Methodological aspects of accounting for special equipment

The procedure for organizing accounting of special equipment and special clothing included in current assets is established by the Methodological Guidelines for Accounting of Special Tools, Special Devices, Special Equipment and Special Clothing, approved by Order of the Ministry of Finance of Russia dated December 26, 2002 N 135n.

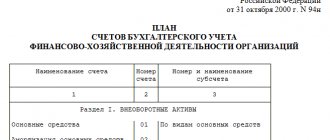

Reflection in accounting of the receipt, availability and movement of special equipment is carried out in accordance with the Instructions for the application of the Chart of Accounts for accounting of financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n.

To account 10 “Materials”, sub-accounts are opened:

10-10 “Special equipment and special clothing in the warehouse”;

10-11 “Special equipment and special clothing in operation”;

At the same time, in accordance with clause 9 of the Methodological Instructions, an organization can organize accounting for special equipment in the manner prescribed for accounting for fixed assets, in accordance with the Accounting Regulations “Accounting for Fixed Assets” PBU 6/01, approved by Order of the Ministry of Finance of Russia dated March 30, 2001 N 26n.

The chosen method of accounting for special equipment must be fixed by the Organization in its Accounting Policy (clause 7 of the Accounting Regulations “Accounting Policy of the Organization” (PBU 1/2008), approved by Order of the Ministry of Finance of Russia dated October 6, 2008 N 106n).

What kind of document is this?

The act of write-off certifies the fact of using material assets or rendering them inoperable as a result of certain events.

It indicates the deregistration of an item that subsequently cannot be used to solve production problems. Material assets are items acquired by a business entity through its own financing of the purchase operation. They can be used to implement entrepreneurial ideas when creating products, as well as to meet the needs of the enterprise.

Write-off order

A distinctive feature of material assets is the fact of their acquisition at the expense of a business entity. One of their many varieties are instruments. They are used to meet the needs of a company or to support a production process.

During operation, all tools wear out, as a result of which their further use becomes impractical, which is the reason for their write-off.

The act certifying the deregistration of material value must display information identifying it, the reason for the event, as well as the quantity and value of the items being written off. The document must reflect details that allow the document to be interpreted with a specific business entity, as well as the date of its preparation. The documentation is the basis for the accountant to issue a certificate allowing the item to be removed from the register.

Regulatory and legal sources do not provide for an approved form of the form, however, authorized bodies put forward their own requirements for its design. The standard form of the document can be taken as a sample act of writing off material assets that have become unusable. Based on it, it is recommended to develop a template that can be used by a specific enterprise in accordance with its procedure for maintaining and recording document flow.

Types of special equipment in construction

Special tools and special devices are technical means that have individual (unique) properties and are intended to provide conditions for the manufacture (production) of specific types of products (performance of work, provision of services).

The composition of special tools and special devices includes: tools, dies, molds, molds, rolling rolls, pattern equipment, stocks, molds, flasks, template special equipment, other types of special tools and special devices.

Technical means intended for the production of standard types of products, works or services are not taken into account as special tools (special devices) (clauses 2 - 4 of the Guidelines for accounting for special tools).

Counted as special equipment:

- special technological equipment (chemical, metalworking, forging, thermal, welding, other types of special technological equipment) used to perform non-standard operations;

- control and testing apparatus and equipment (stands, consoles, mock-ups of finished products, testing facilities) intended for adjustments, testing of specific products and delivery to the customer (buyer);

- reactor equipment;

- decontamination equipment;

- other types of special equipment.

Technological equipment for performing typical (standard) operations is not taken into account as special equipment (clauses 5, 6 of the Guidelines for accounting for special tools).

In other words, special equipment is labor tools reusable in production, which provide conditions for performing specific (non-standard) technological operations.

Thus, the main qualifying feature of special tools, equipment and devices (special equipment) is that this thing must have unique properties. Equipment or tools can be considered special only if they are not used in the construction of other types of objects.

Therefore, a drill, hammer drill or jackhammer are not special equipment (as they can be used for various operations). For example, with a drill you can drill holes in metal and wood, and of different diameters. Similar reasoning can be made in relation to a rotary hammer and a jackhammer.

Scaffolding also cannot be classified as special equipment, since scaffolding is used to accommodate workers, tools and materials when performing standard construction and repair work at height.

At the same time, if a company purchased a unique drill or auger, they can be recognized as special equipment.

Special equipment also includes formwork for unique, unrepeatable structures for the following reasons:

- Formwork sets of this type are not intended for the production of standard monolithic structures.

- Formwork is a special device that has individual (unique) properties and is designed to provide conditions for the manufacture (production) of specific types of products (performance of work, provision of services).

In this case, the accountant must keep records of such formwork according to the rules of Methodological Instructions No. 135n.

At the same time, organizations are given the right to independently determine a specific list of labor tools taken into account as part of special equipment, based on the characteristics of the technological process (clause 8 of the Guidelines for accounting for special tools).

Accounting for special equipment as part of current assets

Special equipment can be capitalized as materials regardless of cost and useful life - this is its peculiarity.

There is no obligation to take it into account as part of the operating system; this is only the right of the company (clause 9 of Methodological Instructions No. 135n.).

Therefore, the Organization has the right to take into account expensive special equipment (for example, costing 350 thousand rubles) and long-term use (over 12 months) as part of the materials.

So, like other materials intended for use in the production of products (when performing work, providing services), special equipment is taken into account on account 10 “Materials”.

At the time of receipt and before transfer to production or operation, special equipment is reflected in a separate subaccount 10-10 “Special equipment and special clothing in warehouse.”

If special equipment consists of individual elements that have different periods of use, then you can use clause 43 of Methodological Instructions N 135n, which allows the use of a simplified method of accounting for special equipment in enlarged sets.

A set of special equipment as a whole is accepted as an accounting unit and is assigned one item number.

The initial cost (actual cost) of the kit is equal to the sum of the costs associated with the acquisition and (or) production of each item (component). In this case, the organization establishes a single useful life for the entire set based on the expected period of production of this type of product (work, service), and all costs for maintenance, repair and replacement of individual parts of the set are included in the costs of ordinary activities, that is, in composition of the actual cost of products (works, services).

At the time of transfer of special equipment and special clothing into production (operation), the cost of these assets is not transferred in full to production costs (as is done in relation to inventories used in production for management needs).

Special equipment and special clothing continue to be accounted for as part of current assets in account 10 “Materials”, but only in another subaccount - subaccount 10-11 “Special equipment and special clothing in operation” - in the amount of actual costs associated with the acquisition ( manufacturing), that is, at actual cost.

Responsibility

The act of write-off indicates the legality of the procedure for deregistration of instruments that have become unusable. Since it is compiled by members of the commission, its representatives are responsible for carrying out the procedure in accordance with legal requirements and for the accuracy of the data displayed in the document.

Financially responsible persons who threw away unusable tools, but did not initiate the procedure for registering the write-off of items, may be accused of theft of valuables owned by a business entity. Its manager has the right to demand from the person who is guilty in his opinion compensation in full the cost of the goods.

Methods for writing off the cost of special equipment as expenses

In order to write off the cost of special equipment as expenses (debit of the cost accounting account in correspondence with the credit of account 10, subaccount 10-11 “Special equipment and special clothing in operation”, a construction organization can choose one of two write-off methods:

- method of writing off the cost in proportion to the volume of products (works, services);

- linear method.

In relation to a group of homogeneous objects of special equipment, only one method of write-off can be used, for example, the straight-line method (it must be applied throughout the entire useful life of the objects included in the group).

Consequently, the cost of special equipment items included in another group can be written off in a different way (in proportion to the volume of products (works, services) produced).

In addition, the cost of special equipment intended for individual orders can be fully repaid at the time of its transfer to production (operation) (clause 25 of the Guidelines).

In terms of individual orders, a one-time write-off of special equipment is combined with a method of assessing inventories at the cost of each unit, when inventories cannot replace each other in the usual way, which may well be the case in terms of special tools (devices). As for mass production, it is characterized by a large volume of product output, when one operation is performed at many workplaces. In this case, the special equipment partially loses its specificity (individuality) in relation to the production process, therefore its cost is written off at a time, as is customary with a conventional tool.

The cost of special equipment is written off as expenses that form accounting profit (loss).

In this case, an accounting entry is made to the debit of the production cost accounts and the credit of account 10, subaccount 10-11 (clause 27 of the Methodological Instructions, Instructions for using the Chart of Accounts).

Accounting for special equipment in 1C: Accounting 3.0

Special equipment in enterprise operation

Each company individually is obliged to prescribe what exactly is special equipment for them; in the accounting documentation it can be either a material or a fixed asset (this depends on the price of the special equipment in operation).

Note: in 2022, the procedure for accounting for special equipment will be changed; it will be carried out according to the FSBU standard 5/2019 “Inventories”.

Accounting for special equipment

Next, let's look at an example. We will register special equipment as material, working in the 1C Accounting program, version 8.3. To do this, you need to use the following accounting accounts:

- account 10.10 “Special equipment and special clothing in the warehouse”;

- account 10.11.2 “Special equipment in operation.”

Note: you should not forget that when special equipment is entered into the “Nomenclature” directory, be sure to indicate the name of the group “Special equipment”.

Registration takes place using receipt documents, after which the special equipment must be transferred for use (but for special equipment in operation, as for other equipment, there are also the functions “returned” and “written off”). All documentation for these operations is located along the path “Warehouse → Workwear and equipment.”

Rice. 1 Section Workwear and equipment in the 1C: Accounting program, version 8.3

To put special equipment into operation, you need to use the document inside the 1C: Accounting program, version 8.3 “Transfer of materials for operation.” Next, be sure to fill out the tabs inside the document (in the “Purpose of use” column, fill in according to the method for paying for the cost of special equipment).

After creating the above document in the “Purpose of use” line, you need to create a position inside the directory with the following details: nomenclature (will be specified automatically), name (can be any), repayment of the cost of special equipment during operation, as well as the account to which the expenses go (in the example accounting account 20.01).

Rice. 2 Usage destination line details

Also, to repay the cost of special equipment, you can make another position in the “Purpose of use” line and inside the fields indicate the method of repayment of the cost - “Linear” for one year.

Rice. 3 Repayment method – linear

The cost will be paid every month, according to the routine “Month Closing” processing.

Rice. 4 Repayment of the cost of special equipment for routine processing Closing of the month

Another way to receive payment is to choose the method of paying off the cost “Proportional to the volume of work”, after which be sure to write down the entire volume for the specific special equipment in operation. Next, once a month it will be necessary to enter production volumes. According to the “Closing of the month” processing, the cost of special equipment will be repaid.

In the case of returning special equipment, if the service life of the special equipment has expired, using the document “Return of materials from service”, enter the required special equipment in the “Batch” column.

Rice. 5 Return of special equipment from service

And in the case when it is necessary to decommission special equipment, we will use the document “Decommissioning of materials”, and in the “Batch” tab we will add the documents according to which the special equipment began to be used. To select the type of write-off, go to the “Write-off of expenses” tab.

Rice. 6 Disposal of special equipment

Proportional method

The method of writing off the cost in proportion to the volume of produced products (works, services) is advisable to use for those types of special equipment, the useful life of which is directly related to the number of produced products (works, services).

In this case, the part of the cost of the asset to be transferred to costs is determined based on the natural indicator of the volume of products (work, services) in the reporting period and the ratio of the actual cost of the special equipment object to the expected volume of output of products (work, services) for the entire expected useful life the specified object.

Linear method

With the straight-line method, the monthly amount of the cost of a special asset transferred to costs is calculated based on the actual cost of the asset and standards calculated on the basis of the useful life of this asset.

If in any reporting period the use of a special asset is temporarily suspended, the straight-line write-off of its value as an expense does not cease.

The enterprise sets the useful life of special equipment independently based on the fact that such a period should be understood as the period during which the use of the object will bring economic benefits (income), that is, the object will be used for its intended purpose.

Construction companies, as a rule, use a linear method of writing off the cost of special equipment.

Accounting for special equipment as part of fixed assets

If the special equipment meets the criteria established by clause 4 of PBU 6/01:

The asset is accepted by the organization for accounting as fixed assets if the following conditions are simultaneously met:

- the object is intended for use in the production of products, when performing work or providing services, for the management needs of the organization, or to be provided by the organization for a fee for temporary possession and use or for temporary use;

- the object is intended to be used for a long time, i.e. a period exceeding 12 months or the normal operating cycle if it exceeds 12 months;

- the organization does not intend the subsequent resale of this object;

- the object is capable of bringing economic benefits (income) to the organization in the future.

then, in accordance with the accounting policy, accounting for special equipment is carried out according to the rules provided for by PBU 6/01.

The cost of fixed assets is repaid through depreciation (clause 17 of PBU 6/01).

In practice, construction organizations use the linear method of calculating depreciation.

Depreciation deductions under the linear method of calculating depreciation are made based on the initial cost of the fixed asset and its useful life, established by the organization when accepting this object for accounting. Depreciation is calculated monthly. This follows from paragraph. 2 clause 18, para. 2, 5 clause 19, clause 20 PBU 6/01.

The accrual of depreciation charges for an asset begins on the first day of the month following the month in which this object was accepted for accounting, and is carried out until the cost of this object is fully repaid or it is written off from accounting (clause 21 of PBU 6/01).

Depreciation charges for fixed assets used in production activities are recognized as expenses for ordinary activities in the reporting period to which they relate. This follows from clauses 5, 8, 16, 18 of the Accounting Regulations “Expenses of the Organization” PBU 10/99, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 N 33n.

Nuances

To facilitate accounting and ensure the absence of claims from the inspecting authorized bodies, in the act, the name of the written-off object should be indicated in accordance with the identification displayed in the receipt papers. It is important to indicate the purpose of the instrument being written off, as well as its analytical accounting number. The act can be generated in the form of a summary statement, in which data is displayed only upon actual write-off. The date of deregistration is determined not by the date of registration of the statement, but by its actual parameter.

Income tax

For profit tax purposes, accounting for items of special equipment is carried out in the following order:

- items of special equipment worth more than RUB 100,000. and a useful life of more than 12 months are recognized as depreciable property;

- items of special equipment with a useful life of less than 12 months or costing no more than 100,000 rubles. - as part of material costs. In this case, the costs of purchasing items of special equipment that are not depreciable property are included in material costs in full as they are put into operation.

Moreover, from 01/01/2015, in order to write off the cost of the specified property over more than one reporting period, the organization has the right to independently determine the procedure for recognizing material expenses in the form of the cost of such property, taking into account the period of its use or other economically feasible indicators (clause 3, clause 1, art. 254 of the Tax Code of the Russian Federation, paragraph “a”, paragraph 7 of Article 1, paragraph 1 of Article 3 of the Federal Law of April 20, 2014 N 81-FZ “On Amendments to Part Two of the Tax Code of the Russian Federation”).

This procedure must be defined in the accounting policy for tax purposes (which follows from Article 313 of the Tax Code of the Russian Federation).

general information

The card in form 423-APK is used for plumbing and agricultural equipment. The useful life of such objects must be more than 12 months, and the cost can be any - it is prescribed in the accounting policy. Previously, the maximum such figure was 2,000 rubles.

The purpose of the card is to record the receipt and movement of inventory, and promptly provide information about the amount of available inventory in a structural unit.

The document is issued for objects of the same type that have the same economic function and value. Therefore, it is advisable to unite them according to homogeneous varieties. For example:

- general purpose equipment and equipment (cutting, plumbing, universal measuring instruments and devices, etc.);

- special tools and devices (tools, molds, etc.);

- production equipment (desks, workbenches, racks, cabinets, cabinets, etc.);

- household supplies (office furniture, telephones, fire-fighting equipment, etc.);

- other objects (dinnerware and cutlery, equipment for cultural events, sports equipment, etc.).

On the front side, data about the objects at the time of transfer to operation is entered, as well as data about disposal. On the reverse side you need to indicate information about the write-off of inventory and list the values received from the liquidation according to the accounting accounts.

For your information! A special commission assembled by order of management decides whether the equipment is suitable for work or not. Her task is to inspect the objects, check the terms of use according to the documentation, make a decision and fill out her fields.

Fill out the card in a single copy. The procedure is carried out on the basis of primary documents for the receipt, movement or disposal of objects.

If a factual error is discovered (incorrect date or amount), you can use the traditional procedure for correction. First, you need to cross out the fragment with the error with one line, then indicate the correct option above or next to it, then write in the margins of the document: “Believe the corrected one,” put a date and signature.

Application of PBU 18/02

In order to bring accounting and tax accounting closer together and to avoid tax differences, uniform methods for writing off the cost of special equipment in accounting and tax accounting should be chosen. For example, the following should be stated in the Accounting Policy:

For accounting purposes, a special tool is accepted for accounting as part of current assets, the repayment of the cost of a special tool is carried out in a straight-line manner, starting from the month of transfer to operation.

For tax accounting purposes, the cost of property worth less than 100,000 rubles, which is not recognized as depreciable, is written off as expenses during the useful life established for accounting purposes, monthly in the amount of expenses recognized in accounting.

Or

For accounting purposes, special equipment is accounted for according to the rules established by the Accounting Regulations “Accounting for Fixed Assets” PBU 6/01, approved by Order of the Ministry of Finance of Russia dated March 30, 2001 N 26n.

Depreciation on fixed assets in accounting and tax accounting is calculated using the linear method.

Let us explain the above with examples.

Example

A construction organization purchased and put into operation a special tool (a unique drill) with a useful life of 30 months.

According to accounting and tax records, the costs of purchasing a special tool amounted to 35,400 rubles. (including VAT RUB 5,400). The special tool was put into operation in the month of purchase.

In accordance with the accounting policy, for accounting purposes, a special instrument is accepted for accounting as part of current assets, the repayment of the cost of a special instrument is carried out in a straight-line manner, starting from the month of transfer to operation.

The useful life established by the organization for the purchased special tools is 30 months.

For tax accounting purposes, the cost of property that is not recognized as depreciable is written off as expenses during the useful life established for accounting purposes, monthly in the amount of expenses recognized in accounting.

To account for income and expenses, the organization uses the accrual method.

Based on the example data, the Organization monthly writes off the cost of a special tool in an amount equal to 1000 rubles as expenses that form accounting and tax profit. ((RUB 35,400 - RUB 5,400) / 30 months).

In the accounting of a construction company, an operation associated with the acquisition and commissioning of a special tool, the useful life of which exceeds 12 months, and the acquisition costs are less than 100,000 rubles. should be reflected as follows:

| Contents of operations | Debit | Credit | Amount, rub. | Primary document |

| A special instrument with a useful life exceeding 12 months has been accepted for accounting. (37 760 — 5760) | 10-10 | 60 | 30 000 | Supplier shipping documents, Receipt order in form M-4 |

| VAT presented by the seller is reflected | 19 | 60 | 5 400 | Invoice |

| The submitted VAT is accepted for deduction | 68 | 19 | 5 400 | Invoice |

| The transfer of special tools into operation is reflected | 10-11 | 10-10 | 30 000 | Requirement-invoice in form M-11 |

| The cost of the special tools was paid to the seller | 60 | 51 | 35 400 | Bank account statement |

| Monthly for 30 months | ||||

| Repayment of the cost of special tools is reflected | 20 | 10-11 | 1 000 | Accounting certificate-calculation |

Example

An organization purchased and in the same month put into operation special equipment - a unique formwork worth 118,000 rubles. (including VAT RUB 18,000) per unit.

Payment to the seller is transferred after receiving the special equipment.

According to the accounting policy, special equipment is accounted for according to the rules established by the Accounting Regulations “Accounting for Fixed Assets” PBU 6/01, approved by Order of the Ministry of Finance of Russia dated March 30, 2001 N 26n.

The useful life of special equipment for accounting and taxation purposes is determined by the organization based on expected physical wear and tear taking into account the operating mode and is 40 months.

Depreciation on fixed assets in accounting and tax accounting is calculated using the linear method.

To account for income and expenses, the organization uses the accrual method.

The amount of monthly depreciation deductions in accounting and tax accounting for special equipment will be 2,500 rubles. ((RUB 118,000 – RUB 18,000) / 40 months).

In the accounting of a construction company, an operation associated with the acquisition and commissioning of special equipment, the useful life of which exceeds 12 months, and the acquisition costs amount to more than 100,000 rubles. should be reflected as follows:

| Contents of operations | Debit | Credit | Amount, rub. | Primary document |

| Special equipment with a useful life exceeding 12 months has been accepted for registration. (47 200 — 7 200) | 08 | 60 | 100 000 | Supplier shipping documents |

| VAT presented by the seller is reflected | 19 | 60 | 18 000 | Invoice |

| Special equipment with a useful life of more than 12 months is reflected in the OS | 01 | 08 | 100 000 | Certificate of acceptance and transfer of fixed assets, Inventory card for recording a fixed asset item |

| Accepted for deduction of VAT presented by the seller | 68 | 19 | 18 000 | Invoice |

| The cost of special equipment was paid to the seller | 60 | 51 | 118 000 | Bank account statement |

| Monthly for the next 40 months, starting from the month following the month the special equipment was accepted for registration | ||||

| Depreciation accrued on special equipment | 20 | 02 | 2 500 | Accounting certificate-calculation |

Example

The organization purchased a special tool worth RUB 35,400 for use in its main production. (including VAT RUB 5,400).

The organization did not incur any other costs associated with the purchase of the tool. The special tool is designed to produce 200,000 units.

20,000 units manufactured in the first month of using the special tool,

60,000 units each were produced in the second, third and fourth months of use.

The organization prepares financial statements on a monthly basis. The organization uses the accrual method of tax accounting.

The cost of a special tool in accounting and tax accounting is written off in proportion to the volume of products produced.

Thus, the cost of the special instrument is repaid in the following amounts:

- in the first month of use – 3,000 rubles. ((RUB 35,400 – RUB 5,400) / 200,000 units x 20,000 units);

- in the second, third and fourth months of use, 9,000 rubles each. ((RUB 35,400 – RUB 5,400) / 200,000 units x 60,000 units).

Review of programs for warehouse accounting in 1C

Trade management 8

The 1C: Trade Management 8 configuration is a modern tool for increasing the business efficiency of a trading enterprise. The program allows you to comprehensively automate the tasks of operational and management accounting, analysis and planning of trade operations, thereby ensuring the effective management of a modern trading enterprise.

One of the main features of 1C: Trade Management 8 is its versatility - the program supports all main types of trade (retail, wholesale, credit, pre-order, commission), which allows it to be successfully implemented in most trade organizations.

The program supports the following taxation systems:

- general taxation system - OSNO (registration of entrepreneurs operating under an individual scheme (IP) is not supported);

- simplified taxation system - simplified taxation system;

- single tax on imputed income - UTII.

The functionality of the solution is flexibly adapted by enabling/disabling various functional options. For example, the program can be significantly simplified for a small organization by disabling some features required only by large companies (the disabled functionality is hidden from the interface and does not interfere with the work of users). The following will be a description of the functionality of the solution including all options.

"1C: Trade Management 8" provides automatic selection of data necessary for accounting and transfer of this data to "1C: Accounting 8".

Using the 1C: Trade Management 8 program together with other programs allows you to comprehensively automate wholesale and retail enterprises. The program can be used as a control system for the 1C: Retail 8 solution.

"1C: Trade Management 8" automates the following areas of business activity:

- Monitoring and analysis of enterprise performance indicators.

- Treasury Department.

- Customer relationship management.

- Sales management.

- Warehouse and inventory management.

- Procurement management.

- Cost management and cost calculation.

- Regulated accounting.

- Planning.

- Integration with the Honest Sign system.

- Sharing with "1C: Document Flow 8".

1C: Retail 8

The software product "1C: Retail" is a universal solution for managing retail trade. The solution automates all the main business processes of both an individual store and a large retail chain.

With its help, you can organize effective management of sales and purchasing, inventory and warehouse, store personnel, assortment and pricing, marketing promotions and loyalty systems. Automates the cashier's workplace. Provides prompt generation of reports for monitoring and analyzing performance indicators of retail outlets.

“1C: Retail 8” supports the requirements of 54-FZ (fiscal data formats 1.05 and 1.1, provided that the format is supported by a cash register), works with connected retail equipment, and is integrated with state accounting systems for goods circulation: EGAIS, Mercury, Chestny Znak.

The system is customized individually for the tasks of any retail industry. It can be used independently, including as a cash register program, or in conjunction with other 1C solutions: 1C: Trade Management 8, 1C: Our Management, cloud service 1C: Cash.

"1C: Retail 8" is a ready-made solution for automating all major business processes in retail enterprises. The system can be effectively used both in individual stores and in distributed retail chains, both in small retail outlets and in stores with a large number of workplaces, including as a cash register program.

The functionality of “1C: Retail 8” can be configured in accordance with the methodology adopted at a particular enterprise for managing assortment and pricing, a system of discounts, a method of processing warehouse operations and retail sales, and other organizational and technological features of store operations. User profiles that match typical store employee roles allow you to get started quickly without any setup.

Functionality "1C: Retail 8":

- Online cash register support.

- Integration with labeling systems.

- Basic version.

- Marketing.

- Regulatory and reference information.

- Inventory and purchasing management.

- Warehouse management.

- Sales management.

- Accounting for means of payment.

- Reporting system.

- Store personnel management.

- Connected equipment.

- Data exchange.

- Integration with EGAIS.

- Service "1C: Checking price tags".

- Service "1C: Storekeeper".

1C: Enterprise Accounting 8

“1C: Accounting 8” is the most popular accounting program that can take accounting automation to a whole new level. A convenient product and services connected to it will allow you to effectively solve the problems of the accounting department of any business.

continuously improves the program and services in order to offer a modern and universal accounting solution that meets the needs and tasks of users.

“1C: Accounting 8” is a professional accountant’s tool with which you can maintain accounting and tax records, prepare and submit mandatory reports. The program combines all the achievements of previous versions and new solutions based on the practical experience of accountants of hundreds of thousands of enterprises and organizations.

Clear accounting in accordance with legislation and business needs, saving time when calculating taxes, preparing documents and business transactions, effective user support combined with high comfort of work - these are just some of the key features of 1C: Accounting 8.

Functionality "1C:Accounting 8":

- Principles of accounting.

- Cash.

- Settlements with counterparties.

- Inventory assets.

- Trade.

- "1C-Reporting".

- Production.

- Fixed assets.

- Intangible assets.

- Salary.

- Separate units (CORP).

- End of the period.

- Verification of credentials.

- Regulated reporting.

- UTII.

- VAT.

- USN.

- Income tax accounting.

- Patent.

- Integration with GIS.

1C:Comprehensive Automation

The “1C: Integrated Automation” configuration will meet the automation needs of enterprises in various industries and types of activities.

The use of “1C: Integrated Automation” will be effective in the growing business of small and medium-sized enterprises, the management processes of which require clear coordination and coordinated actions of several performers. The 1C: Integrated Automation program allows you to:

- expand opportunities for managing and organizing accounting activities at the enterprise: planning, CRM and marketing, sales, purchasing, warehouse work, production, personnel activities, payroll and others;

- process customer orders from the online store website;

- organize regular analytical work;

- monitor the efficiency of key enterprise processes;

- submit regulated reports via the Internet using the 1C-Reporting service.

Functionality "1C: Integrated Automation":

- Monitoring and analysis of enterprise performance indicators.

- Budgeting.

- Treasury Department.

- Customer Relationship Management (CRM).

- Sales management.

- Accounting in production.

- Warehouse and inventory management.

- Procurement management.

- Cost management and cost calculation.

- Personnel management and payroll.

- Accounting and tax accounting.

- Inventory planning.

- Integration with the Honest Sign system.

- Sharing with "1C: Document Flow 8".

1C:ERP

“1C:ERP Enterprise Management” (“1C:ERP”) is an innovative and effective solution for creating a comprehensive information system for managing any enterprise. This product allows you to automate basic business processes, monitor key performance indicators of the enterprise, organize the interaction of services and departments, coordinate the activities of production departments, evaluate the efficiency of the enterprise, individual departments and personnel.

"1C:ERP" was created taking into account the best global and domestic practices in automation of large and medium-sized businesses, as well as with the direct participation of representatives of large industrial enterprises. Thanks to the expert approach to development and step-by-step testing, 1C:ERP received exactly those functional capabilities that are most in demand in large enterprises with various areas of activity, including in technically complex multi-faceted industries.

Since 2014, over 5,000 enterprises have become clients of 1C:ERP Enterprise Management:

- to optimize the production process, draw up a reliable schedule of activities, taking into account equipment load and provision of resources;

- during the transition from obsolete disparate management systems - to organize effective work in a single information space;

- for simple and convenient tracking of key performance indicators of the enterprise at all levels of management;

- for the coordinated work of enterprise services in the construction and execution of sales, production and procurement plans;

- to implement an effective cash management system and develop optimal ways to achieve the company’s financial goals;

- to increase the efficiency of commercial and logistics services, improve the quality of customer service, increase the accuracy and efficiency of obtaining information;

- to obtain reliable data on the activities of the enterprise, costs and revenues in the context of the required analytics.

Functionality "1C:ERP":

- Monitoring and analysis of performance indicators.

- Financial management and budgeting.

- Treasury Department.

- International financial accounting.

- Sales management.

- Customer relationship management.

- Procurement management.

- Warehouse and inventory management.

- Regulated accounting.

- Cost management and cost calculation.

- Personnel management and payroll.

- Manufacturing control.

- Organization of repairs.

- Inventory planning.

- Integration with the Honest Sign system.

- Functional model "1C:ERP Enterprise Management".

- Sharing with "1C: Document Flow 8".

BIT.WMS

Program for complex automation of warehouse logistics. The solution is flexibly customized to suit the specifics of any enterprise.

The functionality of the BIT.WMS system allows you to optimize processes and solve the main problems that are relevant for warehouse complexes:

- optimization of the use of warehouse space when placing and storing goods;

- reduction of warehousing costs;

- reducing the time and number of errors for processing warehouse operations;

- increasing the accuracy and efficiency of goods accounting;

- elimination of losses associated with the critical timing of the sale of goods;

- reducing wage costs for warehouse workers;

- monitoring the execution of operations and actions of employees in real time;

- partial or complete elimination of warehouse downtime during inventory;

- reducing the risk of misgrading down to zero;

- eliminating dependence on employees’ knowledge of the location of goods.