Withholding personal income tax from material benefits

In order to determine at what rate material benefits are subject to personal income tax, it is necessary to find out what material benefits are and from what sources they are generated.

Income in the form of material benefits arises for the taxpayer on the following grounds (Article 212 of the Tax Code of the Russian Federation):

- Saving on interest on borrowed funds received from an organization or entrepreneur.

- Price difference when purchasing material assets from interdependent persons (entrepreneurs, organizations) under civil contracts.

- Price difference when purchasing securities and financial instruments of futures transactions.

Material benefits are subject to personal income tax in full for all the above reasons. However, there are some peculiarities when obtaining savings on interest for using credit funds.

Firstly, the following are not subject to taxation:

- Benefit in the form of an interest-free credit period using a bank card, received from a bank located in the Russian Federation.

- Interest savings when using loan funds for the construction or purchase of new housing (rooms, apartments, shares) or land for construction in the Russian Federation. This exception applies if the taxpayer has the right to a property deduction, which is confirmed by the tax authority (subclause 1, clause 1, article 212 of the Tax Code of the Russian Federation).

- Saving on interest when refinancing or refinancing loans for the purchase or construction of new housing (apartments, houses, rooms, shares) or land plots for the construction of residential buildings. Valid if there is a valid right to a property deduction, confirmed by the tax authority (subclause 1, clause 1, article 212 of the Tax Code of the Russian Federation).

NOTE! From 2022, financial benefits arising during mortgage holidays are not subject to personal income tax.

Secondly, from 2022, savings on interest for the use of borrowed (credit) funds are recognized as personal income tax income only in cases where:

- the loan was received from an organization or individual entrepreneur that is interdependent with an individual or with which an employment relationship has been established;

- such savings are actually material assistance or a form of reciprocal fulfillment of an obligation to an individual.

It does not matter when the contract was concluded.

If borrowed funds are provided not by a credit or banking institution, but by another enterprise, then personal income tax is withheld from the above savings on a general basis (letter of the Ministry of Finance of Russia dated October 28, 2010 No. 03-04-06/6-256).

Taxation of material benefits

According to paragraph 2 of Art. 224 of the Tax Code of the Russian Federation, material benefits are subject to personal income tax at a rate of 35% . As a general rule, the employer from whom the credit or loan was taken is required to withhold tax (clause 1 of Article 226 of the Tax Code of the Russian Federation).

Example: Raduga LLC provided Kosolapom A.S. interest-free loan and withheld material benefits from his wages at a rate of 35%. At Kosolapogoy A.S. there are no obligations to the tax office.

If income in the form of a material benefit was not received from the employer or the employer did not withhold tax, you are required to independently submit a 3-NDFL declaration to the tax authority and report the tax (clause 4, clause 1, clause 6, article 228).

However, in 2016, changes were made to the Tax Code that simplified the reporting process for taxpayers in cases where they themselves must pay tax on material benefits (if the tax was not withheld by a tax agent).

Since 2016, it is no longer necessary to file a 3-NDFL declaration, you just need to wait for a notification from the tax authority and pay the tax according to this notification (clause 6 of article 228 of the Tax Code of the Russian Federation, part 8 of article 4 of the Law of December 29, 2015 N 396-FZ ). In addition, these changes extended the deadline for tax payment until December 1 (according to 3-NDFL it was until July 15).

Material benefit of personal income tax - 2020-2021

The Tax Code reflects the rates for taxation of material benefits with personal income tax in 2020-2021. Thus, if an individual receives a material benefit, the personal income tax rate may be as follows:

- For residents of the Russian Federation, a rate of 35% applies to the excess of the interest savings received from the tax agent over the value of 2/3 of the Bank of Russia refinancing rate on the date of receipt of income on loans in rubles and 9% per annum on loans in foreign currency.

- For residents of the Russian Federation, a rate of 13% is established for amounts of material benefits on goods purchased from related parties and transactions with securities.

- For non-residents there is a flat rate of 30% for all reasons for the occurrence of material benefits.

Read more about rates in the article “What percentage is personal income tax.”

How to calculate material benefits based on interest?

This is the most common type of financial benefit, so we will show the tax calculation for it.

The procedure for calculating material benefits from savings on interest is prescribed in paragraph 2 of Art. 212 of the Tax Code of the Russian Federation.

Loan in rubles

If the loan was received in rubles, then the material benefit is calculated as the excess of the amount of interest for the use of borrowed (credit) funds expressed in rubles, calculated on the basis of two-thirds of the current refinancing rate established by the Central Bank of the Russian Federation on the date of actual receipt of income, over the amount of interest calculated based on the terms of the contract.

The calculation of material benefits received in rubles can be expressed by the formula:

MV = SZ × (2/3 × StCB – StZ) / DG × DZ,

Where:

MB - material benefit;

SZ - loan amount;

StCB - refinancing rate of the Central Bank of the Russian Federation on the date of receipt of income;

See the rate for different periods here.

StZ - loan rate;

DG - number of days in a year: 365 or 366;

DZ - the number of days of using the loan, including interest-free.

An example of calculating personal income tax on material benefits from savings on interest on loans in rubles from ConsultantPlus. On June 3, 2022, the employer issued Kashin K.K. to the employee. (tax resident of the Russian Federation) loan in the amount of 500,000 rubles. at 4.5% per annum until December 1, 2022. The refinancing rate of the Bank of Russia during this period is 7.5% (conditionally). In this case, Kashin K.K. There is a material benefit when saving on interest, since 4.5% < 5% (2/3 x 7.5%). The employee transferred the entire loan amount and the interest accrued for the period of use of the loan to the organization’s account on November 30, 2022. The employer calculated personal income tax on material benefits as follows. You can view the entire example in K+. Trial access is free.

When calculating material benefits, the following must also be taken into account:

1. Material benefit is considered received on the last day of each month during the entire term of the loan agreement. That is, regardless of when interest is paid and whether it is payable according to the agreement, the material benefit is calculated monthly.

It should be taken into account that if the loan was repaid not on the last day of the month, but on some other day, then the material benefit is still calculated on the last day of the month (see letter of the Ministry of Finance dated January 14, 2016 No. 03-04-06/636 ).

2. If within a certain month the loan was partially repaid, then the material benefit is calculated in 2 steps: on the date of repayment of the loan and on the last day of the month.

Loan in foreign currency

If the loan was received in foreign currency, then the material benefit is calculated as the excess of the amount of interest for the use of borrowed (credit) funds expressed in foreign currency, calculated on the basis of 9% per annum, over the amount of interest calculated on the basis of the terms of the agreement.

The calculation of material benefits received in foreign currency can be expressed by the formula:

MV = SZ × (9% – StZ) / DG × DZ,

Where:

MB - material benefit;

SZ - loan amount;

StZ - loan rate;

DG - number of days in a year: 365 or 366;

DZ - the number of days of using the loan, including interest-free.

An example of calculating personal income tax on material benefits from savings on interest on loans in foreign currency from ConsultantPlus The organization issued on May 13, 2022 to employee Semenov N.N. (tax resident of the Russian Federation) loan in the amount of 10,000 euros at 4% per annum until August 1, 2022. In this case, Semenov N.N. There is a material benefit when saving on interest, since 4% < 9%. The employee transferred the entire loan amount and accrued interest to the organization’s account on July 31, 2022. Let’s assume that the euro exchange rate as of 05/31/2020 was 63.26 rubles, as of 06/30/2020 - 67.50 rubles, and as of 07/31/2020 - 65 ,80 rub. The employer calculated personal income tax on material benefits as follows. Get a free trial of K+ to see the full example.

Loan agreement

The issuance of a loan to an employee is formalized by an agreement in writing (clause 1 of Article 808 of the Civil Code of the Russian Federation). The loan size can be any; there are no legal restrictions. If the loan amount is more than 600 thousand rubles, then the bank will definitely control the transaction. We remind you that the loan cannot be issued in cash from proceeds directly . Money for a loan can either be withdrawn from the account or transferred to the employee by non-cash method (Instructions of the Central Bank of the Russian Federation dated December 9, 2019 No. 5348-U).

The employee can also repay the loan by bank transfer or in cash to the company’s cash desk. By agreement of the parties, the employer may deduct the debt from the employee’s earnings. In this case, the amount of deductions should not exceed 20% of the salary amount.

When the loan repayment period is not specified in the agreement, the borrower must return the money within 30 days from the date the employer submits a demand for repayment (clause 1 of Article 810 of the Civil Code of the Russian Federation).

Other nuances of personal income tax with matvygoda

Do not forget that the calculation of material benefits and the personal income tax calculated from it must be documented. For this purpose, an accounting certificate is drawn up.

When calculating personal income tax, remember that income in the form of material benefits is not reduced by tax deductions (clause 4 of article 210 of the Tax Code of the Russian Federation).

The calculated personal income tax on material benefits must be withheld from the nearest cash income paid to the borrower. In this case, the total amount of personal income tax withheld cannot exceed 50% of the income paid. If the balance of personal income tax on material benefits remains undeducted, then it must be withheld at the next payment of income. If this fails, at the end of the year the unwithheld tax must be reported to the tax certificate 2-NDFL with sign 2.

NOTE! Calculated personal income tax, including on material benefits, cannot be withheld from payments that are not income. For example, personal income tax on material benefits cannot be withheld when reimbursing overexpenditures of accountable money by issuing a loan (clause 4 of article 226 of the Tax Code of the Russian Federation).

If personal income tax calculated on material benefits was withheld when paying vacation or sick pay, then the withheld tax on material benefits must be paid no later than the day of its payment, and the withheld tax on vacation or sick pay can be paid later, but no later than the last day of the month of their payment (clause 6 Article 226 of the Tax Code of the Russian Federation).

Example:

As of March 31, a material benefit was calculated in the amount of RUB 8,000. and personal income tax was calculated on material benefits in the amount of 2800 rubles. (8,000 × 35%). On April 4, vacation pay was calculated in the amount of 54,000 rubles, personal income tax on which is 7,020 rubles. (54,000 × 13%), and vacation pay was transferred to the employee minus the calculated personal income tax on vacation pay and financial assistance in the amount of 44,180 rubles. (54,000 – 7,020 – 2,800). Pay personal income tax on financial assistance in the amount of 2,800 rubles. You need to pay personal income tax on the amount of vacation pay in the amount of 7,020 rubles no later than April 5. Needed no later than April 30th.

KBK personal income tax for material benefits in 2020-2021 is the following - 182 1 0100 110.

Material benefits from savings on interest are not subject to insurance premiums.

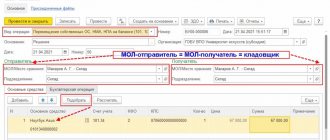

How it works in VLSI

In SBIS, personal income tax on material benefits will be calculated automatically if the following documents are prepared in the system:

- loan issued to an employee;

- payment document for a loan. In this case, the document must indicate the loan agreement number.

The tax amount will be reflected on the employee's payslip.

To deduct an amount from an employee's salary to repay a loan, issue additional withholding.

Personal income tax on material benefits will be withheld on the day of the employee’s next salary payment. After this, transfer the tax to the budget no later than the first working day following the day of deduction.

In reports 6-NDFL and 2-NDFL, the material benefit from savings on interest is reflected separately from income, which is taxed at a rate of 13%.

Results

Material benefit is the income of an individual, subject to personal income tax in a special manner, using special tax rates.

Tax must be calculated on each last day of the month. This is done by the tax agent. He also transfers the tax to the budget or informs the taxpayer and tax authorities about the impossibility of withholding. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.