A separate division is a special structural part of a legal entity that carries out activities outside the location of the head office. An OP is subject to mandatory registration with the Federal Tax Service if it is created for a period of more than 1 month and has workplaces for personnel.

Russian legislation provides for a special algorithm for submitting reports of a separate division without a separate balance sheet in 2021. The procedure is determined depending on the applied taxation regime, the organization of accounting (allocation to the balance sheet) and the location of the OP (OKTMO).

New message forms for the Federal Tax Service

The Federal Tax Service of Russia issued Order No. ED-7-14/ [email protected] , according to which, from December 25, 2020, organizations submit all reports about separate divisions in a new way. New forms for informing the tax service have been approved:

- on granting the authority to make payments in favor of individuals and on the deprivation of such authority;

- on the creation of the OP and on changes in previously sent information;

- on the closure of a separate division.

The form of notification about the choice of a tax inspectorate for registering a legal entity at the location of one of its separate divisions has changed.

Tax payments of separate structures

The taxation option for such structural units is related to their legal status, the types of tax amounts and fees payable, the absence/presence of a local balance sheet and a bank current account.

Separate branches (not registered as a branch) have the right to operate under the simplified taxation system, although organizations themselves that have branches or representative offices do not have such a right (Article 346 of the Tax Code of the Russian Federation).

In order to avoid disputes with the Federal Tax Service regarding the status, and, accordingly, the obligations of the company structure, geographically remote offices should not be granted excessive independence in the form of ownership of property, rights, powers and other attributes. Besides:

- the title documentation of a legal entity should not include a mention of allocated branches;

- the names of the structures should not contain the words “branch”, “representative office”;

- a remote office can operate on the basis of an order from the head of the company (without developing a separate regulation on the separation);

- members of the remote office management should have strictly limited powers.

Payment of tax amounts by a separate organization is carried out taking into account the following:

- The VAT payer is a legal company; a separate type division is not recognized as such, and therefore is not characterized by similar responsibilities. The parent structure reports the total amount at the place of its registration with the Federal Tax Service, without dividing by branches.

- The procedure for making mandatory payments on profits for companies with remote branches is determined by the Tax Code of the Russian Federation (Article 288), according to which calculations are carried out by the parent organization. From the total tax base, a share is allocated for each branch and representative office, according to which advance amounts are transferred to the branches of the Federal Tax Service (regional, central).

- An organization that does not have the status of a major taxpayer sends profit tax reporting to the registration address of the legal organization and to the physical location of each remote unit.

- A separate branch has the right to hire citizens for certain positions, indicating in the employment contract the place of work and the address of a separate division of the organization (Article 57 of the Labor Code of the Russian Federation). Personal income tax amounts withheld from employees of an enterprise are subject to transfer to the place where citizens are registered as taxpayers. Remote structures must register with the Tax Service at the place of their own location; personal income tax is transferred using the details of this Tax Service and data on the income of the entire staff is transmitted.

- Payment of excise taxes is made at the address of the location of the structure engaged in the manufacture or sale of excisable products (services). The corresponding declaration is submitted to the local Tax Service separately for each branch.

- Property tax is subject to separate payment by the leading office and branches, if the latter have their own balance sheet and assets accounted for in it.

- The tax base is established for the branch, the value of which is multiplied with the rate provided for settlements in a certain subject of the country. The resulting figure is subject to payment to the regional budget.

- The transfer of mandatory tax payment on transport is not related to the place of registration of vehicles. The location of the vehicle is recognized as the location of the owner of the specified property (Article 83 of the Tax Code of the Russian Federation). If the vehicle is actually used in a remote unit, but is registered at the head office, then the tax payment will be sent to the central tax authority. Even if the vehicle is registered in the region of a separate branch, the tax is paid at the place of registration of the company's head office (for vehicles registered after 08/24/2013).

- When re-registering a vehicle to a separate structure in another locality of the country, the transport tax payment is calculated in the same way as when registering a vehicle or deregistering the vehicle (using a calculated coefficient).

- The norms of the Tax Code of the Russian Federation do not regulate the payment of tax on land plots. The organization pays the tax and submits the appropriate declaration on the plot of land it owns to the local budget. A territorial unit may transfer tax from its own account, if any.

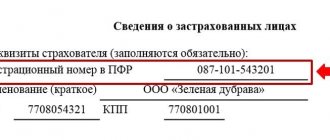

- Remote structures of companies pay insurance contributions to the Pension Fund, Social Insurance Fund, and Compulsory Medical Insurance Fund on their own if they accrue payments or other remunerations due to citizens (individuals). The tax authority is subject to notification of granting separate divisions operating within the territory of the Russian Federation the appropriate powers to make due payments within a period of up to 1 month (Article 23 of the Tax Code of the Russian Federation).

For your information! Previously, in order to independently pay the insurance premium, a separate structure was also required to have its own balance sheet and a separate current account. This requirement has been canceled since 2017.

If a remote unit transfers payments with insurance premiums independently, then reporting to the funds (PFR, Social Insurance Fund) is sent to the place of registration of the payer.

OP tax reporting

Current accounting question: is it necessary to submit separate reports for a separate division and how to do this? The answer depends on the taxation system used by the organization in the reporting period:

- If the company uses OSNO:

- income tax - the OP is required to pay tax and submit a declaration in part of the profit that accrues to this OP, but only in terms of the regional share of the tax;

- VAT - only the head office reports, no divisions according to the OP when filling out the VAT declaration are allowed.

- If the organization applies a simplified taxation regime. The declaration under the simplified tax system is submitted to the Federal Tax Service only at the location of the head office. OPs do not report on simplified procedures to the inspection.

- Land, transport and property tax: how reporting is done in 2022 if the organization has a separate division. If the taxable object is located on the territory of the EP, is registered at the EP (branch) and is used by it to conduct business, then you will have to report to the Federal Tax Service at the location of the unit. You will also have to pay separately.

- Excise taxes. The procedure directly depends on the category of excisable products:

- when selling natural gas, payments and declarations will be made at the location of the enterprise;

- when selling alcoholic products - at the place of its sale;

- for petroleum products and other excisable goods, reporting should be done both at the place of affiliation of the parent organization and all its OPs.

Use free access to the ConsultantPlus instructions on payment and reporting for personal income tax for separate divisions.

to read.

For which tax payments does the OP not report separately?

VAT

The presence of representative offices and branches does not affect the VAT accounting procedure. VAT reports for a separate division are not provided for in 2022. The only peculiarity: when issuing invoices on behalf of the OP, his checkpoint is indicated.

More information about filling out OP invoices

Property tax

The property tax declaration is submitted by the organization at the location of the real estate, and property reporting is not included in the branch reporting.

What reports should be submitted under the OP to the simplified tax system?

The simplified tax system does not have the right to apply to organizations that have branches. The presence of all other types of OP is not an obstacle to the simplified tax system. The filing of separate declarations under the simplified tax system, neither for those allocated to separate balance sheets, nor for separate divisions without a dedicated balance sheet and current account on the simplified tax system, is not provided for by law.

How to take it

If several OPs of a legal entity are located in the same municipality (within one OKTMO), then you can submit reports to one tax office if there are separate divisions of the legal entity in 2022. The Federal Tax Service allows reports to be sent centrally. To do this, submit fiscal forms to the territorial department of the inspectorate at the location of one of the legal entity’s OPs. If the head office is also located within the same OKTMO, reporting to the Federal Tax Service is allowed at the location of the GI.

Please pay special attention to the fact that switching to centralized filing is only permissible after notifying the inspectorate. In both cases, it is necessary to notify the tax authority with which the responsible person is registered (Federal Law No. 325-FZ of September 29, 2019; Order of the Federal Tax Service No. ММВ-7-11 / [email protected] of December 6, 2019).

The deadline for filing a notification in the KND form 1150097 is until January 9 (Article 230 of the Tax Code of the Russian Federation).

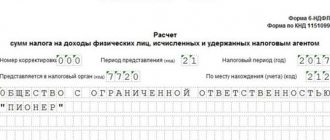

Reports on personal income tax and insurance premiums

If there are employees, the issue of submitting reports and paying taxes by a separate division is determined in a different manner.

| According to personal income tax | For insurance premiums |

| If the employment contract with the employee states that his workplace is located within the OP, then personal income tax will have to be paid at the location of the OP. Therefore, you will have to report separately - submit 6-NDFL and 2-NDFL separately for GI and OP | The OP’s obligation to pay and report arises only if the following conditions are met:

For example, the DAM for a separate division without a separate balance sheet, which does not pay salaries to employees, is submitted through the head office. The norm is enshrined in clause 11 of Art. 431 Tax Code of the Russian Federation |

IMPORTANT!

Reports are also submitted to the Social Insurance Fund in the same way: if the organization pays wages and insurance premiums, it reports to the department as an independent unit. If a separate division does not have a current account, it cannot be registered with the territorial branch of the Social Insurance Fund (letter of the Ministry of Finance No. 03-15-06/92133 dated December 18, 2018).

Definition of a separate division

A division of an enterprise is considered to be separate if it meets a number of criteria (Article 11 of the Tax Code of the Russian Federation):

- physical discrepancy between the location and the main company, i.e. detachment from the head office due to territorial parameters;

- creation of more than 1 workplace, which is stationary and equipped for a period of more than 1 month.

For your information! Territorial branches of an enterprise with a legal status of any type are not recognized as independent legal entities and, accordingly, cannot act as independent taxpayers.

An exception is made for enterprises that apply a simplified tax regime. But for each remote structure, the need to maintain records (tax, accounting) and submit reports is provided.

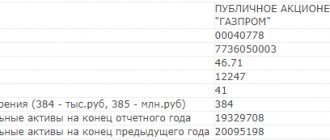

Financial statements

The list of financial forms and reports depends on the place of accounting (allocation to the balance sheet). Accounting in a branch allocated to a separate balance sheet in 2022 is carried out according to general rules: such OPs constitute separate accounting records. These are forms and a list of indicators independently developed by the company to create a balance sheet for management needs (Ministry of Finance letter No. 03-06-01-04/273 dated 06/02/2005). A separate balance sheet is not submitted to the tax office; it is an internal financial document of the organization.

Legislative regulations explain what reports are submitted by a separate division without a separate balance sheet in 2022: if the OP does not keep accounting separately, then the composition and forms of reporting are determined by the head institution. This is operational financial information about performance indicators, property assets and other accounting objects.

In any case, accounting records for OP are not provided to controllers. This information is used to prepare consolidated reporting for the entire organization and for management needs.

There are no separate accounting rules for public sector employees. General standards apply to them: in a budgetary institution, separate divisions themselves do not hand over the balance to the manager or the main manager of budgetary funds. Generalized reporting for all divisions is provided by the parent organization.

Concept of OP

The definition of an OP is given in Article 11 of the Tax Code of the Russian Federation; it means an object at the location of which stationary workplaces are equipped. The Civil Code in Article 55 distinguishes between representative offices and branches.

More information about the creation and types of sections

Separate units with a significant number of employees and operations are allocated to a separate balance sheet. The procedure for payment and reporting of a separate division without a separate balance sheet in 2022 does not differ from the procedure established for branches and representative offices allocated to a separate balance sheet.