What is a power of attorney for the right to sign documents, and what types exist?

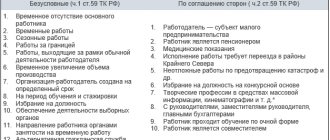

The Civil Code states that a trust document can be considered official only if it is drawn up on paper. Here it is necessary to note the powers and duties assigned to the attorney. One party transfers this document to the other to present a power of attorney to a third party. Here you need to indicate which documentation is allowed to be signed by an authorized employee. The power of attorney has three options:

- One-time . It is used in cases where there is a need to carry out a specific transaction by proxy. After signing the document, this power of attorney ceases to be valid automatically. It may indicate the period after which the document will be cancelled. It is also allowed to enter an action after which the power of attorney will automatically lose its legal force.

- Special . This power of attorney can be used more than once. Typically, this type is drawn up for signing various documents within the same order.

- General . This document gives the attorney broad powers. If he must represent the interests of his company in various areas, he cannot do without a general. The owner is allowed to work with important documentation when making large transactions.

( Video : “How to transfer the right to sign primary documents”)

Who and to whom can issue a power of attorney for the right to sign

Absolutely anyone has this opportunity. The document can be issued by a private person. But such situations are not common compared to organizations. Most often, a power of attorney is issued by a legal entity. Employees of the organization usually act as attorneys. Often these are responsible persons, for example, an accountant, head of a department, etc. Although the function of an attorney can be performed by any employee. Filling out the form is often the responsibility of the secretary. After entering the data, the form is submitted to the director for signature.

Cases cannot be excluded when the representative himself is forced to write out a power of attorney. However, these powers can only be granted by the manager. Permission to transfer is indicated in the permit document. Of course, the head of the company is allowed to do this. But this opportunity is used extremely rarely. This is due to the fact that the document authorizing the transfer of trust must be notarized. Naturally, in this case the director will have to personally visit the notary’s office, which is not always convenient.

If a transfer of authority is needed, the manager just needs to issue a new document for the second employee. In order not to think about it, you need to write out a power of attorney; several of them are issued at once, for each of the employees. Typically, the responsibilities of each employee are spelled out here.

The right of first signature: what is it and who belongs to it

In the course of the activities of even the smallest company, there is a need to prepare documents and submit them to government agencies, financial, commercial and other structures.

Despite the fact that more than 5 years ago the right of first and second signature was abolished, in order to certify the authenticity of documentation and the orders contained therein, it is still necessary to appoint persons who will certify it. They will be held accountable to the law in case of violations. The concept and explanation of what the right of first signature is is presented in:

- Civil Code of the Russian Federation;

- Federal Law of 02/08/1998 No. 14-FZ on LLC;

- Federal Law of December 6, 2011 No. 402-FZ on accounting;

- Order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n;

- other regulations.

According to general rules, the right of first signature belongs to the manager (director) - appointed or elected. No orders or instructions from the owners of the organization are needed to transfer powers to him. But if for some reason the chief accountant or another person has the right of first signature, this point should already be documented.

IMPORTANT!

Until 2013, the law prohibited transferring the right of first signature in a bank to the chief accountant or another employee; all payment orders went through the manager. Now this ban has been lifted, and it does not matter who certifies what. Such powers can be transferred to any citizens working in the company or for the company.

Main features of a power of attorney for the right to sign

It is customary for this power of attorney to be confirmed by a notary. It is usually used to receive goods, equipment, and other valuables transferred between partner companies. But under certain circumstances, you cannot do without visiting a notary. For example, such a need arises when a representative plans to visit the police, court, and various budget institutions. Sometimes an organization asks the manager to draw up a notarized power of attorney. This happens when the director of the company cannot appear in person, and his representative will take part in a transaction for a fairly large amount.

As for the filling rules, here you can use a template approved by the head of the company, or simply draw up a document on a sheet of paper. Here you can also use computer typing, or filling out the document manually. Regardless of which option was chosen, a live autograph of the manager is required. Do not forget that the more powers the attorney has, the more information is provided.

How to write a power of attorney for the right to sign documents

When filling out the form, you need to take into account all the important information:

- Document number assigned by internal document flow;

- Name;

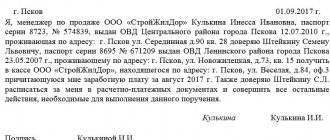

- Date and place of compilation;

- Information about the granting organization;

- Information about the general director;

- Full information about the representative;

- Validity;

- Documents permitted for signature;

- Is a representative allowed to draw up a deed of power for third parties;

- Signatures with transcripts, date of completion.

The law does not provide for the attorney's autograph to be present here. In fact, he is simply assigned certain responsibilities and that’s it. But if you carefully understand this issue, you can understand that if the attorney is not aware of such actions, or he does not want to accept such obligations, then there is simply no point in drawing up a power of attorney. That is why the attorney’s signature is usually affixed to the power of attorney. This means that the employee assumes certain obligations.

Which form to choose

The simplest power of attorney to receive goods and materials (materials and materials) can be drawn up using the unified form No. M-2 or No. M-2a. They are almost the same, the only difference is that form No. M-2 has a spine. It is needed for a log book, but whether to keep it or not is up to you.

Other powers of attorney do not have standardized forms.

If you decide to issue a power of attorney in your own form, do not forget to indicate:

— Date of compilation, preferably in words.

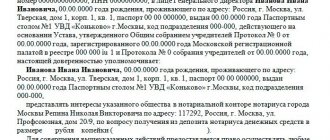

— The name of the organization that issued the power of attorney, its INN/KPP, OGRN, job title and full name of the manager.

— Representative details. For an individual: full name and passport details - passport number, by whom and when it was issued. For an organization: its name, INN/KPP, OGRN, job title and full name of its leader.

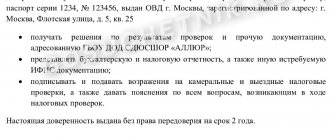

— The powers of the representative are as detailed as possible.

— The period for which the power of attorney was issued. If the period is not specified, the power of attorney will be valid for a year from the date of its preparation.

— Is it possible or not to transfer the powers of a representative to another person by way of delegation.

- Stamp, if any.

Template of general power of attorney for employee

Example of a power of attorney for the tax office