20 March 2020

The housing and communal services sector requires agents to be able to quickly resolve various issues. Multitasking is one of the criteria for residents choosing a management company. Today, users pay special attention to the range of services, the reputation of the management company and the cost of service. Organizations have to comply. Those who work effectively and have no problems with the tax and other regulatory structures win the competition.

Proper accounting in a management company is an important component of the rational use of resources. Without the latter, the implementation of basic functions is impossible. And the management company has many functions: current and major repairs of structures, monitoring the condition of distribution and other equipment, providing apartments and facilities on the territory of the building with utilities.

Where does accounting begin?

Accounting for a management company is a reflection of the purchase of utility resources from suppliers, a reflection of settlements with consumers (homeowners), accounting for materials, wages, taxes, and settlements with contractors. Each sector has its own characteristics.

Accounting for a legal entity begins with the selection and approval of accounting policies. It establishes the rules for accounting for expenses, income, and other assets. If some nuances are not taken into account and a number of issues remain unclear, the practical part of accounting becomes much more complicated. Inconsistencies arise that can have serious financial consequences.

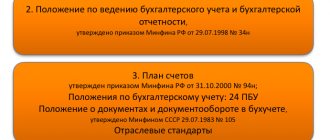

An accounting policy is being developed in accordance with the norms of the Tax Code and PBU. If the legislation does not contain references to any features of its formation, the management company fixes them in the document at its discretion.

The second stage of organizing accounting is developing a chart of accounts. The grounds for its formation are presented in Order No. 94n of the Ministry of Finance. The plan includes only actual accounts that the company will use to reflect the facts of financial and economic activities.

At the next stage, the forms of primary documents are approved. Here you can use unified samples (templates). If there is a need to develop your own forms, they are created taking into account regulatory requirements and document flow rules.

Proper accounting in the management company significantly simplifies its subsequent maintenance by specialized specialists at the sites.

Peculiarities of organizing accounting at housing and communal services enterprises (in management companies)

The activities of enterprises in the housing and communal services sector most often come down to two processes: the acquisition of resources from suppliers and their subsequent resale to residents. The first process forms accounts payable and expenses of the organization, the second - accounts receivable and income.

The accounting policies of housing and communal services organizations are formed by them independently after conducting serious analytical work. The accounting policy should be formed taking into account the specifics of work in the housing and communal services sector, contractual obligations, and the competent organization of tax accounting at the enterprise.

Housing and communal services organizations, which are commercial organizations, maintain accounting records in a general manner in accordance with the system of regulatory accounting regulation, guided by the general principles and rules of accounting, as well as industry recommendations.

Thus, when maintaining accounting records in housing and communal services, the entry, for example, for accrual of revenue from the sale of housing and communal services services is reflected in the general order by accounting entries (Order of the Ministry of Finance dated October 31, 2000 No. 94n): Debit 62 - Credit 90.

How many accountants does a management company need?

The management company can keep records independently (in a standard way) and outsource it. In the first case, a chief accountant and several specialists are hired. Some companies work with one accountant. But this practice cannot be recommended as optimal.

The chief accountant of the management company needs to control accounting in all areas, monitor cash discipline, analyze tax policy, introduce changes to the accounting scheme in order to avoid errors for which tax penalties are charged. It also includes financial analysis, communication with internal and external users of accounting information, support of audits, inspections, preparation of consolidated reporting, control of transfers to the budget and settlements with employees, control of the reflection of business transactions in accounting and the generation of documents on receivables and payables. The need to separate functions and responsibilities among accounting areas is obvious.

Outsourcing accounting allows the management company to optimize the costs of maintaining a staff of specialists. All functions are assumed by a specialized performer. Responsibility for the quality of accounting and reporting also lies on his shoulders.

Accounting for costs of managing apartment buildings

An important nuance of accounting for the property and obligations of housing and communal services organizations is the obligation to keep separate records of income and expenses by type. In accordance with this, real estate management services are accounted for separately on account 20. Since the main income of such organizations is revenue from managing an apartment building, expenses for this type of activity should be taken into account as basic, and not as general business expenses.

Account 26 should reflect expenses not directly related to the main activity.

Account 26 in the management company is used to reflect expenses for other activities.

Accounting practice

Let's move on to the practical aspects of accounting in a management company. Let's start with acquiring resources. Transactions in this group are reflected in the debit of accounts 19, 60, 20, 68 and the credit of accounts 60, 51, 19.

Accounting for transactions for the provision of housing and communal services is carried out by debiting accounts 90 (with corresponding subaccounts), 60, 62, 51 and crediting accounts 20, 62, 90, 68.

Postings to these accounts are relevant for management companies operating under a general or simplified taxation system. The maximum number of postings is made by OSNO users. Simplified people enjoy a VAT exemption. Accordingly, some postings are irrelevant for them.

Accounting for settlements with suppliers and consumers

The most common option for a management company to organize settlements with suppliers and consumers of utility payments is to conclude an agreement on the paid nature of the services provided. In this case, funds received from apartment owners are classified as income of the organization, and the cost of services invoiced by suppliers is classified as expenses.

| Account correspondence | Contents of operation | |

| Debit | Credit | |

| 20 | 60 | For the amount of utilities provided by suppliers for payment |

| 19 | 60 | VAT on supplier services |

| 68 | 19 | VAT offset |

| 62 | 90/1 | Bills submitted for payment to utility service consumers |

| 90/3 | 68 | VAT calculation |

| 90/2 | 20 | Write-off of expenses |

| 50, 51 | 62 | Receipt of funds to pay utility bills |

| 60 | 51 | Transferred to the supplier for utilities |

Taxation of management companies

Accounting is not considered in isolation from tax accounting. Let's figure out what modes management companies use and why.

Organizations in the housing and communal services sector most often work on the simplified tax system and OSNO. The main taxes are income tax and VAT. Under OSNO, both taxes are calculated and paid. Moreover, the rate of both is 20%. Ineffective taxation is a common reason for operating in the red in the first years of a management company’s existence.

As for VAT, there is one important nuance. VAT does not apply to services provided by the management company. True, according to the Tax Code of the Russian Federation (Article 149), they all have the same price. Accordingly, it will not be possible to make a big profit by simply raising the cost of services.

Simplification is relevant for small management companies. The special regime has restrictions on annual income and staff. The simplified tax system allows you to choose a favorable rate taking into account the object of taxation. The regime eliminates the need to reflect the accrual and deduction of VAT in accounting. Reporting on the simplified tax system has a shortened composition. All this makes the regime a priority if the management company fits within the income and staff limits.

Taxation of management companies

The management organization can choose either a general taxation system (hereinafter referred to as OSNO) or a simplified taxation system (hereinafter referred to as simplified taxation system) if the necessary conditions are met. In both cases, the tax base for the purpose of calculating the corresponding taxes is the difference between income and expenses.

When using OSNO, you must pay income tax, which is 20%, and VAT. At the same time, in accordance with Article 149 of the Tax Code of the Russian Federation, the management organization is exempt from paying VAT when providing utilities, carrying out maintenance and repair work on an apartment building with the involvement of relevant organizations.

Enterprises in the housing and communal services sector, using the taxation system in the form of the simplified tax system, do not pay VAT and income tax. Instead, they pay a separate tax due to the simplified tax system. The tax rate depends on the object of taxation and is 6% or 15%.

The right to use the simplified tax system is available to management organizations whose income does not exceed 60 million rubles, the book value of the company’s fixed assets is less than 100 million rubles, and the number of full-time employees does not exceed 100 people.

Postings in different taxation modes

There are few fundamental differences in postings on OSNO and simplified tax systems. One of the main ones concerns VAT. If the management company uses a simplified version, postings D90/3 K68 and D68 K19 are irrelevant for it. 20% VAT is not paid on the simplified tax system.

Postings reflecting settlements with counterparties, recipients of housing and communal services and utility resources, are identical for users of both tax regimes. Management companies on OSNO and the simplified tax system use the same accounts to reflect the corresponding transactions.

Companies operating in the housing and communal services sector are commercial organizations. They are founded for the purpose of making a profit. The activities of management companies are strictly controlled. Evasion of taxpayer obligations entails serious reputational and financial consequences.

If the accounting of a management company is competently organized and carried out by professional specialists, there will most likely be no problems with the tax authorities. But no one is immune from mistakes. The only way to relieve an organization of responsibility for them is to transfer accounting to an outsourcing company. It is recommended to select a contractor based on a set of criteria, from the range of services, the content of the accounting service package to guarantees and the conditions of their validity. Particular attention should be paid to storing data archives and access to the accounting database. As for the financial terms of cooperation with an outsourcer, everything is individual. But the savings will be no less than 30% compared to maintaining a staff of accountants in the management company.

Tags for this publication:

housing and communal services accounting

Settlements of the management company with the ERCC

The management company can cooperate with the unified cash settlement center (UCSC) subject to the conclusion of an agency agreement. To account for settlements with the ERCC, a separate subaccount of account 76 is used.

| Account correspondence | Contents of operation | |

| Debit | Credit | |

| 51 | 76 | Funds received from ERCC |

| 76 | 62 | Utilities paid by homeowners |

| 62 | 90/1 | Income shown |

Accounting statements of housing and communal services organization

The responsibilities of a legal entity working in the housing and communal services sector include maintaining accounting records and providing reporting. This obligation applies to any company, regardless of which taxation system is applied. The reporting set for the year includes:

- balance sheet;

- Profits and Losses Report;

- Explanation of the balance sheet and income statement;

- statement of changes in equity;

- cash flow statement.

Interim reporting includes only the first two forms. If the organization belongs to a small business, the reporting also includes only the balance sheet and income statement. When applying the simplified tax system, reporting is provided in a simplified form and includes a balance sheet, a statement of financial results and a report on the intended use of funds.

In addition, housing and communal services organizations regularly provide information on the number of personnel and data on income tax 2-NDFL. If an enterprise uses OSNO, then it is necessary to submit a tax return for income tax and VAT. Organizations that use the simplified tax system submit a single tax return even if there are no income or expenses in the reporting period.

Service calculation formulas

Formulas for calculating services depend on whether the house has individual and collective (common house) metering devices (RF Government Decree No. 344).

There is a collective PU, individual PU are not in all apartments

In this case, you need to use formula No. 3. To do this, check the box “Use formula No. 3 of Resolution No. 344 if there is a control center and partial equipment of the premises of the control center”

There is a collective control center, all apartments have individual control rooms

In this case, we use formula 3.1 of Resolution No. 344. You need to check the box “Use formula No. 3(1) of Resolution No. 344 if there is a control center and the equipment of all premises of the control center.” Payment for general house needs will be distributed among apartments equipped with IPU.

No collective PU

If there is no collective PU, you need to check the box “Use formula No. 15, resolution No. 344 in the absence of a Communist Party.” Then the payment for the maintenance of common property in an apartment building will be distributed between residential and non-residential premises in proportion to their area.

In the video we explain in detail how to calculate the average consumption using metering devices.