Main characteristics of 66 accounts

According to the Chart of Accounts for the financial and economic activities of organizations and the Instructions for its application (approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n), account 66 in accounting is called “Settlements for short-term loans and borrowings.”

Reflect on account 66 business transactions showing the status of short-term (for a period of no more than 12 months) loans and borrowings received by the organization.

Now about the score 66. It is active-passive:

- passive - because it takes into account debts to counterparties who lent funds to the organization, i.e. there is always a credit balance;

- active - there may be a balance of 66 debit accounts when borrowed funds are repaid in a larger amount or interest has been overpaid.

Also see “Short-term loans and borrowings: line item on the balance sheet.”

Interaction with other accounts

Most often in reporting, account 66 interacts with the following accounts:

- , , - credit money from counterparties, various credit organizations, the budget, etc.;

- 10, 41 - property or commodity loan;

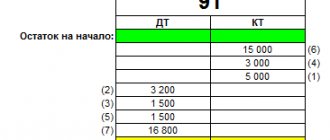

- 91 - other costs of borrowed funds, for example, consultations with third-party lawyers or economists, taking into account exchange rate changes in the case of a foreign currency loan.

During the process of applying for loans, there may be a need for additional expenses, for example, paying state fees for issuing certificates. The indicated costs are taken into account on account 60 “Settlements with suppliers and contractors”.

Account 66 “Settlements for short-term loans and borrowings” is complex in design. When working with it, an accountant should pay attention to several subtleties:

- firstly, separate registration in sub-accounts: counterparties (if there are several loans, this is reflected in separate sub-accounts), types of credit collateral (currency, commodity, bill of exchange, bonds, etc.), separate analytics of interest on loans;

- secondly, a large number of transactions with other accounts, since the distribution of borrowed funds within the enterprise is extensive;

- thirdly, if the company has foreign currency loans, conversion work.

What about the credit of account 66

The amounts of short-term credits and loans received by the organization are shown in the credit of account 66 and the debit of accounts:

- 50 "Cashier";

- 51 “Current accounts”;

- 52 “Currency accounts”;

- 55 “Special bank accounts”;

- 60 “Settlements with suppliers and contractors”, etc.

Interest payable on loans and borrowings received is reflected in the credit of account 66 in correspondence with the debit of account 91 “Other income and expenses”. In this case, accrued interest amounts are taken into account separately.

Analytical accounting on account 66 is carried out according to:

- types of credits and loans;

- credit institutions;

- other lenders who provided them.

The Ministry of Finance does not list possible subaccounts for account 66 in the Chart of Accounts. That is, organizations act here at their own discretion (also see below about bills).

What is count 51 used for?

Account 51 “Current accounts” accumulates all non-cash cash flows of the company in rubles.

The debit of account 51 characterizes the amount of funds entering the current account of a business entity. A loan, on the contrary, records the outflow of money from a company to pay for goods, work or services. In accordance with the order of the Ministry of Finance of Russia “On approval of the chart of accounts for accounting financial and economic activities...” dated October 31, 2000 No. 94n (hereinafter referred to as the chart of accounts), account 51 can be paired with a large number of accounts, both debit and credit:

- 50 "Cashier";

- 60 “Settlements with suppliers and contractors”;

- 62 “Settlements with buyers and customers”;

- 66 “Calculations for short-term loans and borrowings”, etc. (according to the instructions for the chart of accounts).

In this case, correspondence with account 51 itself is allowed (posting Dt 51 Kt 51).

For more information about the chart of accounts, see the article.

Find out how to take inventory of non-cash funds by studying the ready-made solution from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Bonds on the books. account 66

Separate entries in account 66 are made in relation to short-term loans raised by issuing and placing bonds.

| Situation | Solution |

| Bonds are placed at a price exceeding their face value | Make entries according to Dt 51 “Current accounts”, etc. in correspondence with the accounts:

The amount allocated to account 98 is written off evenly during the circulation period of the bonds to account 91 “Other income and expenses”. |

| Bonds are placed at a price below their face value | The difference between the placement price and the nominal value of the bonds is added evenly during the period of circulation of the bonds from the credit of account 66 to the debit of account 91. |

Subaccounts used

By position 60, the following subaccounts are opened:

- 1 – short-term bank loans, where borrowed resources received are reflected on the credit side in correspondence with 50, 51,52, 55 and 60 positions;

- 2 – short-term loans, including those obtained through the issue of bonds;

- 3 – where mutual settlements with credit institutions for keeping records of bills and other debt securities are reflected;

- 4 – interest expenses on resources attracted for a short period;

- 2.1 – short-term borrowed funds in foreign currency.

Bills of exchange on account 66 in the accounting department

A separate sub-account to account 66 reflects settlements with credit institutions for accounting (discounting) bills and other debt obligations with a maturity of no more than 12 months.

| Situation | Solution |

| Accounting (discount) operation for bills and other debt obligations | The organization-bill holder reflects according to Kt 66 (face value of the bill) and Dt 51 “Settlement accounts” or 52 “Currency accounts” (actually received amount of funds) and 91 “Other income and expenses” (account interest paid to the bank). |

| Closing the accounting (discount) operation of bills and other debt obligations | Based on the bank’s notification of payment by reflecting the amount of the bill under Dt 66 and the credit of the corresponding accounts receivable accounts |

| Return by the organization-bill holder of funds received from the bank as a result of discounting (discounting) bills or other debt obligations due to failure by the drawer or other payer of the bill to fulfill its payment obligations on time | Make an entry according to Dt 66 in correspondence with cash accounts. At the same time, the debt for settlements with buyers, customers and other debtors, secured by overdue bills of exchange, continues to be reflected in the accounts receivable. |

Analytical accounting of discounted bills is carried out according to:

- credit institutions that have discounted bills of exchange or other debt obligations;

- drawers;

- separate bills.

Accounting for settlements with credit institutions, lenders and bill drawers within a group of interconnected companies, the activities of which are compiled under consolidated accounting records, is kept separately on account 66.

Account 66.03 “Short-term loans”

Clear about accounting and financial freedom!

General information about the account:

Account synonyms are: account 66.3, account 66-03, account 66/03, account 66 03,

Account type: Passive

see also other accounts in the chart of accounts:

entire chart of accounts

see also PBU: all PBU

Subaccount 66.03 “Short-term loans” is intended to summarize information on the status of short-term (for a period of no more than 12 months) loans received by an organization in the currency of the Russian Federation.

Analytical accounting is maintained for organizations that provided the loan (sub-account “Counterparties”) and concluded agreements (sub-account “Agreements”). Each organization that provided a loan is an element of the “Counterparties” directory. Each concluded agreement is an element of the “Counterparty Agreements” directory.

Description of parent account

: Description of account 66 “Settlements for short-term loans and borrowings”

“Entering initial balances: short-term loans in rubles.”

ENTRY: 000 “Subsidiary account” Credit 66.03 “Short-term loans”

What document 1s

done in

1s:Accounting 2.0/1s:Accounting 3.0

:

— Entering opening balances

on the menu

“Enterprise” type of business transaction

:

«Other accounting accounts"

“Acceptance for accounting of equipment requiring installation received under a short-term loan agreement in rubles.”

ENTRY: 07 “Equipment for installation” Loan 66.03 “Short-term loans”

What document 1s

done in

1s:Accounting 2.0/1s:Accounting 3.0

:

— Operation (accounting and tax accounting)

on the menu

"Operations - Manually entered operations"

“Acceptance for registration of a land plot under a short-term loan agreement in rubles.”

ENTRY: 08.01 “Purchase of land” Credit 66.03 “Short-term loans”

What document 1s

done in

1s:Accounting 2.0/1s:Accounting 3.0

:

— Operation (accounting and tax accounting)

on the menu

"Operations - Manually entered operations"

“Acceptance for accounting of a natural resource management facility under a short-term loan agreement in rubles.”

ENTRY: 08.02 “Purchase of natural resources” Loan 66.03 “Short-term loans”

What document 1s

done in

1s:Accounting 2.0/1s:Accounting 3.0

:

— Operation (accounting and tax accounting)

on the menu

"Operations - Manually entered operations"

“Acceptance for accounting of a construction project under a short-term loan agreement in rubles.”

ENTRY: 08.03 “Construction of fixed assets” Loan 66.03 “Short-term loans”

What document 1s

done in

1s:Accounting 2.0/1s:Accounting 3.0

:

— Operation (accounting and tax accounting)

on the menu

"Operations - Manually entered operations"

“Acceptance for accounting of a non-current asset (equipment) under a short-term loan agreement in rubles.”

ENTRY: 08.04 “Purchase of fixed assets” Loan 66.03 “Short-term loans”

What document 1s

done in

1s:Accounting 2.0/1s:Accounting 3.0

:

— Operation (accounting and tax accounting)

on the menu

"Operations - Manually entered operations"

“Acceptance for accounting of an intangible asset that has not been put into operation under a short-term loan agreement in rubles.”

ENTRY: 08.05 “Acquisition of intangible assets” Credit 66.03 “Short-term loans”

What document 1s

done in

1s:Accounting 2.0/1s:Accounting 3.0

:

— Operation (accounting and tax accounting)

on the menu

"Operations - Manually entered operations"

“Acceptance for accounting of raw materials and supplies under a short-term loan agreement in rubles.”

ENTRY: 10.01 “Raw materials” Credit 66.03 “Short-term loans”

What document 1s

done in

1s:Accounting 2.0/1s:Accounting 3.0

:

— Operation (accounting and tax accounting)

on the menu

"Operations - Manually entered operations"

“Acceptance for accounting of purchased semi-finished products, components, structures and parts under a short-term loan agreement in rubles.”

ENTRY: 10.02 “Purchased semi-finished products and components, structures and parts” Loan 66.03 “Short-term loans”

What document 1s

done in

1s:Accounting 2.0/1s:Accounting 3.0

:

— Operation (accounting and tax accounting)

on the menu

"Operations - Manually entered operations"

“Acceptance for accounting of fuel under a short-term loan agreement in rubles.”

ENTRY: 10.03 “Fuel” Credit 66.03 “Short-term loans”

What document 1s

done in

1s:Accounting 2.0/1s:Accounting 3.0

:

— Operation (accounting and tax accounting)

on the menu

"Operations - Manually entered operations"

“Acceptance for accounting of containers and packaging materials under a short-term loan agreement in rubles.”

ENTRY: 10.04 “Containers and packaging materials” Credit 66.03 “Short-term loans”

What document 1s

done in

1s:Accounting 2.0/1s:Accounting 3.0

:

— Operation (accounting and tax accounting)

on the menu

"Operations - Manually entered operations"

“Acceptance of spare parts for accounting under a short-term loan agreement in rubles.”

ENTRY: 10.05 “Spare parts” Credit 66.03 “Short-term loans”

What document 1s

done in

1s:Accounting 2.0/1s:Accounting 3.0

:

— Operation (accounting and tax accounting)

on the menu

"Operations - Manually entered operations"

“Acceptance for accounting of other materials under a short-term loan agreement in rubles.”

ENTRY: 10.06 “Other materials” Credit 66.03 “Short-term loans”

What document 1s

done in

1s:Accounting 2.0/1s:Accounting 3.0

:

— Operation (accounting and tax accounting)

on the menu

"Operations - Manually entered operations"

“Acceptance for accounting of construction materials under a short-term loan agreement in rubles.”

ENTRY: 10.07 “Materials transferred for processing to third parties” Credit 66.03 “Short-term loans”

What document 1s

done in

1s:Accounting 2.0/1s:Accounting 3.0

:

— Operation (accounting and tax accounting)

on the menu

"Operations - Manually entered operations"

“Acceptance for accounting of construction materials under a short-term loan agreement in rubles.”

ENTRY: 10.08 “Building materials” Loan 66.03 “Short-term loans”

What document 1s

done in

1s:Accounting 2.0/1s:Accounting 3.0

:

— Operation (accounting and tax accounting)

on the menu

"Operations - Manually entered operations"

“Acceptance of inventory and household supplies under a short-term loan agreement in rubles.”

ENTRY: 10.09 “Inventory and household supplies” Credit 66.03 “Short-term loans”

What document 1s

done in

1s:Accounting 2.0/1s:Accounting 3.0

:

— Operation (accounting and tax accounting)

on the menu

"Operations - Manually entered operations"

“Acceptance for accounting of goods under a short-term loan agreement in rubles.”

ENTRY: 41.01 “Goods in warehouses” Credit 66.03 “Short-term loans”

What document 1s

done in

1s:Accounting 2.0/1s:Accounting 3.0

:

— Operation (accounting and tax accounting)

on the menu

"Operations - Manually entered operations"

“Acceptance for accounting of goods at a manual point of sale under a short-term loan agreement in rubles.”

ENTRY: 41.02 “Goods in retail trade (at purchase price)” Credit 66.03 “Short-term loans”

What document 1s

done in

1s:Accounting 2.0/1s:Accounting 3.0

:

— Operation (accounting and tax accounting)

on the menu

"Operations - Manually entered operations"

“Acceptance for accounting of purchased items under a short-term loan agreement in rubles. in organizations engaged in industrial and other production activities"

ENTRY: 41.04 “Purchased items” Credit 66.03 “Short-term loans”

What document 1s

done in

1s:Accounting 2.0/1s:Accounting 3.0

:

— Operation (accounting and tax accounting)

on the menu

"Operations - Manually entered operations"

“Receipt of cash at the organization’s cash desk under a short-term loan agreement in rubles.”

ENTRY: 50.01 “Cash of the organization” Credit 66.03 “Short-term loans”

What document 1s

done in

1s:Accounting 2.0/1s:Accounting 3.0

:

— Receipt cash order

on the menu

"Cash" type of business transaction

:

«Payments for loans and borrowings"

“Receipt of cash to the operating cash desk under a short-term loan agreement in rubles.”

ENTRY: 50.02 “Operating cash” Credit 66.03 “Short-term loans”

What document 1s

done in

1s:Accounting 2.0/1s:Accounting 3.0

:

— Receipt cash order

on the menu

"Cash" type of business transaction

:

«Payments for loans and borrowings"

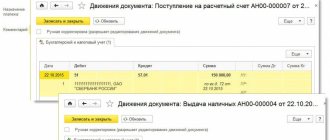

“Acceptance for accounting of funds to the organization’s current account under a short-term loan agreement in rubles.”

ENTRY: 51 “Current accounts” Credit 66.03 “Short-term loans”

What document 1s

done in

1s:Accounting 2.0/1s:Accounting 3.0

:

— Receipt to the current account

on the menu

"Bank" type of business transaction

:

«Payments for loans and borrowings"

“Acceptance for accounting of funds in a special account of the organization (letter of credit) under a short-term loan agreement in rubles.”

ENTRY: 55.01 “Letters of credit” Credit 66.03 “Short-term loans”

What document 1s

done in

1s:Accounting 2.0/1s:Accounting 3.0

:

— Receipt to the current account

on the menu

"Bank" type of business transaction

:

«Payments for loans and borrowings"

“Acceptance for accounting of funds in a special account of the organization (checkbook) under a short-term loan agreement in rubles.”

ENTRY: 55.02 “Checkbooks” Credit 66.03 “Short-term loans”

What document 1s

done in

1s:Accounting 2.0/1s:Accounting 3.0

:

— Receipt to the current account

on the menu

"Bank" type of business transaction

:

«Payments for loans and borrowings"

“Acceptance for accounting of funds in special bank accounts (except for letters of credit, check books, deposit accounts) under a short-term loan agreement in rubles.”

ENTRY: 55.04 “Other special accounts” Credit 66.03 “Short-term loans”

What document 1s

done in

1s:Accounting 2.0/1s:Accounting 3.0

:

— Receipt to the current account

on the menu

"Bank" type of business transaction

:

«Payments for loans and borrowings"

“Expenditure of cash from the organization’s cash desk to repay debt on previously received short-term loans in rubles.”

ENTRY: 66.03 “Short-term loans” Credit 50.01 “Cash of the organization”

What document 1s

done in

1s:Accounting 2.0/1s:Accounting 3.0

:

— Account cash warrant

on the menu

"Cash" type of business transaction

:

«Payments for loans and borrowings"

“Transfer of funds from the organization’s current account to repay debt on previously received short-term loans in rubles.”

ENTRY: 66.03 “Short-term loans” Credit 51 “Current accounts”

What document 1s

done in

1s:Accounting 2.0/1s:Accounting 3.0

:

— Debiting from current account

on the menu

"Bank" type of business transaction

:

«Payments for loans and borrowings"

“Transfer of funds from special bank accounts (except for letters of credit, check books, deposit accounts) to repay debt on previously received short-term loans in rubles.”

ENTRY: 66.03 “Short-term loans” Credit 55.04 “Other special accounts”

What document 1s

done in

1s:Accounting 2.0/1s:Accounting 3.0

:

— Debiting from current account

on the menu

"Bank" type of business transaction

:

«Payments for loans and borrowings"

Chart of accounts

#01 #02 #03 #04 #05 #07 #08 #09

#10 #11 #14 #15 #16 #19

#20 #21 #23 #25 #26 #28 #29

#40 #41 #42 #43 #44 #45 #46

#50 #51 #52 #55 #57 #58 #59

#60 #62 #63 #66 #67 #68 #69

#70 #71 #73 #75 #76 #77 #79

#80 #81 #82 #83 #84 #86

#90 #91 #94 #96 #97 #98 #99

#GTD

For an accountant

Household operations and postings

Terms: what is what

Answers to an accountant

Accounting Regulations (current)

Chart of Accounts

Documents 1c:Accounting

Exchange rates of the Central Bank of the Russian Federation 2005-2021

Archive of articles

Information sources

Newspaper 'Accounting. Taxes. Right'

Clerk.ru

Magazine 'Glavbukh'

website of the Ministry of Finance of Russia

tax service website

tax service information center website

ISS ConsultantPlus website

RBC

Vedomosti newspaper

newspaper 'Kommersant'

BFM.ru/

newspaper 'Russian newspaper'

the correct card for accepting payments

self-employed

:

Raiffeisenbank

debit card Everything is clear and convenient

.

More profitable than competitors' offers: 1.5% cashback on all purchases

+

free annual maintenance

.

Display of receipts and return of credit/borrowed resources in accounting records for item 66

As you can see, the designated position is used when attracting short-term resources not only in national, but also in foreign currency. In the second case, the funds received are displayed in the equivalent of the national currency at the exchange rate of the Central Bank of the Russian Federation on the day the resources were received.

The financing received is recorded in credit 66 of the correspondence account with items 50, 51, 52 and 55.

For the financing received, the company will at some point in time incur certain cost items in the form of interest expenses on loan funds, commissions of the lending institution and exchange rate differences. All these costs and income (if we are talking about a positive exchange rate difference) are taken into account in account 91.1 in the structure of operating costs.

With regard to the return of the received financing and the payment of interest on it, these amounts are reflected in the debit part of position 66 in combination with 50, 51 or 52 accounts.

Scope of application and characteristics

According to the order of the Ministry of Finance of the Russian Federation, the chart of accounts assumes the presence of a special register for storing information on calculations related to loans and credits that can be obtained by placing bonds or receiving written obligations to pay certain funds. This register has number 66.

66 accounting account is a register designed to summarize data on the status of short-term loans or borrowings that were received by an organization or enterprise. Short-term loans are considered to be those taken for a period of no more than one year. All amounts of cash loans that are attracted by issuing bonds are summarized in account 66 for credit and in accounts 51, 52, 55 and 60 for debit.

Account 66 is passive, since it records debts to certain counterparties who lent funds to the organization or enterprise. This register always contains a credit balance.

Important! Despite all this, there may also be a debit balance on the register. This may be for situations in which the borrower's funds are returned in a larger amount than expected, or interest is overpaid. When drawing up a balance sheet in such an outcome of events, information about debt will need to be expanded and the debit balance reflected in the asset of the generated report.

It is worth noting that the interest due on loans received, as well as the accounting of bills and bonds, is carried out in correspondence with other accounts receivable and accounts payable registers (91, 98, 51, etc.).

Application 66 is based on the mapping of short-term loans