What are off-balance sheet accounts?

Accounting provides for a certain professional chart of accounts, using which specialists maintain accounting of the company’s funds. 99 of the accounts presented in the chart are basic, since with their help business transactions in the organization are reflected. 11 registers are off-balance sheet accounts; they are necessary to reflect additional information. These accounts do not reflect the financial condition of the company or a separate production site. Indicators from these accounts are not taken into account when preparing the balance sheet, hence the corresponding name for such accounts - off-balance sheet (

Off-balance sheet account 009

As a rule, business transactions are recorded using double entry. On the one hand, the debit indicates the receipt of funds and the same amount should be reflected in the credit account in another account - the loan. In other words, double entry reflects a clear movement of funds: Debit - Credit and a specific amount.

Important! Off-balance sheet accounts also have debits and credits. But their peculiarity is that the recording is made by one-way wiring. That is, there is no need to simultaneously reflect the same amounts in the debit of one account and in the credit of another.

Account 009 allows you to see transactions on issued funds. These transactions indicate how payments are made and how obligations are secured. This off-balance sheet account summarizes information on valuables that are at the temporary disposal of the company, either temporarily stored in the company or being processed.

Off-balance sheet accounts are necessary for more careful, more thorough accounting. Therefore, they are subject to constant adjustment by legislative acts.

According to accounting terminology, the balance sheet asset contains only the organization's own funds. But quite often a company can use other people’s funds. Special accounting is most convenient for creditors, since it allows the calculation of liquid coverage with accounts payable. Creditors were asked to separate the company's own property in accounting from property that does not belong to it. Thus, the company's property is listed on the company's balance sheet asset, and property not owned by the company remains off the balance sheet. For this purpose, account 009 was created, which is called “Security for obligations and payments issued.” This account shows the write-off of the company's borrowed funds upon repayment. This register is intended to record each security issued.

Accounting for collateral for obligations received and issued

Previous76NextOrganizations issue and receive various types of payment security.

Security (guarantee) is a document in which one organization guarantees another to fulfill obligations within a certain period of time for a certain amount and confirms that it is ready to repay the debt if it arises as a result of failure to fulfill obligations.

According to Art. 329 of the Civil Code of the Russian Federation, the fulfillment of obligations can be ensured by a penalty, a pledge, retention of the debtor’s property, a surety, a bank guarantee, a deposit and other methods provided for by law or contract.

Bonds, bills of exchange, other securities and types of property are used as collateral for loans received, goods shipped, work performed, and services provided.

There are two groups of collateral: “Securities for obligations and payments received” and “Securities for obligations and payments issued.” The chart of accounts for the financial and economic activities of organizations (approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n) provides for two off-balance sheet accounts of the same name with the specified groups of collateral: account 008 “Collateral for obligations and payments received” and account 009 “Collateral for obligations and payments issued." The composition of objects reflected in these accounts, the content of indicators and the procedure for filling out these lines are not defined by regulatory documents. However, according to the Instructions for using the Chart of Accounts, off-balance sheet account 008 “Securities for obligations and payments received” must reflect the guarantees of other organizations received by the reporting organization that secure the assets of the reporting organization recognized in the balance sheet (mainly receivables of any form). In this case, information about collateral that is not realistic for collection should be excluded.

Accounting for received obligations is carried out at the value of the obligation or the value established by the contract.

If the guarantee does not indicate the exact amount, then in accounting it is accepted based on the terms of the contract.

The value of received liabilities at their estimated value is accounted for as a debit to off-balance sheet account 008 “Securities for obligations and payments received.”

The amounts of collateral recorded in account 008 “Securities for obligations and payments received” are written off as the debt is repaid from the credit of this account.

A credit entry on the specified account means, in particular, the end of the property pledge agreement due to the full repayment of the loan (loan) received by the pledgor secured by the property, as well as the restoration of the property as part of one’s own after the expiration of the property pledge agreement and the full repayment of the pledged debt to the pledgee.

In the mortgagee's accounting, the amounts of collateral recorded in account 008 “Securities for obligations and payments received” are written off as the debt is repaid from the credit of the named off-balance sheet account.

Analytical accounting for account 008 “Securities for obligations and payments received” is maintained for each security received.

Off-balance sheet account 009 “Securities for obligations and payments issued” should reflect the guarantees issued by the organization, for which the reporting organization is liable and risks its property. Guarantees issued to secure their own obligations and guarantees issued to secure the obligations of other organizations must be accounted for and disclosed separately in the financial statements (in case of significant amounts in separate lines). In this case, information about collateral with zero risks should be excluded.

All other types of collateral that do not meet the above criteria, information on which is of interest to the user of the statements, must be accounted for in separate sub-accounts and disclosed in the explanations to the financial statements in the forms established by the accounting policies of the organization, or in additional lines of the certificate about the availability of values taken into account on off-balance sheet accounts. These, in particular, include collateral that guarantees the reporting organization's fulfillment of its obligations to creditors, issued by other organizations.

The value of issued obligations at their estimated value is recorded as a debit to off-balance sheet account 009 “Securities for obligations and payments issued.”

The amounts of collateral recorded in account 009 “Collateral for obligations and payments issued” are written off as the debt is repaid from the credit of this account.

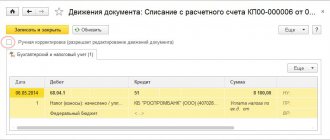

For example, when issuing a guarantee for a bill of exchange, an organization debits account 009 “Securities for obligations and payments issued.” Upon receipt of notification of payment of an issued bill, expiration of the limitation period, or payment of the bill by the guarantor himself, account 009 “Securities for obligations and payments issued” is credited.

By analogy with account 008 “Securities for obligations and payments received,” if the amount is not specified in the guarantee, it is determined based on the terms of the agreement. Analytical accounting on account 009 “Securities for obligations and payments issued” is maintained for each security issued.

As noted, in accordance with paragraph 1 of Art. 329 of the Civil Code of the Russian Federation, the fulfillment of obligations can be ensured by a penalty, a pledge, retention of the debtor’s property, a surety, a bank guarantee, a deposit and other methods provided for by law or contract.

When concluding various agreements, for example a loan or a sale and purchase, the parties may provide for a method of securing the fulfillment of obligations, such as a pledge. Its subject may be any property that either remains with the pledgor or is transferred to the pledgee.

In any case, ownership of it remains with the pledgor.

Therefore, the property pledged is separately reflected in the mortgagor’s accounting records on the same accounts in which it was previously recorded.

The guarantees issued to secure the fulfillment of obligations are recorded by the pledgor in off-balance sheet account 009 “Securities for obligations and payments issued.” The value of the property that is the subject of the pledge in account 009 is taken into account in the amount in which it was valued by the parties in the pledge agreement.

If the main obligation is fulfilled, the property that is the subject of the pledge agreement and previously transferred to the pledgee is returned to the pledgor (Clause 3 of Article 352 of the Civil Code of the Russian Federation).

Example

On April 1, 2008, CJSC Margaritka received a loan from Astra LLC to replenish working capital in cash in the amount of 600,000 rubles. for a period of three months at the rate of 1.6% per month. Under the loan agreement, the borrower (ZAO Margaritka) pays interest monthly.

The loan was issued secured by bonds of a third-party organization with a nominal value of RUB 650,000. In the pledge agreement, the bonds are valued at RUB 640,000. The subject of the pledge in accordance with this agreement is transferred to the pledgee-lender.

CJSC "Margaritka" returned the funds to LLC "Astra" in full upon expiration of the loan agreement - June 30, 2008. On the same day, the collateral was returned to the mortgagor.

The following entries must be made in accounting:

| No. | Contents of business transactions | Account correspondence | Amount, rub. |

| Debit | Credit | ||

| April 1, 2008 | |||

| Received funds under a loan agreement; | 600 000 | ||

| The par value of the bonds pledged is reflected | 58-2 “Bonds pledged” | 58-2 "Bonds" | 650 000 |

| The obligation issued to secure the execution of the loan agreement is reflected; | — | 640 000 | |

| April 30, May 31, June 30, 2008 | |||

| Interest was accrued on the loan received for the month (RUB 600,000 x 1.6%); | 91-2 | ||

| Accrued interest listed | |||

| June 30, 2008 | |||

| Loan repayment reflected | 600 000 | ||

| The par value of the bonds returned by the pledgee is reflected | 58-2 "Bonds" | 58-2 “Bonds pledged” | 650 000 |

| The amount of the repaid obligation under the pledge agreement has been written off. | — | 640 000 |

In the accounting records of the pledgee, the value of the property received as collateral is reflected in off-balance sheet account 008 “Securities for obligations and payments received” in the amount at which this property is valued by the parties in the pledge agreement.

The value of property received as collateral by the pledgee is not subject to income tax (clause 2, clause 1, article 251 of the Tax Code of the Russian Federation).

In our example, the following entries should be made in the accounting records of Astra LLC:

Previous76Next

Regulatory acts

Off-balance sheet accounts are regulated by the following legislative acts:

- Law No. 402-FZ “On Accounting”, which contains the basic requirements for the documentation compiled. The law determines that a company’s own property should be taken into account separately from non-own material assets. For the latter, off-balance sheet accounting must be maintained.

- Article 275 of the Tax Code of the Russian Federation, which regulates the taxation procedure.

- Article 329 of the Civil Code of the Russian Federation, according to which obligations must be secured by penalties, pledges, deposits, guarantees and other means that do not contradict current legislation. In addition, the Civil Code of the Russian Federation specifies the rights and obligations of the parties that are bound by a lease agreement or a commission under it.

- Order of the Ministry of Finance No. 34n as amended in 2022, which explains the procedure for accounting for off-balance sheet accounts.

UTII

Settlements under the guarantee agreement will not affect the calculation of UTII. The object of taxation with a single tax is imputed income (clause 1 of Article 346.29 of the Tax Code of the Russian Federation).

Services for issuing sureties are not listed in the list of activities for which a single tax must be paid (clause 3 of Article 346.29 of the Tax Code of the Russian Federation). Therefore, consider the income and expenses of the organization related to the guarantee separately according to the rules in force for the general taxation system (clause 7 of Article 346.26 of the Tax Code of the Russian Federation and letter of the Ministry of Finance of Russia dated July 23, 2007 No. 03-11-04/3/285) .

Correspondence

009 account can be represented by various information. For example, that third parties who vouch for the company in front of contractors guarantee the reliability of the company. This register reflects information about the property issued as collateral.

A guarantee from a third-party company is registered in the debit of account 009. This will indicate that in the event of financial problems in the company, the partner will receive insurance for the return of amounts. These actions can also emphasize the business reputation of the company, as well as its importance in the business sphere.

If property is transferred in the form of money, then the entries should be as follows:

- debited to accounts that reflect settlements with partners;

- credited to accounts 51 and 52;

- The debit of account 009 reflects the amount of the transaction.

Important! When real estate or other property is pledged, regardless of where it is located, it does not disappear from the company’s balance sheet. This fact must be simultaneously indicated in the debit of account 009, from which, after the return of funds, the debit will be made.

The entry for the loan received under the pledge certificate or warrant will be as follows:

- 51 (66) – a loan issued by a bank or received by a borrower, as collateral was recorded in the company’s warehouse;

- loan 008 – the amount indicated in the receipt for acceptance of the value for storage is reflected (the information is transferred to the lender, documented and serves as security for the return of funds);

- debit 009 – indicates the amount that was provided to the financial organization as collateral along with the warrant.

If the loan has not yet been repaid, but the pledged goods have already been sold, then the postings will be as follows:

62(90.1) – revenue from sales is reflected;

90.3(68) – accrual of VAT on income from sold property;

90.2(41.1) – write-off of products at actual cost;

66(62) – transfer of debt obligations secured by security;

Credit 009 – reflects the warehouse receipt that was transferred to the new owner.

Bank guarantee: tax accounting

Let's determine how to keep tax records of a bank guarantee in 2020:

- Income tax. Bank guarantees are not taken into account in the base for calculating income tax until it is received in cash and income is accrued. Such instructions are contained in subparagraph 2 of paragraph 1 of Article 251 of the Tax Code of the Russian Federation.

- VAT. The amount of the bank guarantee is not taken into account when calculating the base for value added tax. Why? Funds received under a bank guarantee are not income from the sale of goods or provision of services, and therefore should not be taken into account in VAT calculations.

- USN. Guarantee funds accounted for in off-balance sheet account 10 should not be included in the calculation of the tax base (Article 251, 346.15 of the Tax Code of the Russian Federation), since this is a liability, not income. When crediting money to a current account under a bank guarantee, the amount should be reflected when calculating income under the simplified tax system. Receipts are included in non-operating income when calculating the single tax.