Invoice for individual entrepreneurs: with or without tax?

VAT payers cannot issue tax-free invoices to the counterparty - regardless of who the buyer is (individual entrepreneur or company).

It also does not matter that the buyer is not a VAT payer (for example, applies a simplified tax regime). Although in such a situation, if certain conditions are met, invoices may not be issued if the buyer is a VAT non-payer and the parties have agreed not to issue invoices. Tips for drafting a non-invoicing agreement can be found here .

You can find a ready-made sample agreement on non-issuance of invoices when selling goods under a supply agreement in ConsultantPlus. If you do not already have access to this legal system, a full access trial is available for free.

If you are not a VAT payer or are exempt from tax, you can issue VAT-free invoices for individual entrepreneurs or companies:

- at their request;

- due to the requirements of tax legislation.

According to paragraph 5 of Art. 168 of the Tax Code of the Russian Federation, exempt from VAT under Art. 145 of the Tax Code of the Russian Federation, the taxpayer is obliged to draw up invoices without highlighting the amount of tax, but with the inscription or stamp “Without tax (VAT)”.

Important! ConsultantPlus warns As a general rule, there is no need to issue invoices for transactions that are listed in paragraphs 1 - 3 of Art. 149 of the Tax Code of the Russian Federation (clause 1, clause 3, article 169 of the Tax Code of the Russian Federation). An invoice will have to be issued in two cases: For details, see K+. Trial access to the system is free.

From 07/01/2021 a new invoice form is in effect, incl. adjustment, as amended by the Decree of the Government of the Russian Federation dated 04/02/2021 No. 534. The update of the form was caused by the introduction of a goods traceability system. All taxpayers are required to use the new form, even if the goods are not included in the traceability system. We described in more detail the changes made to the invoice here.

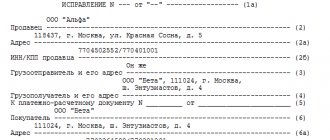

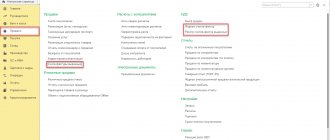

You can download the new invoice form by clicking on the image below:

ConsultantPlus experts have prepared step-by-step instructions for preparing each line of the updated invoice. To do everything correctly, get trial access to the system and go to the Guide. It's free.

Do you need a document?

Clause 4 of Article 169 and Clause 7 of Article 168 of the Tax Code of the Russian Federation indicate cases in which the individual entrepreneur seller is not required to draw up an invoice. For transactions between private entrepreneurs, in the areas of retail trade, provision of services and hired work, invoices are not required.

Also, there is no obligation to draw up such securities in case of cash payment and sale of securities, provided that the parties to the transaction are not intermediaries or brokers.

An individual entrepreneur should not issue invoices when making a transaction with an LLC, individual entrepreneur or a company operating under a special tax regime with simplified taxation.

What do sample invoices without VAT look like?

Let's look at two examples.

Example 1

Individual entrepreneur Elmir Gilmutdinovich Kasimov, who uses OSNO, entered into an agreement for the supply of 420 kg of beets with simplified Producer LLC. At the request of the entrepreneur, Producer LLC compiled and handed over an invoice to him. The company filled out the invoice in the usual manner, except for columns 7 and 8, dedicated to the rate and amount of VAT. In these columns, instead of numerical values, Manufacturer LLC put the inscription “Without VAT”.

This is what a sample invoice for an individual entrepreneur may look like without VAT, download it from the link below:

Example 2

An entrepreneur using the simplified tax system, Nabiullin Timur Rudolfovich, provided a service to the company using the general system of Trading LLC. At her request, the entrepreneur issued an invoice in the amount of 54,150 rubles. without VAT.

What a sample invoice from an individual entrepreneur looks like without VAT, see below and download it from the link:

You can find out whether invoices without VAT need to be registered in the sales book in the Ready-made solution from ConsultantPlus by receiving free trial access to the system.

Sample invoice without VAT

The invoice of individual entrepreneurs and organizations must be filled out without VAT if the person applies the rights to the exemption. There are some peculiarities when issuing an invoice from an individual entrepreneur without taking into account tax.

The obligation to fill out the form appears when the payer of the seller has an exemption in accordance with Article 145. Persons under the Tax Code may not pay the tariff if for 3 consecutive months they received an income of no more than two million rubles and did not sell excisable products.

These payers must submit a notification to the tax office about the application of the right not to pay the fee; the exemption is used for at least 1 year. After this, you should confirm that there are no grounds for refusing the benefit. In other cases, a person is not obliged, but can draw up such a document without VAT.

The example of filling out an invoice without tax is almost no different from a document with a tariff. The procedure for filling out the introductory part is no different. However, to indicate the rate and amount, the entry “Excluding VAT” is made. It is allowed to make an entry in any convenient way - handwritten, stamped, or printed. Thus, drawing up paper without tax is almost no different from drawing up a regular invoice, the only difference is the inclusion of the note “Without VAT”.

Invalid wording of column 7

Column 7 of the invoice indicates the tax rate. If this document comes from a VAT non-payer, this column does not contain numerical values. An invoice without tax is also called zero - this means that according to such a document:

- the seller does not have an obligation to pay tax to the budget;

- The buyer does not have the opportunity to claim a deduction.

What's special about column 7 of the zero invoice? The fact is that you cannot indicate “0” in it. Entering this figure by an entrepreneur will most likely result in negative consequences. Tax authorities will consider that he:

- carried out a transaction taxed at a rate of 0% and will be required to submit a VAT return;

- erroneously indicated a zero rate for goods (works, services) taxed at 20 or 10%, and will offer the individual entrepreneur to pay tax to the budget.

To prevent such misunderstandings from arising, in column 7 of the invoice, an individual entrepreneur (not recognized as a tax payer) must indicate “Without VAT.” With this formulation, the entrepreneur who issued it does not have any obligations (neither reporting nor payment).

Whether it is necessary to issue invoices to individuals, find out here .

Invoice without VAT and erroneous payment purpose

A situation may arise where a tax-exempt person using the special regime issues an invoice without tax, and the buyer mistakenly makes a payment and displays the rate and amount in the payment details.

Once the tax service notices the purpose of the payment during the audit process, clarification will be required. There is a risk of suspension of transactions on the account, write-off of arrears by mistake. To prevent such a situation from arising, it is necessary to carefully study all receipts.

If the accountant independently identifies an incorrect assignment of the contribution, the buyer will need to request a letter clarifying the details. In practice, the fiscal authorities, when identifying a deficiency after submitting a letter, do not require additional paperwork.

The peculiarity of an invoice for individual entrepreneurs without VAT is that it has a similar form and columns as a simple document that is used by persons on OSNO. There are differences only in filling out the seventh and eighth columns.

An invoice without errors: where can you expect trouble?

It happens that, at the request of a partner, you issued an invoice indicating in column 7 “Without VAT”. All other lines and columns are also filled out without errors in accordance with the requirements of tax legislation. And then you started having minor and major troubles with the tax authorities.

This happens when your partner, when filling out a payment order to transfer money to him, indicates the phrase “Including VAT” in the “Purpose of payment” column. What to do if such an error occurs? The first person who might notice this error will be you. You shouldn’t wait for the tax authorities to react, namely when they:

- will require explanations (clause 3 of Article 88 of the Tax Code of the Russian Federation);

- will be called to the inspection (subparagraph 4, paragraph 1, article 31 of the Tax Code of the Russian Federation);

- the account will be blocked (clause 3 of Article 76 of the Tax Code of the Russian Federation);

- they will make a demand for payment of penalties and fines (Articles 75, 122 of the Tax Code of the Russian Federation) or write off the collection tax specified in the payment order.

To avoid possible problems, notify your partner of the error as soon as possible and ask him to contact the bank to correct the erroneous wording in the payment purpose.

How to correct the wording on the purpose of payment in a payment order is described here .

It should be noted that tax authorities do not have the right to charge additional taxes based only on the phrase in the payment order and their own assumptions. Other evidence supported by documents is needed (for example, for the position of the judicial authorities, see the resolution of the FAS ZSO dated March 28, 2011 No. A45-12006/2010).

Should I include an invoice without VAT from an individual entrepreneur using the simplified tax system in the purchase book?

As a general rule, the buyer records invoices received from sellers in the purchase ledger. Based on these records, he determines the amount of VAT deduction. In a zero invoice situation, the buyer does not receive a deduction. Do such invoices need to be reflected in the purchase ledger?

We will not find direct wording that invoices received from sellers with the inscription “Without VAT” do not need to be reflected in the purchase book in the Rules for maintaining a purchase book (approved by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137).

But there are many indirect clues there. In particular, from these Rules it follows that:

- the purpose of the book is to register invoices for the purpose of determining VAT deductions (clause 1);

- invoices are registered in it as the right to deduction arises (clause 2 of the Rules);

- Clause 19 contains a closed list of situations when an invoice should not be registered in the purchase book.

As a result, the conclusion suggests itself: since a zero invoice does not increase the amount of VAT deduction, there is no particular point in registering it in the purchase book. It is possible, for example, not to reflect in the purchase book an invoice received from an individual entrepreneur using the simplified tax system without VAT.

There is no penalty for such failure to be reflected in the law. Although there is arbitration practice to challenge tax authorities’ claims for incorrect maintenance of purchase books by VAT payers. But the courts are against the fine (see, for example, the resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated June 30, 2006 No. A79-15564/2005).

Results

Individual entrepreneurs recognized as VAT payers are required to issue invoices with the allocated tax amount.

Entrepreneurs who do not pay VAT are not obliged, but can, at the request of the counterparty, issue an invoice. At the same time, in columns 7 and 8, dedicated to the tax rate and amount, they should put the inscription or stamp “Without VAT”. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Issuing an invoice with a dedicated tax

An entrepreneur who uses the simplified tax system can become a VAT payer. This is not prohibited by tax. If an individual entrepreneur is ready to pay value added tax to the budget and report on this tax, then he can issue S-F with allocated VAT. In such a situation, the entrepreneur becomes a payer of value added tax. Moreover, the tax base, unlike for entrepreneurs under the general taxation regime, cannot be reduced by input VAT. To understand this system of our legislation, let us give an example.