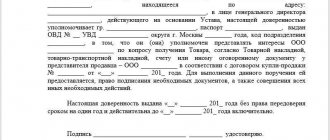

Form

Surely everyone understands that the oral form of any agreement does not give it legal force. This also applies to a power of attorney, which must be drawn up on paper. The attorney to whom the document is written will represent the interests of the company. That is why it is signed by the director or other manager. When designing, you can use a regular sheet of paper. Also, a standard template is used for this, which already contains all the important points.

As a rule, registration is carried out in a simple form, without the involvement of a notary. However, there are situations in which the law requires the preparation of a notarial form. The services of a notary are sought in the following cases:

- Registration of a transaction requires the mandatory presence of a power of attorney drawn up in notarial form;

- The attorney carries out transactions and various actions that are subject to mandatory state registration;

- It is planned that the trustee will dispose of the property rights. Moreover, this right is registered in the state register;

- In any circumstances when the principal wishes to record the transaction in a notary office.

Types of powers of attorney

Appearance is greatly influenced by the powers vested in the attorney to carry out certain obligations. For example, a special power of attorney is needed when the attorney needs to carry out similar tasks. For example, a responsible employee of a company regularly receives inventory items. Special powers of attorney also include those that allow company employees to drive vehicles. Practice shows that a special power of attorney is used extremely rarely. Other types of this document are the most popular.

Contents of the power of attorney

The legal basis for the transfer of powers is specified in Articles 185-189 of the Civil Code of the Russian Federation. The text of the power of attorney to represent the interests of a legal entity must contain the following information:

- full name and legal form of the principal (LLC, JSC);

- date of issue (if absent, the document is considered invalid);

- validity period (if it is not specified, then the document is valid for one year from the date of preparation);

- TIN, KPP, OGRN codes of the organization;

- full name of the manager;

- full name and passport details of the representative;

- a detailed description of the rights being transferred;

- sample signature of the representative;

- signature of the manager or other authorized person.

Additionally, you can specify the condition on the right of sub-assignment and the procedure for exercising powers if there are several such persons.

A general power of attorney to represent the interests of a legal entity conveys the total scope of powers, therefore they are described in general terms, without being specific, for example, like this:

- manage and dispose of the company’s property, with the exception of transactions within the competence of the general meeting of participants;

- represent the company in all state and municipal bodies, institutions, organizations, in organizations of any organizational and legal forms and forms of ownership and in front of any individuals;

- conduct in the interests and on behalf of society any administrative and civil cases in all judicial bodies with all procedural rights and actions;

- on behalf and in the interests of the principal, send and receive any incoming and outgoing correspondence;

- manage cash and non-cash funds of the LLC;

- perform any other legal and actual actions not expressly specified to carry out this instruction.

A power of attorney to represent the interests of a legal entity (general) is drawn up in writing and certified by the signature of the director. The LLC seal is no longer recognized as a mandatory attribute for certifying business papers, but in practice it continues to be used.

But, there are a number of situations when the transfer of authority is formalized by a notary. All of them are listed in Article 185.1 of the Civil Code of the Russian Federation:

- carrying out transactions for which the law provides for a notarial form;

- filing applications for state registration of rights or transactions;

- disposal of rights registered in state registers.

Thus, if transactions or actions not included in this list are carried out under a general power of attorney, then a simple written form is sufficient.

General power of attorney to represent the interests of the organization

This power of attorney gives a full range of powers. Its bearer is allowed to perform various actions while acting as a representative of the company. Here the attorney has no restrictions; he has the right to dispose of the assets and other property of the company, make real estate transactions and perform other significant actions. If a company needs a representative to protect its rights in court, the holder of this power of attorney can become one. He can speak not only in court, but also in other institutions.

( Video : “Everything about drawing up a power of attorney”)

Features of a general power of attorney

The main feature of such a document is that it gives the representative the maximum possible rights. Having such a power of attorney in hand, the representative is allowed to transfer the power of attorney to someone else. Due to the huge range of powers, this power of attorney must be certified by a notary. Moreover, the general's license can be issued not only to employees. The law does not prohibit a company from making third parties its representatives.

As a rule, if an organization issues a general power of attorney, managers act as attorneys, for example, deputy director, head of department and other officials. This is explained by the fact that this type of power of attorney requires maximum responsibility from representatives. The Labor Code states that in this case, the trustee is assigned certain duties, rights and responsibilities. For example, when making transactions under a general power of attorney in the interests of the company, the trustee becomes financially responsible.

What types of powers of attorney are there?

It is immediately necessary to make a reservation that civil legislation does not in any way divide powers of attorney into types; it only establishes the possibility of indicating in the power of attorney the range of powers of the representative.

However, lawyers distinguish several types of power of attorney, based on practice.

General power of attorney

It gives the representative the maximum package of powers without being tied to a specific task. The attorney has almost complete freedom of action.

Such a document can only be signed by the head of the principal legal entity, and the organization’s seal (if any) must be affixed to the form of the document. Also, such a power of attorney can be certified by a notary, but you will not find the concept of “general power of attorney” in the Law. Previously, the term “general power of attorney” could be found in the Methodological Recommendations for Certifying Powers of Attorney of the Chamber of Notaries, but these recommendations were abolished in 2015. In modern notary regulations, general powers of attorney are not found. This does not change the prevalence of this type of power of attorney in practice.

A power of attorney usually contains text with the following content:

“I trust (the attorney) to manage and dispose of all my property, whatever it may be and wherever it is located, as well as to enter into all transactions permitted by law for the management and disposal of property; accept or refuse an inheritance; receive property, money (deposits), securities, as well as documents due to me from all persons, institutions, enterprises, organizations, including from branches of banks of the Russian Federation, post offices and telegraph offices for all reasons; manage accounts in banks of the Russian Federation; receive postal, telegraph and other correspondence of all kinds, including money and parcels; conduct business on my behalf in all government agencies, cooperative and public organizations, as well as conduct my affairs in all judicial institutions.”

As you can see, a general power of attorney gives the representative almost unlimited powers. Such a power of attorney should be drawn up only when there is an inevitable need to vest one person with the authority to carry out all transactions and represent the interests of a legal entity in all government agencies and non-governmental organizations. There is a risk that the representative will use an unlimited power of attorney against the interests of the principal, and transactions made by the representative under the power of attorney may be challenged in court. If the attorney does not need to transfer all powers, then it is better to issue a special or one-time power of attorney.

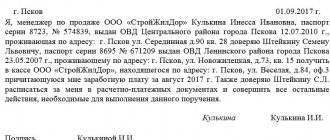

Special power of attorney

It gives the representative the right to repeatedly perform certain actions of the same type. Such a power of attorney is most often issued to employees for the duration of their work function, which is associated with representing the interests of the organization in specific aspects. For example, a seller may be entrusted with the right to conclude transactions, and a lawyer may be entrusted with representing the interests of the organization in all courts and regulatory authorities.

Example of wording in a special power of attorney for a company lawyer:

“Limited Liability Company “Test” authorizes (attorney details) to represent on behalf of LLC “Test” in all courts of the Russian Federation, including arbitration, federal courts of general jurisdiction and magistrates, to perform all procedural actions provided for by current legislation ...; receive any documentation with the right to sign all necessary documents and perform all actions necessary to exercise the powers provided for by this power of attorney.”

A special power of attorney can be issued for either a short period or several years.

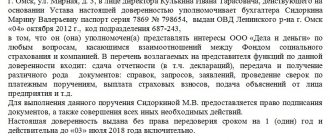

One-time power of attorney

Such a power of attorney is drawn up when the attorney is required to perform only one action in the near future. The validity period of such powers of attorney is usually no more than a month, so that the employee completes the assignment on time and does not use the power of attorney for other purposes. A one-time power of attorney may be required if you need to direct an employee to a one-time, unusual assignment.

For example, a company may ask a trainee to pick up a letter from the post office by issuing him a one-time power of attorney indicating a specific post office and postal item. When the internship period ends, the power of attorney will no longer be valid.

One-time power of attorney

When a representative needs to perform a specific action, a one-time power of attorney is issued. For example, this document is needed if the attorney is entrusted with receiving goods, sending documents, selling property, etc. It is worth noting that after the transaction has been completed, the power of attorney automatically loses its force.

Absolutely anyone can play the role of a trustee. The head of the company chooses who to issue a one-time power of attorney himself. Naturally, the personal and moral qualities of the attorney are taken into account. After all, this is the only way the principal will be sure that the attorney will fulfill the instructions assigned to him. This could be one action or several.

It would be useful to indicate the competence of the attorney. For example, if he is issued a power of attorney to receive cargo, then you can indicate that he is allowed to sign the accompanying papers. As a rule, to issue a one-time power of attorney, there is no need to engage a notary. But if the attorney has the opportunity to draw up a deed of power, it will not be possible to do without the services of a notary.

Who can represent the interests of the organization

Until 2012, there was a rule obliging organizations to issue a power of attorney exclusively for their employees. It was the company employee who had the right to represent its interests in various structures. But today the law does not prohibit issuing a permit to any citizen. In fact, the organization is allowed to write it out not only to a former employee, but also to a stranger.

Another company also has the right to represent the interests of the organization. This can often be encountered when two companies cooperate. Often there is a need to replace each other, protecting interests in various authorities. Naturally, the corresponding powers of attorney contain information that one company is authorized to represent another.

If any responsibilities are assigned to employees of the organization, a power of attorney must also be issued to them. But there is no need to draw up such a permit if the attorney is the head of the company. After all, he must always protect the interests of the company. But you need to remember that a power of attorney is necessary for heads of departments and other employees holding high positions.

What documents will be required

The permit is drawn up with the consent of the head of the organization. But first you need to prepare the necessary documentation. These include:

- memorandum of association;

- position;

- extract from the Unified State Register of Legal Entities;

- manager data;

- documents confirming official authority.

This documentation fully reflects all information about the principal and the attorney.

Notarization

The need for notarization of a power of attorney raises many questions. Thus, there is a popular opinion that it can only be certified with the seal of an organization or individual entrepreneur. In the case of a legal entity, this is true - the head of the company could always transfer his powers to a representative, certifying the document with a personal signature and seal. And after the LLC seal has become an optional attribute, the imprint is no longer required, although it continues to be used in practice.

Until 2011, the same rule applied to individual entrepreneurs - if you have a seal, then you don’t need to go to a notary. This position is based on the provisions of Articles 23 and 185.1 of the Civil Code of the Russian Federation. According to them, the same rules apply to the activities of individual entrepreneurs as to legal entities. In particular, it was allowed to certify the powers of a trustee only with the seal and signature of the individual entrepreneur.

However, in 2011, Article 29 of the Tax Code of the Russian Federation was amended, and now legislative norms require that the powers of a representative of an individual entrepreneur be certified by a notary or in a manner equivalent to a notary. Moreover, this requirement applies only to a power of attorney for representing interests before the tax authorities. In other situations, a simple non-notarial form is appropriate.

How to draw up a power of attorney to represent the interests of an organization in 2022

Many companies use the appropriate form for these purposes. Here, responsible persons must enter information in the blank lines. The document must contain the full name of the organization, information about the authorized representative, and a list of powers.

You can use a ballpoint pen to fill it out. If you select manual filling, try to write legibly. A more convenient option is a computer set. After printing, the principal must put a “live” signature here.

Contents of the power of attorney

Particular attention must be paid to the content. After all, it is this information that allows the representative to fully fulfill the assigned obligations, but at the same time he will not be able to exceed his authority. You also need to provide the following information here:

- Legal form of organization;

- Validity;

- Date of signing of the power of attorney;

- KPP codes, INN, OGRN;

- Legal address of the company or its office;

- Position, full name and other passport details of the manager who signs the power of attorney;

- Personal information about the representative;

- A detailed list of assigned powers;

- Director's signature.

About the seal on the power of attorney

In accordance with Federal Law No. 82 of April 6, 2015, business companies are relieved of the need to own a seal. However, there are a number of requirements for powers of attorney to represent interests in court.

So, in accordance with Art. 53 of the Code of Civil Procedure of the Russian Federation, the powers of representatives of a legal entity (LLC, JSC), in the absence of a seal on the power of attorney, must be confirmed by the constituent documents of the principal or their notarized copies.

If the constituent documents contain information that the principal has a seal, but did not put it on the power of attorney, the latter will be declared invalid.

Accordingly, if the constituent documents do not contain notifications about the presence of a seal, then the power of attorney will be valid without a seal. Principals for whom the law requires a seal (for example, municipal and unitary enterprises) certify the powers of attorney issued by them with the signature of the head and seal.

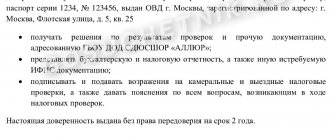

Sample power of attorney to represent the interests of an organization

Formatting the main part of the document

The basis is the “body” of the document itself. There should be information here that allows you to easily identify the representative. As a rule, this is passport data from other identification documents. It would be useful to specify where exactly the person on whom the organization entrusts such responsibility lives.

The text needs to reflect the essence of this document. So write that the bearer has the right to act as a representative of the company, protect its interests, and carry out instructions. Indicate that the attorney is allowed to enter into any transactions with various organizations.

As a rule, the trustee accepts obligations to the company by signing the text of the document. The director of the company certifies the consent of the attorney. After the power of attorney is signed, the attorney has the rights to carry out the prescribed transactions.

Transfer of managerial powers

A legal entity participates in civil, tax and public relations through an approved manager. It acts only on the basis of the charter or an order of appointment, but if it is necessary to transfer some of the director’s rights to the representative, a special document is drawn up for this purpose.

A company representative does not have to be an employee, but this rule has been in effect for a short time. Until 2012, Instruction of the USSR Ministry of Finance dated January 14, 1967 No. 17 prohibited the issuance of powers of attorney to persons not working in this organization. Now the Instruction has been canceled along with this requirement, so any citizen has the right to be a representative of an LLC.

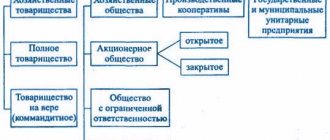

The Civil Code does not divide powers of attorney by type, but in business transactions they are still distinguished:

- General or general - issued for the widest possible range of rights, does not specify the types of transactions or third parties before whom the representative has the right to act on behalf of the principal.

- Special – gives the right to perform an unlimited number of similar actions or transactions (for example, to represent the interests of an enterprise only in judicial or tax authorities).

- One-time – for one specific transaction or action (for example, for a one-time receipt of goods from a supplier).

Read more: Power of attorney to the tax office to represent the interests of a legal entity

Next we will look at how a general power of attorney is issued to represent the interests of a legal entity.

Duration of power of attorney

The law specifies several cases when a document loses its force:

- the term has expired;

- liquidation of the trustee organization;

- the representative is declared incompetent or has died;

- the trustee no longer wishes to carry out instructions.

As a rule, such a power of attorney is issued for a period of up to three years. The minimum period is unlimited. It all depends on the orders that will be carried out. It is recommended to specify the deadline in a separate paragraph. It is worth noting that in the absence of a specific period, it will be equal to one year. The date of registration is considered the beginning of this period. Naturally, in order to know when the countdown of this time begins, it is imperative to indicate the date of compilation. In its absence, the document is considered void, i.e. has no legal force.

There are cases in which the validity of a document must begin after a certain time. In this case, you need to indicate the exact date when exactly this should happen. Often the deadline is marked by a specific date, and the action continues until 24 hours of that day.

Often a power of attorney is issued to perform a specific action. At the same time, this is indicated in the document. Accordingly, the power of attorney loses its force immediately after the specified event. It must be taken into account that not every event can be determined whether it took place or not. That is why, if there is not enough information about when the event should take place and how this can be accurately determined, the power of attorney is considered to have no specific validity period. So it is equal to one year.

( Video : “Power of Attorney: new rules”)

There is much debate about the maximum validity period. This is due to the fact that previously the law prohibited issuing a power of attorney for a period of more than three years. However, as of 2013, this requirement was abolished. Thus, in 2022, the power of attorney has no restrictions on the validity period. Although practice shows that many organizations, out of habit, continue to issue such a document for a period of up to three years. As for the minimum terms, there are no restrictions here either. Here everything is decided by the director of the trusting company.

Signatures of the parties

A power of attorney can be called a one-sided document executed by the principal. In fact, there is no need to obtain the consent of the representative to draw it up. At least, this is not provided for by law. If the attorney's signature is missing here, the document will still have legal force.

But practice shows that signatures are almost always affixed by both parties. Representatives also sign a document confirming that they accept the assigned obligations. If an organization gives an employee authority, it implies that he is willing to carry it out. Otherwise, drawing up a power of attorney simply loses its meaning.

Authorised representative

Other individuals and legal entities can also express the interests of the organization in relations with the tax authorities. They have the right to exercise their powers only on the basis of a power of attorney issued in the manner established by the Civil Code (Article 29 of the Tax Code of the Russian Federation). Employees of the organization (chief accountant, financial director, deputy general director and other heads of various services of the organization), private auditors or specialized firms can act as authorized representatives.

An organization may have several authorized representatives to represent its interests before the tax authorities. She must give each of them a power of attorney. This paper must contain (Articles 185-187 of the Civil Code of the Russian Federation):

- date and indication of place of compilation. A power of attorney that does not indicate the date of its execution is void (Clause 1 of Article 186 of the Civil Code of the Russian Federation);

- organization data: its full name, TIN, location;

- position, full name, passport details, address of the representative - employee of the organization (full name, location of the representative - legal entity, full name, passport details, address - representative - third-party individual);

- a message about the intermediary representing the interests of the organization in relations with the tax authorities;

- rights of an authorized person;

- validity period of the power of attorney. It cannot exceed three years. If this period is not specified, the power of attorney remains valid for a year from the date of its signing (Part 1 of Article 186 of the Civil Code of the Russian Federation);

- signature of the representative;

- signature of the head of the organization that issued the power of attorney, or another person authorized to do so by its constituent documents;

- imprint of the principal's seal.

Sample power of attorney for representation by an authorized representative of the interests of the organization in relations with tax authorities, including for filing tax returns

| Power of attorney No. 22 to represent the interests of the organization in relations with tax authorities Moscow First of October two thousand and eleven Limited Liability Company "Orbita" represented by General Director L.E. Stupin, acting on the basis of the Charter, in accordance with Article 29 of the Tax Code, entrusts auditor Albert Mikhailovich Remezov with a passport series 97 03 N 864256, issued by the Ramenskoye Department of Internal Affairs of Moscow September 29, 2002, residing at the address: 111141, Moscow, st. Kuskovskaya, 32, apt. 54, to represent his interests in relations with the tax authorities. In order to fulfill this order, Remezov A.M. the following rights are granted: — represent the interests of Orbita LLC in the tax authorities on all issues related to this assignment; — submit declarations of Orbita LLC to the tax authorities; — receive and transmit documents; — conduct correspondence in pursuance of this instruction; — sign and perform other legal actions related to the execution of this order. The powers under this power of attorney cannot be transferred to other persons. This power of attorney is valid until October 1, 2012. Sample of Remezov's signature A. M. I certify Remezov. General Director of Orbita LLC Stupin /Stupin L.E./ |

Attention

Officials of tax, customs authorities, internal affairs bodies, judges, investigators and prosecutors cannot be authorized representatives of the taxpayer (Clause 2 of Article 29 of the Tax Code of the Russian Federation).

Please note that the authority of the representative is confirmed by the original power of attorney or its certified copy. This follows from the decisions of the Federal Antimonopoly Service of the Far Eastern District dated December 28, 2009 No. F03-7808/2009 in case No. A51-2623/2009, dated December 24, 2009 No. F03-7569/2009 in case No. A51-7172/2009, dated December 23, 2009 No. F03-7520/2009 in case No. A51-2622/2009 and December 21, 2009 No. F03-7420/2009 in case No. A51-4697/2009. In addition, the presence of a power of attorney is a mandatory condition even if interests in the field of taxation are represented under an agency agreement (see resolutions of the Federal Antimonopoly Service of the North Caucasus District dated December 25, 2009 in case No. A32-16230/2007-66/102-2008-3 /385-2009-29/188, FAS North Caucasus District dated May 29, 2009 in case No. A32-16233/2007-66/100-2008-3/384).

Transfer of powers

The authorized representative must personally perform those actions that are indicated in the power of attorney issued to him. He can entrust their implementation to another citizen or organization. To do this, the document must indicate that he is allowed to do this. Reassignment without such an indication is possible only due to circumstances to protect the interests of the person whose interests are expressed.

Let’s say a company has issued a power of attorney to a third-party company with the right to delegate powers to its employee. Then in this paper she should indicate such a right.

The authorized representative who transferred the authority must notify the principal about this and provide him with the necessary information about the new holder of the authority. Failure to fulfill this obligation makes the transferor responsible for the actions of the person to whom he delegated authority, as if for his own.

A power of attorney issued by way of delegation must be notarized. The period of its validity cannot exceed the validity period of the power of attorney on the basis of which it was issued (Article 187 of the Civil Code of the Russian Federation).

Attention

The fact that an organization can present financial statements to a user through a representative is stated in paragraph 5 of Article 15 of Federal Law No. 129-FZ of November 21, 1996.

Suppose the company has transferred accounting maintenance to a specialized organization. At the same time, the head of the latter entrusted his authority to sign tax and accounting reports to his employee. In this situation, when submitting the company’s declarations to the tax authority, a third-party organization must attach to the reporting:

- a document confirming the authority of your manager to sign the declaration;

- a document that confirms the authority of the individual who signed the declaration to take such actions.

In addition, it is necessary to follow the established procedure for filling out tax return forms for a specific tax, including provisions for confirming the accuracy and completeness of information in the tax return by an authorized representative of the taxpayer (see letters of the Ministry of Finance of Russia dated January 31, 2011 No. 03-02-07 /1-28 and dated November 27, 2009 No. 03-02-07/1-523).

Download samples of powers of attorney to represent the interests of an organization

– General power of attorney from an organization – Standard power of attorney to represent the interests of an organization – Power of attorney to represent interests during an audit – Power of attorney to represent interests in an insurance company – Power of attorney to represent interests in a bank – Power of attorney to represent interests in the tax office – Power of attorney to represent interests in the Federal Antimonopoly Service – Power of attorney for representation of interests in the Pension Fund of Russia - Power of attorney for representation of interests in court.

Power of attorney structure

We offer our users the opportunity to download a standard and fully functional template of a power of attorney from a legal entity to a legal entity. You will need to enter the following information in the template lines to be filled out:

- date of issue of the power of attorney;

- registration number of the power of attorney;

- information about the principal (legal status, details);

- limits of authority;

- validity period of the power of attorney;

- right or lack of right of subrogation;

- signature of the official issuing the power of attorney on behalf of the principal;

- signature of the official accepting the power of attorney on behalf of the authorized person;

- seal of the principal (if available).

The power of attorney is issued in one copy.