How to calculate

Article 127 of the Labor Code of the Russian Federation states: an employee is entitled to payment of compensation for vacation on the last working day. Every working person has 28 calendar days a year for rest (Article 114 of the Labor Code of the Russian Federation). In the cases specified in the law, citizens are entitled to additional paid days or bonus time for rest, as provided by the employer himself in the collective agreement and local regulations. The part over 28 days is allowed to be replaced by a financial payment at the request of the employee. Let us immediately note that the working year is not equal to the calendar year; the countdown begins each time from the date of employment.

If the employee did not rest during the year worked, then vacation pay upon dismissal is calculated 28 days in advance. If some of the allotted days are used, the remaining days are compensated. Money is not paid if the entire allotted period is used.

Which days are taken into account?

To figure out how to correctly calculate compensation for unused vacation upon dismissal, you should determine the principle for calculating vacation days that are reimbursed in money. The number of such days depends on how long the person worked before leaving. Days worked per year are rounded up to months. If more than half a month has been worked, the length of service is rounded up; if less than half, vice versa. To receive payments in 28 days, it is enough to work a full 11 months (without rounding). They also compensate all 28 days for citizens who worked from 5.5 to 11 months and were dismissed due to the liquidation of an enterprise, conscription into the army or staff reduction. But if an employee works for less than half a month, he will not receive compensation.

Here is an example of calculating compensation for unused vacation upon dismissal (2021):

Panfilov I.L. has been working at the company since March 10, 2017. Each working year of Panfilov begins on March 10. He resigns on August 13, 2021. Over the last working year, he worked 4 months and 10 days. Rounding down occurs since less than half the month was worked. Provided that Panfilov has already used rest days for previous periods, compensation is accrued for 5 months. During this time of work he is entitled to 11.66 days of rest.

IMPORTANT!

There is no rounding of unused days. The management of the company has the right to decide whether to round days to whole numbers, but they must do this not in an arithmetic way, but in favor of the employee. For example, the number 11.66 is rounded to 12 whole days (letter of the Ministry of Health and Social Development of Russia dated December 7, 2005 No. 4334-17).

Rules for calculating vacation compensation

Before proceeding with formal calculations, you need to take into account the necessary conditions. The procedure is characterized by certain requirements and nuances that must always be kept in mind in order to receive payments.

Firstly, an employee has the right to count on compensation if he:

- I have already worked for more than half a month;

- the employee is not fired because of his harmful actions;

- works (or worked) under an employment contract (for example, someone works under a civil law contract and is not entitled to payments).

In what cases is compensation provided for a period of well-deserved leave that the employee did not take advantage of:

- if he quits and wants to receive compensation along with the rest of his salary;

- if the employee did not go on vacation, but remains at work.

The overall length of service of the employee also matters - it will act as a specific pay period. It is known that the Labor Code clearly regulates what can be considered fully worked time and what is not included in it.

What is considered part of full-time experience:

- actual hours and days worked;

- days when the employee did not perform his duties, but his job was actually retained by him - paid leave, weekends and holidays, etc.;

- the period for which the employee was wrongfully suspended from his duties but later reinstated;

- weekends and days off that the employer provided to the employee at the latter’s request - in total, such a period should not exceed two weeks.

Part of the length of service - the pay period - will not include days when the employee:

- missed work for an unexcused reason;

- was on maternity leave or leave to care for a small child (up to three years old).

It is important to understand that when we talk about a year as a billing period, we do not mean a calendar year, but eleven months - the working year established by law.

To determine whether an employee has grounds to claim monetary compensation for unused vacation periods, you need to pay attention to the following rules.

If an employee wants to receive this compensation upon dismissal, the conditions are as follows:

- Full compensation (28 calendar vacation days) is provided by law to those employees who have worked for at least twelve months.

- If an employee has worked from five to eleven months inclusive, then he can count on full compensation only in those cases if:

- the company he worked for was liquidated;

- he was fired as a result of staff reductions;

- if he was forced to leave his job (for example, due to military conscription, and so on).

- In other cases, payments are calculated individually.

If a citizen has not used his vacation period (or has several unused vacation days left), then in some cases he can also count on compensation. True, this procedure has its own nuances, which we will discuss separately.

How the calculator works

The compensation calculator on our portal will help you understand how compensation is calculated for unused vacation upon dismissal.

Step 1. Enter the date of hire and date of dismissal into the calculator

We enter into the calculator for calculating unused leave upon dismissal the 2022 dates of employment and dismissal in the format XXXX-XX-XX (year, month, day) or select from the calendar.

Step 2. We indicate the number of vacation days due to the employee per year

The number of such days should be selected from the list. If you click on the arrow in the calculator, the following list will become visible:

- 28;

- 30 - disabled workers;

- 31 - minors with irregular working hours;

- 35 - employed in work with harmful (2, 3 and 4 degrees) and (or) dangerous working conditions;

- 44 - workers in areas equated to regions of the Far North;

- 52 - workers in the Far North;

- other.

If the category of employee does not fall into the proposed list (for example, teachers who are entitled to 42 or 56 days of rest), then select the last item “Other” from the calculator list and indicate the number of days in the window that appears.

Step 3. Add periods to the calculator that are not included in the vacation period

Please note that some periods are not included in the calculation of severance leave. If there were such, we note this in the calculator.

These periods include:

- vacation time at your own expense, if it exceeds 14 calendar days per year;

- child care time up to 3 years;

- time away from work without good reason;

- time of suspension from work due to the fault of the employee.

To mark a period in the calculator, click the “Add Period” button and enter the dates in the same format as you did in the first step.

Step 4. Indicate the number of vacation days for the entire period of work and the average daily earnings

Indicate in the specially designated field of the calculator the total number of days the employee took off for the entire period of his employment and enter the amount of the employee’s average daily earnings (ADE).

IMPORTANT!

Specify fractional numbers in the calculator separated by a period, not a comma.

Step 5. Calculate

Click the "Calculate" button.

The calculator will display the number of unused days on your screen, and monetary compensation for unused vacation will appear - the calculation is complete.

As you can see, the calculation is not that difficult. But where do we get these numbers? Let's figure it out.

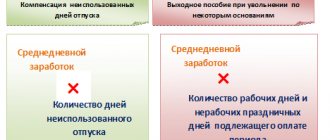

Cheat sheet on compensation for unused vacation

We bring to your attention a reminder that will help you quickly calculate compensation for unused vacation. Moreover, both when an employee is fired, and in the case when the employee remains working in the company, but wants to get money instead of rest. We have focused on when these payments are calculated the same and when there are differences.

DIFFERENCES: In what cases is it necessary to pay compensation Compensation associated with dismissal

The accountant will have to calculate and accrue this payment if the employee is dismissed on one of the grounds provided for by the Labor Code of the Russian Federation. For what reason, it doesn’t matter. Compensation is due in any case. Including upon dismissal through transfer to another company.

But here are the situations when it is not necessary to issue compensation: - an external part-time worker was transferred to the main place of work in the company (this is precisely the case of transfer; if the part-time worker first wrote a letter of resignation, and then an application for employment, then it is necessary to pay compensation) ; - the employee worked for the company for less than half a month (the accountant needs to calculate how many calendar days fall on the time worked; and if this is less than half of the total number of calendar days in a given month, then compensation does not need to be paid).

There are no grounds for paying compensation in cases where an employee is transferred from one unit to another.

And of course, no compensation for vacation is due to those who worked under civil contracts. After all, leave is provided only to employees with whom employment agreements have been concluded. The exception is cases when a civil contract contains provisions on vacations and their compensation. But this rarely happens in practice.

Compensation not related to dismissal

Paying compensation for vacation not related to dismissal is the right, not the obligation of the employer. That is, in principle, management can refuse compensation to an employee and send him on vacation. This follows from Article 126 of the Labor Code of the Russian Federation.

SIMILARITY. How to determine the time for which an employee is entitled to vacation

To calculate compensation, you first need to determine the time for which the employee was not given leave and for which rest is due. The fact is that there are periods that do not give the right to vacation. This:

— the time when the employee was absent from work without good reason (including if he was suspended from work in cases provided for in Article 76 of the Labor Code of the Russian Federation);

— time of maternity leave;

- time of unpaid leave that was granted to the employee at his request and if their total duration exceeds 14 calendar days during the working year. Such a list is given in Article 121 of the Labor Code of the Russian Federation. Please note that the period when a woman was on maternity leave gives the right to leave. This follows from articles 261 and 121 of the Labor Code of the Russian Federation. And therefore, if an employee is fired during this time, she is also entitled to compensation (of course, provided that she did not have time to take the day off).

DIFFERENCES. How to determine the number of calendar days for which compensation is due

The organization is obliged to provide employees with vacations every year. Accordingly, you need to look at for what years the employee did not use vacation. In this case, one must focus not on calendar years, but on the working years of the person being dismissed. So, if the first day of work is May 20, 2008, then the first working year for which the employee is entitled to vacation will end on May 19, 2009.

Compensation related to dismissal

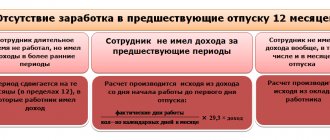

If the employee has not used vacation for the full working year.

In this case, compensation must be paid for 28 calendar days (provided that there were no periods in the year that do not provide vacation rights). The same amount of compensation is also due if you work from 11 to 12 months inclusive during the year. Also, don't forget about extra vacations. Upon dismissal, you must pay compensation for all unused vacations due to the employee in this organization - both main and additional.

We also note that if an employee has not taken vacation for several years, then the organization is obliged to pay him compensation for all days not taken off that have accumulated since the employee joined the company (Article 127 of the Labor Code of the Russian Federation).

If the employee has time that entitles him to vacation, but this time is less than 11 months.

In this case, the number of unused vacation days for which compensation is due is determined by the following formula: number of unused calendar days of vacation = duration of full annual leave: 12 months. *number of complete months worked.

In this case, the full months worked are calculated as follows. Surpluses amounting to less than half a month are excluded from the calculation, and surpluses amounting to half a month or more are rounded up to the full month. This procedure is prescribed in paragraph 35 of the Rules on regular and additional holidays, approved by the People's Commissar of the USSR on April 30, 1930 No. 169.

EXAMPLE

Ivanov N.P. has been working at Priboy LLC since March 14, 2006. On May 20, 2008, he resigned from the organization of his own free will. During the entire period of his work, Ivanov was not on vacation (the employee was not entitled to additional vacations).Ivanov worked for the organization for two full working years: from March 14, 2006 to March 13, 2007 and from March 14, 2007 to March 13, 2008. It turns out that during this time Ivanov is entitled to compensation for 56 calendar days of unused vacation (28 +28).

From March 14, 2008 to May 20, 2008, Ivanov worked for two full months (from March 14 to April 13 and from April 14 to May 13). The excess days from May 14 to May 20 amount to less than half of the month and are therefore excluded from the calculation.

Let's calculate the total number of calendar days of vacation for which Ivanov is entitled to compensation:

56 days + 28 days : 12 months * 2 = 60.66 k.d.

Compensation not related to dismissal

You can replace with money only that part of the vacation that exceeds 28 calendar days per year. That is, if an employee has accumulated unused vacation for two years, then compensation can only be paid for those days that are due in excess of 56 calendar days (28 days * 2 years). Such restrictions are established by Article 126 of the Labor Code of the Russian Federation. In fact, this means that employees can receive money instead of rest only for additional vacations.

If the employee has not used additional leave for the full working year. In this case, compensation must be paid for all days of additional vacation (provided that there were no periods in the year that do not provide vacation rights). You are also entitled to compensation for the full number of days of additional leave if you work from 11 to 12 months inclusive in a year.

If the employee has not taken additional vacations for several years, compensation is due for all the days that the employee did not rest.

If the employee has time that entitles him to leave, but this time is less than 11 months. Then the number of unused calendar days of additional leave for which compensation is due is determined by the formula:

number of unused calendar days of additional leave = duration of additional leave: 12 months * number of full months worked.

In this case, the full months worked are calculated in the same way as is done for compensation upon dismissal. That is, surpluses amounting to less than half a month are excluded from the calculation. And the number of days equal to half a month or more is rounded up to a full month, for which the employee will be entitled to compensation.

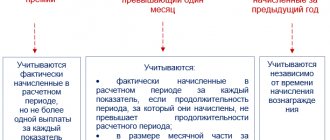

SIMILARITY. How to round the total number of vacation days for which compensation is due

The legislation does not say anything about the fact that the calculated indicator must be rounded to whole calendar days. Therefore, traditionally the calculated value is taken with two decimal places.

However, if the company’s management decides to round the indicator to whole units, then this will have to be done not according to the rules of arithmetic, but upward.

After all, organizations do not have the right to worsen the situation of workers. This is established by Article 8 of the Labor Code of the Russian Federation. That is, it is impossible to pay compensation for, say, not 20.4 days, but 20 days. If we round up, then up to 21 days. This point of view was also expressed in the letter of the Ministry of Health and Social Development of Russia dated December 7, 2005 No. 4334-17.

SIMILARITY. How to determine the amount of compensation

Rest days for which the employee is entitled to compensation are paid based on average earnings. The method for calculating it is completely similar to that used when determining the amount of vacation pay. That is, the main document here is the Regulation on the specifics of the procedure for calculating the average salary, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922.

That is, in the end, having determined the average daily earnings, the accountant will simply multiply it by the number of days for which the dismissed employee is entitled to compensation. The result obtained will be compensation for unused vacation by the employee.

DIFFERENCES. When should compensation be given to the employee?

Compensation related to dismissal

The employee must be given money on his last working day, that is, on the day of dismissal.

It happens that employees take vacation before leaving the organization. Then compensation will have to be issued on the last working day before the vacation. This conclusion follows from Article 80 of the Labor Code of the Russian Federation. After all, it is on the last day of work that the organization must make a final settlement with the employee, issue him a work book and other documents related to the work (upon written application).

In this case, the last day of work will be indicated in the work book as the last day of vacation (Article 127 of the Labor Code of the Russian Federation).

Compensation not related to dismissal

Labor legislation does not establish clear deadlines for payment of money. This is due to the fact that the employer is not obliged to pay compensation for unused vacations. Therefore, the terms are agreed upon individually between the employee and the management of the organization. Typically, compensation is issued along with the next salary.

If the employee has not gone on vacation for several years

According to Article 122 of the Labor Code of the Russian Federation, the organization is obliged to provide employees with vacations annually. That is, in principle, a situation where an employee has not rested for more than a year is a violation of labor legislation. And if labor inspectors discover this during an inspection, they will most likely issue an order to the company to eliminate this violation. And later they may be fined.

However, if this situation does arise in the organization and such an employee decides to quit, then he must be paid compensation for all the days that he did not take time off. This conclusion follows from Article 127 of the Labor Code of the Russian Federation. It says that upon dismissal, the employee is paid compensation for all unused vacations.

Hello Guest! Offer from "Clerk"

Online professional retraining “Chief accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

Formula

The generally accepted formula for calculating compensation for unused vacation upon dismissal is as follows:

Where:

- SDZ is the employee’s average daily earnings.

Average earnings are determined according to the rules of Art. 139 Labor Code of the Russian Federation. Formula:

Where:

- SRS - average annual income (employment payments for the last 12 months);

- 12 - number of months for calculating SDZ;

- 29.3 - the average number of calendar days in a month for calculating vacation payments.

As a result, we get the amount that the employee earned per day.

The number of unused rest days is calculated for the entire period of work in the company, and not just for the year of dismissal. This number is calculated for previous periods using the formula:

Where:

- KND - the number of unused vacation days;

- OG - years worked;

- PDO - allotted vacation days per year;

- IDO - used vacation days for the entire period of work.

If less than 11 months were worked in the last year, the number of unused days for compensation is calculated as follows:

Where:

- KND - number of unused days;

- PDO - prescribed days of rest for 12 months;

- 12 is the number of months in a year.

Where:

- KND - number of unused days;

- PDO - prescribed days of rest for 12 months;

- 12 is the number of months in a year.

Duration of vacation

To find out how much compensation a resigning employee is entitled to, you need to know how much vacation the employee is entitled to per year. But there is a separate category of citizens who can count on a longer guaranteed vacation. This category includes:

- minor workers: 31 k.d.;

- employees with disabilities: 30 k.d.;

- education workers: from 42 to 56 k.d.;

- doctors and candidates of science: from 36 to 48 kd.;

- representatives of emergency services: from 30 to 40 k.d.;

- health workers whose activities involve a risk of contracting HIV infection: 36 k.d.;

- civil servants: 30 k.d.;

- representatives of the Investigative Committee at the Prosecutor's Office of the Russian Federation: 30 k.d.

Compensation payments are subject to personal income tax and insurance premiums are charged. Employees who have not worked for two weeks at the time of termination may be limited in receiving compensation.

You should not think about whether you need to round up compensation days for unused vacation. In case of evasion of payment, you may incur criminal, administrative and financial penalties.

Example of calculation based on formulas, without a calculator

Let's look at how compensation for vacation upon dismissal is calculated using an example. To do this, we will derive the SDZ and the number of days not taken off using formulas (without a calculator).

Example:

Panfilov I.L. has been working at Cinema LLC since March 10, 2017, resigning on August 13, 2021. Every year Panfilov I.L. There are 28 days of rest according to the calendar. While working at Cinema LLC, he used 20 days in October 2017, 14 days in May 2018, 28 days in July 2019, that is, a total of 62. Monthly labor payments to I.L. Panfilov. — 30,000 rubles including bonus. Let's calculate how many days of rest Panfilov has left for 2022 - 2022.

We calculate the number of days of unused vacation upon dismissal using the formula:

Number of unused days for 2022 - 2022 = (3 × 28) - 62 = 22 days.

Over a three-year period from 2022 to 2022. Panfilov I.L. Allotted 84 days of rest (3 × 28), he used 62 days. The number of unused days for previous periods is 22.

How many vacation days did I.L. Panfilov accumulate? for 2022, if he worked for a full 5 months (5 months and 10 days, which are rounded down):

Number of unused days = (28 / 12) × 5 = 11.66 days.

Let’s say that according to the internal rules of the organization, days for compensation upon dismissal are rounded in favor of the employee. Then for 2022 Panfilov I.L. unused 12 days. The total number of days to be reimbursed is 22 + 12 = 34 days.

Let's calculate the average earnings of I.L. Panfilov. in a day. Taking into account the salary of 30,000 rubles, in 12 months he earns 360,000 rubles:

Now it’s easy to understand how vacation time is calculated when you quit 32 days in advance:

1023.89 × 34 = 34,812.26 rubles.

Final amount: before dismissal, Panfilov will receive 34,812 rubles 26 kopecks in compensation.

We calculate the days

So, we have calculated the length of service giving the right to leave and the period for which compensation must be paid. Now you need to determine the number of vacation days that the employee has accumulated during his entire time working in the company.

In general, according to Part 1 of Art. 115 of the Labor Code of the Russian Federation, the duration of vacation is 28 calendar days.

Taking into account the letter of Rostrud dated October 31, 2008 No. 5921-TZ, for one month fully worked in the company, the employee is entitled to vacation in the amount of 2.33 days (28 days / 12 months)

Based on the conditions of our example, Sergeev is entitled to vacation at the rate of 79.22 days ((2 years × 12 months + 10 months) × 2.33 days).

Next, you need to determine how many vacation days he has already used during his time working in this company.

Our Sergeev took 56 days (28 days + 28 days).

The number of days of unused vacation by an employee is determined by the formula (letter of the Ministry of Labor of Russia dated October 28, 2016 No. 14-1/B-1074):

Let's calculate how many days Sergeev is entitled to unused vacation:

79.22 days – 56 days = 23.22 days

Please note that rounding is not required by law. If you still decide to round up and pay compensation only for whole days, do it upward - in favor of the employee. This position is set out in letters of the Ministry of Labor of Russia dated November 2, 2018 No. 14-2/ОOG-8717, the Ministry of Health and Social Development of Russia dated December 7, 2005 No. 4334-17.

In our case, 23.22 days are rounded to 24 days (and not to 23, as we would round based on mathematical rules).

Is it allowed to replace vacation with monetary compensation without dismissal?

Replacement with monetary compensation without dismissal is permissible only for the part of the vacation period exceeding 28 calendar days (Article 126 of the Labor Code of the Russian Federation). This happens upon a written request from the employee. It is allowed to replace days with money in excess of the main vacation. Only those categories of employees who are entitled to additional days of rest (disabled people, teachers, doctors, Northern workers, etc.) are entitled to receive monetary compensation instead of rest. Or if the employer has provided additional days for rest in the company’s local regulations. But this is not in all cases:

- The legal norm uses the wording “can be replaced,” which leaves the employer the right to refuse the employee financial compensation. Payment of money instead of providing extra days of rest is at the discretion of management.

- Vacation will not be replaced with money for pregnant women, minors and workers in hazardous and hazardous industries.

It is also not possible to accumulate vacation days for the previous year, and then take part of the double vacation over 28 days in cash. Article 126 of the Labor Code of the Russian Federation, when summing up and transferring vacations from one year to another, allows for the replacement of only part of more than 28 days in each year.