In the registration application, you must indicate the location of installation of the online cash register, the model of the cash register and fiscal drive, information about the official document and the purpose of the equipment.

Registration of equipment will take about five working days from the tax office. When everything is ready, the OFD will be able to forward the information to the tax office.

Vladimir did not register the equipment on his own. He paid 7 thousand rubles to the cash register seller, who registered for cashless payments. This service is valid for all entrepreneurs.

How to determine whether you need to issue a receipt upon sale

In general, cash receipts are issued upon receipt of non-cash payment / prepayment for goods, work or services (Article 1.1 and Clause 1 of Article 1.2 54-FZ). But much depends on the status of the payer and the form of payment.

- The payer can be an individual, entrepreneur or organization.

- Payment can be made using a means of payment at sight: this occurs when the buyer pays with a card or smartphone. Some payments occur without presenting a means of payment: via Internet banking, from an electronic wallet, or by payment order.

If the payer is an individual, a cash register is needed in any case. If the payer is an individual entrepreneur or a legal entity, it all depends on the form of payment - whether it goes through with the presentation of an electronic means of payment or not. Let's tell you in more detail.

Is a check required for acquiring?

The acquiring receipt is issued in two copies: one for the buyer, the other for the seller. According to current legislation (FZ-290), each organization is required to provide clients with a payment receipt, regardless of the type of activity.

That is, it is always issued when there are commodity relations between the seller and the buyer. Namely:

- when purchasing goods at a point of sale (TT);

- when paying in cafes, hairdressers;

- when ordering services;

- when purchasing online (including plane, train, theater tickets, etc.);

- when paying for subscriptions to paid content;

- when paying out lottery winnings.

If trade relations concern organizations (supply of equipment, goods in large quantities), then in addition to the payment document, you must provide the client’s company with an invoice.

It is worth noting that upon entry into force of 54-FZ, each TT is required to send data on monetary transactions to the tax authorities. This usually happens when an organization interacts with the Fiscal Data Operator (FDO).

Therefore, business owners need to have not only a payment terminal in their stores, but also an online cash register. With its help, information about each purchase is sent directly to the OFD, and then to the tax office. Then the question of whether and why it is necessary to store acquiring receipts arises by itself.

Do you need a cash register when making payments to individuals?

For any non-cash payment from citizens, the seller must use a cash register. The form of payment is not important: the client can pay for the purchase by card or make a transfer from a mobile bank, make a full or partial payment - in any case, a check must be issued. The only difference is that when paying by card through a cash register and bank terminal, a check is usually issued immediately, and when paying through a website or online bank, the check is sent to the client by e-mail or sms before the end of the next business day after the day of payment (letter from the Ministry of Finance of the Russian Federation dated 06/21/2018 No. 03-01-15/42668).

Exceptions : entrepreneurs in certain types of activities are exempt from using cash registers when working with citizens. For example, these are the services of nurses or nannies, production of keys, rental of apartments, educational and sports services. Read more about cash register exemptions in our article.

How to choose a bank

Criteria for selecting an acquiring bank:

- the amount of commission for using the service;

- timing of crediting funds to the account;

- duration of terminal replacement in case of breakdown;

- the presence of special conditions (the possibility of reducing the percentage when a certain amount is reached, reducing tariffs when paying with a card issued by the acquiring bank, etc.).

In most cases, the quality of the services provided depends on the size of the commission, so the pursuit of a low rate is not always justified.

What is the deadline for an individual to punch a check when making a non-cash payment?

When paying by card at the checkout, the receipt is processed immediately. This can be a paper check or an electronic one, then send it to the buyer by e-mail or sms by the end of the next business day after the purchase. Another option is to generate and transmit a QR code to the client to read the receipt.

If a client pays for a product or service remotely - through a website or online banking, you must issue a check before the end of the next business day after the money arrives in your account. If this is a full or partial prepayment, that is, you will transfer the product or service to the client after receiving the money, you will have to issue two checks.

- the first check by the end of the next business day after receiving the transfer, but no later than you transfer the goods or services. Send it by e-mail, sms or via QR code, and if the buyer has not indicated contacts, issue a paper check at the next meeting (clause 5.3, article 1.2 of Law No. 54-FZ). In the receipt for full prepayment, indicate “Advance payment 100%”, and for partial payment - simply “Advance payment”. Sometimes it is not immediately clear what product the client is paying for, then put the “Advance” sign.

- the second check in paper or electronic form along with the goods or service. The feature in this check is “Full payment”, and the payment method is “Advance offset”.

How to generate checks at the checkout for prepayments, read our article.

Sometimes companies and entrepreneurs themselves buy goods or services from citizens . For such a situation, officials do not have a common opinion. The Federal Tax Service believes that the check should be punched if you buy goods from individuals for resale (letters dated 04/13/2020 No. AB-4-20/ [email protected] and dated 08/14/2018 No. AS-4-20/15707). The Ministry of Finance believes that checks are not needed if you pay citizens rent, wages, financial assistance or similar payments (letters dated December 26, 2019 No. 03-01-15/102189 and dated October 10, 2019 No. 03-01-15/77953).

So it’s safer to issue a check to an individual if you are buying a product or service for resale, and in other cases a cash register is not needed.

How does the legislation on cash registers apply when paying with a bank card?

Since July 2022, organizations and individual entrepreneurs have switched to a new procedure for using cash registers.

It is regulated by the Law “On the Application of CCP” dated May 22, 2003 No. 54-FZ, in Art. 1.2 which directly states the seller’s obligation to issue the buyer a document confirming the payment of money - a cash receipt or BSO. This requirement applies to both cash payments and electronic payments. Therefore, now for all sellers whose activities fall under the scope of Law 54-FZ, there is no question of whether it is necessary to punch a receipt when paying by card. The answer is definitely yes. Some categories of organizations and individual entrepreneurs retain the ability to conduct business without cash registers, issuing strict reporting forms.

Find out who has the right to work without using a cash register or who has received a deferment in the material “Is it possible to work without a cash register.”

Depending on the form of payment by bank card - through a terminal or online payment - the cash receipt must be issued on paper or electronically. To send the latter, the seller must ask the buyer in advance for his email address or mobile number.

The Ministry of Finance of the Russian Federation and the Federal Tax Service provided clarification on whether it is necessary to punch a cash receipt when acquiring on the Internet, that is, paying for purchases online with a card. According to the Federal Tax Service letter No. ED-4-20/14361 dated July 24, 2017, online trading must be conducted in accordance with the requirements of Law No. 54-FZ, which means that the seller’s use of cash registers and the issuance of a cash receipt are mandatory.

Is a cash register needed for settlements with counterparties?

There is one type of non-cash payment from entrepreneurs and legal entities when the seller does not generate a check - this is a money transfer by payment order to the details of the seller’s current account (clause 9 of Article 2 of Law No. 54-FZ). Therefore, companies that accept payments only from legal entities and individual entrepreneurs can operate without cash registers at all if they agree with counterparties on payments using account details through a payment card.

If the counterparty paid with a corporate card, contactless payment from a smartphone or through an electronic wallet, you are required to use the cash register and issue a receipt.

When offsetting advances or prepayments between entrepreneurs and companies, the cash register is not necessary, as the Federal Tax Service believes (information on the website dated June 10, 2020, letter of the Federal Tax Service of the Russian Federation dated August 21, 2019 No. AS-4-20 / [email protected] ). But the Federal Tax Service of the Russian Federation in Moscow believes that when providing for goods, including when offset between organizations or entrepreneurs, the cash register must be used (letters dated 08/13/2019 No. 17-15/ [email protected] , dated 08/13/2019 No. 17-15 / [email protected] ).

Can an individual entrepreneur pay a bill from a personal card or personal bank account?

If an individual entrepreneur, under any agreement, must deposit money into the current account of a legal entity or another entrepreneur, he can use funds from his personal account or transfer money from his card, for example, through Internet banking. Specialist consultants do not see any obstacles to this.

This position is supported by the Resolution of the Constitutional Court of the Russian Federation dated December 17, 1996 N 20-P, the Determination of the Constitutional Court of the Russian Federation dated May 15, 2001 N 88-O, according to which, from the point of view of the law, it is impossible to distinguish between the funds of an individual entrepreneur into his personal and those which he uses to conduct business.

Therefore, having a bank card as an individual, an entrepreneur can pay any invoice issued to him using his personal funds, for example, through Internet banking or mobile banking. And this money will be credited in the same way to the current account of a legal entity or other entrepreneur.

Please pay attention . This advice only applies to transferring money to a business account. If one individual entrepreneur pays a bill to another individual entrepreneur by transferring money to his personal bank account or card, problems with crediting may arise. The situation is twofold. Bank of Russia Instruction No. 153-I dated May 30, 2014 “On opening and closing bank accounts, deposit accounts, and deposit accounts” distinguishes between current accounts of legal entities and individual entrepreneurs opened for commercial activities and current accounts of individuals used for conducting settlement transactions.

At the same time, according to paragraph 3 of Art. 845 of the Civil Code of the Russian Federation, the bank does not have the right to determine and control the direction of use of the client’s funds and establish other restrictions not provided for by law or the bank account agreement on its right to dispose of funds at its own discretion.

That is, if a payment from another individual entrepreneur arrives on the personal account or card of an individual entrepreneur and at the same time the purpose of the payment is invoice payment, the bank, on the basis of an agreement concluded with the client, may not accept such a payment if it suspects that it is related to the conduct of a business activities. It is especially risky if such operations are carried out regularly.

Sanctions for non-issuance of checks for non-cash payments

If you do not issue a check for a non-cash payment, you may be fined (Part 2 of Article 14.5 of the Administrative Code):

- fine for the organization - 75-100% of the check amount, but not less than 30,000 rubles;

- fine for a director or individual entrepreneur - 25-50% of the check amount, but not less than 10,000 rubles.

If you punched the check, but did not send it to the buyer, a smaller fine is possible (Part 6, Article 14.5 of the Administrative Code):

- fine for the organization - 10,000 rubles;

- fine for a director or individual entrepreneur - 2,000 rubles.

To simplify accounting when working with a cash register, connect the Kontur.Accounting web service: the system can receive shift closing reports from cash registers. And in Accounting it is easy to keep records, pay salaries and taxes, automatically create reports and send them via the Internet. Test the service for free for 14 days.

Changes in the processing of documents at the cash desk

A new approach to documents drawn up when using cash registers was outlined with the appearance of the updated text of Art. 1, paragraph 1 of which now states that when using cash register equipment one should be guided by:

- Law No. 54-FZ itself;

- regulations adopted in accordance with it.

That is, this automatically abolished the need to prepare previously considered mandatory documents, the unified forms of which were approved by Decree of the State Statistics Committee of December 25, 1998 No. 132:

- Acts:

- on transferring cash meter readings to zero (form KM-1);

- on taking meter readings when transferring the cash register for repairs (form KM-2);

- on the return of money to customers (form KM-3);

- on checking cash at the cash desk (form KM-9).

- Magazines:

- cashier-operator (form KM-4), letter of the Ministry of Finance of Russia dated June 16, 2017 No. 03-01-15/37692;

- registration of meter readings (form KM-5);

- recording calls from technical specialists (form KM-8).

- Reference reports:

- certificate-report of the cashier-operator (form KM-6);

- information on meter readings and revenue (form KM-7).

- shift opening report;

- correction cash receipt;

- report on closing the fiscal drive;

- operator confirmation.

- refund to the buyer;

- issuing funds to the client;

- receiving funds from the client.

At the same time, new documents that are related to cash payments made using online cash registers have been approved by Law No. 54-FZ (clause 4 of article 4.1):

Other documents have changed their form and requirements for details. With the use of the main cash document (check or BSO), it became possible not only to process receipts for purchases, but also such operations as (Clause 1, Article 4.7 of Law No. 54-FZ):

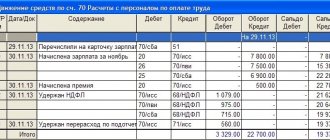

However, changes in documents drawn up using cash registers did not in any way affect the rules for maintaining documentation for the operating cash desk, approved by the Bank of Russia Directive No. 3210-U dated March 11, 2014. Therefore, it is still required to issue cash orders for receipts and expenses (clause 4.1) and maintain a cash book (clause 4.6). In relation to cash revenue, it will be mandatory to register it daily according to a receipt order, drawn up on the basis of a shift closing report generated on the online cash register, which is an analogue of the z-report created at the cash register with ECLZ.

You can find out more about the documents that are required to be completed using CCP in various situations in ConsultantPlus. Trial access to the legal system is free.

Let's look at how to organize cash accounting in the cash register.