Pay taxes in a few clicks!

Pay taxes, fees and submit reports without leaving your home!

The service will remind you of all reports. Try for free

The main purpose of statistical bodies is to provide objective and complete statistical information about economic indicators in the country. To cope with this function, Rosstat identifies companies from which it requests the necessary data either by a continuous method or selectively based on certain criteria. Large and medium-sized businesses often fall into his sphere of attention.

Depending on their type of activity, companies are required to submit reports to Rosstat using special forms. The frequency of submission for each form is different: quarterly, annually, once and every three years. Whether you need to submit reports, in what forms and when - find out at your local statistics office or track them in a special service of Rosstat.

How to find out what reports need to be submitted to Rosstat

Reporting to Rosstat is a mandatory, but not permanent task for organizations and entrepreneurs. Usually the statistics service creates a sample that includes random respondents, but once every five years it conducts a comprehensive study and collects reports from everyone. In addition, new forms are added year after year and old ones are removed. Therefore, if you already submitted the report last year, it is not at all a fact that you will have to submit it again.

You can find out the list of reports that Rosstat expects from you in several ways:

- Wait for notification from Rosstat . The territorial department of the FSGS informs organizations and entrepreneurs about all necessary reports by mail. Rosstat employees send a notification of submission, instructions for filling out and a report form that must be sent to the department. They can do this by mail, fax or electronically. But there are many respondents, but only one Rosstat, and not everyone receives email notifications on time. Failure to receive a notification does not relieve you from the obligation to submit a report and fines, so it is advisable to clarify your responsibilities further.

- Send a request to the department . You can send a request for a list of reports to the Rosstat office. An individual list will be generated for you with all reports and due dates. But preparing it will take time.

- Use the online service . This is the easiest and most convenient way. To instantly receive a list of reports to Rosstat, just enter your TIN. As an alternative to OGRN or OKPO. Using the TIN and OGRN you will receive information about the organization and all divisions, and using OKPO - only about the organization.

Wow! –50% on Kontur.Extern

Hurry up to connect before March 15th.

Report back with new certificates. To learn more

Submission methods

A completed copy of financial statements can be submitted in several ways:

- Deliver the documentation personally to the TOGS department.

- Use postal services by sending by registered letter with acknowledgment of receipt.

- Via electronic sending via the Internet. In this case, the document must be executed in the prescribed manner with an electronic signature.

Based on the information published on the official website of Rosstat, financial statements for 2022 are submitted electronically to the statistics department and the tax service in the same format.

The use of identical methods of sending to these departments makes the work easier. It is enough to generate a report in the electronic system, sign it, and send it to two addresses at once.

How to get a list of reports to Rosstat using TIN

Recently the Rosstat service was updated. Now it has more stable operation and a new interface. The service can be used by all registered businesses, it is free and does not require registration on the Rosstat website, government services portal or anywhere else.

To use the service, enter your INN, OGRN/OGRNIP or OKPO. According to OKPO, the service provides data of the parent organization, and according to INN and OGRN of the parent organization and all its divisions. If you are looking for TIN information, first select the department for which you want to obtain data. The service will show you:

- Statistics codes . In this section you will find out all the codes assigned to your business. These are codes of the form of ownership, organizational and legal form, municipal formation, object of administrative-territorial division, etc. The date of registration, INN and OGRN will also be indicated here. This section will come in handy when you need to fill out the relevant fields in reports or other documents.

- List of forms . This section will contain all the forms required for you, their submission frequency, reporting period and due date. Also in the “Comment” column it will be indicated whether it is possible not to submit the form and what is allowed to replace it. The service will also provide links to download current forms. If you don't see this sign, you don't have forms to turn in.

Information on the list of forms is updated monthly, so you should get into the habit of checking once a month for changes in the list of reports to be submitted. For convenience, Rosstat offers a subscription to notifications of changes. If you do not want to subscribe, remember the deadlines for updating information:

- for monthly forms - from the 30th day of the reporting month, except for forms No. S-1 and No. 4-inventory;

- for quarterly forms - from the 30th day of the last month of the reporting quarter;

- for semi-annual forms - from the 30th day of the last month of the reporting half-year;

- for annual forms - December 30, with the exception of certain forms.

If you received outdated information about separate divisions in the service, send to Rosstat a current list of separate divisions indicating their names, addresses, codes from OKVED2 and other data.

Forms

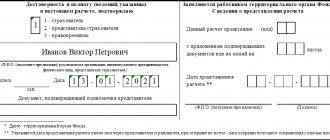

After completing the sampling, Rosstat bodies notify organizations about the submission of reports, providing established forms for completion. A sample of which is presented as follows.

If no notification is received, firms can independently find out which type to submit using the forms.

To understand what kind of reporting to submit using TIN and OKPO, just go to the official website of Rosstat. On the main page you need to fill out the fields, enter your status and details. The system automatically generates a list of reporting forms required for submission and deadlines for submission. If there is no list, it means there is no need to submit in this period. The site is periodically updated to keep the information current.

A company or individual entrepreneur can find out which reports to submit from the territorial office of Rosstat. To do this, a written request is sent.

All reporting forms are grouped by type depending on the type of activity of the counterparty. It contains data of individual entrepreneurs, large enterprises, small and medium-sized companies.

There are report forms specifically designed for certain areas of industry: construction, trade, agriculture. The data provided regarding the number of personnel, manufactured products, and revenue are selected into separate groups of reports.

Who should submit reports to Rosstat

Everyone must submit reports to Rosstat. The respondents include legal entities, individual entrepreneurs, state and local government bodies, branches and representative offices of Russian and foreign companies (Article 6 of the Federal Law of November 29, 2007 No. 282-FZ). The exact list of reports is generated individually for each respondent. It depends:

- on the organizational and legal form;

- on the size of the business;

- from the place of activity;

- from the main and additional activities;

- from other selection criteria that are established for specific reports.

Pay special attention to the size of the business. SMEs have the right to submit reports to Rosstat in a simplified manner. This means that the statistics service forms a sample of companies that must report, and the rest may not submit reports, even if the form itself says that they must do so. Sample observations of micro-enterprises are carried out annually, for small and medium-sized enterprises - monthly or quarterly.

You are considered an SME if:

- in your authorized capital the share of the state, religious and charitable organizations is no more than 25%, and the share of foreign organizations and organizations not from the SME register is no more than 49%.

- average number of employees - up to 250 people;

- the amount of revenue in the previous year was up to 2 billion rubles.

But once every five years, Rosstat conducts continuous monitoring. The last time it was in 2022, the next one will take place in 2026. In this case, all respondents in the study group submit reports. For example, in 2022, all small businesses will submit Form No. MP-SP, and all individual entrepreneurs will submit Form No. 1-Entrepreneur.

Who surrenders, who is exempt from surrendering

The reporting provided to Rosstat requires submission by all business entities, regardless of their type of activity. Large enterprises report on a regular basis, submitting different forms at the same time. Small businesses and micro organizations can report once every 5 years. In the interval between this period, they may be subject to a certain sampling, including indicators of numbers, volume of products sold.

Within sample studies, reports are submitted monthly and quarterly. Enterprises are required to submit documentation on the basis of current legislation. Legal entities report at the place of registration. In case of discrepancy between the actual and legal addresses of the company, annual reports are submitted at the location of the managing body.

- Individual entrepreneurs are exempt from accounting. Based on the annual results, they present to the auditing structure an accounting book showing the income and expense parts.

- Foreign representative offices are allowed not to keep accounting records. They show information about activities in the country in a report to the regulatory authority.

Types of reporting to Rosstat

In 2022, only statistical reporting must be submitted to Rosstat. Almost no one submits financial statements. The exception was organizations that have state secret information in their reporting.

Statistical reports can be divided into groups according to respondents, for example, reports for individual entrepreneurs, for small businesses, for government agencies. Can be divided into groups according to the information provided: employees, key performance indicators, fixed assets, financial condition, etc. Groups are also formed according to the frequency of reporting: annual, semi-annual, quarterly, monthly.

What is this

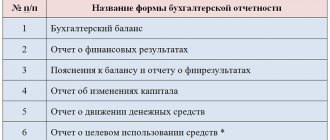

The standard package of documentation for any financial statements is the enterprise’s balance sheet, financial performance report, and the necessary appendices to them. The main task is to consolidate accounting data for a certain period. They are presented in a visual form to interested structures.

In fact, this is the final stage of the accounting stage. All reporting is reflected as a set of totals with an increase. It means leaving in the currency of the Russian Federation, in Russian. The provided indicators are systematized into groups to facilitate their use.

By order of Rosstat, a complete list of documents subject to mandatory certification has been approved. The Ministry of Finance has established and put into effect special forms.

Reporting of counterparties by TIN

Businesses need to regularly check their counterparties. There are all the conditions for this - many special services have been created, to work with which it is enough to know the name and TIN of the counterparty. They collect information from various sources of information about legal entities and individual entrepreneurs:

- Unified State Register of Legal Entities/Unified State Register of Entrepreneurs;

- Unified Federal Register of Bankruptcy Information (EFRB);

- state registers of accredited branches and representative offices of foreign companies;

- Register of rights to real estate (USRN);

- Rospatent and WIPO;

- file of arbitration cases;

- state registration bulletin;

- database of legal documents.

Externa provides a module for express verification of counterparties “Traffic Light”. It collects information from open sources using special algorithms, analyzes it and provides an assessment of the integrity of the company.

A special service from the state is the State Information Resource of Accounting Reports (GIR BO). It is maintained by the Federal Tax Service on the basis of data from financial statements submitted by organizations from 2022. Previously, accounting reports were submitted to Rosstat - it was there that one could obtain information about the activities of counterparties, so look for reports for periods up to 2022 in the Rosstat service.

Individuals, individual entrepreneurs and organizations can obtain information free of charge from the GIR BO. To do this, you need to either submit a request for a specific organization, or connect to the complete database of the information resource. To check the counterparty, it is enough to know the TIN, OGRN or name. The Federal Tax Service will register your request and provide the data on the same day.

Report easily and without errors. A convenient service for preparing and submitting reports via the Internet. We are giving access to Extern for 14 days!

How to clarify statistical reporting: algorithm of actions

If a company has discovered an error in a previously submitted statistical report or has received a notification about this from Rosstat, then it is necessary to submit:

- correction forms;

- a written explanation of the reasons for making corrections.

You can do this:

- personally or through a representative;

- send by mail with a list of attachments;

- transmit via TKS.

The deadline for submission is 3 days from the moment the deficiency is discovered by respondents or regulatory authorities.

In this case, the territorial statistics department does not have the right to refuse to accept updated information. If the respondent submits a “clarification” within the prescribed period, he will not face sanctions. Failure to submit corrected statistical reports on time may result in a fine under Art. 13.19 Code of Administrative Offenses of the Russian Federation.

Letter of Rosstat dated April 24, 2019 No. SE-04-4/55SMI “On clarification of reporting to Rosstat”

Late submission of statistical reporting even by one day will result in refusal to accept it.

The statistical forms indicate specific deadlines for their submission, as well as frequency.

In case of violation of these requirements, companies will be fined under Art. 13.19 Code of Administrative Offenses of the Russian Federation. Let us remind you that the fine for legal entities varies from 20 to 70 thousand rubles; in case of relapse, inspectors will collect 150 thousand rubles from the company to the treasury. Rosstat explains this rigidity by technical limitations that do not make it possible to include a late report in the development of official statistical information (Rosstat letter dated March 15, 2019 No. 04-04-4/40-SMI).

Letter of Rosstat dated March 19, 2019 No. 04-04-4/42-SMI

"On financial statements"