Codes for types of VAT transactions

Codes for types of VAT transactions approved by Order of the Federal Tax Service dated March 14, 2016 N ММВ-7-3/ [email protected]

Applicable from 07/01/2016.

| Name of the type of operation | Operation type code | Comments |

| Shipment or purchase of goods, works, services, rights, incl. transactions taxed at a rate of 0%, shipment or purchase under a commission (agency) agreement, return of goods by the buyer and receipt by the seller, preparation or receipt of a single adjustment SF (except for transactions under codes 06, 10, 13, 14, 15, 16, 27) | 01 | |

| Advances received or transferred, advances received or transferred under a commission agreement (agency), with the exception of transactions under codes 06, 28 | 02 | |

| Operations performed by tax agents under Art. 161 of the Tax Code of the Russian Federation, including intermediary tax agents, with the exception of transactions (clause 4 and clause 5 of Article 161 of the Tax Code of the Russian Federation) | 06 | |

| Shipment or receipt of goods, works, services, rights free of charge | 10 | |

| Carrying out capital construction, modernization (reconstruction) of real estate by contractors; acquisition and transfer of such works by investors; transfer or acquisition by specified persons of capital construction projects, equipment, materials as part of the execution of capital construction contracts | 13 | |

| Transfer of property rights listed in paragraphs. 1-4 tbsp. 155 Tax Code of the Russian Federation | 14 | |

| Drawing up or receiving an invoice by a commission agent or agent when selling or purchasing both own and commission goods at the same time | 15 | |

| Receipt by the seller of goods returned by a buyer who is a non-VAT payer, as well as refusal of goods by companies or entrepreneurs who do not pay VAT (paragraph 2, clause 5, article 171 of the Tax Code of the Russian Federation), except for operations listed under code 17. | 16 | |

| Receipt by the seller of goods returned by the buyer - an individual, as well as refusal of goods (work, services) (paragraph 2, clause 5, article 171 of the Tax Code of the Russian Federation) | 17 | |

| Drawing up or receiving an adjustment invoice in connection with a change in the cost of shipped goods (work, services), rights downwards | 18 | |

| Import of goods into the territory of the Russian Federation from EurAsEC | 19 | |

| Import of goods into the territory of the Russian Federation in customs procedures | 20 | |

| Operations to restore tax amounts specified in clause 8 of Art. 145, paragraph 3 of Art. 170, art. 171.1 of the Tax Code of the Russian Federation (with the exception of paragraphs 1 and paragraph 4 of paragraph 3 of Article 170, transferred to code “01”), as well as for transactions taxed at 0%) | 21 | |

| Operations for the return of advances received from buyers and the offset of advances against the shipment of goods (works, services) | 22 | |

| Purchasing services issued by BSO for business trips and entertainment expenses | 23 | |

| Registration of invoices in the purchase book, in case of confirmation of the 0% rate after 180 calendar days, if VAT was previously calculated for the Northern Federation and included in the sales book if the 0% rate is not confirmed (paragraph 2 of clause 9 of article 165 of the Tax Code of the Russian Federation , clause 10 of article 171 of the Tax Code of the Russian Federation) | 24 | |

| Registration of invoices in the purchase ledger in respect of tax amounts previously recovered from transactions taxed at a rate of 0%; upon receipt by the manufacturer of payment or advance payment for upcoming deliveries of goods with a long production cycle (Clause 7 of Article 172 of the Tax Code of the Russian Federation) | 25 | |

| Drawing up documents containing summary (summary) data on transactions during the month (quarter) when selling goods and services, rights to persons who are not VAT payers, when receiving advances from them on account of future deliveries, when the cost of shipped goods changes (clauses 6, 10 Article 172 of the Tax Code of the Russian Federation) | 26 | |

| Drawing up and receiving a consolidated invoice for intermediary transactions, transport expedition operations and when performing the functions of developers (clause 3.1 of Article 169 of the Tax Code of the Russian Federation) | 27 | |

| Drawing up and receiving a consolidated invoice when receiving advances for intermediary transactions, transport expedition operations and when performing the functions of developers (clause 3.1 of Article 169 of the Tax Code of the Russian Federation) | 28 | |

| Adjustment of the sale of goods (works, services), transfer of property rights, the enterprise as a whole as a property complex on the basis of clause 6 of Art. 105.3 Tax Code of the Russian Federation | 29 | |

| Shipment of goods for which VAT was calculated during customs declaration in accordance with paragraph. 1 pp. 1.1 clause 1 art. 151 Tax Code of the Russian Federation | 30 | |

| The operation of paying VAT amounts calculated during the customs declaration of goods in the cases provided for in paragraph. 2 pp. 1.1 clause 1 art. 151 Tax Code of the Russian Federation | 31 | |

| Acceptance for deduction of customs VAT after 180 days on imports upon completion of the customs procedure of the free customs zone in the territory of the SEZ in the Kaliningrad region (clause 14 of article 171 of the Tax Code of the Russian Federation) | 32 |

Code "21" in the sales book (VAT)

The calculation of VAT payable is carried out taking into account the accrued tax on sales, the amounts of deductions, and sometimes it is necessary to offset the restored tax payable. Maintaining books of sales and purchases helps to systematize accounting. Entries in the sales book are entered on the basis of invoice data in accordance with the rules approved by Government Decree No. 1137 dated December 26, 2011. Clause of these rules states that when restoring VAT, invoices that served as the basis for deducting tax , must be registered in the sales book indicating the amount of tax that is subject to restoration.

The Letter of the Federal Tax Service dated September 20, 2016 No. SD-4-3/ [email protected] explains how to correctly use the VAT transaction code “21”. It is needed for the buyer to reflect the procedure for restoring tax previously accepted for deduction. The encoding is typical for the following cases:

- tax amounts on the purchase of goods, payment for services and work are accepted for deduction before using the right to exemption from taxation, and after sending the corresponding notice of exemption from the duties of the taxpayer in accordance with clause 8 of Art. 145 of the Tax Code of the Russian Federation, VAT is restored;

- tax restoration will also be made when using acquired assets for the production or sale of products, the place of sale of which is not the Russian Federation;

- when tax is restored in the event that the buyer makes an advance payment for future deliveries;

- VAT code “21” must also appear in the sales book in cases where the taxpayer received subsidies or budget investments from the budget of any level to cover previously incurred expenses for the purchase of specific goods or payment for services or work;

- when restoring tax amounts within the rules of Art. 171.1 of the Tax Code of the Russian Federation - the norm applies to capital construction of real estate by contractors, to the purchase of real estate, ships or aircraft, mixed-use vessels, engines for them, to the purchase of goods necessary for construction and installation work;

- when performing transactions that are subject to VAT at a zero rate.

When specifying code “21”, the following set of information must be reflected in the sales book:

- invoice number;

- document date;

- details by which the buyer can be identified - name, tax identification number and checkpoint codes (own details must be entered);

- payment order;

- the cost of goods in accordance with the indicated invoice, including tax and excluding VAT;

- The VAT amount is separately allocated.

Codes for types of VAT transactions when waiving the 0% rate

Codes of types of VAT transactions in case of refusal of the 0% rate, recommended by Letter of the Federal Tax Service of the Russian Federation dated January 16, 2018 N SD-4-3/ [email protected]

Applicable from 01/01/2018.

| Operations (clause 7 of article 164 of the Tax Code of the Russian Federation) | Operation type code | Comments |

| sale of raw materials exported under the customs export procedure, taxation of which is carried out at a rate of 18% | 37 | |

| sales of non-commodity goods exported under the customs export procedure, taxation of which is carried out at a rate of 18% | 38 | |

| sales of non-commodity goods exported under the customs export procedure, taxation of which is carried out at a rate of 10% | 39 | |

| implementation of works (services) provided for in paragraphs. 2.1 - 2.5, 2.7 and 2.8 clause 1 art. 164 of the Tax Code of the Russian Federation, in relation to raw materials (non-raw materials) goods exported under the customs export procedure, taxation of which is carried out at a rate of 18% | 40 |

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Incorrect VAT transaction type codes...

- Codes of types of income in payment documents The law requires that the code for payment of wages and other income be indicated in...

- Reduced VAT rate on the sale of berries and fruits - types and codes have been approved. That from 10/01/2019 the sale of berries and fruits (including...

- Purchasing materials for operations not subject to VAT and transferring them for advertising purposes Let's consider the features of reflecting in 1C received materials intended for operations...

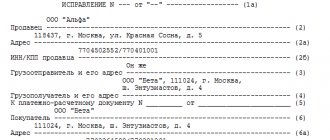

Invoice issued by 1C Accounting, basic version

Content:

1. Invoice when selling goods

2. Invoice for provision of services

3. Invoice (issued) for advance payment in 1C Accounting, edition 3.0

4. Tax agent invoice

5. Checking the invoices

When selling goods, works and services, as well as when receiving an advance payment (advance payment) from buyers, it is necessary to confirm the right to deduct VAT. Using the example of the software product 1C: Accounting edition 3.0, we will consider the main process of reflecting an issued invoice document.

You can view information about issued invoices in the “Sales” menu:

1. Invoices issued – a log of issued invoices;

2. Journal of invoices issued – a journal of invoices received and issued for the quarter. Formed according to the form “Appendix No. 3 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137 (as amended by the Decree of the Government of the Russian Federation of August 19, 2022 No. 981)”;

3. Register of invoices issued - a register of invoices issued by counterparties and basis transactions.

Journal of invoices issued in 1C Accounting, edition 3.0

Invoice for the sale of goods

When selling goods, you can issue an invoice from the document.

Invoice for the sale of goods

Data about the counterparty, contract and sales amounts will be filled in automatically in the invoice when the goods are sold. Please note that the transaction type code will be 01 - Sales of goods, works, services and operations equivalent to it.

Invoice for the sale of goods 1C Accounting, edition 3.0

Invoice for services rendered

When selling services to several contractors, you can issue several invoices simultaneously in the 1C Accounting 8.3 configuration. To do this, in the Provision of services document, you need to check the “Invoice issued” checkbox and post the document. After completion, invoices will be automatically generated for the provision of services.

Invoice for the provision of services in 1C Accounting, edition 3.0

Data about the counterparty, agreement and sales amounts will be filled in automatically. The transaction type code will also be 01.

Filling out data about the counterparty in 1C Accounting, edition 3.0

Invoice (issued) for advance payment in 1C Accounting, edition 3.0

You can issue an invoice from a payment receipt document.

An invoice issued from a payment receipt document in 1C Accounting, edition 3.0

This can also be done using processing at the end of the quarter. Processing can be opened from the “Bank and Cash Desk” menu in 1C Accounting, ed. 3.0.

Processing for generating an invoice in 1C Accounting, edition 3.0

Before starting processing in 1C Accounting, edition 3.0, you must specify the period and fill out the documents for the advance. Then you can open the list of invoices for the advance payment.

List of invoices for advance payments in 1C Accounting, edition 3.0

In the created invoices, the transaction type code will be 02 – Advances received.

Advances received in 1C Accounting, edition 3.0

Tax agent invoice

Invoices for an organization that is a tax agent can be written out from the document “Write-off from a current account.”

Tax agent invoice in 1C Accounting, edition 3.0

Or, like an advance payment, they can be formed using processing.

Generating an invoice from processing in 1C Accounting, edition 3.0

Checking invoice statements

You can check the maintenance of the sales book and purchase book using an express check. You can open it from the “Reports” menu.

Checking the issuance of invoices in 1C Accounting, edition 3.0

In the report you can see errors in the issuance of invoices and recommendations for eliminating them.

Errors in accounting in 1C Accounting, edition 3.0

Specialist

Lyubov Starygina

Full text of the order of the Ministry of Health on the issuance of QR codes for antibodies

From February 21, a COVID certificate with a QR code can be issued based on a positive antibody test, Rossiyskaya Gazeta reports. From this day the corresponding order of the Ministry of Health comes into force. In this way, those who have suffered from the disease asymptomatically will be able to confirm their immunity to coronavirus. If they have antibodies, they will be issued a certificate for six months. At the same time, the Ministry of Health emphasizes that the antibody certificate can be generated only once; repeated issuance of the document based on the results of the antibody test is not provided. After its expiration date, the person is recommended to get vaccinated.

Full text of the order of the Ministry of Health on the issuance of QR codes for antibodies

Those who, in addition to the detected antibodies, were previously identified with COVID-19 using a PCR test and the results of the study are available on public services, the document will be issued for a year. But it will be valid from the date of the positive PCR test.

An antibody test for issuing a certificate can be carried out in any licensed laboratory integrated with the government services portal. To perform this, you will need to donate blood from a vein. The amount of antibodies themselves does not matter; you just need to confirm their presence.

The test period is 1 day. To assess the level of antibodies after illness, it is recommended to test for IgG antibodies to the N-protein, and after vaccination - for IgG antibodies to the RBD domain of the S-protein. But during an illness, IgM antibodies are the first to appear, which indicate the acute phase of the disease.

The Ministry of Health has adjusted the procedure for maintaining and the form of a certificate of vaccination against COVID-19, medical contraindications to it and (or) previous illness caused by coronavirus. The document will be generated once if information on the results of such a test is available on the Unified Portal no later than 3 calendar days from the date of submission of the application on the public services portal. The validity period of the certificate in this case will be 6 months from the date of receipt of the test results, explains Garant.

A QR code certificate can also be issued based on a positive PCR test result confirmed by the results of an antibody test. Test results should also be available on the Unified Portal. In this case, the certificate will be valid for 1 year from the date of the positive PCR test. The order comes into force on February 21, 2022, with the exception of a separate provision for which a different effective date is provided. It was registered with the Ministry of Justice of the Russian Federation on February 8, 2022, Registration No. 67179.

Full text of the order

Order of the Ministry of Health of the Russian Federation dated February 4, 2022 N 58n “On amending appendices N 3 and N 4 to the order of the Ministry of Health of the Russian Federation dated November 12, 2021 N 1053n “On approval of the form of medical documentation “Certificate of preventive vaccinations against the new coronavirus” infection (COVID-19) or the presence of medical contraindications to vaccination" and the procedure for its issuance, the form of medical documentation "Medical certificate of preventive vaccinations against a new coronavirus infection (COVID-19) or medical contraindications to vaccination and (or) a previous disease caused by a new coronavirus infection (COVID-19)" and the procedure for its management, as well as the form "Certificate of preventive vaccinations against the new coronavirus infection (COVID-19) or medical contraindications to vaccination and (or) previous illness caused by the new coronavirus infection (COVID-19) )"

Registered with the Ministry of Justice of the Russian Federation on February 8, 2022 Registration No. 67179

In accordance with paragraph 11 of part 2 of Article 14 and paragraph 3 of Article 78 of the Federal Law of November 21, 2011 N 323-FZ “On the protection of the health of citizens in the Russian Federation” (Collected Legislation of the Russian Federation, 2011, N 48, Art. 6724; 2022, N 31, Art. 4791), paragraph 2 of Article 17 of the Federal Law of September 17, 1998 N 157-FZ “On the immunoprophylaxis of infectious diseases” (Collected Legislation of the Russian Federation, 1998, N 38, Art. 4736; 2013, N 48, Art. 6165) and subparagraphs 5.2.22, 5.2.96 and 5.2.199 of paragraph 5 of the Regulations on the Ministry of Health of the Russian Federation, approved by Decree of the Government of the Russian Federation of June 19, 2012 N 608 (Collected Legislation of the Russian Federation, 2012, N 26, Art. 3526; 2022, N 52, Art. 8131), I order:

1. Amend appendices No. 3 and No. 4 to the order of the Ministry of Health of the Russian Federation dated November 12, 2021 No. 1053n “On approval of the medical documentation form “Certificate of preventive vaccinations against the new coronavirus infection (COVID-19) or the presence of medical contraindications to vaccination "and the procedure for its issuance, the medical documentation form "Medical certificate of preventive vaccinations against the new coronavirus infection (COVID-19) or medical contraindications to vaccination and (or) past illness caused by the new coronavirus infection (COVID-19)" and the procedure for its administration , as well as the form “Certificate of preventive vaccinations against the new coronavirus infection (COVID-19) or medical contraindications to vaccination and (or) previous illness caused by the new coronavirus infection (COVID-19)” (registered by the Ministry of Justice of the Russian Federation on November 15, 2022 ., registration N 65824) according to the appendix.

2. This order comes into force on February 21, 2022, with the exception of subparagraph “a” of paragraph 1 of the appendix to this order, which comes into force on the day following the day of its official publication.

Minister M.A. Murashko

Appendix to the order of the Ministry of Health of the Russian Federation dated February 4, 2022 N 58n

Changes that are being made to Appendices No. 3 and No. 4 to the order of the Ministry of Health of the Russian Federation dated November 12, 2021 No. 1053n “On approval of the medical documentation form “Certificate of preventive vaccinations against the new coronavirus infection (COVID-19) or the presence of medical contraindications to vaccination "and the procedure for its issuance, the medical documentation form "Medical certificate of preventive vaccinations against the new coronavirus infection (COVID-19) or medical contraindications to vaccination and (or) past illness caused by the new coronavirus infection (COVID-19)" and the procedure for its administration , as well as the form “Certificate of preventive vaccinations against the new coronavirus infection (COVID-19) or medical contraindications to vaccination and (or) past illness caused by the new coronavirus infection (COVID-19)”

1. In Appendix No. 3 to the order:

a) in section 2, from the title of the column “Duration for which temporary medical contraindications are established,” the word “temporary” should be deleted;

b) add section 4 with the following content:

"4. Information on positive test results for the presence of antibodies (immunoglobulin G) to the causative agent of the new coronavirus infection (COVID-19) (if available)

2. In Appendix No. 4 to the order:

a) in paragraph 1:

The first paragraph should be supplemented with the words:

“, and information about positive results of tests for the presence of antibodies (immunoglobulin G) to the causative agent of the new coronavirus infection (COVID-19) (by any of the methods) (hereinafter referred to as the antibody test), contained on the Unified Portal.”;

footnote 4 to the first paragraph shall be considered footnote 1;

Paragraph two should be stated as follows:

“The medical certificate is generated in Russian and English no later than 3 calendar days from the date of entering information into the information resource about completion of vaccination against the new coronavirus infection (COVID-19) or medical contraindications to vaccination against the new coronavirus in accordance with the instructions for use of the drug infection (COVID-19) and (or) previous illness caused by a new coronavirus infection (COVID-19). A medical certificate containing information about positive antibody test results is generated once if the specified information is available on the Unified Portal no later than 3 calendar days from the date the citizen submits an application using the Unified Portal.”;

b) paragraph 2 should be supplemented with words

“, or the presence on the Unified Portal of information about a positive antibody test result”;

c) in paragraph 3:

subparagraph 1, after the words “date of occurrence of the event”, add the words

“or the presence on the Unified Portal of information about a positive antibody test result”;

in subparagraph 5:

subparagraph “a” should be supplemented with the following sentence: “This section can also be formed on the basis of information about a positive result of a test for the presence of the causative agent of a new coronavirus infection (COVID-19) using the polymerase chain reaction method (hereinafter referred to as the PCR test), confirmed by a positive test result for antibodies, in this case, in the column “Date of diagnosis” the date of the PCR test is indicated, the column “Date of recovery (if any)” is not filled in, in the column “Name of medical organization” the name of the medical organization that conducted the study is indicated;”;

add subparagraph 6 with the following content:

"6) in section 4:

a) the relevant columns indicate information about positive antibody test results, including the record number of the person who has a positive antibody test result on the Unified Portal, the date of the study, the test method, the name and manufacturer of the medical device used for the study, name of the medical organization that conducted the study;

b) the information in this section is generated once on the basis of a citizen’s application submitted on the Unified Portal, in the event that there is no medical certificate on the Unified Portal containing information about preventive vaccinations against the new coronavirus infection (COVID-19) or a previous illness caused by the new coronavirus infection ( COVID-19). Re-generation of a medical certificate containing the information specified in subparagraph “a” of this subparagraph is not carried out.”

About prepayment codes

In general, when receiving or transferring payment (partial payment) for upcoming deliveries of goods (work, services), property rights, as a rule, the code “02” is entered. An exception according to the Order of the Federal Tax Service of Russia No. ММВ-7-3 / [email protected] is the case of payment (transfer) of an advance payment:

- based on a commission agreement (agency agreement - if the agent performs actions on his own behalf (code “05”);

- for transactions performed by tax agents listed in Art. 161 of the Tax Code of the Russian Federation (code “06”);

- for the operations listed in clauses 3, 4, 5.1 of Art. 154, in paragraphs 1 – 4 of Art. 155 of the Tax Code of the Russian Federation (code “12”).

By Order of the Federal Tax Service of Russia No. MMV-7-3/ [email protected] o.

This order directly states that upon receipt (transfer) of an advance payment for transactions carried out on the basis of commission agreements, agency agreements providing for the sale and (or) acquisition of goods (works, services), property rights on behalf of the commission agent (agent) or for based on transport expedition contracts, the code “02” is entered. Code “12” is also canceled, as is code 11, as we pointed out above. Both codes reflected the same transactions, but code “12” related to prepayment in respect of these transactions. But the operations listed in paragraphs. 1 – 4 tbsp. 155 of the Tax Code of the Russian Federation, now instead of code “11” they are reflected using a new code – “14”. But for prepayment for such operations, a separate code will not be provided. That is, the said prepayment will generally correspond to the code “02”.

As before (as an exception), the code “06” will remain, that is, prepayments made by tax agents will correspond to this code, and not “02”. But additionally, as an exception, the code “28”, which was mentioned above, is also mentioned.