It is generally accepted that a branch is a separate structural unit (the only one or one of several), a significant component of a legal entity (hereinafter also referred to as an organization). Clauses 2 and 3 art. 55 of the Civil Code of the Russian Federation states that such a unit must be located outside the location of the legal entity and can perform its functions in whole or in part, including representative offices. Data on such divisions of a legal entity are indicated in the Unified State Register of Legal Entities.

Typically, such branches include any territorial “branch” of a legal entity if stationary workplaces are equipped at its location. This means that they must be created for a period of more than a month. This is evidenced by the provisions of Art. 11 of the Tax Code of the Russian Federation. It should be taken into account that a separate branch is characterized by the following key features:

- carrying out specific activities on behalf of the parent organization, without being a legal entity;

- documenting internal movements carried out with the organization, as well as displaying mutual settlements in accounting;

- lack of its own, autonomous balance;

- allocation of property to the organization, the owner of which the branch for this reason still does not become;

- the possibility of an organization opening an account for him in order to finance current expenses;

- lack of opportunity to participate in the formation of the authorized capital (AC).

It is recognized that the movement of funds from account to account (between an organization and its branch) is precisely a transfer, but not income or expenses. The key internal document of such a division is the Branch Regulations. The information that should be displayed in it is decided by the parent organization. It is she who organizes tax and accounting in any branch created by her.

Important! The branch forms and maintains accounting depending on its membership in a particular type and in relation to the accounting policies determined by the parent organization.

He does not have the right to develop his own accounting policy (in relation to the norms of PBU 1/2008, approved by Order of the Ministry of Finance of the Russian Federation No. 106n dated October 6, 2008, as amended on April 28, 2017).

On the issue of organizing accounting in separate divisions of a legal entity

In general, the organization of accounting by the parent organization can take different forms. Their use is influenced by the location of the branch, its functions, and the types of activities performed. Also of no small importance are the volume of business operations of the branch, the nuances and sources of its financing, the features of goods flow, and other financial movements.

The type of unit is of dominant importance in this process. They distinguish: a branch that is assigned, allocated to a separate balance sheet, or, conversely, not assigned (i.e., not allocated). Each of these types has its own characteristic features and distinctive features in terms of accounting.

As for the accounting policy (AP), its formation falls entirely on the shoulders of the parent organization. The purpose of the UE is based on the following principles:

- The general working chart of accounts, as well as methods of accounting, are determined.

- The procedure for carrying out analytical accounting of property (legal entity) and cash in the branch, as well as the distribution of expenses between them, is fixed.

- Regulations are established for settlements (with all employees and third parties).

- Corresponding separate sub-accounts are allocated for the branch that is not included in the autonomous balance sheet.

- A system of mutual document flow (“legal entity – its division”) is being established.

- A clear procedure for accounting and documenting business transactions is being introduced.

- The forms of reporting used (tax, accounting, other) are approved.

Among other things, the accounting policy should determine the circle of specific responsible persons, as well as acceptable methods of delivering the required documentation to the organization from its unit.

Separate division: accounting in the sanatorium

After choosing an accounting system, the question arose of how to organize accounting for sanatorium-resort services and catering plant production in a separate division based on the configuration of an aircraft manufacturing enterprise. A sanatorium, allocated to a separate balance sheet, is obliged to keep records within the framework of the methods specified in the accounting policy of the parent enterprise, that is, in the described case, this is the accounting policy of PJSC ".

If we consider the activities of the sanatorium from the point of view of production, we can divide it into two components:

- the main production is the production and release of the final object of sale of the sanatorium, that is, the sanatorium and resort services themselves;

- auxiliary production is the production and release of food plant products.

Based on this approach to the activities of the sanatorium, accounting was able to be implemented using the current configuration of the aircraft manufacturing enterprise, with virtually no modifications to it. The main improvements were related to the implementation of the specific features of the food processing plant: specifications of parts were replaced with recipes for dishes, changes were made to the selection of analogues of raw materials, and the seasonality of food consumption was taken into account.

Accounting in a branch included in the autonomous balance sheet

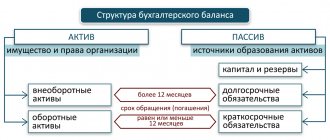

Unlike the previous type of division, in this case, when a branch is assigned to an autonomous balance sheet, its accounting is carried out separately from the accounting of the parent organization. What does the phrase “autonomous, separate” balance mean? As the Ministry of Finance of the Russian Federation notes (see letter No. 04-05-06/27 dated March 29, 2004), this concept is excluded from PBU No. 4/99.

Meanwhile, for the purposes of applying the norms of Ch. 30 of the Tax Code of the Russian Federation, it should be considered that this is a specific list of indicators that the organization has established for its branch. Taking them into account, the division forms its own autonomous balance sheet and reflects the actual property and financial position.

| Features of the operation of a branch included in the autonomous balance sheet | ||

| The branch has its own accounting service (with a staff member of the chief accountant), which conducts accounting and prepares reports independently from the parent structure | The working chart of accounts is formed in relation to the specifics of the branch's activities. As established, not used: sch. 80, 84, 75 and other accounts that are relevant and applied in the parent organization | The branch's accounting department deals with: compilation, systematization, processing, storage of primary documents; taking into account all business transactions, existing obligations and transferred property, which in one way or another relate to the activities of the organization |

Mutual settlements between a legal entity and its structural unit included in the autonomous balance sheet are displayed using an account. 79 (plus subaccounts 97-1 “Calculations for allocated property” or 79-2 “Calculations for current business operations” and other subaccounts). And so on for each branch.

The generated internal reporting is submitted by the division's accounting department to the head office. The received documentation is then used in the preparation of quarterly and annual reporting for the entire organization. As is customary, the count data is analyzed. 79, the balances of the DT of the organization’s subaccounts are compared with the CT of the branch’s subaccounts, and then the CT of the organization and the DT of its division. There shouldn't be any discrepancies.

After this, the “head” accounting department clears out the balances, but in accounting. does not conduct reporting. Accordingly, indicators on the activities of the branch for a specific reporting period are added to the relevant data for the organization. For your information, a similar scheme of actions is used when generating different forms of reporting. For example, when preparing a report on losses and profits or on the movement of funds.

Accounting and document flow in an organization with branches

Let's consider the features of accounting and document flow in an organization that has separate divisions, both allocated and not allocated to a separate balance sheet.

Civil legislation classifies representative offices and branches of a company that are located outside its location as separate divisions (Article 55 of the Civil Code of the Russian Federation). Thus, a branch is a separate division of a legal entity, located outside its location and performing all or part of its functions. A representative office can represent the interests of the organization and protect them. Separate divisions are not legal entities. They are endowed with property by the legal entity that created them and act on the basis of the provisions approved by it.

Heads of branches are appointed by a legal entity and act on the basis of its power of attorney. The named separate divisions must be indicated in the constituent documents of the legal entity that created them.

Let us recall that the recognition of a division as separate for tax purposes does not depend on the powers with which it is vested, on whether its creation is reflected or not in the constituent documents of the organization, and also whether the regulations on the branch (representative office) are approved or not. It is only necessary to have the following characteristics: territorial isolation from the parent organization, the presence of stationary jobs created for a period of more than one month, as well as the organization conducting its activities through a separate division.

Accounting methods

There are two ways of maintaining accounting in organizations with separate divisions - centralized and decentralized.

In the first method, records of all operations carried out by these separate divisions are kept by the parent organization. To do this, each separate division (branch) transfers to it all primary accounting documents, both received from counterparties and generated by its employees. Based on these documents, the accounting department of the parent organization reflects the data in centralized accounting.

In the second method, separate divisions maintain accounting records independently. The parent organization reflects in its accounting only the financial and economic transactions directly carried out by it. In this case, the financial statements as a whole for the legal entity are compiled by summing up the indicators of the accounting registers of the parent organization and branches.

The procedure for recording business transactions in accounting accounts in organizations that have separate divisions depends on whether the latter are allocated to a separate balance sheet or not. In the first case, accounting is carried out decentralized, in the second - centralized.

The branch is not allocated to a separate balance

Within the time limits established in the accounting policy, the branch transfers to the parent organization the primary accounting documents issued outside its order. In accordance with them, the results of financial and economic transactions performed by branches are reflected in the accounting records of the parent organization.

The transfer of primary accounting documents occurs in accordance with a special register, drawn up in two copies. The organization independently develops the register form and approves it as an annex to its accounting policies. Based on paragraph 2 of Article 9 of the Federal Law of November 21, 1996 No. 129-FZ “On Accounting” (hereinafter referred to as Law No. 129-FZ), it is necessary to indicate in the register:

- name of the document, number and date of its preparation;

- the name of the separate division (organization) that compiled the register;

- a list of transferred documents indicating their numbers and dates of preparation;

- signature, full name, position of the employee who submitted the documents;

- signature, full name, position of the employee who accepted the documents;

- date of transfer (reception) of documents.

The register is drawn up in at least two copies.

The rules for document flow between the parent organization and the branch are approved as part of the accounting policy (clause 3 of article 6 of Law No. 129-FZ). They must provide for the composition, procedure and timing of the transfer of information by a separate division to the parent organization and back. That is, the accounting policy must indicate which documents, when and by whom should be submitted to the accounting department of the parent organization from the branch and, conversely, to the accounting department of this separate division from the parent organization.

Financial and economic operations of a branch that is not allocated to a separate balance sheet are reflected in the analytical accounting of the parent organization in additional sub-accounts opened to its accounting accounts.

Accounting statements for such a branch are not prepared separately.

The branch is allocated to a separate balance sheet

A branch allocated to a separate balance sheet maintains accounting independently, separately from the parent organization. However, you should remember the provisions of paragraph 9 of PBU 1/2008. Thus, the accounting methods chosen by the organization when developing its accounting policies are applied from January 1 of the year following the year of approval of the relevant organizational and administrative document. Moreover, they are applied by all branches, representative offices and other divisions of the organization (including those allocated to a separate balance sheet) regardless of their location.

Thus, if the accounting policy for accounting purposes states that depreciation on the organization’s fixed assets is accrued only in a straight-line manner, then the branch cannot depreciate its fixed assets using the reducing balance method or by writing off the value by the sum of the numbers of years of the useful life or proportionally volume of products (works).

Reference

Separate balance sheet of a separate division

In the previously valid PBU 4/96, which was approved by order of the Ministry of Finance of Russia dated 02/08/96 No. 10, the concept of “separate balance sheet” was interpreted as a system of indicators formed by a division of the organization, which reflects its property and financial position as of the reporting date for the needs of managing the organization, including preparation of financial statements.

PBU 4/96 has ceased to be valid since the financial statements of 2000. The definition of “separate balance sheet” was not included in the PBU 4/99 that replaced it. Thus, a certain gap has arisen in the accounting legislation.

In letter dated March 29, 2004 No. 04-05-06-27, specialists from the Russian Ministry of Finance explained that the organization independently establishes a specific list of indicators to form a separate balance sheet for its division and reflect the property and financial position of the division as of the reporting date for the needs of managing the organization.

Thus, a separate balance sheet of a separate division is a list of indicators with the help of which its property and financial position is reflected for the purpose of drawing up the financial statements of the organization as a whole.

The performance indicators of a separate division are formed in a certain system of accounting accounts, which is called the working chart of accounts.

Note that the document flow schedule between the parent organization and the branch allocated to a separate balance sheet, the working chart of accounts, as well as document forms developed by the organization independently are approved as part of the accounting policy. In it, the legal entity must indicate the working chart of accounts of the parent organization and each branch.

The working chart of accounts of a branch, as a rule, does not include accounts that are important for the organization as a whole:

- 75 “Settlements with founders”;

- 80 “Authorized capital”;

- 81 “Own shares”;

- 82 “Reserve capital”;

- 83 “Additional capital”.

The accounting accounts that are included in the working chart of accounts of a separate division must be synchronized with similar accounts in the working chart of accounts of the parent organization.

Exchange of information between the parent organization and the branch

In the process of on-farm settlements, the acceptance and transfer of costs, obligations and financial results between the parent organization and a separate division is carried out on the basis of a document called an “advice note” or “notice”. There is no unified form of advice. An organization can develop it independently, taking into account the requirements of paragraph 2 of Article 9 of Law No. 129-FZ and record it in its accounting policies. In the same organizational and administrative document, she needs to fix the timing of the transfer of advice from the branch to the parent organization and vice versa.

An advice note is drawn up in cases where the parent organization does not participate in the business operations carried out by the branch, and vice versa. Copies of the primary accounting documents that served as the basis for reflecting specific business transactions are attached to each advice note. Advice is not drawn up for transfer and reception transactions between the parent organization and the branch of property and funds. After all, such operations are formalized with the corresponding primary documents: payment orders, invoices, acceptance certificates, etc.

The parent organization and the branch can exchange accounting data by directly importing information from one accounting program to another. In this case, a register of information transfer is compiled indicating from whom and to whom the data was transferred, as well as the number of transferred accounting records, nomenclature, quantity, cost and storage locations of the relevant documents.

Accounting for settlements between the parent organization and the branch

To account for settlements between the parent organization and the branch allocated to a separate balance sheet, account 79 “Intra-business settlements” is used. This account, in particular, reflects settlements for allocated property, mutual release of material assets, sales of products, works, services, transfer of expenses for general management activities, and payment of labor to department employees.

The status of settlements with the specified branch for non-current and current assets transferred to it is taken into account in subaccount 79-1 “Settlements for allocated property”.

Example 1

The parent organization (PrimaVera LLC) transferred to its branch, allocated to a separate balance sheet, a machine that had previously been put into operation. Its initial cost in accounting is 960,000 rubles, and its useful life is 96 months (8 years). By the time the machine is handed over, depreciation has been accrued in the amount of RUB 100,000. (depreciation method is linear).

The ownership of the machine transferred to the branch remains with the parent organization. Therefore, it does not reflect the disposal of the machine.

In the accounting records of the parent organization, on the basis of the invoice for the internal movement of fixed assets (form No. OS-2), the following entries must be made:

DEBIT 79-1 CREDIT 01 - 960,000 rub. — the initial cost of the machine transferred to the branch was written off;

DEBIT 02 CREDIT 79-1 - 100,000 rub. — reflects the amount of accrued depreciation of the machine transferred to the branch.

Together with the machine, in addition to the above-mentioned invoice, the parent organization will transfer to the branch an inventory card for recording the fixed asset object (form No. OS-6) with a note about the movement of the machine within PrimaVera LLC.

In the accounting records of the branch, the receipt of the machine from the parent organization will be reflected in the following entries:

DEBIT 01 CREDIT 79-1 — 960,000 rub. — reflects the initial cost of the machine received from the parent organization;

DEBIT 79-1 CREDIT 02 - 100,000 rub. — reflects the amount of depreciation accrued during the operation of the machine in the parent organization.

The branch will reflect further depreciation on this machine in its accounting records in the same manner as during the period of its accounting on the balance sheet of the parent organization - monthly in the amount of 10,000 rubles. (RUB 960,000: 96 months):

DEBIT 20 CREDIT 02 - 10,000 rub. — reflects the monthly depreciation amount of the machine.

Information on the cost of fixed assets listed on the balance sheet of the branch and the amount of depreciation accrued on them is subject to disclosure in the financial statements of PrimaVera LLC as a whole.

The status of the organization’s settlements with branches allocated to separate balance sheets for current operations is taken into account in subaccount 79-2 “Settlements for current operations”.

Note that in accounting for settlements between the parent organization and the branch, it matters whether the latter has a current account or not. If there is one, then the separate division, as a rule, pays its own expenses. In its absence, the expenses of the branch are paid by the parent organization, which also controls the crediting of revenue for products sold by the separate division to the current account.

Example 2

The branch of PrimaVera LLC, allocated to a separate balance sheet and not having its own current account, provided transportation services to Antik CJSC (customer) in the amount of 55,000 rubles. (excluding VAT) and used the information services of a third-party organization, the cost of which is 36,000 rubles. (excluding VAT).

To pay for information services, the branch sent the parent organization an advice note containing information about the recipient, his details, the amount and terms of payment, with a copy of the invoice attached.

After paying the invoice to a third-party organization and receiving money from Antik CJSC to the current account, the parent organization sent the branch an advice note with information about the transactions performed and enclosing copies of payment orders and bank statements.

The following entries were made in accounting:

in the parent organization

DEBIT 79-2 CREDIT 51 - 36,000 rub. — paid for information services of a third party organization;

DEBIT 51 CREDIT 79-2 - 55,000 rub. — payment has been received from the customer for transport services provided;

at the branch

DEBIT 20 CREDIT 76 - 36,000 rub. — information services are taken into account;

DEBIT 76 CREDIT 79-2 — 36,000 rub. — paid for information services;

DEBIT 62 CREDIT 90-1 - 55,000 rub. — revenue from the sale of transport services is reflected;

DEBIT 79-2 CREDIT 62 - 55,000 rub. — payment has been received for services provided.

Example 3

Let’s use the condition of example 2. Let’s assume that in addition to paying for goods (work, services) purchased by the branch and monitoring the crediting of proceeds to the current account, the parent organization also records the receivables and payables of a separate division.

In this case, business transactions will be reflected in accounting as follows:

in the parent organization

DEBIT 79-2 CREDIT 76 - 36,000 rub. — information services provided to the branch by a third-party organization are taken into account;

DEBIT 76 CREDIT 51 - 36,000 rub. — paid for information services;

DEBIT 62 CREDIT 79-2 — 55,000 rub. — sales of transport services by the branch are reflected;

DEBIT 51 CREDIT 62 - 55,000 rub. — payment has been received for services provided by the branch;

at the branch

DEBIT 20 CREDIT 79-2 — 36,000 rub. — information services are registered;

DEBIT 79-2 CREDIT 90-1 - 55,000 rub. — revenue from the sale of transport services is reflected.

Purchase of property by a branch

The ownership of property (fixed assets, intangible assets) acquired through a branch (created by a branch) belongs to the organization as a whole. Therefore, the initial cost of such property, as a rule, is first reflected in the accounting records of the parent organization, and then in the accounting records of the branch in which it remains.

For example, a branch transmits to the parent organization information about capital investments made in fixed assets acquired (created) by it. The parent organization forms the initial cost of such a fixed asset item and draws up an act in form No. OS-12. Then the transfer of fixed assets to the branch is completed using an invoice for the internal movement of fixed assets (form No. OS-2).

The initial cost of a fixed asset can also be formed by the branch that acquired or created it. In this case, the act in form No. OS-1 is drawn up by the branch and approved by the parent organization. Capital costs of the parent organization are transferred to the branch using an advice note.

Raw materials, materials and goods purchased by a branch allocated to a separate balance sheet are accepted by it for accounting as part of inventories at actual cost in the generally established manner. So, for example, the receipt of materials from the supplier is reflected by the branch in the debit of account 10 “Materials” and the credit of account 60 “Settlements with suppliers and contractors”.

Formation of the cost of products (works, services)

The formation of the cost of products (works, services) in organizations with branches can be carried out in two ways:

- separately in each separate division;

- centrally in the parent organization.

The first method is used if the production of products (performance of work, provision of services) in branches is a complete process. In this case, the parent organization performs only administrative functions not directly related to production.

Example 4

Transway LLC, located in Moscow, provides freight transportation by road. The company has branches, allocated to a separate balance sheet, in many Russian cities. Each of them has specialists to accept orders for transportation, as well as for vehicles used to transport goods. In other words, the branches independently carry out the work of road transportation. Therefore, they form the cost of transportation. At the end of the month, actual expenses for completed transportation are written off from the credit of account 20 to the debit of account 90-2. The parent organization forms the cost of its transportation separately.

The second method is used if the parent organization is involved in the production process. In this case, there is a need to reflect finished products (work performed, services provided) in accounting, taking into account all actual costs.

Example 5

Let's use the condition of example 4. Let's assume that the logistics department, which accepts orders for transportation, carries out dispatch communications with drivers on a flight, and draws up documents related to cargo transportation, is located in the parent organization. In other words, the actual costs of cargo transportation are:

- from the expenses of a separate division for the maintenance of cars and payments to drivers;

- expenses of the parent organization for maintaining the logistics department. In this case, at the end of the month, the branches, on the basis of an advice note, transfer to the parent organization their actual expenses associated with cargo transportation.

The following entry is made in the accounting records of separate divisions:

DEBIT 79-2 CREDIT 20 - actual expenses for cargo transportation were transferred to the parent organization.

The following entries are made in the accounting records of the parent organization:

DEBIT 20 CREDIT 79-2 - expenses of branches for transportation are included in the cost of services provided.

Determination of financial results by a branch

The branch can transfer the resulting financial result (profit or loss) by advice to the parent organization quarterly or at the end of the year. In the first case, the following entries are made:

in the parent organization

DEBIT 79 CREDIT 99 - reflects the quarterly receipt of profit from the branch;

at the branch

DEBIT 99 CREDIT 79 - reflects the quarterly transfer of profit to the parent organization.

Thus, the “Retained Earnings” indicator will not be included in the branch’s balance sheet.

In the second case, the following transactions are made:

in the parent organization

DEBIT 79 CREDIT 84 SUB-ACCOUNT “RETAINED PROFIT OF THE REPORTING YEAR” - reflects the annual receipt of profit from the branch; at the branch

DEBIT 84 SUBACCOUNT “RETAINED PROFIT OF THE REPORTING YEAR” CREDIT 79 - reflects the annual transfer of profit to the parent organization.

The acceptance and transfer of losses of the branch is reflected in the accounting records in a similar way.

Note that a branch determines its own financial result if it represents a complete link in the production process, independently receives revenue from the sale of goods (works, services), and does not depend on the parent organization and its other separate divisions. Otherwise, he should notify the parent organization of his income and expenses in order to determine the final financial result for the organization as a whole.

Accounting statements of an organization with branches

The organization's financial statements must include performance indicators for all branches, representative offices and other divisions (including those allocated to separate balance sheets). This is stated in paragraph 8 of PBU 4/99.

Before preparing financial statements, the branch allocated to a separate balance sheet and the parent organization must reconcile the balances of the subaccounts of account 79. They must be mirror equal. For example, the debit balance of subaccount 79-1 of the parent organization must coincide with the credit balance of the same subaccount of the separate division.

The data of the parent organization and the branch on the subaccounts of account 79 are mutually canceled and are not taken into account when preparing financial statements for the organization as a whole. Otherwise, the total balance sheet currency is overstated.

Balances on other accounts of the branch are added to the balances on the corresponding accounts of the parent organization.

When drawing up a profit and loss statement (Form No. 2), a report on changes in capital (Form No. 3), an appendix to the balance sheet (Form No. 5), the performance indicators of the parent organization and the branch must be added line by line. The same should be done when filling out the cash flow statement (form No. 4). However, in this case, data on cash flows between the parent organization and the branch, that is, turnover on cash accounts (50, 51, 52, 55) in correspondence with account 79, should not be taken into account.

In the manner prescribed by the Tax Code, branches and other separate divisions of Russian organizations perform the duties of these organizations to pay taxes and fees at the location of these branches and other separate divisions (paragraph 2 of Article 19 of the Tax Code of the Russian Federation).

Article 15 of Law No. 129-FZ determines that organizations submit financial statements to executive authorities, banks and other users of financial statements in accordance with the legislation of the Russian Federation.

According to subparagraph 5 of paragraph 1 of Article 23 of the Tax Code of the Russian Federation, taxpayers are required to submit financial statements at the location of the organization in accordance with the requirements established by Law No. 129-FZ. This does not apply to cases where organizations, in accordance with the specified federal law, are not required to maintain accounting records or are exempt from maintaining them.

For the purpose of tax control, taxpayers are subject to registration with the tax authorities both at the location of the organization and at the location of its separate divisions (clause 1 of Article 83 of the Tax Code of the Russian Federation).

Thus, the taxpayer himself is registered with the tax authority at the location of the separate divisions - a legal entity, and not a separate division. Therefore, taxpayers are required to submit the organization’s financial statements to the tax authorities at the location of the separate divisions

Accounting in a separate branch, not included in a separate balance sheet

A structural unit that is not included in the autonomous balance sheet has a small number of employees. The volume of business transactions carried out by him is also insignificant. Accordingly, there is no need to open a bank account for him. For this reason, accounting, and indeed tax accounting too, is carried out for it by the parent organization that created it.

| Some nuances of the operation of a branch not included in the autonomous balance sheet | ||

| Material, monetary, and other resources come to him from the parent organization | Primary documentation generated by the branch on behalf of and in the name of the parent organization is sent within the established time frame to its accounting department, which then processes them and accepts them for accounting. | Separate sub-accounts for the branch (in order to reflect the accounting of property and existing liabilities) are created by the organization. It is on them that households take into account. operations of a separate branch |

A branch that is not included in the autonomous balance sheet can independently conduct accounting and tax accounting, provided that its staff provides an accountant rate . Then he deals with “accounting” issues, but again exclusively in the order established by the accounting policy of the organization. It should be recalled that it is formed only by the parent organization, and the branch does not participate in this process. Most often, such “independent” accounting of a department is limited only to the processing and systematization of primary documentation.

All certificates and registers prepared by the branch accountant are sent to the organization in finished form. Based on this received documentation, it displays business transactions on its accounting accounts.

Concept, legal aspects

All organizational issues that relate to various events in the economic life of an economic entity (creation, reorganization, liquidation, etc.) are regulated by civil law.

In the course of its activities, an economic entity can open separate structural units that are geographically separated from it. For example, they may be located in another city district, locality, constituent entity of the Russian Federation or foreign state. The Civil Code of the Russian Federation distinguishes 2 types of separate divisions of a business entity:

- Branch;

- Representation.

Their main difference lies in the powers granted to them by the parent organization. The branch carries out all types of economic activities or only some of them, including performing representative functions. The second of these is created solely to represent the interests of an economic entity, for example, to receive claims.

Are you an expert in this subject area? We invite you to become the author of the Directory Working Conditions

Note 1

It is worth noting that the Tax Code establishes the obligation to register any division of an organization that is located in a location different from the location of the main organization and is also equipped with workplaces. Moreover, it is assumed that activities in such a unit will last more than 1 month.

Separate structural units, including representative offices and branches, are not separate legal entities. Also, the individual parts of the economic entity under consideration have the following legal features:

- Their activities are carried out only on behalf of the parent organization, the name of which must be contained in their name (if any).

- All claims and lawsuits are brought against the parent organization.

- The property of such units is not their property, but is only used on the basis of ownership and use rights.

- The initiative to create, restructure or close a separate division, the appointment and dismissal of its head and some other significant decisions belongs to the parent organization.

- They operate on the basis of the regulations on the branch (representative office) of the legal entity that established them.

Finished works on a similar topic

Course work Features of accounting in branches and representative offices 420 ₽ Abstract Features of accounting in branches and representative offices 280 ₽ Test work Features of accounting in branches and representative offices 220 ₽

Receive completed work or specialist advice on your educational project Find out the cost

Example 2. Cash flow between an organization and a branch included in the autonomous balance sheet

So, all payments between the branch and the organization are made using an account. 79. When recording transactions, the branch must show: receipt of deducted money, transferring it to such and such an account, the fact of salary transfer, its own revenue, settlements with the supplier.

| Basic transactions for the branch | ||||

| receiving money from the account of the parent organization | deduction of money by the branch for settlement. your organization's account | deduction of salaries to branch employees | transfer of money from the organization’s account to the supplier under an agreement concluded with its branch | branch revenue per race. organization account |

| DT 50 KT 79 | DT 79 CT 50 | DT 70 – KT 79 | DT 60 KT 79 | DT 79 KT 62 |

In turn, the parent organization displays essentially the same operations within the framework of this movement of funds. They relate to the receipt of money by its branch, the transfer of money to their own account, the transfer of salaries to the accounts of employees of a structural unit, etc. The postings also use an account. 79. When making such calculations, it is important to reconcile the calculations between the organization and its branch.

Features of accounting for a separate division

One of the problems in setting up accounting was the insufficient coverage in the guidelines, explanations of the Ministry of Finance and specialized literature of the issues of accounting in sanatorium-resort institutions, as well as relations with the parent organization. For example, we were faced with the problem of determining the cost accounts of the main production. Since the sanatorium is allocated to a separate balance sheet and has a certain degree of autonomy, it is logical to assume that the main costs should be reflected in account 20 “Main production”. On the other hand, a separate division is part of the enterprise, and in relation to it the sanatorium is a service production. Accordingly, accounting for the costs of the main output should occur on account 29 “Service production and facilities”. A justified choice of accounting account is also important because costs for these accounts are recognized differently in tax accounting.

There are no solutions to issues of this kind either in legislative acts or in methodological recommendations and explanations of regulatory authorities; therefore, they are left to the enterprise itself. As a result, it was decided to record the costs of the main production of a separate division on account 29 “Service production and facilities” and the corresponding orders were issued.

Due to the fact that it was decided to separate the separate division into a separate balance sheet, it was planned to record its further interaction with the parent organization using the on-farm settlement mechanism (hereinafter referred to as ICM). There are two parallel water chemistry systems at NAZ: one is built on an external automated system and is designed to account for water chemistry between branches of PJSC “, the second is developed within the NAZ configuration and is intended to account for mutual settlements with a local unit.

Common mistakes of a legal entity and its separate branches

Error 1. If an organization has created at least one separate branch, then it does not have the right to apply the simplified tax system. This norm follows from paragraphs. 1 clause 3 art. 346.12 Tax Code of the Russian Federation.

In this regard, the Ministry of Finance of the Russian Federation (letter No. 03-11-11/29010 dated April 22, 2022) draws attention to the fact that if an organization has applied the simplified tax system previously, then in order to continue to apply this tax regime, it must comply with all the conditions outlined in Chapter. 26.2 Tax Code of the Russian Federation.

Deputy Director of the Department R. A. Sahakyan.

In addition, it should be noted that this Sec. 26.2 of the Tax Code of the Russian Federation covers in detail issues related to the use of the simplified tax system. Art. mentioned above. 346.12 contains an exhaustive list of persons who generally do not have the right to use the simplified tax system.