Accounting for bank commissions and interest under the simplified tax system

The costs allowed to reduce the simplified tax base are fixed in paragraph 1 of Art.

346.16 Tax Code of the Russian Federation. You can familiarize yourself with the list of such expenses and the regulations for their adoption in the article “List of expenses under the simplified tax system “income minus expenses”” .

Costs under the simplified tax system associated with banking interaction include the costs recorded in subparagraph. 9 paragraph 1 of the above article:

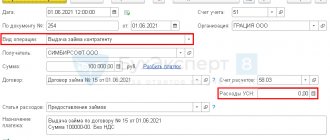

- interest paid for loans and credits provided;

- commissions for services provided by credit institutions.

For more information about how interest is included in expenses, read the publication “Loan Interest Accepted for Taxation.”

In this case, expenses for bank services are taken into account in the manner applied by Art. 254, 255, 263, 264, 265 and 269 of the Tax Code of the Russian Federation for calculating income tax. Art. 264 classifies payment for services of credit institutions as other expenses. As for expenses for creditor services, the letter of the Ministry of Finance of the Russian Federation dated July 14, 2009 No. 03-11-06/2/124 provides a clear explanation of what banking operations they should be associated with. These operations are mentioned in Art. 5 of the Law of December 2, 1990 No. 395-1 “On Banks and Banking Activities”.

ConsultantPlus experts explained in detail how to take into account the costs of certain types of services under the simplified tax system:

Study the material by getting trial access to the K+ system for free.

What the law says

Today, an increasing number of companies and individual entrepreneurs are actively using the services of the bank under the simplified tax system “income minus expenses”. At the same time, credit institutions provide their simplified clients with a fairly wide range of services. Accordingly, the question arises about the tax accounting of bank expenses under the simplified tax system “income minus expenses”.

Clause 1 of Article 346.16 of the Tax Code of the Russian Federation lists costs that, in the final calculation, reduce the unified tax on the simplified tax system. Subclause 9 of this norm deals with the costs of bank services under the simplified tax system.

If we interpret it literally, then the costs of banking services under the simplified tax system include 2 items:

- Established bank interest under the simplified tax system “income minus expenses” for the use of loans and borrowings (without restrictions).

- Costs of paying for services of credit institutions (without restrictions).

In practice, the simplification can be applied to both banks and non-bank credit institutions. So: The Tax Code does not make any division in this regard. That is, the costs of servicing a bank under the simplified tax system also include contacting a credit institution that does not have the status of a bank.

Banking transactions expensed

In accordance with the above-mentioned law, the following are related to the costs caused by banking transactions:

In addition to basic banking operations in Art. 5 of Law No. 395-1 provides a list of services of credit institutions, which, according to the same letter from the Ministry of Finance, are allowed to be accepted for expenses:

Accepted costs must be confirmed by the corresponding primary source. They are taken into tax accounting at the time of payment (clause 2 of Article 346.16 of the Tax Code of the Russian Federation).

All other expenses that arise in the course of interaction with banks, not mentioned above, cannot be taken into account for calculating the simplified tax. Let us dwell on individual services of creditors that raise questions when accepted as costs for the simplified tax system.

Scroll

Based on Article 5 of the Law “On Banks and Banking Activities” No. 395-1, banking services may include the following:

- attracting funds from a company/individual entrepreneur using the simplified tax system for deposits (on demand and for a specific period);

- placing this money on your own behalf and at your own expense;

- opening and maintaining simplified bank accounts;

- money transfers on behalf of a simplifier;

- collection of currency, bills, payment and settlement documents;

- simplified cash service;

- issuance of bank guarantees;

- electronic money transfers.

For any of these operations, the bank’s commission under the simplified tax system “income minus expenses” can be attributed to expenses. In this case, the bank commission is included in the expenses under the simplified tax system, regardless of its size established by the credit institution.

Many simpletons purchase corporate cards. Usually they help speed up and simplify various calculations within the framework of business and/or core activities. So: for transferring funds to corporate cards, bank commissions can also be included as expenses under the simplified tax system. As well as the fee for issuing a check book.

In addition, banks can carry out a number of transactions. There is no complete list in this law. However, here are the most popular ones:

- issuance of guarantees for the simplified person, which provide for the fulfillment of monetary obligations;

- acquisition of the right to demand from third parties the fulfillment of monetary obligations;

- trust management of money and other property of the simplifier;

- leasing to a simplifier special premises or safes for storing documents and valuables;

- leasing operations;

- Providing consulting and information services to the simplifier.

Also see “List of expenses under the simplified tax system “income minus expenses”: table for 2022 with explanation.”

Bank expenses for salary payments on cards

According to the letter of the Ministry of Finance dated July 14, 2009 No. 03-11-06/2/124, the commission for transferring salaries to employee cards is considered a banking transaction and reduces the base for calculating the tax on the simplified tax system. To accept these costs, it is necessary to indicate in the employment contract that the salary is transferred not through the cash register, but by bank transfer.

At the same time, the costs for opening cards for employees, in the opinion of the Ministry of Finance, expressed in this letter, cannot be taken as a credit for tax accounting. But according to the letter of the Moscow Tax Service dated 02.06.2005 No. 20-12/40107, it is possible to take into account in expenses for calculating income tax bank commissions for issuing cards to employees of an organization for the purpose of transferring employer payments to them, but provided that these expenses are under an agreement is taken over by the organization. Since bank commissions for the simplified tax system are accepted as expenses in accordance with the provisions of Art. 264 and 265 of the Tax Code of the Russian Federation, the conclusions of the above letter from the tax service are also applicable for the simplified tax. As we can see, the positions of the Ministry of Finance and the Tax Service of the Russian Federation are different.

Point at which expenses are recognized

According to paragraph 2 of Art. 346.17 of the Tax Code of the Russian Federation, expenses of a taxpayer are recognized as expenses after their actual payment

.

Payment for goods (work, services) and/or property rights is recognized as the termination of the obligation of the taxpayer - the purchaser of goods (work, services) and/or property rights to the seller, which is directly related to the supply of these goods (performance of work, provision of services) and/or transfer property rights. Listed below are the features of recognizing certain expenses

.

Material costs, labor costs, third party services and interest payments for the use of borrowed funds are taken into account at the time of debt repayment

by writing off funds from the taxpayer’s current account, paying from the cash register, or at the time of repaying the debt in another way.

Expenses for payment of the cost of goods purchased for further sale (excluding VAT) in accordance with paragraphs. 2 p. 2 art. 346.17 of the Tax Code of the Russian Federation are taken into account as the specified goods are sold

.

For tax purposes, a taxpayer has the right to use one of the following methods for valuing purchased goods:

- at the cost of the first in time of acquisition (FIFO);

- at average cost;

- at the cost of a unit of goods.

Expenses directly related to the sale of goods, including costs of storage, maintenance and transportation, are taken into account as expenses after they are actually paid

.

Expenses for payment of other taxes and fees are taken into account in the amount actually paid by the taxpayer

.

If a taxpayer has arrears in paying taxes and fees, he will be able to include such debt as expenses:

- only within the limits of actually repaid debt;

- only during those reporting (tax) periods when the taxpayer repays the specified debt (letter of the Ministry of Finance of the Russian Federation dated June 18, 2009 No. 03-11-06/2/105).

Compensation for “Client-Bank”

With the development of information systems, the use of “Client Bank” seems to be a natural process. For operational work, bankers provide similar services. There is no doubt about their economic justification. Art. 346.16 of the Tax Code of the Russian Federation indicates the permissibility of taking banking services into account in the manner specified in Art. 265 Tax Code of the Russian Federation. Subp. 15 paragraph 1 of this article literally indicates the admissibility of accepting bank services as expenses arising from the use of electronic systems for transmitting documents from bankers to the customer and back.

Results

The list of costs that reduce the simplified tax base is set out in paragraph 1 of Art. 346.16 Tax Code of the Russian Federation. Expenses for banking services are given in sub. 9 clause 1 art. 346.16 of the Tax Code of the Russian Federation - they are presented in the form of interest paid for loans and credits, or commissions for the services of credit institutions.

The services of bankers who reduce the simplified tax base are given in Art.

5 of the law of December 2, 1990 No. 395-1. Banking services include them, but in a specific list. Bank commissions under the simplified tax system are included as expenses at the time of actual payment based on the confirming primary receipt. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Question: In 2016, the organization was on the simplified tax system with the object “income”, and from 2022 it switched to the simplified tax system with the object “income minus expenses”.

Is it possible to take into account the bank guarantee fee in 2022 expenses if the bank guarantee was paid and received on December 28, 2016 under a contract that comes into force on January 30, 2017? Answer: There are no explanations from the regulatory authorities regarding this situation. At the same time, since when applying the simplified tax system (“income minus expenses”), expenses for banking services (including remuneration for issuing a bank guarantee) are taken into account in the period in which they were incurred, we believe that the commission for a bank guarantee should be taken into account in expenses for 2022 After changing the object of taxation “income” to the object “income minus expenses” it is impossible. In order to reduce financial risks in this situation, it is advisable to seek clarification from the tax authorities at the location of the organization.

Justification: In accordance with paragraph 4 of Art. 346.17 of the Tax Code of the Russian Federation, when a taxpayer transfers from an object of taxation in the form of income to an object of taxation in the form of income reduced by the amount of expenses, expenses related to the tax periods in which the object of taxation in the form of income was applied are not taken into account when calculating the tax base. In accordance with paragraphs. 9 clause 1 art. 346.16 of the Tax Code of the Russian Federation, when determining the object of taxation, the taxpayer reduces the income received by expenses associated with payment for services provided by credit institutions. In accordance with clause 8, part 1, art. 5 of the Federal Law of December 2, 1990 N 395-1 “On Banks and Banking Activities”, one of the types of services provided by banks is the issuance of bank guarantees. Expenses for banking services are accepted in the manner prescribed by Art. Art. 264, 265 of the Tax Code of the Russian Federation (clause 2 of Article 346.16 of the Tax Code of the Russian Federation). Organizations using the simplified tax system with the object “income reduced by the amount of expenses” take into account expenses in the period when they were paid (cash method) (clause 2 of article 346.17 of the Tax Code of the Russian Federation). In accordance with paragraphs. 1 clause 1 art. 21 of the Tax Code of the Russian Federation, a taxpayer has the right to receive free information from tax authorities at the place of his registration (including in writing) about current taxes and fees, legislation on taxes and fees and normative legal acts adopted in accordance with it, the procedure for calculating and paying taxes and fees, the rights and responsibilities of taxpayers, the powers of tax authorities and their officials, as well as receive forms of tax declarations (calculations) and explanations on the procedure for filling them out.

S.N. Konovalov JSC "Spline-Center" Regional information center

01.02.2018