Personnel market specialists are seething and aggressively predicting a sharp reduction in the number of jobs for accountants. We are scared by outsourcing, automation, smart programs and new services. And so as not to relax, they remind you that accountant is the third largest profession in the country. There are already more than three million of you, the robots are already on your heels, soon you will all go to the labor exchange!

But you and I know that three million specialists do not equal three million professionals. And even in the conditions of the wildest competition, there are always cool accountants behind whom employers and clients stand in line. How to identify such an accountant? Easily. Here are 10 sure signs:

Sign 1. Able to change the focus of attention from details to the global picture.

Accountants are well aware that the devil is in the details and have an eye for detail and inconsistencies. An excellent specialist does not have a blurred eye, he knows how to see every number and every sign. Such data scanning is primarily responsible for extreme concentration, a skill for which is developed through constant training.

Why concentrate so much if everything is black and white? And then, in order to “deceive” the brain - in reality, we do not read texts and tables letter by letter, we perceive words and data entirely, in large chunks, and we will not even notice if the letters in the middle of the word are in the wrong order. Here's a great example:

But a great accountant must see not only the details, but also the big picture. And the main step towards a systematic vision of accounting is the ability to read SALT . It only takes 30 minutes for a professional accountant to understand the state of affairs of the company using OCB (how the company lives, what documents are missing, how work with counterparties is organized, where the problems are) and figure out how he can help such a business. If you know how to read SALT, you will be able to calculate two steps ahead and take into account the tax office’s algorithms.

What quality of work of a chief accountant is considered unsatisfactory?

If management has any doubts about the satisfactory performance of the duties of the person responsible for finance, then the question of his suitability for the position should be raised. Most often, complaints about the quality of the chief accountant’s work appear if:

- accounting registers are maintained incorrectly;

- documentation is processed late;

- reports are not submitted on time or are filled out incorrectly;

- labor discipline is not observed.

No personal or professional qualities of an accountant will help if an employee is caught in theft or forgery of documents. In this case, he must not only be fired, but also punished in accordance with the law.

Sign 2. Keeps abreast of government changes

You yourself know what speed we have in legislating. Something is constantly changing, being supplemented, new forms and amendments are being introduced. An excellent specialist regularly monitors legislation and responds to innovations in a timely manner.

The problem is that “follow the news” is too vague a formulation, which usually boils down to the fact that an accountant visits a news site at most once a week when he remembers that he needs to follow something. You need to work with news tracking in the same way as with any habit: in order for it to become an autopilot and not require volitional efforts, the action must be performed at the same time in the same way. For example, browsing websites while enjoying your morning coffee. For the first month, you can keep a habit tracker.

Advice from practice:

Who exactly should you keep an eye on? Here is the minimum set: Federal Tax Service of the Russian Federation, Pension Fund of the Russian Federation, Social Insurance Fund of the Russian Federation, Ministry of Finance of the Russian Federation.

If you want to save time, it is better to obtain access to any reference and legal system, for example, Consultant, Guarantor or Glavbukh. Yes, it’s paid, but you can find any information and get an answer from an expert.

Who and where can an accountant work?

Employees of this financial profile occupy responsible positions in small, medium and large businesses. They are in demand in banks and investment funds. Without such employees, the activities of economic sectors, including government ones, are impossible. Accounting workers are needed both in industrial enterprises and construction organizations, as well as in the service or entertainment sector. They are part of the staff of tax inspectorates, pension and other social funds, insurance agencies, and charitable organizations.

Sign 4. Doesn’t waste time on routine

Since we are talking about automation, it is worth mentioning another important sign of a good accountant: he knows exactly where he can save time, and at the same time money. There is no need to automate everything and waste money. If you have three new counterparties a year, you definitely don’t need an automatic reliability check service; you can check it manually. But if you have a constant flow of documents for 50-70 items of different names and 10-15 suppliers, then manual entry of the primary document will eat up all your time (and at the same time, your nerves).

Advice from practice:

“On average in a hospital,” entering primary documentation is the most universal way to save time and money. In terms of cost per hour of work, the savings are immediately visible. So we advise you to try the Fasta service: automation of primary entry. Our clients save up to 70% of their working time with it. And as a bonus, it will also help you avoid errors when entering data.

External manifestations of certain qualities of an accountant

Some people are quite successful at hiding their flaws. However, there are external markers that help determine the individual qualities of an accountant:

- frequent delays – irresponsibility;

- constant delays at work - inability to organize one’s activities;

- complaints about other employees - a tendency to conflict;

- a mess on the table is disorder.

If an employee has an orderly workplace, all documents are in folders, the computer is turned on, and the mobile phone is on vibrate alert, then almost certainly this employee’s accounting will be fine.

Sign 5. Friendly with business, helps reduce the tax burden and find optimal solutions

Unfortunately, a huge number of accountants are on the other side of the barricade and are at war with management instead of receiving mutual benefits. It doesn’t matter to the manager exactly how many documents and accounts you processed, how you met the reporting deadlines, and how many skeins of nerves you spent trying to advise employees. One thing is important to him - the result: did the business receive fines? How much did you save on taxes?

Most owners do not understand taxation and accounting, so it is your task to find ways to optimize taxes, calculate risks and sort everything out.

Advice from practice:

Even in tax optimization you can find a robotic assistant. For example, the “Tax Planning” mobile application. It will help manage the amount of taxes before submitting reports, provide all tax breakdowns and give recommendations for reduction.

You will not need to waste time trying to obtain primary information from suppliers, compiling registers and explanations for the owner. “Tax Planning” will make ready-made registers with reduction amounts; all you have to do is make a selection by period so that pending payments do not distort the overall picture.

How to get a profession?

To engage in accounting activities, you can obtain a higher or secondary specialized education in the following areas: economics, finance, banking, merchandising, trading, etc.

An accountant's education requires a university or college degree. People who do not have a certificate of completion of a higher or professional educational institution (or who have completed accounting courses) can only count on the position of assistant without further career growth.

Where to study to become an accountant?

Accounting professions are taught in colleges and universities, which are located in almost every city in Russia. The most prestigious educational institutions are located in Moscow and St. Petersburg. Training is possible on full-time, part-time and part-time basis. Studying at a college takes 3-3.5 years (receiving secondary vocational education), at a university – 4-6 years (receiving a diploma of higher education). List of institutions where you can get secondary specialized education:

- Financial College No. 35 (Moscow).

- Moscow Banking College of Economics.

- Moscow Technological College.

- St. Petersburg Polytechnic College.

- College of Management and Economics “Alexandrovsky Lyceum” (St. Petersburg).

- Economic College (St. Petersburg).

- St. Petersburg Technical College of Management and Commerce.

A higher education in economics will allow an employee to easily find a place in a large organization and move up the career ladder. A university diploma can be obtained from the following institutions:

- Moscow Finance and Law University (MFUA).

- Moscow State University named after. M.V. Lomonosov (MSU).

- Moscow Humanitarian and Economic University (MSEU).

- National Research University Higher School of Economics (HSE).

- Moscow State Institute of International Relations (MGIMO).

- Financial University under the Government of the Russian Federation.

- Russian Economic University named after. G. V. Plekhanov.

The choice of educational institution depends on the capabilities and desires of the applicant.

What subjects do I need to take to become an accountant?

Upon admission to college, applicants undergo internal entrance tests, on the basis of which students are selected.

To enter the university, you must pass the Unified State Exam in the following subjects:

- Russian language;

- mathematics;

- social studies/computer science/foreign language (the choice of subject depends on the specifics of the future job; it is advisable to find out in advance what subject is required when entering the desired university).

A foreign language (usually English) is required upon admission to the Faculty of Economics with a focus on international relations. Thus, upon graduation, a specialist will be able to work in a branch of a foreign company or a Russian organization where work is carried out with foreign partners.

Sign 6. Remembers all dates and submits before the deadline

Dates are the cornerstone of all accountant work. Everything must be done by a certain date: payment of salaries, taxes, rent, preparation of reports. And where there are deadlines, there are always seats on fire, because our national sport is to do everything at the last moment. The solution is simple - when planning, get into the habit of setting a deadline 1-2 days ahead of the actual deadline and plan your affairs: in Google calendar, Bitrix, Megaplan or in any other convenient system.

Advice from practice:

You can also set up a calendar directly in 1C. That's who won't let you forget about important dates. And if you don't want to monitor everything at once, you can highlight just a few areas. Typically, accountants are most worried about reporting deadlines. In this case, the ideal tool would be the 1C:Reporting service. He monitors not only the dates, but also the correct completion of reports, submission and review status.

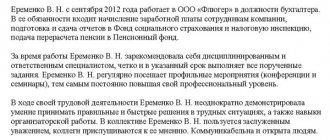

Indicators of quality work of an accountant

No matter how careful the selection of a candidate for a position is, the fruits of an employee’s labor become visible only over time. The quality of an accountant’s work can be assessed in three areas.

- Individual indicators. These are discipline, initiative, independence, innovation, and avoidance of conflict situations.

- Maintaining internal records. This includes making mistakes in documents or their absence, failure to submit reports on time, and diligent performance of job duties.

- External interaction. Work with fiscal authorities, prosecutor's office. Ability to resolve controversial situations.

An accountant's work can be considered high-quality if it is performed quickly, correctly and in full. In order to determine this indicator, some enterprises appoint certifications, others conduct internal audits.

Sign 7. Works in balance and knows when to go on vacation

“Productive work” is not plowing around the clock with cheerful music and a cheerful smile, as is often portrayed by various coaches. The main skill for productive work has always been the ability to rest properly and recover quickly. This applies to work breaks and vacations. If you’ve been sitting on a report for three hours, we’ll assume that you’re already making your fifth or tenth mistake. Each person has concentration limits, and even at their highest they do not exceed 45 minutes.

And a specialist who works without vacation because he “has no time” is a person who is far from being productive. So the accountant definitely needs to rest. Take breaks during the day (for example, working on a timer using the pomodoro method) and go on vacation. Ideally, in the interval between reports: in the inter-reporting period for the 1st quarter and the 2nd quarter/half of the year or during the respite between the 2nd and 3rd quarters.

Advice from practice:

“You can’t just go on vacation” - this is about an accountant. To avoid excruciating pain later, it’s better to do the following before going on vacation:

- if you already know the amounts, then it is worth paying taxes and insurance premiums in advance;

- carry out settlements with suppliers;

- If you know the data for calculating vacation pay for sure, then try to pay vacation pay to those employees who will go on vacation at the same time as you.

Our accountant clients worry much less before going on vacation, because they always have 1C online at their fingertips, so they can connect at any time and solve something burning, even if they are lying on the beach or sipping a pina colada.

Character traits for the profession

Accounting is a profession that is not suitable for everyone. If you want your work to bring pleasure, and not just money, you need to select a specialty based on your personality traits.

Working as an accountant requires perseverance, patience and attention to detail, the ability to work with a large amount of information, analyze it, and generalize it. Accuracy and thoroughness, the ability to remain focused on one task for a long time are important.

Since most of the time will have to be spent at the computer with documents, working with formulas, numbers and tables, this profession is more suitable for introverts. Extroverts will begin to feel sad without communication.

To be a good accountant, you need to be curious and eager to learn new things. Legislation is updated very often, and in order to keep abreast of important changes, you need to read a lot of professional literature and attend training seminars.

On the other hand, it is important to be able to defend the interests of the enterprise, be fair, and stress-resistant. An accountant is a profession that involves communicating with representatives of the tax office and extra-budgetary funds. This requires strength of character and emotional stability.

Sign 8. Never tires of improving your analytical skills

A special feature of an accountant’s work is a continuous huge flow of information that needs to be analyzed, processed and correctly interpreted when making decisions. And in the future, this need will only become more acute, because many standard accounting tasks will be automated, and the main task of a specialist will remain data analysis and decision-making.

This undoubtedly requires an “analytical mindset.” The phrase seems to imply that this ability is given by nature, but it is not. A penchant for analysis - yes, definitely, but otherwise it is a skill. And like any skill, it can be developed.

Advice from practice:

Do you want to develop your analytical skills? Then read a couple of “manuals”, choose the appropriate exercises and act. SWOT, Five Whys, mind maps and games.

Which people are not recommended to be hired as accountants?

There are categories of applicants whom experts do not recommend employing. It is not recommended to hire the following as accountants:

- friends;

- relatives;

- close people of existing employees.

It is better to hire a suitable person from outside.

If the personal qualities of an accountant are impressive, but he lacks professionalism, the right decision would be to hire such a person and train him. In this case, people try very hard and stay with the company for a long time.

Sign 9. Knows the international language of accountants

All financial specialists in the world speak one language - IFRS. And for an accountant, knowledge of international standards opens up new work opportunities. Such a specialist will help the company break into the international market, attract investment from foreign partners and compete on equal terms.

IFRS also affects the salary level. The average salary of an accountant is 40,000 rubles, and a specialist with knowledge of IFRS is already 60,000 rubles.

Advice from practice:

IFRS courses can be taken outside of working hours and you can receive a certificate. The duration of training may vary depending on your current knowledge and skills, the range is usually from 40 to 360 hours.

History of the formation of the profession

The history of the accounting profession dates back to Ancient Egypt: such specialists were called scribes or tax collectors. Their responsibilities included: calculating the costs of transporting goods, constructing structures and land, calculating profits in agriculture, etc.

In Ancient Greece and Ancient Rome, money accounting was carried out by bankers or managers. Only wealthy people could count on this position, who, in case of shortage, replenished the budget from personal funds. Fraud was severely punished, including confiscation of property, expulsion from the country, or exemplary death penalty. The position was occupied mainly by men.

In Europe in the Middle Ages, financial specialists were available in all sectors: estates, castles, monasteries, knightly orders, royal court, etc. hired a person who prepared financial reports for money. At this time, the position of auditor appears. Society has always spoken highly of accountants: the specialist was valued, respected, and his work was placed above science and art.

It has always been difficult to study accounting: it is a complex job that requires deep knowledge and skills, special personal qualities of a professional, etc. Who is an accountant in the 21st century: specialists in this field include an auditor, a financial director, a tax consultant, a senior cashier, etc. .d. More than 90% of modern specialists are female.

Modern accounting professions

The accountant is the second most important person after the general director (decisions on actions with funds are made by management, the activities of a financial department employee are of an executive nature). Its activities are strictly controlled by the employer and the Ministry of Taxes: negligence in the performance of official duties can lead to troubles for both the employee and the entire enterprise.

The profession of an accountant implies documentary maintenance of financial and economic accounting of an organization, which does not contradict the legislation of the Russian Federation. An organization can employ an employee or use accounting support services (hire a specialist to perform single actions (outsourcing).

Accounting is a difficult job because... any error in calculations may lead to disciplinary, administrative, financial or criminal liability. In the accounting profession, the description indicates that a person who has received an economic education can work:

- tax accounting specialist;

- auditor;

- auditor;

- banker;

- financial manager/director;

- economist;

- financier at an enterprise, etc.

A specialist in this field must be a professional in his field (perform one of many functions in an enterprise) and be familiar with all the other intricacies of accounting.

What are the advantages of the profession?

This profession has its advantages and disadvantages. The advantages include:

- stability, demand (a young specialist without work experience can find employment as a junior employee);

- career growth, constant improvement of professional level;

- the ability to perform some functions remotely while working from home;

- Both men and women can become accountants;

- Work experience, obtaining additional knowledge and skills (taking advanced training courses) can significantly increase a specialist’s salary.

An accountant is a creative profession that suits energetic, thinking people who can analyze a given situation and see possible ways to solve a problem.

Disadvantages of Accounting

A high level of income and a prestigious profession have their downside. Disadvantages of the position include:

- high responsibility: an accountant’s mistake can cause trouble for the entire enterprise;

- uneven distribution of effort, which negatively affects the health of the employee: the accountant works especially intensively at the end of each month and year (closing all current affairs, preparing the annual report, etc.).

The job responsibilities that an employee performs directly affect his salary. The subject of an accountant's work is accounting, which is possible thanks to knowledge of tax and financial legislation. This is a difficult profession that requires patience, perseverance, and the desire to constantly improve your level of professionalism.

Sign 10. Improves not only professional, cross-professional skills

Hard skills - professional skills - are certainly important for an accountant, but times are changing and employers are increasingly paying attention to soft or cross-professional skills. And here are the top 3 soft skills for an accountant that are valued by employers and clients:

- Communication skills and ability to work in a team. A modern accountant constantly communicates: with employees, management, counterparties, inspection bodies, and shareholders. You have to communicate a lot, and no one will tolerate a disgusting character just for the sake of professionalism - there is always a good sociable specialist on the market.

- The ability to explain complex things in simple language. It is necessary to explain both to the employees of the organization and directly to management. None of them are required to understand accounting matters, so the task of “explaining” falls entirely on the accountant’s shoulders. And, if he doesn’t know how to show and tell with his fingers, “Houston, we have a problem.”

- Stress resistance and patience . The only thing stable in the life of an accountant is permanent instability. Changes, an eternal state of transition, innovations, improvements... An endless story, seasoned with rush jobs and putting out fires. So the notorious “stress resistance”, which everyone gets tired of in vacancies, in our case is not an empty phrase, but a vital skill.

Soft skills sound simple, but they take time and practice. And they definitely need to be trained, because now in interviews they evaluate not hard skills, but soft skills, not basic intelligence, but emotional intelligence. Follow the time, be flexible - and then everything will work out!

What should be the personal qualities of a good accountant?

If management is satisfied with the level of professionalism of an employee, then they should pay attention to other aspects of it. After all, the personal qualities of an accountant are also very important.

Honesty and integrity of the employee come first for many managers. They are ready to turn a blind eye to other shortcomings of the accountant if they completely trust him. Catching an employee for theft, misrepresentation, or dishonesty should have only one result - immediate dismissal.

- The pedantry and scrupulousness of the accountant will guarantee his accuracy in accounting. Such specialists are always accurate in calculations, attentive to details, and comply with the necessary requirements and rules.

- Organization and discipline are very good qualities for an accountant. Such an employee is not late. Submits all reports on time. And the rest of the employees do not complain about the delay in salaries.

- Stress tolerance greatly helps an accountant cope with psychological stress during audits or conflict situations with counterparties. The presence of this quality is not critical for management, but it is useful for the employee himself.

- Responsibility is mandatory for an accountant. If there is no understanding of this, then it is worth choosing another person for the position.

- Patience. A person who gives up halfway through a job should not become an accountant. If such a specialist appears at the enterprise, then you should not be surprised by fines from the tax service and claims from dissatisfied partners for money transferred incorrectly or on time.

What not to write on a resume

When writing a resume for the position of an accountant, you should not indicate:

- passport details and registration/residence address - just indicate your mobile phone number and city of residence;

- links to your pages on social networks;

- information in a humorous form - a resume is a purely business document that should not contain even a hint of humor.

When writing a resume, you should not get carried away by providing too much information about yourself. One or two pages of printed text for a resume is quite enough. Here you can see a sample resume, which contains all the necessary information.

Management Accounting Skills

Experience in setting up management accounting, maintaining management documentation and making management decisions is directly related to the skill described above. Such accounting allows you to quickly answer the questions: How efficiently did the company perform last month? Which business or department generated the most profit and, most importantly, why? Which units performed “plus” and which ones performed “negatively”? How attractive is the company to creditors and investors? To obtain reliable information about the real state of affairs in the company, it is necessary to have access to all financial documents. This means that here you will have to get into the accounting jungle. Well, who else, if not an accountant, can cope with this task better than anyone else? Hence the high demand - 70% of employers today need a specialist with such skills.

Types of accountants

In small companies, all responsibilities related to financial accounting are performed by one employee. If an organization owns several branches and can increase its staff, then, to control each industry, functions are distributed among target areas. These may be specialists:

- for wages – keep records of employee wages;

- development of financial strategies;

- by materials - keep records of materials used by the organization;

- for tax accounting – provide reliable information on the organization’s taxes;

- for implementation – draw up the organization’s documentation;

- for currency transactions – control monetary transactions.

In addition, there may be a person on staff whose profession is accountant and economist. It is worth explaining who this is and how it differs from an ordinary accounting employee: this specialist is involved in investment policy and the development of financial strategies.

What do you have to do at work and specializations?

Employers place quite serious demands on accountants. This can be explained by the fact that the result of the company’s activities depends on the work of these specialists.

Accountants must meet certain requirements. Without specialized education, it is almost impossible to get a job in a good company. So if you decide to connect your field of activity with accounting, you should take care of obtaining a higher education from a well-established educational institution. Mandatory conditions for employment are knowledge of legislation in the field of accounting and taxation, work experience of at least 1-2 years. So we advise you to look for a part-time job while studying.

In fact, accountants do a huge amount of work. There are several types of activities of specialists in this field.

- Formation of documents according to certain parameters.

- Reception and control of primary documentation. Preparation of documents for their further counting processing. In this case, the accountant must check the legality of the documents, the correctness of the data, and the accuracy of the signature. This specialist has a great responsibility.

- Accounting for inventory items, making payments to customers and suppliers, analyzing the results of the financial and economic activities of a company or enterprise, accounting for volumes of sales of goods.

- Carrying out inventory.

- Finding ways to eliminate losses and production costs.

- Drawing up reporting documentation.

The list of accountant responsibilities is quite long. It largely depends on the scope of the organization’s activities and its scale. In any case, the specialist must have in-depth knowledge in the chosen field of activity.

Summary

Writing an accountant's resume correctly is not so easy, even if you are a qualified specialist. In order to get the desired position, you need to demonstrate your characteristics in the most favorable light.

The first thing worth mentioning is education. It is worth indicating not only the higher or secondary educational institution from which you graduated, but also all additional courses and seminars that you have ever attended. It would also be a good idea to include any supporting certificates.

The experience of an accountant is also important. It is unlikely that you can qualify for a high salary if you have just graduated from university. If you have already worked in your specialty for several years, you will be considered a valuable employee.

An accountant's resume should also contain information about professional and personal qualities. It is important to indicate skills in working with specialized computer programs, as well as knowledge of relevant legislation. The most important qualities for an accountant are responsibility, perseverance, stress resistance and punctuality.

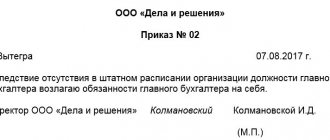

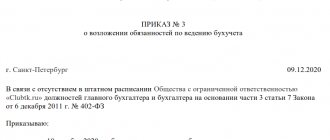

Can the chief accountant act as a director?

To understand whether the chief accountant can act as a director, you need to understand which category the position belongs to. She belongs to the category of managers, therefore, in certain situations, an employee can act as a director in his absence. To do this, an order is drawn up indicating the period during which the employee must either perform only the duties of a director, or combine the duties of a manager with his own. If the volume of work increases, an additional payment will be added. All changes in the scope, content, and remuneration of an employee’s work are indicated in writing.

Knowledge of international standards (IFRS)

International financial accounting standards are a ticket to the big league for any specialist. In an accountant who knows IFRS, the manager sees a person who can increase the level of comprehensive trust in his company. He is well aware that financial reporting that complies with the international format can serve as a magnet for profitable financing and attracting foreign investment. As a result, the company will be able to successfully enter the global market, be competitive and even become a leader.

Mastering the practice of IFRS is like learning the universal language of financiers around the world.

According to experts, accountants who do not study international standards in the next 2-3 years will cease to be valued in the eyes of employers. Without this knowledge, they will not be able to work effectively for either foreign or domestic companies.

Learn IFRS on your own schedule, without leaving home! Complete the comprehensive course “DipIFR. Guarantee” to master the theory and practice of IFRS and prepare for the official ACCA diploma exam DipIFR (rus). Register and take the 1st module of the course for free!

View the course program “DipIFR. Guarantee"

Which accountant skill do employers value most?