The posting of goods is a standard operation in a trading organization. However, when it is reflected in the 1C 8.3 program, there are many nuances.

From the article you will learn:

- how to capitalize goods in 1C 8.3;

- How does a warehouse affect the posting of goods in 1C?

For more details, see the online course: “Accounting and tax accounting in 1C: Accounting 8th ed. 3 from A to Z"

Attention! The VAT rate has been changed from 01/01/2019 from 18% to 20% and from 18/118 to 20/120.

The essence of the concept

An object is understood as any commodity-material product, or rather, value. Inventory and materials are actually a set of goods, and they do not necessarily have to be aimed at selling to the target client. This could be materials, for example. Which will be required for the production or repair of the site. Or equipment designed for work, employee ammunition and much more.

Therefore, any acceptance requires registration, which is designed to identify the number of valuables received, specifics about them, and compliance with invoices. This prevents loss, theft and other reasons for shortage. Accounting is carried out through specialized documents that relate to the field of accounting. After the work has been done correctly, based on the reporting, it is permissible to conduct an inventory and identify shortages or surpluses.

So, in essence, the posting of products is their acceptance and registration. It is these two stages that the operation is often divided into. Reception is carried out by employees authorized in accordance with their official powers. Often this person is called the storekeeper and his assistants. But sometimes this role is taken on by a third party who, on the basis of a power of attorney, acts on behalf of the supplier or company.

Decor

To account for and register the valuables received at the site, we will need to formalize them using several documents. These tasks are greatly simplified by the program, as well as various integrated services that you can find on the Cleverens website.

- Invoice. Moreover, in two copies, since one is accompanying, and the second is reporting. It is certified upon arrival, when the actual reconciliation takes place. The presence of all the values that were declared, their codes and details, and names are revealed. The paper also indicates the price of each individual product and their total cost. And a tax in the form of VAT, which accompanies the sale of each individual unit. As soon as the reconciliation is completed, both parties put their signatures on the invoice.

- Invoice. It is worth knowing that an account is not needed for those companies that operate on a simplified basis. That is, a simplified form of taxation. For the rest, it will allow them to return part of the spent financial resources that went to cover VAT.

- Waybill. This is already a paper that describes all aspects of transportation. It also helps to make a correct calculation for transportation of an object from the previous location to the current one.

There is also another option on how to properly capitalize goods in 1C. This is a UPD design. The abbreviation stands for universal transfer document. Its essence is that it combines both a delivery note and an invoice. Accordingly, when working with it, there is much less red tape, and the process is much simpler. But Russian legislation does not force anyone to use this particular form. Of course, this is simpler and better, but the company has the right to use the old regime with several documents.

Receipt of goods: registration of the operation

Capitalization is two combined operations: the actual receipt of goods and materials and the primary accounting of received assets. Acceptance is usually carried out by a financially responsible person (for example, a storekeeper) or a person with authority under a power of attorney issued by the company, in the presence of a representative of the supplier (unless other conditions are agreed upon).

The release of goods and materials by the supplier company is accompanied by primary accounting documents:

- waybill (in 2 copies) – a document that records the details of both parties to the transaction, the names of the goods supplied, their quantity, price, total cost, VAT. During the acceptance of goods and materials, the compliance of the values stated in it and those actually accepted is checked. Upon completion (if no inconsistencies or defects are found), the information in the invoice is certified by the signatures of representatives of the supplier and buyer, and a seal. A delivery note is a universal document: for the seller it is consumable, and for the buyer it is a document accompanying the receipt of goods;

- invoice – a mandatory document if the supplier pays VAT. An invoice makes it possible to recover VAT on purchased goods. Companies that apply simplified special tax regimes do not work with this tax and have the right not to draw up an invoice, and when receiving goods and materials from a supplier using OSNO, not to accept VAT for reimbursement;

- a consignment note used to formalize the transportation of goods and record payments for their transportation.

The posting of goods to a warehouse is often accompanied by a universal transfer document (UDD), which is a form that combines a delivery note and an invoice and, accordingly, replaces them. UPD came into force in 2013, but is not mandatory for use. Companies are allowed to decide independently whether to draw up two traditional documents or replace them with one UPD, the use of which greatly simplifies the procedure for receiving and transferring inventory items.

For the goods and materials received on the invoice, the storekeeper prepares a capitalization - an acceptance certificate of the TORG-1 form and a product label of the TORG-11 form, where all items of goods are recorded. In case of discrepancies with the invoice or defects identified during receipt of goods and materials, a report of form TORG-2 is drawn up, which will serve as the basis for filing a claim.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

Shortage of goods upon acceptance. Defective goods

If the goods were delivered to you, but something was forgotten, then those lines for which there are no goods are crossed out in the invoice. Each such action is confirmed by the signature of the person who accepts the goods at the warehouse or store. And don't forget about adjusting the invoice.

If the quality of the goods differs from what is specified in the contract or accompanying documents, you need to refuse it and draw up a report on the discrepancy in quantity and quality in the TORG-2 form for domestic goods, or in the TORG-3 form for imported ones. The form is filled out by the financially responsible person in the presence of a representative of the supplier company, and with his consent, an act can be drawn up even in his absence.

If for some reason you need to return a product of proper quality, you need to fill out a TORG-12 invoice form. It is advisable to record the supplier's agreement to this in writing. For example, in the form of concluding an additional agreement to a sales contract or a separate agreement on the return of goods. They indicate the quantity and value of the goods being returned, as well as the reason for the return.

Accounting for receipt of valuables: postings

Let's see what acceptance of inventory items looks like.

| Action | D.T. | K.T. |

| Prepayment that has already been sent. The condition is present only if the supply contract implied it initially | 60 | 50 |

| Capitalized products | 41 | 60 |

| Value added tax | 19 | 60 |

| Expenses incurred due to transportation | 41 | 60 |

| Shipping tax | 19 | 60 |

| Total payment | 60 | 50 |

| Full VAT | 68 | 19 |

It is also worth taking into account the possible situation when some of the products received for verification are in poor condition. There is damage, storage conditions have been violated, etc. Such products are considered defective and cannot be accepted on a general basis. Accordingly, accounting proceeds somewhat differently.

| Action | D.T. | K.T. |

| Return of defects | 60 | 41 |

| Refund of paid tax | 60 | 19 |

| Recovering VAT costs | 60 | 68 |

| Return of funds spent on purchase | 51 | 60 |

Accounting example

Let's see how the adoption goes as usual. More precisely, what the completed table looks like.

| Operation | D/t | K/t | Sum |

| Advance payment to Crocus LLC in the amount of RUB 500,000. | 60 | 51 | 500 000 |

| Receipt of goods to the warehouse of Trend LLC | 41 | 60 | 1 000 000 |

| VAT charged | 19 | 60 | 180 000 |

| Delivery costs | 41 | 76 | 60 000 |

| VAT on transportation | 19 | 76 | 10 800 |

| Payment of the remaining amount for delivered goods | 60 | 51 | 680 000 |

| Delivery payment | 76 | 51 | 70 800 |

| VAT deductible | 68 | 19 | 190 800 |

| Undeclared goods must be returned to the supplier | 68 | 41 | 100 000 |

| Before shipment they are taken into account on the balance sheet | 60 | 68 | 100 000 |

| VAT recovery | 002 | 18 000 | |

| Shipment of undeclared goods and materials to the supplier | 002 | 100 000 | |

| Refund to bank account | 51 | 60 | 118 000 |

Accounting records for goods receipt

We figured out how to receive goods without documents. After receiving the goods acceptance certificate, the accountant must reflect it in accounting. Let's look at how this is done in practice.

Example:

LLC "Zagadka" entered into an agreement with LLC "Lesnoy Dom" for the supply of goods. The contract stipulates the transfer of rights at the time of its actual transfer to the buyer. On January 20, 2021, goods without accompanying documentation arrived at the warehouse of Riddle LLC. Appendix No. 1 to the contract (specification) sets the cost of the goods at 30,000 rubles, including VAT at 5,000 rubles. Documents for this delivery were received from Lesnoy Dom LLC on February 10, 2022. At this time, the product was not sold. By agreement of the parties, the cost of the goods was increased by 1,000 rubles, including VAT of 166.67 rubles. On February 11, 2021, the goods received were paid from the current account.

On January 20, 2022, the accountant of Zagadka LLC must make the following entries in the accounts:

Dt 41 subaccount “Uninvoiced deliveries” Kt 60 - goods from Lesnoy Dom LLC were capitalized in the amount of 25,000 rubles.

Dt 19 Kt 60 - VAT is reflected in the amount of 5,000 rubles.

Read how to take into account input VAT under the simplified tax system here.

Accounting entries on February 10, 2022:

Dt 41 Kt 60 - the cost of the goods according to the documents of Lesnoy Dom LLC was clarified in the amount of 833.33 rubles.

Dt 19 Kt 60 - reflected VAT in the amount of 166.67 rubles.

Dt 41 Kt 41 subaccount “Uninvoiced deliveries” - RUB 25,833.33. — reflects the transfer of goods from the category of uninvoiced delivery to goods confirmed by primary documents.

Dt 68 Kt 19 - accepted for deduction of VAT in the amount of 5166.67 rubles (5,000 rubles + 166.67 rubles).

Accounting entries on February 11, 2022:

Dt 60 Kt 51 - goods received were paid from the current account in the amount of RUB 31,000.00.

Note that if the documents from the supplier were received after the sale of the goods (or not in the year of their receipt), the cost of delivery can be adjusted through invoice 91.

Find out how to keep track of incoming VAT from our material “How to keep track of VAT on purchased assets.”

If the contract does not establish the cost of the purchased goods, then the received inventory items can be taken into account at market prices. And after payment documents are received from the supplier, it is necessary to make adjustments in accounting.

What should I do if documents for uninvoiced supplies are received after the annual reporting has been approved? The answer to this question is in ConsultantPlus. If you do not have access to the system, get a trial demo access to K+ for free.

Methods

There are only two methods by which goods and materials can be accepted. But these operations are very difficult for a new employee. After all, the reception is accompanied by a lot of different information. And if you enter it all and check it, then a huge array of factually unnecessary information will accumulate. And the work will take a long time. Therefore, it is customary to record only key information. This includes the name, quantity, price, VAT and other data. But related information is often simply not noted.

Let's return to the methods. The first of them transmits the entire layer of information through documents. Then the work is greatly simplified. You just need to enter the received data. After all, in essence, posting goods to a warehouse in 1C, what is it, is just an automated procedure for filling out tons of forms, entering information in various fields. The employee carries out a reconciliation, notes the necessary actions, and the smart system does everything further on its own.

And the second way: without accompanying documents. Then you will have to identify all the information manually, as well as enter it. Thus, the procedure will be complicated tenfold, and the registration period will be approximately delayed. It is worth doing your best to avoid receiving goods and materials that cannot acquire accompanying papers.

This is not only unprofitable, but also threatens with serious shortcomings. After all, the human factor comes into play. An employee is capable of making mistakes, which will lead to an incorrect assessment. Accordingly, there will be a shortage ahead, which will be revealed during the inventory.

The second method of accepting surpluses for accounting

This section will also discuss several options for entering information on the capitalization of inventory items.

Presumable situation: a chocolate bar was found in a store warehouse, fallen behind a rack. According to the accounting data, she is not listed. It is necessary to capitalize it. Moreover, the expiration dates are within normal limits. In addition, other chocolate bars from this supplier have been sold in the store for a long time.

In 1C 8.3, in the “Warehouse” menu, select the “Inventory” - “Positioning of goods” section. Using the “Create” button, the “Receipt of goods” opens, where the following fields are filled in:

- organization,

- stock,

- income item.

Due to the fact that the check has not been carried out, the Inventory field is not filled in yet.

In the tabular section, use the “Selection” button to select “Chocolate” and set the quantity, price, and amount.

The document is recorded using the button of the same name. In the “Inventory” field, click the selection arrow, thanks to which the inventory log appears. In it, by clicking the “Create based on” button, select “Posting of goods”. After this, on the basis of the opened act, the “Inventory of goods” form is mechanically created. This inventory is subsequently supplemented with information about the commission, etc.

Next, the “Receipt of goods” form, after filling in all the fields, clicks on the “Post and close” button and closes.

Another option for taking surplus into account: the check was carried out, but inventory items were not recorded at the same time.

In this case, as described above, the “Product Receipt” form opens. Data about the organization and warehouse are entered in the header, and the income item “Capitalization of surplus” is also selected here.

In the “Inventory” line, the act on the basis of which the products are received is noted. Click the “Fill” button to select “Fill according to inventory”. After which the tabular part of the form about the accounting object is filled out.

Finally, click the “Post and Close” button to post and close the document.

Completeness and correctness of the procedure

For the process to proceed correctly, two main factors are necessary. The first is experienced and skillful employees who can easily cope with their official responsibilities. The second is suitable software. After all, we are talking about how to post goods in 1C. An excellent choice would be the “Warehouse” version or other complex products that include this configuration. The difficulty lies in the fact that such software must not only be purchased, but also integrated into the system. Roughly speaking, adapt to current conditions, to the specific features of the selected enterprise. And this task can be handled by auxiliary programs that significantly expand the functionality. You can purchase this entire array of utilities from Cleverence; we are always happy to offer effective services.

- Standard solutions for enterprises.

- Universal boxed products.

- Programs adapted to Russian legislation that will work in strict accordance with the law.

And for employees who are going to carry out the process themselves, there are also several important recommendations.

- Quantity comes first. The very first step should always be to reconcile the quantitative factor. This makes it easier to carry out all the other stages, no matter how you distribute them.

- Do a spot check. It is better to open several boxes right on the spot, randomly checking the quality. If any complaints arise, it is better to resolve this issue with the supplier at the preventive stage. Otherwise, the task may become much more difficult later. Once signatures have been placed on the invoices, filing a claim will become difficult.

- Distribute the received inventory items in the room in exact accordance with their numbers. To simplify further search, inventory, movement and dispatch to points of sale.

Working with imports

A lot of new variables appear that did not exist before. For example, compliance with international standards, which sometimes contradict current Russian legislation. Currency also becomes an important aspect, because valuables were purchased with it, and the full cost is calculated in rubles. That is, you need to convert at the current rate. This means that at a minimum there should be prompt access to it. After all, quotes are constantly changing.

This means that your software must initially be adapted to such conditions and have an import processing function. Otherwise, you will have to keep your own records for each line or product item. Which is long and problematic. In addition, you need to specify the basis for the posting of imported goods. And the taxation system is also capable of undergoing changes.

In principle, when any material value is not produced on the territory of the Russian Federation, it is not subject to the standards that exist in our country. At the same time, others are presented. If they are similar or identical, there will be no problems, but in cases of discrepancy, troubles are quite possible. Storage conditions also raise questions. After all, the path that an object will take is usually very long. And during this period, damage and the appearance of defects are quite possible. And the supplier, who did not discover this in advance, will try not to write off this defect, but to pass it on so that he does not have an unnecessary headache. Therefore, the check must be more thorough.

How to write off and capitalize goods in 1C, step-by-step instructions

Now we will use a specific example to analyze in detail how this mechanism works. And we will clearly show that there is no particular difficulty here. If you choose well and correctly integrate the software into your own accounting system. It is worth considering many elements, distributing the price, identifying the type of documentation, etc.

Setting up the program

First of all, you need to understand that in the program there are several types of warehouse options.

- Wholesale, where products are supplied primarily.

- ATT. Automated point of sale. A standard store where goods are sold. Based on the operation of a cash register that keeps records.

- Manual point. Each sale is not tracked, only a general report is generated for the selected period.

It is also important to set a value expression for assessing the benefit. There are two main options. The first is at the price for which the value was purchased. That is, total costs, taking into account all expense items. The second is the cost of implementation. And by all logic it should be larger. Otherwise, commercial activity will be unprofitable.

Receipt at the wholesale warehouse

A specific electronic document is generated, which looks like an invoice. After all, the posting of goods, what does this mean – the transfer and automation of real registration into the electronic sphere. But the document flow is still identical.

We indicate the invoice number and select the type of warehouse option. We also fully enter the information into the nomenclature. This is all the data discussed above. Price, total cost, quantity, name, VAT.

The generated accounting is saved and from that moment becomes a real document, which in fact already has legal force. It is this that will be relied upon during an inventory or other kind of inspection.

Postings

To make it clear, posting recognizes a recorded action. A document in electronic form that is entered into the information field of the program. It consists of a receivable and a creditor part. It also contains all the information that may be needed for high-quality identification of the object.

Retail receipts

There are no significant differences in this aspect. But we need to focus on pricing. And also understand that a specific point of sale does not make a difference. Whether it is an automated or non-automated point, the procedure remains identical.

Let's see how the system works with different cost formations.

At cost

Used in most cases when it comes to deferred sales. When a specific transfer to another department has not yet been planned and the price list on the counter in the future may still change its original value quite well.

By selling price

It is important to take into account such a concept as trade margin. This amount is formed if the correct data was initially transferred to the program. That is, upon receipt, the price is set at the cost of sales. But if cost data was entered, it will not be calculated automatically. And you will have to spend extra time on this. And this is always very inconvenient.

Therefore, at all stages it is worth focusing on the final price of the product. After all, what does posting of goods mean? Generating reporting for subsequent actions. Not only checking the availability of receipts, but also correctly entering them into the general database.

Documentation

To begin with, it is worth installing a unified document management system. By default, the M-4 form is used for admission. It is this that is considered the main one for the program. Compilation lies on the shoulders of the subject, that is, the person who draws up the values. Thus, this is a storekeeper or someone else from the staff replacing him in this position. And also the workers who actually physically perform the loading - loaders.

How to capitalize retail goods in 1C

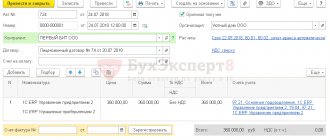

Capitalization of goods at acquisition cost

The organization entered into an agreement with the supplier Riviera LLC for the supply of goods in the amount of 300,900 rubles.

On March 22, the goods were received into the warehouse and accepted for accounting:

- Roller blind “BLACKOUT FIBER” – 50 pcs. at a price of RUB 2,950. (including VAT 18%);

- Thread curtains “Africa” – 100 pcs. at a price of RUB 1,180. (including VAT 18%);

- Blinds “Plastic (white)” – 20 pcs. at a price of RUB 1,770. (including VAT 18%).

The receipt of goods to the warehouse at the cost of purchase is processed in the same way as the receipt of goods to the wholesale warehouse. Only goods accounting accounts for a retail warehouse are automatically established - 41.02.

In this option, it does not matter whether the goods are received in ATT or NTT.

Capitalization to a retail warehouse in 1C 8.3 is completed with the document Receipt (act, invoice) transaction type Goods (invoice) in the section Purchases - Purchases - Receipts (acts, invoices) - button Receipt - Goods (invoice).

Postings

Receipt of goods at sales price

The organization entered into an agreement with the supplier Riviera LLC for the supply of goods in the amount of 649,000 rubles.

- Fabric “Jacquard Sylvia” – 1,000 pcs. at a price of 177 rub. (including VAT 18%);

- Fabric “Blackout Scarlett” – 1,000 pcs. at a price of 472 rubles. (including VAT 18%).

On March 22, the goods were received into the warehouse and taken into account at their sales price.

Sales price as of 05/01/2018:

- Fabric “Jacquard Sylvia” - 236 rubles. (including VAT 18%);

- Fabric “Blackout Scarlett” - 826 RUR. (including VAT 18%).

If the accounting policy provides for a method for valuing goods in retail By sales value , then upon receipt of goods the retail price for the received goods must initially be set, and then its receipt must be formalized. This must be done in order for the 1C program to calculate the trade margin.

You can set the retail price in 1C using the document Setting item prices in the section Warehouses - Prices - Setting item prices.

Capitalization to a retail warehouse in 1C is completed with the document Receipt (act, invoice) transaction type Goods (invoice) in the section Purchases - Purchases - Receipts (acts, invoices) - button Receipt - Goods (invoice).

Accounting accounts in the document are not specified by the user, but are determined automatically when posting the document according to the Warehouse Type :

- Retail store (ATT) - 41.11 “Goods in retail trade (in ATT at sales price)”;

- Manual point of sale (NTP) - 41.12 “Goods in retail trade (in NTT at sales value).”

If goods are received at the NTT warehouse, then the Receipt document (act, invoice) may not display the Nomenclature , but simply indicate the total amount of goods received and their retail value.

This situation is regulated by the Retail Goods Accounting setting.

Postings

The difference between the cost of sales and the cost of acquisition will be reflected in Kt 42.01 (42.02).

We have shown step by step how to post goods in 1C 8.3.

Test yourself! Take the test:

- Test. Purchasing goods from a separate division with delivery costs included in their price

- Test. Accounting for delivery costs of purchased goods, which are accounted for separately and are not included in their cost

- Test. Typical scheme for purchasing goods in wholesale trade in 1C

conclusions

Now we know what the posting of goods in 1C is.

This is a very convenient procedure that simplifies the original, classic version tenfold. In fact, you don’t need to carefully fill it out, because the automatic system will do everything itself using a standard script. And what is more important, she will not make mistakes and will always enter information completely correctly. If necessary, it will identify a shortage, create a request for a refund, or take any other action. The benefits are obvious. All that remains is to select the specific software, or rather, the version, as well as the company that will carry out the integration and supplement this package with auxiliary utilities that allow you to control the entire mechanism from one device. And various boxed offers from Cleverens do an excellent job of fulfilling this role. Number of impressions: 23023