Step-by-step instruction

On May 21, according to the vacation schedule, an order was issued to provide annual regular leave to Elena Viktorovna Avdeeva for the period from 06/07/2022 to 06/17/2018 for a period of 10 calendar days.

On June 4, the accountant calculated and paid vacation pay to the employee.

On July 2 (postponed from June 30) personal income tax was paid on vacation pay to Avdeeva E.V.

Step-by-step instructions for creating an example. PDF

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Accrual of vacation pay | |||||||

| June 04 | 26 | 70 | 13 083 | 13 083 | 13 083 | Accrual of vacation pay | Vacation |

| 70 | 68.01 | 1 701 | 1 701 | Withholding personal income tax | |||

| Payment of vacation pay to a bank card | |||||||

| June 04 | — | — | 11 382 | Formation of payment statement | Statement to the bank - According to the salary project | ||

| 70 | 51 | 11 382 | 11 382 | Vacation pay | Write-off from current account - Transfer of wages according to statements | ||

| Payment of personal income tax to the budget | |||||||

| July 02 | 68.01 | 51 | 1 701 | Payment of personal income tax to the budget | Debiting from a current account – Tax payment | ||

Accounting: no reserve is created

If a reserve is not created in accounting, then reflect the accrual and payment of vacation pay as follows:

Debit 20 (23, 25, 26, 29, 44...) Credit 70

- vacation pay accrued.

Debit 70 Credit 50 (51)

- vacation pay was paid.

This procedure follows from the Instructions for the chart of accounts (account 70).

Make similar entries if the vacation is rolling (that is, it begins in one month and ends in another). In this case, the accountant will not have to distribute vacation pay by month.

This is explained as follows.

Since 2011, expenses incurred by the organization in the reporting period, but relating to subsequent reporting periods, may not be reflected in the balance sheet as deferred expenses (in a separate line). They are shown in the balance sheet in accordance with the conditions for asset recognition established by accounting regulations. And they are subject to write-off in the manner established for writing off the value of assets of this type.

Such rules are established by paragraph 65 of the Accounting Regulations, approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n.

In this regard, account 97 “Deferred expenses” is not used in all cases in which it was used previously. This account can be used provided that the corresponding amounts are expressly named as deferred expenses in the current accounting regulations. Or amounts are accounted for in account 97 if they meet the following criteria:

- the organization incurred expenses, while the counterparty did not have counter-obligations to it (otherwise a receivable is recognized, not an expense);

- these expenses do not form the value of tangible or intangible assets;

- expenses determine the receipt of income over several reporting periods.

Vacation pay accrued in the current month for the next month are not considered deferred expenses, since such expenses do not lead to the receipt of income in several reporting periods (clause 19 of PBU 10/99) and affect the financial result of the period in which they were incurred . Consequently, in accounting, vacation pay does not need to be distributed between the months in which the vacation fell, that is, they should be taken into account at a time upon accrual.

An example of how vacation pay is reflected in accounting. Vacation starts in one month and ends in another. The organization is a small business entity and does not create a reserve for vacation pay.

In June 2015, the manager of Torgovaya LLC A.S. Kondratiev was given basic paid leave. Duration of vacation - 28 calendar days: from June 16 to July 13, 2015. Vacation pay was paid to the employee on June 11, 2015.

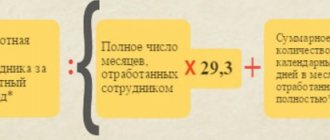

For the billing period - from June 1, 2014 to May 31, 2015 - Kondratiev received a salary in the amount of 360,000 rubles. The billing period has been fully worked out.

Kondratiev’s average daily earnings were: 360,000 rubles. : 12 months : 29.3 days/month = 1024 rub./day.

The accountant accrued vacation pay in the amount of: 1024 rubles/day. × 28 days = 28,672 rub.

including:

- for June: 1024 rub./day. × 15 days = 15,360 rub.;

- for July: 1024 rub./day. × 13 days = 13,312 rub.

The accountant of the organization reflected the accrual of vacation pay in the accounting records with the following entries.

In June 2015:

Debit 44 Credit 70 – 28,672 rub. – vacation pay was accrued to Kondratiev for June and July.

Options for calculating annual leave payment

The program provides two functionality for calculating annual leave payment:

- Automatically , which uses the Vacation .

- Manually , which uses the Payroll .

The automatic vacation calculation functionality is only possible in a small organization with no more than 60 people.

Our article will discuss in detail the automatic functionality for calculating annual leave payment. To do this, you need to check the Keep records of sick leave, vacations and executive documents PDF in the Administration - Program Settings - Accounting Options - Salary Settings - Payroll section.

Reflection of vacation when calculating wages

In the section where vacation accrual is drawn up, you can draw up a salary document. To begin with, you should indicate the date and name of the organization in the header. Now you need to click “Fill” for the program to automatically calculate the required accruals. Thus, it is possible to keep records of all employees of the specified company in accordance with the hours worked by each.

The displayed statistics look like a table in which you can see two columns. One column displays values for salary, and the other for vacation accruals. You also have the opportunity to create a payslip. It can be created separately for each employee, which will take into account the salary for days worked and vacation days.

If you have any questions about calculating vacation pay in 1C, you can ask our specialists right now. Call the phone in your city and order a free consultation.

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter

Regulatory regulation

Basic rules for granting leave

Leave to employees must be granted annually with preservation of their place of work (position) and average earnings (Article 114 of the Labor Code of the Russian Federation, Article 120 of the Labor Code of the Russian Federation). The right to annual basic leave arises after 6 months in the first year of work. Before the expiration of 6 months, the following have the right to leave (Article 122 of the Labor Code of the Russian Federation):

- women before or after maternity leave;

- workers under 18 years of age;

- employees who adopted children under 3 months of age;

- in other cases provided for by federal laws.

In the future, vacation is granted at any time according to the vacation schedule (paragraph 8 of Article 122 of the Labor Code of the Russian Federation).

In the following cases, a forced transfer or extension of vacation is provided (Article 124 of the Labor Code of the Russian Federation):

- temporary disability of the employee;

- performing government duties while on vacation;

- if the employee was not notified of the vacation or did not receive vacation pay within the prescribed period;

- according to production needs, no later than next year;

- in other cases provided for by labor legislation and local regulations.

Annual paid leave must be extended or postponed to another period determined by the employer taking into account the wishes of the employee (Article 124 of the Labor Code of the Russian Federation). Automatic extension of vacation by the employer after a period of incapacity is permissible if the employee has not expressed his wishes (Appeal ruling of the Krasnoyarsk Regional Court dated April 11, 2018 in case No. 33-4718/2018).

Failure to provide annual leave is prohibited (paragraph 7 of Article 124 of the Labor Code of the Russian Federation):

- for 2 consecutive years;

- employees under 18 years of age;

- workers engaged in harmful and dangerous work.

The duration of vacation is calculated in calendar days. If there is a holiday during the vacation period, the vacation is extended by the number of holidays (Article 120 of the Labor Code of the Russian Federation).

Payment for vacation is made 3 days before its start (Article 136 of the Labor Code of the Russian Federation). The State Tax Inspectorate checks that at the time of payment of vacation pay there are 3 full days left before the vacation (Decision of the Perm Regional Court dated January 23, 2018 N 21-46/2018).

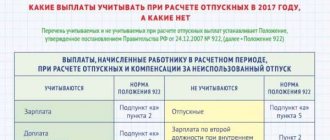

Basic rules for calculating vacation

The amount of payment for annual leave depends on the average salary (Resolution of the Government of the Russian Federation of December 24, 2007 N 922).

The calculation of an employee’s average earnings is carried out based on the wages actually accrued to him and the time he actually worked for the 12 calendar months preceding the vacation (Article 139 of the Labor Code of the Russian Federation).

When calculating vacation pay or changing the minimum wage during the vacation period, it is necessary to compare the average monthly salary with its value: it cannot be lower than the federal minimum wage (clause 18 of the Regulations, approved by Decree of the Government of the Russian Federation of December 24, 2007 N 922).

Average monthly earnings are calculated using the formula:

From 05/01/2018 the minimum wage is 11,163 rubles. (Federal Law dated 03/07/2018 N 41-FZ).

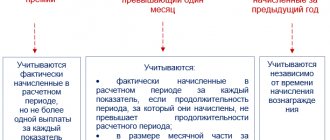

Average earnings are subject to adjustment in the following cases:

- An increase in the federal minimum wage if the average daily earnings for calculating vacation pay turned out to be lower than its value (clause 18 of the Regulations, approved by Decree of the Government of the Russian Federation of December 24, 2007 N 922). The amount of vacation pay is calculated based on the minimum wage:

- There was an increase in salaries for the organization, branch, structural unit (clause 16 of the Regulations, approved by Decree of the Government of the Russian Federation of December 24, 2007 N 922): In the billing period, payments taken into account when calculating average earnings are adjusted.

- In the period between payroll and vacation, the monthly average earnings for the entire period are adjusted.

- During the vacation period, the monthly average earnings for the period from the date of increase are adjusted.

Expenses for additional vacation

In general, the duration of basic paid leave is 28 days. Is it legal to include payment for additional vacations in income tax expenses? Yes, if the right to additional vacation time is enshrined in law.

Dangerous moment

The employer has the right to independently establish additional holidays if they are not provided for by law (Article 116 of the Labor Code of the Russian Federation). At the same time, it is impossible to recognize expenses when calculating income tax if excess leave is provided on the basis of a collective agreement. This is directly stated in the Tax Code.

Expenses for paying additional vacations provided under a collective agreement (in excess of those provided for by current legislation) to employees, including women raising children, are not taken into account when determining the tax base (clause 24 of Article 270 of the Tax Code of the Russian Federation).

You can only take into account the costs of additional rest for employees who are legally entitled to extended leave. At the same time, it will not be superfluous if, in the vacation application, each of them refers to a legal norm that gives the right to additional days of rest. First of all, these are articles 116–118, 321, 335 of the Labor Code. In addition, there are a number of federal laws, for example dated February 19, 1993 No. 4520-1 “On state guarantees and compensation for persons working and living in the Far North and equivalent areas”, and resolutions, for example the Government Decree RF dated December 30, 1998 No. 1588, etc.

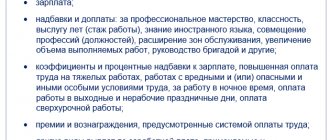

Accrual of vacation pay

Vacation pay is displayed according to Dt of the labor cost account and Kt “Settlements with personnel for wages” (working chart of accounts 1C).

Learn more Determination of methods of accounting for salaries (main transactions)

Annual leave is subject to personal income tax and insurance contributions.

The accrual of vacation is reflected in the Vacation document in the Salaries and Personnel section – Salary – All accruals – Create button – Vacation.

Vacation document accrues vacation pay and calculates personal income tax. Insurance premiums are calculated in the Payroll . Therefore, it is very important to follow the sequence of entering documents: first - the Vacation , then - the Payroll .

The document states:

- Employee - an employee who is granted paid leave.

- Vacation from _ to — vacation period.

When you enter a vacation period, the amount of vacation pay and personal income tax is automatically calculated.

- Accrued - accrued amount of vacation pay.

Accrued link in the Vacation Calculation displays the number of days worked and wages for the previous 12 months to calculate average earnings. If necessary, they can be edited, and the average earnings and the amount of accrued vacation pay are automatically recalculated.

Learn in more detail when average earnings should be adjusted

- Personal income tax - the amount of calculated personal income tax.

personal income tax link in the personal displays the calculation of personal income tax on an accrual basis for the employee for the current tax period.

Postings according to the document

The document generates transactions:

- Dt Kt—accrual of annual leave payment.

- Dt Kt 68.01 - calculation of personal income tax from vacation pay.

Learn more Setting up the main method for reflecting accrued salary

Documenting

The organization must approve the forms of primary documents, including orders for granting leave. In 1C, the Order for Granting Leave (T-6) .

The form of the Order for granting leave in form T-6 can be printed by clicking the Print button - Order for granting leave (T-6) of the Vacation .

The calculation of average earnings can be printed by clicking the Print button - Calculation of average earnings.

Reserve for vacation pay

Since 2011, organizations have been required to create a reserve for vacation pay in accounting, since upcoming expenses for vacation pay are recognized as an estimated liability (clause 8 of PBU 8/2010, letter of the Ministry of Finance of Russia dated June 14, 2011 No. 07-02-06/107). Accordingly, all vacation pay (including for transferable vacation) is written off in accounting at the expense of the created reserve. An exception is provided only for small businesses, provided that they are not issuers of publicly offered securities (clause 3 of PBU 8/2010). Such enterprises have the right not to create a reserve for vacation pay and assign vacation pay directly to current cost accounts.

Payment of vacation pay to a bank card

Vacation pay is paid no less than 3 days before the start date of the vacation (Article 136 of the Labor Code of the Russian Federation).

In our article we will look at the payment of vacation pay under a salary project. Payment of vacation pay to a personal card is processed in the same way. You can familiarize yourself with the nuances using the example of paying wages through a bank (bank cards).

Formation of statements for payment of vacation pay

The formation of a statement for the payment of vacation pay is drawn up in the document Statement to the bank, type of operation For the salary project in the section Salaries and personnel - Salary - Statements to the bank - Statement - For the salary project.

Please pay attention to filling out the fields:

- Type of payment - Salary , since vacation has a document for calculating vacation pay - document Vacation .

- Month —month of vacation accrual.

- Salary project - a salary project drawn up with the bank.

By clicking the Fill , a tabular section is generated with the data for payment based on the results of the specified month:

- For payment - the balance of the accrued amount for which a statement was not previously generated, in our example - accrued vacation.

- Personal account number - personal account number within the salary project.

The document does not generate postings.

Documenting

When transferring wages (vacation pay) to employees under a salary project, it is necessary, along with the payment order, to provide the bank with a list of employees indicating their personal accounts and payment amounts.

1C uses the PDF printable form List of salaries transferred to the bank , which can be printed by clicking the List of transfers the document Statement to the bank .

Vacation pay

The actual transfer of vacation pay is documented in the document Write-off from the current account transaction type Transfer of wages according to statements using the Pay statement at the bottom of the document form Statement to the bank . PDF

Please pay attention to filling out the fields:

- The recipient is the bank with which the salary project is concluded.

- Amount - the amount of vacation pay transferred to the bank, according to the bank statement.

- Statement - a statement according to which wages were transferred.

- Expense item - Labor remuneration , with the Type of movement Labor remuneration PDF, selected from the Cash Flow Items directory.

From June 1, 2022, when paying income to an individual through a bank, payment documents must indicate the code of the type of income for the purposes of enforcement proceedings. And also provide a breakdown of the amount of deduction from income, if any (Part 5.1, Article 70 of Federal Law No. 229-FZ dated October 2, 2007, Bank of Russia Directive No. 5286-U dated October 14, 2019).

To auto-substitute the income code in the Bank Statement, you need to fill out the Type of Income in the Accruals .

- Automatic substitution of income payment code in the statement

- Reminder of codes for income paid to individuals

- Salary payment codes in payment documents

- Difficulties in using income type codes in payment documents

Postings according to the document

The document generates the posting:

- Dt Kt - payment of vacation pay.

Tax accounting

In tax accounting, various scenarios are also possible:

The organization uses the cash method

In this case, the problem of rolling holidays disappears, since expenses are clearly taken into account at the time of cash flow, i.e. payments to their employee.

In our example, if Romashka LLC uses the cash method, then the accountant will reflect the entire amount of vacation pay in the income tax return for the first half of 2022.

2. The organization uses the accrual method, while:

2.1. The organization accrues reserves for vacation pay in tax accounting

In this case, the amount of vacation pay will not affect the calculation of income tax, since the amount of the accrued reserve will be taken into account when calculating income tax.

2.2. The organization does not accrue reserves for vacation pay in tax accounting

This is where exactly the difference arises, which can become a “headache” for an accountant. In this case, vacation pay must be divided and attributed to the periods for which they are accrued. (clause 7 of article 255, clause 1 of article 272 of the Tax Code, letters of the Ministry of Finance No. 03-03-RZ/27643 dated 06/09/14, No. 03-03-06/1/356 dated 07/23/12). In our example, in the income tax return for the first half of 2022, the accountant must reflect 10,000 rubles, and only in the return for 9 months of 2022 will the accountant reflect the entire amount of vacation pay, 28,000 rubles.

At the same time, there is another point of view, confirmed by judicial practice, according to which all expenses can be taken into account during the payment period (part 9 of article 136 of the Labor Code, paragraph 4 of article 272 of the Tax Code, resolution of the Federal Antimonopoly Service of the West Siberian District dated November 7, 2012 No. A27- 14271/2011, Moscow District dated June 24, 2009 No. KA-A40/4219-09, Volga District dated November 14, 2008 No. A55-4199/2008, Federal Tax Service letter dated March 6, 2015 No. 7-3-04/614).

The organization applies the simplified tax system

3.1. simplified tax system with the object “income”

In this case, of course, no amount of vacation pay will be taken into account when calculating the tax, since the regime itself does not provide for a tax reduction on the amount of any expenses.

3.2. simplified tax system with the object “income minus expenses”

In this case, all vacation pay will go towards reducing the single tax during the payment period. In our example, the accountant will reflect the entire amount of vacation pay in the Income and Expense Book as early as June 2022.

Reflection in reporting 6-NDFL

Tax amounts are calculated by tax agents on the date of actual receipt of income on an accrual basis from the beginning of the tax period. The dates for receiving income depend on the type of income; for vacation pay, this is the date of actual payment of vacation pay to the employee.

In 1C, this date is the date of the document of actual payment transfer: it will be reflected on page 100 of Section 2 of form 6-NDFL. In our example, this is the date of the document Write-off from the current account , specified in the Date .

In Form 6-NDFL, the accrual and payment of annual leave is reflected in:

Section 1 “Generalized indicators”:

- line 020 - 13,083 , amount of accrued income;

- pp. 040 - 1 701 , amount of calculated tax.

- pp. 070 - 1 701 , amount of tax withheld.

Section 2 “Dates and amounts of income actually received and withheld personal income tax”: PDF

- page 100 - 06/04/2018 , date of actual receipt of income;

- page 110 - 06/04/2018 , tax withholding date.

- page 120 - 07/02/2018 , tax payment deadline.

- pp. 130 - 13,083 , the amount of income actually received.

- pp. 140 - 1,701 , amount of tax withheld.

Accounting

Accounting rules do not require the distribution of vacation costs depending on the number of vacation days falling within a particular reporting period (month, quarter, year). The organization makes a decision on this issue independently, taking into account the requirements of regulatory legal acts on accounting (letter of the Ministry of Finance of Russia dated December 24, 2004 No. 03-03-01-04/1/190).

Vacation expenses are estimated liabilities. This is due to the one-time fulfillment of a number of conditions, the requirement for compliance with which in order to recognize liabilities as estimated is established by paragraph 5 of PBU 8/2010 “Estimated liabilities, contingent liabilities and contingent assets” (approved by order of the Ministry of Finance of Russia dated December 13, 2010 No. 167n; hereinafter - PBU 8/2010).

Firstly

, the Labor Code obliges employers to provide employees with annual leave and pay them. An organization cannot avoid fulfilling this requirement.

Secondly

, the organization will spend money on paying for employee vacations, that is, its economic benefits will decrease.

Third

, it is, of course, possible to establish the amount of vacation payments, but the need to bear these expenses will occur in an uncertain time and in an unknown amount.

Since vacation expenses are an estimated liability, they must be reflected in accounting as a reserve and then, at the expense of this reserve, all vacation expenses must be written off in the reporting period. Now this is not a reserve for upcoming expenses, as it was before, but one of the estimated reserves formed in accordance with PBU 8/2010.

You can read more about the rules for creating a reserve in the electronic berator for PC, which can be installed on your computer by following the link www.berator.ru/pk

.

In accounting, an estimated reserve for vacation pay is created in order to reliably take into account the employer’s obligations to employees (clauses 5, 8 of PBU 8/2010).

For information

Vacation pay is also subject to insurance contributions (Federal Law No. 212-FZ). The amounts of accrued insurance contributions are taken into account in account 69 “Calculations for social insurance and security”.

Estimated liabilities are reflected in the account for reserves for future expenses (clause 8 of PBU 8/2010). This means that the reserve for vacation pay is taken into account in account 96 “Reserves for upcoming expenses” in the subaccount “Reserve for vacation pay.”

A reserve is accrued on the credit of account 96. The amount of the reserve can be attributed to expenses for ordinary activities, to other expenses, or included in the value of the asset:

DEBIT 20 (08, 23, 25, 26, 29, 44) CREDIT 96, subaccount “Reserve for vacation pay”

– deductions have been made to the reserve for upcoming vacation pay. The use of the reserve (accrual of vacation pay when granting vacation, compensation for unused vacation) is reflected by an entry in the debit of account 96:

DEBIT 96 CREDIT 70

– accrued vacation pay (compensation for unused vacation);

DEBIT 96 CREDIT 69

– insurance premiums for vacation pay are calculated (compensation for unused vacation).

If an organization does not create a reserve for future expenses to pay for vacations in tax accounting (Article 324.1 of the Tax Code of the Russian Federation) or creates these reserves in accounting and tax accounting using different methods, then at the time the amount of the estimated liability is calculated, it is necessary to reflect the deferred tax asset. Its value is determined by multiplying the amount of deduction to the accounting reserve (or the deviation of the accounting reserve from the tax reserve) by the income tax rate - 20 percent. The wiring will be like this:

DEBIT 09 CREDIT 68

– a deferred tax asset is reflected when calculating the amount of the reserve for vacation pay.

When granting vacation or accruing compensation to an employee for unused vacation, these expenses in accounting are written off against the reserve and must be accrued.

be recognized in tax accounting as labor costs. The previously recognized deferred tax asset will be settled to the extent that it is attributable to expenses recognized in tax accounting. The wiring will be like this:

DEBIT 68 CREDIT 09

– the deferred tax asset is repaid when vacation is granted to the employee (compensation for unused vacation is calculated).

If in accounting the amount of accrued vacation pay exceeds the amount of the accrued reserve, the excess amount is immediately written off to cost accounts (clause 21 of PBU 8/2010). There should be no debit balance on account 96.

Reflect the amount of personal income tax withheld from vacation payments by posting:

DEBIT 70 CREDIT 68, subaccount “Calculations for personal income tax”

– personal income tax is withheld from employee vacation payments.

Payment of personal income tax to the budget

Payment of personal income tax to the budget is carried out no later than the last day of the month in which vacation pay was paid (paragraph 2, paragraph 6, article 226 of the Tax Code of the Russian Federation).

Payment of personal income tax to the budget is reflected in the document Write-off from the current account transaction type Tax payment in the Bank and cash desk section - Bank - Bank statements - Write-off button.

Please pay attention to filling out the fields:

- Transaction type - Tax payment .

- Tax - personal income tax when performing the duties of a tax agent .

- Type of liability - Tax .

- for - June 2018 , the month of income accrual (vacation).

Postings according to the document

The document generates the posting:

- Dt 68.01 Kt - payment of personal income tax to the budget for June.

Checking mutual settlements

Checking mutual settlements with an employee

You can check mutual settlements with an employee using the report Balance sheet for the account “Settlements with personnel for wages” in the Reports section - Standard reports - Account balance sheet.

The report can be generated on the date of payment of vacation. But in order to check that the conditions for the payment period for vacation are met (at least 3 days before the start of the vacation), it is recommended that the end date of the report indicate the date three days before the start of the vacation. In our example, vacation starts on June 7, therefore, the report must be generated for June 4.

The company's debt in the form of wages as of May amounted to 23,500 rubles. PDF

Another debt as of June 4 to employee Avdeeva E.V. no, therefore, there is no arrears in vacation pay.

Checking settlements with the budget

To check the calculations with the budget for personal income tax, you can create a report Analysis of account 68.01 “Personal income tax when performing the duties of a tax agent”, in the section Reports - Standard reports - Account analysis.

In our example, vacation pay was paid on June 4, the deadline for transferring personal income tax was June 30, i.e., the last day of the month in which vacation pay was paid. June 30 is a Saturday, which means the deadline for personal income tax payment is postponed to the next business day - July 2 (the final date of our report).

The absence of an opening balance in account 68.01 “Personal income tax when performing the duties of a tax agent” means that there is no debt to pay personal income tax to the budget.

See also:

- Salary settings in 1C

- Payroll

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Calculation and payment of personal income tax on vacation pay...

- Calculation and payment of vacation pay (calculation) ...

- The deadline for paying personal income tax on additional accrued vacation pay and benefits (ZUP 3.1.5.212 / 3.1.6.37) ...

- Determining the date of payment of vacation pay (ZUP 3.1.5.272 / 3.1.7.87) According to Art. 136 of the Labor Code of the Russian Federation, vacation payment is made no later than...

Vacation pay for rolling vacation

Situation: how to reflect in accounting the accrual of vacation pay from the reserve for rolling vacation (starts in one month and ends in another)?

The full amount of accrued vacation pay must be written off against the amounts of the previously created reserve. The fact that the leave is transferable from one month to another does not matter.

The reserve for vacation pay is an estimated liability (clause 5 of PBU 8/2010). It is reflected in accounting as of the reporting date. Its value represents the “virtual” debt of the organization if it had to simultaneously accrue and pay vacation pay to all employees. This debt includes both the vacation pay itself and the amount of taxes and contributions that must be paid to the budget from it.

This procedure for creating an estimated liability is provided for in paragraph 15 of PBU 8/2010.

At the time of payment of vacation pay to the employee, part of the estimated liability will be repaid. According to the rules of labor legislation, vacation pay is paid to the employee no later than three days before the start of the vacation (Article 136 of the Labor Code of the Russian Federation). Consequently, regardless of whether the vacation is transferable from month to month or not, the estimated liability is repaid in full when vacation pay is paid. This means that when accruing vacation pay to a specific employee, the previously created reserve must be reduced by their full amount. There is no need to break the vacation into parts in order to write off the obligation in parts corresponding to the number of vacation days in each month.

This follows from the provisions of paragraphs 5 and 21 of PBU 8/2010. An exception is the situation when the amount of the reserve turned out to be insufficient to write off accrued vacation pay at its expense.

An example of how accrual of vacation pay is reflected in accounting using the created reserve for vacation pay. Vacation starts in one month and ends in another

In June 2015, the manager of Torgovaya LLC A.S. Kondratiev was given basic paid leave. Duration of vacation - 28 calendar days - from June 16 to July 13, 2015. Vacation pay was paid to the employee on June 11, 2015.

For the billing period - from June 1, 2014 to May 31, 2015 - Kondratiev received a salary in the amount of 360,000 rubles. The billing period has been fully worked out.

Kondratiev’s average daily earnings were: 360,000 rubles. : 12 months : 29.3 days/month = 1024 rub./day.

The total amount of vacation pay is: 1024 rubles/day. × 28 days = 28,672 rub.

Including:

- for June: 1024 rub./day. × 15 days = 15,360 rub.;

- for July: 1024 rub./day. × 13 days = 13,312 rub.

The accountant of the organization reflected the accrual of vacation pay in the accounting records with the following entries.

In June:

Debit 96 subaccount “Reserve for vacation pay” Credit 70 – 28,672 rubles. – vacation pay was accrued to Kondratiev for June–July.