The purpose of the statutory activities of non-profit organizations is not related to making a profit. Additionally, an NPO may have revenue and profit that is used for statutory purposes. Separate accounting of these two areas arises, which must be reliably reflected and separate reporting must be provided for them.

The purpose of reliable reporting:

- Correctly reflect voluntary contributions and donations so that government agencies do not recognize them as revenue and do not charge taxes

- Submit more than 36 reports to the Tax Service, Pension Fund, Social Insurance Fund, Rosstat, Ministry of Justice and avoid a fine

- Increase the transparency of a non-profit organization and raise the level of trust in society.

- Confirmation of the targeted expenditure of funds for statutory purposes.

The reporting of non-profit organizations differs significantly from commercial ones:

- NPOs submit a different form of balance sheet

- Always fill out Form 6 in the balance sheet, a report on the intended use of funds

- Additionally report to the Ministry of Justice

- Fill out additional sheets in the simplified taxation system or profit declaration

- Always included in the selection of additional Rosstat reports

- Otherwise, they reflect benefits on insurance contributions to the Tax Service

- And much more.

This is a big question; we will consider it based on the areas of reporting. Do not forget that for each report not submitted on time, the fine will be from 500 to 2000 rubles, plus penalties and a fine for the tax not paid according to the report!

Accounting statements of non-profit organizations

NPO reports to the Ministry of Justice

Tax reporting of NPOs

Reporting for NPO employees

Reporting to Rosstat

Additional NPO reports and their deadlines

Non-profit organizations need to ensure timely submission of reports and correct completion of submitted documents. You should know that quite often errors in reports submitted to various government bodies become the cause of claims against an NPO, which may be accused of violating the law and suspend its activities. The NPO submits its first mandatory report on the 15th of the following month after registration with the Federal Tax Service.

Non-profit organizations, along with other enterprises and structures, need to prepare documentation for submission to regulatory authorities in the form of reporting - tax, accounting and statistical. NPOs also report on insurance premiums and submit special reports to the Ministry of Justice of the Russian Federation. In order to submit all the necessary documents in a timely manner and avoid problems with the law, non-profit entities must know what reports NPOs submit, the deadlines for their submission, and other aspects of reporting that require special attention.

In 2022, reporting is submitted using an EDS (Electronic Digital Signature), via the Internet using special operator programs.

Accounting statements of non-profit organizations

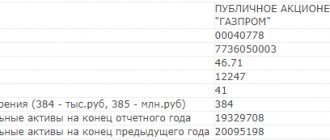

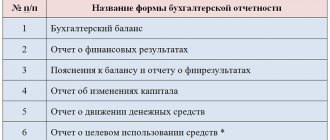

All subjects of non-profit activities are required to maintain accounting records for non-profit organizations and submit financial statements once a year in accordance with the general rules. When reporting to the relevant authority, they must prepare the following documentation for submission

- NPO balance sheet (form No. 1);

- reports confirming the targeted expenditure of funds (form No. 6).

Each document is filled out and executed in accordance with the established form; when drawing them up, the features and specifics of the activities of a non-profit organization are taken into account.

Some NPOs additionally submit a statement of financial results. It appears in the following cases

- the work of the non-profit organization brought it revenue;

- the report is necessary to assess the financial condition of the NPO.

If a report on financial results is not required, then income from the operation of the NPO is reflected in the document on the intended use of the funds received.

Accounting statements of non-profit organizations are submitted within 90 days after the end of the reporting period.

The balance sheet of NPOs differs from the balance sheet prepared by commercial enterprises. Thus, the “Capital and Reserves” section was replaced with “Targeted Financing”. It indicates the amounts of sources of asset formation, and also reflects the balances of target revenues. Also, some other lines in the NPO balance sheet have been replaced, which is due to the nature of the activities of non-profit enterprises.

The report on the targeted expenditure of funds indicates expenses for charitable purposes, various events, wages and other expenses necessary for the functioning of the organization. The amount of financial receipts - total and for specific items - various contributions, income from activities, cash balance at the beginning and at the end of the reporting period.

Important! Accounting reports are submitted annually, but do not forget that tax reports are submitted quarterly! The report to the Pension Fund SZV-M is submitted monthly! Monthly and quarterly reports are mandatory even for inactive (zero) non-profit organizations.

On the procedure for reporting by non-profit organizations

Non-profit organizations submit accounting and tax reports according to general rules.

The procedure and deadlines for submitting special reports are fixed in Order of the Ministry of Justice dated May 26, 2022 No. 122.

Reports ON0001, ON0002, ON0003, OR0001 must be submitted once a year until April 15 inclusive. Reporting deadlines for form SP0001: April 30, July 31, October 31 and January 31. The reporting deadline for the SP0002 form is April 15, and the SP0003 form is October 31.

Reports on the activities of non-profit organizations with the function of a foreign agent, to the extent of information submitted to the Ministry of Justice of Russia, are subject to mandatory posting on the Internet or provision to the media once every six months (clause 3.2 of Article 32 of the Federal Law of January 12, 1996 No. 7-FZ ).

Methods for transmitting reports:

- personal visit;

- mailing;

- through an electronic document management operator;

- by email if there is an electronic digital signature of the head of the non-profit organization and the accountant;

- publication of reports and performance results on the official website of the Ministry of Justice;

- publishing reports in the media or on your own website on the Internet.

Prepare, check and submit reports to the Federal Tax Service, Pension Fund of the Russian Federation, Social Insurance Fund, Rosstat, RAR, RPN via the Internet

Try it

NPO reports to the Ministry of Justice

Subjects of non-profit activities provide NPO reports to the Ministry of Justice, indicating all the necessary information in forms approved by the Ministry of Justice of the Russian Federation. The submitted reports confirm that there are no foreigners among the NPO employees, and the organization does not have foreign sources of funding.

NPO reporting to the Ministry of Justice, the deadlines for its submission are as follows:

- Form No. 1 (ON0001) - the document contains information about the leaders of the non-profit organization, as well as the nature and specifics of its activities;

- Form No. 2 (ON0002) – it provides data on the targeted funds and property used;

- Form No. 3 (ON0003) – the report reflects all funds and property received by NPOs from international and foreign companies and enterprises, from foreigners and stateless persons. You can fill it out by visiting the official portal of the Ministry of Justice.

All these NPO reports to the Ministry of Justice have the following deadlines for submission - until April 15 of the year following the reporting period.

Some non-profit entities do not submit reports to the Ministry of Justice on certain forms in the following cases:

- the organization did not receive funds from foreign companies or foreign persons;

- the founders or employees of the NPO are not foreigners;

- During the reporting period, the organization received revenues totaling no more than 3 million rubles.

In this case, instead of the above forms, an Application for Continuation of Activities must be filled out, which has a free form and complies with the requirements of the legislation of the Russian Federation.

!Important. Submitting reports to the Ministry of Justice confirms the NPO’s intention to work this year. In the absence of correctly submitted reports, the Ministry of Justice initiates the forced liquidation of the NPO and there is a risk of disqualification of persons registered in the Unified State Register of Legal Entities, in accordance with Federal Law-129.

Unlike the measures taken by the tax inspectorate, the Ministry of Justice rarely fines non-profit organizations, but acts in the following order.

- The NPO receives an order to submit reports at its legal address. I advise you to always keep track of the legal address of the NPO.

- If the NPO has not submitted reports within 30 days, a forced liquidation mechanism is initiated, and the Ministry of Justice makes an appropriate decision.

- After 10 days, an entry about the upcoming liquidation appears in the Unified State Register of Legal Entities.

- It is published in the newsletter for 3 months. The NPO must have time to eliminate all shortcomings within this period. At this stage, submitting reports is more difficult; it takes about a month.

- After publishing the newsletter within 30 days, the NPO is deleted from the Unified State Register of Legal Entities. At this stage, nothing can be done.

If you have received an entry in the Unified State Register of Legal Entities, we advise you not to tempt fate anymore. Consider concluding an agreement with professionals in the field of non-profit organizations, for example with Us. Save the NGO and not get into this situation again.

You can read more about reports to the Ministry of Justice in a separate article, this is really important.

Features of ANO affecting reporting

The following features of ANO influence the reporting of such companies:

- focus on achieving social goals;

- obtaining material benefits is not a priority;

- activities are regulated by the Civil Code of the Russian Federation, the Tax Code of the Russian Federation and industry legislation;

- there may be associations of individuals;

- the basis of accounting is the targeted revenues of the autonomous non-profit organization, which are necessarily reflected in the reporting;

- submission of reports is established according to deadlines typical for legal entities;

- mandatory content in reporting of information relating to the property of the autonomous non-profit organization, both in monetary and other forms;

- as income, the reporting reflects receipts from participants, voluntary donations, revenue from certain types of work, interest on stocks and bonds, and others;

- to generate reporting, they use data on the balances of property obtained through targeted investments;

- reporting is prepared using documents justifying transactions;

- it is necessary to have confirmation of the property transfer transaction;

- it is necessary to have documents confirming the expenses of the autonomous non-profit organization.

Main tax regime

Non-profit enterprises using the main tax system submit the following list of documents to the tax office

- VAT declaration – submitted strictly in electronic form, via digital signature, before the 25th day of the month following the reporting period. This report must be submitted every quarter. In the absence of an object subject to VAT, non-profit enterprises submit reports consisting of a title page and the first section;

- income tax return – a non-commercial entity engaged in business is a payer of income tax. For each reporting period, reporting is provided, which must be submitted within 28 days after the end of the quarter. A full report for the tax period is submitted by March 28 of the year following the reporting year. If an NPO does not carry out entrepreneurial activities, then it provides a report to the tax service, but not a zero one. Target revenues should be deciphered in SHEET 7.

- reporting on property taxes - in the course of their activities, NPOs pay taxes on the property they have on their balance sheet. Quarterly, non-commercial entities transfer payments and provide their calculations in the appropriate form. Non-profit organizations that do not own fixed assets are exempt from filling it out. Deadlines for NPOs to report on property taxes – the declaration is submitted within 30 calendar days after the end of the reporting period;

- land tax - if a non-profit organization has a land plot at its disposal, it fills out the corresponding declaration before February 1 of the year following the reporting period;

- transport tax report - the form is filled out if the NPO has a vehicle on its balance sheet, it is also submitted before February 1.

Also, subjects of non-commercial activities submit some other documents:

!!! From 2022, data on the average headcount will no longer be presented as a separate report. This applies both to the form at the end of the year and in the next month after the creation of the organization. The average headcount indicator has been added to the DAM form on the title page of the report!!!

- 6-NDFL (Personal Income Tax) - quarterly, until the 30th of the next month, even if there are no employees.

- 2-NDFL - annually before March 1, employee income certificates drawn up in a certain form are submitted. If there were no employees, it is not necessary to submit. (valid until 2022)

!!! From January 1, 2022, a new 6-NDFL reporting form was approved, combining forms 2-NDFL and 6-NDFL. The new report form will be used from the 1st quarter of 2022 (for 2022 - form 2-NDFL is submitted separately for the last time!) 2-NDFL will be included in the appendix to the 6-NDFL report, this appendix must be filled out only in the annual report (for the 4th quarter) !!!

- Calculation of insurance premiums for employees is quarterly until the 30th, even if there are no employees.

!!! From January 1, 2022, the updated form of the DAM report comes into force.

Accounting support

Zero 1500 rub. Activity 3500 rub. Activities + Salary 5000 rub.

• Personal accountant • Possibly remotely • 12 years of experience • 1000+ NGOs • All forms • Grants

Call your accountant right away

*The cost in Moscow and Moscow Region, St. Petersburg and Leningrad region is respectively: 2000, 5000, 7000 rubles

Call

Reporting to the simplified tax system

Non-profit organizations operating under a simplified taxation regime submit such reports to the tax office

- Declaration under the simplified tax system must be filled out and submitted by a non-profit enterprise that is under a simplified taxation regime. Reporting deadlines for non-profit organizations - documentation is submitted by March 31 of the year following the reporting period.

Important! If the NPO had no income, Sheet 6 is still filled out - target income.

NPOs using the simplified system do not pay VAT, income and property taxes, as well as some other payments. But there are exceptions for enterprises leasing property and in some other cases, which must be clarified with the tax authorities.

When submitting NPO reports 2022, non-profit entities, along with other enterprises, bear full responsibility to the federal tax inspectorate for the information provided in the documents.

Important! The use of the simplified tax system does not exempt you from submitting quarterly: 6-NDFL, Calculation of insurance premiums, Calculation to the Social Insurance Fund and monthly SZV-M to the Pension Fund of the Russian Federation. All of the above reports are submitted even by non-profit organizations.

If ANO is on the simplified tax system

ANO, like other companies, has the right to apply the simplified tax system in two options: 6% or 15%.

The advantages of using the simplified tax system for autonomous non-profit organizations are as follows:

- reduction in the number of reports submitted per year from 41 to 34;

- reports can be submitted without using an electronic signature.

Important! There are two features of using the simplified tax system for autonomous non-profit organizations:

- ANO is allowed to use the simplified tax system even if the share of participation of another person is above 25% (clause 12, clause 3, article 346.12 of the Tax Code of the Russian Federation);

- the use of the simplified tax system is possible even if the cost of fixed assets (non-depreciable) is more than 150 million rubles. (Clause 1.Article 256 of the Tax Code of the Russian Federation).

Example No. 1. ANO “VVV” for the tax period received a profit in the amount of 550 tr. The amount of expenses amounted to 435 tr.

Let’s assume that ANO “VVV” is using the simplified tax system at 15%:

(550 – 435) * 15% = 17.25 tr. – the amount of tax to be paid.

Now let’s define the simplified tax system 6%:

550 * 6% = 33 tr.

Obviously, for VVV LLC the simplified tax system of 15% is more profitable.

Important! Targeted revenues that ANO receives and uses for their intended purpose are not taxed (Part 2, Article 251 of the Tax Code of the Russian Federation). It is necessary to maintain separate records for such forms of income.

Reporting for NPO employees

All NPOs also provide regulatory authorities with reporting on contributions and personal income tax paid by the organization for its employees.

If there is no salary, reporting is still provided, just zero.

Benefits on insurance premiums in reporting. Almost all NPOs registered with the Ministry of Justice are considered social; using the simplified tax system, they can charge and pay contributions of 20%. And when the employee’s payroll reaches more than RUB 1,565,000. per year, no insurance premiums are paid at all.

It is important to correctly reflect the application of the benefit in reporting and prepare documents in advance in case of an audit at the end of the year. A preferential rate of 20% is a right, not an obligation. Unconfident accountants often refuse to use it for fear of auditing the entire organization.

It is important to note that non-profit volunteers without wages are not indicated in employee reporting.

Reporting on insurance premiums

All non-profit organizations are required to timely submit reports to the Tax Service, the Social Insurance Fund and the Pension Fund of the Russian Federation. NPO reports 2022 on extra-budgetary funds are submitted according to rules common to enterprises of all types of activities.

Non-profit organizations must fill out the following documents:

Reports to the Federal Tax Service - calculation of insurance premiums (DAM). Provided quarterly until the 30th.

Reports to the Social Insurance Fund - form 4-FSS are submitted to the social insurance fund of the non-profit organization. It can be presented in electronic format or on paper, but the deadlines for submitting reports to the Social Insurance Fund differ.

- submitted electronically by the 25th of the next month;

- on paper must be submitted by the 20th of the next month;

If a non-profit organization does not have permanent employees during the reporting period, then it must submit zero NPO reports to the social insurance fund. The deadline for its submission is until the 20th day of the month following the reporting period.

Reports to the Pension Fund of the Russian Federation - reports to the Pension Fund of the Russian Federation are submitted on paper or in electronic form.

- SZV-M - monthly to the Pension Fund of Russia until the 15th of the next month, even if there are no employees.

- SZV-STAZH - annually until March 1, even if there are no employees.

- Information about the registered person’s work activity (SZV-TD)

!!! Starting from January 1, 2022, two deadlines are set:

- in cases of transfer to another permanent job or acceptance of the Application for the form of maintaining the work book SZV-TD is provided no later than the 15th day of the month following the month in which personnel changes occurred or the Application was accepted;

- in cases of conclusion (termination) of employment contracts (hiring, dismissal), the SZV-TD form is submitted no later than 1 business day following the day of issuance of the relevant order (instruction), other decisions or documents confirming the registration (termination) of the employment relationship.

According to the innovations, since 2016, non-profit entities must fill out and submit the SZV-M form to the Pension Fund every month when reporting for employees. This is reporting that provides information about the insured persons indicating their SNILS.

According to the written explanation of the Russian Pension Fund, a zero monthly SZV-M is surrendered even in the absence of employees with the indication of the head of the non-profit organization.

In addition, non-profit organizations applying reduced tariffs must fill out additional subsections in the RSV and 4-FSS forms.

Deadlines for submitting reports for ANO on the simplified tax system

The deadlines for submitting reports in 2022 are set taking into account weekends and holidays. In this situation, the deadline is postponed to the next working day.

The table shows the deadlines for submitting reports for autonomous non-profit organizations that use the simplified tax system in 2022.

| Report type | Term | |||

| 1st quarter | 2nd quarter | 3rd quarter | 4th quarter | |

| simplified tax system | For LLC - 04/01/2022, for individual entrepreneurs - 04/30/2022 | |||

| Property tax | 30.04 | 30.07 | 30.10 | 30.04.2022 |

| Transport tax | 03.02.2022 | |||

| Land tax | 03.02.2022 | |||

| Financial statements | 01.04.2022 | |||

| SZV-M | 15.02 15.03 15.04 | 15.05 15.06 15.07 | 15.08 15.09 15.10 | 15.11 16.12 15.01.2022 |

| 6 personal income tax | 30.04 | 31.07 | 31.10 | 01.04.2022 |

| 4 FSS on paper | 22.04 | 22.07 | 21.10 | 20.01.2022 |

| 4 FSS in electronic form | 25.04 | 25.07 | 25.10 | 27.01.2022 |

| 2 personal income tax | 01.04.2022 | |||

| SZV-experience | 02.03.2022 | |||

| Average headcount | 20.01.2022 | |||

Important! For 2022, a simplified procedure for reporting was approved - submitting a simplified taxation system (STS) declaration may not be necessary for individual entrepreneurs and legal entities if they have used online cash registers for a whole year and their tax base is “Income”.

Reporting to Rosstat

Subjects of non-commercial activities, along with other legal entities, must promptly submit statistical reports to Rosstat, indicating the necessary information. The deadlines and rules for submitting the required documents are determined by the legislation of the Russian Federation, and in case of failure to submit reports, administrative liability is provided. All NPOs are required to submit a balance sheet to Rosstat.

Subjects of non-profit activities must annually submit an individual list of reports to state statistical bodies, which can be found on the Rosstat website. As a rule, common to all non-profit organizations, as a rule, are:

- financial statements submitted to the Federal Tax Service by April 1 of the year following the reporting period;

- Form No. 1-NPO - the report indicates information about the activities of a non-profit enterprise; it must be submitted before April 1 of the year following the reporting period;

- form No. 11 (short) - the document indicates information about available fixed assets, their quantity and movement. The form must be submitted once each year by April 1st.

- 1-SONKO - Information about the activities of a socially oriented non-profit organization. The form must be submitted once each year by April 1st.

- P-4 - Information on the number and wages of employees

Other reports are also submitted to local branches of Rosstat ; according to the deadlines for submission, they can be monthly or quarterly. The final list of documentation included in the statistical reporting of NPOs is determined depending on the specifics of the organization’s activities. Before submitting reports, you must check with local statistics offices which forms should be submitted to a particular non-profit organization; the number and names of forms may change every year.

Important! It is possible to check additional reports for your organization on the statistics website, here is the link. For non-profit organizations, the list of additional forms can be quite large.

Socially oriented non-profit organizations submit Form 1-SONKO to Rosstat, which provides all the necessary information about the activities of the socially oriented NPO. Form 1-SONKO must be submitted by April 1 of the year following the reporting period.

Non-profit organizations that, in the course of their activities, help solve social problems are considered socially oriented. SONPOs include entities that provide social protection of individuals, nature protection, as well as objects of cultural or architectural value, and animal protection. Also, such organizations provide legal assistance to individuals and legal entities. They are engaged in charity work and activities in various fields - cultural, scientific, educational and others.