When required

Only its head has the right to act directly on behalf of the institution. The remaining persons who are entrusted with working with the Federal Tax Service fill out a power of attorney for the tax authorities to receive documents and submit reports. The director delegates authority to:

- receiving documents, requirements, notifications, extracts, certificates from the territorial Federal Tax Service;

- submission of reports and written requests to the department;

- signing notifications of delivery of documentation.

The trust papers are filled out in several copies: during the initial visit to the department, the inspector leaves the form with him. If the next time the representative goes to another employee of the Federal Tax Service, he will also request documentary evidence of authority.

IMPORTANT!

Trust papers from legal entities are certified by the signature of the head and the seal of the institution (if there is one). But the documentary transfer of powers of an individual entrepreneur must be confirmed by a notary (clause 3 of Article 29 of the Tax Code of the Russian Federation).

In what cases is a tax power of attorney used?

Under certain circumstances, any citizen may not visit the Federal Tax Service office in person, but give the right to provide documents to such a body to another person.

Typically this need is associated with the following situations:

- in case of illness of the principal;

- when leaving on vacation or a long business trip;

- in case of permanent residence in another city and the impossibility of appearing at the Tax Service office at the place of registration.

Powers of attorney of this kind are often issued to employees of organizations whose managers do not have time to independently deal with documentation related to taxation and fees. For example, a company accountant often has a power of attorney to submit reports to the tax office, but in this case such an employee may have limited powers.

In particular, an accountant may have the right to submit certain documents and receive various acts, but at the same time, the head of the organization may not give permission to sign certain types of papers received by the Federal Tax Service (documents for accounting accounts, acts of reconciliation of accounts, and others).

Attention! A power of attorney gives the right to represent the interests of the principal not only in the Federal Tax Service, but also in other services and bodies controlled by laws on taxes and fees. Such institutions include some extra-budgetary funds and customs authorities.

How to write

Compiled in simple written form. There is no unified form; the manager delegates those responsibilities that are required for a particular institution. This is what is described in the trust document:

- Information about the principal: name, INN, OGRN, legal address, full name. and the legal basis for the manager’s actions.

- Personal information about the person being trusted: full name, passport, address.

- List of powers.

- Certified signature of the trustee (if required by the terms of the trust).

- Manager's signature. The stamp is placed if it is available at the institution.

Rules for drawing up a power of attorney

Such a document is drawn up in accordance with certain requirements for design and content. This is an official document, which, if executed incorrectly, may cause Tax Service employees to refuse to issue or accept the principal’s documents.

If a document requires notarization, this can be easily avoided, since the power of attorney is drawn up on a form provided by a notary. But even if you use a sample from the Internet for a tax power of attorney or even write it by hand, the notary will still check the correctness of the entered data during certification and indicate any mistakes made.

The power of attorney must contain the following points:

- name and date of preparation (mandatory point, without which the document will be considered invalid);

- place of compilation;

- passport details of the principal or details of the legal entity from which the document is being drawn up (including checkpoint and tax identification number, legal address, name, position and full name of the manager);

- Full name and passport details of the authorized representative;

- powers and rights that the person in whose name the power of attorney is drawn up will have;

- validity period of the document (the maximum validity period of the power of attorney is three years from the date of preparation; without specifying the period, the document is valid for one year).

Sample

Template - power of attorney to receive a certificate from the tax office and submit reports to the Federal Tax Service:

| Power of attorney _______ date in words By this power of attorney _____________________________ (name of organization), TIN ______________, OGRN ______________, legal address: ___________________ represented by _________________________, acting on the basis of ________, this power of attorney authorizes __________________________________________, passport series _____, No. _________, issued by _____________________, registered at the address: ___________________________

This power of attorney has been issued without the right of subrogation for a period of _______. I certify the signature of the authorized representative ____________. Supervisor _______________________ (space for printing if available) |

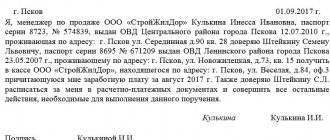

And this is what a completed power of attorney for the representation of interests in the tax office for an accountant of the institution looks like:

Examples of powers of attorney for the Federal Tax Service

In accordance with the order of the Federal Tax Service of the Russian Federation dated July 31, 2014 N ММВ-7-6/ [email protected] when submitting a tax return (calculation) in electronic form under the TKS by a representative of the taxpayer, a document (copy of the document) giving the right to confirm the accuracy and completeness of the information, specified in the declaration (calculation) is provided to the tax authority before sending the tax return (calculation). A copy of this document is retained by the tax authority for 3 years after expiration.

You will need to provide the Federal Tax Service with a copy of the power of attorney in paper or scanned form. Also, in the Kontur-Extern system you will need to fill out a Message about representation (see Peculiarities of sending tax reports through an authorized representative).

We invite you to familiarize yourself with examples of powers of attorney for the following cases:

1. The reporting is signed by an electronic signature issued to the accountant of this organization

2.Reporting is carried out by a third-party organization indicating the responsible person authorized to submit reports

3. The reporting of an individual entrepreneur is maintained by another individual entrepreneur, and the power of attorney is notarized

Also study the instructions for forming a power of attorney in the new Externa interface.

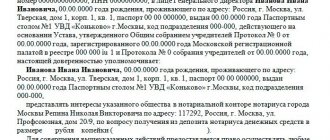

1. The statements are signed with the electronic signature of the accountant

Such a power of attorney should be issued in the case where the electronic signature certificate is not issued to the head of the organization. For example, the head of Organization 1 LLC, represented by General Director I.I. Ivanov. authorizes the chief accountant Petrov P.P. represent interests in the Federal Tax Service.

Save a sample of this power of attorney (situation 1)

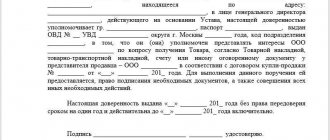

2. Reporting is carried out by a third-party organization indicating the responsible person authorized to submit reports

Such a power of attorney should be issued in the case where the reporting of Organization 1 is maintained by a third-party company - Organization 2. In this case, the power of attorney clearly indicates the authorized person in Organization 2, who has the right to sign. Thus, either the head of Organization 2 or its authorized representative specified in the power of attorney will be able to submit reports.

Accounting service providers can see the validity periods of all certificates and powers of attorney in Externa.

Save a sample of this power of attorney (situation 2)

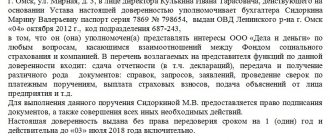

3. The reporting of an individual entrepreneur is submitted by another individual entrepreneur, the power of attorney is notarized

Such a power of attorney should be issued in the case where the reporting of the individual entrepreneur Ivanov I.I. appears to be an individual entrepreneur S.S. Sidorov, and the power of attorney is notarized.

Save a sample of this power of attorney (situation 3)

An already completed power of attorney can be printed from the payer’s details.

Report easily and without errors. A convenient service for preparing and submitting reports via the Internet. We are giving access to Extern for 14 days!

When working with a power of attorney at the stage of checking the Federal Tax Service report, a message about an error or refusal to accept may appear. The procedure for different cases is described in the articles:

- error “You may need a power of attorney to submit reports”;

- refusal “There is no information about the power of attorney with the tax authority”;

- refusal “Incorrect indication of information about the power of attorney”;

- refusal “Inconsistency of information about the taxpayer in the tax return and in the information message about the representative office”;

- refusal “The representative does not have the authority to sign and submit tax reporting (electronic document).”

When is an electronic power of attorney needed?

Taxpayer reports are increasingly being submitted electronically. This is convenient and safe, especially since many tax offices, due to the coronavirus pandemic, accept visitors by appointment and in limited numbers.

In addition, some reports, such as VAT returns and annual financial statements, are only accepted in electronic form.

From July 1, 2022, the Federal Tax Service began issuing free electronic signatures for heads of organizations, as well as individual entrepreneurs. Digital signatures for employees and other authorized representatives must be issued at your own expense.

But if previously the electronic digital signature of a representative included data about the organization or individual entrepreneur, now only the last name, first name and patronymic will be known from it. Therefore, without a power of attorney, it is unclear who exactly the proxy represents.

In this regard, if a representative submits reports electronically, then he definitely needs a power of attorney in the format from Order No. ED-7-26/ [email protected]

Document validity period

As a general rule, a power of attorney from an individual entrepreneur is valid for the entire period specified in it, but no more than 3 years from the date of signing. After this time, the power of attorney must be renewed - i.e. draw up a new paper. However, even if the period is not specified for some reason, the power of attorney is still considered valid for 12 months from the date of its preparation.

Termination is determined by the revocation of the power of attorney on the part of the individual entrepreneur (he applies to the same or another notary) or the termination of the specified period. In this case, you should focus on the following rules:

- If an end date is specified, the document expires on that day before midnight local time.

- If a period is specified (for example, 2 years), the paper ceases to be valid the next day, also at midnight.

- If an event is specified as the end (for example, the transfer of documents to the tax service) - immediately after the occurrence of this event.