How debts are formed

Accounts receivable and payable are an obligatory component of the financial and economic activities of any organization. It is impossible to work without debt. This is not about loans, credits and borrowings. Debtor and creditor are formed during standard business transactions.

For example, the usual delivery of goods means the emergence of an obligation to the supplier to pay for the products provided. This is how a creditor is formed. But transferring an advance to suppliers or shipping goods to the buyer without payment is an example of the occurrence of receivables: a third-party entity has obligations to the organization.

Why is this necessary?

When conducting an inventory of liabilities, accountants often identify debts whose status has not changed for a long time. And it is not possible to collect such debt due to various factors. There is no point in leaving the delay in accounting. The amount can be written off as expenses of the organization.

The essence of such a decision as recognizing a debt as uncollectible is the ability to take into account the company’s losses for taxation (clause 2, clause 2, article 265 of the Tax Code of the Russian Federation). It is impossible to collect an uncollectible debt. Consequently, part of the organization's money or assets is completely lost. And this is a loss.

But not all types of delays can be taken into account for tax purposes. An exhaustive list of situations is enshrined in paragraph 2 of Art. 266 Tax Code of the Russian Federation. Consequently, if a company has a debt in its accounting that does not comply with the norms of fiscal legislation, then the recognition of bad receivables on it is not allowed, which means that losses cannot be taken into account when calculating income tax.

Unconfirmed accounts receivable

If the receivables listed on the accounts are not supported by primary documents or are confirmed only by a reconciliation report, then you will not be able to prove its reality in court. The reconciliation act is not included in the list of primary accounting documentation that confirms the completion of business transactions - this is confirmed by decisions of the FAS Moscow District dated 08/14/2009 No. KA-A40/4665-09-2, FAS East Siberian District dated 04/14/2010 in case No. A10 -38883/2009 and letter from the Federal Tax Service “On confirmation of expenses in the form of amounts of receivables with an expired statute of limitations” dated December 16, 2010 No. ШС-37-3/16955.

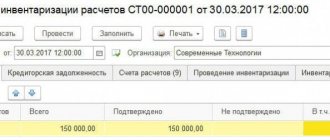

Such debt still needs to be written off, but it must be written off at the expense of profit, not taken into account as expenses for tax purposes. In edition 3.0 of “1C: Accounting 8” this is reflected as follows: in the document “Debt Adjustment”

in the

“Other income and expenses” field, select

the expense item

“Other expenses not taken into account for tax purposes

.

The same method can be used if the amount of debt is small, and the costs of the court will be greater than the amount collected from the debtor.

Bad debt requirements

Let us outline the key conditions in accordance with the Tax Code of the Russian Federation.

| Conditions for recognizing a debt as unrecoverable | Expiration of the limitation period, more details: “Limitation period for debt: main points” |

The obligation has been terminated according to the provisions of the Civil Code of the Russian Federation:

| |

The inability to fulfill obligations was confirmed by the bailiff. Wherein:

| |

| A citizen-debtor (individual) is declared bankrupt in court. At the same time, all his obligations were recognized as repaid, that is, freed from the claims of creditors. |

IMPORTANT!

Similar conditions for recognizing debt as bad in accounting are not established at the legislative level. The regulations contain a reservation only regarding the limitation period. But for work it is advisable to use a tax list of conditions. It is important for an organization to establish the conditions and procedure for recognizing bad debts in its accounting policies.

Under what circumstances can accounts receivable not be considered uncollectible?

It should also be taken into account that in some situations it is impossible to write off a debt legally even if the above criteria are met. Let's look at the most common examples:

- The company filed a claim in the arbitration court to collect receivables. The judgment was rendered in favor of the creditor. Subject to the support of the court, it will not be possible to write off the debt on the basis of the expiration of the statute of limitations. It is still possible to do this, but only if you have a bailiff’s order in hand to complete the paperwork, and also subject to the liquidation of the debtor-legal entity.

- If the court has denied the opportunity to collect the receivables, then it will not be possible to write them off under any circumstances.

- If the debtor who became bankrupt had a guarantor, then the receivables cannot be written off either. In this case, you should wait for the expiration of the statute of limitations or the bailiff’s decision on the impossibility of collecting the debt.

- If the debtor has merged with another legal entity, then repayment of the company’s debt should be sought from the debtor’s legal successor.

- If your debtor was an individual entrepreneur, and then it was liquidated, then the receivables must be returned by the entrepreneur, but as an individual. The debt can be written off only if the citizen becomes bankrupt, when the bailiff issues a corresponding ruling or the statute of limitations has passed.

In addition, under no circumstances can a change in the tax regime by an organization serve as a basis for debt write-off. In this case, every effort should be made to repay the debt. The chances of a successful outcome will be much higher if you involve experienced lawyers in this process.

What debts cannot be considered bad

In addition to the conditions for recognizing receivables as uncollectible, the Federal Tax Service has outlined a number of additional rules. If they are not observed, then the debt cannot be taken into account as a bad debt. This means that it cannot be counted as an expense for tax purposes.

If inspectors identify improperly written off arrears, the company will face sanctions. Firstly, tax authorities will restore the income tax base or simplified tax system to 15%. And, of course, additional tax will be charged on the restored amount. Secondly, the company faces a fine of 20% of the underpaid tax amount. Thirdly, penalties. Well, for dessert: if the Federal Tax Service admits that the taxpayer deliberately underestimated the base, then the amount of the fine will double - 40% of the debt.

The following cannot be classified as bad debts:

- Not documented. Moreover, a supply agreement alone is not enough. Invoices, certificates of completed work, payment slips and checks are required. That is, documents confirming that the debt exists.

- Related to the sale of goods, works or services. For example, arrears arising from securities or from the assignment of rights are quite difficult to offset. Such an operation requires a written explanation from the Federal Tax Service. But over time, controllers became more loyal to such debts.

- Needed to be collected. If the creditor has not taken any action to get his money or assets back, then such a delay cannot be recognized in tax accounting.

- Pardoned by settlement agreement. If the creditor forgave the debt or received at least something in return and a settlement agreement was concluded about this, then the delay cannot be considered hopeless.

- They have a guarantee. Obligations with a guarantee cannot be considered hopeless. If the main debtor is unable to pay, then collection should be directed to the guarantors.

- They are in solidarity. This means that the obligations under the contract are divided between several persons, without singling out the main debtor. Then the delay cannot be recognized as hopeless until at least one defendant has the opportunity to pay the bills.

All cases are individual. It is necessary to approach the issue of debt write-off thoroughly. Establish the procedure for recognizing debt as uncollectible in your accounting policies.

Documents for writing off bad debts

For tax purposes, bad debts can be recognized as expenses only if documents are available.

Judicial practice indicates that the amounts and dates of bad debts must be confirmed by an agreement that specifies the date of payment, acts of acceptance of services provided (if they are executed in accordance with the terms of the agreement), payment orders, as well as an inventory report of receivables for the end of the reporting (tax) period, indicating that at the time of writing off the specified debt has not been repaid, by order of the manager to write off the receivables as bad debts (Determination of the Arbitration Court of the Sverdlovsk Region dated August 14, 2015 No. A60-27406/2015, Resolution AS of the Moscow District dated July 17, 2015 No. A40-29510/14).

WRITTEN OFF DEBT OF DEBBITORS, CREDITORS: TAX CONSEQUENCES

How to complete the operation

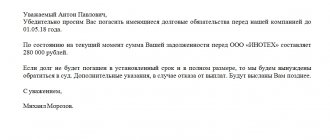

Any accounting transaction must have documentary evidence. Writing off hopeless overdue payments is no exception. But what documents should be used to document the situation? We follow the instructions:

- Prepare documentation confirming the actual existence of the debt. This is a supply or contract agreement. We also need acts of completion of work, delivery notes, invoices, payment orders for the transfer of advance payments, and bank account statements.

- Now prepare forms confirming the grounds for write-off. These may be acts of reconciliation, an order to liquidate a company, a court decision on bankruptcy, an extract from a bailiff on the termination of enforcement proceedings and other certificates.

- Based on the collected documents, prepare an order to write off the bad debt. A sample is shown in the illustration.

- Reflect the transaction in accounting and tax accounting. Draw up an accounting statement or other accounting form provided for by the accounting policies.

Sample order to write off irrevocable debt

Conditions for recognizing debts as bad (uncollectible)

08.07.2021

The Tax Code allows, when calculating income tax, to take into account losses from writing off debts, which, according to clause 2 of Art. 265 of the Tax Code of the Russian Federation are recognized as hopeless (uncollectible).

What conditions will allow debts to be recognized as bad and taken into account as non-operating expenses?

About bad (uncollectible) debts

According to paragraph 2 of Art. 265 Tax Code of the Russian Federation

Bad debts include debts to the taxpayer for which:

– the established limitation period has expired; – in accordance with civil law, the obligation is terminated due to the impossibility of its fulfillment, on the basis of an act of a government body or as a result of the liquidation of the organization.

There are also two grounds for recognizing a debt as hopeless if the impossibility of collection is confirmed by a decision of the bailiff on the completion of enforcement proceedings:

– it is impossible to establish the location of the debtor, his property, and obtain information about his funds; – the debtor does not have property that can be foreclosed on.

Also, the debts of a citizen declared bankrupt are recognized as bad, for which he is exempt from further fulfillment of creditors’ claims (considered repaid) in accordance with Federal Law of October 26, 2002 No. 127-FZ “On Insolvency (Bankruptcy)”

.

For your information:

debt to a taxpayer-organization, if it meets the criteria for bad debt, can be taken into account when determining the income tax base (

Letter of the Ministry of Finance of Russia dated December 11, 2020 No. 03-03-06/1/108754

).

To recognize a debt as bad, it is sufficient to have one of the listed grounds ( Letter of the Ministry of Finance of Russia dated November 16, 2010 No. 03-03-06/1/725

).

Other grounds for recognizing a debt as bad Art.

266 of the Tax Code of the Russian Federation does not provide for this.

Let us give examples when a debt to an organization is not hopeless in accordance with paragraph 2 of Art. 266 Tax Code of the Russian Federation

and cannot be taken into account in reducing the income tax base:

– the country of the foreign counterparty – the debtor has introduced restrictions on the fulfillment of obligations in relation to Russian organizations ( Letter of the Ministry of Finance of Russia dated 06/07/2017 No. 03-03-06/1/35488

);

– the court made a decision to refuse to collect the debt ( letters from the Ministry of Finance of Russia dated July 22, 2016 No. 03-03-06/1/42962

,

dated September 18, 2009 No. 03-03-06/1/591

and

dated February 2, 2006 No. 03- 03-04/1/72

);

– the debtor ceased operations due to a merger with another legal entity. As the Ministry of Finance explained in Letter No. 03-03-06/1/52041 dated 09/06/2016

, in the event of a merger of the debtor organization with another legal entity on the basis

of Art.

58 of the Civil Code of the Russian Federation, the rights and obligations of each of them are transferred to the newly emerged legal entity. Consequently, when a debtor organization merges with another legal entity, the right to demand repayment of receivables from the creditor organization passes to the newly created legal entity - the legal successor.

Let us dwell in more detail on each of the conditions, the fulfillment of which will allow debts to be recognized as bad and taken into account as part of non-operating expenses.

The statute of limitations for the debt has expired

Upon expiration of the limitation period, the debt may be recognized as a bad debt, which is taken into account as part of non-operating expenses of the reporting period in which the limitation period expires ( clause 7 of Article 272 of the Tax Code of the Russian Federation

).

The calculation of the limitation period for the purpose of recognizing a debt as bad is carried out by the taxpayer in accordance with the provisions of the Civil Code ( Letter of the Ministry of Finance of Russia dated May 17, 2021 No. 03-03-06/1/37298

).

Let us recall certain norms of the Civil Code of the Russian Federation dedicated to this period:

– the statute of limitations is the period for protecting the right under the claim of a person whose right has been violated ( Article 195 of the Civil Code of the Russian Federation

);

– the general limitation period is set at three years ( Article 196 of the Civil Code of the Russian Federation

);

– its course begins from the day when the person learned or should have learned about the violation of his right ( clause 1 of Article 200 of the Civil Code of the Russian Federation

), and ends in the corresponding month and day of the last year of the period (

clause 1 of Article 192 of the Civil Code of the Russian Federation

);

– the running of the limitation period may be interrupted by the obligor’s performance of actions indicating recognition of the debt. After the break, the limitation period begins anew; the time elapsed before the break is not counted towards the new term ( Article 203 of the Civil Code of the Russian Federation

).

At the same time, the Civil Code of the Russian Federation does not specify which specific actions of the obligated person interrupt the course of the period. Their approximate list is given in paragraph 20 of the Resolution of the Plenum of the Armed Forces of the Russian Federation dated September 29, 2015 No. 43

. Such actions may include, but are not limited to:

– recognition of the claim; – a change in the contract by an authorized person, from which it follows that the debtor acknowledges the existence of a debt, as well as the debtor’s request for such a change in the contract (for example, a deferment or installment plan); – drawing up an act of reconciliation of mutual settlements, signed by an authorized person.

For example, as noted in the Resolution of the FAS UO dated 01.02.2013 No. F09-150/13 in case No. A71-4334/2012

, the signing of an act of reconciliation of mutual settlements by the debtor indicates the latter’s recognition of the amount of debt reflected in the reconciliation act; therefore, the limitation period should be calculated from the date of signing the last of the reconciliation acts.

For your information:

recognition of a written-off debt as uncollectible based on the expiration of the established limitation period is carried out regardless of the measures taken by the taxpayer for the forced collection of such debt (

Letter of the Ministry of Finance of Russia dated 02/16/2021 No. 03-03-06/2/10482

).

In practice, situations are possible when an organization goes to court, which recognizes the existence of a debt from the counterparty, but the latter never repays this debt. In this case, the organization has no right to recognize the “debtor” as uncollectible after the expiration of the limitation period. Thus, in the Letter of the Ministry of Finance of Russia dated August 13, 2012 No. 03-03-06/1/408

it is said that

paragraph 2 of Art.

266 of the Tax Code of the Russian Federation does not provide for a special procedure for recognizing as bad debts to a taxpayer that are payable by the debtor on the basis of a court decision that has entered into legal force. Due to the fact that the creditor has exercised the right to judicial protection of the claim, it is impossible to recognize this debt as bad on the basis of the expiration of the statute of limitations.

In Letter dated May 29, 2013 No. 03-03-06/1/19566

financiers indicated: a debt subject to collection through enforcement proceedings may be recognized as uncollectible for the purposes of taxation of profits of organizations if the impossibility of its collection is confirmed by a resolution of the bailiff on the completion of enforcement proceedings as specified in

paragraph.

2 p. 2 art. 266 of the Tax Code of the Russian Federation on grounds, or in the event of liquidation of the organization in the prescribed manner.

These reasons will be discussed further.

The impossibility of debt collection was confirmed by a bailiff

According to para. 2 – 4 p. 2 tbsp. 266 Tax Code of the Russian Federation

Bad debts (uncollectible) are also debts, the impossibility of collection of which is confirmed by a decree of the bailiff on the completion of enforcement proceedings, issued in the manner established by

Federal Law No. 229-FZ of October 2, 2007

, in the event of the return of the writ of execution to the recoverer on the following grounds :

– it is impossible to establish the location of the debtor, his property, or to obtain information about the availability of funds and other valuables belonging to him in accounts, deposits or deposits in banks or other credit organizations; – the debtor does not have property that can be foreclosed on, and all measures taken by the bailiff that are permissible by law to find his property were unsuccessful.

Thus, a taxpayer who has a receivable can classify it as uncollectible if one of the above circumstances occurs ( letter of the Ministry of Finance of Russia dated 02/09/2017 No. 03-03-06/1/7131

,

dated November 14, 2016 No. 03-03-06/1/66459

).

If the debtor has two or more debts to the organization under different agreements, while one of them has a court decision on its collection and the bailiff has confirmed the impossibility of establishing the whereabouts of the debtor and there is no property on which collection can be imposed, then the question arises: can is it possible to include in non-operating expenses the amounts of all

existing debts of this debtor, including those for which there is no court decision?

The Ministry of Finance believes that only that specific debt can be taken into account in expenses for tax purposes in respect of which there is a decree from the bailiff on the completion of enforcement proceedings (see letters dated July 21, 2015 No. 03-03-06/2/41683

,

dated August 12 .2013 No. 03-03-06/1/32519

).

If, in accordance with civil law, the obligation is terminated...

...due to the impossibility of its execution

According to paragraph 1 of Art. 416 Civil Code of the Russian Federation

the obligation is terminated by impossibility of performance if it is caused by a circumstance for which neither party is responsible.

Impossibility of performance as a basis for termination of an obligation must occur due to objective circumstances (for example, a fire that destroyed all the debtor’s property and made it impossible for him to fulfill his obligations).

A debt to an organization may also be owed by a citizen, and the impossibility of fulfilling the obligation by the latter may be due to his death. In accordance with Art. 418 Civil Code of the Russian Federation

the obligation is terminated by the death of the debtor if the performance cannot be carried out without the personal participation of the debtor or the obligation is otherwise inextricably linked with the personality of the debtor.

Thus, for profit tax purposes, a citizen’s debt may be considered uncollectible due to the death of the debtor, except in cases where the obligation is transferred to the heirs by way of succession ( Letter of the Ministry of Finance of Russia dated September 28, 2009 No. 03-03-06/1/622

) .

...based on an act of a state body

Clause 1 of Art. 417 Civil Code of the Russian Federation

established: if, as a result of the issuance of an act of a state body, the fulfillment of an obligation becomes impossible in whole or in part, the obligation is terminated in full or in the relevant part.

The parties who suffered losses as a result of this have the right to demand compensation in accordance with Art.

13 and

16 of the Civil Code of the Russian Federation

.

Such legislative and regulatory acts of state authorities and local governments are laws, decrees, resolutions, orders, regulations.

...in connection with the liquidation of the debtor organization

General provisions on liquidation.

Liquidation of a legal entity entails its termination without transfer in the order of universal succession of its rights and obligations to other persons (

Clause 1 of Article 61 of the Civil Code of the Russian Federation

).

In accordance with this article, a legal entity may be liquidated:

– by decision of its founders (participants), including in connection with the expiration of the period for which the legal entity was created, with the achievement of the purpose for which it was created ( clause 2

);

– by court decision in the cases provided for in paragraph 3

;

– as a result of declaring a legal entity bankrupt ( clause 6

).

According to paragraph 9 of Art. 63 Civil Code of the Russian Federation

the liquidation of a legal entity is considered completed, and the legal entity is considered to have ceased to exist after information about its termination is entered into the Unified State Register of Legal Entities in the manner established by

Federal Law No. 129-FZ dated 08.08.2001

.

For your information:

An organization has the right to recognize a debt as uncollectible and include its amount in expenses when calculating the income tax base after making an entry in the Unified State Register of Legal Entities on the exclusion of a legal entity - the debtor from the register (

Letter of the Ministry of Finance of Russia dated March 25, 2016 No. 03-03-06/1/16721

).

Documentary evidence of the liquidation of the debtor organization can be an extract from the Unified State Register of Legal Entities, the procedure for obtaining which is established by Art. 6 of Federal Law No. 129-FZ

(

Letter of the Ministry of Finance of Russia dated March 25, 2016 No. 03-03-06/1/16721

).

At the same time, information about the liquidation of a counterparty posted on the official website of the Federal Tax Service cannot be used as the only documentary evidence of expenses in the form of the amount of bad debt written off ( Letter of the Ministry of Finance of Russia dated February 15, 2007 No. 03-03-06/1/98

).

Liquidation by decision of the tax authority.

Tax authorities have the right to exclude an inactive legal entity from the Unified State Register of Legal Entities in the so-called simplified procedure.

The procedure for excluding a legal entity from the Unified State Register of Legal Entities by decision of the registering authority is established by Art. 21.1 of Federal Law No. 129-FZ

.

In accordance with paragraph 1 of Art. 64.2 Civil Code of the Russian Federation

is considered to have actually ceased its activities and is subject to exclusion from the Unified State Register of Legal Entities in the manner established by

Federal Law No. 129-FZ

, a legal entity that, during the 12 months preceding its exclusion from the Unified State Register of Legal Entities, did not submit reporting documents required by the tax legislation of the Russian Federation and did not carry out transactions at least one bank account (inactive legal entity).

According to paragraph 2 of Art. 64.2 Civil Code of the Russian Federation

the exclusion of an inactive legal entity from the Unified State Register of Legal Entities entails legal consequences provided for by the Civil Code of the Russian Federation and other laws in relation to liquidated legal entities.

From the provisions of paragraph 5 of Art. 21.1 of Federal Law No. 129-FZ

it follows that the procedure for excluding a legal entity from the Unified State Register of Legal Entities, provided for by this article, also applies in cases where it is impossible to liquidate a legal entity due to the lack of funds for the expenses necessary for its liquidation and the impossibility of assigning these expenses to its founders (participants); the presence in the Unified State Register of Legal Entities of information in respect of which an entry was made about their unreliability, for more than six months from the date of making such an entry.

At the same time, neither the Civil Code of the Russian Federation nor Federal Law No. 129-FZ

does not classify these organizations as non-operating legal entities.

At the same time, the legal consequences established by paragraph 2 of Art. 64.2 Civil Code of the Russian Federation

, apply only to inactive legal entities that are excluded by the registration authority from the Unified State Register of Legal Entities on the basis of

clause 1 of Art.

21.1 of Federal Law No. 129-FZ (this position is confirmed

by the rulings of the Supreme Court of the Russian Federation dated December 26, 2018 No. 301-KG18-8795

and

dated February 12, 2019 No. 304-KG18-18451

).

According to the Ministry of Finance, the receivables of the debtor excluded from the Unified State Register of Legal Entities in accordance with clause 5 of Art. 21.1 of Federal Law No. 129-FZ

, cannot be considered uncollectible for profit tax purposes on the basis of liquidation of the debtor.

At the same time, nothing prevents the taxpayer from recognizing such a “debt” as uncollectible on other grounds specified in paragraph 2 of Art.

266 of the Tax Code of the Russian Federation (

letters of the Ministry of Finance of Russia dated 06/03/2021 No. 03-03-06/1/43317

,

dated 02/26/2021 No. 03-03-06/1/13404

). For example, if the statute of limitations expires.

Termination of the activities of the individual entrepreneur.

An extract from the Unified State Register of Individual Entrepreneurs on the termination of the activities of an individual entrepreneur is not a sufficient basis for recognizing a debt as uncollectible for the purposes of calculating income tax (

Letter of the Ministry of Finance of Russia dated September 16, 2015 No. 03-03-06/53157

).

That is, if the debtor of the organization is an individual entrepreneur, it should remember that in order to apply the provisions of paragraph 2 of Art. 266 Tax Code of the Russian Federation

The concept of “liquidation of an individual entrepreneur” is not identical to the concept of “liquidation of an organization.” In other words, after making an entry in the Unified State Register of Entrepreneurs about the termination of a citizen’s activities as an individual entrepreneur, he loses the right to engage in entrepreneurial activities. However, at the same time, he continues to bear property liability to creditors as an ordinary citizen. Despite the fact that an individual has lost the status of an individual entrepreneur, his debt has not gone away and the creditor organization, when calculating the income tax base, will not be able to take into account his debt in expenses on such a basis as the liquidation of an individual entrepreneur.

For tax purposes, it is safer for an organization to take into account the receivables of individual entrepreneurs as bad debts for other reasons (for example, after the statute of limitations has expired).

Write-off of accounts receivable for counterparties declared bankrupt.

In accordance with

Art.

2 of the Bankruptcy Law, bankruptcy proceedings are understood as a procedure applied in a bankruptcy case to a debtor declared bankrupt in order to proportionately satisfy the claims of creditors.

The court declaring a debtor bankrupt entails its liquidation ( Clause 1, Article 65 of the Civil Code of the Russian Federation

).

The basis for making an entry in the Unified State Register of Legal Entities about the liquidation of the debtor is the ruling of the arbitration court on the completion of bankruptcy proceedings. From the date of making an entry about the liquidation of the debtor in the Unified State Register of Legal Entities, bankruptcy proceedings are considered completed ( clause 3

,

4 tbsp. 149 Bankruptcy Law

).

The receivables of an organization declared bankrupt, in respect of which a bankruptcy management procedure has been introduced, cannot be recognized as uncollectible until the completion of bankruptcy proceedings, provided that the creditor has declared his claims in the prescribed manner and is included in the register of creditors.

Thus, the debt of an organization in respect of which a bankruptcy procedure is being carried out, included in the register of creditors’ claims, cannot be recognized as uncollectible for profit tax purposes and is not taken into account in expenses when forming the tax base until the completion of bankruptcy proceedings ( letter of the Ministry of Finance of Russia dated December 11, 2015 No. 03-03-06/1/72494

,

dated 04.03.2013 No. 03-03-06/1/6313

).

Situations are possible when only part of the receivables is included in the register of creditors' claims for a particular counterparty. At the same time, a bankruptcy procedure was carried out in relation to this counterparty and it was excluded from the Unified State Register of Legal Entities. In this case, the organization has the right to write off the entire amount of debt. A similar conclusion follows from established arbitration practice.

Thus, in the Resolution of the FAS VSO dated September 24, 2008 in case No. A33-16514/07-F02-4677/08

noted: the fact that the debt was not included in the register of creditors' claims in full does not affect the possibility of classifying bad debt as non-operating expenses.

If bankrupt debtors had joint and several debtors.

According to

paragraph 1 of Art.

322 of the Civil Code of the Russian Federation , a joint obligation (liability) or a joint claim arises if the solidarity of the duty or claim is provided for by an agreement or established by law, in particular, if the subject of the obligation is indivisible.

Clause 2 of Art. 323 Civil Code of the Russian Federation

It has been established that a creditor who has not received full satisfaction from one of the joint and several debtors has the right to demand what was not received from the remaining joint and several debtors. Joint and several debtors remain obligated until the obligation is fully fulfilled.

If an organization has entered into an agreement with a counterparty that provides for joint and several obligations and joint and several debtors, then if the main debtor is declared bankrupt (an arbitration court ruling has been made to complete bankruptcy proceedings, the debtor organization is excluded from the Unified State Register of Legal Entities), it cannot recognize the debt under the obligation as uncollectible and, therefore, take it into account in expenses for tax purposes ( Letter of the Ministry of Finance of Russia dated April 12, 2012 No. 03-03-06/1/194

).

The debtor-citizen is declared bankrupt

Bad debts (debts that are unrealistic for collection) are also recognized as the debts of a citizen declared bankrupt, for which he is exempt from further fulfillment of creditors’ claims (considered repaid) in accordance with the Bankruptcy Law

.

According to paragraph 6 of Art. 213.27 Bankruptcy Law

claims of creditors not satisfied due to the insufficiency of a citizen's property are considered repaid, except for cases provided for by this law.

After completing settlements with creditors, a citizen declared bankrupt is released from further fulfillment of creditors’ claims, including claims of creditors not declared when introducing the restructuring of the citizen’s debts or the sale of the citizen’s property (release of the citizen from obligations) ( Article 213.28 of the Bankruptcy Law

). Based on the results of consideration of the report on the results of the sale of the citizen’s property, the arbitration court issues a ruling on the completion of the sale of his property.

That is, if there is a debt to an organization of an individual and this person is declared bankrupt and released from obligations (including obligations to it), the organization has the right to take this debt into account when calculating the taxable base.

* * *

Intending to take into account receivables as part of non-operating expenses on the grounds listed in paragraph 2 of Art. 266 Tax Code of the Russian Federation

, the organization should keep the following in mind.

The amount of written off receivables is reflected in non-operating expenses for profit tax purposes only if the corresponding “receivable” is recognized as a bad debt (debt that is unrealistic for collection) on the grounds provided for in paragraph 2 of Art. 266 Tax Code of the Russian Federation

(see

Letter of the Ministry of Finance of Russia dated February 26, 2021 No. 03-03-06/1/13389

).

Documents confirming the grounds for classifying debt as bad for the purposes of Art. 266 Tax Code of the Russian Federation

, must be issued in accordance with the requirements of the legislation of the Russian Federation.

At the same time, the Tax Code of the Russian Federation does not establish a specific list of documents that confirm expenses incurred, thereby not limiting the taxpayer in confirming the legality of accounting for relevant expenses ( Letter of the Ministry of Finance of Russia dated December 17, 2020 No. 03-03-06/1/110632

).

Ermoshina E. L., expert of the information and reference system “Ayudar Info”

Send to a friend

Accounting and tax accounting

When working with irrevocable overdue payments, it is important to take into account the opinion of officials about write-offs and reserves. If the company has a reserve for doubtful debts, the amount of bad debt is written off against this reserve. If the non-refundable delay is greater than the reserve, then the difference is taken into account as part of other expenses for taxation.

We described in the article “Reserves for doubtful debts in accounting” how a debt is recognized as doubtful and what are the rules for forming a reserve fund.

After the amount of the irrecoverable overdue amount is written off from the balance sheet accounts, it must be reflected on the balance sheet. For this purpose, account 007 “Debt of insolvent debtors written off at a loss” is used. It is mandatory to keep off-balance sheet accounting of written-off amounts in case the creditor restores its solvency and is able to pay. In this case, the income tax will have to be reinstated.

Let's consider the procedure for recording the main situations of writing off bad debts.

Write-off of accounts receivable in tax accounting

Only organizations that consider income tax on an accrual basis can write off unreceivable receivables as expenses. Accordingly, simplifiers and UTII payers cannot take bad debt into account in expenses (letter of the Ministry of Finance of Russia dated November 13, 2007 No. 03-11-04/2/274). Individual entrepreneurs on OSNO also do not have the right to carry out the procedure for writing off receivables.

Unlike tax accounting, the formation of a reserve for doubtful debts is a right, not an obligation of the organization. That is, for tax purposes, the algorithm for liquidating receivables depends on whether a reserve for doubtful debts has been created. If there is one, then the enterprise writes off accounts receivable from the reserve, and assigns the part of the debt not covered by the reserve to non-operating expenses.

All details on writing off bad receivables using the reserve for doubtful debts are set out in the Ready-made solution from ConsultantPlus. Study the material by getting trial access to the K+ system for free.

If the reserve is not formed, then the receivables are written off for non-operating expenses. An expense is recognized on the date of the earliest event:

- the statute of limitations has expired;

- an entry about the termination of the debtor’s work appeared in the register of legal entities;

- documents were received from bailiffs.

Supporting documents for tax accounting purposes should be kept for at least 4 years.

If you paid an advance to a supplier and then recognized this debt as bad, then the VAT accepted for deduction must be restored.

| However, there are certain nuances in this issue, which can be studied in our article “How to take into account VAT amounts when writing off accounts receivable . |

IMPORTANT! If the company decides to recognize an individual’s debt as bad and, after writing off the receivables, to charge it as expenses, it is necessary to transfer personal income tax from the amount of the debt. From the point of view of officials, in this case the individual benefits from cost savings, and the company must act as an agent for personal income tax. In particular, the Ministry of Finance of Russia writes about this in letter dated March 19, 2018 No. 03-04-06/16933 and the Federal Tax Service of Russia in clarification dated December 31, 2014 No. PA-4-11-27362.

Goods, work or services not paid for by the buyer

The seller will have to write off the entire debt amount along with the amount of value added tax. It is impossible to claim VAT for deduction in such a situation. We reflect transactions in accounting:

| Operation | Debit | Credit |

| The goods have been shipped to customers | 62 | 90-1 |

| The cost of shipped products is taken into account | 90-2 | 41 |

| VAT charged | 90-3 | 68 |

| On the date of debt write-off | ||

| Write-off of bad debt reflected | 91-2 | 62 |

| The amount written off is reflected on the balance sheet | 007 | |

Advance payment to supplier without subsequent shipment

| Operation | Debit | Credit |

| An advance was transferred to the supplier for future delivery of goods and provision of services | 60 | 51 |

| VAT on advance payment is deductible | 68 | 76 |

| On the date of debt write-off | ||

| The debt is written off, including VAT | 91-2 | 60 |

| VAT on advance has been restored | 76 | 68 |

| The debt is reflected in the off-balance sheet account | 007 | |

How are overdue accounts receivable formed?

In this case, the situation looks completely different if the period allotted for the transfer or transfer of funds as payment for the delivered goods or services under the agreement between the parties has expired, and the creditor has not received funds from the debtor. In such a situation, such receivables are considered already overdue.

Overdue debt can be of many different types.

For example, this includes both short-term and long-term debt, since here, in fact, the main role is played by the very fact of missing the last time period for making a payment (which is indicated in the agreement signed by both parties). At the same time, within the framework of overdue debt, in current accounting practice it is customary to talk about its two main types - doubtful and bad types of debt.

Sanctions for violation of contract terms

| Operation | Debit | Credit |

| On the date of recognition of sanctions by the debtor or the court | ||

| Penalties and fines for non-fulfillment of contract terms are taken into account | 76-3 | 91-1 |

| On the write-off date | ||

| A penalty or fine has been written off due to impossibility of collection. | 91-2 | 76-3 |

| The amount is reflected on the balance sheet | 007 | |