Send this article to my email

In this article we will step by step analyze how to correctly reflect the purchase of foreign currency in the 1C: Enterprise Accounting program, edition 3.0.

To purchase currency in 1C 3.0 from an organization, at least two current accounts must be entered into the database, one in rubles, the second in the currency that is planned to be purchased. You can enter them in the organization’s card by clicking on the Bank accounts link.

I will set up your 1C. Experience since 2004. Read more →

Further, all the documents that need to be completed are available in the Bank and cash department section.

The first stage of purchasing currency in 1C: Accounting

Executing a payment order, followed by sending it to the bank for the purpose of purchasing currency. In the 1C program you need to enter a Payment order.

The counterparty is the bank from which the currency is purchased; accordingly, the bank must be selected in the Buyer line. Amount – the amount of payment in rubles, for example, we need to purchase 10,000 dollars at the rate of 62 rubles, we indicate the amount of 620,000 rubles.

To display a printed form, use the Payment Order button (if it is not there, see the Print button). This document is intended specifically for preparing a printed document and is not mandatory in the 1C program, because he himself does not form any movements and does not create any postings.

The generated form can be saved on a PC for subsequent sending to the bank using the save icon, or you can send an email directly from the database if an account has been set up in it.

Purchasing foreign currency in 1C: Accounting

12:10 09.09.2019 11:49:23 Elchin Rafiev (rafiev) 16788

+2

Firms buy currency for various purposes: to pay for an import contract, travel expenses, pay salaries to employees of a foreign representative office, repay loans received in foreign currency, etc. This example considers the operation of purchasing currency in the 1C: Accounting 8 program. Video lesson in the 1C: Accounting program 8. ?—————————————————————————————————— We recommend! New online course on the simplified tax system in 1C: Accounting 3.0! https://www.e-office24.ru/cdo/learning/preview/1s_bukhgalteriya_8_red_3_0_usn/ Free online course “First acquaintance with 1C:Enterprise 8” on the website: https://www.e-office24.ru/cdo /learning/preview/pervoe_znakomstvo_s_1s_predpriyatie_8/ ?————————————————————————————————— Other video lessons 1C: Accounting: Printing an invoice with logo and signatures in 1C https://www.youtube.com/watch?v=gSKtFzLNRQc Editing and creating contracts using templates in the 1C: Accounting 3.0 program https://www.youtube.com/watch?v=nxJvMV2sjn4 How set up automatic filling of the counterparty details in 1C: Accounting https://www.youtube.com/watch?v=TRI5scMHCyM Printing a register of documents of various types in the 1C: Accounting 3.0 program https://www.youtube.com/watch?v=kFFDuYDZZ_4 How to configure the location of open windows https://www.youtube.com/watch?v=iJOHmbhCd_A How to print several selected documents from the program at once https://www.youtube.com/watch?v=TXklrE2uDD8 Change in the calculation of property tax in 1C: Accounting 8 edition 3.0: https://www.youtube.com/watch?v=BoAdx53LCOk Calculation of transport tax in the 1C: Accounting program: https://www.youtube.com/watch?v=kA4Xz_ic-vs Accounting for workwear in the 1C Accounting 8 program: https://www.youtube.com/watch?v=QXB5HFOsuvM Advertising expenses (standardized) in the 1C Accounting 8 program: https://www.youtube.com/watch?v=ahgTlgijOBk Purchase of fixed assets in the 1C Accounting 8 program: https://www.youtube.com/watch?v=o85piT8_FyM Data exchange with the Bank Client programs in 1C: Enterprise Accounting 2.0 https://www.youtube.com/watch?v=BEoW5X8j7ZE ?————————————————————————————————— Subscribe to our channel about 1C: https://www.youtube .com/Ekaterinburg1C ————————————————————————————————— We are on social networks: VKontakte - https://vk. com/ekaterinburg_1c Facebook - https://www.facebook.com/1c.ekaterinburg Instagram - https://instagram.com/asp.1c Twitter - https://twitter.com/1C_Ekaterinburg ?——————— —————————————————————————— © https://asp-1c.ru 1C in Yekaterinburg | Program 1C | 1C:Enterprise 8 | 1C:Accounting 8 | 1c accounting

Categories:

1c accounting

The second stage of purchasing currency in 1C Accounting

Reflections of the bank debiting from the company's account the amount specified in the payment order submitted to it. In 1C, this operation is displayed using Write-off from a current account. You can enter it in the list of bank statements using the Write Off button. When you click it, a new document form opens.

Filling features:

Type of operation in this case Other settlements with counterparties.

Some of the information (organization, counterparty, accounts) corresponds to a previously issued and transmitted order, according to which the bank carries out operations on the movement of funds belonging to the organization.

In the Agreement field, the agreement concluded by the organization with the bank is indicated, the type of agreement is Other, the currency is Russian ruble.

Accounts: accounting - 51, settlements 57.02. Please note that to use account 57, the option to use account 57 when moving funds must be enabled in the organization’s accounting policy. If account 67 is not used, the settlement account is 76.09 instead.

Stage three of purchasing currency in 1C

The bank purchases foreign currency. Here the amount is converted into ruble equivalent, and for correct calculation it is necessary to maintain up-to-date exchange rate data in the database. The purchase of currency in 1C Accounting is registered with the document Receipt to the current account (the same list of bank statements, but the button in this case is Receipt, not Write-off).

Filling features:

Type of transaction – Purchase of foreign currency;

The organization, counterparty, agreement are the same as those indicated when performing the write-off, but the bank account is no longer in rubles, but in foreign currency.

Settlement account 57.02

Watch video instructions on channel 1C PROGRAMMER EXPERT

EVERYONE MUST DO THEIR JOB! TRUST THE 1C SETUP TO A PROFESSIONAL. MORE →

Discuss the article on the 1C forum?

Buying currency in 1C

The process of purchasing currency is essentially identical to selling it. Only first, funds are debited from the ruble account, and then credited to the foreign currency account. Among the nuances that require attention, it is necessary to highlight:

- Type of write-off transaction – “Other settlements with the counterparty”;

- Type of receipt transaction - “Purchase of foreign currency”;

- Settlement account – 57.02.

This article describes the methodology for setting up the application solution “Trade Management, Rev. 11” for maintaining records of purchase transactions for imported goods from a foreign supplier with payment through the organization’s foreign currency account.

In particular, let's consider:

Applicability

The article was written for the editors of 1C: Trade Management - 11.1. If you use this edition, great - read the article and implement the functionality discussed.

If you use (or plan to implement) the current edition of UT 11, then its functionality and interface will differ slightly, but the bank document still has a currency conversion operation.

The most noticeable difference between UT 11.3/11.4 and 11.1 edition is the Taxi interface. Therefore, in order to master the material in the article, reproduce the presented example on your UT 11 base. This way you will reinforce the material with practice :)

Formulation of the problem

The organization is engaged in purchasing goods from a representative of a foreign company. Payment is made from the organization's foreign currency account to the supplier's foreign currency account.

Configure the system, reflect currency conversion, payment to the supplier.

Solution

System Setup:

Set the flag in the Administration – Organizations and funds section:

- in the Currencies section - Multiple currencies.

- in the Cash – Multiple Bank Accounts section.

Let's create a new item for working with imported goods - specify the Type of item

with the type

Product

, indicate the working name -

Vacuum cleaner Bosh

, indicate the

Keep records by gas customs declaration

to be able to enter gas customs declaration numbers, unit of measurement - pcs.

(click to enlarge image)

Working with currency

In the Master Data – Currencies section, click the Select

From the classifier we search for the required currency and add it to the list of used currencies.

the Load exchange rates button

We perform the download for the specified period.

In the Inventory and Purchasing – Suppliers section, create a new supplier using the assistant, indicate the name and identification data of the partner, and indicate that the legal entity does not operate in the Russian Federation.

(click to enlarge image)

In the second step, be sure to set the Supplier

. We will open a bank account later.

Registration of goods receipt

In the Inventory and Purchases section – Receipt Documents, create a new document Receipt of Goods

, fill out the header, on the

Additional

indicate the currency USD, check the box

Price includes VAT

.

(click to enlarge image)

In the tabular section Products

select the Vacuum cleaner Bosh product range in the amount of 10 pcs.

at a price of 750, in the column GTD number

we indicate the GTD and the country, having previously created them.

(click to enlarge image)

We carry out the document.

Bank accounts

We will create a bank account for the organization in US Dollars. To do this, in the Master Data section – Bank accounts of organizations, add a new account. If there is no such section, check the Multiple bank accounts

(clause 1). We indicate the organization, account number, bank details (in our example the bank is not specified).

Counterparty Bank

Currency conversion is carried out by the bank, so first we will create a new counterparty with the name Bank

and create two bank accounts for him - one in rubles, the second in dollars.

(click to enlarge image)

Currency conversion

To pay the supplier, it is necessary to convert the currency from rubles from the ruble account into dollars and place them in the foreign currency account. The currency conversion is carried out by the bank. First, we transfer the required amount from the organization’s ruble account to the bank’s ruble account, and then the bank transfers the amount in foreign currency from its foreign currency account to the organization’s foreign currency account.

In the Finance section - Write-off of non-cash funds, we will create a document Write-off of non-cash funds with the operation Currency conversion

.

On the left side in the header, select the organization’s ruble account, below, select the currency – USD. The exchange rate is automatically entered. Now you can enter the amount in rubles to get a value equal to 7500USD (from the receipt document). You can use a calculator to calculate.

On the right side we indicate the Counterparty - the Bank, the Recipient's Account is the bank's ruble account, the Recipient is the organization's foreign currency account.

(click to enlarge image)

If the bank rate differs from the rate of the Central Bank of the Russian Federation, then you can enter the rate value in the appropriate field.

In this example, we assume that the bank does not charge a commission. If there is a bank commission, then the bank creates a bank order and debits the commission value from the organization’s ruble account.

Based on the document, you can create

statement (if it was not created on this day) or

add

the current document to the statement.

(click to enlarge image)

Now you need to register the receipt of currency to the organization’s foreign currency account. This operation is documented in the document Receipt of non-cash DS

with the operation type

Currency conversion

. (Sometimes some people mistakenly put the transaction type as Other receipts).

This document can also be drawn up on the basis of the document Write-off of non-cash DS.

(click to enlarge image)

After posting the document Receipt of non-cash DS

you need to add this document to the statement, which can be easily done using the creation mechanism on the basis.

(click to enlarge image)

In this example, we create all documents manually, however, in real conditions, organizations use unloading from the client’s bank and documents Receipt of non-cash DS

, statements are created automatically by processing (section Finance - Exchange with the bank).

(click to enlarge image)

“Data exchange in use” flag in the bank account card

and configure the client-bank program.

To check the correctness of the currency conversion operation, we will use the reports from the Finance – Finance Reports section:

Currency conversion control

.

(click to enlarge image)

The report shows that a conversion has been made from rubles to dollars, showing the amount in rubles and the amount in foreign currency.

You can view the current status of accounts using the Non-cash funds

(or

Cash Flow

).

(click to enlarge image)

The report shows that the organization’s foreign currency account received an amount of 7,500 USD, and the amount in rubles was debited from the ruble account.

Settlements with suppliers

Mutual settlements with suppliers can be viewed from the counterparty (Supplier) card or using a report

(click to enlarge image)

the Status of settlements with suppliers report

, which can be drilled down to documents by setting the

By calculation objects

.

(click to enlarge image)

To pay off the debt, we will create a document with the transaction type Payment to supplier

. It is convenient to create this document based on the document - then some of the details will already be filled in automatically.

If you create a document from the Finance section - Write-off of non-cash DS, then you need to fill out the details yourself. In this case, you don’t have to fill in the document amount – it will be filled in automatically when you select settlement documents. To do this, you need to fill in the organization, Account - the organization's currency account, the Counterparty and its currency account. In our example, the counterparty account has not yet been created, so we will create it from the account selection form. In the new invoice we will indicate its number; the USD currency will be entered automatically. It is also convenient to fill out the Presentation field with a clear name (in our example we added the name of the organization). Since there is only one account, its number in the account name is not needed.

After posting the document, it must be added to the statement, for which we select Create based on – Current account statement.

(click to enlarge image)

Let's check that mutual settlements with the supplier are closed - we will generate reports already known to us, for example, the Statement of settlements with partners

.

Closing the month

We will carry out operations to close the month - Section Finance - Closing the month.

Among the regulatory documents we see the document Revaluation of Currency Funds. This document reflects the difference in exchange rates on the day the goods are received from the supplier and the day of payment. As a result of differences in exchange rates, exchange differences appear that form income or expense.

St. Petersburg, 2013

In this article we will look at an example of sales and purchases, currency conversion in 1C 8.3 (Accounting 3.0).

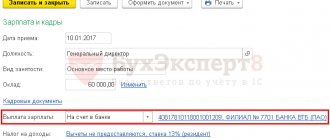

For example, let’s take the situation that we want to sell 900 US dollars to VTB Bank and receive the ruble equivalent from it.

First, let's decide on the reference books that we will need:

- The counterparty bank and the agreement with it in foreign currency (USD).

- Our organization and two bank accounts - rubles and dollars.

The sale of foreign currency occurs in two stages:

- We transfer funds from our foreign currency account (document Write-off from current account).

- We receive the ruble equivalent back from the counterparty bank to our ruble account (document Receipt to current account).

Let's consider filling out the documents:

Debiting from current account

Most often, this document is created using the “Payment Order”, but for simplicity we will immediately enter “ “:

When filling out the document, you should pay attention to the fields “Type of transaction” - “Other settlements with the counterparty” and the field “Settlement account” in the tabular section - we will insert account 57.22 (Sales of foreign currency) into it.

Get 267 video lessons on 1C for free:

That's it, we sent the money to the bank. After the bank processes our payment, it will return the rubles to the ruble account.

To be sure, let’s check the document and look at the postings of 1C 8.3:

Receipts from the sale of foreign currency

After the money arrives in our ruble current account, you can create a document. This is usually done by downloading from . I recommend checking the correctness of the details that the program automatically entered.

The document must be completed as follows:

Please pay attention to the following fields:

- The transaction type must have the value “Proceeds from the sale of foreign currency”.

- Agreement - you must indicate the same agreement that was used in the “Write-offs” document.

- Settlement account - if you also selected 57.22, check that it is installed correctly.

but you don’t know how to correctly process the purchase and sale of currency in the 1C Accounting program (edition 3.0) - in this case, this article will help you.

This material clearly shows how to record currency purchase and sale transactions in 1C in accordance with Russian legislation.

Accounting for currency transactions

First, let’s briefly and briefly understand the accounting procedures for the transactions that interest us.

According to Article 14 of Federal Law No. 173-FZ “On Currency Regulation and Currency Control,” organizations can, without restrictions, open special currency accounts in authorized banks for conducting transactions in foreign currency. To account for such currency in the chart of accounts, there is a special account 52 “Currency accounts”, the debit of which reflects its receipt (including purchases), and the credit reflects write-offs (including sales).

Currency accounting falls under PBU 3/2006 “Accounting for assets and liabilities, the value of which is expressed in foreign currency.” The regulation establishes the need to recalculate the value of relevant assets into rubles at the official exchange rate. Recalculation must be carried out on the date of the currency transaction, as well as on the reporting date (for the purpose of preparing financial statements). This may cause:

- Positive exchange rate differences: according to accounting – other income (clause 7 of PBU 9/99); for tax accounting - non-operating income (Article 250 of the Tax Code of the Russian Federation);

- Negative exchange rate differences: according to accounting – other expenses (clause 11 of PBU 10/99); for tax accounting - non-operating expenses (Article 265 of the Tax Code of the Russian Federation).

It should also be taken into account that when selling currency, ruble receipts from this operation are qualified as other income (account 91.1), and the corresponding disposals are classified as other expenses (account 91.2).

Preliminary setup of the 1C 8.3 Accounting program

If the movement of funds between foreign currency and current bank accounts does not occur within one day, then the intermediate account of the chart of accounts 57 “Transfers in transit” should be used, otherwise account 76.09 “Other settlements with various debtors and creditors” can be used.

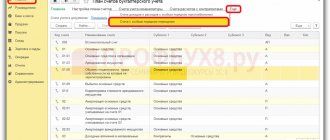

In our example, we will go along the first path, so we need to check whether the organization is enabled to use account 57 in the 1C Accounting 8.3 program. To do this, we will open the list of accounting policies of organizations. Section Main – group of commands Settings – command Accounting policy:

Then open the current accounting policy (corresponding to the desired organization and period) for editing:

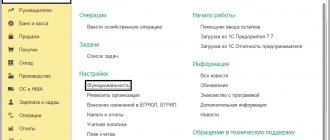

In addition, let’s make sure that in Enterprise Accounting 1C 8.3 the ability to maintain is installed. For our release of the 1C Accounting 8.3 configuration, the corresponding flag is “Calculations in currency and cu.” located on the Calculations tab. It is possible that in your version of the configuration the setting may be on a different tab; it should be found in the “Program Functionality” form:

You can open the form as follows: Main section – group of commands Settings – command Functionality:

The flag “Settlements in foreign currency and monetary units” is set to active. makes foreign currency accounts available to the user in the chart of accounts, and also allows you to select a foreign currency for settlement in created agreements with counterparties:

Since in the example we will work with foreign currency and convert it into ruble equivalent, we will need to store and periodically update a list of exchange rates for different dates in 1C 8.3. The 1C Accounting program allows you to automatically download the required exchange rates for the desired period. This is done as follows:

- Let's open the list of currencies. Section Directories – group of commands Purchases and sales – command Currencies:

- On the form that opens, click the Download currency rates button, then in the window that appears, select the currency and set the download period, then click Download: