Updated fuel consumption standards.

All types of fuel are written off based on their actual consumption, but not higher than the approved fuel consumption standards.

The consumption standards for fuel and lubricants in road transport are established by Methodological Recommendations put into effect by Order of the Ministry of Transport of the Russian Federation dated March 14, 2008 No. AM -23‑r (hereinafter referred to as Order No. AM -23‑r, Methodological Recommendations). According to these recommendations, the fuel consumption rate in relation to road transport implies the established value of the fuel consumption rate when operating a vehicle of a specific model, brand or modification. The standards are intended for calculating the standard value of fuel consumption at the place of consumption, for maintaining statistical and operational reporting, determining the cost of transportation and other types of transport work, planning the needs of organizations to provide petroleum products, for calculating the taxation of enterprises, implementing a regime of economy and energy saving of consumed petroleum products, conducting settlements with vehicle users, drivers, etc.

It is worth noting that from April 6, 2022, these standards have been updated for some cars and trucks (buses, vans) of domestic production and the CIS countries, which have been produced since 2008. Also, from this date, the new edition contains the maximum values of winter surcharges to fuel consumption standards for the constituent entities of the Russian Federation and their parts. The changes were made by Order of the Ministry of Transport of the Russian Federation dated 04/06/2018 No. NA -51‑r.

Are autonomous institutions obliged to apply the standards of fuels and lubricants established by Order No. AM -23‑r? To be guided by Order No. AM -23‑r, the following is prescribed:

- Ministry of Justice - for the purpose of organizing the operation of vehicles (Letter dated September 21, 2009 No. 03-2609);

- Ministry of Finance - when determining the validity of expenses incurred for the purchase of fuel (letters dated January 27, 2014 No. 03-03-06/1/2875, dated January 30, 2013 No. 03-03-06/2/12, dated June 3, 2013 No. 03-03 ‑06/1/20097, dated 09/03/2010 No. 03‑03‑06/2/57, dated 01/14/2009 No. 03‑03‑06/1/6).

At the same time, it should be taken into account that the norms established by Order No. AM -23-r are advisory in nature, and failure to comply with the procedure provided for therein does not entail the application of administrative liability measures and budget coercive measures, orders to eliminate violations of budget legislation (Letter of the Ministry of Finance of the Russian Federation dated 13.12 .2013 No. 02‑10‑010/55111).

If Order No. AM -23‑r does not establish fuel and lubricant standards for a vehicle used in an institution, how to justify fuel consumption? In accordance with paragraph 6 of the Methodological Recommendations for models, brands and modifications of automobile equipment for which the Ministry of Transport has not approved fuel consumption standards, heads of local administrations of regions and organizations can put into effect by their order standards developed on individual applications in the prescribed manner by scientific organizations, carrying out the development of such standards using a special program-method. Before the adoption of a local act approving the standards, the institution can be guided by the relevant technical documentation and (or) information provided by the car manufacturer (letters of the Ministry of Finance of the Russian Federation dated July 11, 2012 No. 03-03-06/4/71, dated June 10, 2011 No. 03-03 ‑06/4/67).

Individual calculation of fuel consumption

An alternative to the options described above is accounting for fuel in tanks (or in car tanks) using a unique, developed system that will take into account all the standards, technical features, operating conditions of the car and other important parameters.

It is worth noting once again that the standards published by the Ministry of Transport are only methodological, comparatively comparable data. That is, they are not considered mandatory for use, and each vehicle fleet has the right to independently determine correction factors, based on the characteristics of its equipment. With this approach, nothing will prevent you from applying the coefficients proposed by the department in the future.

To develop your own fuel metering system for a fleet of vehicles, it is necessary to form a special commission, which should include company managers, technical specialists, and, of course, drivers.

This commission carries out control measurements of fuel consumption, which are based on:

- technical parameters of the machine;

- condition of the car;

- terms of use of the vehicle;

- seasons;

- etc.

The standards that will be obtained based on the work of such a commission are documented for each vehicle. The same standards will apply to the write-off of fuel and lubricants in a transport company. Such internal local documents can be edited, for example, when a company purchases new cars. But the main thing is to remember to document all changes in acts.

Of course, in reality, very few fleets develop their own fuel consumption standards. Either management lacks the desire, or there is a lack of experience and understanding of all the intricacies of the process. Although in this matter it is quite easy to find those who can provide competent support and assistance. Even a service station employee can partially cope with this task.

Specialized companies that install satellite fuel monitoring systems (for example, GLONASS fuel accounting) take the task as seriously as possible. In any case, you need to understand that with properly organized accounting and write-off of fuel and lubricants for special equipment, you can avoid excessive fuel consumption by as much as 20%.

Waybills are the basis for writing off fuel and lubricants.

Each fact of economic life is subject to registration with a primary accounting document. Primary documents serve as the basis for accepting the fact of economic life for accounting.

The main primary document for the purpose of accounting for the operation of official vehicles and the write-off of fuel and lubricants is the waybill. Properly issued waybills are accepted for registration.

Mandatory details and the procedure for filling out waybills are approved by Order of the Ministry of Transport of the Russian Federation dated September 18, 2008 No. 152 (hereinafter referred to as Order No. 152). According to this document, the mandatory details of the waybill include the following:

Name and number of waybill

The name reflects the type of vehicle for which the waybill is issued (passenger car waybill, truck waybill, etc.). The waybill number is indicated in the heading part in chronological order in accordance with the numbering system adopted by the vehicle owner

Information about the validity period of the waybill

Such information includes the date (day, month, year) during which the waybill can be used, and if the waybill is issued for more than one day - the dates (day, month, year) of the beginning and end of the period during which waybill can be used

Information about the owner (owner) of the vehicle

The name, legal form, location, telephone number, main state registration number of the legal entity are reflected

Vehicle information

Such information is indicated:

– type of vehicle (passenger car, truck, bus, trolleybus, tram) and model of the vehicle, and if the truck is used with a car trailer, car semi-trailer – model of the car trailer, car semi-trailer;

– state registration plate of the vehicle;

– odometer readings (full kilometers) when the vehicle leaves the garage (depot) and enters the garage (depot);

– date (day, month, year) and time (hours, minutes) of the vehicle’s departure from its permanent parking place and its arrival at the parking lot;

– date (day, month, year) and time (hours, minutes) of pre-trip control of the technical condition of the vehicle (if its mandatory implementation is provided for by the legislation of the Russian Federation)

Driver information

The driver's full name is reflected, as well as the date (day, month, year) and time (hours, minutes) of the driver's pre-trip and post-trip medical examinations

In addition to the listed details, additional details may be placed on the waybill, taking into account the specifics of activities related to the transportation of goods, passengers and luggage by road.

Currently, there are no unified forms of waybills required for use by state (municipal) institutions. Based on this, in order to determine the volumes of consumed fuel and lubricants that are subject to write-off, these institutions have the right to:

- use the forms of waybills (f. 0345001, 0345002, 0345004, 0345005, 0345007), approved by the Resolution of the State Statistics Committee of the Russian Federation dated November 28, 1997 No. 78 “On approval of unified forms of primary accounting documentation for recording the work of construction machines and mechanisms, work in road transport” ( hereinafter referred to as Resolution No. 78) (Letter of the Ministry of Finance of the Russian Federation dated October 3, 2012 No. 02-06-10/4066);

- use independently developed forms of waybills, subject to the inclusion in them of the mandatory details provided for by Order No. 152 (Letter of the Ministry of Finance of the Russian Federation dated August 25, 2009 No. 03-03-06/2/161 “On the use of independently developed forms of waybills”). Moreover, it is advisable for institutions to consolidate the use of such forms in their accounting policies.

A waybill is issued for each vehicle used by a legal entity. The issuance of waybills is subject to registration in the appropriate journal. The official responsible for issuing waybills is obliged to issue a “ticket” before issuing it to the driver and register the issued document in the journal.

All changes (corrections) made to the waybill are confirmed by the signature of the driver and the person responsible for issuing the waybills.

Issued waybills must be kept for at least five years.

Types and capabilities of accounting systems

Such a system is a software and hardware complex that allows you to monitor various parameters of the use of cars and other units running on gasoline or diesel fuel. The general principle of operation is to equip equipment with sensors to collect certain data and then transfer it to a central program, where a dispatcher or other employee can analyze the information received, generate reports and transmit them for further solving identified problems.

Now an organization can choose from several types of systems that differ in functionality and, of course, cost.

Satellite tracking

One of the most accessible systems relies on a PC program or smartphone app and beacons installed on vehicles. By connecting them to GPS and GLONASS satellites, management can not only track the vehicle’s position in real time and all routes, but also keep fuel consumption statistics.

The main disadvantage of the system is the calculation method itself, since it is based on the distance traveled and is completely mathematical, that is, it does not take into account many features, such as gasoline consumption for warming up the engine and idle time in traffic jams, as well as increased consumption associated with natural wear and tear. In addition, it makes sense to use beacons only on moving cars.

Fuel sensors

The above equipment can be supplemented with fuel level sensors and devices that transmit their readings to the central program. Such a system is more expensive, but also provides more reliable data, since all calculations are based directly on the fuel level in the tank, and not on data on movement and theoretical consumption.

Such a system can be considered an ideal option for most enterprises whose vehicle fleet consists of passenger cars and heavy-duty vehicles or even construction equipment.

High precision installation

And the last of the possible options for monitoring fuel consumption is a large system that includes not only GPS and GLONASS beacons, but also many other sensors, including flow meters, pressure and temperature sensors, and others. It is the most expensive, but allows you to obtain maximum information about the operation of each machine of the enterprise, including special equipment.

Such a high-precision installation is most relevant for the largest enterprises that own not only automobiles, but also other vehicles, and consume huge amounts of fuel during their operation.

In conclusion, it is worth noting that any of the above remedies can effectively solve at least some of the above problems and stop (or at least detect) employee misconduct. At the same time, the first solution copes directly with control of consumption rather poorly, but is quite capable of eliminating deviations in the route and trips on personal business. And more advanced systems can truly effectively control each vehicle, even with a large fleet.

What is a waybill

A waybill is a primary document that records the vehicle’s mileage. Based on this document, gasoline consumption can be determined.

Organizations for which the use of vehicles is the main activity must use the PL form with the details specified in Section II of Order No. 152 of the Ministry of Transport dated September 18, 2008.

Do you doubt the correctness of the posting or write-off of material assets? On our forum you can get an answer to any question that raises your doubts. For example, in this thread you can clarify what the basic fuel consumption rate is recommended by the Ministry of Transport.

We wrote about how the waybill was adjusted on our website:

For organizations that use a car for production or management needs, it is possible to develop a PL taking into account the requirements of the Law “On Accounting” dated December 6, 2011 No. 402-FZ.

An example of an order for approval of a DP can be found here.

In practice, organizations often use PLs that were approved by Decree of the State Statistics Committee of the Russian Federation dated November 28, 1997 No. 78. This resolution has PL forms depending on the type of vehicle (for example, Form 3 - for a passenger car, Form 4-P - for a truck) .

Mandatory details and the procedure for filling out travel forms are presented here .

You can learn about filling out waybills taking into account the latest innovations in the Ready-made solution from ConsultantPlus.

Inventory of fuels and lubricants at the enterprise

On the date of the inspection, the inventory commission (usually an accounting employee included in its composition) displays the balance of fuel and lubricants according to accounting data, and receipts are collected from the responsible persons for the delivery to the accounting department of all documents that recorded the receipt of fuel and its consumption.

Only after this do they begin directly measuring fuel and lubricants in containers and tanks. The nature of this work requires the use of special tools and measuring equipment - weighted tapes, measuring rods, etc. Inventory of fuels and lubricants is the most troublesome procedure of all types of control activities.

It is especially difficult to carry out measurements in large tanks with a capacity of 2 or 5 thousand tons. When recording natural indicators in such containers, auditors need to take into account the presence of condensation that accumulates in them due to significant temperature changes. Also, a mandatory procedure is to calculate the surface tension error of each type of inventory fuel depending on the air temperature on the day of inspection.

The actual quantity of fuels and lubricants stored in sealed containers that cannot be opened according to storage specifications is calculated using certain formulas.

Accounting for fuel consumption in the waybill

If we analyze the PL forms contained in Resolution No. 78, we will see that they contain special columns designed to reflect the turnover of fuel and lubricants. This indicates how much fuel is in the tank, how much has been dispensed and how much is left. Using simple calculations, the amount of fuel used is determined.

If we turn to Order No. 152 of the Ministry of Transport, then among the mandatory details of the submarine there will not be a requirement to reflect the movement of fuel. In this case, the document must contain speedometer readings at the beginning and end of the journey, which will allow determining the number of kilometers traveled by the vehicle.

When the PL is developed by the organization independently and it does not contain information on the use of fuels and lubricants, but contains only data on the number of kilometers, the standard volume of used fuels and lubricants can be calculated using the order of the Ministry of Transport of Russia dated March 14, 2008 No. AM-23-r. It contains fuel consumption standards for different brands of vehicles and formulas for calculating consumption.

Thus, on the basis of the PL, either the actual or standard write-off of fuel and lubricants is calculated. The data calculated in this way is used for reflection in accounting.

However, the use of PL to account for fuel consumption is impossible in some cases. For example, when chainsaws, walk-behind tractors, and other similar special equipment are refueled with gasoline. In these cases, a fuel and lubricants write-off act is applied.

A sample act for writing off fuel and lubricants can be viewed on our website.

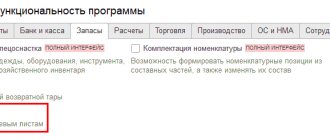

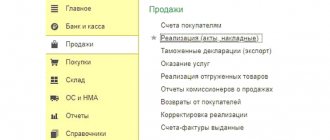

Accounting automation tools

Special automated systems for recording waybills and fuels and lubricants will help the accountant avoid the above-mentioned mistakes. They will remind you of the required fields, track the correctness and timing of the use of standards, and compliance of actual fuel consumption with the standard. In addition, such programs allow you to quickly fill out any number of waybills, which significantly facilitates the work of an accountant.

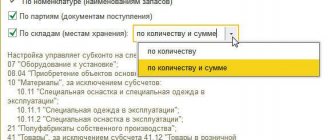

The more complex the accounting of fuels and lubricants in an organization, the greater the capabilities the automated system should have. When choosing a program, make sure it can:

- maintain a unified register of waybills;

- take into account the receipt and consumption of fuel and lubricants by vehicles, drivers and types of fuel and lubricants;

- take into account fuel consumption according to consumption standards or actual consumption based on the data from waybills, taking into account seasonality and road conditions;

- control deviations of actual costs for fuels and lubricants from the normative ones (saving modes, excessive consumption of fuels and lubricants);

- generate reports on drivers, types and brands of fuels and lubricants, on vehicles by division (department);

- prepare printed forms of the necessary reports on mileage and operating time, on the movement of fuel and lubricants, on issued auto parts and much more.

Accounting for fuel and lubricants

Like all inventories, fuel and lubricants are accounted for in the accounting department at actual cost. Expenses that are included in the actual cost are indicated in section II of PBU 5/01.

Acceptance of fuel and lubricants for accounting can be carried out on the basis of gas station receipts attached to the advance report (if the driver purchased the fuel in cash) or on the basis of coupon stubs (if gasoline was purchased using coupons). If the driver purchases gasoline using a fuel card, then accounting for fuel and lubricants on fuel cards is carried out on the basis of a report from the company issuing the card. Write-off of fuel and lubricants can be carried out using the following methods (section III):

- at average cost;

- at the cost of the 1st time of acquisition of inventory (FIFO).

PBU 5/01 has another write-off method - at the cost of each unit. But in practice, it is not applicable for writing off fuel and lubricants.

The most common way to write off fuel and lubricants is at average cost, when the cost of the remaining material is added to the cost of its receipt and divided by the total amount of the remainder and receipt in kind.

Write-off of fuels and lubricants

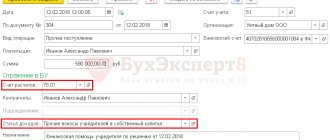

Accountants write off spent fuel and lubricants on the basis of documents - waybills, statements or acts drawn up by authorized persons. How often this operation occurs determines the procedure for writing off fuel and lubricants in budgetary institutions, established in the accounting policy. In small organizations that do not have a fleet of vehicles and the consumption of fuel materials is small, it is convenient to do this monthly. This is what the main wiring looks like:

| Debit | Credit | The essence of the operation |

| 040120272 | 010533443 | Write-off for current expenses |

| 0109хх272, where “xx” is the desired code | 010533443 | Write-off to cost |

When preparing financial statements, the write-off of fuel and lubricants in budgetary institutions for the entire period is checked and, if necessary, adjustments are made.

Write-off of gasoline using waybills (tax accounting)

If everything is quite simple with the write-off of fuel and lubricants in accounting, then the recognition of these expenses in tax accounting raises questions.

1st question: in what expenses should fuel and lubricants be taken into account? There are 2 options here: material or other expenses. According to sub. 5 p. 1 art. 254 of the Tax Code of the Russian Federation, fuels and lubricants are included in material costs if they are used for technological needs. Fuel and lubricants are included in other expenses if they are used to maintain official vehicles (subclause 11, clause 1, article 264 of the Tax Code of the Russian Federation).

IMPORTANT! If the main activity of an organization is related to the transportation of goods or people, then fuel and lubricants are material costs. If vehicles are used as service vehicles, then fuel and lubricants are other expenses.

The second question: should we normalize the costs of writing off fuel and lubricants within the framework of tax accounting? The answer to this can be found by linking the details of the waybill and legislative norms:

- The PL calculates the actual use of fuel and lubricants. The Tax Code of the Russian Federation does not contain direct indications that expenses for fuel and lubricants should be taken into tax accounting only according to actual standards.

- The PL contains information only about the actual mileage. However, fuels and lubricants can be calculated according to order No. AM-23-r, paragraph 3 of which states that the standards established by it are also intended for tax calculations. The Ministry of Finance of Russia in its letters (for example, dated 03/22/2019 No. 03-03-07/19283, dated 06/03/2013 No. 03-03-06/1/20097) confirms that order No. AM-23-r can be used to establish justification of costs and determine the cost of fuel and lubricants in tax accounting according to standards multiplied by mileage.

IMPORTANT! In tax accounting, fuels and lubricants can be taken both according to actual use and according to the quantity calculated based on the standards.

In practice, a situation is possible when an organization uses transport for which fuel consumption standards are not approved in Order No. AM-23-r. But in paragraph 6 of this document there is an explanation that an organization or individual entrepreneur can individually (with the help of scientific organizations) develop and approve the necessary standards.

The position of the Ministry of Finance of Russia (see, for example, letter dated June 22, 2010 No. 03-03-06/4/61) is that before developing standards for the write-off of fuel and lubricants in a scientific organization, a legal entity or individual entrepreneur can be guided by technical documentation.

There are no explanations in the Tax Code of the Russian Federation on how to act in such a situation. In cases where an organization independently established standards for writing off fuel and lubricants and, having exceeded them, took into account the amount of excess fuel use in tax accounting, the tax inspectorate may not recognize this as an expense. Accordingly, additional income tax may be charged. In this case, the court may well support the position of the inspectorate (see, for example, the resolution of the Administrative Court of the North Caucasus District dated September 25, 2015 in case No. A53-24671/2014).

Read about the amount of fines for not having a waybill in this article .

Problems of lack of control

If there is a negligent attitude towards reporting and calculating fuel costs and a complete lack of control, the company may face a number of problems associated, first of all, with the dishonesty of drivers. Examples include:

- Drain off the remains. After a work shift or during downtime of a company vehicle, the driver can drain unused gasoline or diesel fuel and use it for further resale or refueling his own car.

- Working with “left” checks. This method is used in cases where fuel is purchased at the expense of the drivers themselves, and the costs are reimbursed by the company’s accounting department against the provided check. By purchasing “left” checks, the driver gets the opportunity to “cash out” the difference between them and the actual cost of refueling.

- Personal trips. If the vehicle's route is not tracked by the company, the driver may use fuel for his own needs and trips.

- Inflating readings. When the vehicle is idle, drivers can also increase the odometer, compensating for the difference between its readings and the true values in their favor.

This is not a complete list of ways to deceive a company, so organizations that are responsible about spending and saving resort to various methods of tracking the gasoline consumption of company vehicles. Most often, specialized fuel consumption monitoring systems are used for this.

An example of writing off fuel and lubricants using waybills

One of the most common types of fuel and lubricants is gasoline. Let's consider the example of purchasing and writing off gasoline.

Pervy LLC (located in the Moscow region) purchased 100 liters of gasoline in September at a price of 38 rubles. without VAT.

At the same time, at the beginning of the month, the LLC had a stock of gasoline of the same brand in the amount of 50 liters at an average cost of 44 rubles.

Gasoline in the amount of 30 liters was used to refuel a VAZ-11183 Kalina car. The organization uses a car for official transportation of management personnel.

The organization uses average cost estimates for materials.