License to use computer programs

A license agreement is an agreement on granting rights to use a work to a person who is not its author or other copyright holder by force of law (Clause 1 of Article 1286 of the Civil Code of the Russian Federation). A software license, depending on the scope of the licensor’s rights, can be of two types: simple (non-exclusive), which presupposes that the copyright holder retains the right to issue similar licenses to other persons; exclusive, which deprives the licensor of such a right.

In this case, the formula “1 agreement = 1 type of license” is not mandatory. By virtue of paragraph 3 of Article 1236 of the Civil Code of the Russian Federation, within the framework of 1 agreement, a combination of conditions of both types is allowed in relation to different methods of using the software.

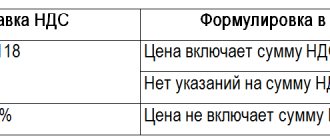

VAT on contracts for the creation of computer programs and databases

Absence in paragraphs. 26 clause 2 art. 149 of the Tax Code of the Russian Federation, a direct reference to other types of agreements for the disposal of property rights to software other than a license agreement is an obstacle to the use of VAT benefits when transferring rights under such unnamed agreements.

It seems that the tax authorities cannot doubt the validity of applying the provisions of Federal Law dated July 19, 2007 N 195-FZ under an agreement on the alienation of exclusive rights, since this type of agreement is directly indicated in Articles 1233, 1234 and 1285 of the Civil Code of the Russian Federation as a contractual structure for the transfer of exclusive rights to software. At the same time, this agreement is far from the only basis for transferring exclusive rights to the new owner.

Ready-made solution for your business

Software Development Kit

A complete set of documents for secure software development. Protects you in relationships with developers, clients, freelancers and full-time programmers.

View the solution

Thus, on the basis of clause 2 of Article 1288 of the Civil Code of the Russian Federation, an author's order agreement may provide for the alienation to the customer of the exclusive right to software that should be created by the author, or the provision to the customer of the right to use this software within the limits established by the agreement. In the first case, the law establishes the application to such the agreement of the rules of the Civil Code of the Russian Federation on the agreement of alienation of exclusive rights, and in the second - the license agreement. Thus, one can reasonably believe that it is necessary to apply VAT benefits in the event of obtaining rights to computer programs and databases under a copyright order agreement.

Furthermore, in accordance with Art. 1296 of the Civil Code of the Russian Federation, in the case where a computer program or database was created under an agreement, the subject of which was its creation (by order), the exclusive right to such a program or such a database belongs to the customer, unless the agreement between the contractor (performer) and the customer provides other.

In this case, the legislator, in order to additionally protect the customer of software development, as in the case of creating a work for service, established a presumption that the exclusive rights to the work belong to the customer.

From this provision, the tax authorities conclude that within the framework of the specified agreement, the transfer of exclusive rights is not carried out, since the customer acquires exclusive rights to the software developed under the agreement by force of law (see Letter of the Ministry of Finance of the Russian Federation dated January 22, 2008 N 03-07 -11/23, Letter of the Ministry of Finance of the Russian Federation dated 04/01/2008 N 03-07-15/44, Letter of the Federal Tax Service for Moscow dated August 11, 2008 N 19-11/75222).

However, this position is not flawless. Firstly, in paragraphs. 26 clause 2 art. 149 of the Tax Code of the Russian Federation there is no indication of the specific type of agreement on the transfer of the exclusive right to computer programs and databases, under which benefits can be applied. Secondly, the conclusion that it is impossible to transfer exclusive rights to software under a contract is doubtful.

In development of the second thesis, we can refer to the fact that in terms of the subject matter, a contract for the development of programs and databases does not differ from a contract for an author's order. The distinction is made, again, only according to the subject composition: the contractor under a work contract (Article 1296 of the Civil Code of the Russian Federation) is a legal entity, and in a contract of author's order (Article 1288 of the Civil Code of the Russian Federation) - an individual. At the same time, the article on the author's order agreement contains a reference to the application to it of the provisions of the agreement on the alienation of an exclusive right or a license agreement, while Article 1296 of the Civil Code of the Russian Federation directly states that the rights belong to the customer, if the agreement between the contractor (performer) and the customer does not otherwise provided. However, establishing a presumption that the rights belong to the customer does not at all mean that he has an exclusive right from the moment the ordered software is created without transfer from the performer (contractor).

By virtue of the provisions of Articles 1255, 1257 and 1295 of the Civil Code of the Russian Federation, the copyright in the work in full initially belongs to its author. Thus, an organization acting as a performer under a contract, the subject of which was its creation (by order), must first obtain such rights from the author under a contract of author's order or on the basis of the provisions of the law on official work. Thus, the customer cannot acquire exclusive rights to the software without their transfer from the author and the contractor.

The issue can be resolved similarly under contract agreements, which did not provide for the creation of software for the customer, when the parties provided for the transfer of such a right to the customer.

However, due to the lack of law enforcement practice on this issue, in order to minimize tax risks, we recommend that when creating programs and databases, you acquire exclusive rights to them on the basis of a separate agreement on the alienation of the exclusive right. The above rules of law and the principle of freedom of contract do not prevent the parties from concluding an agreement providing for the financing of work on the creation of software with the subsequent transfer of exclusive rights to them to the customer for a separate fee.

3

VAT tax agent

Cases when a Russian company has obligations as a tax agent for VAT are transferred

are listed in Article 161 of the Tax Code of the Russian Federation. One of the cases is the purchase of goods, works or services from foreign sellers who are not registered in Russia, and the place of sale is the Russian Federation. Thus, a transaction with a foreign seller will entail agency VAT if three conditions are met:

- the foreign supplier is not registered in the Russian Federation (but if he has a division in the Russian Federation that is registered with the tax authorities, this division will pay VAT);

- the product or service is subject to VAT;

- The place of implementation is the Russian Federation.

The place of implementation of works and services is determined according to the rules of Article 148 of the Tax Code of the Russian Federation. This article establishes that the place of transfer, grant of patents, licenses, trademarks, copyrights is the territory of the Russian Federation if the buyer works in the Russian Federation. If the conditions for recognizing a company as a VAT agent are met, then the tax must be calculated and withheld from the payment to the foreigner.

GK about computer programs

The Civil Code of the Russian Federation classifies computer programs as objects of intellectual property - the results of intellectual activity (Article 1225 of the Civil Code of the Russian Federation). They are objects of copyright and are protected as literary works (clause 1 of Article 1259, 1261 of the Civil Code of the Russian Federation). Intellectual property rights are recognized for objects of intellectual property, the element of which is the exclusive right (property right) (Article 1226 of the Civil Code of the Russian Federation).

The copyright holder (licensor) may grant another person (licensee) the right to use the result of intellectual activity by concluding a license agreement within the limits established by this agreement (Clause 1 of Article 1235 of the Civil Code of the Russian Federation). This does not entail the transfer of the exclusive right to the licensee (clause 1 of Article 1233 of the Civil Code of the Russian Federation). Accordingly, the licensee can use the result of intellectual activity only within the limits of those rights and in the ways provided for in the license agreement.

VAT exemption

The commented letter refers to the transfer by a foreign company of the right to use a computer software product to a Russian organization on the basis of a license agreement.

In this situation, only two conditions are met for the obligations of a tax agent for VAT to arise:

- a seller who is a non-resident who is not registered in the Russian Federation;

- the place of provision of services is the territory of the Russian Federation.

But the third condition is not met. Operations for the transfer of exclusive rights to inventions, utility models, industrial designs, programs for electronic computers (computers), databases, topologies of integrated circuits, production secrets (know-how), as well as rights to use the specified results of intellectual activity on the basis of a license contracts are exempt from VAT (subclause 26, clause 2, article 149 of the Tax Code of the Russian Federation).

This benefit also applies to cases where an organization acquires rights to computer programs from foreign copyright holders. A Russian organization as a tax agent should not withhold VAT from amounts paid to the foreign copyright holder and transfer it to the budget. Both tax specialists and financiers have repeatedly spoken about this since the introduction of this benefit - since 2008.

simplified tax system

If an organization pays a single tax on the difference between income and expenses, then take into account the costs associated with the acquisition of rights under a license agreement when calculating the single tax, provided that they are listed in Article 346.16 of the Tax Code of the Russian Federation.

Consider the licensor's remuneration in the form of periodic (current) payments as expenses, regardless of the type of intellectual property used (subclause 32, clause 1, article 346.16 of the Tax Code of the Russian Federation).

A one-time (fixed, lump-sum) payment can be taken into account when calculating the single tax only for certain types of intellectual property: computer programs and databases, topologies of integrated circuits, inventions, utility models and industrial designs, trade secrets (know-how) (subclause 2.1 p. 1 Article 346.16 of the Tax Code of the Russian Federation). For more information about which license payments are taken into account during simplification and which are not and on what basis, see the table.

Other costs associated with obtaining rights under a license agreement should be taken into account when calculating the single tax, provided that they are listed in Article 346.16 of the Tax Code of the Russian Federation.

However, please note that some of them can be recognized only if the requirements provided for them by Chapter 25 of the Tax Code of the Russian Federation are met. In particular, this applies to notary expenses (subclause 4, clause 1 and clause 2, article 346.16 of the Tax Code of the Russian Federation).

State fees for registration of licensing agreements for any type of intellectual property can be taken into account when calculating the single tax (subclause 22, clause 1, article 346.16 of the Tax Code of the Russian Federation).

However, do not take into account other fees associated with state registration of a license agreement when calculating the single tax. Such expenses are not mentioned in Article 346.16 of the Tax Code of the Russian Federation (letter of the Ministry of Finance of Russia dated April 22, 2010 No. 03-11-06/2/66).

Do not deduct input VAT related to the listed license payments. Include it in expenses when calculating the single tax. Provided that the amount of the license fee, to which VAT applies, is taken into account in expenses. This procedure follows from subparagraph 8 of paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation.

Consider expenses as they are paid (clause 2 of Article 346.17 of the Tax Code of the Russian Federation).

If an organization pays a single tax on income, then license payments for acquiring the right to use intellectual property will not affect taxation. Since with such a taxation object no expenses are taken into account. This procedure is established by paragraph 1 of Article 346.18 of the Tax Code of the Russian Federation.

An example of accounting for expenses in the form of license payments for the acquired right to use a trademark when calculating a single tax. The organization applies simplification

Torgovaya LLC (licensor) entered into a license agreement with Alpha LLC (licensee) for the right to use the Hermes trademark. The duration of the agreement is three years from the date of entry into force.

The license agreement provides for a one-time remuneration to the licensor in the form of a one-time (lump sum) payment in the amount of 590,000 rubles. (including VAT - 90,000 rubles), as well as periodic license payments in the amount of 5,900 rubles. (including VAT - 900 rubles) starting from the month following the month of conclusion of the contract.

The agreement comes into force from the moment of its state registration. The agreement was registered on January 14. Upon the entry into force of the agreement and the transfer of non-exclusive rights, the parties drew up an act of acceptance and transfer of non-exclusive rights to intellectual property. On the same day, Alpha transferred the lump sum payment.

On February 9 and March 10, Alpha transferred periodic license payments in full to Hermes.

"Alpha" calculates a single tax on the difference between income and expenses.

Alpha's accountant did not include the amount of a one-time (lump sum) payment in the amount of 500,000 rubles. (RUB 590,000 – RUB 90,000) included in expenses for the first quarter. Since this type of expenses under a license agreement for a trademark is not provided for in Article 346.16 of the Tax Code of the Russian Federation. And also did not take into account the amount of VAT in the amount of 90,000 rubles related to this remuneration.

The accountant took into account periodic license payments in monthly expenses (in February and March) in the amount of 5,900 rubles.

Thus, license payments in the amount of 11,800 rubles were taken into account as part of the expenses for the first quarter. (5900 rubles × 2 months).

How to confirm a benefit

So, rights to software products under a license agreement are transferred under a preferential tax regime. However, the Tax Code of the Russian Federation has not established a list of documents confirming the right to VAT exemption for such transactions. The Russian Ministry of Finance drew attention to this in a commented letter. But there are letters from the Ministry of Finance in which it indicates that the preferential tax regime is valid only if there is an appropriate agreement (see, for example, letters dated October 7, 2010 No. 03-07-07/66, dated January 12, 2009 No. 03-07- 05/01, dated 02/21/2008 No. 03-07-08/36, etc.). This means that a license agreement is required and it must be drawn up correctly.

A correctly drawn up license agreement must contain all the essential conditions established by the Civil Code of the Russian Federation in Article 1235. Otherwise, it will be declared invalid and the benefit unconfirmed.

The essential terms of the license agreement are:

- subject of the contract;

- methods of using intellectual property;

- the amount of remuneration if the license agreement is paid.

Expert “NA” V.Yu. Kirpichnikov

VAT on sublicense agreements

For the above reasons, in practice, questions arise about the possibility of applying the established VAT benefit in the event of obtaining an exclusive right to computer programs and databases created under a contract, as well as when the right to use software is granted under a sublicense agreement. Both types of agreements are not directly named in Article 149 of the Tax Code of the Russian Federation, however, there are reasonable grounds to believe that the VAT benefit is applicable in these cases as well.

Ready-made solution for your business

Software distribution package

A set of documentation for the legal distribution of software. Protects you from claims from tax authorities, copyright holders and end users.

View the solution

Despite the fact that in paragraphs. 26 clause 2 art. 149 of the Tax Code of the Russian Federation contains a direct indication of the exemption from VAT for granting the right to use computer programs and databases only under a license agreement; we believe it is possible to use this benefit in the case of granting rights to software under a sublicense agreement. To substantiate this position, we can refer to the following. Above we cited the norm of paragraph 5 of Article 1238 of the Civil Code of the Russian Federation on the application of the rules of the civil code on a license agreement to a sublicense agreement. These agreements have the same subject - granting the right to use computer programs and databases for a period. The difference between agreements is based on the subject composition: in a license agreement, the author or other copyright holder (i.e., the owner of exclusive rights) acts on the side of the licensor, and in a sublicensing agreement, the person who was previously granted the right to use the software acts as the licensor.

We believe that the VAT benefit is not limited to the provision of preferences to developers when introducing rights to software into civil circulation under a license agreement. The copyright holder of exclusive rights to programs or databases can be any person who is not the author and has received such rights through alienation, under a contract for the creation of software, or in another manner prescribed by law. Thus, Federal Law No. 195-FZ of July 19, 2007 puts authors on an equal footing with other copyright holders. Therefore, in the same way, it would not be correct to place derivative rights holders (licensees) on unequal taxation terms with derivative rights holders (non-developer rights holders). That is, the provisions under discussion are not related to the establishment of a special tax status of the author or copyright holder acting as a licensor under a license agreement, but are aimed at introducing a preferential tax regime for transactions granting the right to use special innovative objects - computer programs and databases.

Important! The position on the admissibility of applying the provisions of Federal Law dated July 19, 2007 N 195-FZ when transferring rights to a personal computer and database carried out by a licensee on the basis of a sublicense agreement has been repeatedly confirmed in letters of the Ministry of Finance of the Russian Federation (see Letter of the Ministry of Finance of the Russian Federation dated December 25, 2007 N 03 -07-11/640, Letter of the Ministry of Finance of the Russian Federation dated January 30, 2008 N 03-07-07/06, Letter of the Ministry of Finance of the Russian Federation dated February 21, 2008 N 03-07-08/36, Letter of the Ministry of Finance of the Russian Federation dated 01.04.2008 N 03-07-15/44, Letter of the Ministry of Finance 02.11.2009 N 03-07/280, 09.11.2009 N 03-07-11/287).

2