The salary intended to be paid for the performance of labor functions belongs to the employee who earned it. No one has the right to restrict its payment. But there are special cases stipulated by law, which provide for some deduction of funds from the amount due for payment. An important basis is the receipt by the employer of a writ of execution - a document obliging the withholding.

- What may serve as a reason for sending a writ of execution,

- How does the retention procedure work?

- in what amount and how is all this recorded in the accounting accounts?

We analyze it in the material below.

Question: How to record deductions from an employee’s salary (using the example of one month) based on two writs of execution for the collection of arrears in payment of bank loans in the amount of 100,000 rubles. and 50,000 rubles? The employee's salary is 50,000 rubles. Payment of wages is made by transferring funds to the employee’s bank account. For profit tax purposes, income and expenses are accounted for using the accrual method. View answer

Legislative justification

Federal and labor legislation regulates the process of withholding part of labor income under executive documents.

Question: How can an employer deduct from an employee’s wages under a writ of execution (loan repayment) if the employee has submitted a notarized agreement to pay alimony for a minor child in the amount of 70%? View answer

Art. 98 of the Federal Law of October 2, 2007 No. 229-FZ “On Enforcement Proceedings” speaks of the obligation of employers or other persons making payments, on the basis of enforcement documents, to deduct part of the funds from the amount due to the debtor and transfer them to the recoverer. This act also lists the documents that serve as legal grounds for monetary deductions.

IMPORTANT! The withholding and transfer of money under executive documents in no way depends on the will of the payer of the salary and the employee himself; this is an unconditional obligation.

The Labor Code of the Russian Federation (Article 138) limits the percentage of possible deductions, and also stipulates cases to which the limit does not apply.

Accounting records of deductions are made in accordance with the instructions set out in Letter of the FSSP of Russia dated June 25, 2012 No. 12/01-15257.

Question: The employer withheld alimony from the employee’s wages based on his personal application, but the organization did not receive a writ of execution. Does the employee have the right to withdraw this application? Is the employer obliged to notify the recipient of alimony about the withdrawal of the specified application? View answer

From what income can amounts be withheld under a writ of execution?

Deductions under a writ of execution are possible from:

- wages, including those paid in kind, salary advances, average earnings saved for the duration of a business trip;

- bonuses, allowances, incl. for working in hazardous conditions;

- payments for part-time work (both internal and external);

- payment for downtime;

- vacation pay, including compensation for unused vacation;

- temporary disability benefits;

- material assistance;

- other income paid by the employer to the employee.

You can also withhold money under a writ of execution from amounts paid under a civil contract (for example, for renting an employee’s personal property or for performing work under a contract).

Direction of writ of execution

A writ of execution is a document handed over to a bailiff (executor), which is sent by him to make deductions at the place of official employment of a person recognized as a debtor.

Question: The debt on a bank loan is deducted from an employee’s salary according to a writ of execution. Does the employer need to submit a writ of execution to the Social Insurance Fund of the Russian Federation (pilot project) if an employee goes on maternity leave? View answer

Such papers may include:

- documents issued by courts based on decisions made;

- court orders;

- agreements on payment of alimony (certified by a notary);

- papers issued by labor dispute commissions;

- acts of regulatory authorities authorized to carry out collections from bank accounts if there are no or insufficient funds in these accounts;

- executive orders of bailiffs;

- agreement on the recovery of funds out of court under a pledge agreement (with the executive signature of a notary);

- other documents required by law.

REFERENCE! Most often, the accounting department of organizations receives writs of execution, alimony agreements, and bailiff orders. The original document or a duplicate issued by the same authority must be presented.

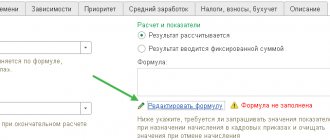

How to close a writ of execution in 1C

If we have specified a date for the termination of the writ of execution, or the withholding is limited to a specified amount, then the document will terminate automatically upon reaching these conditions.

Rice. 13 How to close a writ of execution in 1C

If we have not set an end date, or we have changed the terms of the document, then we can close it or change the conditions using a special document that can be entered in the same journal “Alimony and other permanent deductions”.

Rice. 14 Magazine “Alimony and other permanent deductions”

In the form that opens, select the employee for whom we close or change the document, indicate the source sheet and set the switch - “Stop with:” and set the date (or change other conditions).

Rice. 15 Specify the source sheet and set the switch – “Stop with:...”

Another way to change the terms of payments is to create “Changes of the writ of execution” on the basis.

Rice. 16 Changes to the writ of execution

This method is more convenient, since the document is filled out automatically based on the specified document. All we have to do is make changes or terminate it by setting a date.

Rice. 17 All we have to do is make changes or terminate it by setting a date

The saved document will be available in the “Alimony and other permanent deductions” journal.

Rice. 18 The saved document will be available in the journal “Alimony and other permanent deductions”

Let's set up deduction accounting in 1C:ZUP

We will set up automated work with writs of execution.

The first consultation is free! from 2600 rub./hour

To learn more

Finalization of writs of execution in 1C: ZUP

Do you need a non-standard accounting of employee debt deductions?

We include a guarantee for improvements in the contract! from 2600 rub./hour

To learn more

What exactly is the subtraction from?

When it is necessary to reduce wages by a certain amount, the question may arise: from which components of the salary it should be deducted. Since monetary remuneration for work consists of several elements, the legislation takes into account exactly those types of income that are subject to reduction by the amount of deduction.

The money supply that makes up wages consists of:

- the actual remuneration - salary or tariff rate;

- compensatory additional payments for length of service, rank, special working conditions, etc.;

- incentive bonuses: bonuses, incentives, etc.

This entire amount is first reduced by the amount of mandatory tax deductions, and only then the required deductions are calculated (Article 99 of Federal Law No. 229).

What income cannot be withheld?

There are payments to which the withholding procedure is not applicable: their list is regulated by Art. 101 Federal Law No. 229. These types of income include:

- assistance accrued in the event of the death of a family member;

- humanitarian aid;

- compensations provided for by the Labor Code of Russia;

- means designed to compensate for damage caused to health.

NOTE! For persons obligated to pay alimony for children under the age of majority, this amount will be deducted, among other things, from compensation payments for health - in these cases, the restriction is lifted.

Compensation for damage to a budgetary institution

The employer has the right to apply to the perpetrator, in addition to measures to compensate for the material damage caused, measures of influence determined by internal regulations. This could be deprivation of a bonus, imposition of a penalty, reprimand, etc. This operation will be reflected in accounting as follows (clauses 84, 109, 110, 114, 115 of Instruction No. 174n): Contents of the transaction Debit Credit Amount, rub. Write-off of the cost of gasoline (30 l x 29 rubles) 0 401 10 172 0 105 34 440 870 Reflection of the amount of damage at market value (30 l x 29 rubles) 0 209 74 560 0 401 10 172 870 Receipt from the guilty person to the cash desk of the amount of compensation for damages market value 0 201 34 51017 0 209 71 660 870 Depositing funds from the cash register to the account in cash 0 210 03 560 0 201 34 61018 870 Depositing funds to a personal account with the Federal Treasury 0 201 11 51017 0 210 03 660 870 Example 3.

According to the advance report submitted to the accounting department, the balance of the accountable amount is 1000 rubles. was not returned by the employee on time. A month later, the employee quit, and this amount was not withheld from his salary.

We recommend reading: Organization of the Work of the Legal Department of the PFR

How much can you hold

Even after making a legal deduction, the employee cannot be deprived of too much of his earnings. The law protects the debtor by limiting the maximum amount of deductions from his wages. However, when calculating the amount of deductions, there are several legislative nuances.

- As a general rule, the percentage of all deductions should not exceed a fifth of the amount of income.

- In certain situations, specifically specified in laws, more than half of the funds cannot be withheld.

- The maximum amount of deductions for writs of execution - up to 70% - is possible for certain reasons strictly regulated by law (Article 138 of the Labor Code of the Russian Federation, Article 99 of Federal Law No. 229):

- child support for small children;

- compensation for damage to health;

- benefits upon death of the breadwinner;

- compensation as a result of the commission of a crime.

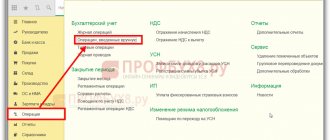

Deductions from salaries in the 1C program: Enterprise Accounting 8

Published 10/03/2016 12:07 Author: Administrator Sometimes situations arise in which it is necessary to withhold certain amounts from an employee’s salary. In one of the previous articles, we already looked at Retention based on a writ of execution in 1C: Enterprise Accounting 8 edition 3.0. In this article we will look at how to work with other types of deductions: debt on accountable amounts, union membership dues and the cost of damaged material assets (defects in the manufacture of products).

How are these deductions fundamentally different from the deductions based on a writ of execution, discussed earlier? The fact is that accounting for such operations is not automated in the 1C: Enterprise Accounting 8 program and therefore raises quite a lot of questions from users.

But before we begin to deal with how these situations are reflected in the program, I would like to remind you that, according to Article 138 of the Labor Code of the Russian Federation, the amount of deductions at the initiative of the employer should not exceed 20% of the employee’s salary. Therefore, if the amount of deductions exceeds the maximum possible, then the balance is withheld in the next month. So, let's look at how to reflect each of the three listed cases in the program.

1. Retention of debt on accountable amounts

Let’s say that an employee did not fully account for the amounts issued on account and did not return the balance of the debt. It was decided to withhold the specified amount from his salary. First of all, we need to add a new Calculation Type . To do this, open the section “Salaries and Personnel”, “Directories and Settings”, “Deductions”

Click on the “Create” button and fill in: - name - code of the calculation type, which must be unique, that is, it must not be repeated. The “Deduction Category” field is not filled in in our case, since there is no suitable category in the list for the “Retention of Accountable Amounts” calculation type.

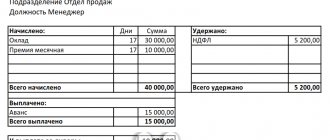

Write it down and close it. Next, create a “Payroll” document. Open the section “Salaries and Personnel”, “Salaries”, “All Accruals”. After automatically filling out this document, go to the “Deductions” tab, click the “Add” button and fill in: - Full name of the employee - type of calculation - amount of deduction - recipient of the deductions

But if we post the document, we will notice the following peculiarity: the document did not automatically generate postings for this deduction. To register this fact in accounting, you must additionally use the “Operation” document (section “Operations”, “Accounting”, “Operations entered manually”).

We add the posting Dt account 70 Kt account 71.01 “Settlements with accountable persons”

Why then was it necessary to add this deduction to the payroll document if the postings still have to be generated manually? And this must be done so that this amount is reflected in the payroll and payslip, and is also taken into account when determining the amount to be paid. We will generate a pay slip (section “Salaries and Personnel”, “Salary”, “Salary Reports”, “Pay Slip”) and check the amount withheld.

2. Withholding of trade union dues

We start again by setting up the calculation type. As in the first case, fill in the name and code of the calculation type. Only now we select the deduction category “Trade Union Dues”, because she is on the list.

Write it down and close it. We create the “Payroll” document, fill it out and use the “Add” button on the “Deductions” tab to enter the necessary information, selecting the created type of calculation.

Next, we register the amount of deduction in accounting using the document “Operations entered manually.” We create a posting for Dt account 70 Kt account 76.49 “Calculations for other deductions from employees’ salaries”

To check, we will generate a payslip; the amount withheld should be reflected in the Withheld .

3. Retention for marriage.

Let's consider an example when an employee of the organization Maxima LLC manufactured a part with a defect that cannot be corrected, and we must deduct the cost of damaged material assets from his salary. Just as in previous cases, we start by setting up the calculation type. We do not fill out the retention category.

Now we fill out the “Payroll” document and add information about our deduction to the appropriate tab. Click on the link in the lower left corner to view and print the Payslip

We register the amount of deduction in accounting by filling out the document “Operations entered manually.” We create the posting Dt 70 Kt 73.02 “Calculations for compensation for material damage.”

As you may have noticed, the reflection of all three situations in the program is approximately the same, only the postings that need to be generated manually are different. You can use the same algorithm of actions when creating any other deductions that are needed in your organization.

Author of the article: Svetlana Gubina

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

0 Olga_91 06/19/2018 21:40 Thank you very much for the information! You helped a lot, I wish there were more useful articles like this! =))

Quote

+2 Arthur 10/16/2016 19:34 Dear Olga Shulova! Thank you very much for all this information, you tell us in such detail that everything is immediately clear. I am very glad that I found you on the site and often use your information about 1s 8.3, thank you again!!!

Quote

Update list of comments

JComments

Several writs of execution per person

When more than one writ of execution is received for the same employee, when calculating deductions, you must adhere to priority in the order. When there are several sheets, the employee at fault must still retain at least 50% of his salary (except for special cases that provide for maximum deduction).

Each subsequent portion is deducted from the amount remaining after deduction upon request of the higher priority. The priority of satisfying the claimant's requirements is established by Part 1 of Art. 111 of Law No. 229-FZ.

Salary reductions will continue until the claimant receives the funds due to him, indicated in the writ of execution, in full.

If it is impossible to simultaneously comply with the obligations under the deduction limit and the accrual of penalties for the same queue, then the funds allocated under several writs of execution should be distributed proportionally.

Actions of an employer who has received a writ of execution

The law dictates the obligation of the salary payer (tax agent), upon receipt of the writ of execution, to begin making deductions from the salary and other working income of the debtor provided for by the Federal Law. For all types of enforcement documents, deduction must be made on the day the document is received, and the withheld funds must be transferred to the claimant within three days. An exception is the alimony agreement - deductions under it must occur every month.

IMPORTANT INFORMATION! The costs of transferring money to the collector also lie on the shoulders of the debtor.

Deductions based on writs of execution and accounting

It is necessary not only to correctly calculate and make monetary deductions, but also to correctly carry them out in financial accounting. In accounting, the credit item of account 76 “Settlements with various debtors and creditors” is intended for this purpose.

If the organization is large and such deductions need to be made frequently, then it is advisable to open a sub-account specifically to record such deductions. In this case, such a sub-account must be registered in the working plan of accounts (clause 4 of PBU 1/2008, approved by order of the Ministry of Finance of the Russian Federation dated October 6, 2008 No. 106n). The accounting entry will look like this:

- debit 70, credit 76, subaccount “Deductions according to use. sheets": deduction from an employee’s salary on the basis of an executive document (name);

- debit 76, credit 50 (51), subaccount “Deductions according to use. sheets": the withheld financial resources are sent to the claimant.

Additional expenses intended for the delivery of funds to the address (bank commission for transfer, postage, etc.) are collected from the debtor, and the accountant also needs to write them off correctly. You can also open a separate sub-account for this.

The employee can agree to voluntarily write off this amount or deposit it in cash at the cash desk. If consent is not received, these funds will be collected forcibly - the organization will simply add another writ of execution. Wiring:

- debit 70, credit 76, subaccount “Additional expenses on writs of execution”: deduction from the employee’s salary of expenses associated with withholding on the basis of a writ of execution (name);

- in case of voluntary contribution of funds by an employee - debit 50(51), credit 73, subaccount “Additional expenses under writs of execution”: an amount has been deposited to reimburse the employer’s expenses for the payment of funds under the writ of execution (name).

Alimony: entries in accounting

Let's look at accounting using an example.

Manager Altufiev S.N. According to the writ of execution, he pays alimony for two children in the amount of 1/3 of his earnings. The employee's salary for January 2022 was 30,000 rubles. The employee did not write an application for a personal income tax deduction.

| Sum | Debit | Credit | |

| Salary accrued | 30 000 | 44 | 70 |

| Personal income tax withheld 30 000 × 13 % | 3900 | 70 | 68 |

| Maintenance payments are withheld from the employee's income (30 000 – 3900) × 1/3 | 8700 | 70 | 76 |

| The withheld amounts are transferred to the recipient's current account | 8700 | 76 | 51 |

| Bank commission paid for transfer (0.1%) 8700 × 0,1 % | 8,70 | 73 | 51 |

| Bank commission for transfer is withheld | 8,70 | 70 | 73 |

| Employee's salary transferred 30 000 – 3900 – 8700 – 8,70 | 17 391,30 | 70 | 51 |

The recipient can also choose to receive the payment in cash.

Alimony payments were issued from the cash register, posting Dt 76 Kt 50.