Forms of personalized accounting

Since 2022, changes have come into force in the accounting procedure for insurance premiums, which employers calculate from payments to their employees. Control over their accrual and payment was transferred to the Federal Tax Service. In this regard, the reporting submitted to the Pension Fund was also reformed. The reporting provided to the Pension Fund of the Russian Federation is necessary for organizing the registration of citizens in the pension system, monitoring the insurance period, and tracking the right to assign an early pension. Resolution of the Board of the Pension Fund of the Russian Federation No. 507p dated December 6, 2018 approved personalized accounting reporting, which is still used today:

- SZV-STAGE;

- SZV-ISH;

- SZV-KORR;

- EDV-1.

Resolution No. 507p explains what EDV-1 is and who submits it - this is information on the policyholder that is transferred to the Pension Fund. In essence, this is an inventory for SZV-STAZH. All policyholders rent it out.

Use free instructions from ConsultantPlus experts to correctly fill out the SZV-STAZH in 2022.

Penalties for late submission or errors in EFA-1

Liability can be applied for various types of violations:

- The Pension Fund will not accept reports on forms SZV-STAZH, SZV-KORR, SZV-ISKH, which the policyholder sent by mail without EDV-1. In this case, as well as if inaccuracies or errors are found in EDV-1, the Pension Fund of the Russian Federation will send the policyholder a notice to eliminate the shortcomings - they must be corrected within 5 working days (Part 5 of Article 17 of the Law of 01.04.1996 No. 27-FZ “On individual (personalized) accounting...").

- If the reports SZV-STAZH, SZV-KORR, SZV-ISKH are submitted late, the policyholder will be fined. The fine will be 500 rubles. for each employee for whom a report was filed or should have been filed (paragraph 3 of Article 17 of Law No. 27-FZ dated April 1, 1996).

- If the report is submitted on paper, and the number of employees is 25 or more, then the policyholder will be fined 1,000 rubles.

- If personalized accounting information is not submitted to the Pension Fund on time or is submitted incompletely, officials will be fined 300–500 rubles. (Article 15.33.2 of the Administrative Code).

Who takes the new EFA-1 form and when to do it in 2022

Reports on personalized accounting are provided to the Pension Fund. The Pension Fund determines who should submit the EDV-1 inventory to SZV-STAZH - all organizations and individual entrepreneurs that attract employees are required to submit EDV-1:

- under employment contracts;

- under civil law contracts.

Employers-insurers are required to calculate and pay insurance premiums from the remuneration paid to employees in accordance with the rules of Chapter 34 of the Tax Code of the Russian Federation. Insurance premiums, among other things, are paid for compulsory pension insurance.

The reporting form in question is not an independent document. It is an additional inventory form to the main report. Thus, who and when submits the EFA-1 report in 2022 depends on the timing and order of submission of the main forms listed above. All insurers provide it within the prescribed period. In addition, a report will have to be prepared if the employee has applied for a pension.

IMPORTANT!

Information on the policyholder is transferred to the Pension Fund of the Russian Federation before March 1 of the year following the reporting year. The deadline for submitting EFA-1 in 2022 is until 03/01/2022. This is Friday, a weekday, there are no transfers.

Who must report on the SZV-STAZH form

The employer’s obligation to annually report on the insured persons within the framework of personalized accounting is provided for in paragraph 2 of Art. 11 of the Law of 04/01/1996 No. 27-FZ (as amended on 12/28/2016), for this purpose a new reporting form SZV-STAZH was developed (adopted by Resolution of the Pension Fund Board of 01/11/2017 No. 3p, Appendix No. 1). The report contains information for each employee: about his period of work, accrual and payment of insurance “pension” contributions in the reporting year.

Filling out the SZV-STAZH for 2022 is mandatory for all organizations, individual entrepreneurs, private lawyers and notaries who have employees under employment and civil law contracts, for whose remuneration “pension” insurance contributions are accrued. It is necessary to submit the SZV-STAZH form even if in the reporting year no remuneration was paid to employees under existing contracts, or all employees were dismissed.

Read also: SZV-STAZH - new form 2018

SZV-STAZH: you will find a sample of filling out when dismissing an employee in our article, and here we will talk about the final form.

And if the policyholder does not have a single insured person, is it possible for SZV-STAZH 2022 to fill out an example of a “zero” form? A form with “zero” indicators will not pass format-logical control, since it will not contain a single record about the insured persons and the periods of their work in Section 3, therefore there is no need to submit a “zero” SZV-STAGE.

Read also: Is it necessary to take the zero SZV-INTERVIEW (2019)

At the end of this article you can find and download an example of filling out for SZV-STAZH 2017.

The deadline for submitting the report depends on the reason for its submission:

- The form with the “original” type is submitted once a year, before March 1 of the following year.

- If an employee retires, the SZV-STAZH form of the “assignment of pension” type is filled out, which is submitted to the Pension Fund of the Russian Federation within three days after the future pensioner contacts the employer.

- In the event of liquidation/reorganization of an employer, the SZV-STAZH is submitted within a month after approval of the liquidation/separation balance sheet; the same period is valid for individual entrepreneurs who decide to cease their activities.

Failure to submit the “original” or “pension” SZV-STAZH form on time, reflecting false information in it, or erroneously not reflecting information, threatens the policyholder with a fine of 500 rubles. for each insured person (Article of Law dated April 1, 1996 No. 27-FZ).

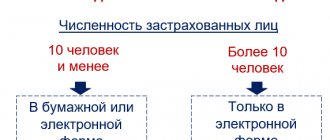

Policyholders will be helped to prepare the SZV-STAZH form by the program for filling out, located on the official website of the Pension Fund of Russia. Reporting is submitted exclusively electronically by policyholders who provide information on 25 or more insured persons, while the rest have the right to report “on paper”.

Determining the type of information

The current inventory form was approved by Resolution of the Board of the Pension Fund of the Russian Federation No. 507p dated December 6, 2018. It is necessary to fill out EDV-1 when providing other forms of personal accounting: SZV-STAZH, SZV-ISKH and SZV-KORR. The rules for filling it out depend on which of these reports the inventory is compiled for.

Let's look at how to fill out EDV-1 for SZV-STAZH for 2022, similarly.

Completing a report begins with determining its type. Reporting happens:

- original - submitted during the initial submission complete with the main document;

- corrective - provided if corrections are made to section 5 of the original reporting;

- canceling - provided if the data specified in the original form in section 5 is canceled.

The type of form provided must be indicated by placing an “X” in the appropriate box.

What does the form look like?

The initial questionnaire was approved by resolution of the Pension Fund Board No. 485p dated September 27, 2019. The new form was approved by Resolution of the Board of the Pension Fund of the Russian Federation No. 846p dated December 7, 2020 “On amendments to the Resolution of the Board of the Pension Fund of the Russian Federation dated September 27, 2022 N 485P.” The form is a one-page form on which you must indicate basic information about the insured person. All data is entered into specially designated cells.

Sections that are always filled

Sections 1, 2 and 3 are completed regardless of which main report the inventory is attached to.

Section 1 reflects information on the policyholder transferred to the Pension Fund for maintaining individual (personalized) records (EDV-1):

- registration number in the Pension Fund of Russia: has 12 characters and is assigned when registering a company with the Pension Fund of Russia;

- TIN and checkpoint;

- name of the insured.

Section 2 is intended to indicate the period for which reports are submitted. It must indicate the year. And a coded designation of the time period for which the report is provided:

- quarter;

- half year;

- year;

- another time interval for which reporting was to be submitted.

The SZV-STAZH report is submitted once a year, therefore the reporting period code in EDV-1 for this report is always 0. A complete list of reporting period codes for previous years is indicated in the appendix to the procedure for filling out personalized accounting forms.

Section 3 is intended to indicate the number of persons for whom information is filed in the main report. Opposite the name of the corresponding form indicated in column 1, we reflect the number of insured persons in column 2. Only one line is filled in in this tabular part.

Rules for filling out SZV-STAZH and EDV-1

The SZV-STAZH form is always submitted along with the ODV-1 inventory, without which the Pension Fund of Russia will not accept information on employees. We'll look at how to fill out these forms below.

Read also: EDV-1 - a new form

Procedure for filling out SZV-STAZH in 2022

The form of information on insurance experience includes 5 sections, when filling out which you should follow the instructions for filling out the SZV-STAZH 2022 form (Appendix No. 5 to Resolution of the Pension Fund Board No. 3p). The information is filled out according to accounting data (information on wages, insurance contributions) and personnel documents (periods of work).

When starting to fill out the SZV-STAZH for 2022, you should determine what type of information it will contain and mark it with an “X”:

- the “original” form for the reporting year is submitted for all insured persons for the first time;

- “supplementary” is submitted only for persons for whom the “original” form contained errors, as a result of which data on length of service was not taken into account on their personal accounts;

- “appointment of pension” - this type of form is submitted to employees who, in order to assign a pension, need to take into account the period in the current year before the reporting deadline.

The amount of filling out the SZV-STAZH report depends on the type of information:

- in the “original” and “supplementary” sections 1, 2 and 3 are filled in;

- when “assigning a pension”, fill out sections 1 to 5.

Section 1

Enter information about the policyholder here:

- TIN and KPP, which is indicated for legal entities and their separate divisions;

- number assigned to the Pension Fund upon registration;

- short name of the company (as in the constituent documents), or full name. entrepreneur.

Section 2

Indicate the reporting period for which the SZV-STAZH is submitted: “2017” (see below for an example of filling).

Section 3

“Information about periods of work” includes information for each employee:

- full name, patronymic, surname (columns 2, 3, 4),

- SNILS (column 5),

- period of work in the reporting year (columns 6, 7).

As for the period of work in columns 6-7 of the SZV-STAZH report, completion should take into account the following nuances:

- If an employee worked the whole year without a break, one line is filled in with the start and end dates of work, but if there are several such periods (for example, the employee was on sick leave, on vacation, or quit in the middle of the year, and was hired again in the same year ), then each period is entered in a separate line, despite the fact that the name and SNILS of such an employee are indicated once (in the example below for SZV-STAZH 2022, the next vacation and other periods are reflected in a separate line).

- For those who were hired before 2022 and continue to work after its end, the period “from 01/01/2017 to 12/31/2017” is indicated.

- When submitting information such as “appointment of a pension”, the rules for filling out the SZV-STAZH require indicating the period of work up to the day of the employee’s expected retirement, which he indicated in his application.

Columns 8-13 are filled out using the codes given in the “Classifier of Parameters” used when filling out persuance accounting reports (appendix to the Procedure for filling out SZV-STAZH). Columns 9, 12 and 13 are not filled out in the absence of documentary evidence of work in special conditions, or in case of non-payment of insurance premiums under the additional tariff, or under non-state pension early provision agreements.

According to the procedure for filling out the SZV-STAZH 2022 form, column 14 o only in cases where the day of dismissal of the employee in the reporting year coincided with December 31.

Section 4 and Section 5

These sections are relevant only when submitting information of the “pension assignment” type:

- Section 4 reflects the fact of accrual (payment) of “pension” contributions for the period specified in columns 6 and 7, as well as whether additional tariff contributions were accrued to the employee for the same period.

- Section 5 contains information on the payment of contributions under non-state early pension agreements.

The SZV-STAZH form indicating the position is signed by the responsible person; if available, the employer’s seal is affixed.

A sample of filling out the SZV-STAZH for 2022 can be found below.

How to fill out EDV-1

In addition to filling out the SZV-STAZH, the instructions require additionally submitting another form - ODV-1. This form is an accompanying document: the completed information about the SZV-STAZH experience is formed into “packages” (one package - one file), and an inventory according to the EDV-1 form is attached to each of them.

The inventory form can be found in Appendix No. 2 to the Pension Fund Resolution No. 3p. The inventory consists of 5 sections. When submitting SZV-STAZH information, all sections except 4 are filled out.

The type of the form is “initial”, and if it is necessary to correct or cancel previously submitted data in section 5, indicate the type “corrective” or “cancelling”.

Section 1

The same details of the policyholder are indicated as in section 1 of the SZV-STAZH form.

Section 2

The reporting period displays the year, as well as the code, according to the “Classifier of Parameters” - for 2022. this is "0".

Section 3

In the “List of incoming documents”, select a line of the SZV-STAZH form, and enter the number of persons for whom information is provided in this package of documents.

Section 4

Not to be filled in when submitting SZV-STAZH.

Section 5

This part of EDV-1 is filled out if there is information about persons employed in jobs that give the right to early assignment of a pension (Article of Law No. 400-FZ dated December 28, 2013).

When section 4 EDV-1 is filled out

This part of the inventory is filled out only if it is submitted together with SZV-ISH or SZV-KORR reports with the “special” type. A form with the “OSOB” type is provided for the insured person, information on which was not included in the reporting previously provided by the policyholder, with the exception of reporting in the SZV-STAZH form.

If there is a need to adjust information about accrued contributions for one employee, this entails changes in information about accruals and debts for the entire policyholder as a whole. In order for the Pension Fund to be able to correctly correct information previously submitted by the company, Section 4 is intended.

Let's show with an example how to fill out section 4 of EFA-1. The company submitted the DAM to the Pension Fund for 2022 with the following data:

| 2017 | Debt at the beginning of the reporting period, rub., kopecks. | Insurance premiums accrued, rub., kopecks. | Insurance premiums paid, rubles, kopecks. | Debt at the end of the reporting period, rub., kopecks. | ||

| Total | For 2016 | For 2022 | ||||

| For the insurance part of the pension | 100 000,00 | 2 000 000,00 | 1 950 000,00 | 100 000,00 | 1 850 000,00 | 150 000,00 |

In 2022, it was discovered that information was not submitted for one employee. According to it, for 2022, contributions were calculated for the insurance part of the pension in the amount of 10,000 rubles. The organization submits information for this employee using the SZV-ISH form and fills out section 4 of the inventory as follows:

How to correct errors in EDV-1

To correct information in a previously submitted report on the EFA-1 form with the “Initial” type, you must submit an inventory with the type:

- “Corrective”, if the data in section 5 is corrected;

- “Cancelling”, if the data in section 5 needs to be canceled.

EFA-1 forms with this type of information do not accompany information packets. That is, EDV-1 is submitted as a separate report without the forms SZV-STAZH, SZV-KORR, SZV-ISKH.

Sections 1, 2 and 5 are filled out in the inventory in the same way as in the inventory for SZV-STAZH. Sections 3 and 4 are left blank.

How to fill out section 5 of the EFA-1 form

This section is filled out by policyholders when submitting the initial SZV-STAZH or SZV-ISKH only if the information contains data on employees who have rights to early assignment of a pension. Such persons include:

- those employed in hazardous and difficult working conditions;

- public transport drivers;

- civil aviation employees;

- professional rescuers, fire service workers;

- those employed in work with convicts;

- other persons named in clauses 1-18 of part 1 of article 30 of Federal Law No. 400-FZ of December 28, 2013.

Section 5 contains data on the number of such workers, their positions, codes of special working conditions and codes corresponding to positions from lists No. 1 and No. 2 of professions that give rights to preferential pensions (Resolution of the USSR Cabinet of Ministers No. 10 of January 26, 1991).

Form ADV-1 for a child

In the modern world, even minor children have an insurance certificate. It is required both in kindergarten and at school. Obtaining SNILS became mandatory in 2012 according to Federal Law No. 313 of November 29, 2010. The parents fill out an ADI-REG for children and write an application to receive SNILS for the child. If the child is already 14 years old and has received a passport, then he can apply for a certificate independently.

If a certificate for a child is issued by one of the parents, then he applies to the territorial office of the Pension Fund of the Russian Federation with the child’s birth certificate and his passport.

An example of how to fill out a form to receive SNILS for a child:

Sample filling

To determine whether you need to take EFA-1 and which sections of the report to fill out, use our cheat sheet.

| Main report | Main report view | Chapter | ||||

| 1 | 2 | 3 | 4 | 5 | ||

| SZV-STAZH | Initial, contains information about persons entitled to early pension assignment | + | + | + | — | + |

| In all other cases | + | + | + | — | — | |

| SZV-ISH | Contains information about persons entitled to early pension assignment | + | + | + | + | + |

| In all other cases | + | + | + | + | — | |

| SZV-KORR | Corrective | + | + | + | — | — |

| Canceling | + | + | + | — | — | |

| Special | + | + | + | + | — | |

Let's sum it up

The EFA-1 report for 2022 must be submitted together with the SZV-STAZH report within the same deadlines and in compliance with the same procedure.

Relevant in 2022 is the form approved by Resolution of the Pension Fund of Russia Board of December 6, 2018 No. 507p.

In the EDV-1 form submitted along with the SZV-STAZH, Section 4 is never completed.

Section 5 should be completed only if the policyholder has employees entitled to early retirement and information about this is already included in columns 9, 10 or 12 of the SZV-STAZH form.

Step-by-step instructions for filling out and sample

If a representative of the enterprise’s personnel service is filling out the document, then he must understand the rules of this process.

To correctly form the ADV-1 form, the following steps are performed:

- personal information about the new employee is entered, for which his full name, date of birth and gender are indicated;

- information for filling out the form is taken exclusively from official documentation received from a specialist, so the data must match the information from the passport;

- the place of birth given in the passport is indicated, and not only the city is entered, but also the region, district and country;

- the citizenship of the new hired specialist is selected;

- the place of registration and the address of the citizen’s actual place of residence is indicated;

- indicate contact information represented by telephone number and email address;

- passport details are entered, and it is allowed to use other identification documents;

- a correctly formed application form of the insured person is signed by the direct employee, if there are no serious reasons for the director of the enterprise to carry out this process;

- at the end the date of compilation is indicated, after which the documentation is transferred to the representatives of the Pension Fund, and an accompanying inventory is attached to it.

Any hired specialist can understand the rules for creating the ADV-1 form. If false or incorrect information is entered, this will lead to negative consequences. Funds transferred in the form of insurance premiums for an employee will not accumulate in his individual account. Therefore, you will have to check and draw up a new questionnaire.