What is the accounting policy of the organization

There are business transactions that can be reflected in different ways. The rules of tax accounting (TA) and accounting (BU) imply several methods, and the company has the right to choose one of them. Here are some examples:

- In NU, organizations have the right to reflect the depreciation premium, that is, to write off 10% (in some cases - 30%) of the original cost of a fixed asset (clause 9 of Article 258 of the Tax Code of the Russian Federation) as current expenses. But it is permissible to refuse the bonus;

- in tax accounting, for most fixed assets it is allowed to choose the depreciation method: linear or non-linear (clause 1 of article 259 of the Tax Code of the Russian Federation). The choice of depreciation method is also fixed in accounting (clause 18 PBU 6/01 “Accounting for fixed assets”, clause 35 FSBU 6/2020 “Fixed assets”; see “What will change in the accounting of fixed assets: read the new FSBU 6/2020 ").

Receive an enhanced qualified electronic signature certificate in an hour

- In accounting, companies (except small enterprises) are required to create reserves for upcoming vacations. To do this, it is necessary, among other things, to calculate the starting amount of the reserve. The calculation method is not established by the standards. An organization can determine the starting value for each employee, or for the division as a whole (see “How “former” small businesses can create a reserve for upcoming vacations in accounting”).

In addition, organizations have the right to choose: use unified forms of primary documents, or develop their own. This applies to the invoice in form No. TORG-12, vacation schedule, time sheet, staffing table, etc.

Create a staffing table using a ready-made template Try for free

ATTENTION

An accounting policy (AP) is an internal document of a company, which records all the ways it has chosen to reflect operations and the forms of primary documents. For example, the CP may stipulate that depreciation of fixed assets is calculated using the straight-line method. Bonus depreciation does not apply. The starting amount of the expense reserve for upcoming vacations is calculated for each employee. When shipping goods, a unified form of invoice TORG-12, etc. is used.

Accounting policies for accounting purposes

All legal entities must form a management system for accounting purposes. This follows from paragraph 3 of PBU 1/2008 “Accounting policies of the organization.” Both the head office and each branch, division and representative office of the organization are required to adhere to the UP (clause 9 of PBU 1/2008).

Accounting policies should, in particular, ensure:

- Completeness of reflection in accounting of all facts of economic activity.

- Timely reflection of each transaction in accounting and financial statements.

- Equality of analytical accounting data with turnover and account balances on the last day of each month.

REFERENCE

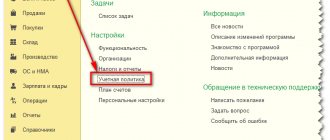

A working chart of accounts is one of the elements of the management program for accounting purposes.

From all the accounts (approved by order of the Ministry of Finance dated October 31, 2000 No. 94n), the organization selects those that it will use in its work. As a last resort, with the permission of the Ministry of Finance, it is permissible to introduce a new account. To do this, you can use “free” numbers from the approved plan (see “Chart of Accounts in 2022”). Get a sample accounting policy for a small LLC Get it for free

Accounting policy for tax accounting purposes

If the Tax Code allows for different accounting methods, the company must choose one of them and consolidate it in its UP.

IMPORTANT

You cannot deviate from the approved accounting policies. This was indicated by the Constitutional Court in its ruling dated May 12, 2005 No. 167-O. It says, we quote: “However, by choosing a specific option for such a policy, each taxpayer is included in the corresponding taxation mechanism and, as a result, is deprived of the opportunity to use another.”

Step-by-step instructions for the formation and development of an organization's accounting policy

Step 1. Taking into account the main assumptions when forming the accounting policy of the organization.

When forming an organization's accounting policy, it is necessary to focus on legal requirements and norms. In order not to miss this or that requirement, accountants use step-by-step instructions that prescribe not only the procedure for action, but also establish some verification boundaries. Otherwise, when creating a convenient and functional accounting system, inaccuracies may be made, which will subsequently lead to losses. A professional accountant cannot make mistakes and must be guided by serious facts when working with specific documentation and accounting systems in general.

The first step is to study and analyze the legislative system of the Russian Federation. It is important to know that the formation of an organization’s accounting policy is based on the “Accounting Policy of Organizations” (regulations dated October 6, 2008, Order of the Ministry of Finance).

In the Regulations you will find the assumptions and requirements that the accountant is guided by in the process of his work. In order to begin to formulate the organization's accounting policy, let's pay attention to the existing assumptions.

- The property is detached. Each company has its own assets and property.

At the same time, the company employs people who are its owners, managers, and employees. When formulating an organization's accounting policies, it is necessary to take into account the assumption that the company's assets and liabilities do not overlap with the personal assets and liabilities of its employees, as well as with the assets and liabilities of third-party companies. Thus, the company's property should not be used for personal purposes, just as the property of its employees should not be associated with the obligations that the organization has assumed. In order to ensure transparency related to assets, equipment and funds, the accountant must ensure that all document flow reflects the real situation, the equipment indicated in the reports is available and used for its intended purpose. It is important not to take the assumption literally. The company may have employees who are working from home due to health reasons or personal arrangements. In this case, the company has the right to provide them with the necessary equipment and give them the opportunity to build their work efficiently, despite the remoteness. Also an exception to the rule is leasing (Federal Law “On Financial Lease”). - The activity is continuous. This assumption indicates that the company for which the organization’s accounting policies are being developed plans to continue operations and fulfill obligations given to investors, creditors, partners, clients and employees. If there is no such intention, and the company will be liquidated (as planned), this must be declared. Such a statement is made when developing the organization’s accounting policies: in documentation, reports and explanatory notes, which are in addition to the annual report for the past year.

- Accounting policies are applied consistently. The development of an organization's accounting policies does not happen just like that. It is necessary not only to keep accounting records efficiently and legally, but also to compare data between reporting periods and make forecasts. This assumption indicates that the company intends not to deviate from the developed accounting system and plans to use it every new billing period. At the same time, this rule allows for changes in the accounting policies of the organization: this happens if laws or the specifics of the company’s business activities change.

- The facts of financial and economic activities are temporarily determined. This assumption suggests that the period of occurrence of the facts of economic activity is taken into account, and not the time when the funds were actually paid. For example, the period when wages were accrued, and not the period when they were directly paid to employees.

Step 2. Taking into account requirements and standards when developing the organization’s accounting policies.

- Completeness of documentation. It says that the company’s documentation must reflect every single fact of its economic and financial activities. This is exactly how the organization’s accounting policy should be formed: each operation must be reflected and documented.

- Timeliness of reports. Timely reports, declarations and other types of documents required by third-party organizations (tax service, social funds) are guarantors of efficient work and the absence of fines. Also, do not forget about the primary documentation, which is drawn up at the time of the transaction or immediately after it is completed.

- Prudence. Prudence is concerned with balancing income and expenses. On the one hand, the organization must be more enthusiastic about the possibility of new expenses and expenses than revenues and profits in general. This way, specialists will be prepared for unexpected losses and will be able to organize their work in such a way as to be prepared for their occurrence. At the same time, this approach should not be confused with the formation of hidden reserves and the desire to hide income and demonstrate expenses in order to avoid unnecessary tax payments. We are only talking about correctly reflecting the current situation in the balance sheet and being prepared for additional expenses.

- Content is more important than form. The point is that the content (the meaning of conducting financial activities) always takes precedence over the form (the fact of completing this or that documentation or performing a financial and economic action). For example, large loans can be issued to the heads of organizations, but not during a period when the company’s condition is unstable, it has outstanding debts and a large number of unfulfilled obligations.

- No contradictions. Analytical and synthetic accounting must be identical at least by the end of each calendar month.

- Rational approach. The development of an organization's accounting policy involves the use of an accounting system that is fully adequate to the size of the company, the characteristics of its activities and future plans.

Step 3. Taking into account the main features of the company.

In order to develop a unique, convenient, but not inconsistent with the laws of the Russian Federation, it is necessary to take into account all the features of the organization, namely:

- Organizational and legal form.

- Industry and type of activity.

- Number of employees, volume of activity, coverage of the client base.

- Features of the administrative apparatus.

- Financial plans and strategies.

- Basic component (initial capital).

- Qualification level of accountants.

Only after analyzing all of the above factors (there may be significantly more), an accountant will be able to create an organization’s accounting policy that will make the company’s work more convenient, efficient and revealing.

By taking into account these characteristics of the organization, a system will appear that will reduce risks, eliminate fines and increase the benefits of any company, be it a large international holding company or a small private firm.

Step 4: Verify compliance with key regulatory standards.

The development of the organization's accounting policies occurs in full compliance with existing standards and requirements. It should be based on legislative acts, decrees of the President of the Russian Federation, and all existing government resolutions. In addition, the accountant also relies on more specific laws relating to the direct conduct of accounting activities, namely: all standards and regulations related to accounting, comments from the Ministry of Finance, instructions, standards, templates and reporting forms.

Only by knowing all the existing provisions and understanding the system of their interaction with each other, can you formulate a convenient and effective accounting policy for the organization, which will help avoid risks and fines, and also provide the opportunity to conduct serious analytical work (within the organization) and make high-quality forecasts.

Requirements for registration of an enterprise's accounting policy

Neither laws nor other regulations establish strict requirements for the design of accounting policies. Paragraph 8 of PBU 1/2008 only says that it is necessary to draw up an organizational and administrative document: order, regulation, standard, etc.

In practice, the vast majority of legal entities do the following: they issue an order approving the accounting policies signed by the director. During tax audits, inspectors usually request this document. If it is missing, some business transactions may be considered incorrectly executed, which will entail additional taxes, as well as, possibly, penalties and fines.

REFERENCE

The order is allowed to be drawn up in free form.

The main thing is to put the number, date and signature. And also list the persons who are responsible for compliance with the UP. As for the policy itself, it can be stated in the text of the order, or issued in the form of an appendix. Most often, two policies are drawn up: a separate tax policy and a separate accounting policy. In each of them, several sections are drawn up: “fixed assets”, “allocation to direct and indirect expenses”, “creation of reserves”, etc. Any other options are acceptable if they meet the needs of the company.

Approval of accounting policies

As a general rule, newly created companies develop a management program and apply it from the beginning of their activities until the end of the period (reporting or tax). Then the policy is adjusted or the old one remains. In the first case, a new order is issued, in the second case, by default the previous document continues to be in effect.

The deadlines for approving accounting policies for accounting and for tax accounting purposes are different:

- The accounting policy for accounting purposes is approved no later than 90 days from the date of state registration of the legal entity (newly created or reorganized). But it applies from the moment the entry is made in the Unified State Register of Legal Entities. If the UP changes from next year, the corresponding order must be approved before January 1 of this year (clause 9 of PBU 1/2008).

- Newly created organizations approve their VAT accounting policies no later than the end of the first tax period (quarter). And they apply - from the date of creation (clause 12 of article 167 of the Tax Code of the Russian Federation).

- There are no deadlines for approval of the UE for income tax. But it is indicated that in the general case it must be applied until the end of the current tax period (Article 313 of the Tax Code of the Russian Federation).

IMPORTANT

It is not prohibited to change accounting policies in the middle of a reporting or tax period.

But this requires substantial reasons. There are two of them. The first is the emergence of new operations or a new type of activity. The second is amendments to tax legislation, or to federal or industry standards. For accounting purposes, there is an additional basis - the development or selection of a more effective method of accounting. Get a free sample accounting policy and do accounting in a web service for small LLCs and individual entrepreneurs

Do I need to approve accounting policies every year?

Thus, the regulatory documents listed in the previous section containing the requirements for accounting policies do not contain any mention of the mandatory annual approval of the management program. There is also no direct prohibition on this.

What should I do? The decision remains with the company itself. Only she has the right to establish and consolidate the procedure for annual (or other frequency) approval of the UP.

They will help you create an accounting policy: Transition to FAS 5/2019 “Inventories”: what to change in the accounting policy PBU 1/2008 “Accounting policy of an organization” (nuances) Setting up an accounting policy in 1C Accounting Ready-made accounting policy - a sample for an organization What’s new in accounting policy for 2022? Document flow schedule for accounting policy - sample VAT accounting policy for 2022 - sample

However, when making such a decision, you need to consider the following:

- If the accounting policy does not change from period to period, it is reasonable to apply the principle of rationality - instead of the annual approval of the accounting policy, during its initial registration, indicate the date from which the specified document is subject to application (instead of indicating the next year).

- Make all changes and additions to the UP without re-affirming the entire current UP, i.e. adding them when changing the accounting method - from the beginning of the year, with amendments to the legislation - from the moment they enter into force.

In some cases, the need for frequent approval of the UP may arise, for example, if:

- Constantly at different points of the CP, multiple insignificant nuances are adjusted, which are formalized in separate additions to the CP - in such conditions it is difficult to fully understand the impact of these adjustments as a whole on the content of the accounting policy, and therefore there is a need to approve a new edition of the CP;

- the accounting methods used have radically influenced the type and composition of the current UP - here the approved accounting policy is replaced by adjustments and loses its purpose, therefore it is advisable to approve a new edition of the UP taking into account all the amendments in a single text.

How to draw up an organization's accounting policy for 2022

It is necessary to reflect the changes that will come into force. Here are the main innovations:

- In 2022, there will be limits allowing the use of the simplified tax system. In terms of the number of employees - 130 people, in terms of income - 219.2 million rubles. (RUB 200 million x deflator coefficient 1.096; see “Deflator coefficients for 2022 officially approved”). If these indicators are not met, a different tax system should be chosen in advance;

- in 2022, reduced insurance premium rates will continue to apply to small and medium-sized businesses. They apply to the part of the salary exceeding the minimum wage (clause 2.1 of Article 427 of the Tax Code of the Russian Federation). Tariffs affect the size of the vacation reserve;

Calculate insurance premiums at a new, reduced rate Try for free

- From January 2022, it is mandatory to apply the federal standard “Fixed Assets” instead of PBU 6/01. The accounting policy can provide, for example, that fixed assets - just like in tax accounting - include objects worth more than 100,000 rubles. (see “What will change in the accounting of fixed assets: read the new FAS 6/2020”);

- from 2022, benefits will be introduced for catering enterprises: reduced rates on insurance premiums for the average number of employees for the previous calendar year from 251 to 1,500 people, as well as the abolition of VAT. To receive the benefit, the following conditions must be met: taxable income does not exceed 2 billion rubles. and the share of income from catering services is at least 70% (see “Abolition of VAT and other benefits for catering: read the review of amendments to the Tax Code of the Russian Federation”).

Fill out and print the waybill with all the required details

Small businesses may not draw up accounting policies at all

Alas, this is not true. For small businesses there are many concessions in terms of accounting and reporting. In particular, they can keep records and prepare reports in a simplified form. But the opportunity to take advantage of this indulgence should be spelled out in the accounting policy.

By the way, in the summer of 2016, new amendments and relaxations in terms of accounting came into effect. And it’s more convenient to use them right from the beginning of the year. Let us remind you that we are talking about amendments that were made to the PBU by order of the Ministry of Finance of Russia dated May 16, 2016 No. 64n.

Firstly, you can now take into account raw materials and materials at the supplier’s price. Previously, the value of assets additionally included transportation costs, fees to intermediaries, etc. Moreover, according to the new rules, all inventories can be written off at a time if the activities of a small enterprise do not involve significant balances on them. Each company determines the level of materiality independently. For micro-enterprises there are no these additional conditions; they can write off any inventories without restrictions (clause 13.2 of PBU 5/01).

Secondly, depreciation on fixed assets can be calculated once a year - on December 31. In this case, depreciation on production and business equipment can be written off at a time (clause 19 of PBU 6/01).

Read also “Small businesses will have to submit statistical form No. TZV-MP”