20.03.2019

Since 01/01/2017, the Federal Tax Service has been checking the correctness of calculation, completeness and timeliness of payment of insurance premiums. All control procedures in relation to insurance premium payers are carried out in accordance with tax legislation. This control is carried out through desk and on-site inspections. In this publication we will consider issues related to conducting desk tax audits.

In accordance with paragraph 7 of Art. 431 of the Tax Code of the Russian Federation, payers of insurance premiums who are obligated to pay them must submit calculations for insurance premiums no later than the 30th day of the month following the billing (reporting) period to the Federal Tax Service:

– at the location of the organization; – at the location of separate divisions of the organization that accrue payments and other remuneration in favor of individuals.

Thus, reporting for 2022, submitted in the form approved by Order of the Federal Tax Service of the Russian Federation dated October 10, 2016 No. ММВ-7-11/ [email protected] , must be submitted no later than January 30, 2019.

The calculation accepted by the tax authority undergoes a desk audit.

How is a desk audit of insurance premiums carried out?

The procedure for conducting a desk audit is established by Art. 88 Tax Code of the Russian Federation. According to paragraph 1 of this article, control measures are carried out at the location of the tax authority. By virtue of the norms of paragraph 2 of Art. 88 of the Tax Code of the Russian Federation, insurance premiums are checked by authorized officials of the tax authority in accordance with their official duties without any special decision of the head of the tax authority within three months from the date the taxpayer submits a tax return (calculation) (see Letter of the Federal Tax Service of the Russian Federation dated September 21, 2016 No. BS-4-11/ [email protected] ). Taking into account the fact that the desk tax audit of insurance premiums is carried out on the basis of the calculation of insurance premiums, its beginning can be considered the date the tax authority receives the calculation. In this case, the date of receipt by the tax authority of the calculation and the date of the actual start of the desk tax audit of this calculation may not coincide (see Letter of the Ministry of Finance of the Russian Federation dated December 22, 2017 No. 03-02-07/1/85955).

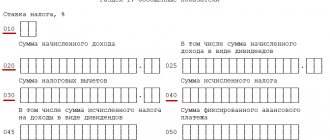

During a desk audit of insurance premiums, the tax authority draws attention to the control ratios outlined in the Letter of the Federal Tax Service of the Russian Federation dated December 29, 2017 No. GD-4-11 / [email protected] We note that, guided by the specified letter, policyholders can check the completion of individual lines and sections .

Note that during a desk inspection, an act is drawn up within 10 working days from the date of completion of the inspection only if the Federal Tax Service has identified violations (clause 5 of Article 88 of the Tax Code of the Russian Federation). If the calculation has been checked and there are no errors, then, accordingly, the act is not generated.

On-site inspection: certificate of completion of the inspection

On the last day of the on-site inspection of insurance premiums, the head of the inspection team (Pension Fund of the Russian Federation, Social Insurance Fund of Russia) draws up a certificate of the inspection carried out (Part 23, Article 35 of the Law of July 24, 2009 No. 212-FZ, clause 9.1 of the Methodological recommendations approved by the order Board of the Pension Fund of the Russian Federation dated February 3, 2011 No. 34r). The forms of certificates about the inspection carried out are given in the appendices to the Resolution of the Board of the Pension Fund of the Russian Federation dated January 11, 2016 N 1p, Order of the Federal Social Insurance Fund of the Russian Federation dated January 11, 2016 N 2.

For information on the timing of an on-site inspection of insurance contributions by the Pension Fund of the Russian Federation and the Social Insurance Fund of Russia, see:

- How inspections are carried out by the Pension Fund of the Russian Federation;

- How inspections are carried out by the FSS of the Russian Federation.

The Pension Fund of the Russian Federation draws up a certificate in form 15-PFR, the Federal Social Insurance Fund of Russia draws up a certificate in form 13-FSS.

If the fund’s employees have drawn up a certificate, then the verification can be considered completed. At the same time, representatives of extra-budgetary funds no longer have the right to be on the territory of the organization, request documents and carry out any control measures (part 14 of article 35 of the Law of July 24, 2009 No. 212-FZ, paragraph 3 of clause 6.1 of the Methodological Recommendations, approved by the order of the Board of the Pension Fund of the Russian Federation dated February 3, 2011 No. 34r).

About the documents required when checking insurance premiums.

Often, the insuring institution has a question: does the tax authority have the right to request additional documents from the policyholder, in addition to the submitted calculation of insurance premiums? As a general rule, the object of inspection is the calculation of insurance premiums, the form and procedure for filling which are approved by Order of the Federal Tax Service of the Russian Federation No. ММВ-7-11/ [email protected] (hereinafter referred to as Procedure No. ММВ-7-11/ [email protected] ).

In addition, the object of verification of insurance premiums may be other documents confirming the validity of reflecting amounts not subject to insurance premiums and the application of reduced insurance premium rates. The Federal Tax Service has the right to request them when conducting tax control (see clause 8.6 of Article 88 of the Tax Code of the Russian Federation). As we can see, this right is legislatively approved in the Tax Code of the Russian Federation.

For your information:

for all cases of requesting explanations or documents, as well as making corrections from the taxpayer as part of a desk audit

of Art.

88 of the Tax Code of the Russian Federation establishes a single deadline for submission - within five days.

If the inspected person is unable to submit the requested documents within the specified period, he must, within the day following the day of receipt of the request for the submission of documents, notify the tax authority in writing of the impossibility of submitting the documents within the specified period. The notification should reflect the reasons why the requested documents cannot be submitted within the established time frame, and the time frame within which the inspected person can submit the requested documents (clause 3 of Article 93 of the Tax Code of the Russian Federation).

In accordance with paragraph 5 of Art. 88 of the Tax Code of the Russian Federation, the person conducting a desk tax audit is obliged to consider the explanations and documents submitted by the taxpayer. If, after considering the submitted explanations and documents, or in the absence of explanations from the taxpayer, the Federal Tax Service establishes the fact of a tax offense or other violation of the legislation on taxes and fees, tax authority officials are required to draw up an inspection report in the manner prescribed by Art. 100 Tax Code of the Russian Federation. However, it is necessary to take into account that sending a request to the insured organization to provide explanations on identified errors in the calculation of insurance premiums, on contradictions between the information contained in the submitted documents, before drawing up a tax audit report does not indicate a tax violation. Such clarifications are given in the Letter of the Federal Tax Service of the Russian Federation dated February 21, 2018 No. SA-4-9/ [email protected]

In what cases is the calculation not presented?

We would like to remind you that on January 1, 2018, the changes introduced by the Federal Law of November 27, 2017 No. 335-FZ came into force, in particular to Art. 431 Tax Code of the Russian Federation. These amendments expanded the list of grounds for the tax authority to recognize calculations of insurance premiums as unsubmitted. So, the calculation (adjusted calculation) is considered not presented if:

1) there are errors regarding information about an individual:

– in the amount of payments and other remuneration in favor of individuals; – in the base for calculating insurance contributions for compulsory pension insurance within the established limit; – in the amount of insurance contributions for compulsory pension insurance, calculated on the basis of the base for their calculation, not exceeding the maximum amount; – in the database for calculating insurance premiums for compulsory pension insurance at an additional rate; – in the amount of insurance contributions for compulsory pension insurance, calculated at an additional rate;

2) there are errors in the form for the billing (reporting) period and (or) each of the last three months of the billing (reporting) period;

3) in the calculation submitted by the payer (updated calculation), the amounts of the same indicators for all individuals do not correspond to the same indicators for the payer of insurance premiums as a whole;

4) the calculation (updated calculation) contains inaccurate personal data identifying the insured individuals.

In any of the above cases, the tax inspectorate will send a notification about the presence of inconsistencies in the calculation (clause 7 of Article 431 of the Tax Code of the Russian Federation):

– no later than the day following the day of receipt of the payment in electronic form; – no later than 10 days following the day of receipt of the payment on paper.

On-site inspection: inspection report

No later than two months from the date of issuing the certificate, the inspectors draw up an on-site inspection report (Part 2, Article 38 of Law No. 212-FZ of July 24, 2009, clause 9.2 of the Methodological Recommendations approved by the order of the Board of the Pension Fund of the Russian Federation dated February 3, 2011 city No. 34r). The forms of on-site inspection reports are given in the appendices to the Resolution of the Board of the Pension Fund of the Russian Federation dated January 11, 2016 N 1p, Order of the Federal Social Insurance Fund of the Russian Federation dated January 11, 2016 N 2.

The Pension Fund of the Russian Federation draws up an act in form 16-PFR, the Federal Social Insurance Fund of Russia draws up an act in form 18-FSS.

Inspectors must draw up a report, even if the results of the inspection did not reveal any violations. In this case, the controllers also describe everything that they checked and record in the report that no violations were found (part 2 of article 38 of the Law of July 24, 2009 No. 212-FZ, clause 9.2 of the Methodological recommendations approved by order of the Board of the Pension Fund RF dated February 3, 2011 No. 34r).

The fund's employees must draw up an on-site inspection report strictly according to the established rules. In this they should be guided by Part 2 of Article 38 of the Law of July 24, 2009 No. 212-FZ and the relevant appendices to the Resolution of the Board of the Pension Fund of the Russian Federation dated 01.11.2016 N 1p, Order of the Federal Social Insurance Fund of the Russian Federation dated 01.11.2016 N 2.

The inspectors draw up two copies of the report in Form 18-FSS: one of them remains in storage at the branch of the FSS of Russia, the other is handed over to the inspected organization. The act in form 16-PFR is drawn up in three copies: one remains in storage at the branch of the Pension Fund of the Russian Federation, the second - with the audited organization, the third is handed over to the tax inspectorate, which participated in the audit. Such rules are established by Resolution of the Board of the Pension Fund of the Russian Federation dated January 11, 2016 N 1p and Order of the Federal Social Insurance Fund of the Russian Federation dated January 11, 2016 N 2.

About false personal data.

Often policyholders are concerned about issues related to unreliable personal data identifying insured individuals, which are indicated in section. 3 calculations for insurance premiums. The fact is that personal data is not always incorrect: it may be correct, but irrelevant on the date of submission of the calculation (for example, the last name has been changed or the employee’s passport has been replaced). Will the settlement be accepted in this case?

In Letter No. GD-4-11/574 dated January 16, 2018, Federal Tax Service officials noted the following. When accepting the calculation of insurance premiums, the personalized data of the insured persons reflected in the reporting form is verified with the data available in the information resources of the tax authorities. If the submitted calculation for insurance premiums reflects out-of-date personal data of insured individuals, the tax authorities have the opportunity to identify them using information that has lost its relevance on the date of submission of the reporting form. In this regard, the indication in the calculation of insurance premiums of personal data that has lost its relevance does not prevent its acceptance by the tax authority.

If the tax authority, during a desk audit, reveals discrepancies between the information on the accrued amounts of insurance contributions for compulsory pension insurance in the calculation submitted by the payer and the information on the specified amounts from calculations for previous reporting periods sent by the tax authority to the Pension Fund of the Russian Federation for reflection on the individual personal accounts of insured persons , the tax authority informs the payer about this with a request to submit updated calculations (Letter of the Ministry of Finance of the Russian Federation dated December 18, 2017 No. 03-15-06/84451).

Errors in calculation of insurance premiums.

Will the calculation of insurance premiums be accepted if there is an error in the calculation of insurance premiums, for example, for compulsory medical insurance (CHI)? As a general rule, if an institution discovers an error in the calculation of insurance premiums submitted to the tax authority, the taxpayer has the right to:

– make the necessary changes to the calculation; – submit an updated calculation to the tax authority.

At the same time, an updated calculation submitted after the expiration of the established deadline for its submission is not considered submitted in violation of the deadline (clause 1, 7, article 81 of the Tax Code of the Russian Federation, clause 1.2 of Procedure No. ММВ-7-11 / [email protected] ).

As stated in the Letter of the Federal Tax Service of the Russian Federation dated February 19, 2018 No. GD-4-11/ [email protected] , by virtue of clause 7 of Art. 431 of the Tax Code of the Russian Federation, the presence of errors in the calculation submitted by the payer when calculating insurance premiums for compulsory medical insurance is not a basis for refusing to accept the calculation.

As noted above, when conducting a desk tax audit and identifying errors in the calculation of insurance premiums, the tax authority, on the basis of Art. 88 of the Tax Code of the Russian Federation informs the payer about this with the requirement to provide the necessary explanations within five days or submit an updated calculation to the tax authority.

Let us note that the organization is obliged to eliminate errors and submit a corrective report (clause 6 of article 6.1, clause 7 of article 431 of the Tax Code of the Russian Federation):

– within five working days from the date of sending the notification in electronic form; – within 10 working days from the date of sending the notice on paper.

On-site inspection: decision on the report

Based on all available inspection materials (on-site inspection report, written objections of the organization to the act, documents requested from the organization or its counterparties), the inspectors make a final decision based on the results of the on-site inspection and formalize it. This follows from the provisions of parts 1, 8 of Article 39 of the Law of July 24, 2009 No. 212-FZ, paragraph 9.3 of the Methodological Recommendations approved by the order of the Board of the Pension Fund of the Russian Federation of February 3, 2011 No. 34r.

When making a decision based on the results of the inspection, the head of the fund’s department (his deputy) is obliged to find out whether there are circumstances that exempt the organization from liability (lack of guilt, expiration of the statute of limitations) (Clause 4, Part 6, Article 39 of the Law of July 24, 2009 No. 212-FZ). In addition, in court it is possible to prove that the insured has circumstances that mitigate his liability (resolution of the Constitutional Court of the Russian Federation of January 19, 2016 No. 2-P).

The timing, procedure and rules for drawing up a decision based on the results of an on-site inspection of insurance premiums are similar to the procedure for drawing up a decision based on the results of a desk audit.