Why is a collection order necessary?

The role of a collection order is simple: to pay for any services or work without the direct participation of the payer and his prior consent. However, such a procedure is only possible if an appropriate agreement has been concluded between the counterparties (i.e., including a clause on collection payment).

In other words, thanks to this document, the bank of the recipient of the goods or service transfers funds to the bank of the contractor or manufacturer, bypassing the parties to the transaction themselves. Neither the customer nor the contractor may provide the bank with any payment orders or other documents; the only thing that happens is that the payer’s bank notifies its client about the transfer of funds, and the recipient’s bank about their crediting to the account.

- Form and sample

- Online viewing

- Free download

- Safely

FILES

In what cases is this document required?

It cannot be said that the collection order is widespread. However, in some cases it occurs quite often, for example, in the practice of the tax inspectorate, when a collection order is sent to the tax debtor’s bank and debts are automatically written off from his accounts (such collection orders are subject to unconditional execution and cannot be contested). Or in the activities of public utilities, when an agreement is concluded between public utilities and the recipient of the service with the possibility of direct (i.e., not requiring the permission and participation of the direct payer) payments - in this case, the payment from the bank of the recipient of the service to the bank of the utility organization is also transferred by using a collection order.

Organizations sometimes also enter into similar agreements with each other, but this practice is not generally applicable, since it requires one hundred percent trust in relations between counterparties, as well as their indisputable solvency.

Use of collection orders when collecting under enforcement documents

Payments by collection orders are used not only for the collection of tax payments and fees, but also for withholding funds under executive documents. In this case, orders to withdraw money from the debtor’s current accounts are formed by the banks themselves on the basis of the writs of execution received by them and the claimant’s application (or the determination of the bailiffs) (Article 70 of Law No. 229-FZ).

The writ of execution is issued by the judicial authorities. The application is generated by the claimant. It usually contains a request to collect funds from a specific debtor under a specific executive document and transfer the collected funds to the bank account of the collector.

For details on submitting writs of execution to the bank, completing the application and the timing of its execution, see the special article “How to submit a writ of execution to the debtor’s bank.”

What needs to be done for the “scheme” to work

If enterprises are interested in making payments between them without their direct participation, they need

- conclude an agreement between themselves in which it is required to include a clause on settlements through a collection order;

- submit this agreement to the servicing credit institution.

After the agreement is concluded and the transaction is completed, the supplier’s (seller’s) bank forwards the collection order to the consumer’s (buyer’s) bank. Then the bank notifies the buyer about receipt of the document for payment and, if confirmed, the transfer occurs, then the recipient's bank similarly informs its client about the crediting of funds to the account.

How are payments made using a collection order?

When both parties to a transaction, trusting each other, most often the main and subsidiary enterprises, agree that financial settlements will be carried out without their direct participation, they need to:

- Provide in the contract a clause giving the right to carry out settlements between the parties using collection orders;

- Submit the agreement signed by the parties to the bank where the supplier’s current account is opened.

After fulfilling the terms of the contract, completing the shipment (providing the service), the executor’s (supplier, seller) bank issues (sends) a collection order to the payer’s bank (recipient of goods, services).

After this, the payer’s bank notifies him that a document for payment has been received and, if this fact is confirmed, transfers funds to the recipient’s account, and the recipient’s bank notifies him that money has been credited to the account.

Who is interested in the collection form of payment?

First of all, collection is beneficial to the buyer. This is due to the fact that he always retains the right to transfer the payment or refuse it (this determines the low reliability of these transactions). However, the seller can hedge his bets by pre-stocking certain documents, in the absence of which the buyer will not be able to take possession of the goods legally.

This is important to remember, given that this banking operation is carried out in conjunction with the acceptance of such a payment, which implies the immediate shipment of products under the current contract, regardless of whether funds have been received from the buyer or not. The buyer pays the price of the goods upon receipt of a complete package of payment documents, which must first be checked by the seller to ensure compliance with its cost, quality and quantity with the conditions specified in the contract.

The payment procedure by collection orders has one significant drawback: documents go through banks for quite a long time, so payment may not occur as quickly as we would like. Along with this, there is an advantage: in banks this service is quite cheap.

Rules for registration and preparation of a collection order

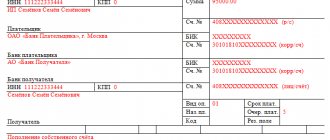

The collection order must be drawn up in a certain form. It contains

- information about the parties to the agreement (names of enterprises),

- information about the banks between which direct transfer of funds occurs,

- numbers of current accounts of organizations,

- transfer amount,

- number and date of document preparation.

If there is an undisputed collection of funds from the payer’s account (for example, when writing off tax debts and other reasons), then the collection order must also indicate a reference to the rule of law.

The document is drawn up in four copies :

- the first one remains with the employees of the credit institution and on the basis of it the funds are written off from the payer’s account;

- the second copy is transferred to the receiving bank. In cases where the accounts of both organizations are in the same bank, the second copy of the collection order receives the status of a memorial order when funds are credited to the payee's account;

- the third copy is intended for the account holder himself;

- the fourth copy is certified by a bank employee and the seal of the credit institution and handed over to the client.

Collection order. Form and sample 2022

What is a collection order?

Did you know that there is a way to withdraw funds from a third party's account without their consent? And we are not talking about ordinary theft, but about completely legal actions. Moreover, it often helps restore legal justice. Perhaps an informed reader has encountered collection orders in his life, but for most this topic is terra incognita.

Scope of application of the collection order

There are several forms of non-cash payment documentation; these, along with, for example, payment requests, letters of credit and checks, also include collection. In simple terms, a collection order is an official document that allows the bearer to withdraw financial assets from the account specified in this very document. This procedure is regulated by the Civil and Tax Codes of the Russian Federation, as well as a special resolution of the Bank of Russia of 2012 regarding the rules of money transfers.

When is this document needed?

Typically, ordinary citizens rarely encounter this, but in everyday life such papers are used:

- bailiffs - tax services - extra-budgetary funds - counterparties (if there is an agreement)

Let's take a quick look at each of the options listed above.

The intervention of bailiffs is an extreme measure that is applied to the debtor regarding the collection of funds. In this case, it is enough for the bank to provide only a court order, on the basis of which the funds will be withdrawn.

The tax authorities first present their demands in writing to the company (or individual) who owes the money, but if the other party ignores these requirements, then the federal authority has the right to collect the debt through collection, but this can only be done within two months after the final date of non-payment . Extra-budgetary funds also present their demands through the Federal Tax Service.

Also, the payment method using collection is sometimes used by counterparties when concluding transactions - the bank needs to provide not only the original agreement, but also accompanying invoices or invoices. For both parties, in this case, the advantages of this payment method outweigh the disadvantages.

Design rules

A collection order is not an ordinary bank payment; it must contain several very important elements for the operation to be successful and considered legal. In addition to standard data (payer and beneficiary bank details, INN and KPP codes), you need to indicate (depending on the current situation):

- A link to the current legal act, according to which it is possible to carry out an undisputed write-off of funds from the debtor’s account. In addition to the number and date of the act, be sure to specify the numbers of the article, paragraph/subparagraph.

- Number and date of the concluded contract between the counterparties. It is also necessary to write down the numbers of the clause and subclause of the agreement, on the basis of which the parties agreed on the payment method in question.

- Details of the writ of execution from legal proceedings, which confirms the fact of forced collection of funds from the specified account.

Features of compilation

Bailiffs and the Federal Tax Service have their own form for such operations, and individuals and legal entities use form 0401071, which is accepted in all banks in our country. You can submit it not only in paper form, but also in electronic form.

Sample of filling out a collection order

Any inaccuracies in such an important document may result in the bank refusing to withdraw funds from the client's account (although they must immediately notify the recipient of the errors). Therefore, we suggest that you familiarize yourself with the template before starting to fill out the original:

Sample of filling out a collection order

- First, write the document number and indicate the date it was completed.

- Next, indicate the type of payment and amount (necessarily in words and numbers).

- Then information about the payer is entered into the form: in the required cells put

- TIN and checkpoint numbers,

- full name of the company,

- information about the payer's bank (indicating its BIC).

- Next, in a similar manner, information about the payee and the credit institution in which he is serviced is entered into the collection order form.

- On the right side of the document, the current accounts of all organizations specified in the document are entered, and below:

- type of payment,

- purpose of payment

- and its order (if necessary).

- Then an agreement is entered into the document, according to which it became possible to use this document in settlements between enterprises (number and date of its preparation).

- Finally, the document must be signed by a responsible bank employee.