OKOF for computers and peripheral equipment

OKOF is a detailed code with a complex structure assigned to homogeneous elements of non-current property. A complete list of them is contained in the All-Russian Classifier of Fixed Assets (the abbreviation stands for this).

These sets of figures are needed to facilitate control over working capital, streamline the process of calculating depreciation on them, and record transactions occurring with fixed assets in primary documents and reporting.

Now there is a new edition of the list of ciphers established by the Order of the State Standard of Ukraine dated December 12, 2014. No. 2018-st. Until 2017, a different list was used; it was put into effect by Decree of the State Standard of the Russian Federation dated December 26, 1994 No. 359.

Important!

Equipment that was registered during the period when the “old” list of codes was in force is not required by law to be transferred to new codes before it is deregistered. However, such a need may still arise. And for this, there are so-called transitional keys, which show the correspondence between old and new codes.

By the way, sometimes reverse translation is necessary (new ciphers into old ones). This is due to the fact that preferential property is determined by the relevant Government Resolutions, in which the list of fixed assets has not been adjusted taking into account the changed OKOF. Accordingly, when identifying units of non-current assets with new codes that can be used to obtain a preference, you have to use transitional keys to find out what code they would have been assigned if the 1994 edition of the list was still in effect.

Problems often arise with determining the OKOF of a computer and peripheral equipment.

Typically, a computer consists of many components: screen, system unit, keyboard, mouse, printer, scanner. When purchasing this equipment necessary for the work of each organization, the question arises: to take it into account as a whole or in parts. Especially if the components are purchased at different times and their service life varies.

The explanatory letter of the Ministry of Finance dated 06/02/2010 No. 03-03-06/2/110 makes this point transparent. Recognized as depreciable in accordance with

Art. 256. According to the Tax Code of the Russian Federation, property (in this case, a personal computer) is taken into account as a single object of fixed assets if the components included in its composition cannot be used as independent means of labor.

As we understand, the keyboard, mouse, printer and other PC components do not work individually. It turns out that these computer elements must be taken into account all together, one OKOF at a time. For convenience in accounting, it is recommended to assign a single service life to these components - as a rule, this is 2-3 years. Another option is not prohibited (different service life for individual components), but it may raise unnecessary questions and claims from regulatory authorities and create other difficulties associated with accounting.

The new Classifier for computers (and peripheral equipment) provides the following code: 320.26.2.

Okof laser printer 2022

All accountants are required to include OKOF 2018 codes in their accounting documents - from the current version of the All-Russian Classifier of Fixed Assets. It was adopted and introduced for use by order of Rosstandart dated December 12, 2014 No. 2018-st. Its official abbreviated name is OK 013-2014 (SNA 2008).

- 100.00.00.00 – Residential buildings and premises

- 200.00.00.00.000 - Buildings (except residential) and structures, expenses for land improvement

- 300.00.00.00.000 - Machinery and equipment, including household equipment, and other objects

- 400.00.00.00 - Weapon systems

- 500.00.00.00.000 - Cultivated biological resources

- 600.00.00.00 — Expenses for the transfer of ownership rights to non-produced assets

- 700.00.00.00 — Intellectual property objects

Subgroups 320.26.2 in OKOF

The code provided for designating computers has 4 subgroups. They detail the equipment intended for processing and outputting information according to various significant characteristics. These are the subciphers:

- 320.26.20.11 – intended for PCs whose weight does not exceed ten kilograms. This is computer equipment in the form of MacBooks, tablets, electronic diaries, etc.

- 320.26.20.13 – machines equipped with processors and components for receiving and outputting data.

- 320.26.20.14 – equipment, the purpose of creation and acquisition of which is automatic processing of entered information.

- 320.26.20.15 – computer equipment, the housing of which includes devices for storage and (or) input/output.

Every time an organization purchases new digital equipment, the accountant independently chooses which OKOF corresponds to it. It is under this code that accounting and control of incoming office equipment will be carried out.

Okof for thermal transfer printer

Laser printers and MFPs are classified as office equipment; their service life is 3-5 years.

Timely write-off of depreciation cost allows the company to timely generate funds for the purchase of new equipment.

The nature of the decrease in the value of fixed assets is described using the rules by which depreciation is carried out, where OKOF is the normative source.

OKOF is an all-Russian classifier of fixed assets, which is used to account for fixed assets of an enterprise. Taken together, the use of certain codes helps government statisticians assess the nature and quality of enterprise property.

OKOF: code

Classifier: OKOF OK 013-2021 Code: 330.28.99.14 Name: Other printing equipment, except for office-type printing equipment Subsidiary elements: 7 Depreciation groups: 0

Straight adapter keys: 6

- 330.28.99.14.110 — Intaglio printing machines

- 330.28.99.14.120 — Printing machines for screen printing

- 330.28.99.14.130 — Printing machines for flexographic printing

- 330.28.99.14.140 — Printing machines for combined printing

- 330.28.99.14.150 — Digital color printing devices

- 330.28.99.14.160 — Risographs

- 330.28.99.14.190 - Other printing equipment, except for office-type printing equipment, not included in other groups

OKOF code for a printer used to print digital business cards

Since the OKOF classifier was adopted a long time ago, the name “printer” cannot be found in it. Classify it as group 14 3020210 Electronic computer technology

. If you need specific code, this seems to me the most suitable:

14 3020360 Information input and output devices

14 3020210 Electronic computing equipment, including personal computers and printing devices for them

; servers of various performance; network equipment of local computer networks; data storage systems; modems for local networks; modems for backbone networks

What is the OKOF of thermal transfer printers?

1C free 1C-Reporting 1C:ERP Enterprise management 1C:Free 1C:Accounting 8 1C:Accounting 8 CORP 1C:Accounting of an autonomous institution 1C:Accounting of a state institution 1C:Municipal budget 1C:Settlement budget 1C:Clothing allowance 1C:Money 1 C: Document flow 1C: Salaries and personnel of a budgetary institution 1C: Salaries and personnel of a government institution 1C: Salaries and personnel management 1C: Salaries and personnel management CORP 1C: Integrated automation 8 1C: Lecture hall 1C: Enterprise 1C: Enterprise 7.7 1C: Enterprise 8 1C: Retail 1C: Management of our company 1C: Management of a manufacturing enterprise 1C: Trade management 1 Enterprise 8

We recommend reading: When did the zemstvo paramedic program begin

We use cookies to analyze traffic, tailor content and advertising to you and enable you to share on social media. If you continue to use the site we will assume that you are happy with it.

Question: Which OKOF code should I use for my laser barcode reader and thermal transfer printer? (response from the Legal Consulting Service GARANT, October 2022

Ease of use - at any time when working with the GARANT system, you can seek personal advice and get an answer to your question; the answers are stored in the GARANT system and contain hyperlinks to additional thematic materials contained in the system.

Quality assurance - the Legal Consulting Service consists of qualified experts in the field of accounting and taxation, labor and civil law in the field of regulation of business activities. All answers undergo mandatory additional centralized examination by reviewers of the Legal Consulting Service.

Which depreciation group does the printer belong to?

Code OKOF (version from 01/01/2021) 330.28.23.23 - Other office machines (including personal computers and printing devices for them ; servers of various capacities; network equipment of local computer networks; data storage systems; modems for local networks; modems for backbone networks)

Some experts classify the printer as OKOF code 320.26.20.15 - Other electronic digital computing machines, whether or not containing in one housing one or two of the following devices for automatic data processing: storage devices, input devices, output devices.

OKof for laser barcode reader

Since it was adopted later than OKOF, and the last changes were made to it in 2022, in the “Note” field you can find those objects that are not in the Classifier.

In addition, if you cannot directly find the name of an object in OKOF, you can solve the problem by searching for the purpose of the fixed asset.

For example, objects such as a laser barcode reader and a thermal transfer printer are not mentioned in OKOF.

The grouping of fixed assets according to the accounts of the Unified Chart of Accounts is carried out in accordance with the subsections of OKOF (clause 45 of Instruction No. 157n). The main method for selecting an OKOF code is to search by object name.

But since the Classifier was approved 20 years ago and was changed only once, in 2022, many modern types of fixed assets are simply not there.

If the search for the OKOF code by name did not produce any results, it is also recommended to study the Classification of fixed assets included in depreciation groups, approved by Decree of the Government of the Russian Federation dated January 1, 2021 No. 1 (hereinafter referred to as the Classification).

OKOF codes for office electronics

Shock absorption groups for code 320.26.2

In accordance with the annex supplementing the Decree of the Government of the Russian Federation dated January 1, 2002 N 1, which regulates the assignment of fixed assets to depreciation groups, the code in question is not included in any of the depreciation groups.

In accordance with

Art. 258 of the Tax Code of the Russian Federation , if the property is not included in the structure of any of the depreciation groups, then the organization can set their service life independently, based on the technical documentation accompanying the equipment.

Thus, for a computer (both as a whole and for its component parts), the service life is usually set in the range of two to three years. This corresponds to the second depreciation group.

Which depreciation group should the printer be assigned to in 2022?

According to the third category, equipment is written off over the years. On the one hand, this is true in large companies. On the other hand, modern peripherals are designed to operate for at least 3 years. The manager of the enterprise will not encourage the write-off of expensive color laser printing equipment with a scanner from fixed assets. What conclusion can be drawn from this? On January 1 of this year, a new classifier of fixed assets came into force, it is also known as OKOF. It is impossible to imagine without modern technology that allows you to easily solve all kinds of problems.

Depreciation is calculated based on the useful life of a fixed asset, which is determined using a classifier in which objects are combined into depreciation groups. New posts The procedure for the implementation of administrative supervision by internal affairs bodies. Contents: The procedure for the police to carry out administrative supervision over persons released from places of imprisonment Order of the Ministry of Internal Affairs of the Russian Federation dated July 8. The procedure for implementation Read in full.

Transition keys

As mentioned above, transition keys are a table in which correspondences are established between OKOFs from the old and new editions of the list.

Translation of codes for equipment may be necessary in one direction or the other (not only from old to new, but also from new to old).

In particular, the transition key regarding office equipment looks like this.

As you can see, the “old” Classifier provides greater detail on computers and their components. In the “new” list, this group of equipment is united by one code.

Okof Printer Coming 2022

Attention! Since 2022, a new Classifier of Fixed Assets (OKOF) has appeared, with new codes - OK 013-2021 (SNA 2021)! For fixed assets put into operation from 2022, useful lives will have to be determined using new codes OK 013-2021 (SNA 2021) and depreciation groups. The article discusses the features of preparing the federal statistical observation reporting form No. 11 (short) for 2022 for state bodies, local governments, state and municipal institutions.

By what OKOF is a computer monitor taken into account?

A computer monitor is a component of a PC that cannot independently generate income for an enterprise, since it simply does not function separately from other computer components. And participation in the formation of profit is one of the main conditions for classifying equipment as depreciable property (along with a period of use exceeding a year and an initial cost of 40 thousand rubles in accounting and from 100 thousand rubles in tax accounting).

So, in accordance with the standards of PBU 6/01, the screen must be taken into account as part of the computer assembly. After all, the monitor is its integral part, one of the components that, together with others, ensures the functioning of the equipment. In this case, code 320.26.2 applies.

However, the law does not prohibit the accounting of some components of non-current property as separate items of fixed assets if their useful life periods differ (for example, clarifications on this point are contained in Letter of the Ministry of Finance of Russia dated July 14, 2017 N 02-05-10/44839).

It turns out that the monitor can be taken into account under OKOF 330.28.23.23 “Other office machines”. This is the second depreciation subgroup, which assumes a service life of two to three years.

Depreciation group for the printer in 2022

Each enterprise in the process of work uses various property, which is its property by law and is on the balance sheet of the organization. These funds are necessary in the process of producing goods, performing a number of works and providing services. It is necessary to register a property taking into account its initial cost, and during operation, its residual value is taken into account.

Include curtains and blinds as part of fixed assets and assign them to expense item KOSGU 310. In accounting, the main criterion for fixed assets is its useful life. It must exceed 12 months. Curtains and blinds last more than 12 months. If the other criteria are met, classify them as fixed assets.

Computer shock-absorbing group assembly

Depreciation groups are determined depending on the service life of the property - that is, the period during which it can be used in the organization and participate in the creation of profit.

There are 10 such subgroups in total; they are listed in the above-mentioned Government Resolution No. 1 of 01.01.2002. If any type of equipment is not listed in any of these groups, then its service life is established in accordance with the technical documentation attached to it.

The computer assembly is part of the second depreciation subgroup. The service life of the objects included in it is from two to three years.

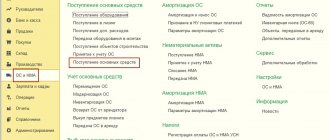

Systematization of accounting

In accounting, information about the components of a computer is systematized in the context of the following OKOFs:

- 330.28.23.21 – for copiers;

- 330.28.23.23 – for screens;

- 320.26.20.15 (or 330.28.23.23) – for the system unit.

Which depreciation group do printers belong to in 2020?

Timely write-off of depreciation cost allows the company to timely generate funds for the purchase of new equipment. The nature of the decrease in the value of fixed assets is described using the rules by which depreciation is carried out, where OKOF is the normative source.

This is interesting: War in Ethiopia 1977 USSR how to get a participant or veteran of the war

This will not be a fixed asset, but a non-depreciable asset, the cost of which can be immediately taken into account as material expenses on the date of commissioning. The components of a computer, without which it cannot work, must be taken into account as a single object of fixed assets - a computer. The components of a computer are a monitor, system unit, keyboard, mouse, speakers, etc.

OKOF table for office equipment

In this paragraph of the article, we will consider a table in which, for the convenience of accountants, codes for the most popular types of office equipment (in the old and new editions) are presented.

| Name of equipment | Old code | New code |

| Printer | 143020360 | 320.26.2 |

| Scanner | 143020000 | 330.28.23.23 |

| MFP | 143020360 | 320.26.2 |

| PC | 143020209 | 320.26.20.14 |

| Laptop | 143020204 | 320.26.20.11.110 |

| Tablet | 143020204 | 320.26.20.11.110 |

| Computer speakers | 143221125 | 320.26.30.11.150 |

| Server | 143020100 | 320.26.20.14 |

| Router (modem) | 143313450 | 320.26.30.11.190 320.26.30.23 |

| Landline telephone | 143222134 | 320.26.30.23 |

| Energy charging devices | 143440142 | 330.26.51.66 |

| Projector | 143322030 | 330.26.70.16 |

| Power supply | 143020000 | 330.28.23.23 |

| Mobile telephone | Absent | 320.26.30.22 |

MFP laser okof 2022

At the same time, in this document, in the Third depreciation group, copying means are indicated: OKOF code (version from 01/01/2017) 330.28.23.22 - Offset sheet-fed copying machines for offices OKOF code (version before 01/01/2017) 14 3010210 - MFP blueprinting equipment also include printers and fax devices, which belong to the 2nd depreciation group: Code OKOF (version from 01/01/2017) 330.28.23.23 - Other office machines (including personal computers and printing devices for them; servers of various capacities; network equipment local area networks; data storage systems; modems for local networks; modems for backbone networks)

At the same time, this document specifies copying means: Code OKOF (version from 01/01/2017) 330.28.23.22 - Sheet-fed offset copying machines for offices Code OKOF (version before 01/01/2017) 14 3010210 - MFP blueprinting means include also printers and fax devices, which belong to the 2nd depreciation group: Code OKOF (version from 01/01/2017) 330.28.23.23 - Other office machines (including personal computers and printing devices for them; servers of various capacities; network equipment for local computing