Among the variety of taxes and fees intended for mandatory calculation by business entities, VAT occupies a special place. The specificity of this tax lies in the complexity of its correct calculation, and in the ambiguity of the interpretation of the provisions of Chapter 21 of the Tax Code, which is subject to regular changes.

Over the 25 years that have passed since the introduction of the Law on Value Added Tax, many legal provisions relating to VAT have been subject to serious revision.

But over the past 10 years, the current tax rates listed in Article 164 of the Tax Code of the Russian Federation have remained stable.

On a note! You can calculate the tax amount using a special VAT calculator.

VAT rate for export

There are several points of view explaining the appearance of the 0% VAT rate.

On the one hand, VAT is an indirect tax paid by the buyer. Foreign buyers are not subject to the Russian Tax Code and therefore do not have to pay Russian VAT. In this regard, the sale of Russian goods and services to foreigners should occur without tax.

On the other hand, exports are of great importance for the economic growth of the country, so the state is interested in businesses striving to develop sales not only within the country, but also abroad. To increase the interest of entrepreneurs in export operations, there are various stimulating economic instruments. One of them is the VAT rate for export transactions, equal to 0%. Against the backdrop of fairly high regular VAT rates, one of which was recently increased, the use of a zero VAT rate for exports looks very attractive.

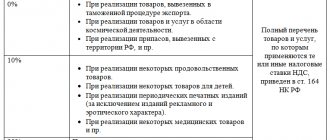

Let us remind you what VAT rates exist in Russia in 2022:

Tax rates

In the Russian Federation, norms may be applied to a business entity that exempt it from the need to pay VAT. This right is given to the taxpayer by Articles 145 and 164 of the Tax Code of Russia.

In order to understand what the VAT rate “0” and “without VAT” is, what is the difference between these types of taxation, let’s consider the features of each of them.

Exemption from the VAT burden can be of two types:

- VAT rate “0%” is identified as export. In this case, the taxpayer is recognized as a VAT payer;

- “Without VAT” - this type implies that there is no VAT at all in the sales amount, and the subject is not a tax payer, or is exempt from paying it for a certain period.

Zero rate

So, the subject of our article is VAT on the export of goods.

As mentioned, the VAT rate for exports is 0. Clause 7 of Art. 164 of the Tax Code of the Russian Federation was introduced recently and allows in some situations to refuse the 0% rate:

It is logical to ask, for what purpose or for what reasons can one refuse a preferential rate? One of the reasons is this: you cannot simply take and apply a 0 VAT rate when exporting; you need to confirm it. And confirmation of the 0 VAT rate for export requires the collection of a large amount of documentation, that is, labor and time costs.

We will tell you further what is needed to confirm the zero VAT rate for export.

Results

Having understood the questions of what a VAT rate “0” and “without VAT” is, what is the difference in the activities and status of taxpayers for which these rates may be applicable, we can draw the main conclusion:

- a 0% VAT rate applies to VAT payers carrying out certain transactions that are subject to taxation;

- the status “Without VAT” applies to persons exempt, including temporarily, from the duties of a VAT payer (for example, to entities on the simplified tax system).

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Confirmation of eligibility for a 0 percent rate

The procedure for confirming the zero VAT rate is described in Art.

165 Tax Code of the Russian Federation. To prove the legality of applying the zero VAT rate for exports, it is necessary to generate the following package of documents:

Instead of copies of the specified documents, paragraph 15 of Art. 165 of the Tax Code of the Russian Federation allows the submission of electronic registers indicating the registration numbers of the relevant declarations.

Electronic registers must be compiled in approved formats and sent to the tax authority via TKS through an EDI operator duly registered in the Russian Federation.

It must be borne in mind that during the audit, tax authorities may require the submission of documents from the electronic register.

The taxpayer is given 180 calendar days to collect documents.

If after 180 days the documents are not collected, the goods sold must be subject to VAT according to Russian rules (at the rates from paragraphs 2 and 3 of Article 164 of the Tax Code of the Russian Federation). If the taxpayer nevertheless collects the entire package of documents after 180 days and pays VAT under Art. 164 of the Tax Code of the Russian Federation, the right to submit documents to the tax office is retained. If the tax authorities come to the conclusion that the 0% rate has become confirmed, the previously paid VAT on exports will be returned to the taxpayer.

Clause 10 of Art. 165 of the Tax Code of the Russian Federation states that the VAT declaration and confirmation documents must be submitted to the tax office at the same time.

When the tax office may refuse to apply a preferential VAT rate

When selling packages that contain groups of goods with different VAT rates, the use of a reduced percentage may lead to justified claims from the tax authority.

Example 1

To increase sales, trading organizations often use a sales scheme for self-assembled kits, where goods are subject to VAT at different rates. For example, on the eve of the New Year holidays, a huge number of children's gifts appear on sale, containing sweets and toys. Confectionery products (sweets) are subject to VAT at the rate of 18%, and children's toys belong to a preferential group of goods.

The Ministry of Finance and the Federal Tax Service considers the use of a 10% VAT rate on a New Year's gift set when setting the price to be an illegal action, since the list of codes of the Government of the Russian Federation No. 597 dated June 18, 2012 does not contain such a position.

A similar situation may arise, for example, when selling specialized magazines with the provision of an additional service - access to a web resource or electronic media. In this case, the 10% rate applied to printed products can only be applied directly to the magazine. The service of virtual news publication should be taxed at the standard rate of 18%.

Keep in mind ! To avoid tax claims when selling sets with different VAT percentages, it is advisable to indicate in the documents and on the price tag the individual product items included in the set.

Example 2

Sales of bakery products are carried out using a reduced VAT rate of 10%. When updating the product range, you should be careful about the names of new products. For example, the term “pizza” is not in the list of OKP , therefore, despite actual compliance with the letter of the law, for formal reasons the manufacturer must apply a rate of 18% when selling pizza.

Conclusion: It is advisable to choose a name for a new product for which it is planned to apply a preferential VAT rate, being as close as possible to the terms used in regulatory documents - lists of OKP approved by the Government of the Russian Federation.

Simple names will not give tax authorities grounds to refuse to use the reduced tax rate.

Features of VAT accounting in the presence of export operations

If a company begins to export, then the question arises: what accounting features exist for this type of activity?

Let's analyze the subtleties of export in terms of VAT calculation. Let's consider the concept of export in relation to goods. When exporting services, VAT is paid in the general manner if they are provided on the territory of the Russian Federation. Services are not subject to VAT if provided outside the Russian Federation.

If an organization carries out both taxable and non-VAT-taxable transactions, then clause 4 of Art. 149 of the Tax Code of the Russian Federation requires separate accounting of such transactions, because one of the main conditions for accepting input VAT from a supplier for deduction is the condition that the purchased goods (work, service) are used for operations subject to VAT.

By analogy, we can say that when a 0% rate is applied, it becomes necessary to keep separate records of such transactions. Thus, separate accounting for VAT on exports is necessary.

Let's turn to the regulatory framework. Paragraph 3 clause 10 art. 165 of the Tax Code of the Russian Federation prescribes separate VAT accounting according to the rules established by the taxpayer himself, if he has activities taxed at a 0% rate. However, there is an exception to this rule: when exporting non-commodity goods registered after 07/01/2016, separate accounting can be omitted and VAT can be deducted in the general manner.

Deadline for determining the tax base:

Taxpayers using the simplified tax system, in accordance with paragraph 2 of Art. 346.11 of the Tax Code of the Russian Federation, must pay VAT when importing goods into the customs territory of the Russian Federation. However, nothing is said about the need to pay VAT on exports. Thus, when exporting, simplifiers do not have any VAT obligations.

VAT 0 percent is used in the following cases - list

In addition to the updates that came into force on October 1, 2019, the zero VAT rate is used in the following cases:

- for export sales (including to EAEU countries), application of re-export procedures to goods and placement in a free customs zone;

In what cases is it possible and meaningful to abandon the zero rate and pay VAT at rates of 20 or 10%, ConsultantPlus experts told. You can view the explanations for free by getting trial access to K+.

- international cargo transportation and provision of services related to transportation of this kind;

- transfer through pipelines abroad of the Russian Federation of oil, its products, as well as natural gas and the provision of services associated with the transportation of such goods;

- management of the electrical network through which electricity is supplied abroad of the Russian Federation;

- storage and transshipment of goods heading outside the Russian Federation in ports (sea and river);

- using the processing regime in the customs territory;

- provision of trains and containers, provision of transport forwarding services for the purpose of exporting goods from the territory of the Russian Federation;

- transportation by inland water transport of cargo intended for export to the point of reloading it onto a vehicle traveling beyond the border of the Russian Federation;

- export outside Russia of hydrocarbon raw materials and products of their processing from the territory of offshore fields belonging to the Russian Federation, but not in the export mode;

- air transportation of goods carried out by Russian carriers between foreign points with an intermediate landing in Russia;

- providing services for VAT refund to a foreign buyer exporting goods purchased at retail in the union outside the EAEU;

- providing services for the transit movement of foreign goods across the territory of the Russian Federation from the place of import to the place of export;

- provision of trains and containers, provision of transport forwarding services during transit transportation of goods of foreign origin in the Russian Federation;

- passenger transportation carried out crossing the Russian border;

- passenger transportation within Russia by air, if it is carried out from or to the Kaliningrad region, Crimea, Sevastopol or the Far Eastern Federal District;

- creation of space-related equipment and provision of services related to space exploration;

- sale to state funds or banks of precious metals by persons engaged in their extraction or production from scrap and waste;

- sales made for the purpose of use in foreign representative offices;

- sales of fuel and fuels and lubricants that ensure the operation of air and sea/mixed (river-sea) vessels traveling beyond the border of the Russian Federation;

- transportation of goods intended for export or re-export and provision of services related to such transportation;

- railway movements of goods from the Russian Federation to a country that is a member of the Customs Union, and transit transportation between foreign states and member countries of the Customs Union, as well as between countries of the Customs Union;

- railway passenger transportation in suburban and long-distance (except international) traffic;

- sale of sea vessels created in the Russian Federation;

- sales made for the purpose of use by international organizations operating in the Russian Federation;

- provision of sea or mixed (river-sea) vessels with a crew for the transportation of goods in the Russian Federation or beyond its borders for a time;

- sales related to the FIFA World Cup in Russia in 2022;

- sales related to the Olympic and Paralympic Games in the Russian Federation in 2014.

Note that the last two points have actually lost their relevance, but continue to remain on the list.

Deduction for export transactions

A pressing question is whether an organization is entitled to deduct VAT when exporting?

The answer is yes. Input VAT for export, that is, the VAT that you paid to the seller for goods used for export, is deductible. But for this there is a certain procedure, somewhat different from the general procedure for accepting VAT for deduction. Those involved in the distribution of VAT on exports need to pay special attention to the process of VAT deduction.

The procedure for applying deductions when calculating export tax is described in paragraph 3 of Art. 172 of the Tax Code of the Russian Federation. It states that exporters of non-commodity goods can deduct input VAT in the general manner, that is, in the same way as for ordinary non-export sales. These rules were introduced on July 1, 2016. Those exporters who refused to use the preferential rate do the same.

For commodity exporters, the process of applying deductions depends on whether a package of documents confirming the zero rate has been collected or not. In addition, if VAT was accepted for deduction earlier, VAT restoration will be required when exporting this product.

Filling out a VAT return when exporting

Let's consider what data and in what sections must be entered when filling out a VAT return for export.

Declaration for export of non-commodity goods

When exporting non-commodity goods, VAT is deductible according to the same rules as for ordinary transactions.

Line 120 of Section 3 must be completed. The fact that the collection of documents does not affect the period for recognition of the deduction does not exempt the taxpayer from collecting a package of documents confirming the zero rate. If this package is formed in the reporting quarter of shipment, the amount of the tax base falls into line 020 of section 4, and line 030 remains empty, otherwise a double deduction will result. Section 4 is completed in the same way during the period of receiving the full package of documents. An example of filling out a declaration regarding export, that is, filling out the specified lines, is shown below.

How to report VAT if you export raw materials

As already mentioned, when exporting raw materials the situation is different, which is why the declaration is filled out differently. For such exporters, there are special export sections 4, 5 and 6 in the declaration.

The completed sections of the declaration (they may be in different declarations for different tax periods) are presented below:

VAT refund on export

VAT refund when exporting is a frequent procedure.

This is due to the peculiarities of export operations, namely the fact that when a 0% rate is applied, the VAT charged to the buyer is zero. Provided that goods for export are purchased from VAT payers, that is, when input VAT exists, VAT refund on export becomes inevitable. The same situation as with the return of export VAT may arise for ordinary transactions carried out within the country. The procedure for refunding export VAT and regular VAT does not differ in any way. Only the package of necessary documents differs: as already mentioned, in order to receive a VAT refund when exporting from Russia, you must collect documents confirming the zero tax rate.

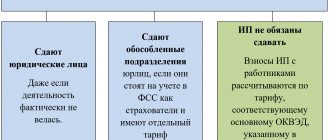

Organizations on OSN or simplified tax system without VAT

An organization has the right not to pay VAT in two cases:

- If it applies the general taxation system and has revenue of less than 2 million rubles for the three previous consecutive calendar months, by virtue of Article 145 of the Tax Code of the Russian Federation.

- If special tax regimes are applied: simplified tax system, UTII, unified tax system or patent system in relation to activities falling under these regimes.

The first option is voluntary, that is, having decided for yourself whether it is profitable to work with VAT or without VAT, and having chosen the second option, the LLC can work without VAT at will (if its company meets the requirements of paragraph 1 of Article 145 of the Tax Code of the Russian Federation). But in simplified regimes there is no VAT due to the provisions of the Tax Code. But exemption from VAT does not apply to transactions involving foreign economic activity, namely the import of goods into the territory of Russia. Transactions on the sale of excisable goods are not exempt from paying value added tax. In addition, the organization has the right to act as a tax agent in relation to other VAT payers.

Working with VAT and without VAT, first of all, depends on the type of activity of the taxpayer. Obviously, when selling goods at retail, a businessman can purchase them from other entrepreneurs or organizations under preferential tax regimes, and then it does not matter to him whether his invoices contain an allocated tax. A sample invoice without VAT may upset wholesale buyers, since it is important for them to have input tax in order to receive a deduction.

If an organization on the general taxation system has decided to operate without VAT, then it must collect and submit to the Federal Tax Service all the documents that are necessary to obtain an exemption from VAT. These include:

- notification of the established form on the use of the right to exemption from VAT;

- extract from the balance sheet (for organizations on the OSN and organizations that have switched from the Unified Agricultural Tax to the OSN);

- an extract from the sales book, copies of the journal of received and issued invoices for the previous reporting period (for organizations on the OSN);

- extract from KUDiR (when switching from the simplified tax system to the OSN).

All documents must be submitted to the Federal Tax Service no later than the 20th day of the month from which the organization wants to operate without VAT. The tax inspectorate does not send any decision in response, since such an exemption, by virtue of the Tax Code of the Russian Federation, is not permissive, but notifying in nature. But before making such a decision, it is worth comparing the options and understanding what is more beneficial for the economic prospects of your LLC: with VAT or without VAT.

Differences between exports to the EAEU and other countries

Many Russian companies work with neighboring countries, so questions often arise about the specifics of paying VAT when exporting to Uzbekistan from Russia or about VAT reimbursement when exporting to Kazakhstan.

Peculiarities of trade in terms of VAT with close neighbors do exist, but not with all of them. Countries that are part of the Eurasian Economic Union (EAEU) are subject to special conditions:

So, what are the features of accounting for VAT when exporting to Belarus and other EAEU countries?

Despite the fact that VAT for exports to Kazakhstan and other EAEU states is zero, since in any case a zero tax rate is applied, an invoice must be drawn up. Indication of the zero VAT rate and the code of the type of goods according to the Commodity Nomenclature of Foreign Economic Activity is mandatory. Here is an example of filling out an invoice indicating the zero VAT rate when exporting to Belarus in 2022: