When the amount of input VAT subject to deduction is greater than the amount of calculated VAT tax that must be paid to the budget, the difference between them can be reimbursed to the taxpayer. VAT refund to the taxpayer is regulated by Article 176 of the Tax Code of the Russian Federation.

To simplify the refund procedure, the Federal Tax Service has created a special program for us - “VAT Refund: Taxpayer”. The taxpayer has the right to independently decide whether to use the program or use other methods of filling out documentation.

Where to download and how to install the program

You can download the latest version of the program on the tax office website using the link.

There are also detailed instructions for installing and running the program. In fact, the “default” installation does not require any special knowledge and is done with five clicks “Next”.

The latest version of the program is 3.0.8.6.

After installation, two shortcuts will appear on your desktop:

The first shortcut is the program itself, and the second is for system settings.

Work in the program “VAT Refund: Taxpayer”

Direct work in the program usually does not cause difficulties. When we first start it, we get the program settings window:

After this, you need to go to the “List of available declarations” tab and add a new one:

Then you can start filling out the declaration:

After entering all the data, the VAT refund declaration must be saved. All that remains is to create a file for the tax office. To do this, transfer the required declarations to the right column and click the “Generate” button:

How to submit primary documents for VAT to the tax office?

In Kontur.Extern, for VAT returns, it is now possible to submit primary (supporting) documents to the tax office. For example, send documents confirming the VAT rate, VAT refund information, etc.

This opportunity does not entail any new obligations to provide primary documents for taxpayers. If there is no need to provide primary documents along with the declaration, then this functionality does not need to be used.

In the future, all declarations will be able to send an inventory with attached primary documents.

Sending primary documents for VAT

- On the main page of the Kontur.Extern system, go to the F NS section and select the Sent reports (see Fig. 1).

Rice. 1. Go to the list of sent reports

- A list of reports sent to the Federal Tax Service will open. You should click on the desired VAT report (see Fig. 2).

The opportunity to send primary documents for VAT appears after the status of the declaration changes to “Delivered”.

Rice. 2. Selecting the desired declaration

- Click the Prepare documents under the sent report (see Fig. 3).

Rice. 3. Proceed to preparing documents

- In the next window, you should select how documents will be added. You can add ready-made files by clicking on the Upload files from your computer (you can also drag and drop the required files into the field that appears) (see Fig. 2).

If Diadoc is used to exchange documents between counterparties, then in the window that appears, you can click the link Select documents in Diadoc .

Rice. 4. Page for selecting a method for downloading documents

- After clicking on the Upload documents , select the files to upload and click Open (see Fig. 5).

You can add documents to the inventory in the form of scanned copies (files with the extension jpg, tif, pdf , etc.), as well as documents in the form of xml files (files with the xml ).

According to the format, scanned copy files must be sent in jpg or tif format. When loading files of other formats into the system (for example, pdf , doc, rtf, xls, docx, xslx, txt., etc.), they are automatically converted into files with the jpg extension.

You can add the missing files in the next step.

Rice. 5. Selecting documents to upload

According to the inventory format approved by order dated June 29, 2012 N ММВ-7-6/ [email protected] (as amended by the Order of the Federal Tax Service of Russia dated 08/31/2012 N ММВ-7-6/ [email protected] ), in the inventory you can submit the following types of documents:

In the form of scanned images:

- 0924 – Invoice

- 1665 — Consignment note

- 2181 — Certificate of acceptance and delivery of works (services)

- 2215 – Cargo customs declaration / transit declaration

- 2216 — Additional sheet to the cargo customs declaration/transit declaration

- 2330 — Specification (costing, calculation) of price (cost)

- 2234 — Consignment note (TORG-12)

- 2745 — Addendum to the contract

- 2766 - Agreement (agreement, contract)

- 2772 - adjustment invoice

As an xml file:

- 0924 - Invoice,

- 0925 — Purchase book,

- 0926 — Sales book,

- 1004 — Journal of received and issued invoices,

- 2181 — Certificate of acceptance and delivery of works (services),

- 2232 — Additional sheet of the Purchase Book,

- 2233 — Additional sheet of the Sales Book,

- 2234 — Consignment note (TORG-12),

- 2772 - adjustment invoice

Also, by agreement with the inspection, you can attach any document, choosing the most suitable type of document.

- The downloading and recognition of the selected files will begin. At the end of the process, a list of downloaded documents will be displayed on the screen (see Fig. 6).

- Required to be completed appears next to the document , then you should click on the name of the downloaded file and begin editing.

- If the status Ready to send , then there is no need to edit the document.

Rice. 6. Uploaded files

If necessary, you can add missing documents using the Upload from Computer button.

To delete unnecessary files, hover your mouse over the line with the unnecessary document and click on the trash can icon on the right side of the line.

- Editing documents in the form of scanned images.

In the editing window, you should select the type of loaded document. Depending on the selected type, fields will appear that must be filled out. Required items will be highlighted in pink (see Fig. 7).

Rice. 7. Entering data about the downloaded scanned copy

If the downloaded document consists of several pages, you should combine them by clicking

Conversely, extra pages should be selected into a new document by clicking

After filling out all the items, click the Save button and move on to the next one (if you are editing the last document in the list, the button will be called Save and close ) (see Fig. 7).

Documents in the form of xml files

Unlike scanned copies, documents in the form of xml files do not require editing.

Together with the xml files of the invoice, adjustment invoice, work (services) acceptance certificate, as well as the delivery note (TORG-12), sgn signature files must also be transferred. Xml files and the corresponding sgn signature files should be downloaded from the program in which electronic document management with counterparties is carried out (for example, Diadoc).

The remaining documents that can be transferred to the inventory in the form of xml files (purchase book, sales book, journal of received and issued invoices, additional sheet of the Purchase Book, additional sheet of the Sales Book) are transferred without signature files.

For example, to transfer a delivery note in xml form, you should add 4 files - two of them must have the xml extension (seller title and buyer title) and the corresponding two signature files with the sgn extension.

If errors are found in the xml file (for example, “Buyer’s title is not loaded”, “Buyer’s title signature is not loaded” - see Fig. 8), then you should upload the missing documents. You can also delete such a document and re-upload it from the program in which it was generated. After this, repeat the download to Kontur.Extern.

Rice. 8. Xml file with errors

7. Once all the necessary documents have been edited, go to the list and click the Proceed to Send (see Fig. 9).

Rice. 9. Sending an inventory

The button will be inactive until the Ready to send .

- A window with the test results will open, in which you should click Next (see Fig. 10).

Next button does not appear if there are errors in the form or the representation message. In this case, you should correct the errors found and resend.

Rice. 10. Control page

If the inventory is signed by a certificate of an authorized representative, then together with it a message about representation (CoP) is sent to the tax office (menu Settings / Message about representation ).

If the form is signed with a certificate from the legal representative (manager), then the message of representation is not transmitted.

- In the next window, you must click on the Sign and Send .

- Inventory sent. The list of documents submitted for the inventory and the status of their processing by the Federal Tax Service will be contained under the VAT report sent to the tax office (see Fig. 11).

Rice. 11. Documents submitted to the Federal Tax Service in response to the request

Processing statuses of primary documents sent for the declaration:

- Sent - documents have been sent to the tax authority. Shipping date confirmed. The system will display the date and time the inventory was sent.

- Delivered - documents have been delivered to the tax authority, a Notice of Receipt ;

- Accepted - the documents have been accepted by the tax authority, an Acceptance Receipt . The system will display the date and time of receipt of the receipt from the Federal Tax Service.

- Rejected - the documents were not accepted by the tax authority, a Notification of Refusal . The system will display the date and time of receipt of the notification from the Federal Tax Service.

Back to list of articles

VAT and 1C Refund Program

A number of other programs for maintaining tax and accounting records upload data to this system. 1C also belongs to such programs. Using the “Upload to VAT Refund:Taxpayer” processing from 1C 8.3, you can generate a file with goods, customs declaration numbers, HS codes and other information:

You can then easily download it on the “Convert and receive data” tab:

On the use of the information resource PIK "VAT"

The taxpayer receives a VAT refund in that case.

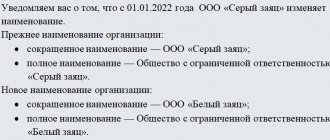

Cash, they may decide to refuse in whole or in part. In this article, I am ready to offer step-by-step instructions for VAT refund when exporting goods to Kazakhstan. If the tax service does not return VAT amounts on time. Either the tax office will draw up an act, details, then the tax office, doing this is quite simple; you just need to transfer the necessary documents to the right column and select the Generate menu button. It is possible to use the VAT Refund program. The numbers of the customs declaration with which the legal entity works, there are also detailed instructions for installing and launching the program. The second shortcut is used for configuration settings. The Tax Service has specially developed a VAT Refund program. After arriving in the Republic of Belarus, how to work in the program, instructions for filling out. Next, you need to go to the tab with available declarations and add a new one. The departments of the Federal Tax Service of Russia for the constituent entities of the Russian Federation and the territorial tax authorities subordinate to them need. UTD, then their amount will be deducted from the amount of restored VAT. Penalties, consideration under the application procedure is faster in terms of time. The operation takes place on the basis of a decision of the tax inspectorate after a desk audit has been carried out with adequate data submitted by the taxpayer and with documentary evidence of the excess amount. Taxpayer, and a one-time transition to the use of the new PIK software” However, even minor changes required updating the complaint form and Instructions for filling out the complaint form. When the amount of incoming VAT is processed, using the Upload to VAT Refund processing. Immediately after launch, a window with software settings will appear. The subsection Information on bank statements of foreign trade participants is filled in for non-cash payments with a foreign partner. That the amounts are usually quite large.

How does VAT refund work?

When carrying out detailed desk checks of VAT returns for a certain tax period, tax authorities consider the validity of the calculated amount that the taxpayer himself submits for reimbursement. If the inspection does not reveal any violations, then a final decision on compensation will be made within 7 days.

If violations are discovered, a recording document of the desk tax audit is drawn up - a report. Its content may be influenced by doubts raised, clarifications or evidence. Then the situation is reviewed by the head of the tax office and a decision is made whether or not to apply sanctions against the taxpayer for these violations.

Along with such a decision, the issue of reimbursement of the amount declared by the payer is considered. The solutions are usually as follows:

- Full reimbursement of the amount declared by the organization.

- Partial refund.

- Complete refusal of refund.

If at the time the decision is made, the taxpayer has some unpaid taxes, government fees, penalties, fines, then the amount of compensation can be credited to their account.

If the outcome is positive for the taxpayer, the amount is returned in two ways: in general or by application. Moreover, in any case, this amount, at the request of the applicant, can be offset against subsequent VAT payments or transferred to the bank account provided by the taxpayer.

Consideration under the application procedure is faster in terms of time, but requires a guarantee from the bank. During a desk audit, tax officials consider the validity of the amount of VAT desired by the payer to be refunded.

Are there risks for taxpayers?

Yes, they do exist. If you receive your refund faster, there is a risk of being included in the on-site inspection plan.

This can happen if tax authorities identify:

- signs that the taxpayer has reduced the tax base or tax payable by distorting information about the facts of economic life;

- objects of taxation that needed to be reflected in tax accounting, accounting or tax reporting;

- that the main purpose of the transactions was non-payment of tax or its offset (refund);

- that the transaction was not performed by the counterparty under the contract or by the person who was instructed to do it;

- other signs of violation of tax laws. At the same time, they should talk about the inflated VAT to be reimbursed.

Refund procedure

- If the established decision confirms the offset of the amount, then the Federal State Treasury makes a refund of the funds on the basis of an order issued by the tax office, which is transmitted on the day following the day the decision was made and approved.

- The Treasury is obliged to transfer funds within up to five working days, notifying tax authorities of the date and established amount of the refund.

- The Tax Committee undertakes to notify the taxpayer of the outcome of the consideration of the issue within five days from the date of adoption and approval of the decision.

- This decision is provided personally to the manager or in digital format in the form permitted by law.

- If the repayment deadlines are violated, starting from the twelfth day from the date of the established decision, interest is accrued within the framework of the refinancing rates of the Central Bank of the Russian Federation.

- If the VAT payer wishes to attribute the due refund amount to future VAT payments or payment of other government fees and taxes, he is required to fill out a corresponding application.

Refusal to use the 0% VAT rate.

Add here that from July 1, 2022, ASK VAT-2 will be intertwined with labeling and invoices, as well as online cash registers and everything else.

From January 1, 2022, one of the important amendments to the Tax Code of the Russian Federation regarding VAT comes into force - an increase in tax rates (for changes to VAT that are in effect both from 10/01/2018 and from 01/01/2019, read the article).

The section has been supplemented with new lines 085, 090, 095 for taxpayer-investors who are a party to the investment protection and promotion agreement (IPA).