If there is a need to transfer goods or containers from one division of the company to another, for example, from a warehouse to a sales floor or production workshop, an invoice for internal movement form TORG-13 is generated in two copies. This form is used not only to confirm the transfer of values between structural divisions, but also between financially responsible persons. In the article we will tell you how the TORG-13 invoice for internal movement, transfer of goods, containers is filled out, by whom and how it is signed.

What data does it include?

To account for internal movement, an organization has the right to develop its own document form or use the unified TORG-13 form . If an organization develops its own document form, it must be approved by order of the enterprise and contain the following data:

- Name of the organization;

- Title of the document;

- information about the sender and recipient of goods and materials;

- information about the transferred goods (its name and quantity in physical and value terms).

How to fill it out

Here are instructions on how to fill out TORG-13:

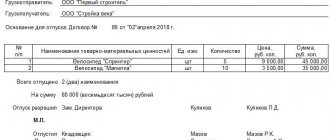

- The top table contains information about the structural divisions of the enterprise between which the movement of inventory and materials is carried out, and the accounting accounts reflecting the business transaction.

- In the lower table of the invoice you should indicate information about the goods, materials or containers (name, unit of measurement, quantity and accounting value).

- Under the bottom table, financially responsible persons of the departments put signatures with a transcript. The presence of a seal on the invoice is not provided.

At the enterprise, TORG-13 is filled out in two copies, one for each structural unit.

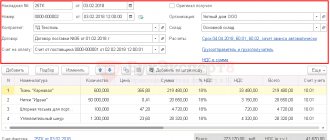

Accounting programs provide automatic filling of the document. To generate a TORG 13 invoice in 1C, go to the “Warehouse” menu, then select “Movement of goods”:

Please note that a separate tab is provided to record the movement of containers.

Features of compilation

The document for the movement of inventory items within the organization is drawn up by the materially responsible person from whose warehouse the inventory items are released. Vacation without documentation is not permitted.

TORG-13 is drawn up in two copies , one remaining with the person who released the goods, and the second with the person who accepted them. The executed documents serve as the basis for writing off inventory items from the materially responsible person releasing them, and the department that received the inventory items accepts them for accounting on the basis of the invoice.

Numbering is carried out according to the rules established in each specific enterprise. As a rule, each type of document has its own continuous numbering; for ease of recording, a letter prefix can be added to the document number.

When filling out documents, special attention must be paid to the columns where the names of the sender and recipient should be indicated. Errors in the names of issuing and receiving structural units lead to distortion of data in accounting and to discrepancies between the actual availability of inventory and materials and data in accounting.

Errors in the name of inventory items are not allowed ; for better identification, it is recommended to keep records not only by name, but also using a code. If goods of the same name differ in grade, it is necessary to indicate the grade of the goods and materials being sold.

Some types of inventory items can be accounted for in different units of measurement (for example, in kilograms and linear meters). When releasing such goods, it is necessary to indicate the unit of measurement in which they were accepted for accounting. The responsible person cannot transfer goods from one unit of measurement to another, bringing all sold goods and materials into a single form.

Columns indicating the quantity of goods sold are required . When transferring inventory items in packages, you must indicate the number of piece products in one package and the number of such packages. The weight of the goods is indicated not only net, but also gross, if the financially responsible person has such information.

Data on the price and cost of inventory items at accounting prices are also indicated. The columns indicating quantity and amount are summed up and a total is summed up. The quantity of commercial products in various units of measurement is summed up for the purpose of control checking the quantity of products supplied.

Without specifying data on the exact name and quantity of goods and containers, the invoice for internal movement is invalid.

TORG-13 is signed by financially responsible persons who released and accepted the goods and materials. Be sure to indicate the names of their positions and the transcript of the signature.

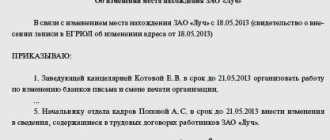

Without the signatures of financially responsible persons, the document is invalid . It is not allowed to endorse the invoice by a person who does not have the right to do so. The right to sign is assigned by order of the organization.

The unified form does not provide for the affixing of a seal, however, if materially responsible persons have seals in structural units, then in order to provide greater control and prevent forgery of signatures, it is recommended to affix them additionally. The absence of a seal is not a violation unless it is established by a local act of the organization.

Who uses the form and when

For proper accounting of inventory items, internal document flow is necessary.

For example, at manufacturing enterprises, inventory items have to be moved from one warehouse to another, from a warehouse to production, etc. To register these facts of economic activity, an invoice for internal movement is used in the TORG-13 form, the form of which was approved by Decree of the State Statistics Committee No. 132 of December 25. 1998. The use of the document is not mandatory; the company has the right to develop its own form in compliance with the requirements of Art. 9 of Law No. 402-FZ of December 6, 2011 “On Accounting”. But in most cases, a unified invoice form is used, since it contains all the necessary details and is available for generation in accounting and warehouse programs. ConsultantPlus experts discussed how to organize warehouse accounting. Use these instructions for free.

In the absence of facts confirming the movement of goods between branches and separate divisions of the company, disputes often arise with tax authorities. For example, the transfer of materials to production is an expense item for calculating income tax. While the materials are still in the warehouse, they do not reduce the tax base.

In addition, if inventory items are lost, questions arise regarding the recovery of losses from financially responsible persons. The employee who signs the invoice confirms responsibility for the safety of material assets. The list of MOLs is approved by an order signed by the head of the enterprise.

Key points about when and why TORG-13 is used:

- movement of goods between warehouses;

- transfer of materials to production;

- movement of inventory items between company divisions, etc.

The form is not used to account for fixed assets; their movement is documented in other documents.

Not everyone knows what it is, TORG-13, but many are familiar with the TORG-12 invoice. This form is used to ship inventory items to the buyer and is confirmation of the transfer of ownership of the goods. TORG-13 is used only for internal movement. These two documents should not be confused.

Read more: “We fill out the delivery note TORG-12 according to the sample”

Is it necessary to record the document in the accounting journal?

Documents reflecting the movement of inventory items within the enterprise are recorded in the accounting journal . A record of an invoice for internal movement is reflected for both the issuing and receiving parties.

The form of the journal can be arbitrary, but it must contain data that allows you to identify the documents specified in it:

- document number and date of issue;

- name of the unit - the second party to the business transaction for the movement of inventory items;

- the total quantity and amount of inventory items indicated in the invoice.

The materially responsible person reflects data on the movement of inventory items in warehouse accounting cards, and the invoices themselves are transferred to the accounting department of the enterprise according to the register .

When is the TORG-13 form needed?

Form TORG-13, approved by Decree of the State Statistics Committee of the Russian Federation dated December 25, 1998 No. 132, is used to document internal (within one organization) movements of goods and materials (goods, products, semi-finished products, raw materials, containers). This document is not related to the movement of fixed assets (they have their own form), but is significant for the movement of other property related to the production of products between any divisions or materially responsible persons (MRP) of one legal entity:

- head and separate,

- isolated,

- workshops,

- MOLs.

It is drawn up in 2 copies, one of which is written off at the transferring unit (or at the MOL), and the other at the receiving unit (at the MOL) the receipt is recorded. Stamping in the TORG-13 form is not provided.

If the address of the location of the unit is important for moving, then the TORG-13 form developed by the State Statistics Committee of the Russian Federation can be supplemented with the corresponding line or column.

The use of the TORG-13 form is not mandatory. You can independently develop a form of similar content, focusing on the mandatory requirements for the details of the primary document, Art. 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ.

Read more about these requirements in the article “Primary document: requirements for the form and the consequences of its violation.”

The absence of invoices for internal movements between branches or OPs often becomes the subject of disputes with fiscal officials. What are the consequences of not having documents confirming the movement and how to properly complete the operation, find out in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

How long should it be stored?

All primary documents must be stored in the organization for five years after the reporting year, i.e. the year in which they were issued, then they can be destroyed.

They may be needed if discrepancies are identified during a warehouse inventory or to confirm the correctness of the reflected data during a tax audit.

If you are interested in what other invoices can be used, you can read about the following types: demand invoice, for transfer of finished products to the storage location, consignment note, transport and goods, return, for issue of goods, receipt and expense.

Thus, the internal movement of goods and containers is documented with an invoice. The organization has the right to develop its own document form or use the unified TORG-13 form. It is stored in the company's accounting department for five years, after which it can be disposed of.

Basic filling rules

The TORG-13 invoice form was approved by the State Statistics Committee in 1998. Since the beginning of 2013, it has ceased to be mandatory for unified completion. Now enterprises have the right to prepare their own version of the invoice, but it must reflect the same details. Information about this is specified in No. 402-FZ. The document can be issued to control the movement of raw materials, materials used in production, finished products and other inventory items.

The invoice must be filled out to confirm the transfer of valuable property between departments (workshops, warehouses, etc.), as well as between authorized persons. The document is drawn up by the person responsible for material assets and filled out in two copies: the first is transferred to the recipient, the second remains with the sender.

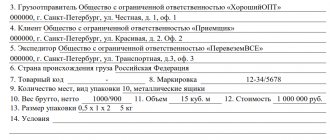

The header of the document contains the full name of the organization and the organizational and legal form of work. Data about the sender and recipient must be recorded in tabular form: the name and type of activity of each department must be indicated. In addition, you need to fill out account information on the same form.

In the following table you must enter information about the property being transferred. The following information about inventory items is recorded:

- Product name and characteristics.

- Code, product grade and units of measurement.

- Quantity and weight of goods. Net and gross weight is indicated.

- The book value of products in ruble equivalent.

It is also necessary to calculate the total cost of the transferred property; on the second side, you need to fill in the “Total” line. The document is signed by the person responsible for issuing the goods and materials.

In what situations is the document used?

The invoice exists to record the movement of commercial products and packaging between representative offices, branches, warehouses and materially responsible persons (MRP) within one legal entity.

Relocation may include:

- transfer of products from one warehouse to another;

- sending inventory items from the warehouse to the sales floor or vice versa;

- sending goods from the warehouse to other divisions of the legal entity;

- transfer of products from one financially responsible person to another.

Important. Based on the TORG-13 form, the products are written off from the person who issued them and are registered with the person who accepted the MOL.