established for certain types of costs incurred when moving a fixed asset (Article 272 of the Tax Code of the Russian Federation). For example:

- the salary of employees who dismantle and install equipment is taken into account monthly (clause 4 of article 272 of the Tax Code of the Russian Federation);

- transport services are taken into account on the date of provision (subclause 6, clause 1, article 254, clause 2, article 272 of the Tax Code of the Russian Federation).

With the cash method, reflect the costs of performing work to move fixed assets as they are completed and paid for (clause 3 of Article 273 of the Tax Code of the Russian Federation).

Consider moving expenses due to the need to use fixed assets in service industries and farms separately.

When is the acceptance certificate applied?

The transfer and acceptance certificate (OS-1, OS-1a, OS-1b) are used to include in the fixed assets the following objects:

- by purchasing, for a fee, from third parties;

- contract or economic method, that is, through construction;

- by receiving it free of charge;

- when contributing to the authorized capital as a contribution from one of the participants;

- receiving into operational management;

- by renting, or leasing with purchase;

- upon receipt under a deed of donation;

- from transfer to joint activity or trust management;

- from transfer in exchange for other property.

The act is used to put the OS into operation. The exception is cases in which OS objects are entered in a special order. this is required, for example, when purchasing real estate or a vehicle, when state registration documents are required. Before such documents are submitted, fixed assets are not accepted for accounting; they are taken into account as part of unfinished capital investment.

The transfer and acceptance certificate is also drawn up upon disposal of fixed assets, including not only the sale of the object, but also its exchange and gratuitous transfer. An act is drawn up in at least two copies and approved by the heads of the receiving and transferring companies. All technical documentation related to this object is attached to this act.

The act must contain information about the OS object:

- its name and inventory number;

- initial cost;

- date of commissioning;

- data on production or receipt by the company;

- useful life;

- method of depreciation.

In addition, characteristics specifically related to the OS object are indicated, for example, the presence of precious materials, quantitative, qualitative indicators, extensions related to the object, etc. Only the most important indicators are indicated and duplication should be avoided. If group accounting of assets occurs, then the characteristic is given to a group of objects.

If a company acquires objects that were already in operation, then the act provides a section that indicates information about the state of the operating system on the date of its transfer. This section is filled out according to the information provided by the transferring party and is for informational purposes only.

Important! If the OS belongs to several organizations at once, then the size of the share is indicated in the act. The first page of the document indicates the participants in shared ownership (including their shares).

Act OS-1b is drawn up if the same type of inventory, equipment or tools are received, having the same cost and received in the same month.

Important! Completed documents, as well as attachments to them, must be transferred to the accounting department, where an inventory card is created on the OS.

BASIS: VAT

When moving a fixed asset on your own (i.e., without involving a third party), there is no obligation to charge VAT. This is explained by the fact that VAT is charged when performing operations (providing services) to divisions of the organization (subclause 2, clause 1, article 146 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated June 16, 2005 No. 03-04-11/132 and the Ministry of Taxes of Russia dated January 21, 2003 No. 03-1-08/204/26-B088). The movement of fixed assets does not apply to such work (services).

Input VAT on materials (work, services) used in the internal movement of fixed assets should be deducted in the usual manner (paragraph 1, clause 5, article 172 of the Tax Code of the Russian Federation). That is, after registration of the specified materials (works, services) and in the presence of an invoice (clause 1 of Article 172 of the Tax Code of the Russian Federation). The exception to this rule is when:

- the organization enjoys VAT exemption;

- the organization uses the fixed asset after the transfer only to perform VAT-free transactions.

In these cases, input VAT is included in the cost of materials (work, services) used when moving the fixed asset. This procedure follows from paragraph 2 of Article 170 of the Tax Code of the Russian Federation. In addition, in the latter case, input VAT on the residual value of the fixed asset must be restored (clause 3 of Article 170 of the Tax Code of the Russian Federation).

If an organization uses a fixed asset to perform both taxable and non-VAT-taxable operations, distribute the input tax on the cost of materials (work, services) used in its movement (clauses 4 and 4.1 of Article 170 of the Tax Code of the Russian Federation).

How to register the transfer of an employee within an organization

The movement of employees within an enterprise within one department, workshop or division, or to another division is prescribed in the Labor Code of the Russian Federation. Regardless of the type and location of the move, the entire internal transfer procedure must be completed properly, with all necessary documents completed.

For example, if an employee’s employment contract specifies a specific unit (machine) on which he is obliged to perform his work, then assigning him the same work, but on a different device, will entail a change in the essential terms of the employment contract. Which, accordingly, can already be considered a translation.

simplified tax system

The tax base of simplified organizations that pay a single tax on the difference between income and expenses, the costs of moving are reduced, provided that they are listed in Article 346.16 of the Tax Code of the Russian Federation. For example, when calculating a single tax, you can take into account:

- materials (for example, gasoline) used when moving fixed assets (subclause 5, clause 1, article 346.16 of the Tax Code of the Russian Federation);

- salaries of employees involved in the movement of fixed assets (subclause 6, clause 1, article 346.16 of the Tax Code of the Russian Federation);

- transport services of third-party organizations for the movement of fixed assets (subclause 5, clause 1, article 346.16 of the Tax Code of the Russian Federation).

Reduce the tax base as expenses for moving fixed assets arise and are paid (clause 2 of Article 346.17 of the Tax Code of the Russian Federation).

The tax base of simplified organizations that pay a single tax on income is not reduced by expenses for moving fixed assets (clause 1 of Article 346.14 of the Tax Code of the Russian Federation).

When moving goods and materials for internal needs, is it necessary to issue invoice forms TTN-1?

– Instruction No. 58 * establishes that TTN-1 invoices are issued when moving goods within an organization between places of production, which must be observed by organizations. Of course, it would be logical for sectoral government bodies to establish specific forms for such movement. But today the order is the same... And one more thing. After all, it’s not just about Instruction No. 58! There are Rules for the road transport of goods, approved by Resolution of the Council of Ministers of the Republic of Belarus dated June 30, 2008 No. 970, according to which a consignment note must be issued for the road transport of goods. But the specifics of indicating information in such invoices, depending on the specific situation, are already determined by the organization, naturally, taking into account the general rules established by Instruction No. 58. By the way, draft amendments to Instruction No. 58 are currently being discussed, which should, incl. make the procedure for issuing invoices in these situations clearer. _________________ * Instructions on the procedure for filling out the consignment note and delivery note, approved by Resolution of the Ministry of Finance of the Republic of Belarus dated June 30, 2016 No. 58 (hereinafter referred to as Instruction No. 58).

– I would like to remind you that, according to subparagraph. 1.12 clause 1 art. 22 of the Tax Code, organizations must ensure that in places of storage and (or) sale of inventory items, during their transportation, the presence of documents confirming the acquisition (receipt) of inventory items. And these should not be just any documents, but documents whose form is approved by authorized government bodies. Failure to comply with this requirement may result in confiscation of valuables...

OSNO and UTII

If a fixed asset is used in the activities of an organization subject to UTII and in activities for which the organization pays taxes under the general taxation system, then the costs of internal movement of the fixed asset must be distributed (clause 9 of Article 274 of the Tax Code of the Russian Federation).

VAT allocated in the invoice for the purchase of materials (works, services) for the internal movement of fixed assets also needs to be distributed. Distribute VAT according to the methodology established in paragraphs 4 and 4.1 of Article 170 of the Tax Code of the Russian Federation.

For more information about this, see How to deduct input VAT when separately accounting for taxable and non-taxable transactions.

The amount of VAT that cannot be deducted should be added to the share of expenses for the organization’s activities subject to UTII (subclause 3, clause 2, article 170 of the Tax Code of the Russian Federation).

Why do you need a document to move NFA?

The document in question (form 0504102) was put into circulation by order of the Ministry of Finance of the Russian Federation dated March 30, 2015 No. 52n, which approved the mandatory forms of unified accounting for budgetary organizations.

You can get such an invoice for free by clicking on the picture below:

The invoice is used when accounting for various objects of non-financial assets if they are moved between different departments of the institution, between different materially responsible specialists, or from one place of storage or operation to another within the institution.

The document is drawn up in 3 copies by the transmitting party. All of them are signed by the persons involved in the movement of the accounting object. The first should be sent to the accounting department, the second - to the person who transferred the object, the third - to the person who accepted the non-financial asset.