Types of existing penalties

Before considering the question of how to post a fine or penalty in accounting, let’s figure out what sanctions of this kind may be. They are divided into two groups:

- Accrued by counterparties to each other in connection with violation of contractual obligations.

- Arising in case of non-compliance with tax legislation.

Sanctions of the first group are provided for in the texts of agreements concluded between counterparties as mutual and can equally arise for each of the parties. For example, penalties are usually established for the buyer for late payment, and for the supplier for failure to meet the delivery deadline. More serious sanctions (in the form of a fine) are intended to ensure the fulfillment of obligations that seriously affect the very fact of the functioning of the counterparty or lead to significant losses for it (including due to failure to fulfill obligations to a third party). The amount of sanctions arising between counterparties is indicated in the contract either directly (such as the amount of interest for each day of delay in payment or delivery) or by describing the calculation algorithm.

Situations in which penalties and fines are assessed for violations of tax legislation are given in the Tax Code of the Russian Federation; there are also indications of their specific amounts, and, in necessary cases, calculation algorithms. Here, taxpayers usually become the payers of sanctions, although in a number of cases (for example, a delay in the return of overpaid tax to the budget or the amount of VAT to be refunded), the same kind of responsibility is established for the tax authorities.

Thus, a specific legal entity may turn out to be both a payer and a recipient of payments from both groups, and accounting entries for fines and penalties will arise not only when accounting for expenses on them, but also when reflecting income.

What is a penalty

In accordance with the Civil Code of the Russian Federation, a penalty is a sum of money that the debtor is obliged to pay to the creditor in the event of non-fulfillment or improper fulfillment of an obligation, in particular, for its delay (Article 330). Moreover, the agreement on the penalty must be made in writing, regardless of the form of the main obligation, otherwise it is declared invalid (Article 331).

There are two types of penalties: a fine or a penalty. The fine is a fixed payment and can either be specified as a fixed amount or calculated as a percentage of a particular amount. The penalty is a variable value, its size depends on the duration of the period of violation. The amount of the penalty is determined as a percentage of the amount of the obligation, the fulfillment of which it ensures.

The rules for calculating penalties are also determined by the Civil Code of the Russian Federation. The first day of delay is the date following the day of fulfillment of the obligation in accordance with the contract. Last day is the date preceding the day of actual fulfillment of the obligation.

Example.

According to the terms of the contract, the deadline for fulfillment of obligations by the supplier (contractor) is defined as follows: “no later than June 20, 2016.” The goods were actually delivered on July 20, 2016. The period of delay lasted from June 21 to July 19 and amounted to 29 days.

Reflection in accounting of sanctions under contracts with counterparties

How can accounting entries reflect fines or penalties that arise in relations with counterparties? Expenses or income generated by a legal entity in this case are among others (clause 7 of PBU 9/99 and clause 11 of PBU 10/99, approved by orders of the Ministry of Finance of Russia dated May 6, 1999 No. 32n and No. 33n). The chart of accounts (approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n) recommends using account 91 to reflect them, the credit of which will show income, and the debit - expenses.

The corresponding account for account 91 in the entry for reflecting a fine or penalty in accounting will be settlement account 76, to which the Chart of Accounts provides for the opening of a sub-account called “Settlements for claims.” Analytics in this sub-account is organized by counterparties and each arising claim.

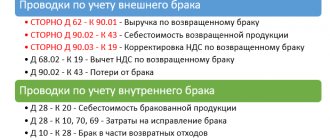

That is, the entries for the accrual of penalties will look like this:

- Dt 91 Kt 76 from a legal entity reflecting the claim addressed to it (i.e. its expense);

- Dt 76 Kt 91 from a legal entity that has submitted a claim to its counterparty and is counting on the receipt of funds to its address.

The amount accompanying these postings will be determined in the same way for both entries: as corresponding to the volume of accruals, either recognized by the debtor or established by the court (clause 10.2 of PBU 9/99, clause 14.2 of PBU 10/99). Accordingly, the moment of reflection in accounting will coincide with the moment of either recognition or adoption of a court decision.

Payment of sanctions will be expressed by posting Dt 76 Kt 51 (transfer to the counterparty) or Dt 51 76 (receipt from the counterparty).

Important! ConsultantPlus warns The Russian Ministry of Finance identifies cases in which penalties are subject to VAT. These are situations when... See K+ for more details. Trial access is available for free.

Reflection of indicators in reporting forms

The composition of the data and the list of reporting forms for reflecting settlements with the counterparty for penalties, including the status of settlements, the amounts of accrued income and their cash execution are given in Table 1.

Table 1

| Reflected indicator | Reporting forms | |

| budgetary and autonomous institutions | government institutions | |

| Amounts of debt at the beginning and end of the period and indicators of its change - increase/decrease (according to settlement accounts - 209.40 or 205.41) | “Information on accounts receivable and payable” Columns 2-14 (except for columns 6 and | |

| "Balance…" | ||

| Lines 580 or 590, columns 5, 9 | Lines 580 or 590, columns 3, 6 | |

| “Report on the financial results of the institution” | ||

| Lines 481, 482, column 6 | Lines 481, 482, column 4 | |

| Amounts of accrued income (account 401.10) | “Report on the financial results of the institution” | |

| Column 6 line 050 | Column 4 line 050 | |

| “Certificate on the conclusion by an institution of accounting accounts for the reporting financial year” | “Certificate on the conclusion of budget accounts for the reporting financial year” | |

| Counts: 5, 18, 13 | Counts: 3, 4, 7 | |

| Amounts of income received to the cash desk, to the personal or current account of the institution (according to the relevant accounting accounts) | “Report on the institution’s implementation of its financial and economic activity plan” | “Report on budget execution...” |

| Line 010, columns 5, 6, 7 | Line 010, columns 5 (6) | |

| "Cash Flow Statement" | ||

| Line 060 column 4 | ||

If transactions are correctly reflected in accounting in “1C: Public Institution Accounting 8”, the above indicators in the reporting forms are filled out automatically using the “Fill”

.

A budgetary institution should pay special attention when carrying out operations to fulfill planned income assignments without cash flow. An example is the transfer of payment under the contract in an amount reduced by the amount of the penalty. In accordance with the requirements of Instruction No. 33n, in this case, the amount of income must also be reflected in the Income section of the “Report on the institution’s implementation of its financial and economic activity plan (form 0503737)” in column 8.

How to reflect the accrual and payment of tax penalties and fines in accounting

The basis for making entries for penalties or fines assessed for payment to the budget are documents with the amounts of these payments issued by the tax authority:

- decisions based on the results of the audit;

- requirements for payment of taxes (contributions).

For the taxpayer, they represent an expense that must be reflected on account 99 or account 91, depending on the type of tax.

For which taxes the Ministry of Finance requires penalties and interest to be reflected on account 99, and for which on account 91, find out from the Typical Situation from ConsultantPlus by receiving a free trial access.

The corresponding account for tax sanctions will be account 68, in which both penalties and fines should be allocated for each tax (contribution) in the analytics.

The accrual of sanctions in favor of the tax authorities will thus be reflected by the entry Dt 99 (91) Kt 68, and the entry for payment of fines or penalties will look like this: Dt 68 Kt 51.

If the payer of sanctions against a legal entity turns out to be a tax authority, then the accounting entries in this case will be similar to those used when calculating similar payments arising under contractual relationships with other counterparties:

- Dt 76 Kt 91 - accrual of income under sanctions;

- Dt 51 Kt 76 - receipt of funds for their payment.

The Chart of Accounts does not provide for the attribution of such income to account 99. The use of account 91 in this posting indicates the preference for reflecting tax sanctions paid by the taxpayer through account 91, since this provides a more convenient comparison of income and expenses.

Income tax penalties

The organization (OSNO) untimely paid income tax to the federal budget for the 4th quarter. Having discovered an error, I independently calculated penalties for the profit tax for the 4th quarter of 2022 and reflected their accrual in accounting. The calculated amount of penalties is RUB 21,000.

The accrual of penalties is documented in the Transaction in the Transactions – Accounting – Transactions entered manually section.

The tabular part is filled in with the following entries:

- Debit – 99.01.1 “Profits and losses from activities with the main tax system”; Subconto 1 – components of the financial result Tax penalties due .

Analytics Income tax and similar payments are used when calculating (additionally accruing) income tax or other taxes that are accrued in Dt 99. For example, a trade fee or tax under the simplified tax system. In our example, penalties are charged on income tax, and not the tax itself. Therefore, such analytics are not applicable.

- Credit — 68.04.1 “Calculations with the budget”; Subconto 1 – type of payment to the budget Penalties: additionally accrued / paid (independently);

- Subconto 2 – budget levels Federal budget .

Results

Sanctions reflected in accounting in the form of penalties and fines arise:

- in relations between counterparties due to violation of contractual relationships;

- in case of non-compliance with the requirements of tax legislation.

In both cases, a specific legal entity may be both a payer and a recipient of payments under sanctions. That is, entries for fines and penalties will reflect either expenses or income in his accounting:

- for settlements with the counterparty - Dt 91 Kt 76 (expense) or Dt 76 Kt 91 (income);

- for tax payments - Dt 99 (91) Kt 68 (expense) or Dt 76 Kt 91 (income).

Accounting analytics should be organized by counterparties and claims (for account 76), types of taxes and sanctions (for account 68), and assignment of sanctions (for account 91).

Sources:

- Tax Code of the Russian Federation

- Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n

- Order of the Ministry of Finance of Russia dated May 6, 1999 No. 32n

- Order of the Ministry of Finance of Russia dated May 6, 1999 No. 33n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Accounting for penalties payable under contractual obligations

The payer of penalties for improper fulfillment of contractual obligations, including penalties under a leasing agreement, will have mirror entries. Penalties must be reflected as other expenses on the date on which:

- or you voluntarily acknowledged your obligation to pay them;

- or a court decision on their collection has entered into force.

According to a court decision, payment can be forcibly collected from the debtor through the bailiff service.

Accrual of penalties and postings to the payer:

| Operation | Debit | Credit |

| Sanctions payable recognized | 91-2 | 76 |

| Penalty transferred to recipient | 76 | 51 |

In tax accounting, sanctions are taken into account as part of non-operating expenses in accordance with paragraphs. 13 clause 1 art. 265 Tax Code of the Russian Federation.