If you are interested in switching to simplified taxation, you probably know about the advantages of this tax system. The problem is that you can switch to the simplified tax system in strictly defined periods:

- within 30 days after registration of an individual entrepreneur or company;

- from January of the new year.

This procedure for starting to apply the simplified taxation system is established by Article 346.13 of the Tax Code of the Russian Federation.

Free tax consultation

Is it possible to switch to the simplified tax system in the middle of the year?

Taking into account the above, the general rule is this: a newly registered organization or individual entrepreneur can switch to the simplified tax system in the middle of the year.

And the very concept of “middle of the year” is conditional here, because a new business can submit a notification about the transition to a simplified system at the very end of the year or at the beginning. The main thing is to comply with the deadline of 30 days after registration.

For example, if an individual entrepreneur registered on November 20, then he can switch to the simplified tax system within the next 30 days. But if the entrepreneur did not know about this, then the next time he will have the opportunity to transfer from the beginning of the new year. You just need to remember to submit a notice of transfer no later than December 31 of the current year.

It is worse if an LLC or individual entrepreneur is registered at the very beginning of the year, for example, in January-February, and the 30-day deadline for submitting a notification is missed. Then you will have to wait almost a whole year for the right to the simplified tax system.

How to switch to UTII

Submit a tax application within five working days from the date from which you began to conduct the imputed activity.

For organizations, the application form is UTII-1, for individual entrepreneurs - UTII-2.

For now, the question remains controversial from what date to count 5 days if current activities are transferred to UTII. After all, in fact, you have already started it and 5 days have passed since the beginning. The Ministry of Finance writes in its letter:

If interpreted literally, the application must be submitted within 5 days after you yourself decide to switch to UTII. To be completely sure, we advise you to clarify this point with your tax office.

Individual entrepreneurs on NPD can switch to the simplified tax system in the middle of the year if restrictions are violated

However, for individual entrepreneurs there is one opportunity to switch to the simplified tax system within a year. To do this, after registration, an individual entrepreneur must switch to paying tax on professional income.

The NAP regime has several important restrictions, in particular, on annual income - no more than 2.4 million rubles. You also cannot hire workers or engage in many types of activities. If an individual entrepreneur on an NPD violates the terms of application, he loses the right to this regime.

Only in this case can an entrepreneur submit a notification to the simplified tax system without waiting until the end of December. At the same time, you must inform about the choice of a simplified program within 20 days after losing the right to NAP.

But if you voluntarily waive the tax on professional income, the individual entrepreneur will find himself on the general system with the highest tax burden. This was the answer given by the Federal Tax Service on its website.

Features of the transition to the simplified tax system when combined with the PSN

Individual entrepreneurs have another special regime - PSN. An individual entrepreneur patent is issued for a specific type of activity and is valid from one to several months.

Is it possible to switch from a patent to the simplified tax system in the middle of the year? Yes, but if the individual entrepreneur announced in advance the choice of a simplified regime. How does this happen in practice?

Let’s assume that the entrepreneur did not submit a notification to the simplified tax system after registration, so he is recognized as a payer of the general taxation system. Moreover, at any time of the year he can apply for a patent and pay taxes for a specific type of activity within the framework of the PSN. If the individual entrepreneur violates the terms of application of the patent or its validity period expires, then the business remains to work on OSNO.

If, immediately after registration, the entrepreneur announced the choice of a simplified system, but at the same time filed a patent, then he combines two modes: simplified tax system and PSN. In this case, if the terms of application of the patent are violated, the individual entrepreneur loses the right to the PSN and remains only on a simplified basis. This is stated in paragraph 6 of Article 346.45 of the Tax Code of the Russian Federation.

In a letter dated June 29, 2017 N SD-4-3/ [email protected] , the Federal Tax Service described how to switch from a patent to the simplified tax system in the middle of the year if the terms of the patent tax system are violated. In this case, the tax is recalculated within the simplified tax system from the date of issue of the patent.

Moreover, if the individual entrepreneur has already paid the cost of the patent or part of it, then this amount is taken into account when calculating the simplified tax. To reflect these amounts in the new declaration under the simplified tax system, special fields have been provided.

Is it possible to close and reopen within a year to switch to the simplified tax system?

Some individual entrepreneurs are trying to find a workaround to switch to a simplified system within a year.

If the notification to the simplified tax system was not submitted within 30 days after registration, you must close the individual entrepreneur and register again. And already on the second attempt, be careful and not miss the 30-day deadline for switching to the simplified version. Is it possible to do this?

Formally, this situation does not violate the law, because repeated registration of individual entrepreneurs by the same person within a year is not prohibited. And Article 346.13 of the Tax Code of the Russian Federation does not contain any special conditions for the transition to the simplified tax system for such re-registered entrepreneurs. This means that the general procedure for submitting a notification for simplified registration applies to them - 30 days after registration of an individual entrepreneur. And it doesn’t matter what the score is throughout the year.

However, the Federal Tax Service does not agree with this, believing that if the entrepreneur re-registers within a year, he has no real intention to stop the business. He has one goal - to reduce the tax burden, bypassing the provisions of the Tax Code of the Russian Federation.

Here, of course, one can argue. It’s one thing when several days passed between the closure and subsequent opening of an individual enterprise. What if six months have passed? Or did the first attempt to start a business fail, and literally 2-3 months later a new idea appeared and the person decided to try again?

But, for example, there is a ruling of the Supreme Court dated June 30, 2015 No. 301-KG15-6512, which considered the following case. The individual entrepreneur closed and reopened within a year with the goal of not even switching to the simplified tax system, but only to change the object of taxation: from Income to Income minus expenses.

At the request of the Federal Tax Service, the court saw signs of tax evasion here, because under the simplified tax system for income this entrepreneur would have paid more to the budget than under the simplified tax system for income minus expenses. Therefore, the individual entrepreneur was left in the same regime that he used before the closure, that is, the simplified tax system for income.

So switching to a simplified system through closing and opening individual entrepreneurs within a year is a risky option. And if the Federal Tax Service suspects tax evasion here, fines cannot be avoided. But, of course, everything is very individual, so it cannot be denied that in practice such a situation may go unnoticed.

But this option is suitable, even purely theoretically, only for individual entrepreneurs. If you have registered an LLC, then it cannot be closed so easily. Liquidation of a company that has no debts and problems with reporting will take more than two months. And there are even more problematic companies. In this case, it is easier to wait until the beginning of the new year to switch to the simplified tax system.

Of course, you can open another LLC and immediately switch to the simplified tax system. Just don’t use it in dubious schemes to generally reduce the tax burden of a business, because the Federal Tax Service is well aware of all these methods.

Additional conditions for the transition to the simplified tax system for an operating business

When switching to the simplified tax system for an already operating business, it is not enough to wait until the beginning of the next year to submit a notification. It is important to ensure that the organization complies with the established limits:

- income for nine months of the year in which the application for the simplified tax system is submitted does not exceed the values specified in Article 346.12 of the Tax Code of the Russian Federation;

- the residual value of fixed assets as of October 1 of the year of filing the notification does not exceed 150 million rubles.

The starting value of the income limit for nine months is 112.5 million rubles, but an annual deflator coefficient is applied to this amount. In 2022, its value is 1.032 (Order of the Ministry of Economic Development dated October 30, 2020 N 720). Taking this into account, the transition to the simplified tax system from 2022 is possible if the LLC’s income for nine months did not exceed 116.1 million rubles.

Requirements regarding income limits and the value of fixed assets do not apply to individual entrepreneurs. However, both organizations and individual entrepreneurs planning to switch to the simplified tax system must comply with another limit - no more than 130 employees.

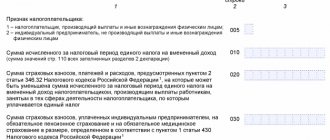

Notification about the transition to "simplified"

To notify the Federal Tax Service of the transition to the simplified tax system, a company or individual entrepreneur must fill out a special notification in form No. 26.2-1. Its form is recommended by order of the Federal Tax Service of Russia dated November 2, 2012 No. ММВ-7-3/ [email protected] (Appendix No. 1).

If the taxpayer has previously submitted such an application and has not been deregistered as a payer of the simplified tax system (for example, when combining the simplified tax system with UTII), there is no need to notify the tax authorities again.

The document can be sent to the Federal Tax Service by mail (by a valuable letter with a list of attachments), via electronic communication channels, or delivered in person.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

conclusions

- The tax period under the simplified system is a calendar year, during which accounting rules specific to this system apply.

- In general, you cannot switch from OSNO to simplified tax system in the middle of the year.

- Closing and reopening an individual entrepreneur within a year just to change the taxation system is risky. The Federal Tax Service may accuse an entrepreneur of tax evasion and fine him.

- If the right to NAP is lost, the entrepreneur can switch to the simplified tax system within a year. Organizations do not have such an opportunity.

- To switch to the simplified tax system, in the general case, notification form 26.2-1 is used. But individual entrepreneurs who have lost the right to NAP must submit another notification - from the letter of the Federal Tax Service dated December 20, 2019 No. SD-4-3 / [email protected]

- An individual entrepreneur who combines the simplified tax system and the PSN can completely switch to the simplified system if he has violated the terms of application of the patent. However, you cannot simply switch from a patent to the simplified tax system if a notification has not been submitted in advance. In this case, you need to wait until the beginning of next year.

- If an already operating organization plans to switch to a simplified taxation system, it is necessary to ensure compliance with the limits on income for nine months and the residual value of fixed assets.

How does the tax regime change from OSNO to simplified tax system?

So, the first thing a taxpayer must do to switch from the OSNO to the simplified tax system is to submit a notification to the Federal Tax Service at the location of the organization or the registration address of the individual entrepreneur before December 31 of the year preceding the year in which the simplified tax system began to be applied.

A profit and loss statement, balance sheet, and list of employees are attached to the notification.

Since the “simplers” replace income tax, property tax and VAT with a single tax, there is a need to create a transition period.

The following rules apply to enterprises that used the accrual method when determining the tax base (hereinafter - NB) for income tax (Article 346.25 of the Tax Code of the Russian Federation):

- The NB on the date of transition to the new regime includes advance payments received before the transition, if counter-execution was made after the transition.

- The “simplified” National Bank does not take into account income or expenses already taken into account for income tax.

- Expenses incurred before the transition to the simplified tax system are used when calculating the NB “income minus expenses”, but depending on the moment of their payment (before or after the transition), they are recognized, respectively, either at the time of implementation or at the time of payment.

- For the purposes of the simplified tax system, unaccounted income on debt obligations concluded under OSNO is taken into account (letter of the Ministry of Finance of Russia dated July 11, 2014 No. 03-03-06/1/33868).

- If the organization used the cash method of NB accruals, these rules do not apply (see letter of the Ministry of Finance of Russia dated 03/07/2012 No. 03-11-09/12).

In the fourth quarter of the tax period before the year of using the simplified tax system, you can obtain a VAT deduction from advances for goods or services that will be received after acquiring the status of “simplified”, for fixed assets and intangible assets (clause 5 of article 346.25 of the Tax Code of the Russian Federation).