Income tax is the main payment for large and medium-sized businesses, as well as some small companies that have not switched to special regimes. This is a direct tax that legal entities pay on what they earn. Let's look at the nuances of determining the base for its calculation, the payment procedure and the rates in force in 2022.

What is income tax

This direct tax is levied on legal entities, and it is calculated from the amount of final profit generated at the end of the reporting period - from the profitability of the institution obtained after deducting the expenditure part. Collection operations are regulated by Chapter 25 of the Tax Code of the Russian Federation.

Legal entities are required to deduct a certain percentage of their income and send this amount to the budget system of the Russian Federation. Calculating income taxes in 2022 is an example of a critical operation that an accountant must perform correctly. If the fee is calculated with errors, the organization faces penalties from the Federal Tax Service. Our material provides up-to-date information: income tax - calculation, example for dummies, formula and calculation procedure.

So, the payers of the fee are legal entities that receive profit and are subject to the general taxation regime. Foreign enterprises (including those working through Russian representatives) conducting business on the territory of the Russian Federation and receiving income from financial and economic activities in the Russian Federation are required to pay tax. We will demonstrate with an example how to calculate the income tax of an organization that pays the fee.

By law, these categories of taxpayers are exempt from paying tax:

- institutions under special tax regimes (simplified, UTII, Unified Agricultural Tax);

- individual entrepreneurs;

- gambling companies;

- organizations taking part in preparations for large-scale events of national importance (for example, enterprises involved in preparations for the World Cup in Russia).

How is current income tax reflected in accounting?

Maintaining correct accounting is the key to ensuring that taxable profit according to tax regulations and accounting accounting will coincide. The given accounting formula for the current income tax represents the sum of the data in the accounting accounts. The correctness of tax reflection in accounting can be checked.

Conditional expenses (income) are reflected in a separate subaccount of account 99. To control the data, they are checked against the turnover in this subaccount. To control PND and PNR, a separate sub-account is also opened for account 99. A negative difference between the sub-account turnover is shown by PND, and a positive difference - PNR.

IT represents the difference in debit and credit turnover on account 09; according to IT, account 77 provides the same information.

Current income tax is reflected in the income statement on line 2410.

A new form for the financial results report has been prepared, which will be relevant starting with the reporting for 2022. In addition to the usual current income tax, it takes into account the so-called deferred income tax. According to the legislator, this is the total change in IT and IT, except for transactions not included in the calculation of accounting profit. Deferred and current income taxes in the new form amount to the amount of income taxes for the period.

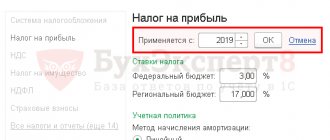

Basic rates

Calculate income tax at the rate for 2022 for taxpayers under the general tax regime - 20% of the obtained financial result of the activity. Until 2016, organizations contributed 18% to the regional budget and 2% to the federal budget. Since the end of 2016, a different breakdown by budget level has come into force (Order of the Federal Tax Service of the Russian Federation No. ММВ-7-3 / [email protected] dated 10/19/2016). Now taxpayers transfer 17% to the regional budget and 3% to the federal treasury. Local governments have the opportunity to reduce the tax rate transferred to the treasury of a particular region, but the regional rate should not be less than 13.5%, and the minimum overall rate should not be less than 16.5%.

Let's look at an example of how to calculate income tax for the general tax rate. Each region has established minimum values for certain types of taxpayers. For example, in Moscow, a reduction in the tax burden to 13.5% is confirmed by the Federal Tax Service for enterprises that employ people with disabilities, produce vehicles, or represent special economic zones, technopolises and industrial parks. In St. Petersburg, only those payers who work in the territory of the special economic zone pay a simplified regional contribution of 13.5%.

Some categories of taxpayers pay fees at special rates, the accrued amounts of which are sent exclusively to the federal budget. Special rates apply to the following categories of payers for certain types of income:

- foreign companies that do not have a Russian representative office, producing hydrocarbons and controlled foreign companies - 20%;

- foreign companies without a representative office in Russia pay a tax on income from the rental of vehicles and for international transport - 10%;

- Russian enterprises from dividends of foreign and Russian companies and from dividends from shares on depositary receipts - 13%;

- foreign companies receiving dividends from Russian enterprises and owners of yield on state and municipal securities - 15%;

- companies receiving income from interest on municipal securities and other income, according to paragraphs. 2 clause 4 art. 284 of the Tax Code of the Russian Federation - 9%.

Medical and educational institutions, residents of special economic zones and free economic zones in Crimea and the city of Sevastopol, organizations participating in regional investment projects and operating in the territory of rapid socio-economic development are exempt from paying the fee.

Amounts that allow you to reduce the amount of tax accrued from the base

However, the process of calculating the amount of tax based on the results of the reporting or tax period does not end with the calculation made from the tax base.

This happens primarily because the calculated payment amount also corresponds to the income from which advances have already been accrued based on the results of the reporting periods preceding the current calculation period. Their amounts must be subtracted from current accruals.

In this case, what should be the amount of advances that reduce the tax accrued for the year? This will depend on what frequency for reporting periods (quarterly or monthly) is chosen by the taxpayer and whether monthly payments are made at the end of the quarter:

- When reports are submitted quarterly, the amount of advances will be determined as the amount of tax accrued from the tax base for 9 months of the year and advances calculated based on the results of this period for payment during the 4th quarter. If monthly payments are not calculated, the second term is not used.

- For reports generated monthly, the amount of accrued tax must be taken from the corresponding tax base for 11 months of the year.

That is, in any case, this value is taken according to the tax return compiled for the last reporting period of the year. The amount of tax accrued from the profit received in it is reflected in line 180, and taking into account the breakdown by budget - in lines 190, 200. Information on advances accrued based on the results of 9 months for payment in the 4th quarter can be found in lines 290–310.

Note! The income tax return for 2022 must be submitted using a new form. Comments and an example of how to fill it out were prepared by ConsultantPlus experts. You can view them by getting free trial access to the system.

In addition, the taxpayer has the right to reduce the accrued current payment by the following amounts:

- taxes paid outside the Russian Federation (Article 311 of the Tax Code of the Russian Federation);

- trade tax (clause 10 of article 286 of the Tax Code of the Russian Federation) - only in relation to charges to the regional budget;

- 1/10 of the capital investments giving the right to an investment deduction for accruals to the regional budget (Article 286.1 of the Tax Code of the Russian Federation).

Negative amounts that arise when accounting for accruals on advances form the amount of tax by which the tax authority will reduce tax accruals, as a result of which the taxpayer will begin to be overpaid. Other amounts taken into account in reducing accruals can only reduce them to zero (clause 3 of article 286.1, clause 3 of article 311 of the Tax Code of the Russian Federation).

Calculation formula

All step-by-step instructions on how to calculate income tax come down to using formulas. You will find the figures for them in the balance sheet and in the reporting. To calculate the amount of income, use the formulas:

TNP = D – PNO + SHE – IT;

TNU = R – PNO + SHE – IT,

Where:

- D - enterprise income;

- R - expenses of the enterprise;

- PNO - permanent tax obligations;

- ONA - deferred tax assets;

- ONO - deferred tax liabilities;

- TNP - current income tax;

- TNU - current tax loss.

Filling out reports using examples

Let's look at an example of how to divide and report deferred tax that does and does not affect accounting profit or loss.

The fixed asset was accepted for accounting in December 2022. The initial cost is 12,000 thousand rubles, the useful life is 60 months.

For 12 months of 2022, depreciation in the amount of 2,400 thousand rubles was accrued in accounting. The residual value as of December 31, 2022 amounted to RUB 9,600 thousand.

In tax accounting, an expense was recognized in the form of a depreciation bonus - 360 thousand rubles. and for the year they accrued depreciation in the amount of 2328 thousand rubles. Residual value as of December 31, 2022 – 9312 thousand rubles.

As of December 31, 2022, the organization carried out a revaluation in accounting, as a result, the amount of the revaluation amounted to 960 thousand rubles. After revaluation, the initial cost of the fixed asset in accounting is equal to 13,200 thousand rubles, accrued depreciation is 2,640 thousand rubles.

Data for the facility as of December 31, 2022 are presented in the table below.

| Indicator, thousand rubles. | Cost in accounting | Cost in tax accounting | Deductible temporary difference | Taxable temporary difference |

| OS cost excluding revaluation | 9600 | 9312 | – | 288 |

| Revaluation amount | 960 | – | – | 960 |

Let's assume that the organization calculates the current income tax based on the declaration. UR (UD), PNR, PND does not form. Deferred taxes are reflected in account 99:

Debit 99 subaccount “Deferred income tax” Credit 77

- RUB 57,600 (RUB 288 thousand × 20%) – ONO was formed;

Debit 83 subaccount “Additional valuation of fixed assets” Credit 77

- 192,000 rub. (960 thousand rubles × 20%) - ONO was formed.

In the statement of financial results, the organization will reflect IT in two amounts - 57.6 thousand rubles. and 192 thousand rubles. If the first amount, together with the current tax, will reduce profit before tax, then the second amount will reduce the total financial result.

In the balance sheet, the organization will reflect the total amount of IT at the end of the reporting period. At the same time, it will reduce the amount of revaluation by 192 thousand rubles. – the amount of IT arising in connection with the revaluation. Consequently, under the item “revaluation” the organization will reflect the balance in account 83.

In accounting for 2022, the company accrued depreciation in the amount of 2,640 thousand rubles, excluding revaluation - 2,400 thousand rubles. The residual value as of December 31, 2022 amounted to 7,920 thousand rubles, excluding revaluation - 7,200 thousand rubles.

In tax accounting for 2022, depreciation was accrued in the amount of 2,328 thousand rubles. The residual value as of December 31, 2022 amounted to RUB 6,984 thousand.

Data on the object as of December 31, 2022:

| Indicator, thousand rubles. | Cost in accounting | Cost in tax accounting | Deductible temporary difference | Taxable temporary difference |

| OS cost excluding revaluation | 7200 | 6984 | – | 216 |

| Revaluation amount | 720 | – | – | 720 |

The organization reduced IT with postings:

Debit 77 Credit 99 subaccount “Deferred income tax”

- 14,400 rub. (RUB 288 thousand – RUB 216 thousand) – IT was reduced;

Debit 77 Credit 83 subaccount “Additional valuation of fixed assets”

- 48,000 rub. (960 thousand rubles – 720 thousand rubles) – IT has been reduced.

In the financial results report, the organization will reflect IT in two amounts - 14.4 thousand rubles. and 48 thousand rubles. This time, the change in IT will be with a “+” sign, since you are reducing the previously generated indicators.

In the balance sheet, the amount of IT at the end of the reporting period will decrease by 62.4 thousand rubles. (14.4 thousand rubles + 48 thousand rubles). At the same time, the amount of revaluation will increase by 48 thousand rubles. compared to the previous period. In the future, an increase in revaluation will occur annually by the same amount as a result of a decrease in the previously formed IT and in three years will reach a value of 960 thousand rubles. It was precisely this amount of revaluation that was initially reflected in accounting as a result of the revaluation of fixed assets.

Calculation examples

Let's look at an example of calculating income tax for a financial year. Let's say the company is on the general taxation system. Income for the reporting period amounted to 6,000,000 rubles. Costs for the same period are 2,000,000 rubles. Thus, net profit: 6,000,000.00 – 2,000,000.00 = 4,000,000.00. Here are instructions on how income tax is calculated in this case:

- Contributions to the regional budget will be: 4,000,000.00 × 17% = 680,000.00 rubles.

- Interest paid to the federal budget: 4,000,000.00 × 3% = 120,000 rubles.

Here are instructions on how income tax is calculated if an organization belongs to a separate category of taxpayers paying contributions to the regional treasury at a simplified tax rate of 13.5:

- Local budget: 4,000,000.00 × 13.5% = 540,000.00 rubles.

- The required 3% must be paid to the federal treasury: 4,000,000.00 × 3% = 120,000.00 rubles.

Let's look at another example of calculating corporate income tax using a formula with tables - for an LLC. According to the profit and loss statement in Form No. 2, LLC “Company” received income in the amount of 600,000.00 rubles. Cost structure according to the formula:

- 5000 rub. — permanent tax liability;

- 6500 rub. - Deferred tax assets;

- 35,000 rub. — accrued depreciation (linear method);

- RUB 50,000.00 - non-linear depreciation - for tax purposes.

The deferred tax liability is: 50,000 – 35,000 = 15,000 rubles.

Income tax for the reporting period: 600,000.00 × 20% (17% + 3%) = RUB 120,000.00.

Let's reflect the accounting records by indicators in the table:

| Wiring | Sum | Contents of operation |

| Dt 99 Kt 68 | 120 000,00 | Tax payment for the reporting year is taken into account |

| Dt 99 Kt 68 | 5000,00 | Permanent tax liability carried out |

| Dt 09 Kt 68 | 6500,00 | Deferred tax assets offset |

| Dt 68 Kt 77 | 15 000,00 | Deferred tax liability accepted |

Tax returns are submitted to the territorial Federal Tax Service before the end of the reporting period (year). The organization distributes payment amounts evenly and pays them in advance - monthly or quarterly throughout the reporting period. After the end of the year, the accountant transfers the remaining amount of income tax.

Sheet 02 Calculation of income tax and advance payments

For 2022, changes are being made to Art. 286 of the Tax Code of the Russian Federation (Federal Law of April 22, 2020 N 121-FZ):

- The revenue limit for payment of quarterly payments is increased from 15 to 25 million rubles. quarterly;

- Taxpayers who pay monthly advance payments based on estimated profits can switch to paying monthly advance payments based on actual profits before the end of 2022, starting from the January-April reporting period.

Organizations affected by coronavirus are exempt from advance payments of income tax in terms of payments for the second quarter of 2022 (Federal Law of 06/08/2020 N 172-FZ).

Read more Cancellation of taxes for the 2nd quarter of 2022 for affected industries

Let's look at the step-by-step filling out of the Sheet 02 declaration regarding the calculation of income tax for the first half of the year and the amount of monthly advance payments for the third quarter.

Step 1. Determine the amount of income tax for the first half of the year (pages 180-200)

The amount of income tax in 1C is calculated automatically based on the tax base indicated on page 120 and the rate on page 140 (150-170).

Check the calculation for the first half of the year using the formula:

In our example, the total amount of income tax (page 180) is 2,800,000 x 20% = 560,000 rubles, including:

- to the federal budget (p. 190) - 2,800,000 x 3% = 84,000 rubles;

- to the budget of a constituent entity of the Russian Federation (page 200) - 2,800,000 x 17% = 476,000 rubles.

Step 2. Enter the amount of advance payments calculated for the previous period (pages 210-230)

Advance payments that the organization must pay for the period of the first half of the year must be indicated on page 210 (220, 230) in 1C manually, since they are calculated according to the declaration for the first quarter of the current year and consist of:

- tax calculated based on the results of the first quarter (pages 180, 190, 200);

- accrued advance payments payable in the second quarter (lines 290, 300, 310);

- trade tax paid in the first quarter, by which the profit tax for the first quarter was reduced (p. 267).

In lines 220, 230 in the declaration for the first half of the year, manually enter the amounts calculated using the formula:

In our example, the amount of accrued advance payments for the first half of the year is:

- federal budget (p. 220) - 30,000 rubles. + 30,000 rub. = 60,000 rub.;

- budget of a constituent entity of the Russian Federation (p. 230) - 170,000 rubles. + 170,000 – 30,000 rub. = 310,000 rub.

The calculated amounts are indicated on page 210 (220,230) of the declaration for the first half of the year.

Step 3: Check the amount of trade fee paid (pages 265, 266, 267)

Lines 265, 266, 267 of Sheet 02 of the declaration in 1C are filled out automatically if the organization has registered a retail outlet in the program and automatically calculates the trade fee.

In the declaration for the first half of the year, these lines are filled in as follows:

- p. 265 – the amount of trade tax actually paid to the budget of a constituent entity of the Russian Federation since the beginning of the year. In our example, the amount is 60,000 rubles.

In 1C, in line 265, the turnover according to Kt 68.13 is automatically filled in ( Type of payment - Tax accrued/paid ). In our opinion, this is not an entirely correct algorithm for filling out the line, since the amount accrued may not always coincide with the amount paid, i.e. with the turnover Dt 68.13 Kt. Therefore, pay attention and check the completion of this line. If necessary, refill it manually.

Another feature of the program : line 265 will not be automatically filled in if there is a credit balance in account 68.13 “Trade fee” on the date of signing the income tax return.

- line 266 – the amount of the trading fee by which the profit tax was reduced in previous reporting periods of the current year. This line should be equal to the amount on page 267 in the declaration for the first quarter.

In 1C, in the half-year declaration, line 266 automatically fills in the amount of the reduction in income tax on the trading fee for the first quarter, i.e. this is the turnover:

- Dt 68.04.1 ( Budget level - Regional budget , Type of payment - Tax accrued/paid ).

- Kt 68.13 ( Type of payment - Tax accrued/paid ).

In our example, page 266 is equal to 30,000 rubles.

- p. 267 – the amount of the trade fee, which reduces the calculated income tax for the first half of the year to the republican budget. The line indicator cannot be greater than the amount on page 200 “Amount of accrued tax to the budget of a constituent entity of the Russian Federation.”

Find out in detail about the features of reducing income tax by the amount of trade tax

In 1C, line 267 automatically fills in the amount of the reduction in income tax on the trading fee for the first half of the year, i.e. this is the turnover:

- Dt 68.04.1 ( Budget level - Regional budget, type of payment - Tax accrued/paid ).

- Kt 68.13 ( Type of payment - Tax accrued/paid ).

In our example, page 267 is equal to 60,000 rubles.

Read more about the Trade Fee

Step 4. Determine the amount of tax to be paid additionally (pages 270, 271) or reduced (pages 280, 281)

Now determine which is bigger:

- actual tax amounts calculated based on the results of the first half of the year (pages 190, 200);

- the amounts of accrued advance payments that the taxpayer was obliged to pay in this period (pages 220, 230) taking into account the trade tax (page 267), calculated based on the results of the declaration for the first quarter.

Step 4.1. Federal budget

If line 190 is greater than line 220 , then the tax to the federal budget for the first half of the year must be paid in addition, i.e. in 1C line 270 will be automatically filled in according to the formula:

If line 190 is less than line 220 , then the tax to the federal budget at the end of the first half of the year will be reduced, i.e. in 1C line 280 will be automatically filled in according to the formula:

In our example, line 190 (amount of 84,000 rubles) is greater than line 220 (amount of 60,000 rubles), therefore, the tax to the federal budget for the first half of the year will be additionally paid:

- page 270 = 84,000 - 60,000 = 24,000 rub.

Step 4.2. Budget of a constituent entity of the Russian Federation

If line 200 is greater than the amount (line 230 + page 267) , then the tax to the budget of the constituent entity of the Russian Federation for the first half of the year must be paid additionally, i.e. in 1C line 271 will be automatically filled in according to the formula:

If line 200 is less than the amount (line 230 + line 267) , then the tax to the budget of the constituent entity of the Russian Federation at the end of the first half of the year will be reduced, i.e. in 1C line 281 will be automatically filled in according to the formula:

In our example, line 200 (amount 476,000 rubles) is greater than the sum of lines 230 and 267 (370,000 = 310,000 + 60,000), therefore, the amount of tax to the budget of a constituent entity of the Russian Federation at the end of the first half of the year will be additionally paid:

- page 271 = 476,000 0 = 106,000 rub.

Step 5. Determine the amount of advance payments due in the third quarter (pages 290-310)

Organizations paying monthly advance payments must, based on the results of the first half of the year, calculate the advances payable in the third quarter. Such payments are reflected on line 290 (300, 310).

In 1C, these lines are filled in manually. Advance payments payable must be calculated using the formula:

If, as a result of the calculation on page 290 (300, 310), a zero or negative value is obtained, then this line NOT filled in, and in the third quarter, monthly advance payments are not paid (paragraph 6, clause 2, article 286 of the Tax Code of the Russian Federation).

In our example, the amount of monthly advance payments payable in the third quarter is calculated:

- total (page 290) - 560,000 rub. – 200,000 rub. = 360,000 rubles, including: to the federal budget (p. 300) = 84,000 rubles. – 30,000 rub. = 54,000 rub.;

- to the budget of a constituent entity of the Russian Federation (p. 310) = 476,000 rubles. – 170,000 rub. = 306,000 rub.

Advance payments

If the organization’s profitability amounted to no more than 15 million rubles (quarter) for the previous tax period, then it has the opportunity to pay an advance on income tax quarterly. The amount is calculated from the actual amount of income.

If the company has a profitability exceeding 15 million rubles, then it must make an advance payment monthly. An example of how to calculate an organization’s income tax: a specialist will calculate the fee based on the estimated level of income predicted based on the reporting data of the previous quarter.

Expenses and income of the organization

Income is the proceeds from the main types of financial and economic activities of the institution. Income is the enterprise's revenue from third-party resources. Such sources will be funds received from leased property, loans provided, etc.

Here is an example of how to calculate income tax in 2022. When calculating the payment, net income is accepted - without deductions for value added, excise taxes, etc. Accompanying documentation must be attached to the indicated income - payment orders, invoices, accounting data from the book of income and expenses.

Expenses are costs aimed at satisfying the production, general economic and basic needs of the organization (wages, materials, equipment, etc.). Expenses can also be indirect, for example, expenses aimed at paying off interest on loans. All costs must be reasonable and documented.

Principles of forming the tax base for profit taxation

Profit for the purposes of its taxation with the appropriate tax is income reduced by the amount of expenses (Article 247 of the Tax Code of the Russian Federation).

How to calculate profit for the year? The same as for reporting periods, based on the fact that both reporting and tax periods are counted from the beginning of the year (Article 285 of the Tax Code of the Russian Federation) and, accordingly, data for both components of the calculation of profit must be taken on an accrual basis. The volumes of income and expenses for calculating the profit base are determined according to the rules of Chapter. 25 of the Tax Code of the Russian Federation, and since these rules do not always correspond to the rules used in accounting, the need arises:

- in separate tax accounting, from which information about the data for calculating profit will be taken (Article 313 of the Tax Code of the Russian Federation);

- reflection in the accounting of persons not exempt from the application of PBU 18/02 (approved by Order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n), the amount of tax related to permanent and temporary differences arising between accounting and tax accounting.

Both tax revenues and tax expenses are divided:

- On those related to implementation. Moreover, the amount of income here will also include income from one-time sales (for example, excess inventory, which in accounting is traditionally not taken into account in the amount of income from ordinary activities).

- Non-realization.

It is in this breakdown that the components of the profit calculation are reflected in the tax return. But their difference will not yet form the final value of the tax base. To obtain it, the base calculated as income minus expenses must be increased by the amount of losses accepted to reduce this base in a special manner, and reduced by the amounts:

- income not taken into account in profit (this, in particular, is income taxed at tax rates different from the basic one);

- existing losses from previous years, if there is a need to take them into account in profits.

The basic tax rate is applied to the result obtained after the last transactions.

A ready-made solution from ConsultantPlus will help you reflect income tax in accounting, depending on whether you apply PBU 18/02 or not. If you do not already have access to this legal system, a full access trial is available for free.

What expenses are deducted from income?

To find out the amount of net profit, income is subtracted from expenses. All expenses must be confirmed and economically justified. To do this, the accountant must correctly prepare and maintain primary and tax documentation. When calculating profit, the following costs are taken into account:

- production;

- general economic;

- representative;

- transport;

- advertising, but not more than 1% of sales revenue;

- expenses for training and advanced training of personnel;

- interest on loans and credits.

What expenses are not taken into account when calculating?

When calculating income tax, the following costs are not taken into account:

- contributions to the authorized capital;

- penalties and fines;

- property and funds transferred to pay for loans and borrowings;

- advance payment for goods or services;

- the cost of property transferred free of charge and the costs of transfer;

- pension benefits;

- vouchers for treatment and rest of employees, etc.

A complete list of expenses that are not taken into account in the calculation is given in Art. 270 Tax Code of the Russian Federation.

How to determine profit or loss before tax?

Profit before tax is a financial result that reflects the positive results of an enterprise.

It means that the commercial activities of the enterprise were effective and the company fulfilled its main task. There is one simple rule in economics that helps determine whether an enterprise has made a profit or a loss. To do this, it is necessary, on a certain date (for the reporting period), to compare the income received from the sale of products, services or work (revenue) and the expenses that the company incurred. Costs include:

- wage costs for hired labor;

- insurance premiums accrued to the wage fund in accordance with Chapter. 34 Tax Code of the Russian Federation;

- cost of materials, components, semi-finished products;

- depreciation (depreciation) of assets;

- commercial expenses for advertising and sales of products, utilities, rental payments;

- other expenses.

If income exceeded expenses, then the organization made a profit, if vice versa - a loss.

Of course, this rule is very general. There are many nuances of reflecting income and expenses in accounting and tax accounting. They are established at the legislative level in regulatory documents and are mandatory for use. For example, in PBU 9/99 “Income of the organization”, PBU 10/99 “Expenses of the organization”, Ch. 25 of the Tax Code of the Russian Federation and others.

Profit before tax is one of the indicators of the financial statements of an enterprise. It is reflected in line 2300 “Profit (loss) before tax” of the Statement of Financial Results. The value of this indicator is defined as the difference between income and expenses determined according to accounting rules. It should be equal to the difference in the total debit and credit turnover in account 99 “Profit and Loss” in correspondence with the subaccount “Profit/Loss from Sales” of account 90 “Sales” and the subaccount “Balance of other income and expenses” of account 91 “Other income and expenses” " If the indicated difference is positive, this means that the company has made a profit from its activities; if it is negative, it has received a loss.

Detailed instructions for filling out line 2300 of Form 2, including a practical example, can be found in ConsultantPlus:

Get trial access to K+ for free and go to the Accounting Guide.

Despite the name of the indicator "profit before tax", its product by the income tax rate, as a rule, will not coincide with the amount of income tax indicated in the tax return. This is due to the fact that the procedure for recognizing income and expenses that form profit before tax in accounting differs from the procedure for recognizing income and expenses for the purpose of calculating income tax. Organizations required to apply PBU 18/02 reflect these differences in accounting by recognizing temporary and permanent differences in accounts 77 “Deferred tax liabilities”, 09 “Deferred tax assets” and a separate sub-account to account 99 “Permanent tax liabilities (assets”) .

For more information about who should apply PBU 18/02, read the material “PBU 18/02 - who should apply and who should not?” . Also find out what changes in PBU 18/02 from 2020.

In tax accounting, instead of the concepts of profit and loss before tax, the concept of “tax base” is used. The tax base for the purposes of calculating income tax is determined as the difference between income and expenses determined according to the rules of Chapter. 25 Tax Code of the Russian Federation. The product of a positive tax base and the profit tax rate will be equal to the calculated tax for the reporting (tax) period. If a loss is incurred, then the tax base is recognized as zero and profit tax for this period is not calculated.

Read about accounting for losses for tax purposes in the material “Tax loss is...”.

Recognition of income and expenses

The moment of recognition of income and expenses is the period in which the receipts or expenses taken into account when calculating fees are posted. This is important for calculating income tax for dummies. The moment of recognition directly depends on the method of recognition of income and expenses. There are cash method and accrual method.

If an organization has chosen the cash method, then it must record income when it is immediately received, and expenses when funds are written off. Under the cash method, tax payments are reflected on the days of receipt. write-offs. The cash method cannot be used by banking organizations. The organization has the right to recognize profitability (costs) upon receipt (write-off) in the case where revenue is recorded in the amount of no more than 1 million rubles for each quarter (the last 4 quarters are taken into account). If revenues exceed this threshold, then the company must switch to the accrual method.

Under the accrual method, all income and expenses are recorded in accounting when they arise, and tax payments are reflected on dates confirmed by primary documents. The actual date of payment does not matter.

An institution has the right to annually choose the method of recognizing income and expenses and notify the tax office about this by December 31 of the current year.

Domestic principles for calculating the tax base

In modern Russian legislation, the tax base meets the following mandatory requirements.

- All issues related to the method of determining and the procedure for establishing the tax base are regulated by the Tax Code of the Russian Federation.

- Each accounting period is reflected in the financial documentation maintained by the taxpayer, and on the basis of these documentary evidence, the quantitative characteristics of the tax base are calculated at the end of each individual period.

- If in the current period an error was found in the calculation of the tax base relating to an already expired period of time, it is necessary to recalculate the tax base of the “erroneous” period.

- If the period in which the error was made cannot be accurately determined, it will be necessary to recalculate the tax base at the present time, that is, in the reporting period.

- The procedure for calculating the tax base is determined by the Ministry of Finance of the Russian Federation. Accounting for profits and costs based on business results for the required period reflected in the financial documentation should be kept by:

- individual entrepreneurs;

- organizations;

- tax agents.

- Individual taxpayers take as the basis for calculating the tax base their own profit accounting data, as well as information received from the other party - the counterparty of their activities (organization, other individual).