What's changing in 2022

The Federal Tax Service has adjusted the current legislation and made the following changes:

- Property tax assessments have been cancelled. There is no longer a need to send quarterly advance reports to the Federal Tax Service.

- Taxpayers submit only an annual report—the final property tax return. The form is submitted annually, no later than March 30 of the next reporting period - year (clause 3 of Article 386 of the Tax Code of the Russian Federation).

- The obligation to pay quarterly advances on property taxes remains. But only for those taxpayers who need to transfer an advance according to the decision of the regional authorities. But the rules for calculating advance payments have changed. From 2020, the contribution to the budget is calculated according to the changed cadastral value of real estate. Let us remind you that until January 1, 2020, a different rule was in effect - the calculation was carried out according to the cadastral value determined as of January 1 of the reporting year.

How to fill out an advance calculation for property tax for the 3rd quarter of 2022

The procedure for filling out the Calculation is given in Appendix No. 6 to Order No. ММВ-7-21/271. Filling out begins with the registration of the title, which reflects all the registration information of the company, the code of the Federal Tax Service to which the report is submitted. The reporting period code for the 3rd quarter (9 months) is “18”. If the report is primary, the adjustment number “0—” is indicated.

Next, the values on the basis of which tax calculations were made for object B are transferred to sections 2 and 2.1, based on its value on the balance sheet. Section 3 indicates the calculation of the tax for object A, calculated from its cadastral value as of 01/01/2019.

Finally, the summarized value of the calculated advance payment for the 3rd quarter is entered into Section 1. The amounts payable are indicated in the context of each OKTMO and KBK.

The property tax report (advance calculation) generated according to our example data for 9 months of 2022 will be as follows:

Who is renting in 2022

Calculation of property tax refers to mandatory periodic reports. It is rented out by legal entities and individual entrepreneurs who pay property fees.

The obligation to provide a tax calculation for advance payment of property tax 1152028 arises for all payer organizations without exception. Submit the register of enterprises and individual entrepreneurs to OSNO, USN, UTII, Unified Agricultural Tax. But there is a nuance. Property tax is a tax of regional jurisdiction. And only local legislators decide what the frequency of reporting and payment of contributions is. If any subject of the Russian Federation does not define the obligation to provide calculations and advances for property tax, then there is no need to submit them to the regulatory authorities.

When to submit the calculation

The obligation to prepare tax calculations for advance payments of corporate property tax is fixed at the regional level. This fiscal obligation is classified as regional taxes; therefore, the legislative authorities of the subject have the right to provide for advance payments for taxpayers.

If advance payments are provided in your region, then payments to the budget are made quarterly: for 1 quarter, half a year and 9 months. But when KND form 1152028 is submitted, the deadlines are identical for all regions - before the 30th day of the month following the reporting quarter. At the same time, the terms of advance payment are approved individually for each region separately.

Current information by region, payment deadlines and tax rates, table:

The declaration must be submitted by March 30 of the year following the reporting year. Moreover, all taxpayers will have to submit a final declaration, regardless of the availability of advance payments.

Due dates

IMPORTANT!

The report has been canceled since 2022! There is no need to fill out and submit form 1152028 for the 1st quarter of 2022!

Calculation of property assessment payments is a periodic report. It is sent once a quarter according to the scheme “in the current quarter we report for the previous one.” See the main deadlines in the table.

| Billing period | Deadline for submission | Period code |

| 1st quarter | Until April 30 | 21 |

| 2nd quarter - half year | Until July 30 | 17 |

| 3rd quarter - nine months | Until October 30 | 18 |

We will separately present the dates for reorganized enterprises:

| Billing period | Deadline for submission | Period code |

| 1st quarter | Until April 30 | 51 |

| 2nd quarter - half year | Until July 30 | 47 |

| 3rd quarter - nine months | Until October 30 | 48 |

Certificate 2 personal income tax for 2022: new form

Let's start with the fact that from 2021 there is no such thing as “personal income tax certificate 2” as an independent document. It became part of the annual calculation of 6-NDFL. Instead of certificate 2 personal income tax, two different certificates of income of individuals are used, which have a new form - for the Federal Tax Service and citizens:

- for filing with the tax office

- “Certificate of income and tax amounts of an individual.” This document is Appendix No. 1 to the Calculation in form 6-NDFL (KND code 1151100), approved by Order of the Federal Tax Service dated September 28, 2021 No. ED-7-11 / [email protected] Please note that this form is new and is used for submitting calculations for 2022. The certificate is filled out and submitted to the tax service only when submitting the Calculation for the year.

- for issuance to employees

- “Certificate of income and tax amounts of an individual.” This document is Appendix No. 4 to the Order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11 / [email protected] (as amended by the Order of the Federal Tax Service of Russia dated September 28, 2021 No. ED-7-11 / [email protected] ). This form is also new and has a KND code 1175018.

How to divide property for calculation

In 2022, the procedure for calculating property taxes has changed significantly. Now the calculation (taxable) base does not include movable property. The calculation reflects information only on immovable fixed assets.

In the new reports, there is no need to divide fixed assets into movable and immovable property. But property assets will still have to be divided, and according to this principle:

- By type of calculation. The advance payment is calculated based on the average annual and cadastral value of the property. For this purpose, the report provides various sections.

- At the location of the real estate. If the assets of the enterprise are located on the territory of various municipalities. They will have to be divided according to OKTMO code, and reports and taxes will have to be sent to various territorial tax departments.

- According to tax rates. The calculation must be carried out for all types of rates applied to the payer’s tax objects.

- By types and amounts of benefits applied. Some property assets are taxed at reduced rates or are completely tax-free. The scope of benefits is set by local legislators. All types of preferential property must be reflected in separate calculation columns.

Before submitting reports, the responsible executor studies regional standards, and only after that he calculates the value of the property.

How to calculate the tax base based on the average annual cost

The average cost is the ratio of the total value for the desired position for a specified amount of time and a similar time period. The average cost is an annual average due to the fact that the reporting period for property tax is a year.

The average annual cost is calculated as follows:

- The frequency is determined. The property advance report is submitted once a quarter. For the first quarter, the required period is 4 months, for the second - 7 months, for the third - 10 months.

- The residual price of the property is determined on the first day of each subsequent month.

- The value of preferential or non-taxable fixed assets is deducted. For the calculation, you only need the price of immovable fixed assets taxed at a specific rate.

The calculation for the first quarter is determined as follows: the total value of the average annual value of property (ASV) as of the 1st day of each subsequent month is divided by 4. AVV is calculated from January 1 to April 1. 4 is a four month period from January to April.

Delivery methods

Calculation of advance payments for property tax can be submitted to the inspection:

- on paper (for example, through an authorized representative of the organization or by mail);

- in electronic form via telecommunication channels. If the average number of employees for the previous year (in newly created or reorganized organizations for the month of creation or reorganization) exceeds 100 people, then in the current year property tax calculations can only be submitted in this way. This also applies to organizations that are classified as the largest taxpayers. They must submit tax reports electronically via telecommunications channels to interregional inspectorates for the largest taxpayers.

This is stated in paragraph 3 of Article 80 of the Tax Code of the Russian Federation.

Attention: if an organization is required to submit reports electronically, but submits them in paper form, it will be fined 200 rubles. for each calculation. This is stated in Article 119.1 of the Tax Code of the Russian Federation.

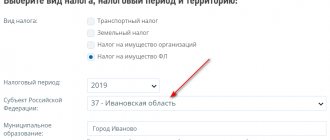

How to calculate the base according to cadastral valuation

Calculation based on cadastral value is even simpler. The regional database records the values of the cadastral value of specific real estate objects. This value is subject to updating, that is, it is periodically recalculated taking into account assessment data. The list of objects whose taxation is based on cadastral value is published annually at the beginning of the reporting period (year).

To calculate the advance, the contractor opens the legislative list, finds the object and identifies the current cadastral value. The value calculated for the current period remains unchanged throughout the year. If the object belongs to preferential property, then all the required benefits are applied to the estimated value. The calculation of the advance payment for cadastral value is differentiated in proportion to the share of ownership (for objects in shared ownership) and location (for assets located in different regions).

How to calculate an advance payment for property taxes

Any tax is calculated according to a single scheme - the base is multiplied by the current rate. Property contributions are no exception. For advance payments, the amount received must be indexed by ¼ - the number of months in the billing period.

The property tax advance is calculated in two ways.

| Method | Description | Formula |

| At average annual cost | The cumulative average price for the selected period is multiplied by the tax rate and by ¼ (or simply divided by 4) | A = (CCi × CH) / 4 |

| According to cadastral value | The cadastre value is multiplied by the tax rate, and the resulting value is multiplied by ¼ | A = (Sk × CH) / 4 |

There are a number of rules for calculating the cadastral value. If legislators have not carried out a cadastral valuation and have not determined the price for the current period, then the advance payment for property tax is calculated based on the average annual cost. The second point is that for organizations that during the reporting period acquired or sold real estate valued according to the cadastre, a special Ki coefficient is used when making calculations. This is an index that determines the number of complete months of ownership of the property. If a real estate transaction took place at the beginning of the month (before the 15th), then this period is taken into account in full. If ownership rights are re-registered after the 15th, this period is excluded from the calculation.

Calculation of advance property tax: example

Duet LLC has two real estate items on its balance sheet with different valuations:

- building A, worth RUB 600,000 according to the cadastre. as of 01/01/2019. Tax rate 1.5%;

- building B, the value of which is determined by the average annual residual value. Tax rate 2.2%.

We will calculate the advance payment for object A using the formula:

AB = KS × ¼ × SNI = 600,000 x ¼ x 1.5% = 2250 rub.

For object B, we calculate the average residual value based on the following data:

| As of date in 2022 | Residual value (RUB) | NI rate |

| 01.01 | 180 000 | 2,2% |

| 01.02 | 176 000 | |

| 01.03 | 172 000 | |

| 01.04 | 168 000 | |

| 01.05 | 164 000 | |

| 01.06 | 160 000 | |

| 01.07 | 156 000 | |

| 01.08 | 152 000 | |

| 01.09 | 148 000 | |

| 01.10 | 144 000 |

Tax base for building B = (180,000 + 176,000 + 172,000 + 168,000 + 164,000 + 160,000 + 156,000 + 152,000 + 148,000 + 144,000) / 10 months. = 162,000 rub.

AB = 162,000 x ¼ x 2.2% = 891 rub.

The total amount of the advance payment for property tax for the 3rd quarter amounted to 3141 rubles. (2250 + 891).

How and where to submit

The calculation is submitted to the territorial office of the Federal Tax Inspectorate. Taxpayers provide reporting data to the Federal Tax Service at the place of registration. Individual divisions send the form to the inspectorate at the address of the structure's registration. If the object is located in several regions (registered in different municipalities), then they report to the Federal Tax Service for each territory of registration of property assets.

The delivery format is determined by the number of taxpayer employees. If the number of employees exceeds 100 people, then the property tax calculation is sent electronically via telecommunication channels. If the enterprise is small, then reporting is submitted on paper.

Where to submit the payment

To correctly determine where to submit the calculation of advance payments for property taxes, answer three questions:

- Is your organization the largest taxpayer?

- Based on what value was calculated the tax base for the property for which you are submitting calculations: from the average or cadastral?

- Does the organization have separate divisions with property on their balance sheet? And if so, how is the tax distributed among local budgets?

If your organization is the largest taxpayer, then for all objects, even those that are taxed at cadastral value, submit a single report at the place where the organization is registered as the largest taxpayer. This is stated in paragraph 1.5 of Appendix 6 to the order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895.

But if the organization is not one of the largest, then for each property with a cadastral tax base, submit separate calculations at the location of these objects. The Federal Tax Service of Russia sent such clarifications to the tax inspectorates by letter dated April 29, 2014 No. BS-4-11/8482.

Let's move on to the next question. Does the organization have separate divisions? If not, then submit the calculation for the property, the tax base for which you calculate from the average cost, to the inspectorate at the location of the organization.

For the property of separate divisions (the tax base for which is calculated from the average cost), report depending on the budget structure of a particular region. Property tax amounts or advance payments may:

- go entirely to the regional budget;

- partially or fully go to the budgets of municipalities;

- distributed among the settlements included in the municipality.

If in your region there is no distribution of property taxes between municipal budgets, then calculations of advance payments can be submitted centrally - at the location of the organization. But this needs to be agreed upon with the inspectorate. This is stated in paragraph 1.6 of Appendix 6 to the order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895.

Is property tax in the region credited (in whole or in part) to local budgets? There are several options, all of them are in the table below:

| Where is the organization, its separate branches with a separate balance sheet or geographically distant real estate located? | Which tax office should I submit reports to? | How many reports to submit? | How to reflect tax in reports |

| In several municipalities under the jurisdiction of different tax inspectorates | By location of each separate division with a separate balance sheet or geographically remote real estate | For each division with a separate balance sheet and for each geographically remote property, submit separate calculations | In the submitted forms, reflect only the tax, the payment of which is controlled by the tax office of the relevant municipality |

| In several municipalities under the jurisdiction of one tax office | By location of the organization's head office | Submit a single report for all property on which you pay tax in the territory of the municipality | Calculate the reporting tax separately for each municipality |

| In one municipality | In your reports, reflect all property taxes under one OKTMO code - the municipality at the location of the organization's head office |

Similar explanations are contained in paragraph 7 of the letter of the Ministry of Finance of Russia dated February 12, 2009 No. 03-05-04-01/08.

At the same time, the following is provided for municipalities such as districts. It will not be possible to provide a single calculation if, by decision of local legislators, part of the property tax is transferred to the budgets of the district’s settlements. Then you will have to submit separate calculations.

All these rules are spelled out in paragraphs 1 and 5 of Article 386 of the Tax Code of the Russian Federation, and are also set out in the letter of the Federal Tax Service of Russia dated April 29, 2014 No. BS-4-11/8482. The diagram below and the table will help you not to get confused about where to pay property tax (including advances) and where to submit reports.

How to fill it out correctly

The rules for filling out reporting forms are the same for all tax registers. Here are brief instructions for filling out advance payment form 1152028:

- All forms must be filled out in the required color only—black block font or handwritten in black, blue, or purple ink.

- Page numbering is continuous.

- The initial registers are numbered with the code “0—”. Correction forms are submitted with correction numbers in the order “1—”, “2—” and so on.

- Corrections using a proofreader are not allowed.

- Stapling paper that damages the integrity of the report is prohibited.

- Duplex printing is not available.

- All calculations are rounded. If the calculated value after the decimal point is less than 50 kopecks, then it is not taken into account. Indicators of 50 kopecks and more are rounded to the nearest sign - the ruble.

Let's imagine filling out the main sections in the form of a table.

| Section number | Section title | Filling procedure |

| — | Title page | All taxpayer registration information is entered. INN and KPP (they will be duplicated on each page of the report), full or short name (as in the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs), telephone number, responsible person. The title page also contains the details of the report itself - the period and year of submission, the adjustment number, the Federal Tax Service code and the coding of the place of registration. Information about the reorganization of the taxpayer is also displayed here. |

| 1 | Advance payment amount to be paid to the budget | In this section, the property tax payer accumulates all reporting data. OKTMO and KBK are indicated, by which the direction of movement of the contribution is determined, and the total value of the advance payment itself for the period. If the taxpayer conducts mutual settlements with various regional budgets, then the OKTMO group - KBK - the advance amount is filled in for each subject payment. |

| 2 | Calculation of the amount of advance tax payment in respect of taxable real estate | This section provides information for calculating the advance (the average annual value as of the 1st day of each subsequent month), sums up the average value of the property for the period, indicates the tax rate and calculates the advance for the reporting quarter. This section provides the coding, amount and cost of the benefit. |

| 2.1 | Information about real estate subject to tax at the average annual value | This block details information about taxable property. The OKOF code and the residual value of property assets at the end of the quarter are also indicated here. |

| 3 | Calculation of the amount of advance tax payment for the reporting period on a real estate property, the tax base for which is determined as the cadastral value | The third section calculates the advance payment based on the cadastral value. The code for the type of property and information, OKTMO, and cadastral details are determined. Then there is a direct calculation of the advance on the assessed value (the assessment value is multiplied by the tax rate). As a result, the calculated advance on the cadastral (page 090 of section 3) and average annual cost (page 180 of section 2) is summed up and entered in line 030 of the first section. |