Who should prepare invoices for services?

Drawing up an invoice for services, if the taxpayer works with VAT, is the same necessity as when selling goods or performing work. Accordingly, this obligation is valid:

- for individual entrepreneurs and organizations that operate on the general taxation system (if the service they sell does not fall under the exceptions established by the provisions of paragraph 2 of Article 149 of the Tax Code of the Russian Federation);

- Individual entrepreneurs who partially work on the SOS, combining this mode with the PSN (for types of activities falling under the SOS).

Taxpayers working under the simplified tax system and the patent system are generally exempt from paying VAT. But there are a number of situations that predetermine the possibility of occurrence and they have an obligation to pay tax.

Read more about such situations in the article “VAT under the simplified tax system: in what cases should I pay and how to take into account the tax in 2022 - 2022?”

Organizations and individual entrepreneurs who are VAT payers will need to draw up invoices for services when they provide services:

- VAT payer;

- to a VAT defaulter, unless a written agreement has been drawn up with him to waive the use of invoices.

Invoices drawn up for services are subject to the principles of their application and design rules common to such documents. However, they have a number of peculiarities in filling.

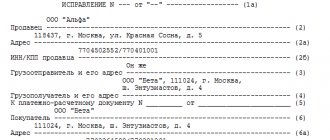

From 07/01/2021 a new invoice form is in effect, incl. adjustment, as amended by the Decree of the Government of the Russian Federation dated 04/02/2021 No. 534. The update of the form was caused by the introduction of a goods traceability system. All taxpayers are required to use the new form, even if the goods are not included in the traceability system. We provide more information about changes to invoices here.

You can download the new invoice form by clicking on the image below:

ConsultantPlus experts have prepared step-by-step instructions for preparing each line of the updated invoice. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

Errors when filling out invoices

When filling out the specified details, taxpayers sometimes make mistakes, which for tax purposes are divided into significant and insignificant.

Let us emphasize: such errors entail negative consequences primarily for buyers, and not for the seller. In particular, significant errors may cause the buyer to be denied VAT deduction, since the invoice, by virtue of clause 2 of Art. 169 of the Tax Code of the Russian Federation is the basis for accepting tax amounts presented to the buyer by the seller for deduction. Let us give examples of significant and insignificant errors made by VAT payers when preparing invoices (see table).

| Errors in invoice details | |

| Non-essential* | Essential |

| Error in numbering of invoices (see Letter of the Ministry of Finance of the Russian Federation dated January 12, 2017 No. 03-07-09/411) | Errors in the seller's address. Does not entail negative consequences:

|

| Incorrect indication of the checkpoint (or its absence in the invoice), since the checkpoint is not a mandatory detail | Errors in the name of the seller or buyer and their TIN (see Letter of the Federal Tax Service of the Russian Federation dated 01/09/2017 No. SD-4-3/ [email protected] )** |

| Lack of payment order number on the invoice | Incorrectly specified name of the shipped goods (works, services, property rights) (see Letter of the Ministry of Finance of the Russian Federation dated August 14, 2015 No. 03-03-06/1/47252) |

| Incorrect indication (failure to indicate) the code or name of the country of origin of the goods or the number of the customs declaration (see Letter of the Federal Tax Service of the Russian Federation dated 09/04/2012 No. ED-4-3 / [email protected] ) | Errors in value indicators, if they do not allow determining the cost of goods (work, services) and the amount of tax charged (for example, due to an incorrectly specified tax rate) (see Letter of the Ministry of Finance of the Russian Federation dated April 19, 2017 No. 03-07-09/23491 ) |

*Those errors in invoices that do not interfere with the identification of the seller and buyer, the name and cost of goods (work, services, property rights), the rate and amount of tax are considered insignificant.

** Indicating the name of the buyer with an error in the organizational and legal form, according to the Ministry of Finance, is not a significant error (see Letter dated May 15, 2019 No. 07-01-09/34738).

What types of invoices for services are established by the Tax Code of the Russian Federation?

Invoices issued for services, as well as those drawn up for the sale of goods or work, are divided into 3 types:

- regular, issued upon shipment;

- advance payment, issued upon receipt of advance payment for the provision of services;

- adjustment, created in cases of agreement on a change in the price or volume of services performed, for which shipping documents have already been issued.

The execution of each of these types of documents has its own specifics.

Filling out an invoice for services rendered

A complete list of invoice details is given in clause 5 of Art. 169 of the Tax Code of the Russian Federation, suggests that this document should indicate:

- serial number, as well as date of formation;

- names of the seller and buyer, their addresses, TIN;

- names of the shipper and consignee, their addresses;

- number of the document used to make the prepayment (if any);

- list of goods sold, its total quantity (or volume);

- currency used in compilation;

- government contract identifier;

- unit of measurement of the volume sold (when possible), as well as its price excluding VAT;

- total cost of goods sold excluding VAT;

- the amount of excise tax (if any is charged);

- applicable VAT rate;

- the amount of VAT calculated at the specified rate;

- total cost of goods sold including VAT;

- in the case of importing goods from abroad - the state of origin of the product, the number of the declaration issued at customs;

- code of the type of goods according to the Commodity Nomenclature of Foreign Economic Activity of the EAEU;

- information about goods subject to traceability: product lot number, unit of measurement and quantity of goods.

The specificity of issuing invoices for services is that some of these details are either not filled in at all, or allow some deviations from the general rules, i.e.:

- There is no need to provide the names of the shipper and consignee (a dash is placed), since in this case no products are shipped (subclauses “e”, “g”, paragraph 1 of Section II of Appendix 1 to the Decree of the Government of the Russian Federation of December 26. 2011 No. 1137).

- When it is difficult to determine a specific unit of measurement for a service, it may not be specified. In this case, dashes must be placed in the corresponding columns. If a unit is nevertheless determined, its name must be taken from the OK 015-94 (MK 002-97) classifier.

- Excise taxes on services in the Russian Federation are not established by law, therefore, in the corresponding column there will be an entry: “Without excise tax.”

- Data on goods imported from abroad are not filled in in the service document (we put dashes).

The name of the service appearing on the invoice must correspond to that specified in the contract for its provision (letter of the Ministry of Finance of Russia dated July 26, 2011 No. 03-07-09/22).

A sample of filling out an invoice for services in 2020-2021 can be downloaded from ConsultantPlus, having received trial demo access to the system.

Differences between an advance invoice

For the invoice for the received advance payment, Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137 proposes the same form as for sale. But fill it out taking into account the following features:

- The data of the shipper and consignee is always missing.

- Indication of payment document details is required.

- Information about the unit of measurement, quantity and price of the goods can be indicated with 100% prepayment. In other cases there will be none.

- The rate for calculating VAT on advance payment is a special calculation rate (20/120 or 10/110). For goods that are not subject to VAT or taxed at a rate of 0%, an advance invoice is not prepared.

See also “Rules for issuing invoices for advance payments in 2020 - 2022”.

Filling out an invoice for amounts prepaid for services

There are few fundamental differences in filling out a document drawn up upon the provision of a service and an advance invoice:

- in the advance invoice you can give a general name of the service if the agreement between the supplier and the buyer, from where the Ministry of Finance of Russia orders this name to be taken, has not been signed by that time;

- the advance invoice must reflect the number of the document confirming the fact of receipt of the advance payment, but if it was received in non-monetary form, a dash is placed;

- When generating an advance invoice, there is no need to indicate the volume of services provided, their units of measurement, as well as their prices.

Thus, when generating an advance invoice for services, you can put dashes everywhere except for the paragraphs that contain:

- document number and date;

- names of the seller and buyer, their tax identification number, addresses;

- number of the document confirming the prepayment;

- name of the service;

- name of currency;

- prepayment amount;

- tax rate;

- the amount of VAT charged to the buyer.

IMPORTANT! The tax rate should be indicated in the advance invoice for services as 20/120 or 10/110, and not as the usual 20 or 10% for many taxpayers (clause 4 of Article 164 of the Tax Code of the Russian Federation).

Filling out a corrective invoice for services

The adjustment invoice for services should reflect:

- the exact name of the document (i.e. “Adjustment Invoice”);

- number, as well as date of compilation;

- numbers and dates of generation of invoices, according to which the cost or volume of services provided is adjusted;

- names of the seller and buyer, their addresses, TIN;

- names of services for which price adjustments are made or volume indicators are clarified;

- indicators of the volume of services (if any) before and after adjustments;

- name of settlement currency;

- government contract identifier (if available);

- price per unit of measurement of service;

- cost of services provided without VAT - before and after adjustments to prices and volumes of services;

- tax rate;

- VAT amount - before and after adjustments;

- cost of services provided including VAT - before and after adjustments;

- the difference between the figures on the original invoices and those resulting from the adjustments.

For a sample of filling out an adjustment invoice, created on a current form, see the material “Sample for filling out an adjustment invoice.”

And about the differences between an adjustment and a corrected invoice, read the article “In what cases is a corrected invoice used?” .

ConsultantPlus experts explained how a customer can issue invoices for services under an intermediary agreement. Get trial access to the system and upgrade to the Ready Solution for free.

Results

Invoices in connection with services are issued by VAT payers, using all 3 types of this document: main, advance, adjustment. The specificity of reflecting data on services in them is that not all of their details are required to be filled out.

Sources:

- Decree of the Government of the Russian Federation of December 26, 2011 N 1137

- Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Basic principles and rules for filling out the SF

To create an invoice, use the standard form provided in Appendix 1 to Government Decree No. 1137 of December 26, 2011 (link at the end of the article).

It must reflect all information required by law. The main function of the document is to confirm the shipment of goods, the performance of work or the provision of services. An equally important task of the Federation Council is to confirm the payment of value added tax. It is in accordance with the invoice that VAT is subsequently calculated.

For all SFs, a serial number is required. The algorithm for assigning it is not specifically specified in the law. As a rule, the SF is numbered in ascending order within the tax period or calendar year. If necessary, you can reserve serial numbers. The Ministry of Finance also allows monthly numbering.