The tax rate under the simplified tax system depends on the object of taxation. According to Art. 346.20 of the Tax Code of the Russian Federation, 6% is paid by companies and individual entrepreneurs who have chosen the “income” object, 15% is transferred by individual entrepreneurs and organizations that have notified the transition to “income minus expenses”. Regional authorities are given the right to reduce established rates, so in individual regions of the Russian Federation the tax is calculated differently. We will tell you what rates apply under the simplified tax system in St. Petersburg in 2022 in our material.

Rate for simplified tax system “income” in St. Petersburg

In general, “simplified” people in St. Petersburg pay 6% single tax on their income. The reduction is provided only for certain categories of payers, the list of which is quite limited. At the same time, additional conditions are put forward for the application of the benefit.

According to the simplified tax system for “income”, the rate in St. Petersburg will be 1% if the taxpayer simultaneously meets the following requirements:

- pays the average monthly salary to employees not lower than the established regional minimum wage;

- its main activity as of December 1, 2020 is preferential.

In 2022, the regional minimum wage in St. Petersburg did not change. For commercial organizations it is approved at the level of 19,000 rubles. (in this case, the tariff rate or salary should not be less than 14,300 rubles), for budgetary ones it is equal to the federal one - 12,792 rubles. (Regional agreement No. 343/19-C dated December 27, 2019).

The following types of activities according to OKVED 2 codes are eligible for benefits:

- 55 – provision of places for temporary residence, with the exception of code 55.9 (applies to places in dormitories for students, schoolchildren, other students of educational institutions, seasonal workers, etc.);

- 79 – activities of travel agencies and other companies in the field of tourism;

- 86.90.4 – activities of sanatorium and resort organizations.

The code of the main activity can be checked using an extract from the Unified State Register of Legal Entities, Unified State Register of Individual Entrepreneurs on the website of the Federal Tax Service.

What percentage is the tax on the simplified tax system “income minus expenses”

The rate for the simplified tax system “income minus expenses” is set at 15% based on clause 2 of Art. 346.20 of the Internal Revenue Code. Subjects of the Russian Federation may set reduced tax rates - from 5 to 15%.

The establishment of the right to such a reduction is due to the provision of regions with the opportunity to stimulate the development of certain types of activities or an increase in the number of taxpayers of certain groups. Payers of the simplified tax system do not have the obligation to confirm their right to apply a preferential regional tax rate (letter of the Ministry of Finance dated October 21, 2013 No. 03-11-11/43791).

Rate under the simplified tax system “income minus expenses” (SPB)

According to the simplified tax system in St. Petersburg, “income minus expenses,” the rate was reduced back in 2015. It was approved at the level of 7%. This benefit is provided to all “simplified” residents of the city who have chosen the simplified tax system “income minus expenses.”

In 2022, the reduced rate related to the simplified tax system “income-expenses” continues to apply in St. Petersburg. Legislators decided to leave the rate at the same level. In St. Petersburg, according to the simplified tax system “income-expenses”, the rate of 7% is valid for any companies and individual entrepreneurs. There are no additional requirements for taxpayers.

Tax calculation according to the simplified tax system: income minus expenses in 2018-2019

The simplified tax system for income minus expenses is one of the types of simplification.

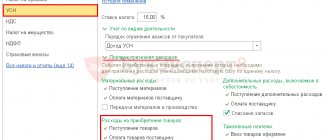

There are 2 types of tax base for the simplified tax regime: “income” and “income minus expenses”. How to choose a suitable taxation object, read the material Which object is more profitable under the simplified tax system - “income” or “income minus expenses”? .

You can read about the advantages and disadvantages of the second type of simplification in our material.

The simplified tax system for income minus expenses, unlike the simplified tax system for income, takes into account not only the income received, but also the expenses incurred when determining the taxable base. However, not all expenses can be recognized as a reduction in the single tax base. Their list is prescribed in the Tax Code of the Russian Federation.

You can familiarize yourself with the types of expenses that are accepted for the purposes of calculating simplified tax in our articles:

- “Acceptable expenses under the simplified tax system in 2017”;

- “List of expenses under the simplified tax system, income minus expenses”;

- “Expenses that officials forbid the “simplified” to take into account”.

It should be noted that all expenses must be economically justified and have documentary evidence.

Read more about the rules for accepting expenses for accounting in the following materials:

- “Accounting for expenses under the simplified tax system with the object “income minus expenses”;

- “The procedure for writing off expenses under the simplified tax system: income minus expenses.

A whole chapter in the Tax Code of the Russian Federation is devoted to the simplified tax system. There are also explanatory letters from the Ministry of Finance of the Russian Federation, the Federal Tax Service of the Russian Federation, decisions of the Arbitration Court and a number of other documents designed to convey to taxpayers the correct procedure for accounting and calculating taxes.

However, in practice, more clear and illustrative examples of calculating income minus expenses under the simplified tax system may be required in different situations for different types of activities of the taxpayer. You will find them in the articles on our website:

- «Bookkeeping in a cafe using the simplified tax system (nuances);

- «Bookkeeping at a travel agency using the simplified tax system (nuances);

- “We take VAT into account in expenses - special conditions;

- “Loss based on the results of the first half of the year - how to file it correctly?.

For certain types of activities and certain categories of taxpayers in the regions, rates may be reduced, and this will also play a role in the choice of an object for taxation.

Find out where the reduced rates are set here .

Tax according to the simplified tax system in St. Petersburg is 0% for new individual entrepreneurs

The category of “simplified” payers to whom the legislators of the northern capital decided to provide a “tax holiday” are individuals registering for the first time as an individual entrepreneur with the Federal Tax Service of St. Petersburg (Article 1.1 of Law No. 185-36).

Tax holidays apply to those individual entrepreneurs who have chosen to conduct business in the following areas:

- manufacturing industry (section “C” of the Classifier OKVED 2) and production, with some exceptions (production of wine, cider and other fermented drinks, including beer, palm oil, tobacco, medicines, distillation, mixing, purification of alcohols; according chemical industry and metallurgy);

- professional, scientific and technical activities (section “M” according to OKVED 2, also with a number of exceptions - architecture and engineering planning, technical testing, etc., advertising, marketing, accounting services, activities of head offices and management consultations, veterinary services);

- healthcare and social services according to OKVED 2, excl. Class "Activities in the field of health care").

Another condition for applying tax holidays under the simplified tax system in St. Petersburg is the number of employees of the new individual entrepreneur. There should be no more than 15 people on average per year. The calculation includes, incl. part-time workers and contractors under GPC agreements.

Newly created individual entrepreneurs that simultaneously meet all the above requirements do not pay a single tax under the simplified tax system during the first 2 tax periods from the date of state registration (clause 4 of Article 346.20 of the Tax Code), that is, they apply a 0% rate.

The zero rate under the “tax holiday” will last until the beginning of 2024.

Tax accounting and reporting under the simplified tax system (USN) income minus expenses

For the simplified tax system, income minus expenses requires tax accounting and reporting. For simplifiers, simpler tax accounting is expected, exemption from payment of a number of taxes, as well as submission of one single tax return. Tax accounting is mandatory for all categories of persons who use the simplified tax system. Legal entities are required to maintain accounting records. Individual entrepreneurs do not have such an obligation.

The tax return is submitted after the end of the tax period. During reporting periods, the simplifier transfers advance tax payments. You will find more detailed information about the tax and reporting periods, as well as about submitting the necessary reports, in our article “Reporting and tax period under the simplified tax system in 2022” .

The tax accounting register is a book of income and expenses, which must be compiled by both companies and individual entrepreneurs. The book should be used only for transactions under the simplified tax system if the organization combines several tax regimes. It is checked by tax inspectors, since it is based on it that the calculation base for the single tax is determined. That’s why filling it out correctly is so important. You will learn the procedure for filling out the book of income and expenses from our article .

Rates for payers with income above 150 million or with more than 100 employees

Since 2022, the norms of the Tax Code of the Russian Federation related to the loss of the right to the simplified tax system have been revised. “Simplified” residents do not lose the right to a special regime, but are required to use increased tax rates if (clauses 1.1, 2.1 of Article 346.20 of the Tax Code of the Russian Federation as amended by Federal Law No. 266-FZ of July 31, 2020):

- their income since the beginning of the year amounted to less than 200 million, but more than 150 million rubles;

- the average number of employees was less than 130, but more than 100 people.

The Tax Code of the Russian Federation does not allow regions to reduce rates in such a situation. Therefore, the St. Petersburg law does not apply to these cases. If a company or individual entrepreneur exceeded the limits on income and number, but remained within acceptable limits, from the beginning of the quarter in which this happened, tax on income over 150 million rubles. accrued at the rate:

- 8% for the object “income”;

- 20% for the “income-expenses” object.

Having received an income of over 200 million rubles. or having recruited more than 130 employees, the taxpayer will lose the right to “simplified taxation”.

Taxes under the simplified tax system “income minus expenses”

Taxpayers using the simplified tax system are exempt from paying:

- property tax, except for real estate, the value of which is determined as cadastral (this, in particular, office, retail and service premises and buildings);

- VAT (with rare exceptions);

- income tax (for self-employed persons - personal income tax), except for income in the form of dividends and income taxed at special rates.

Other taxes, fees and contributions are paid on a general basis.

Read about what rules to follow when applying the simplified tax system in 2018-2019 in terms of insurance premiums.

If taxpayers have chosen a taxation system such as the simplified “income minus expenses” with a rate of 15%, then they must maintain KUDiR. You must have all documents confirming expenses and their payment. “Simplified” taxpayers are required to conduct cash transactions in accordance with the general procedure. And also submit tax and statistical reporting.

For information about the “simplified” option not to use online cash registers when providing services to the population (except for public catering services) until July 1, 2019, read the publication “A deferment for online cash registers has been introduced.”

Taxpayers who have chosen income-minus-expenses taxation are not exempt from performing the duties prescribed for tax agents. In addition, they must comply with all controlling person regulations if they hold relevant interests in controlled foreign companies.

Rates for taxpayers affected by the coronavirus pandemic

In 2022, St. Petersburg had reduced rates for another category of taxpayers - individual entrepreneurs and legal entities whose main activity is classified as industries affected by the coronavirus pandemic (Article 1.2 of Law No. 185-36). The list of such industries is given in the Appendix to Law No. 185-36, and the rates were:

- 3% for simplified tax system “income”;

- 5% - for the simplified tax system “income minus expenses”.

To apply these rates, it was also necessary to comply with the condition of paying the average salary to employees in an amount not lower than the regional minimum wage in 2022.

These rates do not apply when calculating taxes for 2022.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

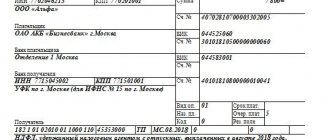

KBK for the simplified tax system income minus expenses for 2018-2019

KBK is a 20-digit budget classification code, which is divided into 4 main blocks. Each number has a specific meaning and carries the necessary information. KBK helps to avoid confusion when transferring payments to the budget or extra-budgetary funds. By specifying the wrong code, the taxpayer risks “losing” his payment in the web of the budget system.

On our website you can always find the current KBK simplified taxation system income minus expenses. Read about their meanings and differences from the KBK for the simplified tax system “income” here .

The same material indicates what changes have occurred in the KBK regarding the minimum tax from 2022.

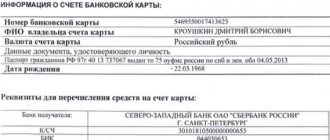

Equally important when transferring tax is the correct filling in of the payment order details. The taxpayer must check his bank details with the tax office to which he is attached for tax accounting.

The payment order contains many fields that must be filled out. Find out how to fill out each field of a payment slip for paying tax under the simplified tax system, income minus expenses, from the articles “Details for paying the simplified tax system in 2022” and “Sample payment slip for the simplified tax system, income minus expenses in 2017” .

Minimum payments

If an enterprise applies the simplified tax system “Income – Expenses”, the tax rate must be at least 1%, regardless of the amount of income. An exception is made for situations where no income was recorded for the entire tax period.

When receiving even a small income that turns out to be less than or equal to the expenses incurred, the tax must be calculated at a minimum one percent rate.

For business entities that use a simplified taxation system, rates of 1% are relevant if the following conditions are met:

- tax liability is calculated according to the “Income minus Expenses” principle;

- during the reporting period, revenue receipts were recorded;

- the difference between cash receipts and production expenses turned out to be zero or negative.

In the described situation, according to the simplified tax system, the 2022 rates in the minimum amount are applied to the amount of income received during the reporting period.

For more information about this, see “Payment of the minimum tax under the simplified tax system.”

Individual entrepreneur on the simplified tax system “income minus expenses”

The simplified tax system “income minus expenses” is applied to individual entrepreneurs under the same conditions that apply to legal entities (Article 346.12 of the Tax Code of the Russian Federation):

- They carry out activities not prohibited by clause 3 of Art. 346.12 Tax Code of the Russian Federation.

- The established annual income limit is observed. At the same time, to begin applying the regime, the 9-month IP limit may not be observed (letter of the Ministry of Finance of Russia dated March 1, 2013 No. 03-11-09/6114).

- The average number of employees does not exceed 100.

- The residual value of depreciable fixed assets is less than RUB 150,000,000.

Newly registered individual entrepreneurs whose activities are related to production, provision of social services or scientific activities have the right to apply a preferential tax rate of 0% during the first 2 years of operation.

Read more about preferential simplified taxation rates in this article.

STS “income minus expenses” 15%: minimum tax

For simplifiers who have chosen “income minus expenses” as the object of taxation under the simplified tax system (rate 15%), a special tax is established in the amount of 1% of the total amount of income received during the year. A single tax in the established minimum amount is paid if the calculated tax amount (tax rate multiplied by the difference between income and expenses) for the year is less than the minimum.

The minimum tax is paid at the end of the year when submitting a tax return. In this case, taxpayers make advance payments on the basis of calculations made in the generally established manner.

For information on calculating the minimum tax, read the article “How to calculate the minimum tax under the simplified tax system in 2018-2019?”

Regional rates

In the constituent entities of the Russian Federation, according to the simplified tax system “Income minus Expenses”, the rate may be less than the base value. Thus, the current rules allow for legislative approval of rates of this type in the range of 5–15% at the level of an individual region. To reduce the tax burden in relation to the activities of simplifiers, the authorities of a constituent entity of the Russian Federation must issue a law changing the size of the rate under the simplified tax system. Regional authorities have also been given the right to adjust the tax rate in relation to the simplified tax system rate in 2022 for the “Revenue” object. Fluctuations in this percentage tax rate are allowed within 1 – 6%. Each update of the value of this indicator must also be supported by legislation.